“The fundamentals are there for a return to stronger revenue growth in 2023. We’re approaching next year with a focus on prioritization and efficiency that will help us navigate the current environment and emerge stronger… I think those who are patient and invest with us will be rewarded.” — Founder/CEO Mark Zuckerberg

1. Demand

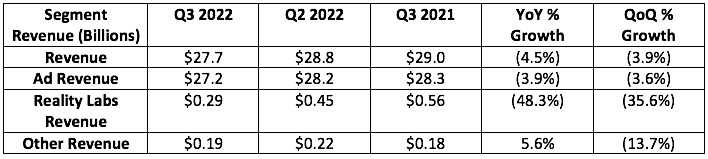

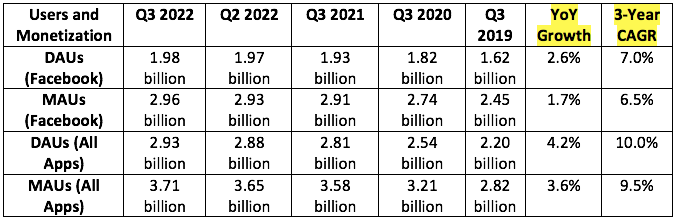

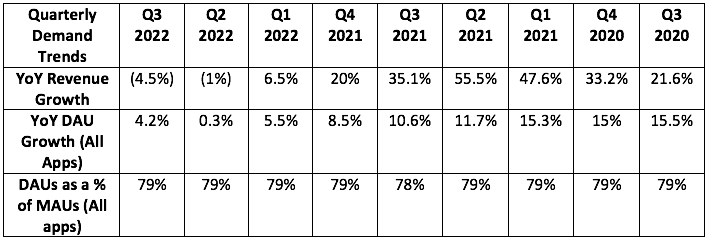

Meta guided to $27.25 billion in revenue while analysts were looking for $27.4 billion. It posted $27.7 billion, beating its expectations by 1.6% and analyst estimates by 1.1%.

More Context on Demand:

- YoY revenue growth would have been +1.7% on a constant currency basis.

- Advertising revenue YoY grew +3% constant currency which was better than the extremely low expectations.

- Total impressions grew 17% YoY which was in line with expectations. Price per impression fell by 18% which was worse than expected.

- Meta is still dealing with Reels monetization ramping and a weak ad market as significant revenue headwinds. Conversely, we have now lapped the bulk of the IDFA headwind and it’s now up to Meta to finish addressing measurement and targeting issues. This is no longer an Apple issue.

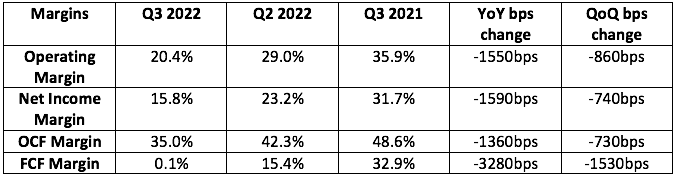

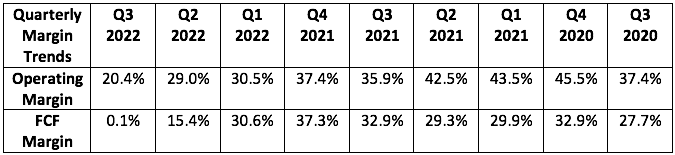

2. Profitability

Analysts were looking for $1.86 in earnings per share. Meta earned $1.64, missing expectations by 11.9%. It earned roughly double that last year. Yikes.

Meta sharply missed analyst expectations of $2.82 billion in free cash flow (FCF). It generated close to $0 in FCF. Double Yikes. Capital Expenditure growth year-to-date of 66.4% was even faster than expected. Yikes Yikes Yikes.