In case you missed it:

- Nvidia & Cava Earnings Reviews

- Lemonade Earnings Review

- Coupang Earnings Review

- SoFi Earnings Review

- Netflix Earnings Review

- Nu Earnings Review

- Celsius Earnings Review

- Mercado Libre Earnings Review

- Amazon, Cloudflare and Disney Earnings Reviews

- Datadog Earnings Review

- Taiwan Semi Earnings Review

- Airbnb Earnings Review

- Uber Earnings Review

- Shopify & Chipotle Earnings Reviews

- Alphabet & AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- Meta, Tesla & Starbucks Earnings Reviews

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

- Spotify Earnings Review (section 3)

- The Trade Desk Earnings Review

- Hims Earnings Review

- Grab Earnings Review

- Palo Alto, DraftKings & Robinhood Earnings Reviews (sections 2, 3 & 4)

Table of Contents

- 1. Brief Earnings Snapshots – Gitlab, Okta & Sea L …

- 2. CrowdStrike (CRWD) — Detailed Earnings Review

- 3. Uber CEO Interview with Morgan Stanley

1. Brief Earnings Snapshots – Gitlab, Okta & Sea Limited

As a reminder, earnings “snapshots” are very brief 30,000 ft. views of quarterly results. Earnings “reviews” are the detailed summaries. I am working on finding time for three catch-up reviews this season (CRM; XYZ; SE). I hope to have a full review of the On Running quarter included in Saturday’s article. The other three will be published in the coming weeks as things slow back down.

a. GitLab (GTLB)

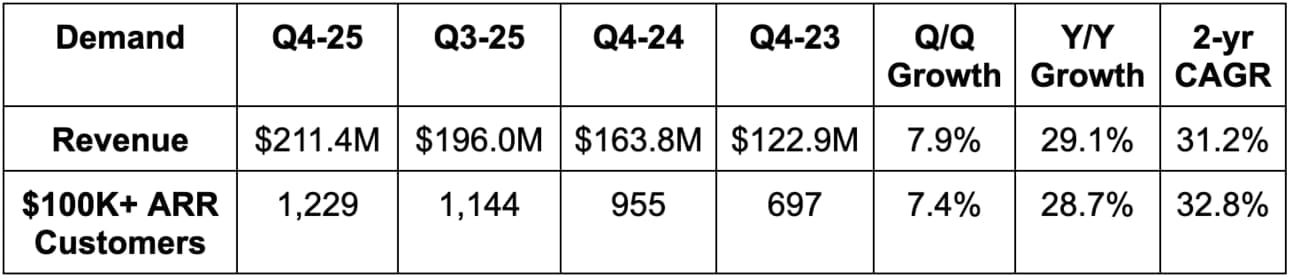

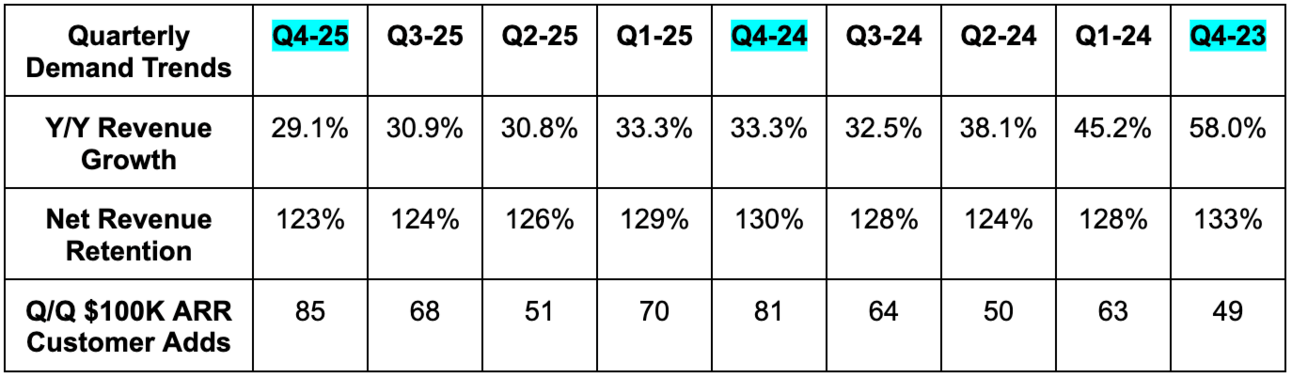

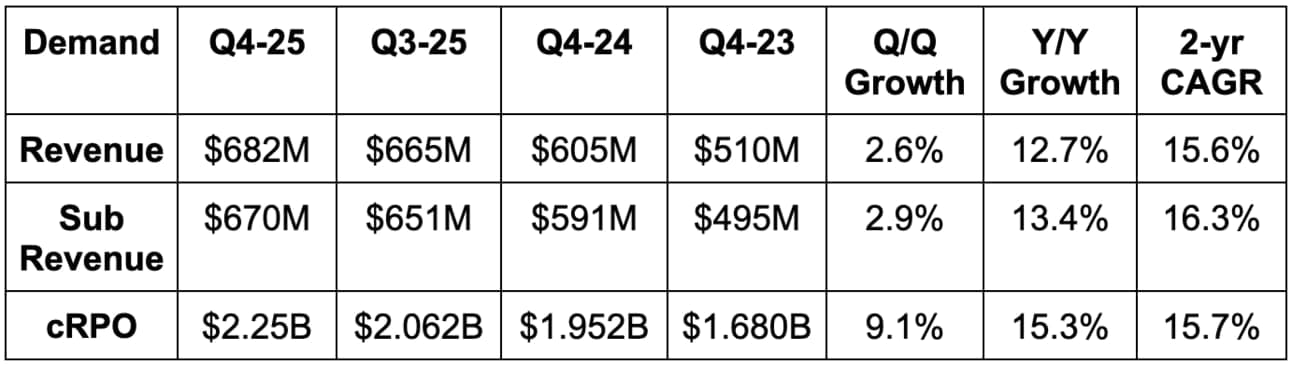

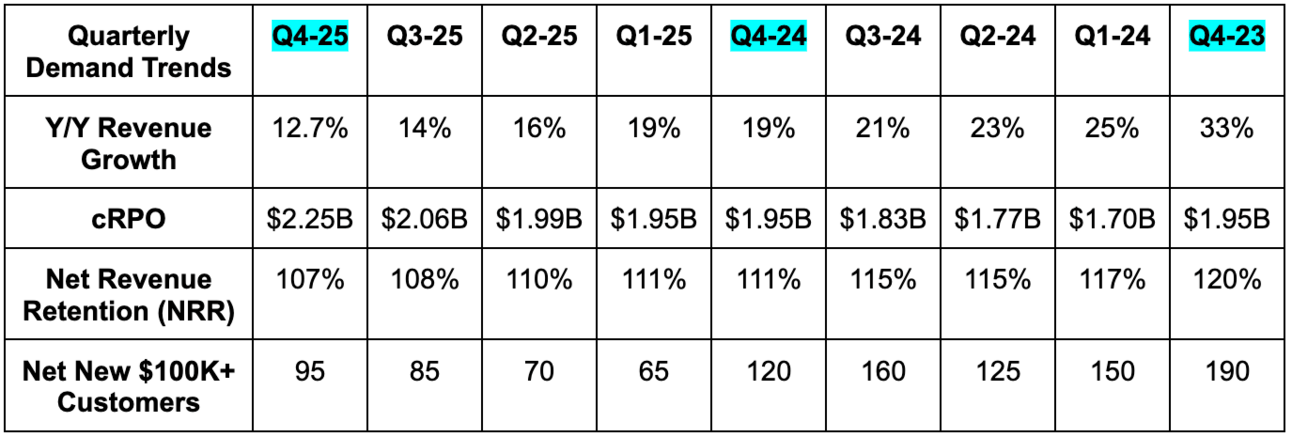

Demand:

- Beat revenue estimate by 2.4% & beat guidance by 2.9%.

