1. Demand

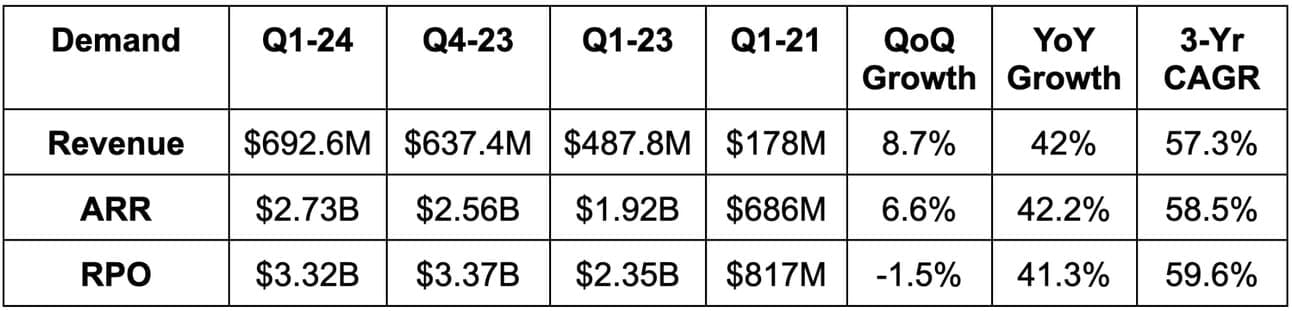

- Beat revenue estimates by 2.4% & beat its guidance by 2.3%.

- Beat annual recurring revenue (ARR) estimates by 0.4%. Beat $161 million net new ARR estimates by 7.7%.

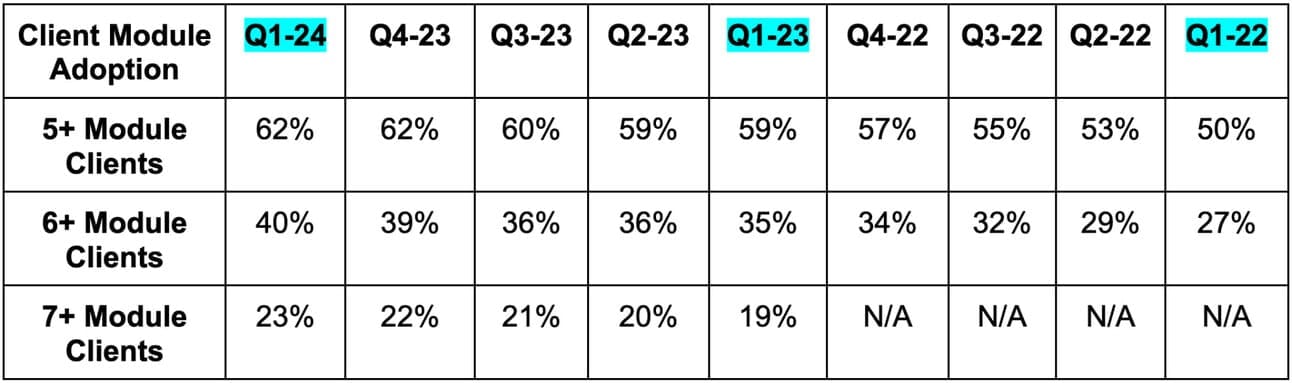

More Demand Context:

CrowdStrike stopped disclosing customers with 4+, 5+ and 6+ modules after Q4 2022 and began disclosing 5+, 6+ and 7+ module customers instead. Why? Because too many of them had 4+ modules. Great problem. More module adoption is not only a revenue driver, but a margin expander as well as there is virtually no added OpEx to sell additional modules after the first.

- 57.3% 3-yr revenue CAGR vs. 61.3% last Q & 66.8% 2 Qs ago.

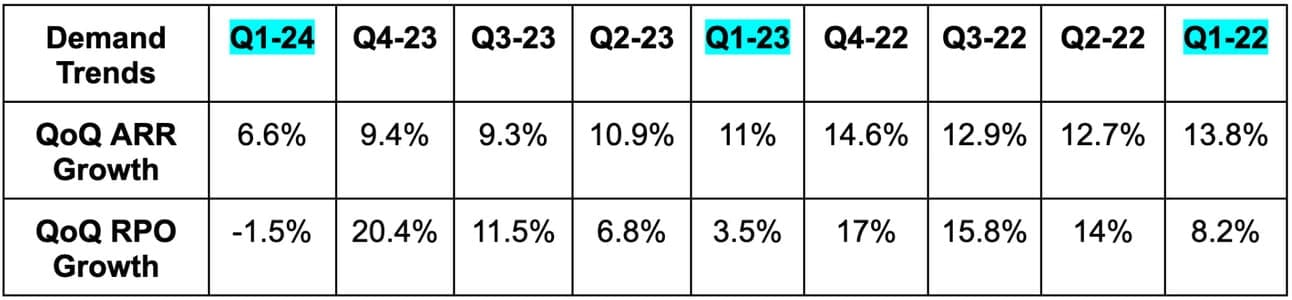

- Q2 pipeline set new records and gives Kurtz confidence in modest net new ARR growth in the back half of the year. Management did not formally update its “flat to modestly up” net new ARR growth, but Kurtz made it seem like “modestly up” was the actual base case.

