CrowdStrike is a next-generation, cloud-native endpoint cybersecurity company. Its bread-and-butter is called endpoint detection and response (EDR), which replaces legacy anti-virus. Beyond EDR, it offers applications in cloud security, log management, forensics, identity security, data protection and more to round out its “Falcon Platform.” Falcon’s edge is in its ability to digest near-endless amounts of data to automate and uplift breach protection. CrowdStrike uses the diverse dataset from its scale and powerful cross-selling to constantly improve Falcon’s efficacy and use cases. It can recycle this same data over and over again to efficiently develop new products for the single, lightweight interface. More utility without adding complexity.

Important Endpoint Security Acronyms:

- Endpoint detection and response (EDR) provides end-to-end visibility and protection with automated remediation and detection services.

- Managed detection and response (MDR) encompasses CrowdStrike’s team of threat hunters to augment EDR with human touch when needed.

- Extended detection and response (XDR) is EDR with 3rd party, non-endpoint data sources infused. The incremental data uplifts breach protection and extends it beyond the endpoint.

Important Log Management Acronyms:

- Log Scale ingests, organizes and stores data logarithmically. This allows for ingestion with more scale and faster time to value. As an important aside, Log Scale is a key ingredient for Falcon Extended Detection and Response (XDR). It is instrumental in XDR’s onboarding of needed data sources in a scalable and efficient manner.

- Security Information and Event Management (SIEM) aggregates security logs/data to help organizations uncover and remediate threats. Log Scale is closely related to SIEM as Log Scale is what actually collects data from various sources to be utilized here.

Important Cloud Security Acronyms:

- Cloud Security & Posture Management (CSPM) tells you about your vulnerabilities and misconfigurations.

- Cloud Infrastructure Entitlement Management (CIEM) tells you who is entering a software environment. It tells you if these entrants are allowed and exactly what they’re allowed to do.

- Cloud Workload Protection (CWP) is a preventative measure to observe if anything bad is being done by entrants. This sounds the alarm bell while preventing and remediating cloud infrastructure attacks. It’s closely related to CSPM and CIEM.

- Cloud Native Application Protection Platform (CNAPP) is the overall suite tying all of these cloud products together.

- Application Security Posture Management (ASPM) locates and facilitates the safe control of cloud apps.

1. Demand

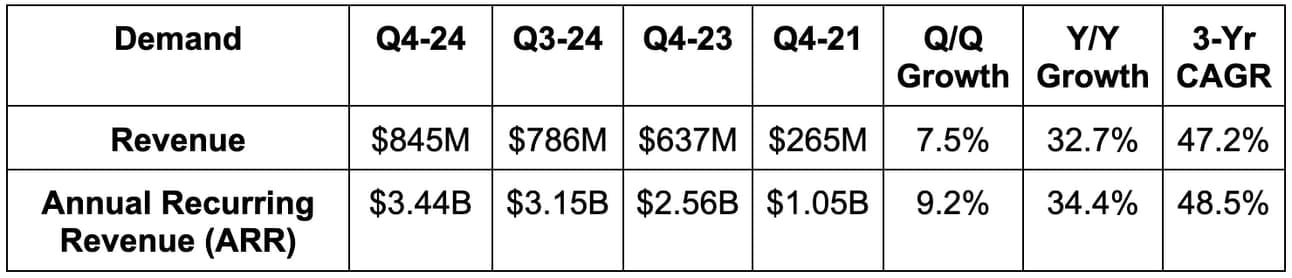

- Beat revenue estimates by 0.6% & beat guidance by 0.7%.

