Today’s Piece is Powered by My Friends at BBAE:

1. Demand

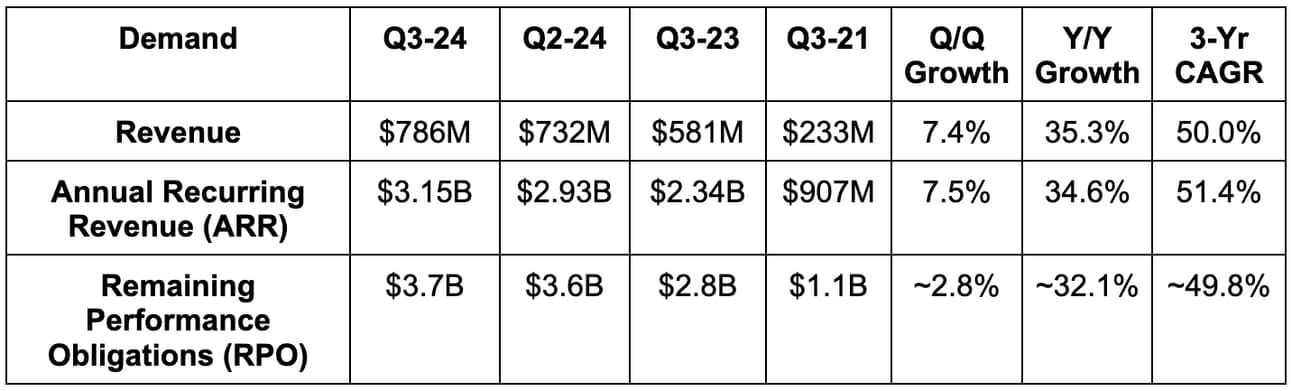

- Beat revenue estimates by 1.1% & beat guide by 1.2%.

- Beat net new annual recurring revenue (NNARR) estimates by 5.2%. Note that aggregate estimates come from the sell side. I was able to get access to a survey of buy side estimates for NNARR this quarter. CrowdStrike surpassed that number by 1.4%. This is the single most important metric that it reports.

- Based on this, it also beat total ARR estimates.

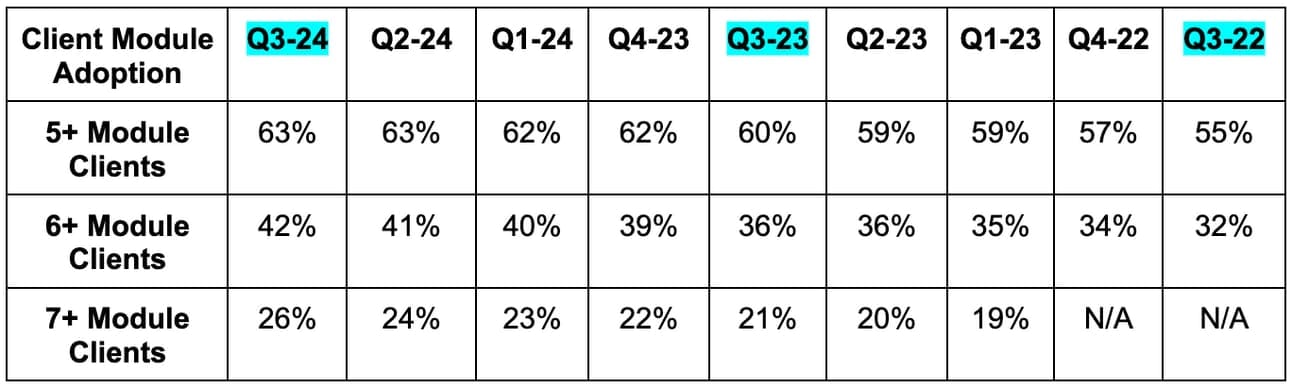

CrowdStrike incurs nearly all client-related costs when it sells its first module. Up-selling additional modules thereafter comes with extremely high incremental profit. That means the pattern above not only means more revenue, but better margins too. Speaking of margins…