- 31.2% 2-yr revenue CAGR vs. 31.7% Q/Q & 34.2% 2 Qs ago.

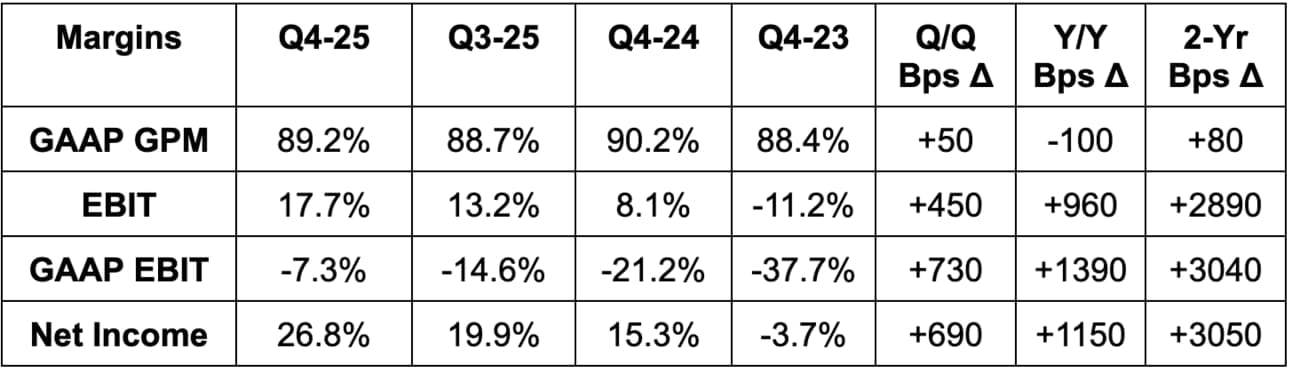

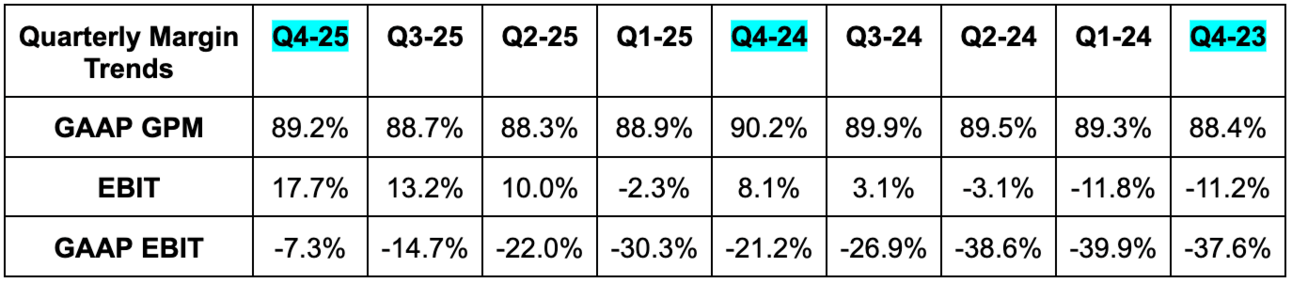

Profits & Margins:

- Beat EBIT estimates by 28.5% & beat guidance by 31.2%.

- Beat $0.23 EPS estimates by $0.10 & beat guidance by $0.10.

- Met gross profit margin (GPM) estimates.

- Beat FCF estimates by 43%.

Balance Sheet:

- $1B in cash & equivalents.

- Diluted share count rose 8.6% Y/Y.

- Basic share count rose 4.1% Y/Y.

- No debt.

Guidance & Valuation:

- Annual revenue guidance slightly missed by 0.3%. The high-end of the range was in line with estimates. Q1 revenue guidance met estimates.

- Annual EBIT guidance missed by 3.4%. Q1 EBIT guidance beat estimates.

- Annual $0.70 EPS guidance missed by $0.11. Q1 EPS guidance met estimates. Raised tax rate estimate to 22%.

