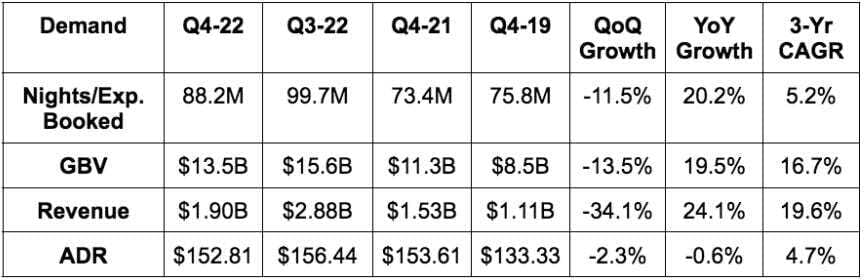

1. Demand

Airbnb beat revenue estimates by 2.2% & beat the midpoint of its guidance by 3.3%. This is despite a 700 basis point (bps) foreign exchange (FX) headwind vs. a 600bps headwind it assumed in its guide. Strong result.

Results were roughly in line with abstract total nights and experiences booked guidance offered last quarter.

More Demand Context:

- Airbnb gained share in global nights stayed vs. 2021 & 2019 — across all markets.

- Generated $8.4 billion in 2022 revenue growing 40% YoY (46% FXN).

- YoY listings growth ex-China accelerated vs. last quarter to 16% YoY. New host initiatives are working.

- It removed all listings in China in 2022 to focus entirely on its outbound business there.

- Cross border & high density urban growth vectors continue to recover while Airbnb’s long term and off the grid stays remain resilient. Good combination.

- Guest cancellations are still above 2019 levels but fell YoY.

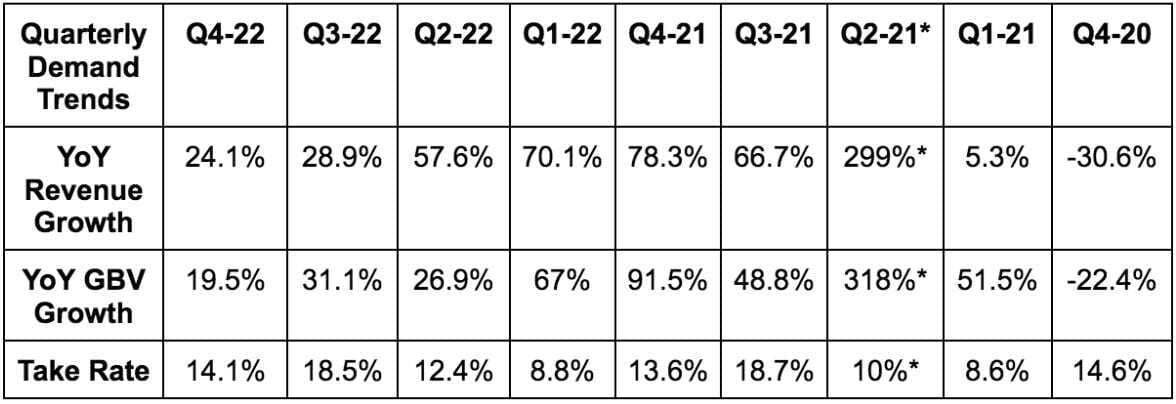

- Take rate rising YoY is a matter of reservation booking timing. “On a time adjusted basis take rate is very stable” per CFO Dave Stephenson

- Q2 2021 and throughout 2021 is when it got pent up demand release. The easy comps = why growth was so rapid at that time.

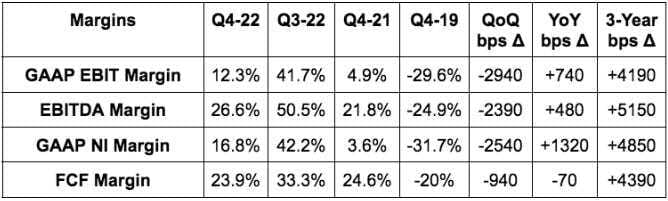

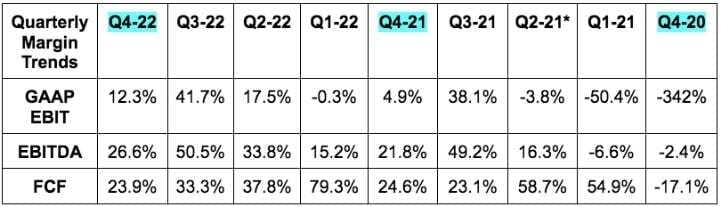

2. Margins

- Beat EBITDA estimates by 16.8% and beat its EBITDA guide by 23.4%.

- Beat GAAP EBIT estimates by 34.3%.

- Beat GAAP EPS estimates of $0.27 by $0.21.

- More than DOUBLED free cash flow estimates.

More Margin Context:

- Continued operating leverage in Q4 2022 has been extremely rare among all of the large cap companies that I cover. Most companies are seeing margin contraction. Wonderful deviation from that trend here.

- Airbnb generated $1.9 billion in 2022 GAAP net income vs. ($352M) in 2021. It grew FCF YoY by 49% in 2022. Cost controls are not taking the shine off of its demand growth. Airbnb’s headcount is down 5% vs. pre-pandemic with revenue up 75%. It cut marketing spend yet continued to find robust demand growth.

- That’s why margins are exploding higher and why it’s so nice to be a verb. Where should we stay? Just Airbnb it.