The rest of the Microsoft review, Amazon & part one of the Apple review are all coming tomorrow. The rest of Apple, Starbucks and Cloudflare (maybe just part 1) will come Saturday.

In case you missed it:

- Alphabet & Tesla Earnings Reviews.

- SoFi & PayPal Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews (from two weeks ago).

- Portfolio Earnings Season Preview.

- Updated Holdings & Performance as of Today.

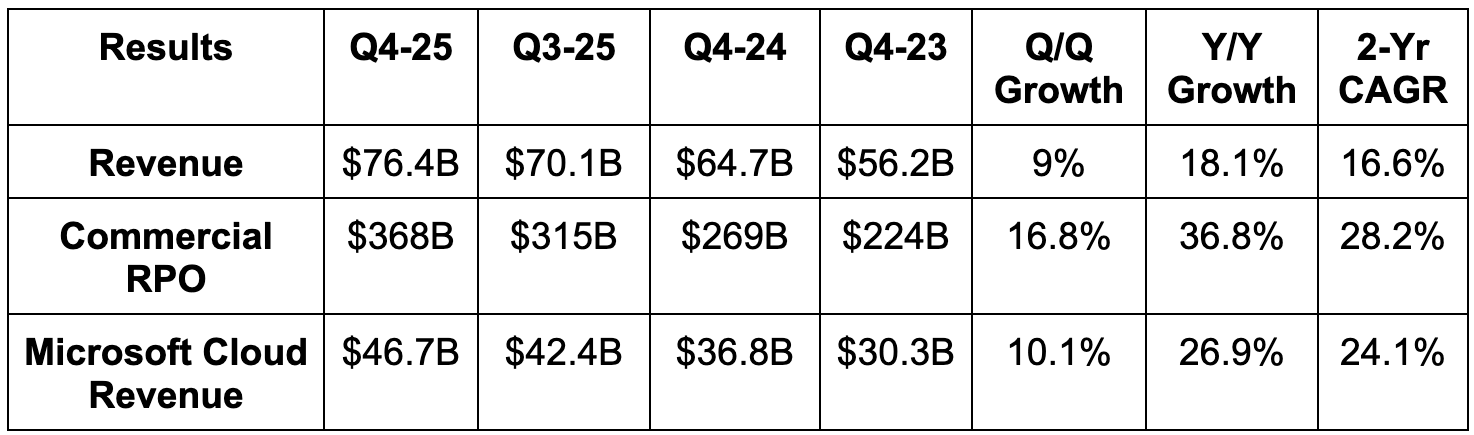

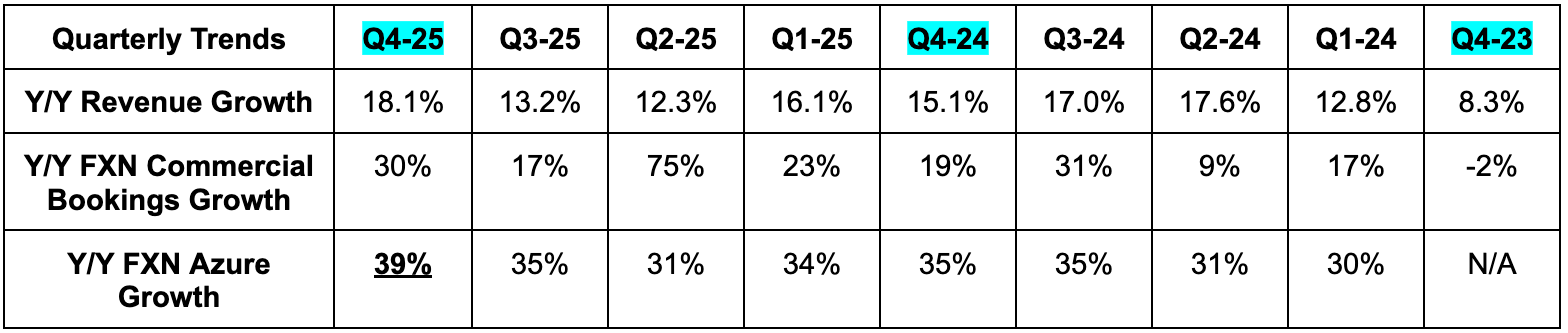

1. Microsoft (MSFT) — Brief Earnings Snapshot

a. Demand

- Beat revenue estimate by 3.4% & beat guidance by 3.7%.

- Beat 34.5% foreign exchange neutral (FXN) Azure growth estimates & guidance by 4.5 points each.