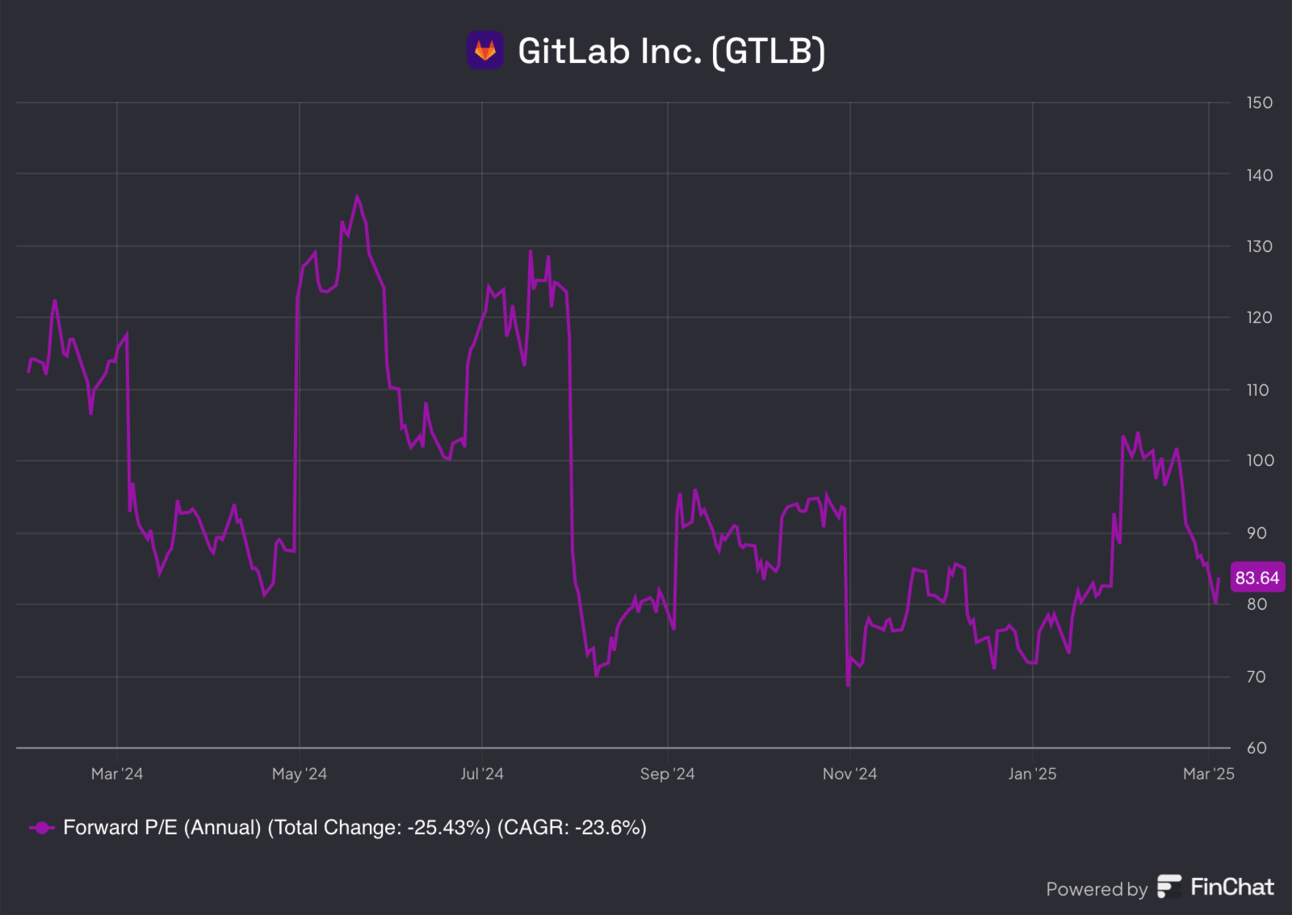

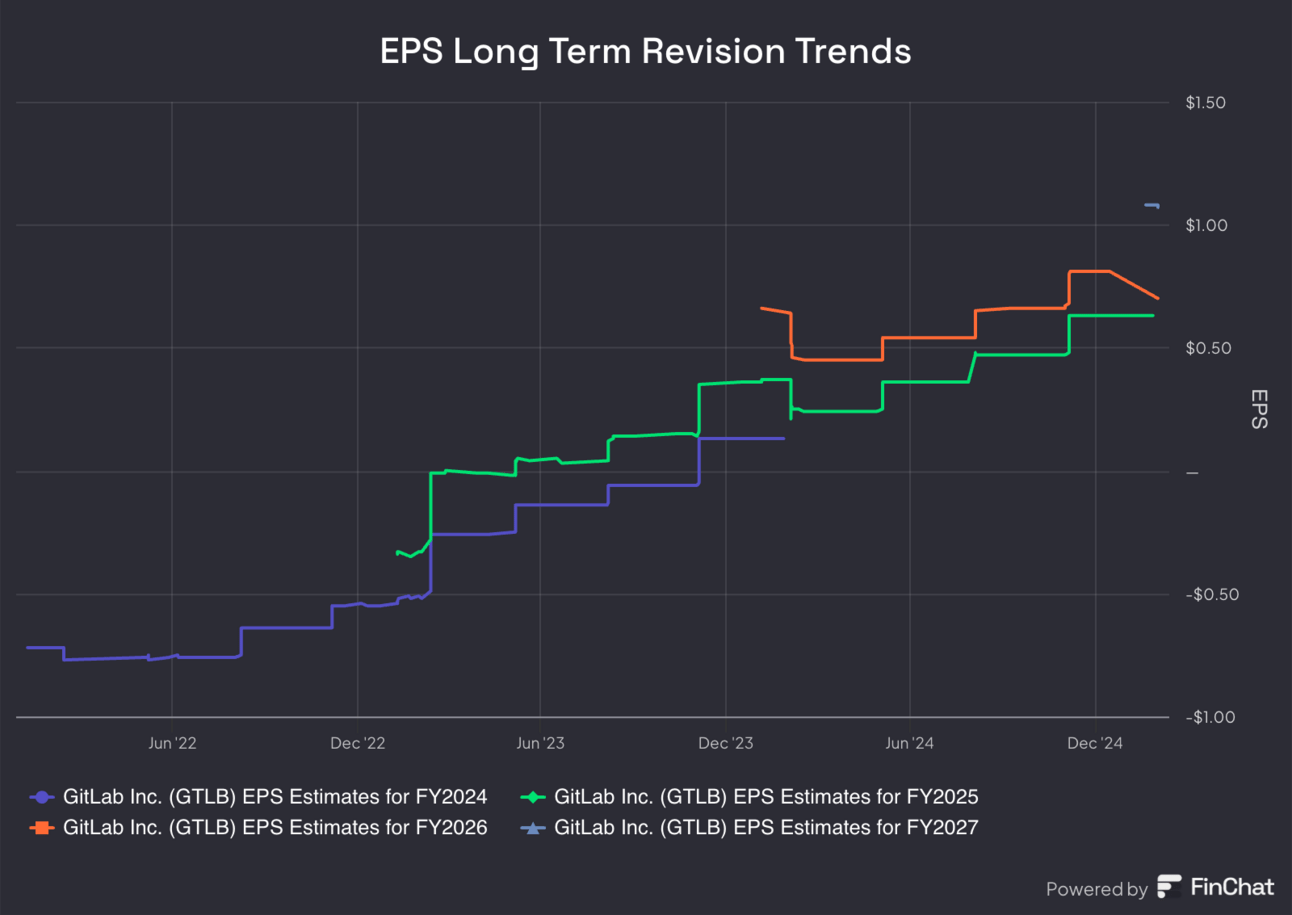

Gitlab trades for 83x forward EPS guidance. EPS is expected to fall this year due to large tax rate change headwinds before rising by 54% the year after.

b. Okta (OKTA)

Demand:

- Beat revenue estimate by 1.9% & beat guidance by 2.1%.

- Beat current remaining performance obligation (cRPO) guidance by 5.4%.

