As always, please feel free to share this far & wide if you find the piece valuable. That is how we grow.

1. Demand

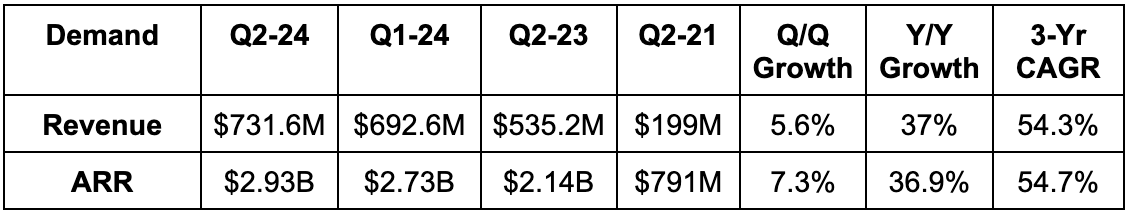

- Beat revenue estimates by 1% & beat guidance by 1.3%.

- Beat annual recurring revenue (ARR) estimates by 2.8%. Some data sources had higher estimates which CrowdStrike slightly beat. This ARR performance was also ahead of CrowdStrike’s implied guidance.

2. Profitability

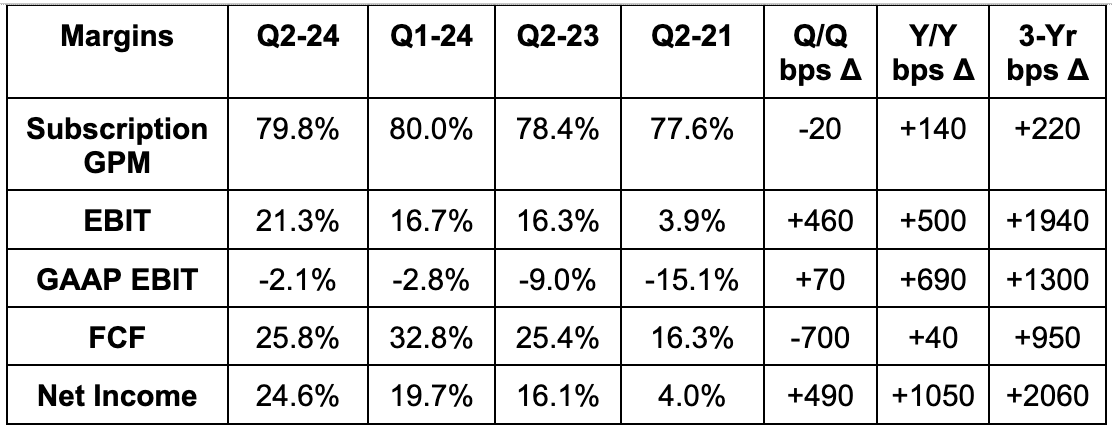

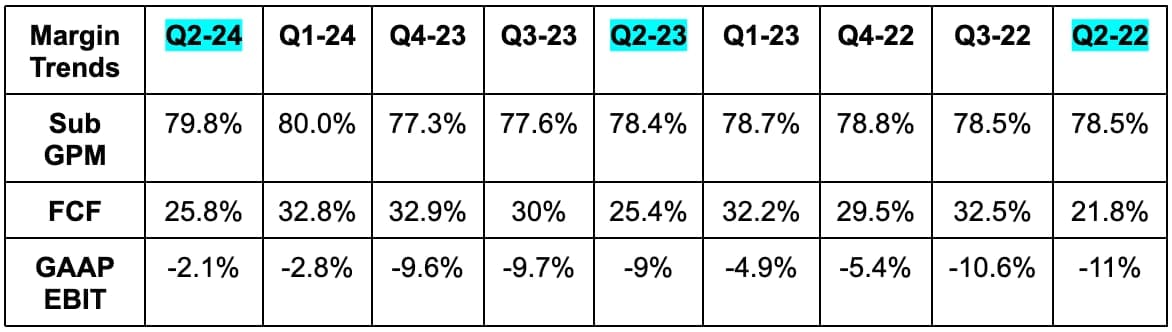

- Beat EBIT estimates by 30% & beat guidance by 30%.

- Beat $0.56 EPS estimates & guidance by $0.18.

- Beat FCF estimates by 4.8%.

3. Annual Guidance

- Raised revenue guidance by 0.5% & beat estimates by 0.4%. This represents about 35.5% Y/Y growth.

- Raised EBIT guidance by 18.2% & beat estimates by 18%.

- Raised $2.38 EPS guidance by $0.42 & beat estimate by $0.40.

- Reiterated 30% FCF margin guidance for the year.

- Reiterated 2% dilution for this year and under 3% next year as it re-ramps hiring. Important.

Next quarter guidance was slightly ahead on revenue and well ahead on profit metrics.

4. Balance Sheet

- $3.17B in cash & equivalents.

- $740M in debt.

- Diluted shares up 4.3% Y/Y; basic shares up 2.2% Y/Y.