1. Taiwan Semicondutor (TSM/TSMC) — Earnings Review

a. Taiwan Semi 101

Taiwan Semi builds chipsets for other companies like Nvidia, AMD and Qualcomm. It does so in its highly expensive and complex chip fabrication plants. These are called “fabs” for short.

Needed Definitions:

- Fab means a factory.

- Nanometer (NM) describes the chip technology. Smaller NM is more advanced, as it uses smaller transistors. This means TSM can pack more transistors into a single chip while making those chips more energy efficient and cost-effective.

- Transistors function as switches or signal amplifiers.

- “Advanced Technology” revenue is revenue from 3nm (N3), N5 & N7 technology. Anything under 7nm is “advanced.”

- Wafer (sometimes called substrate) refers to the raw materials (like silicon) that are used to manufacture chips. Wafers are used to build integrated circuits (ICs), with the IC’s transistors guiding and facilitating functions. Nvidia’s Blackwell and Hopper chips are considered ICs.

- Traditional foundry services entail the actual creation of a chip on a silicon wafer and testing these products. On the other hand, packaging involves storing, integrating and prepping chip components with thermal protection, connectivity equipment and encapsulation (physical damage protection).

- Chip-on-wafer-on-substrate (CoWoS) is a packaging process that combines chips into a single unit. It allows things like GPUs, high-bandwidth memory (HBM) and custom chips to be vertically stacked and connected on a single wafer to improve speed and performance.

- Lithography is the process of using thin layers of glass to etch or print chip patterns onto wafers. A light-sensitive material is added to wafers, “masks” are placed on top to guide where light and chemicals (used to manipulate wafers) etch desired patterns. Lithography is paramount to TSM’s production.

- AI Accelerators, as the name indicates, accelerate high-performance compute (HPC) workloads in the realm of AI. GPUs are a type of AI accelerator, along with Application Specific Integrated Circuit (ASICs) (custom chips for specific use cases), Google’s Tensor Processing Units (TPUs; for machine learning). Some don’t include high-bandwidth memory (HBM) in this category, as HBM is for memory rather than things like data processing. TSM does include this. HBM facilitates ultra-low latency, high-bandwidth support for querying and data processing tasks as a wonderful complement to Nvidia’s Blackwell GPUs, for example.

b. Key Points

- The tech roadmap & fab construction plans are on schedule.

- Nvidia H20 sales in China being allowed would support more AI growth.