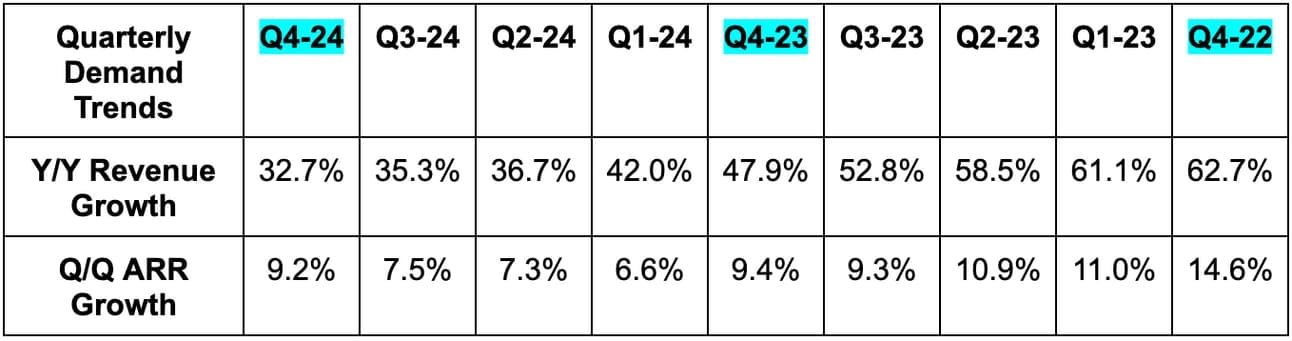

- 47.2% 3-yr revenue compounded annual growth rate (CAGR) vs. 50.0% Q/Q & 54.3% 2 quarters ago.

- Subscription revenue rose 33% Y/Y.

- Beat annual recurring revenue (ARR) estimates by 1.2%.

- This is its 2nd straight quarter of accelerating net new ARR (NNARR) growth. That’s the most important demand number to track.

2. Profitability

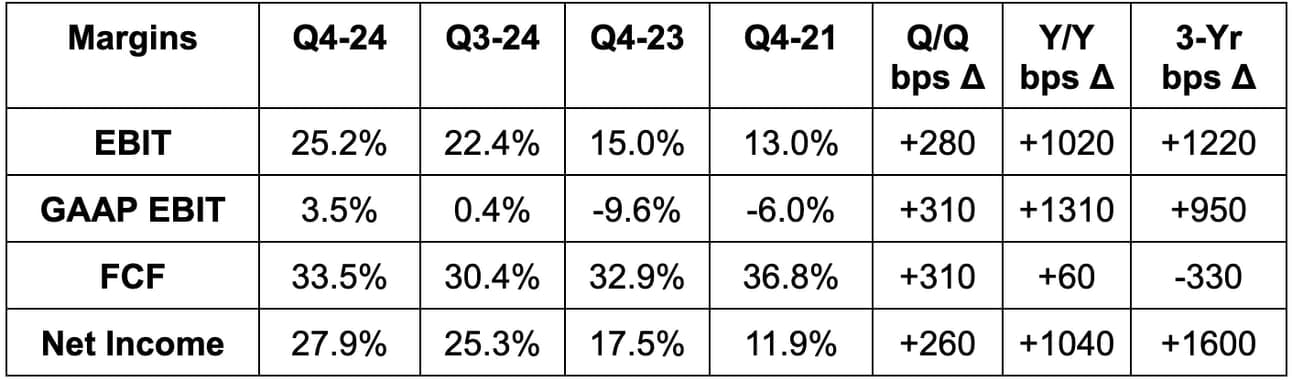

- Beat EBIT estimates by 14.5% & Beat guidance by 14.5%.

- Beat $0.12 GAAP earnings per share (EPS) estimates by $0.10.

- Beat $0.82 EPS estimates by $0.13.

- Beat free cash flow (FCF) estimates by 7.0%.

- The company’s GAAP profitability now makes it eligible for S&P 500 inclusion and the coinciding potential boost to passive share demand.

CrowdStrike earned $3.09 per share vs. $1.54 Y/Y for about 100% Y/Y growth. FCF rose 39% Y/Y to reach $938 million for calendar 2023.

3. Balance Sheet

- $3.5 billion cash & equivalents.

- $740 million debt.

- Basic shares +2.5% Y/Y; diluted shares +5.5% Y/Y.

4. Annual Guidance & Valuation

Annual guidance was 0.3% ahead on revenue, 1.1% on EBIT and $0.11 better than $3.76 earnings per share (EPS) estimates. Encouragingly, this guidance assumes no macro improvements. It bakes in continued budget scrutiny and sales cycle elongation just like it saw in 2023. Under-promise… over-deliver.

In other news, it’s accelerating hiring and growth spend amid robust demand. This will lead to most of its fiscal year 2025 operating leverage coming later in the year. More spend won’t, however, lead to worsening margins. It raised its annual FCF margin target from 31% to 32% to pair nicely with the EBIT and new income beats. Finally, it sees net revenue retention (NRR) hovering around 120% for the year.

Net new ARR (NNARR) growth for Q1 is supposed to be about $198 million if we assume double-digit to low teens growth guidance means 13% Y/Y. This was exactly in line with Q1 2024 ending ARR guidance comfortably ahead (thanks to the Q4 beat). It expects (NNARR) growth to accelerate throughout the year. Q1 deal pipeline size is strong.