“There is no vendor in the market with our vision, our platform or our ability to execute at scale.” — CEO/Founder/President George Kurtz

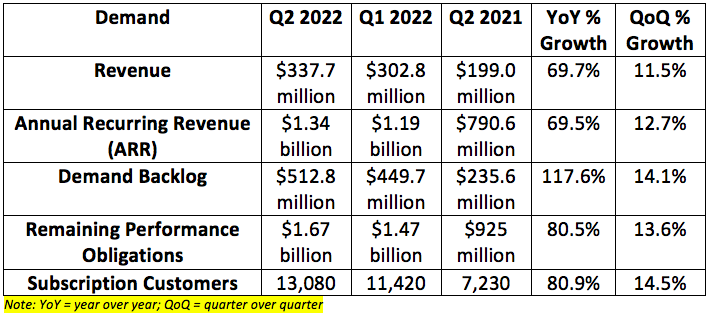

1. Demand

CrowdStrike internally guided to $318.3-$324.4 million in revenue for this quarter. Analysts were expecting $323.2 million in revenue. CrowdStrike posted $337.7 million beating the high point of its internal guide by 4.1% and analyst estimates by 4.5%.

The elevated backlog and remaining performance obligation growth both offer strong forward-looking indicators for continued elevated revenue growth going forward.

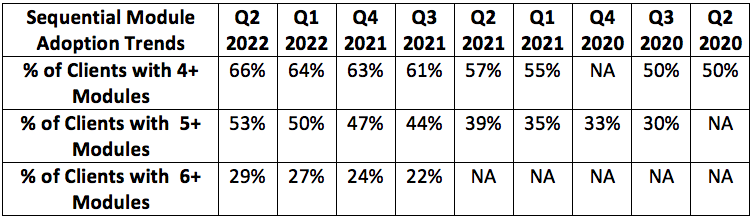

This module adoption trend (pictured above) is a strong sign of more margin expansion to come. It costs the company virtually nothing to onboard additional modules for a client after the first has been integrated — additional module purchases directly feed CrowdStrike’s profitability.

As a reminder, CFO Burt Podbere recently updated investors on CrowdStrike’s long term plans to introduce 1-2 new modules every year. Areas such as Zero Trust and Cloud Workloads will likely be 2 of the major themes of these debuts going forward.

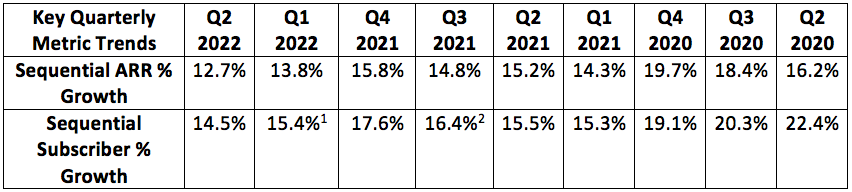

- Q1 fiscal 2022 subscriber growth includes an inorganic boost from CrowdStrike’s acquisition of Humio. Without this boost, sequential subscriber growth would have been 14.0%.

- Q3 fiscal 2021 subscriber growth includes an inorganic boost from CrowdStrike’s acquisition of Preempt Security. Without this boost, sequential subscriber growth would have been 15.4%.

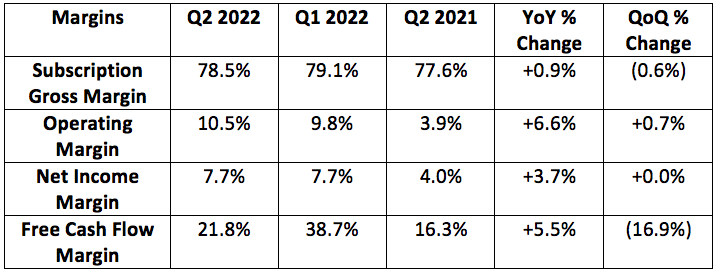

2. Margins

CrowdStrike internally guided to $26.3-$30.7 million in operating income for the quarter. It posted $35.3 million beating the high point of its internal guide by 15%.

CrowdStrike internally guided to $0.07-$0.09 in earnings per share (EPS) for the quarter. Analysts were expecting the company to earn $0.09 per share. CrowdStrike posted $0.11 per share beating the high point of its internal guide and analyst estimates by $0.02.

Subscription gross margin will continue to fluctuate but the company expects it to remain at least in the 77%-82% range in the years to come.

Stock based compensation as a % of revenue was 22.5% of company sales vs. 18.9% of company sales year over year. This is a massive company cost.

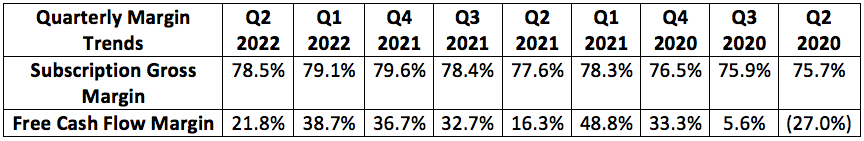

The second quarter is a seasonally weak period for CrowdStrike’s subscription gross margin and free cash flow margin -- as depicted in the chart below.

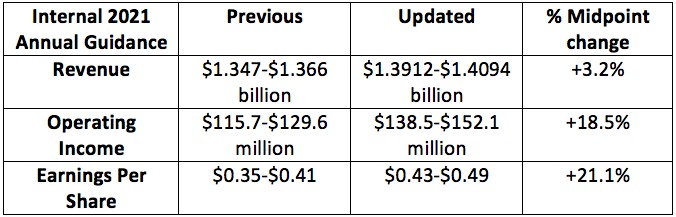

3. Guidance Updates

For next quarter, CrowdStrike guided to $358-$365.3 million in sales. Analysts were expecting $350.9 million.

“Given our strong performance and growing market momentum — and reflecting our view of a continued robust demand environment — we are raising our guidance for fiscal year 2022.” — CFO Burt Podbere