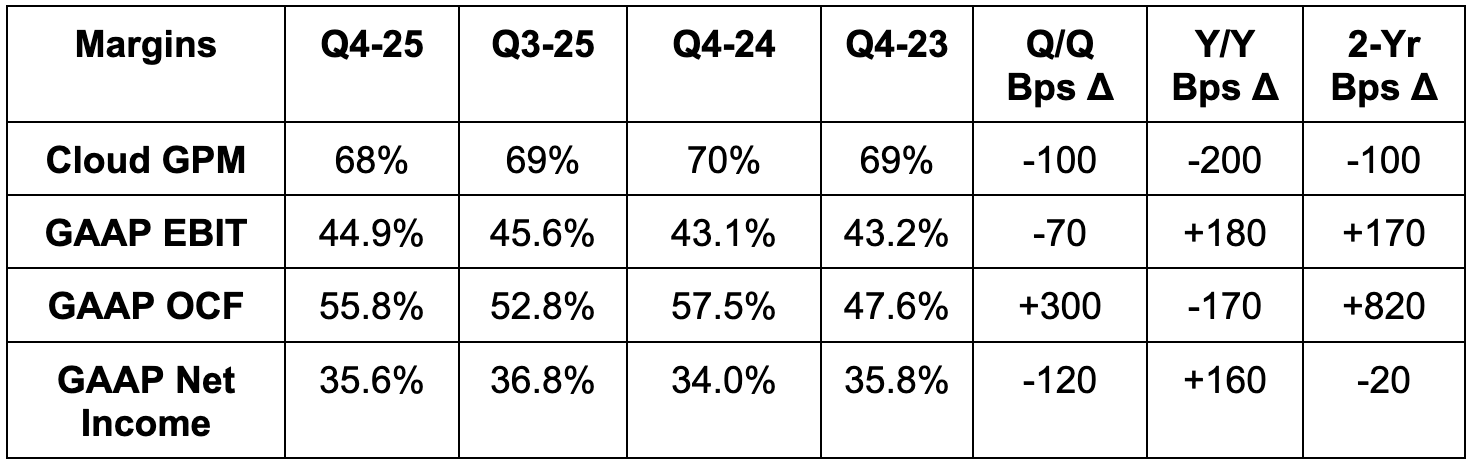

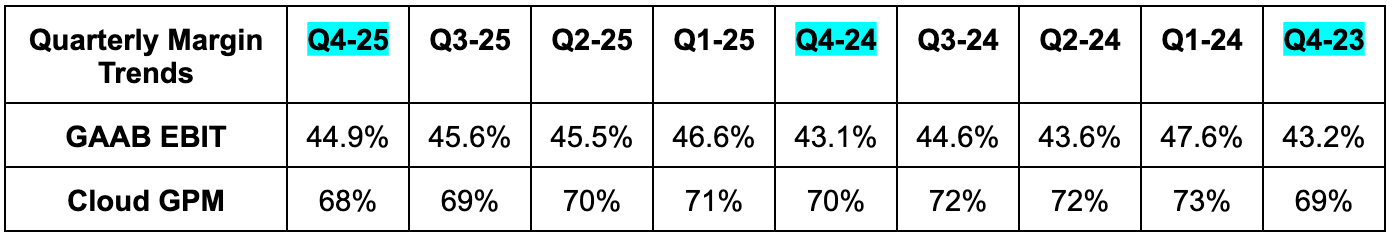

b. Profits

- Beat EBIT estimate by 6.8% & beat guidance by 7.3%.

- Beat $3.37 GAAP EPS estimates by $0.28.

- Beat FCF estimates by 21%.

c. Balance Sheet

- $94B in cash & equivalents.

- $40B in debt.

- Slight Y/Y share count reduction.