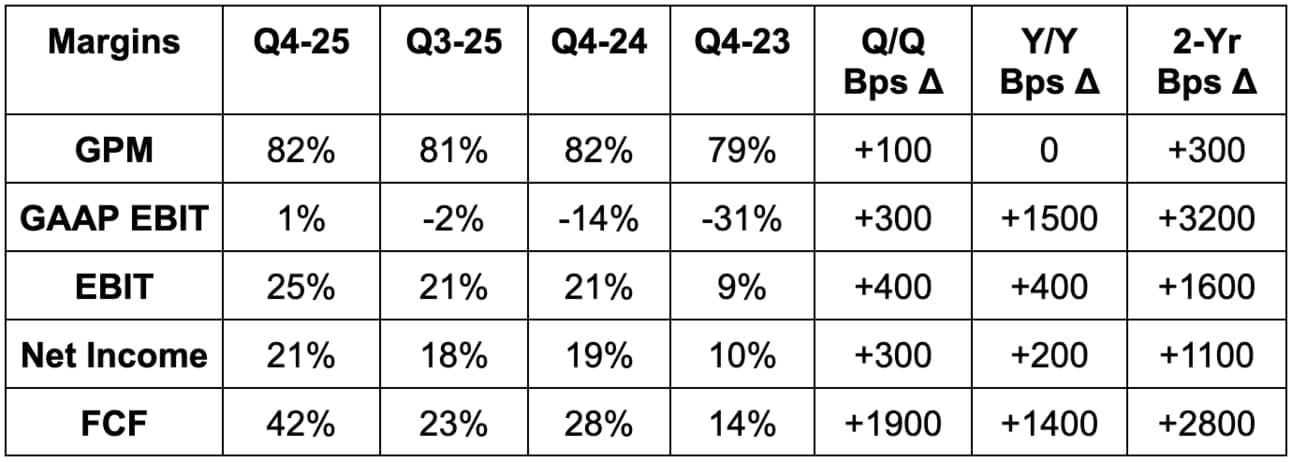

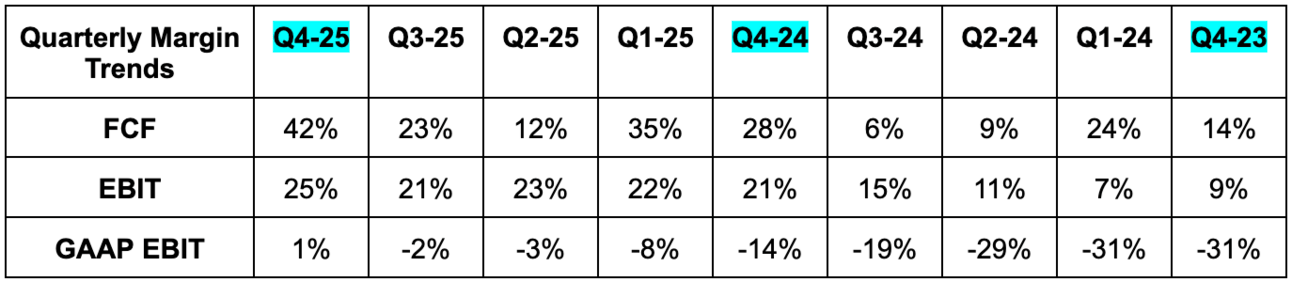

Profits & Margins:

- Beat EBIT estimates by 8% & beat guidance by 8.4%.

- Beat FCF estimates by 35% & beat guidance by 33%.

- Beat GPM estimates.

- Beat $0.74 EPS estimates by $0.04 & beat identical guidance by $0.04

Balance Sheet:

- About $2.5B in cash & equivalents.

- $500M in convertible senior notes.

- Diluted shares rose by 1.3% Y/Y.

Annual Guidance & Valuation:

- Annual revenue guidance beat by 2%.

- Annual EBIT guidance beat by 13%.

- Annual $3.17 EPS guidance beat by $.23.

