Other Reviews to Read From This Season:

- Palantir & Hims Earnings Reviews.

- Alphabet Earnings Review.

- Meta, Robinhood & Starbucks Reviews.

- Apple & Duolingo Earnings Reviews (sections 2 & 3).

- Tesla Earnings Review.

- Amazon & Microsoft Earnings Reviews.

- PayPal Earnings Review.

- SoFi Earnings Review.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio & performance vs. the S&P 500 as of today.

Table of Contents

1. Celsius (CELH) — Brief Earnings Snapshot

a. Headline Results

- Missed revenue estimates by 5.6%.

- You can only blame Pepsi inventory resets for so long!

- The core Celsius business again lost Q/Q market share. It now has 10.9% market share vs. 11% Q/Q and 12.3% Y/Y.

- Missed $0.20 EPS estimates by $0.02.

- Missed EBITDA estimates by 21%.

- Alani Nu M&A closed after Q1 ended. There was no financial impact this quarter. Alani Nu’s market share rose from 3.1% to 5.3% Y/Y.

Alani Nu will begin greatly propping up inorganic growth rates starting next quarter. But? That can’t last longer than 4 quarters if the core Celsius brand keeps endlessly ceding market share. And you can’t blame market share losses on poor macro, as everyone in the sector is dealing with the same challenges. This looks like a brand that has peaked.

b. Valuation

No formal guidance.