- 11% Y/Y dividend growth

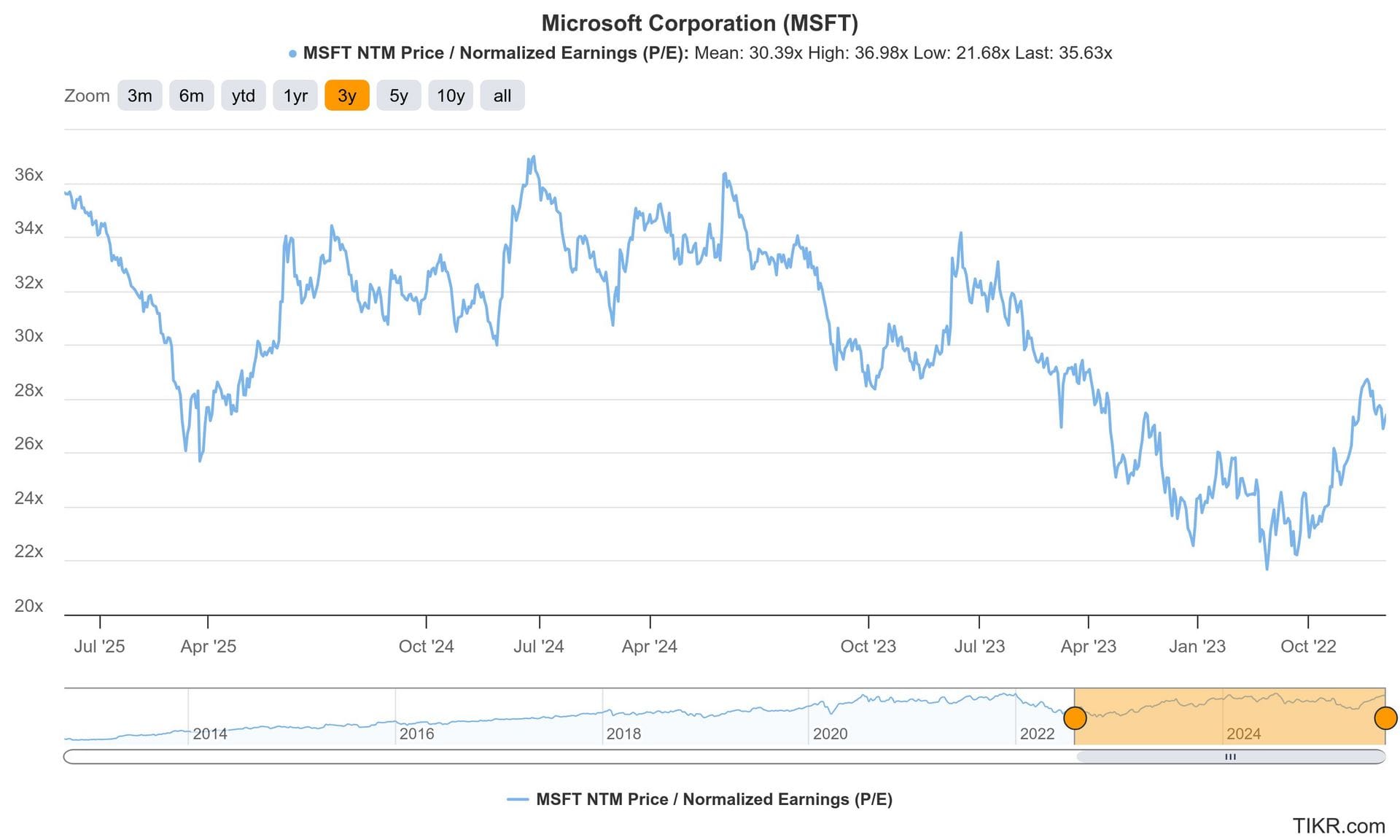

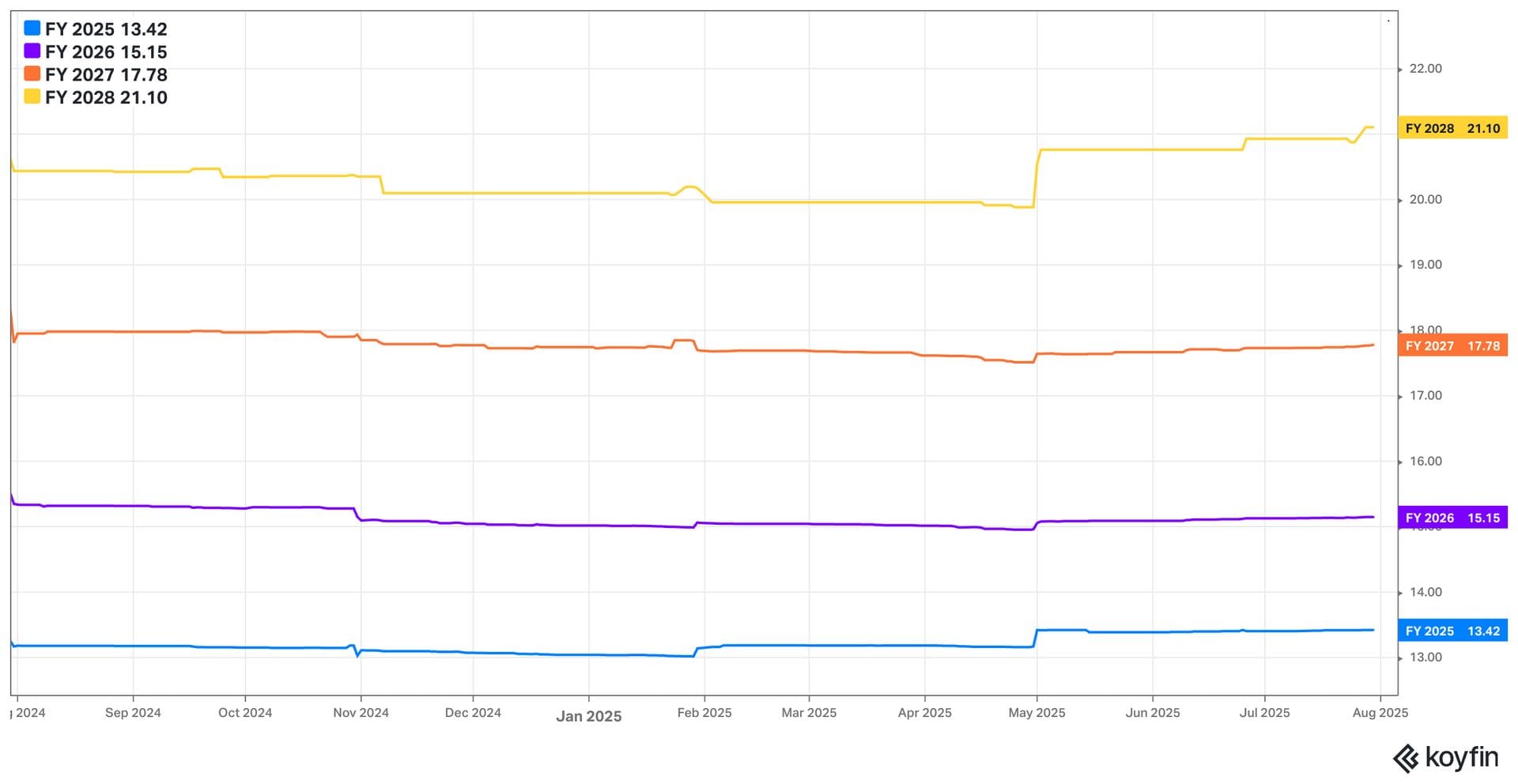

d. Guidance & Valuation

- Q1 revenue guidance beat estimates by 1.4%.

- Q1 EBIT guidance beat estimates by 3.5%.

2. Meta (META) — Earnings Review

a. Key Points

- Ad pricing pressure concerns throughout the quarter were noise.

- Massive top-line outperformance for Q2 and the Q3 guide — not driven by FX favorability.

- Expense growth will remain rapid in 2026.

