Table of Contents

1. Dell & Workday — Brief Earnings Snapshots

a. Dell

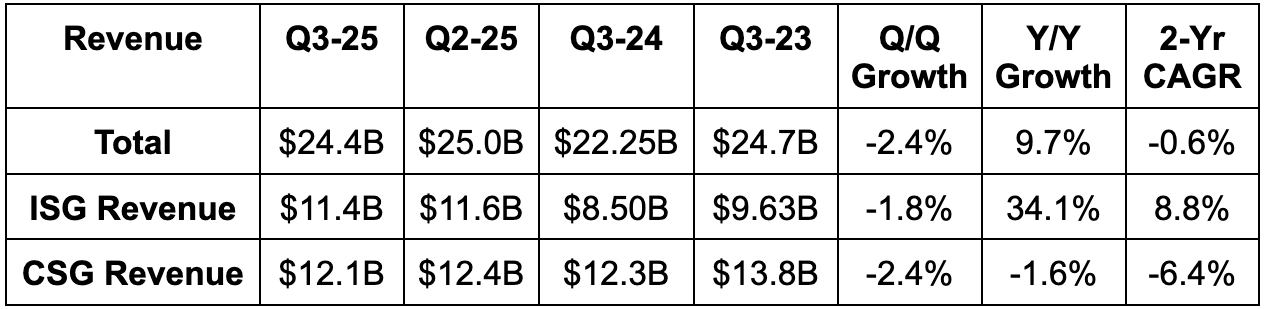

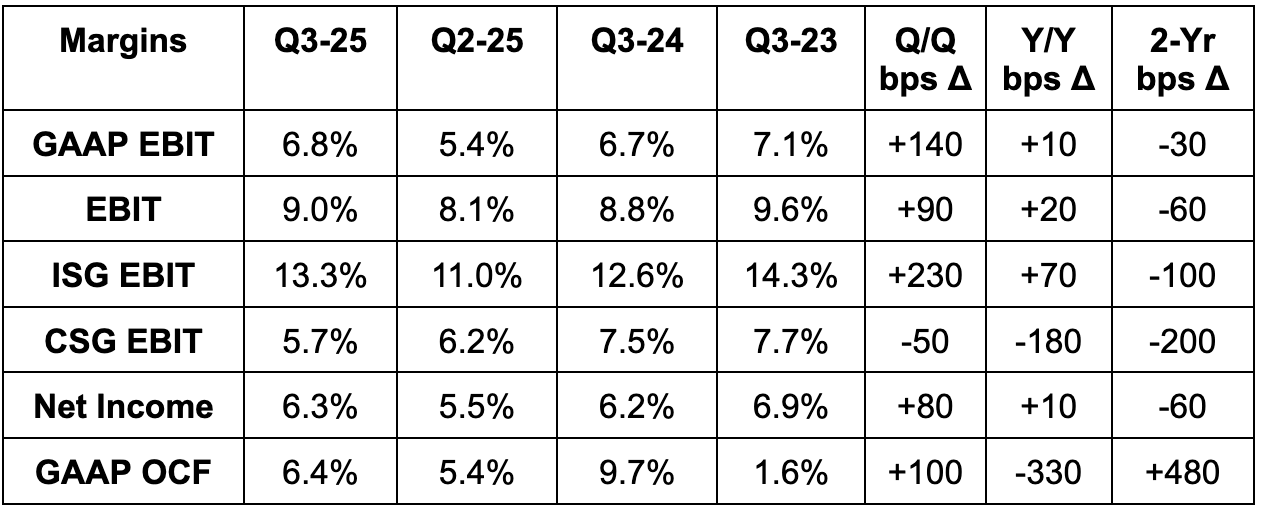

Results:

- Missed revenue estimate by 1.2% & missed guidance by 0.4%.

- Beat $2.00 EPS estimate & beat identical guidance by $0.15 each.

- Missed $1.40 GAAP EPS estimate by $0.18.

- Missed $1.3 billion free cash flow (FCF) estimate by about $600 million.

- Missed 22.3% gross profit margin (GPM) estimates by 50 basis points (bps; 1 basis point = 0.01%).

Balance Sheet:

- $6.6 billion in cash & equivalents.

- $25 billion in total debt.

- Stock comp dollars fell 13% Y/Y. Guided to about 0.2% Q/Q dilution.

- Dividends rose 17% Y/Y.

