Meta needs no introduction.

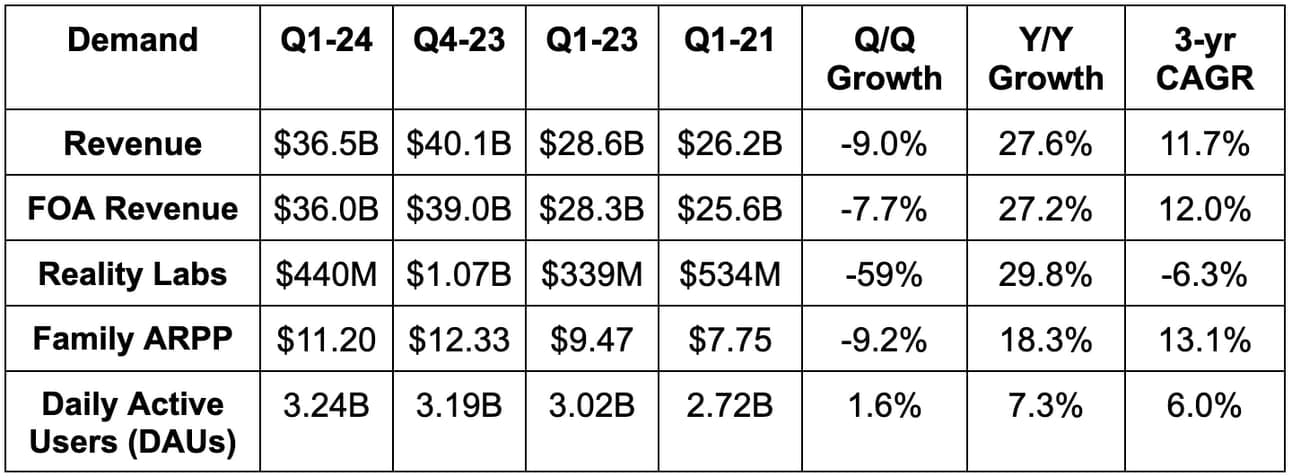

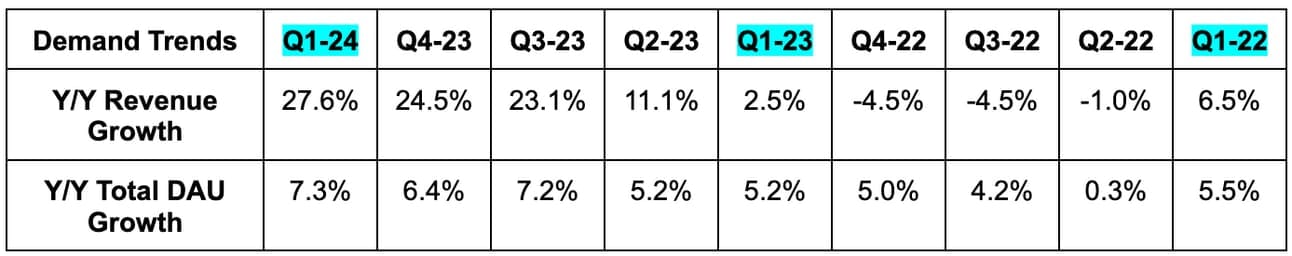

1. Demand

- Beat revenue estimates by 1.0% & beat its revenue guidance by 2.0%.

- Beat daily active user (DAU) estimates by 5.0%.

As of this quarter, Meta no longer discloses Facebook-only DAUs – only user metrics for its Family of Apps (FOA) overall.