2. Profitability

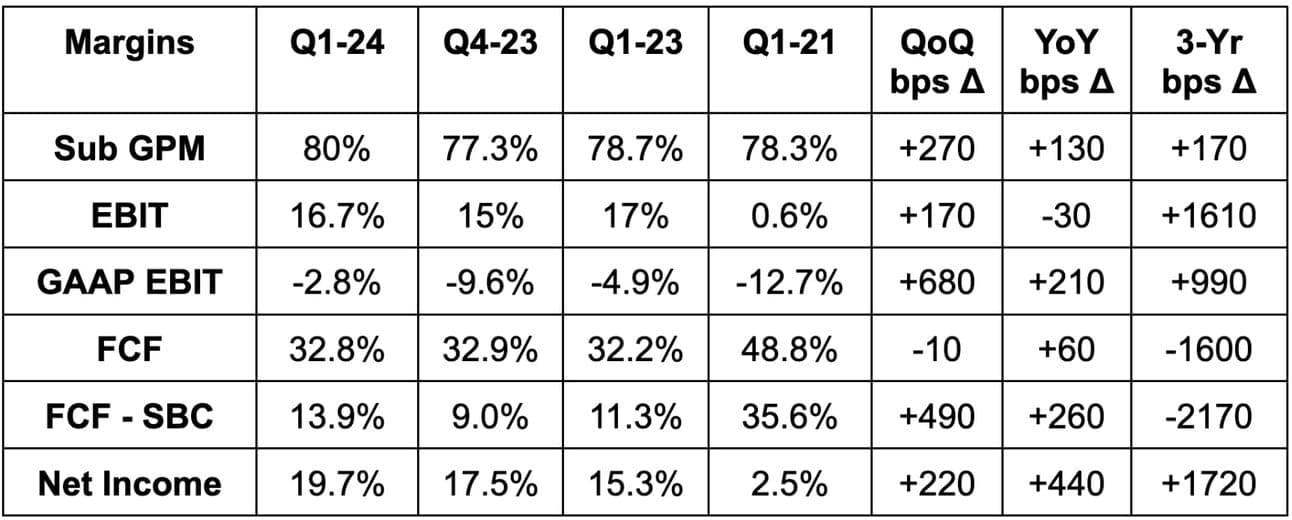

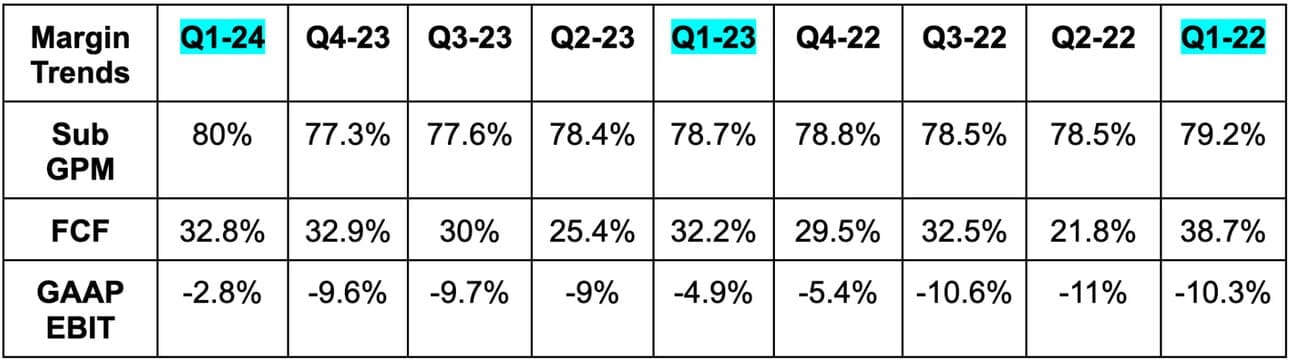

- Beat subscription gross margin (GPM) estimates of 76.3% by a robust 370 basis points (bps). The 80% subscription gross margin it delivered also beat its guidance by 170 bps.

- Beat EBIT estimates by 6.4% & beat guidance by 7%.

- Met free cash flow (FCF) estimates.

- Beat $0.50 EPS estimates by $0.07 & beat its guidance by $0.06.

- Beat ($0.10) GAAP EPS estimates by $0.10. This was its first quarter of positive GAAP net income. This was powered by over $30 million in interest income and slower hiring during the quarter than CrowdStrike expects for the rest of the year. While it is rapidly racing to a sustainable inflection here, this was a one-off event that should not be expected next quarter. The -2.8% GAAP EBIT margin is a better sense of its underlying GAAP profitability as of today.

More Margin Context:

- Q1 2021 was an abnormally strong quarter for cash collections. This propped up cash flow margins and made for a tough 3-year comp. CrowdStrike’s FCF margin target is 30% -- it’s comfortably ahead of that.

- This was the first time CrowdStrike reached an 80% subscription gross margin. Its aforementioned investment in data center optimization is bearing fruit… on schedule and as expected.

- Sales and marketing rose Q/Q due to timing of in-person events. This is not expected to be a durable trend.