a. Coupang 101

Coupang is an e-commerce and logistics giant in Korea. It’s quickly expanding into food delivery, entertainment, financial services and also Taiwan. The company “exists to deliver new moments of wow for customers,” which is why its membership program is called “Wow.” Coupang’s “product commerce” offerings include its budding marketplace and fulfillment business, while “developing offerings” include everything else.

This is the topic of my next deep dive and I’m not sure when I’ll be able to publish that. For this reason, the review contains more information on product, value proposition, prospects and risks than it otherwise would. Coupang’s calls are always quite brief (usually 30-40 minutes with a very short press release and presentation). This was my way of rounding out the review with more context to explain why I’m so bullish.

b. Key Points

- Strong quarter despite rampant foreign exchange (FX) headwinds.

- Developing offerings growth remains rapid.

- Confident about 2025.

- Taiwanese expansion is going very well. It may now be trying to re-enter Japan.

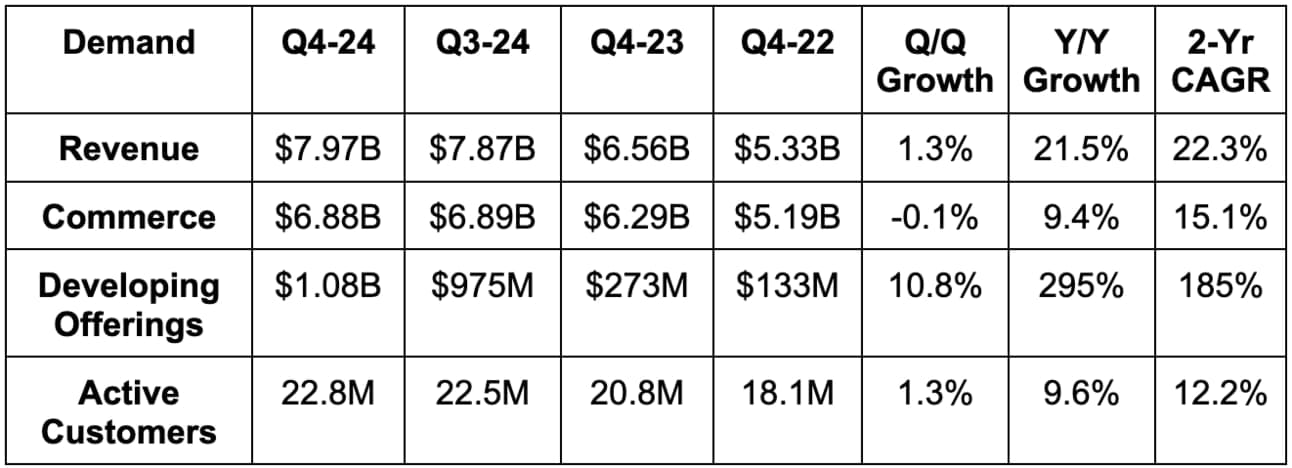

c. Demand

- Coupang missed revenue estimates by 2.1%.

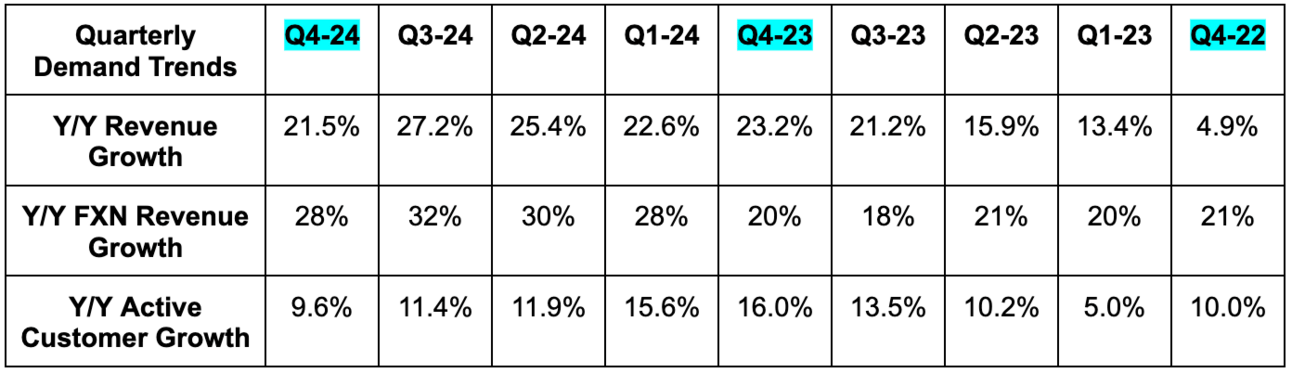

- FX represented a large, 7 point headwind to revenue growth.

- Excluding Farfetch M&A, revenue rose by 14% Y/Y and 21% Y/Y on a foreign exchange neutral (FXN) basis.

- 0% Y/Y revenue per commerce customer growth was 6% FXN.

- Developing offerings growth excluding Farfetch M&A was 124% Y/Y and 136% Y/Y FXN. This compares to 155% Y/Y FXN growth last quarter.

- Coupang has delivered 20%+ Y/Y FXN growth in 15 of its 16 quarters since going public. That’s especially impressive considering the current scale.

“It’s worth highlighting that we have seen a significant weakening of the Korean won versus the U. S. Dollar, reaching its lowest levels in over ten years.”

CFO Gaurav Anand