a. Key Points

- Challenging quarter amid challenging times.

- Market share trends are good.

- International expansion is going well.

- Working through margin and revenue headwinds.

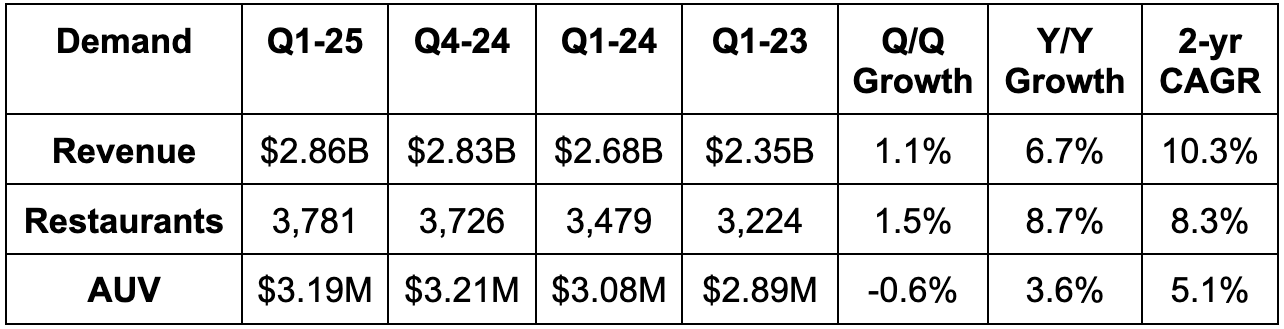

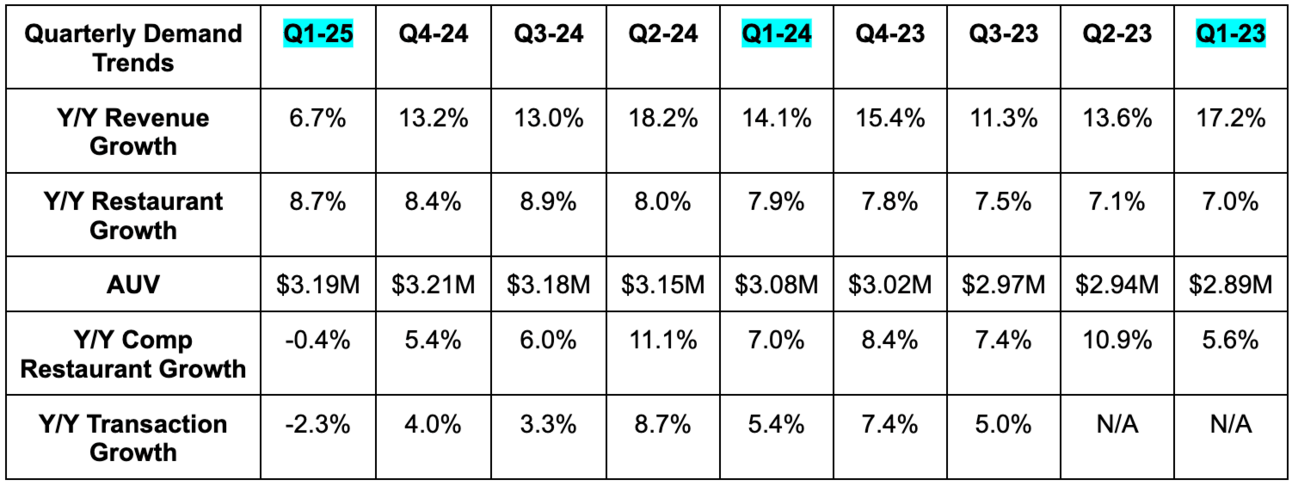

b. Demand

- Revenue missed estimates by 3%.

- - sales growth of -0.4% missed 1.9% estimates.

- Locations roughly met estimates.

- Slightly beat $318M average unit volume (AUV) estimates.

- -2.3% Y/Y transaction growth missed 0% Y/Y growth guidance.

