Today's Piece is Powered by Quartr:

1. Meta Demand

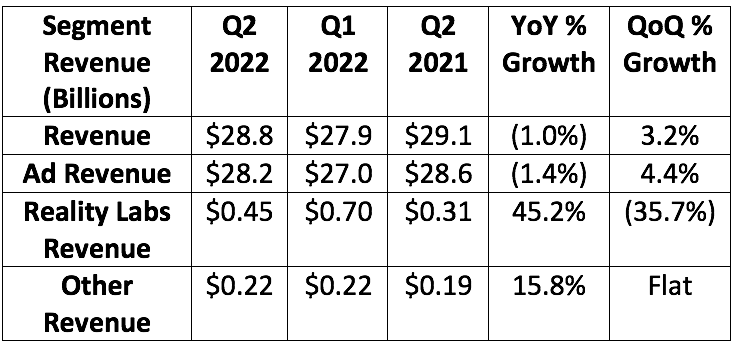

Meta Guided to $29.0 billion in quarterly revenue and posted $28.8 billion, missing expectations by 0.7%.

Analysts Expected (per Bloomberg Terminal):

- $28.9 billion in revenue. Meta missed by 0.4%.

- $28.5 billion in ad revenue. Meta missed by 1.0%.

- Ad impression growth of 9.6%. Meta posted 15% growth, sharply beating expectations.

- Ad price growth of (9.7%). Meta posted (14%) growth sharply missing expectations.

“It was good to see a positive trajectory on our engagement trends this quarter from Reels and our investments in AI.” — Founder/CEO Mark Zuckerberg

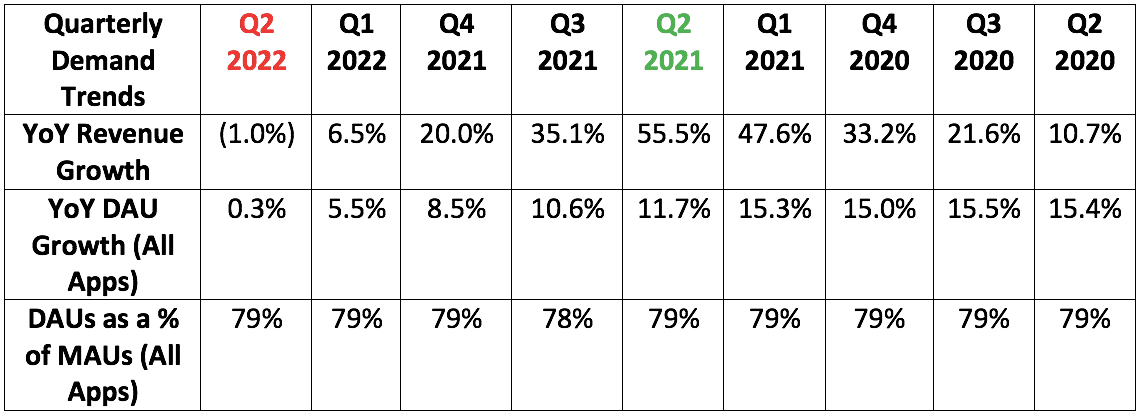

Facebook’s user growth missed analyst expectations by under 1% in 3 of 4 categories. Interestingly, for Facebook DAUs, it posted a slight beat. Note that global user growth was impacted by ending its Russian operations.

More context on demand:

- Revenue grew 3% YoY constant currency. Dollar strength shaved 400 basis points off of its growth.

- This quarter marked Meta’s toughest YoY pandemic growth comp.

- Headwinds ranging from IDFA to lapping stimulus/social distancing, to a content monetization shift to Reels to broader macro all continued to weigh on growth this quarter.

- Ad revenue growth was strongest in APAC and weakest in Europe. The same can be said for ARPU.

2. Profitability

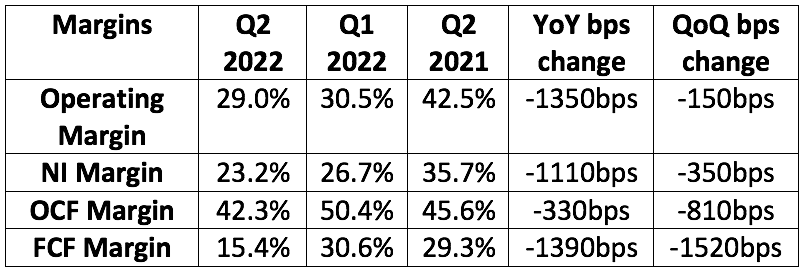

Analysts were looking for $2.55 in earnings per share (EPS). Meta earned $2.46, missing expectations by 3.6%.

More Margin Context:

- FCF margin is where Meta’s heavy CapEx impacts margins most noticeably.

- Analysts were only expecting $3.55 billion in FCF while Meta’s $4.45 billion beat expectations by 25.4%. It’s controlling costs.

- Meta's tax rate was 18% vs. 17% YoY -- a slight help to net income.

- Quest 2 price increases allowed Meta to shrink its loss reserves which slightly aided margins this quarter.

There's a very good reason as to why I'm an active Quartr user.

Must cost a fortune, right? Wrong. It’s a free-to-use force multiplier for research efficiency. Simply go to your app store of choice and try it today. There’s no other free tool like Quartr out there -- and I’m confident that you’ll all agree. Check it out here.

3. Guidance

For Q3 2022, analysts wanted $30.4 billion in revenue. Meta guided to $27.25 billion missing expectations by 10.4%. Worst part of the report, but also understandable.

Meta also told us that Reality Labs revenue will be lower next quarter vs. this quarter.