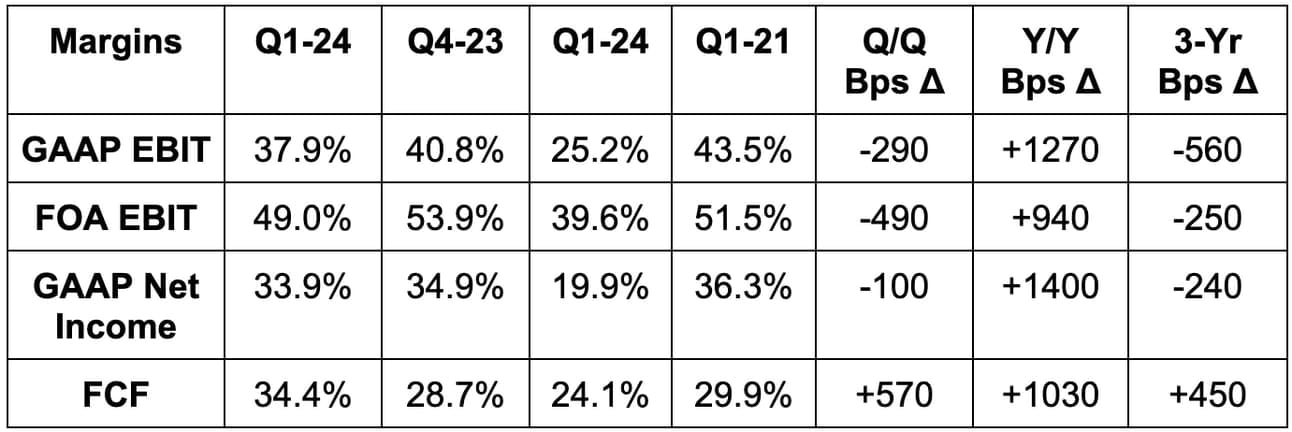

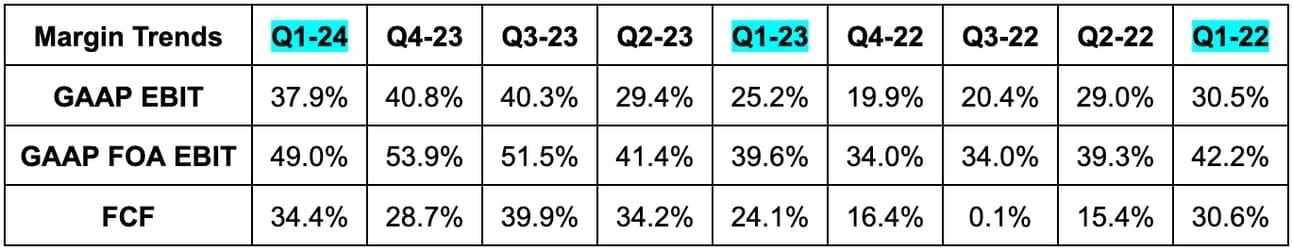

2. Profitability & Margins

- Beat EBIT estimates by 3.1%.

- Beat $4.33 GAAP EPS estimates by $0.38.

- Beat free cash flow (FCF) estimates by 10.1%.

3. Fortress Balance Sheet

- $58 billion in cash & equivalents.

- $18.4 billion in total debt.

- Share count fell by 1.7% Y/Y.

- Headcount fell 10% Y/Y, but continued to rise Q/Q.

4. Guidance & Valuation

For the 2nd quarter, the midpoint of Meta’s revenue guidance missed by 1.2%.

For the year, it raised its operating expense (OpEx) guide by 1.0% & raised its capital expenditure (CapEx) guide by 11%. It also told us that 2025 CapEx would rise Y/Y vs. 2024.

Meta trades for about 20x earnings with earnings expected to grow by 35% Y/Y. With the 1% OpEx boost for 2024 and the Q1 EPS beat, I don’t anticipate earnings estimates falling much after this report. Conversely, it trades for about 21x 2024 FCF with FCF expected to grow by 13% Y/Y. I would anticipate FCF estimates being revised lower with the large CapEx raise.

Love this visual?

My good friend Carbon Finance sends out a weekly visual newsletter with the most important infographics, insights, and insider trades.

It’s completely free and only takes 5 minutes to read.

Join 10,000+ investors and subscribe here now.