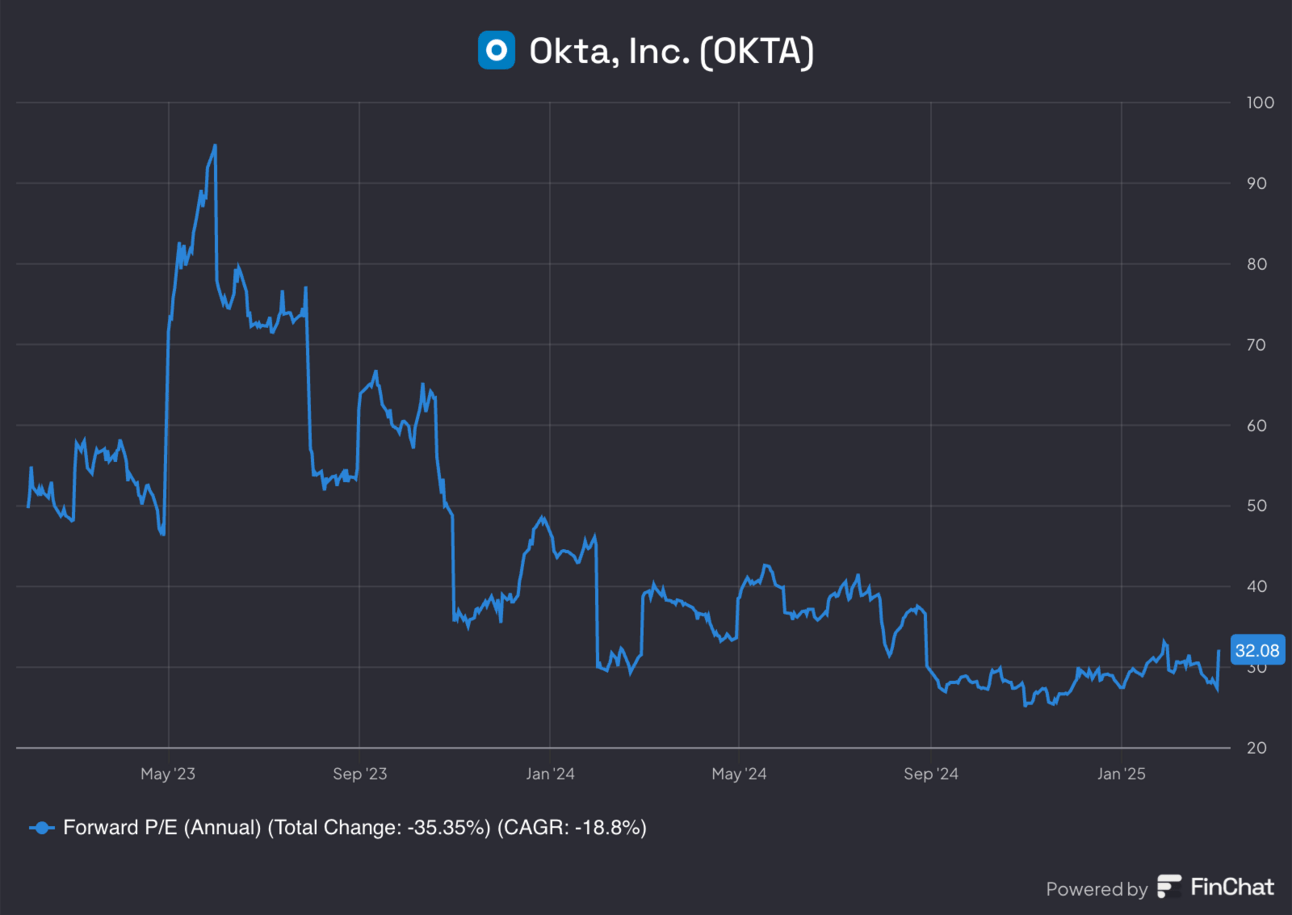

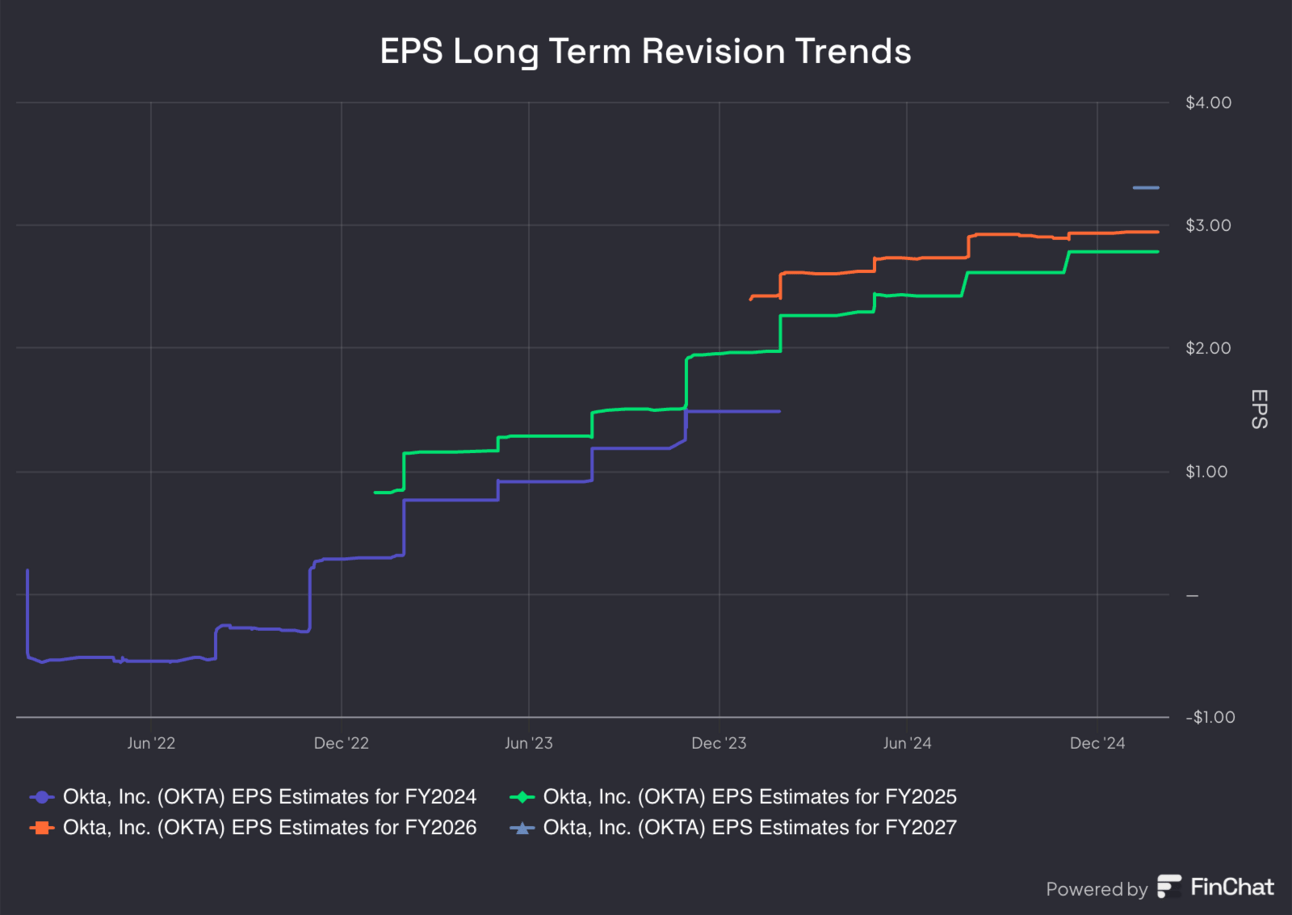

Okta trades for 32x its forward EPS guidance. Guidance implies 13% Y/Y EPS growth for this year. Analysts expect 6% EPS growth the following year.

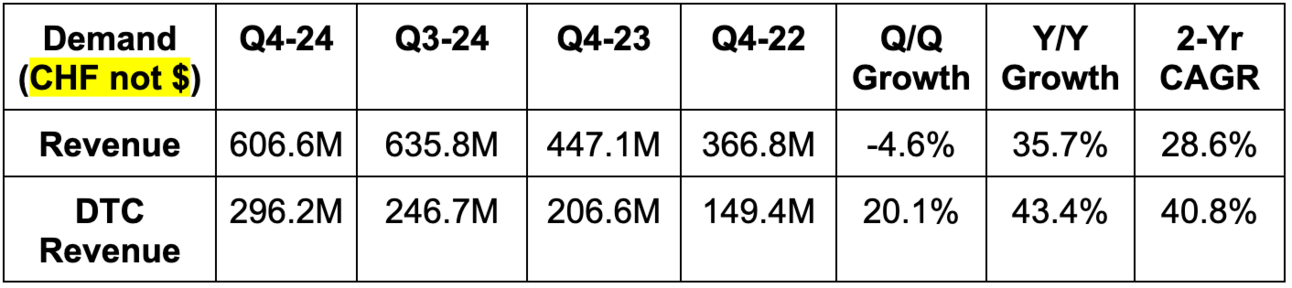

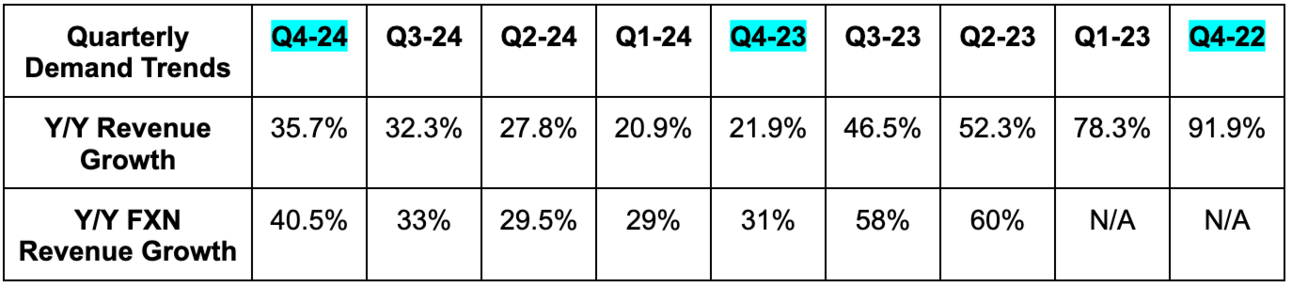

c. On Running (ONON)

Demand:

On Running beat revenue estimates by 2% & beat guidance by 5%. Direct to consumer (DTC) revenue beat by 2%. Wholesale revenue beat by 2.5%.