Guidance & Valuation:

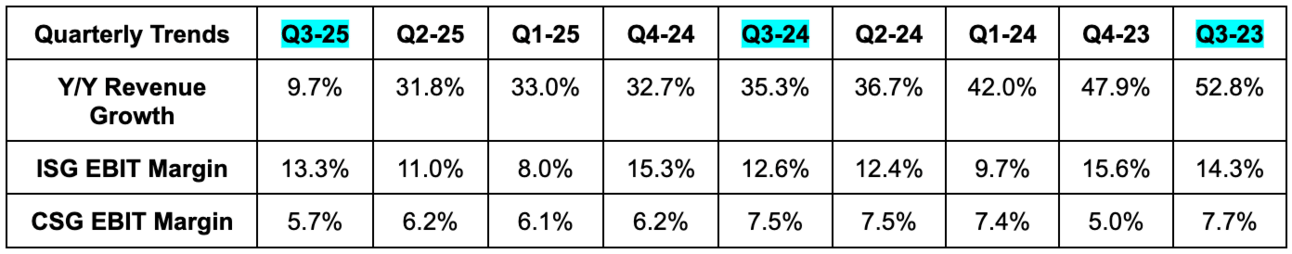

Q4 revenue guidance missed by 2.8% while $2.50 Q4 EPS guidance missed by $0.14. It lowered annual growth forecasts from 10% Y/Y to 9% Y/Y. It raised its annual EPS guidance by a penny due to the Q3 beat.

EPS is expected to compound at a 16% clip over the next two years.

b. Workday

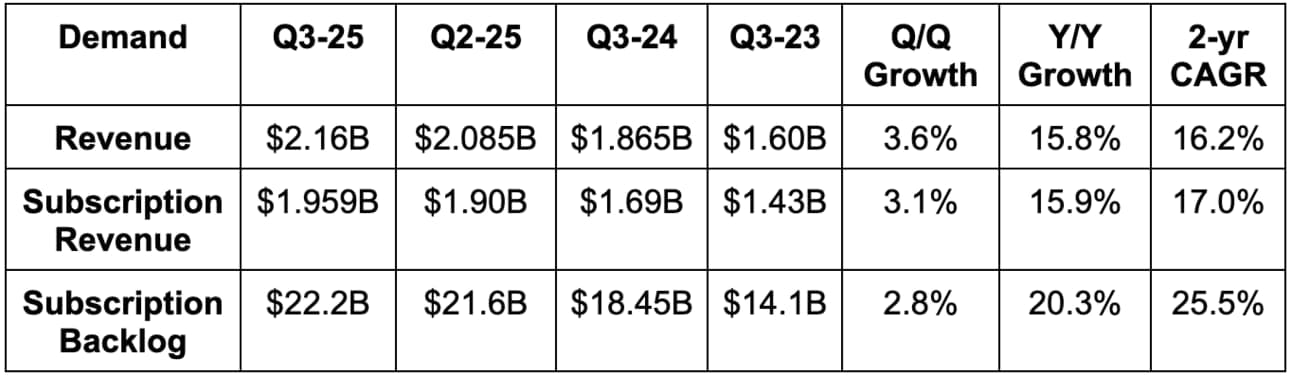

Results:

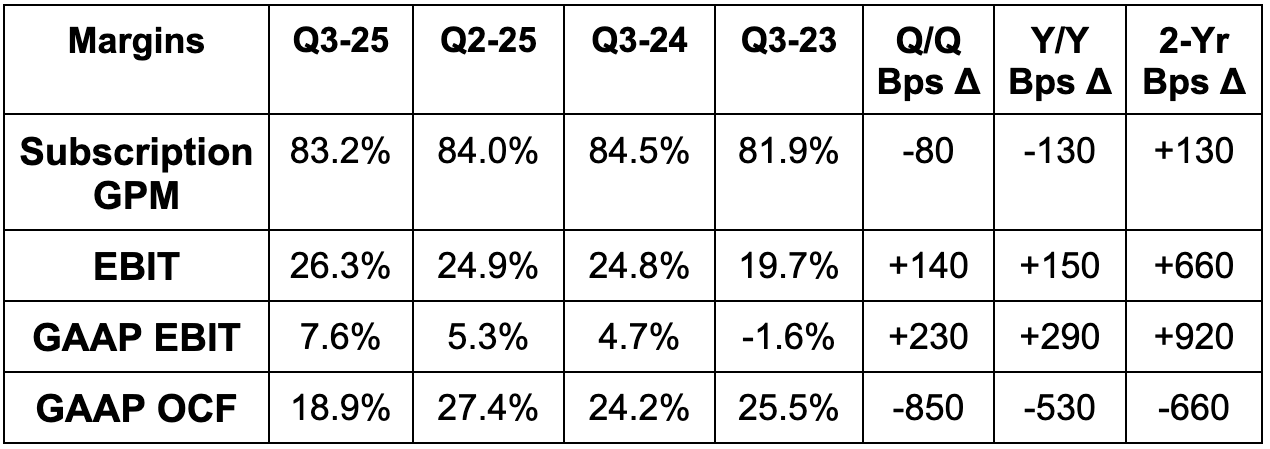

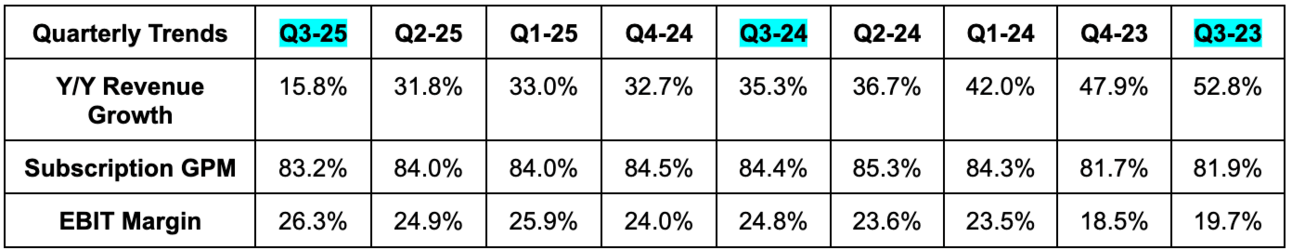

- Slightly beat subscription revenue guidance by 0.2%.

- Beat revenue estimates by 1.4%.

- Beat 25.5% EBIT margin estimates by 80 bps & beat 25.3% EBIT margin guidance by about 100 bps.

- Beat $1.76 EPS estimates by $0.13.

- Missed $508 million operating cash flow (OCF) estimates by about $100 million. This metric is very lumpy on a quarterly basis.

Balance Sheet:

- $6.2B in cash & equivalents.

- $3 billion in debt.

- Diluted share count rose by 0.8% Y/Y.

Guidance & Valuation:

- Lowered Q4 subscription revenue guidance by 0.8%, which represents a slight lowering of annual revenue guidance.

- Slightly lowered Q4 EBIT margin guidance, but reiterated full year margin expectations.

EPS is expected to compound at a 19% clip for the next two years.

2. CrowdStrike (CRWD) – Detailed Earnings Review

a. CrowdStrike 101

CrowdStrike is a next-gen, cloud-native endpoint cybersecurity company. It competes directly with SentinelOne, Microsoft Defender and Palo Alto. Its bread-and-butter is called endpoint detection and response (EDR), which replaces legacy anti-virus (AV). Beyond EDR, it offers applications in cloud security, log management, forensics, identity, data protection etc. to round out its “Falcon Platform.” Falcon’s edge is in its ability to digest near-endless amounts of data to automate and uplift breach protection. CrowdStrike uses its large and diverse dataset to constantly improve Falcon’s efficacy and use cases… all with a single console and single agent to ensure superior interoperability. It can recycle this same data over and over again to efficiently develop new products for a single interface. More utility without adding complexity or cost.

Important Endpoint Security Acronyms:

- Endpoint detection and response (EDR) provides end-to-end visibility, constant monitoring and full protection of endpoints (like a company iPhone). It unveils, prioritizes and responds to over-served threats.

- Managed detection and response (MDR) encompasses CrowdStrike’s team of threat hunters to augment EDR with human touch when needed.

- Extended detection and response (XDR) is EDR with 3rd party, non-endpoint data sources infused. The incremental data sharpens breach protection and extends it beyond the endpoint.

Important Log Management Ideas & Acronyms:

CrowdStrike’s security data lake is a vital complement to every single product it offers. It uses log scale to ingest, logarithmically organize and store data. Broader data ingestion means better breach protection, as Falcon’s products are more properly trained on larger sets of relevant insight. CrowdStrike also says customers get lower cost and faster querying speeds with it. This allows for ingestion with more scale and faster time to value.

- As an important aside, Log Scale is a key ingredient for Falcon XDR. It is instrumental in XDR being able to onboard needed data sources in a scalable and efficient manner.

- Security Information and Event Management (SIEM) aggregates security logs/data to help organizations uncover and remediate threats faster. Log Scale is closely related to SIEM, as Log Scale is what actually collects data from various sources to be utilized here.

Important Cloud Security Acronyms (alphabet soup, I know):