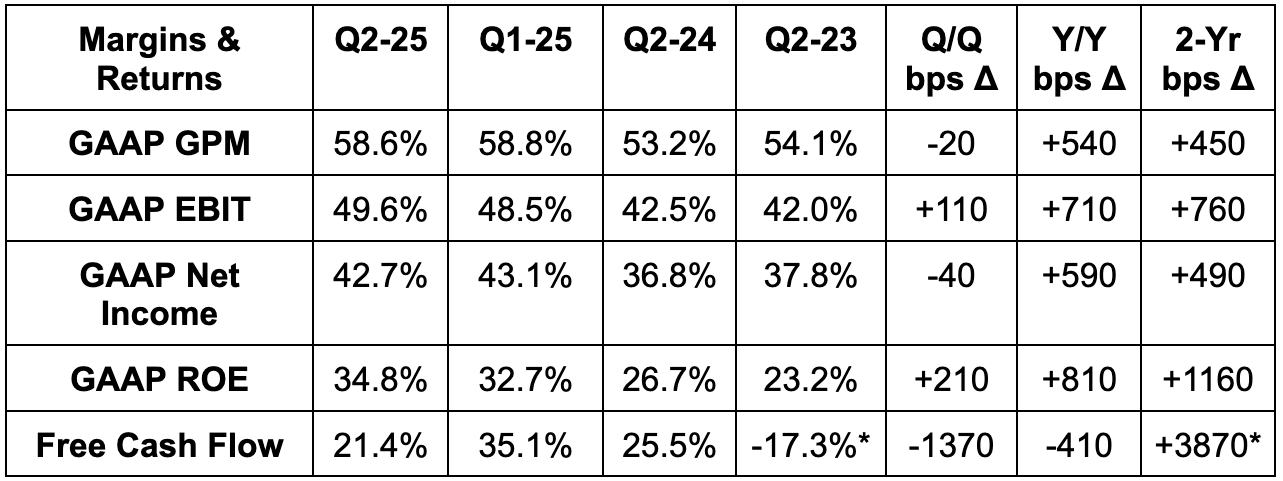

- Gross profit margin (GPM) dilution was driven by foreign exchange (FX) and international expansion.

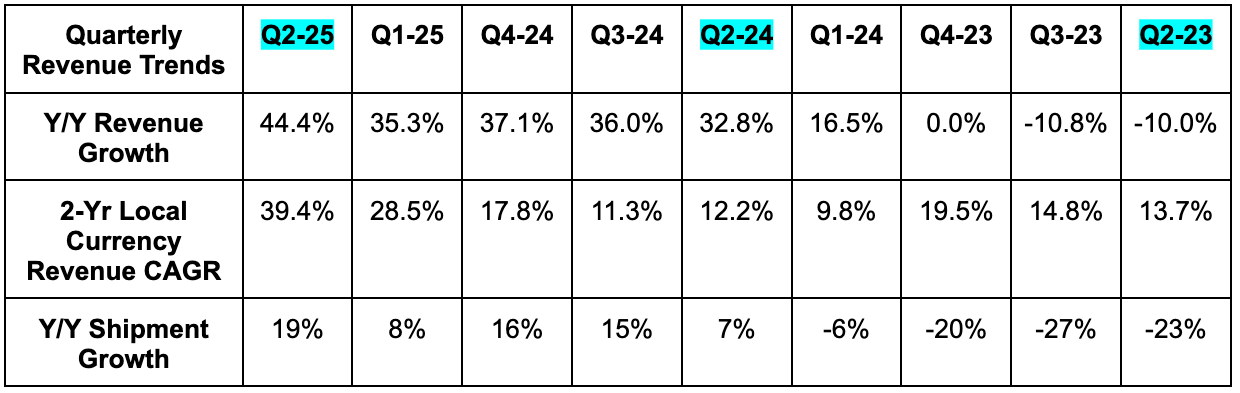

- Nice acceleration in Y/Y growth despite a more difficult comp.

c. Demand

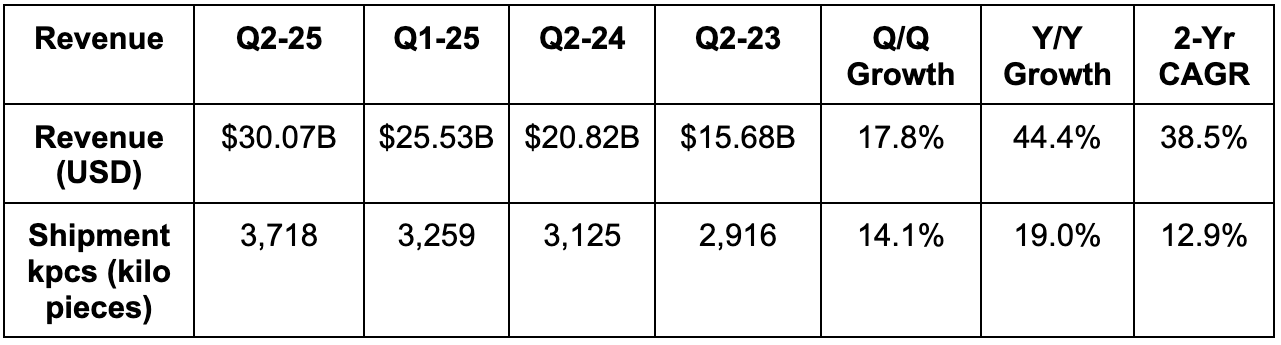

TSM beat revenue estimates by 1.6% & beat guidance by 4.4%. It reports revenue on a monthly basis, so strong April, May & June reports led to estimates rising materially beyond its initial quarterly guidance. In local currency terms, revenue rose by 38.6% Y/Y vs. 41.6% Y/Y last quarter and 38.8% 2 quarters ago.

d. Profits & Margins

- Beat EBIT estimate by 5%

- Beat GPM estimate by 60 bps & beat GPM guide by 60 bps.