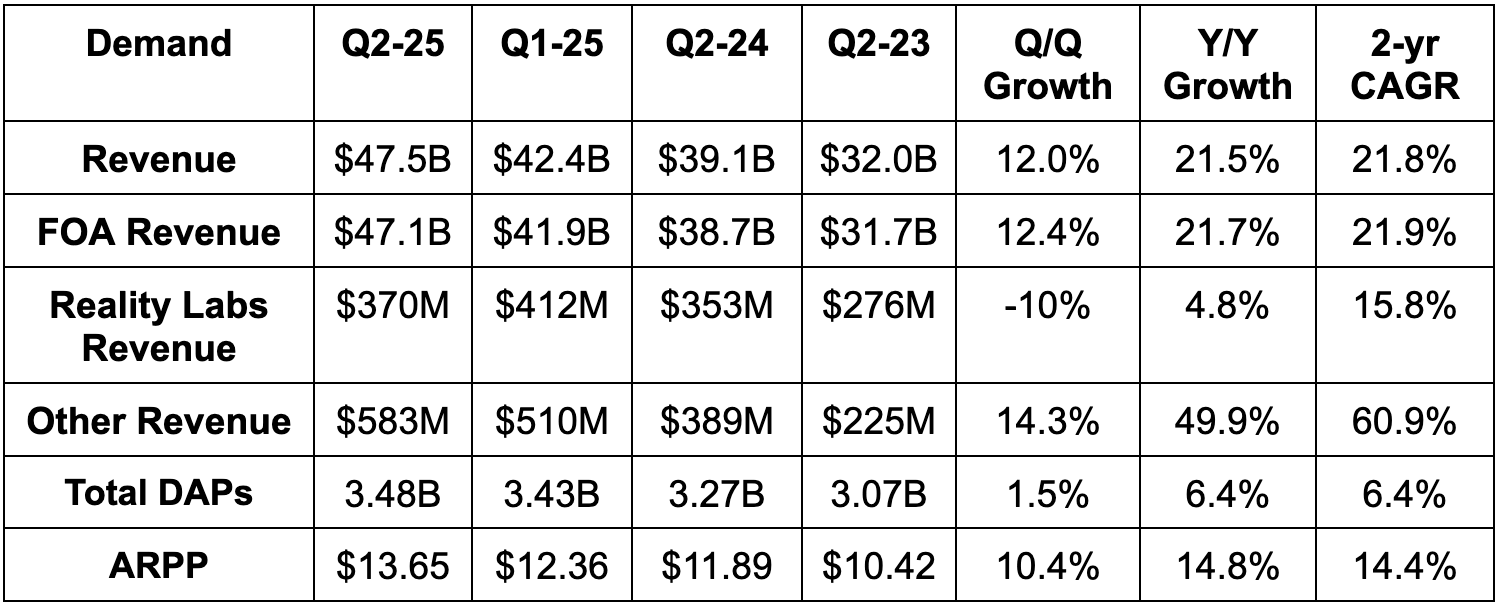

b. Demand

- Beat revenue estimate by 6% & beat guidance by 7%.

- Family of apps (FOA) beat estimates by 6%.

- Other revenue, which consists of WhatsApp Business Messaging and Meta Verified, beat estimates by 16%.

- Reality Labs missed estimates by 4%.

- This beat was not foreign exchange (FX) favorability driven. FX was actually less favorable than expected, so the beat is entirely driven by fundamental outperformance. There was virtually zero FX tailwind vs. Meta guiding to a 1-point tailwind.

- 21.8% 2-yr revenue compounded annual growth rate (CAGR) vs. 21.8% Q/Q & 22.6% 2 Qs ago.

- Beat daily active people (DAP) estimates by 1.5%.

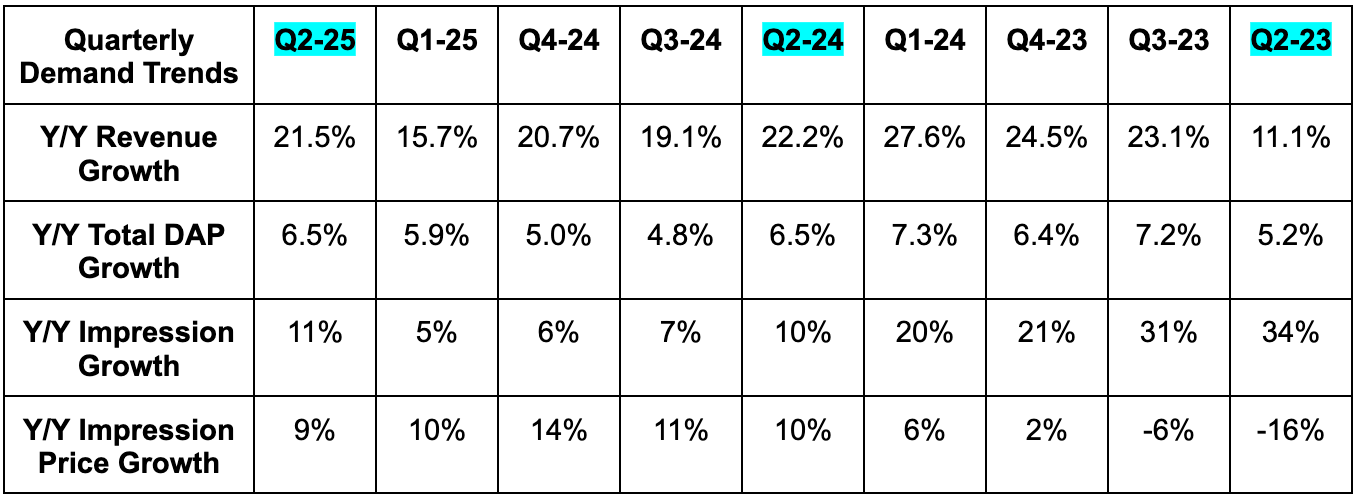

- 11% impression growth beat 7% estimates.

- 9% price-per-impression growth beat 7.6% estimates. As we’ve covered in weekly articles throughout the quarter, there have been a few notes about weaker price-per-impression trends for Meta. That now looks inaccurate, as pricing significantly outperformed.

- Beat $12.96 average revenue per person (ARPP) estimates by $0.69.