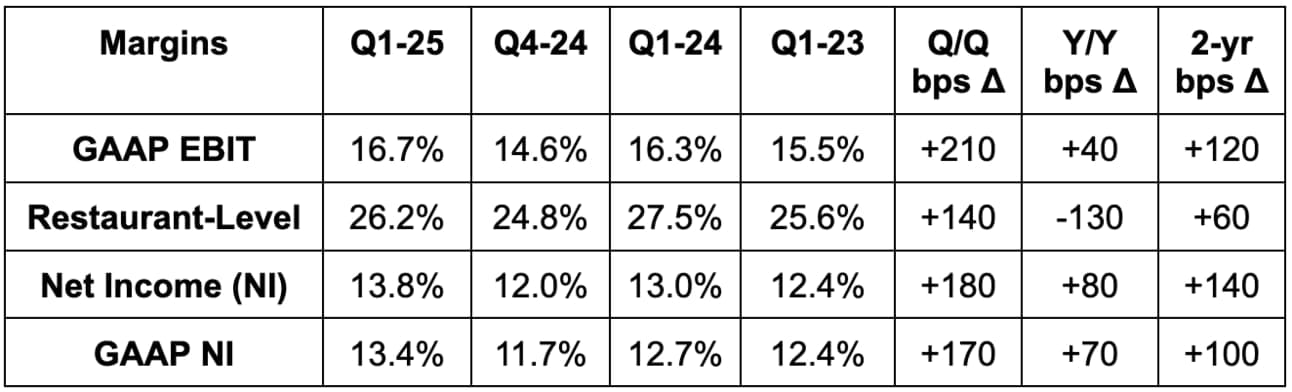

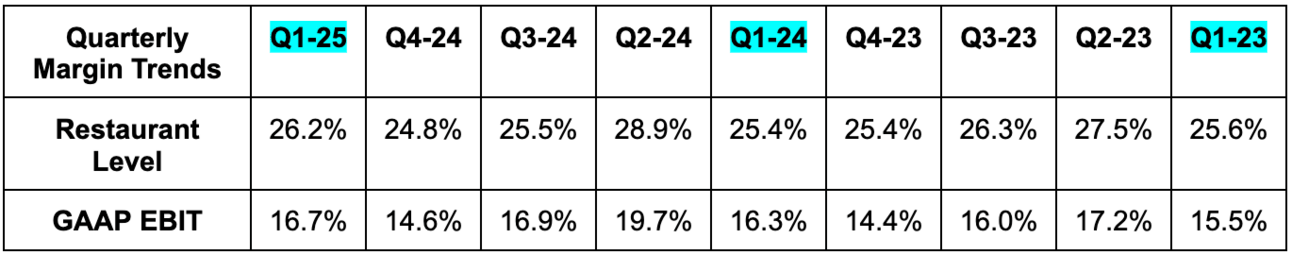

c. Profits & Margins

- Beat 26.0% restaurant-level margin (RLM) estimates by 20 basis points (bps; 1 basis point = 0.01%).

- RLM is similar to gross margin for this industry.

- Beat 16.5% EBIT margin estimates by 20 bps.

- Beat $0.28 EPS estimates by a penny. EPS rose by 7.6% Y/Y.

Food, beverage and packaging (FBP) costs were 29.2% of sales vs. 30.4% Q/Q and 28.8% Y/Y. Larger portion investments offset price hikes. It sees FBP costs rising to 30% of sales due to normalizing avocado prices next quarter.

Labor costs were 25% of revenue vs. 24.4% Y/Y due to lower fixed cost leverage and wage inflation. It will lap the 20% wage hike in California next quarter and labor cost is expected to fall to 24.5% of revenue.

d. Balance Sheet

- $725M in cash & equivalents; $689M in short-term investments.

- $701M in long-term investments.

- No traditional debt. Just $4.5B in operating lease liabilities. Natural part of this business model.

- Share count fell by 1.5% Y/Y.