Today’s piece is powered by my favorite research platform:Stratosphere.io.

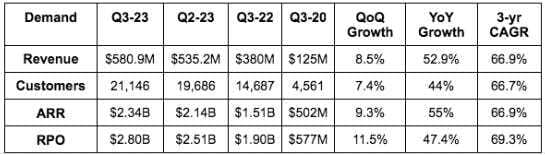

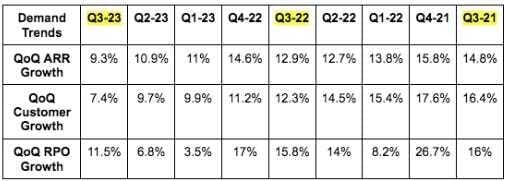

1. Demand

- Beat its revenue guide by 1.5% and estimates by 1%

- Missed customer estimates by 0.8%.

- Met Annual Recurring Revenue (ARR) estimates.

- ARR missed CrowdStrike’s internal expectations (which weren’t publicly shared) -- more on this later.

More Demand Context:

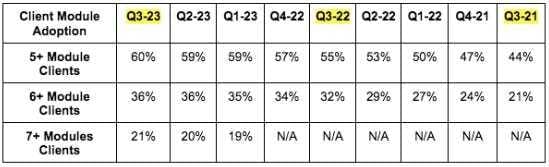

- CrowdStrike stopped disclosing customers with 4+, 5+ & 6+ modules after Q4 2022 and began disclosing 5+, 6+ & 7+ module customers instead. Module adoption remains brisk.

- More module adoption is not only a revenue driver, but a margin expander as well. Why? Because there are virtually no added operating expenses for CrowdStrike selling every module after the first.

- Partner-sourced ARR grew 55% YoY.

- Clients contributing over $1 million in net new ARR rose 67% YoY.

- Gross retention remains at record highs over 98%.

- Net retention was at its highest level in 7 quarters. This implies a reading over 125%.

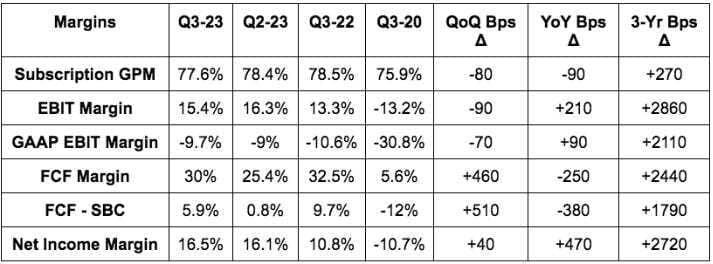

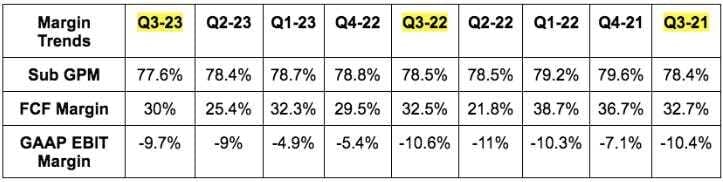

2. Profitability

- Beat its EBIT guide by 19.2% & beat estimates by 16.6%.

- Beat its net income guide & beat estimates by 29%.

- Beat free cash flow (FCF) estimates by 7%.

More Margin Context:

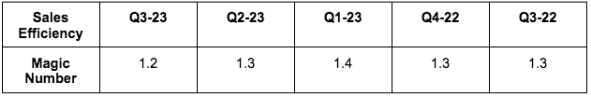

Magic number refers to net new subscription revenue multiplied by 4 and then divided by the company’s sales and marketing expense. Anything above 1.0 is a sign to Podbere to lean even more heavily into growth spend. Still, this is CrowdStrike’s lowest magic number since going public.

Fundamental stock research just got way easier. Thanks to Stratosphere.io, no longer must we dig through endless SEC filings for relevant information.