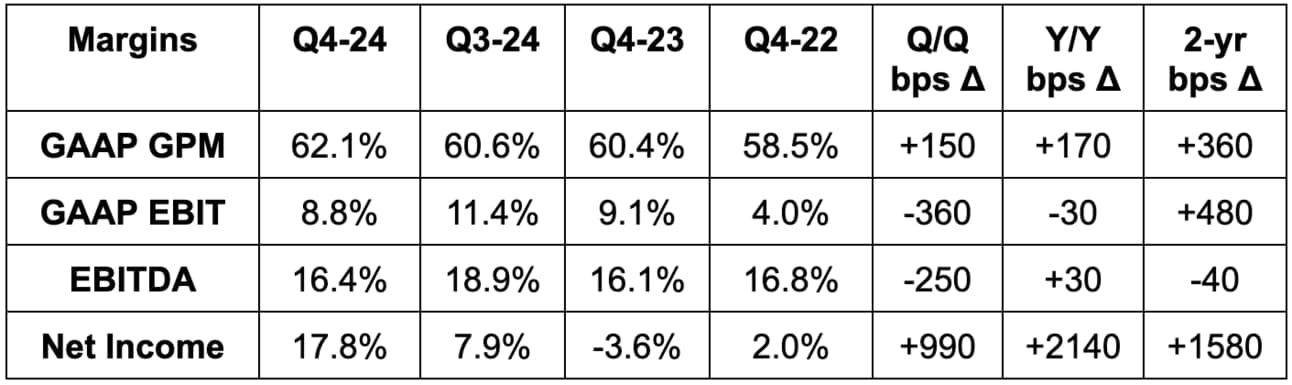

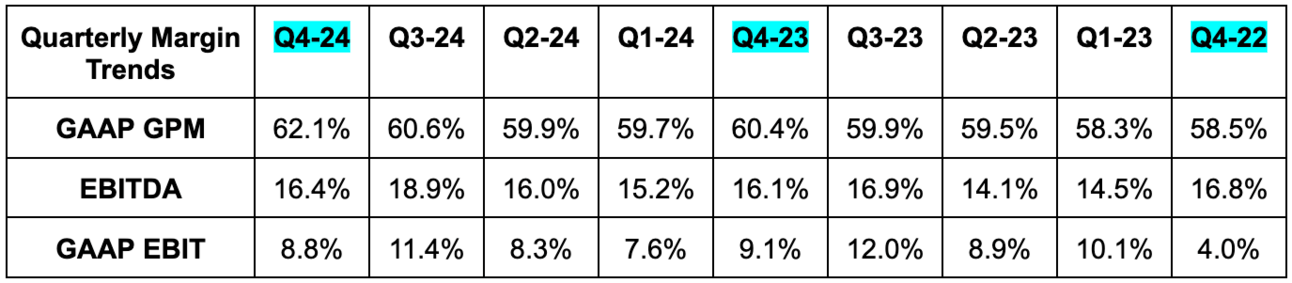

Profits:

- Beat 61.6% GAAP GPM estimates by 50 bps & beat guidance by about 50 bps.

- Beat 16.3% annual EBITDA margin guidance with a 16.7% EBITDA margin for the year. This also beat 16.4% margin estimates.

- Beat EBIT estimates by 2%.

- Beat $0.18 EPS estimates by $0.15. Net income and EPS are heavily influenced by foreign exchange gains and losses. I don’t pay much attention to this metric for this specific company.

Balance Sheet:

- CHF 924M in cash & equivalents.

- CHF 419M in inventory.

- No debt.

- Diluted share count rose 1.6% Y/Y.

Guidance & Valuation:

- The company guided to CHF 2.94 billion in 2025 revenue. This missed by 0.5%. It also sees at least 27% foreign exchange neutral (FXN) growth for 2025.

- It also guided to a 60.5% GPM for the year, which missed 60.9% estimates.

- Its 17.3% annual EBITDA margin guidance met estimates.

- The company is tracking ahead of its multi-year targets and “enters 2025 with remarkable brand momentum.”

On trades for 48x 2025 earnings estimates, which should be stable following this report. EPS is expected to grow by 26% this year and by 36% next year.

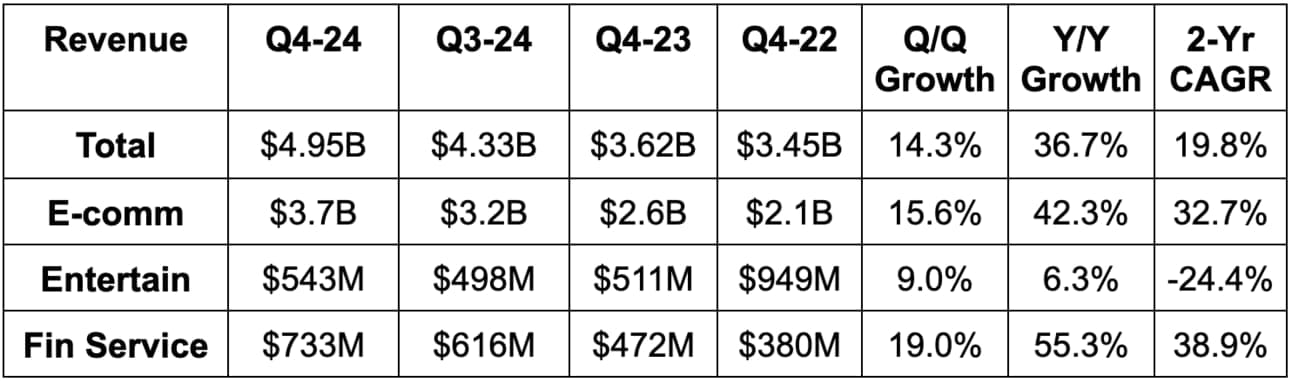

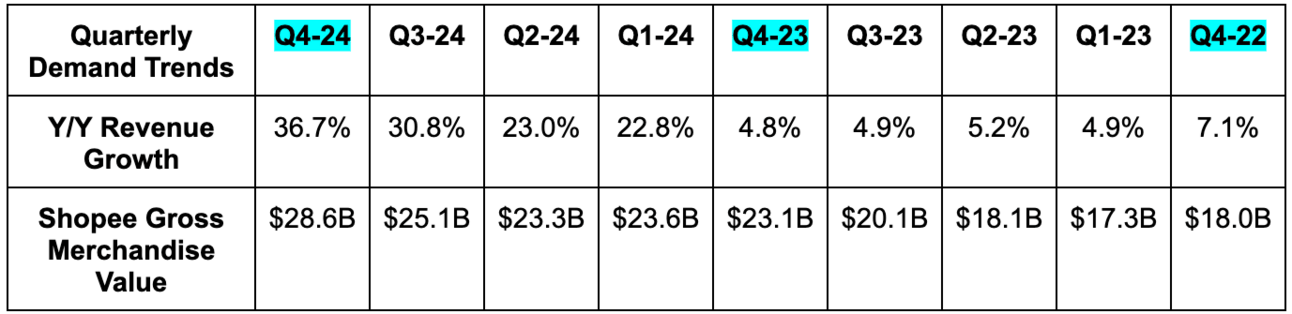

d. Sea Limited (SE)

Demand:

- Beat revenue estimates by 6.9%. Its 19.8% 2-year revenue CAGR vs. 17.1% Q/Q & 13.4% 2 Qs ago.

- E-commerce revenue beat by 5%; entertainment revenue beat by 2%; financial services revenue beat by 13.5%.

- E-commerce gross merchandise value (GMV) beat estimates by 5%.

- Entertainment active and paying user growth both missed estimates by 2.5% and 1%, respectively.

