Today’s Piece is Powered by Quartr:

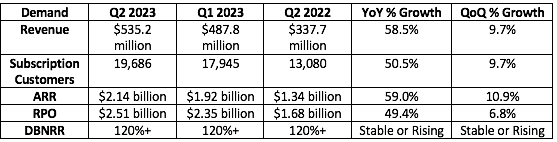

1. Demand

“As organizations respond to macroeconomic conditions, they are looking to standardize with a new security partner with better protection & less cost. Our ability to deliver immediate ROI & consolidate across the security stack sets us apart.” -- Founder/CEO George Kurtz

CrowdStrike guided to $514.8 million in revenue for the quarter while analysts expected $517.2 million. It generated $535.2 million in sales, beating its expectations by 4% and analyst estimates by 3.5%.

Per The Bloomberg Terminal, analysts were also looking for:

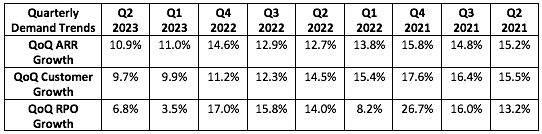

- Net new Annual Recurring Revenue (ARR) of $191 million. CrowdStrike added $218.1 million, beating expectations by 14.1%.

- Beats of this size in previous quarters were due to especially large deals being signed. This strength was broad-based and unrelated to any single contract.

- 19,631 customers. CrowdStrike reported 19,686, beating expectations slightly.

More Demand Context:

- CrowdStrike is the 2nd fastest software company ever to reach $2 billion in ARR.

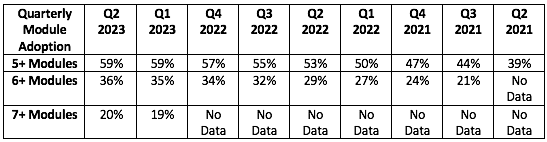

- CrowdStrike stopped disclosing customers with 4+, 5+ & 6+ modules after Q4 2022 and began disclosing 5+, 6+ & 7+ module customers instead. Module adoption remains brisk.

- More module adoption is not only a revenue driver, but a margin expander as well.

- This was the first quarter where we got no sequential up-tick in 5+ module customers. This isn’t a massive deal, but I’d like to see momentum resume next quarter.

- Please note that customer wins from its Managed Security Service Provider (MSSP) segment are not included in the total customer count. And that contribution continues to become more and more material. MSSP growth eclipsed 150% YoY this quarter.

“We are still in the early innings of new customer growth.” — CFO Burt Podbere."

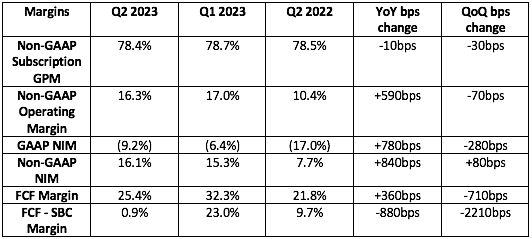

2. Profitability

CrowdStrike guided to:

- $66.4 million in Non-GAAP net income while analysts expected $66 million. It generated $85.9 million, shattering its expectations by 29.3% and analyst estimates by 30%. This came out to $0.36 in earnings per share which beat by a similarly wide margin.

- $71.9 million in Non-GAAP operating income. It generated $87.3 million, beating expectations by 21.4%

Analysts also expected:

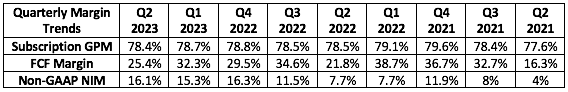

- A 78.8% subscription gross margin. It missed expectations by 40bps.

- $139.3 million in FCF. It posted $135.8 million, missing expectations by 2%. This was my least favorite part of the call, but it reiterating its 30% minimum FCF margin guide for the year made me feel much better.

- $106.2 million in SBC. CrowdStrike paid out $131.6 million as it continues to aggressively hire. This was the other negative from the call… but it’s the price to pay to rapidly hire new talent to support growth. The lowering of its full year diluted share count eased my concern here as well.

More Margin Context:

- CrowdStrike’s effective tax rate this quarter was less than 1% vs. just under 1.5% YoY. This aided net income growth a bit which is why the operating income beat was smaller.

- The Gap between income statement and cash flow statement margins is largely via stock based compensation. That’s why I include FCF - SBC margin.