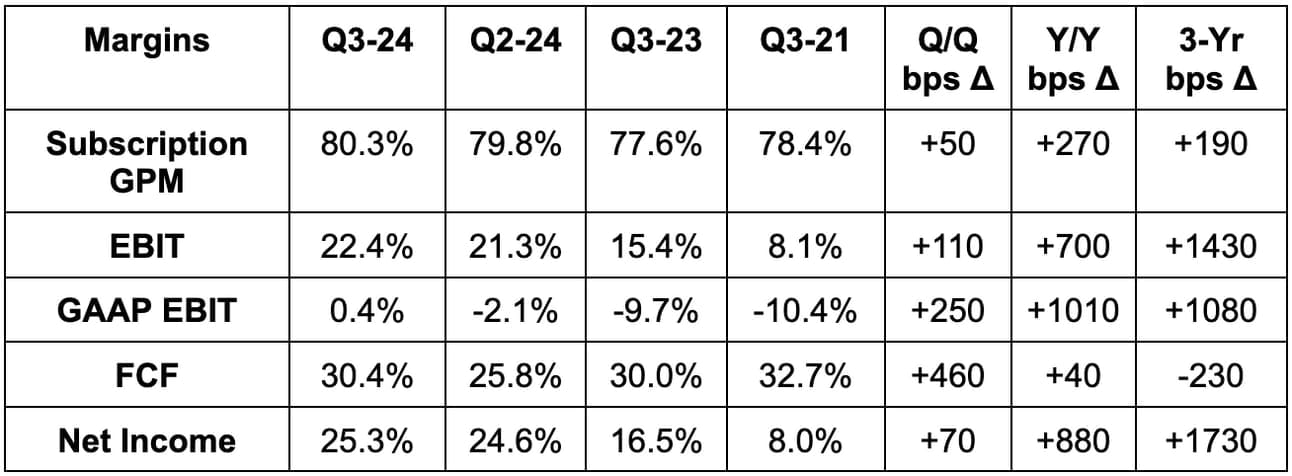

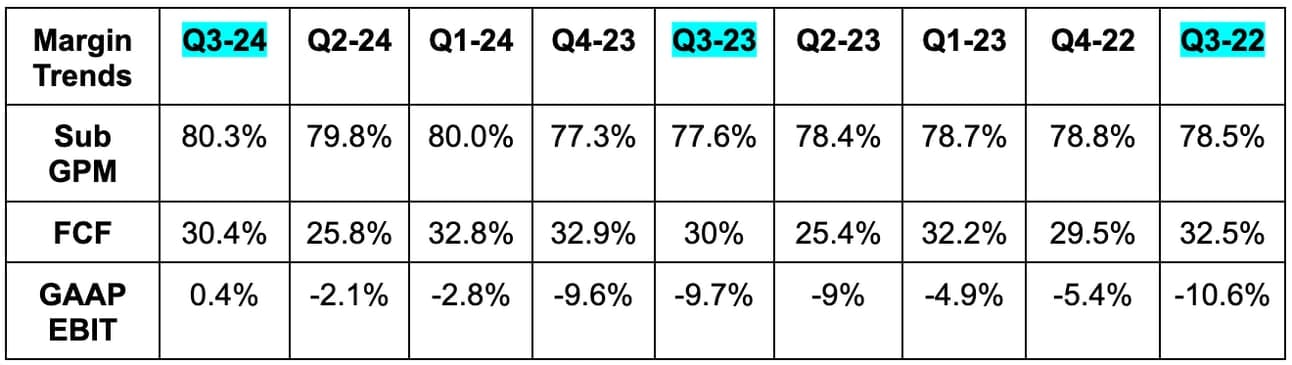

2. Margins

- Beat EBIT estimates by 12.6% & beat guide by 13.1%.

- Beat $0.74 earnings per share (EPS ) estimates by $0.08 & beat guide by $0.08. EPS rose by 105% Y/Y.

- Beat $0.06 GAAP EPS estimates by $0.05.

- Beat free cash flow (FCF) estimates by 3.5%.

- Subscription gross profit margin (GPM) was about 300 basis points (bps; bps = 0.01%) better than expected.

As you can see, gross margin took a brief and modest tumble throughout fiscal year 2023. This was due to up-front investments in server and data center infrastructure to foster better efficiency over time. Those investments were incurred and the margin line resumed expansion starting in FY 2024 — as planned.

A quarter earlier than expected, this was CrowdStrike’s first quarter of positive GAAP EBIT. It had already reached positive GAAP net income thanks to its pristine balance sheet and strong net interest income.

Looking for a better investment platform? Enter BBAE. The product speaks for itself. The Town Square copy trading tool allows you to emulate Wall Street’s finest. Its curated stock themes (under BBAE Discover) inspire new ideas, and its valuable technical and fundamental research tools guide you through key concepts.

BBAE is the broker dedicated to giving investors what matters to us. No gimmicks, no charms, no confetti, and never any pressure to trade. This is THE broker for long-term investors. Oh… and it’s offering generous deposit bonuses of up to $400. Check it out here. You’ll be glad you did.

3. Guidance

For fiscal year Q4 2024, CrowdStrike’s guidance was slightly ahead on revenue. I was able to get access to a J.P. Morgan survey of buy side expectations for next quarter revenue. This likely featured a small sample size of respondents, but CrowdStrike’s guidance was about 1% lighter than that figure. Importantly, the guidance assumes zero Q4 budget flush, which typically benefits CrowdStrike at the end of each fiscal year. It sees this flush as possible, but chose to leave it out of the guide.

Under. Promise. Over. Deliver.

Q4 guidance was 5.1% ahead on EBIT and about 4.5% ahead on net income.