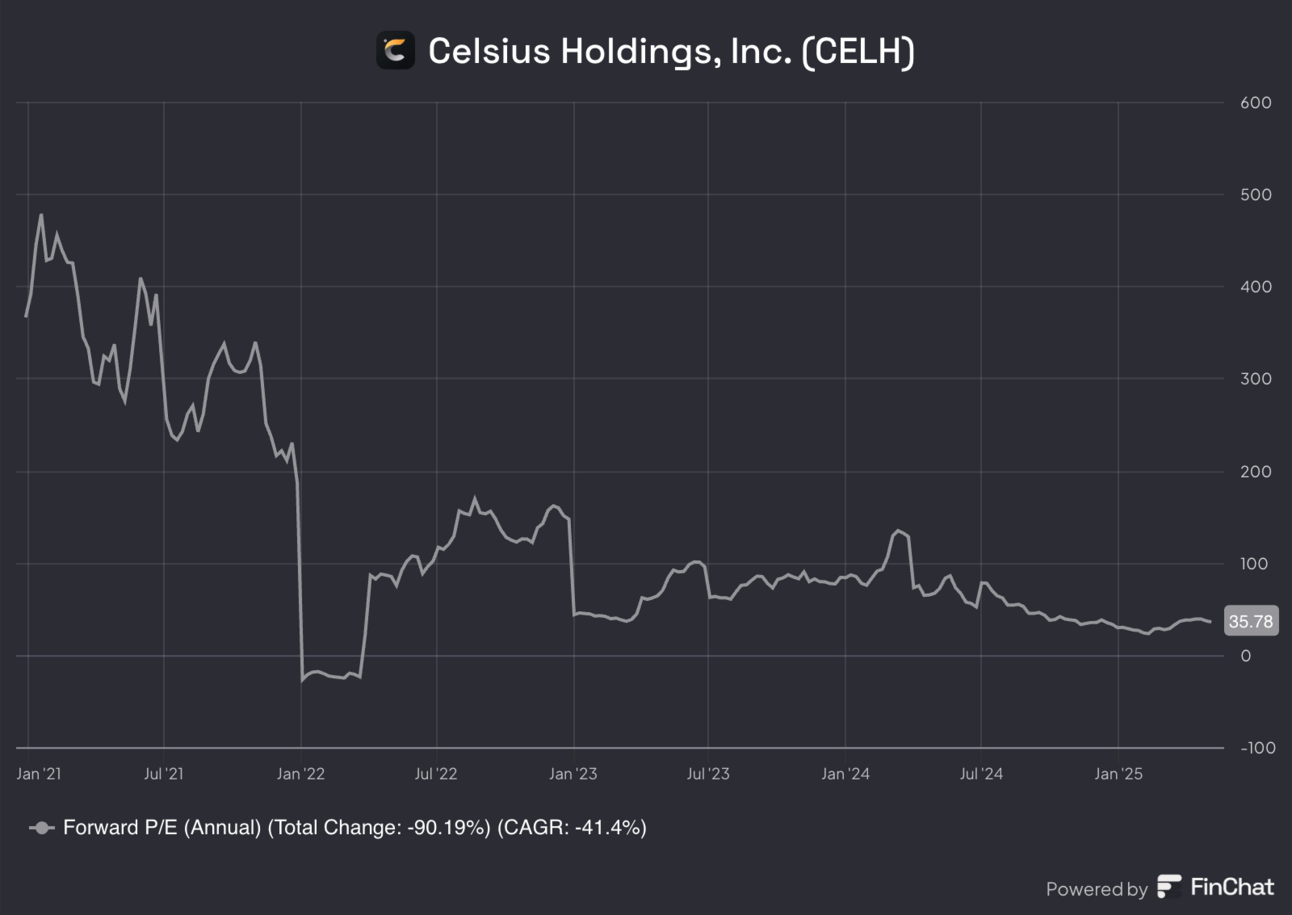

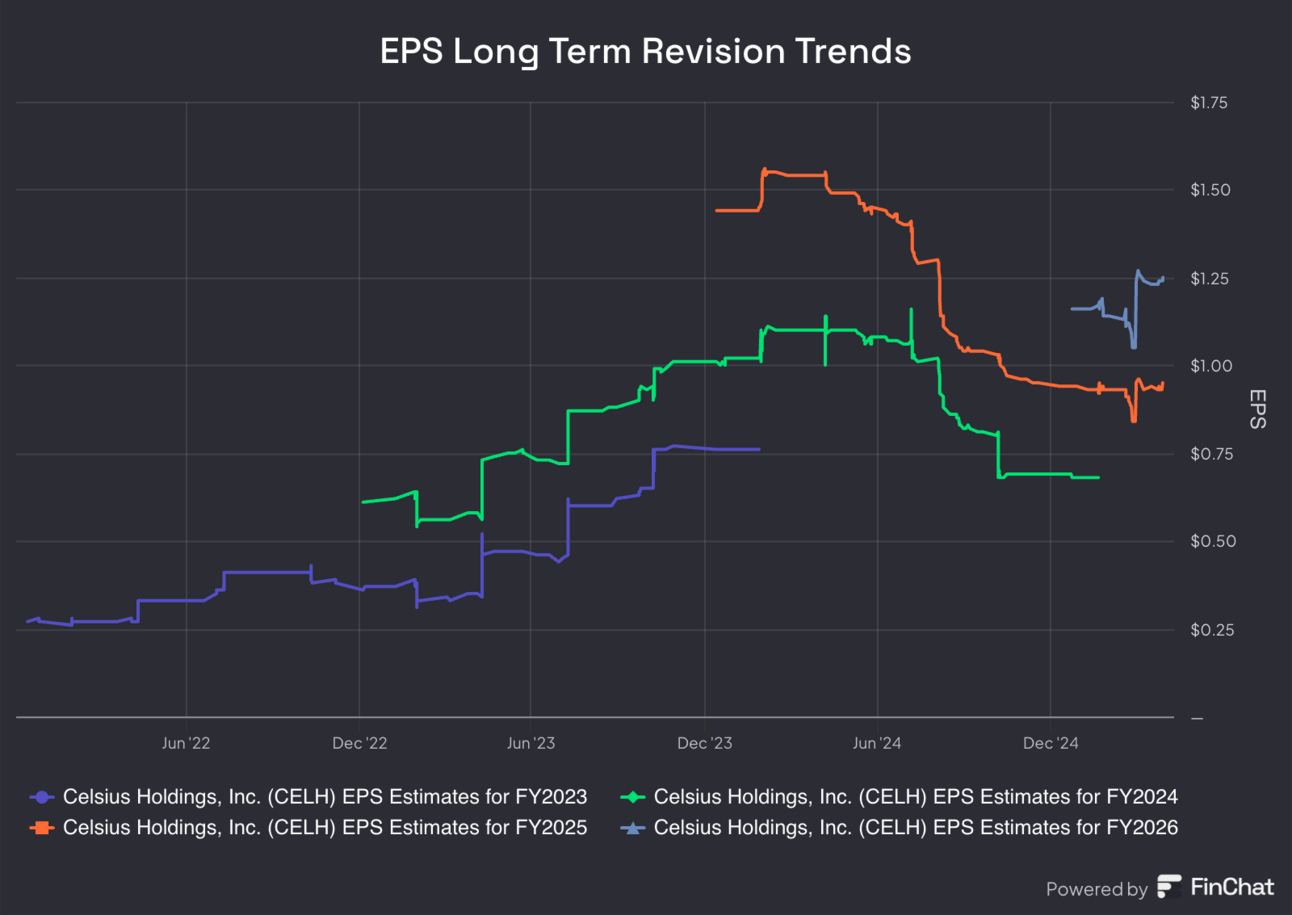

Celsius trades for 36x forward EPS as of right now. EPS is expected to grow by 22% this year and by 38% next year. Estimates will fall following this report.

c. Balance Sheet

- $977M in cash & equivalents.

- $141M in inventory vs. $131M Q/Q.

- $824M in convertible preferred shares (from the Pepsi partnership); no traditional debt.

- Stock compensation is very low at a little over 1% of revenue.