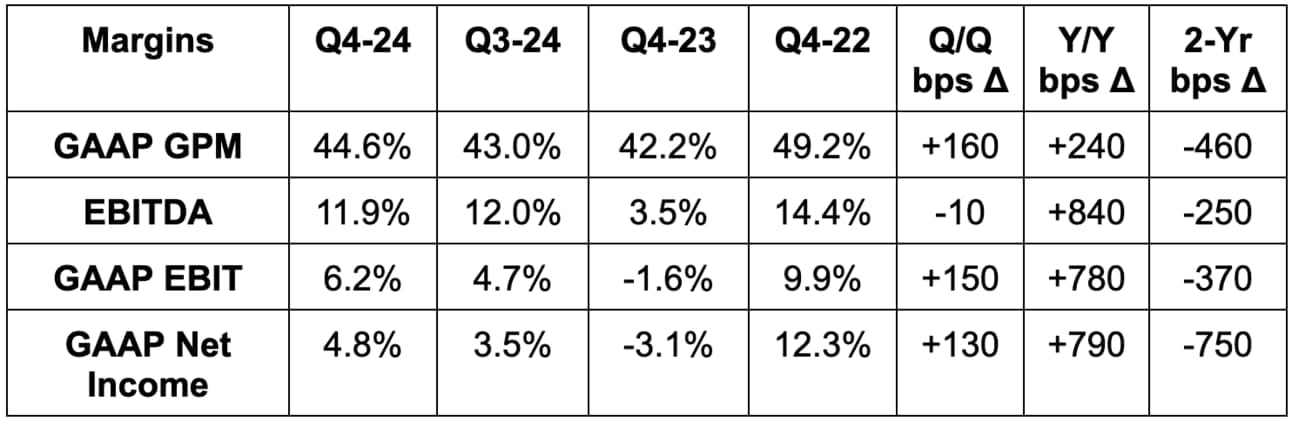

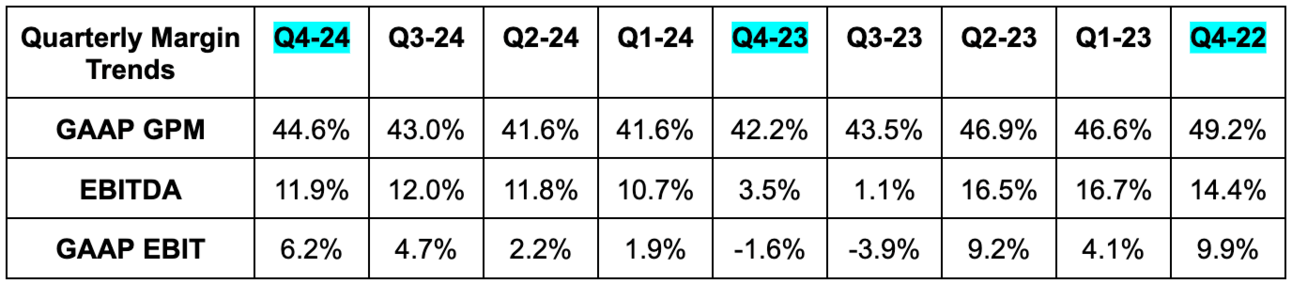

Profits & Margins:

- Beat 43.6% GAAP GPM estimates by 100 bps.

- Beat EBITDA estimates by 3.3%.

- E-commerce EBITDA nearly doubled estimates. Financial services EBITDA beat estimates by 5.5%. Entertainment EBITDA missed by 5%.

- Roughly met GAAP EBIT estimates.

- Missed $0.44 GAAP EPS estimates by $0.05.

Balance Sheet:

- $8.6B in cash & equivalents. $1.65B in restricted cash.

- $2.6B in convertible senior notes; $380M in debt.

- $9.9B in total cash, equivalents & investments.