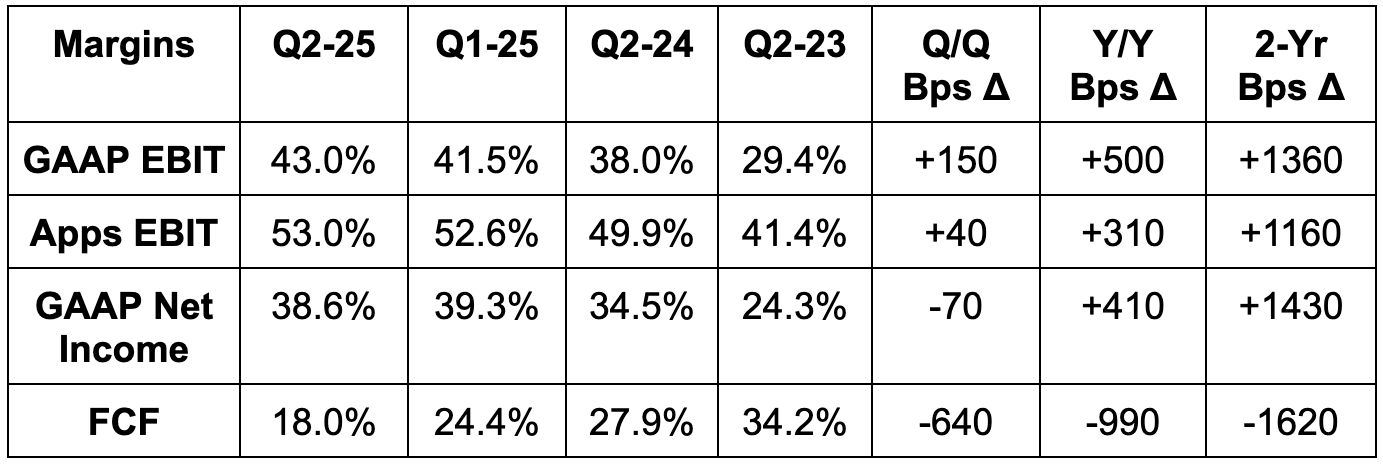

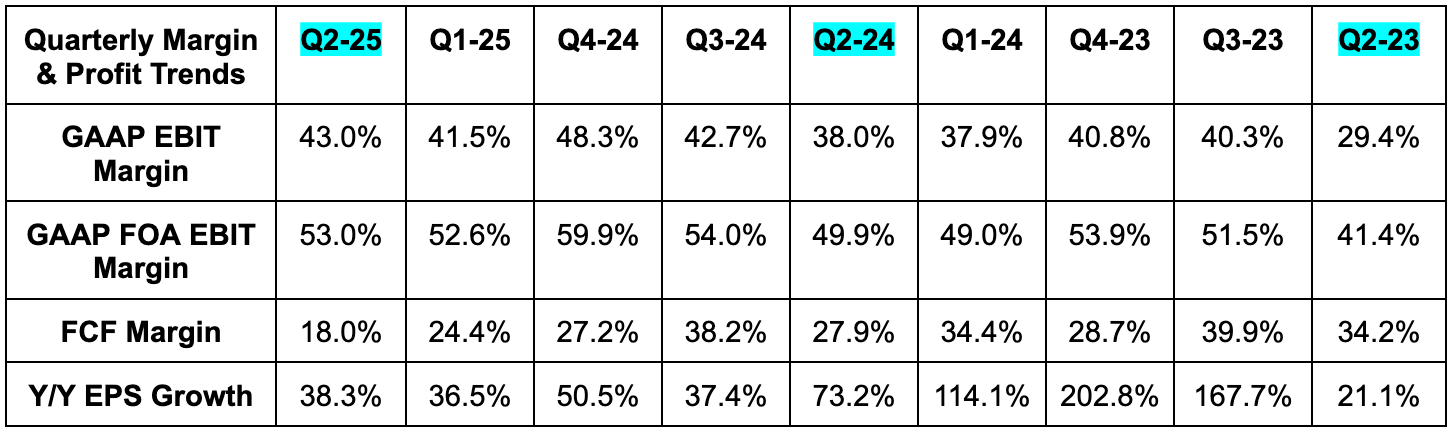

c. Profits & Margins

- Beat free cash flow (FCF) estimates by 42%.

- This is despite spending $17B in CapEx vs. $16.3B expected.

- On the other hand, FCF estimates have been significantly lowered due to Meta’s aggressive CapEx plans. Still impressive, but they did beat a lowered bar.

- Beat EBIT estimates by 20%.

- OpEx rose 12% Y/Y due to 16% cost of revenue growth, 27% G&A growth and 23% R&D growth. Marketing rose by 9% Y/Y as well.

- Beat $5.89 GAAP EPS estimate by $1.25.

d. Balance Sheet

- $47B in cash & equivalents.

- $28B in debt.

- Share count fell by 1.5% Y/Y

e. Guidance & Valuation

Q3 revenue guidance was 6% ahead of estimates. This includes a 1% foreign exchange (FX) tailwind. It did slightly raise its OpEx and CapEx guidance for 2025, which were both slightly above expectations. For Q4, they expect slower Y/Y revenue growth than the 21% Y/Y growth guided to for Q3. This was as expected (consensus growth estimates for Q4 are 13.5% Y/Y).

