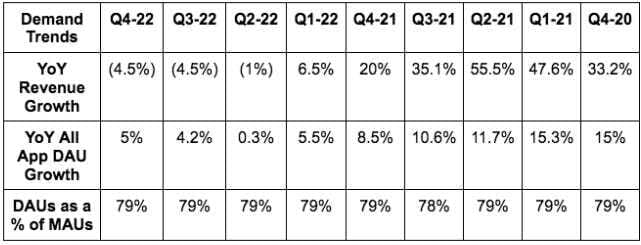

1. Demand

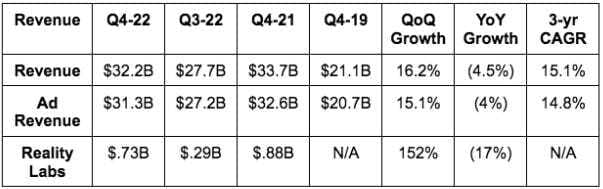

Meta beat revenue estimates by 1.6% & beat its guide by 2.9%.

Demand Context:

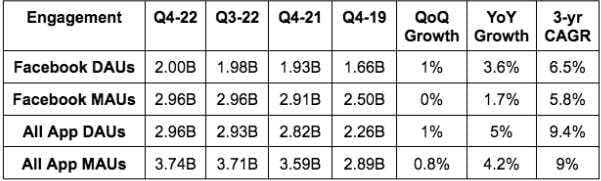

- DAUs for Facebook in the U.S. -- its most mature market -- rose 1% QoQ & 2.1% YoY. Despite what some say, Facebook is not dead… at all. It was hibernating through the post-pandemic hangover as I said all along.

- Facebook Reality Labs revenue fell 18% YoY & more than doubled QoQ (hardware release).

- FX was a 700bps headwind to growth.

- Its 15.1% 3-year revenue CAGR compares to 16.2% last Q & 19.5% 2 Qs ago.

- Ad impressions rose 23% YoY; price per impression fell 22% YoY. Reels, Apple signal loss and weak macro all are contributing to pricing pressure… BUT:

Meta is now through Apple’s IDFA change making cross app data sharing (and so targeting) more difficult . The 8% IDFA revenue growth headwind in 2022 will now turn to a YoY comp TAILWIND starting in Q1. This is happening as its ad investments and Reels monetization both take hold. Compelling setup.

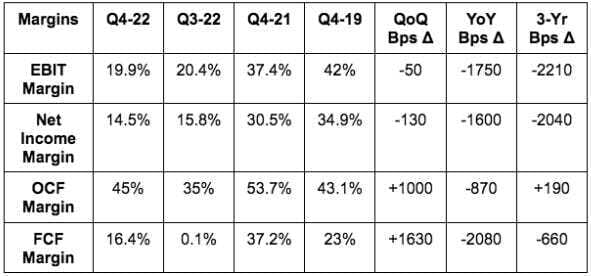

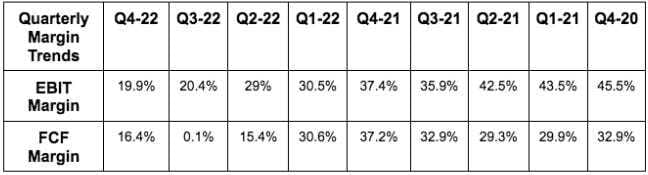

2. Profitability

Meta missed EBIT estimates of $7.54 billion by 15%. This includes restructuring charges explained below. It would have earned $10.6 billion in EBIT without these charges. Similarly, EPS missed $2.23 estimates by $0.47, but Meta’s $1.76 in earnings would have been $3.00 with no restructuring charges.

Meta nearly doubled free cash flow estimates which is the profit metric not impacted by these charges.