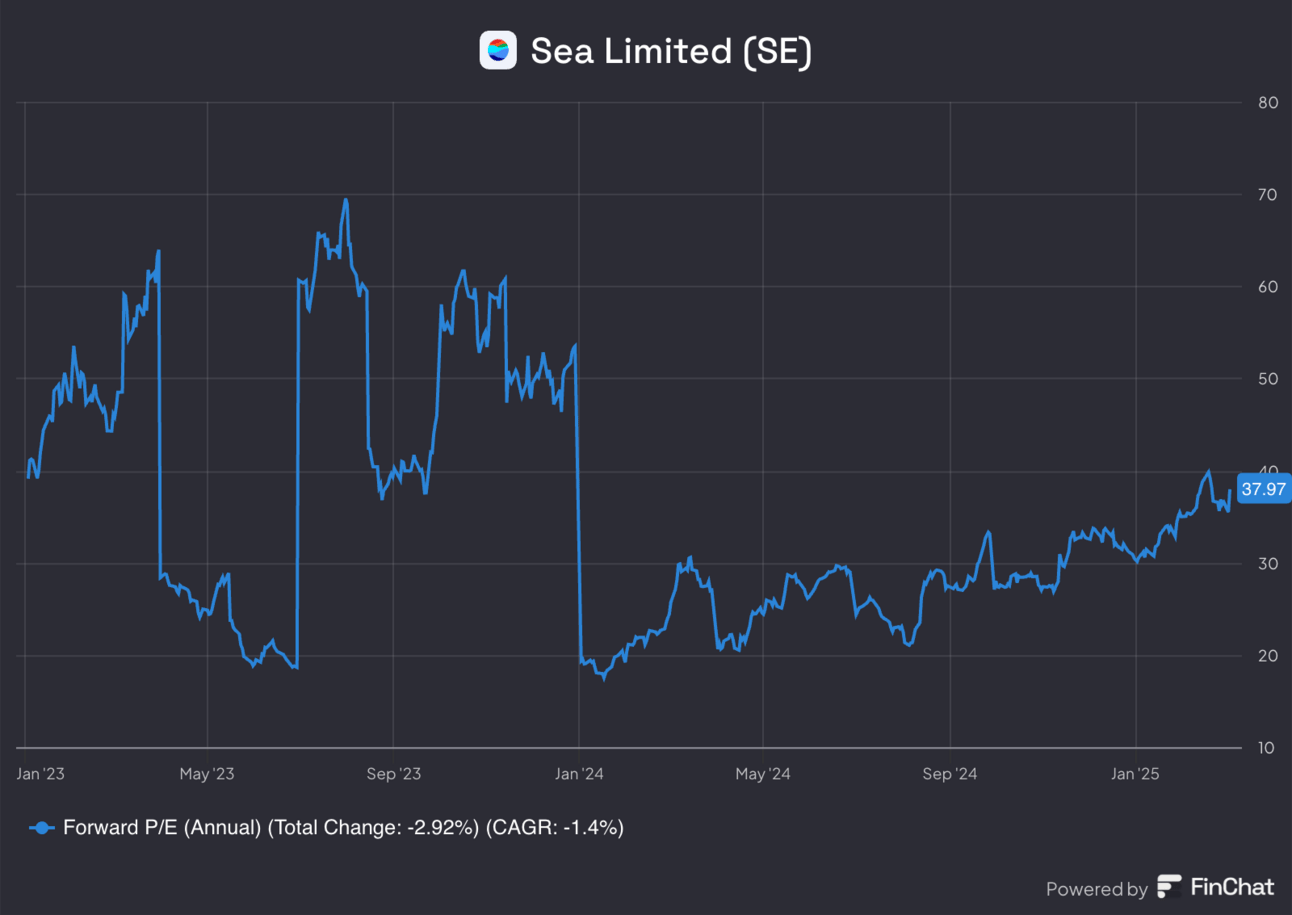

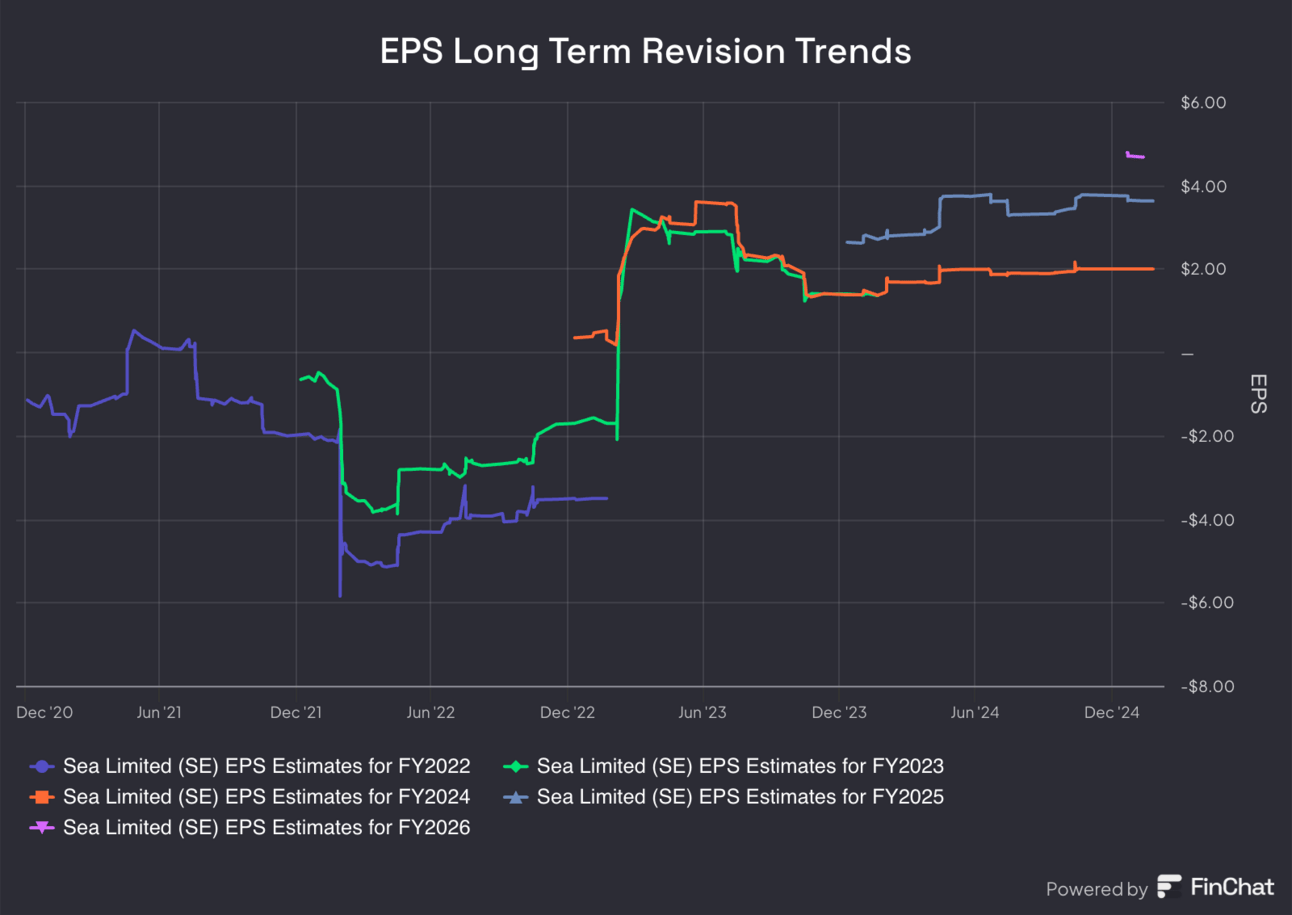

Valuation:

The company trades for 38× 2025 EPS. EPS is expected to grow by 82% this year and by 29% next year.

2. CrowdStrike (CRWD) — Detailed Earnings Review

a. CrowdStrike 101

CrowdStrike is a cloud-native endpoint cybersecurity company. It competes directly with SentinelOne, Microsoft Defender and Palo Alto. Its bread-and-butter is called endpoint detection and response (EDR), which replaces legacy anti-virus (AV). Beyond EDR, it offers applications in cloud security, log management, forensics, identity, data protection etc. to round out its “Falcon Platform.” Falcon’s edge is in its ability to digest near-endless amounts of data to automate and uplift breach protection. CrowdStrike uses its large and diverse dataset to constantly improve Falcon’s efficacy and use cases… all with a single console and single agent to ensure superior interoperability. It can recycle this same data over and over again to efficiently develop new products for a single interface. More utility without adding complexity or cost. More margin-accretive cross-selling too.

Important Endpoint Security Acronyms:

- Endpoint detection and response (EDR) provides end-to-end visibility, constant monitoring and full protection of endpoints (like an iPhone). It unveils, prioritizes and responds to threats.

- Managed detection and response (MDR) encompasses CrowdStrike’s team of threat hunters to augment EDR with human touch when needed.

- Extended detection and response (XDR) is EDR with 3rd party, non-endpoint data sources infused. The incremental data sharpens breach protection and extends it beyond the endpoint.

Important Log Management Ideas & Acronyms:

CrowdStrike’s security data lake is a vital complement to every single product it offers. It uses log scale to ingest, logarithmically organize and store data. Broader data ingestion means better breach protection, as Falcon’s products are more properly trained on larger sets of relevant insight. CrowdStrike also says customers get lower cost and faster querying speeds with it. This allows for ingestion with more scale and faster time to value.

- As an important aside, log scale is a key ingredient for Falcon XDR. It is instrumental in XDR being able to onboard needed data sources in a scalable and efficient manner.

- Security Information and Event Management (SIEM) aggregates security logs/data to help organizations uncover and remediate threats faster. Log scale is closely related to SIEM, as log scale is what actually collects data from various sources to be utilized here.

Important Cloud Security Acronyms (alphabet soup, I know):

- Cloud Security & Posture Management (CSPM) tells you about your vulnerabilities and misconfigurations.

- Cloud Infrastructure Entitlement Management (CIEM) tells you who is entering a software environment. It tells you if these entrants are allowed and exactly what they can do.

- Cloud Workload Protection (CWP) is a preventative measure to observe if anything bad is being done by entrants. This sounds the alarm bell while preventing and remediating cloud infrastructure attacks. It’s closely related to CSPM and CIEM.

- Application Security Posture Management (ASPM) locates and facilitates the safe control of cloud apps.

- Cloud Native Application Protection Platform (CNAPP) is the overall suite tying all of these cloud products together.

In the realm of GenAI, Charlotte AI is CrowdStrike’s security copilot. It levels up the capabilities of security analysts by actively detecting anomalies, orchestrating remediation and fixing issues in an automated fashion. It’s a force multiplier for efficiency gains in a world where most companies are starved for more security resources and talent. All of this pushes beginner-level security analysts to much higher levels of capability.

Falcon Flex:

Falcon Flex is CrowdStrike’s selling program to bolster customer “flex”ibility over product purchases. It allows clients to pay for only the modules they need as they need them. There are no pre-set commitments and no mandated usage; they can run through credits at their leisure. This will be the firm’s main go-to-market strategy going forward, as it has shown to lower cross-selling friction, raise deal size and create stickier customers.