For 2026, rising depreciation costs from infrastructure spend and more compensation from the research team they’re assembling will lead to OpEx growth being faster in 2026 than in 2025. This means at least $142B in OpEx for 2026 and is materially above $130B expectations. Also for 2026, it guided to roughly $30B in Y/Y dollar growth (same as 2025). This brings them to $99B in 2026 CapEx, which is far higher than $80B estimates. This is the only thing to pick on from the report, but with revenue and profit outperformance so significant, it’s hard to complain. They see a massive opportunity to spend productive dollars and raise their financial ceiling. Year after year, they’ve demonstrated a world-class ability to deliver fantastic return on investment (ROI) with these costs (outside of Reality Labs). There is no founder on the planet I trust more than Zuck to spend $99B in CapEx in a single year. While that’s a massive number, I say go for it. They’re elite capital allocators; they’re already showing how powerful of a tailwind AI can be for today’s top-line performance. Go. For. It.

Other guidance notes:

- They plan to fund most of the CapEx next year from their balance sheet, but are exploring some financing options and partnerships.

- Infrastructure spend will remain highly flexible. They can easily shift it to and from parts of the business as needs evolve.

- They think new tax laws will reduce this expense this year and in future years.

- It also sounded like daily active users continued to grow into Q3.

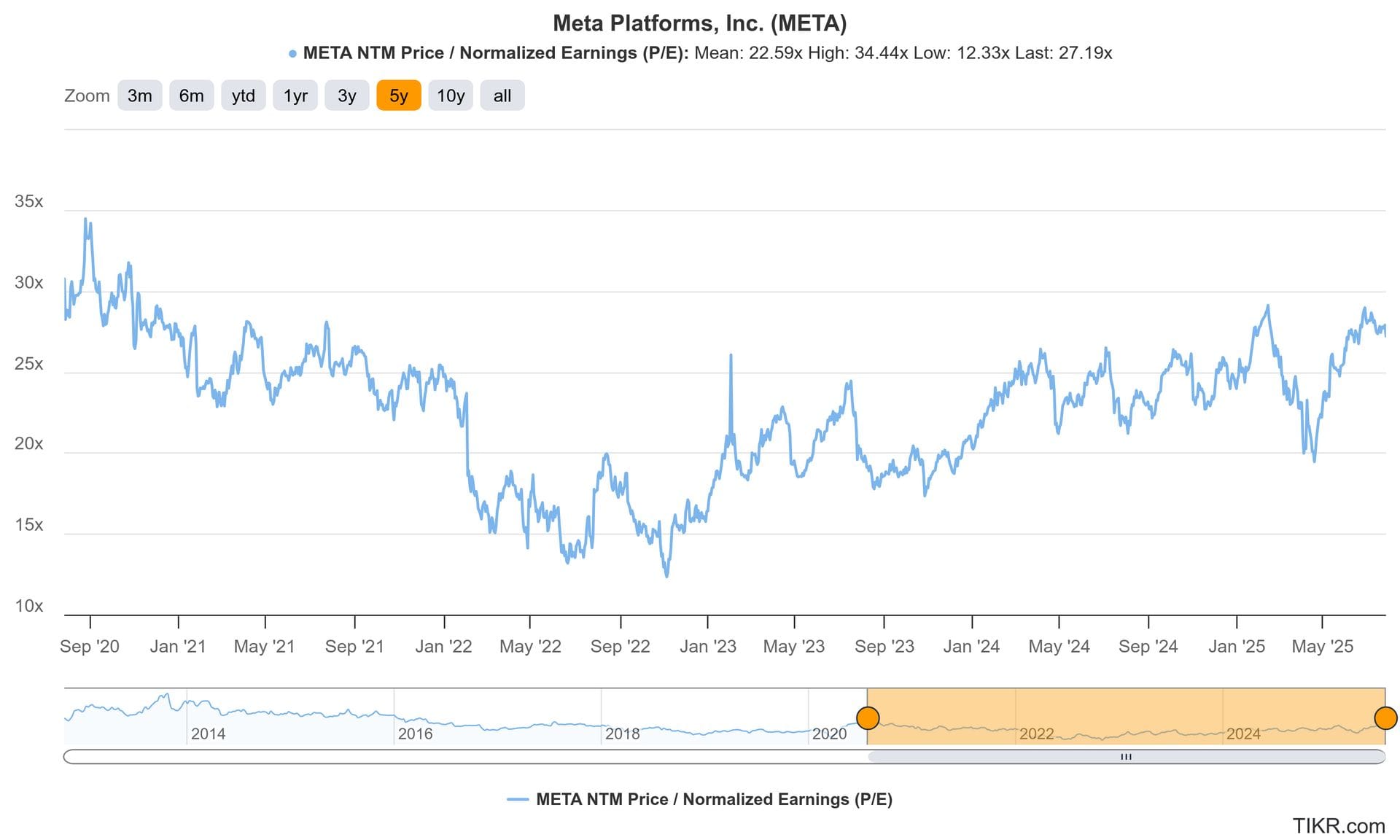

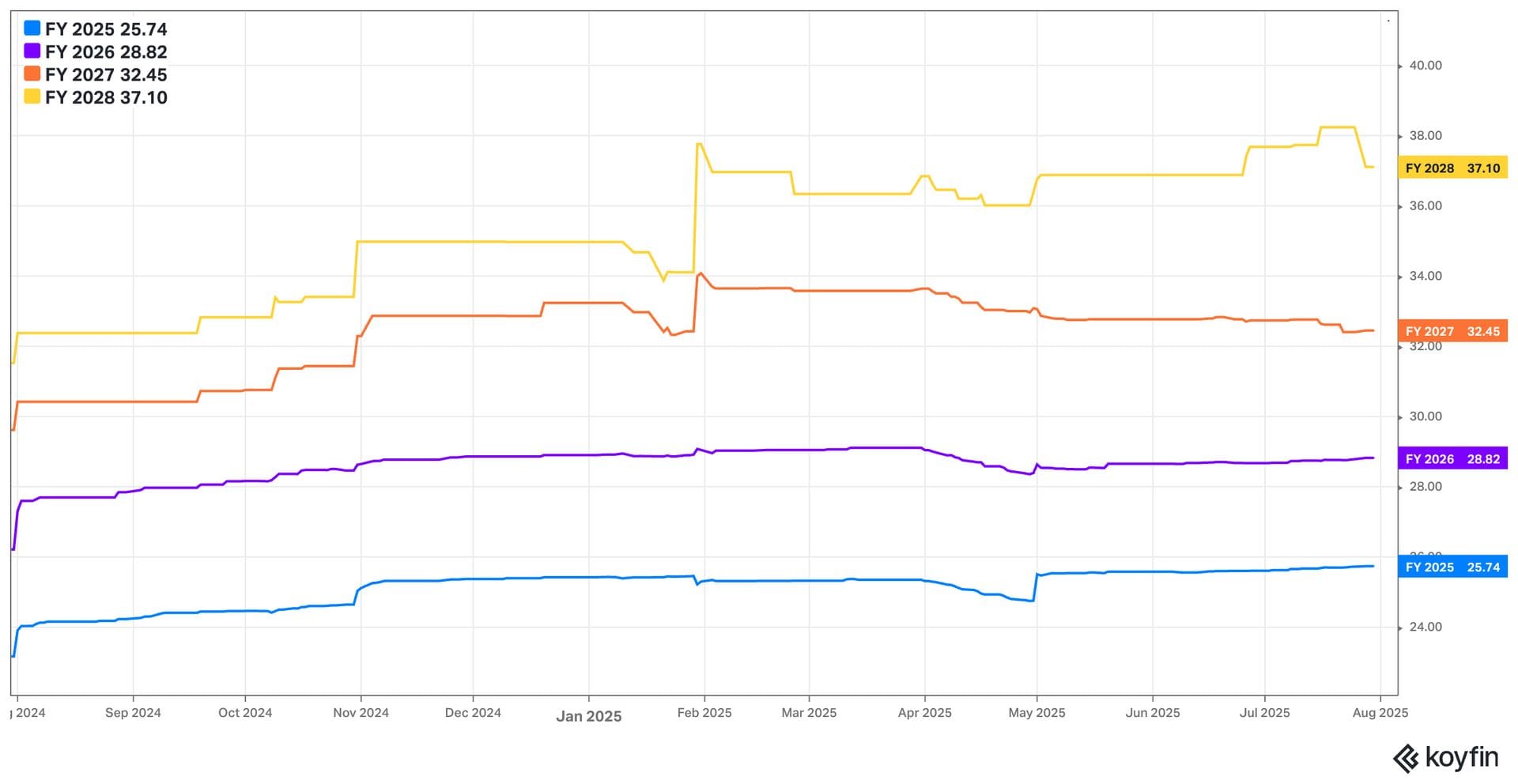

Meta traded for 27x forward EPS entering the report. Estimates are going to rise for 2025 following this report. EPS is expected to grow by 9% Y/Y this year (will be revised) and 11% Y/Y next year. 11% Y/Y growth next year could modestly fall. Maybe not considering how sharp revenue outperformance is. We’ll see.