- Beat $2.36 EPS estimate by $0.11.

- EPS rose by roughly 60% Y/Y in local currency terms and by 67% Y/Y in U.S. dollars.

- Excluding a large tax charge in Q2 2023, FCF margin would have been 7.7%.*

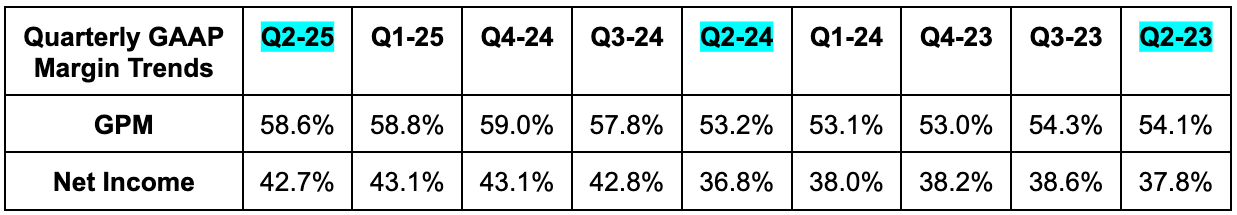

Q/Q gross margin contraction was partially due to ramping foreign exchange (FX) headwinds. Currency headwinds were nearly 5% larger than expected and led to a larger-than-expected 180 bps GPM headwind. Next, the GPM headwind from global manufacturing expansion was slightly more than 100 bps vs. just 80 bps assumed in its guidance. Newer facilities in the USA, Japan and Europe don’t enjoy the yield, capacity utilization, overall efficiency or economies of scale that their Taiwan facilities do. This means they’re currently lower-margin assets. Despite these two larger-than-expected headwinds, cost discipline and outperformance utilization helped the company surpass expectations. The things they can’t control turned into raging headwinds and they out-executed that problem within the things they can control.

e. Balance Sheet

- $90.3B cash & equivalents.

- $4.7B long-term investments.

- Inventory rose 12% Y/Y.

- $32.3B in total bonds payable.

- Share count was roughly flat Y/Y.

- Days of inventory on hand fell from 83 days to 76 days due to strong N3 and N5 performance.

f. Guidance & Valuation

For Q3, Revenue guidance beat estimates by 2%. They’ve seen no change in customer demand or buying patterns stemming from the trade war. No increased timidness; no pull-forwards. Separately, while Chinese stimulus is helping near-term demand for non-AI products, they think this will be short-lived and that the overall recovery for that demand bucket will be “mild.”

For Q3 profitability, 56.5% GPM guidance missed 57.4% estimates. The FX headwind rising from 180 bps to 260 bps Q/Q is the first reason for the miss. International expansion is the other. Importantly, they continue to expect international expansion over the next 5 years to lower GPM by about 250 bps during the first part of that planning period and around 350 bps over the second part. For context, their goal is to remain at or above a 53% GPM.

They’d be comfortably ahead of that even if we included the full 350 bps headwind in this quarter. Furthermore, they expect to deliver best-in-class margins in every market. Meaning? Modest GPM contraction in future quarters will in no way mean their competitive moat is deteriorating. This was a reiteration they offer basically every quarter, but still great to hear. Finally, EBIT guidance beat estimates by 1%. This was thanks to the revenue beat.

“We have confidence in a 53% GPM or higher and I want you guys to pay more attention to the or higher.”

CEO C.C. Wei

For the full year, it raised revenue growth guidance from about 25% Y/Y to nearly 30% Y/Y. This is despite baking tariff-related uncertainty into the forecast and “more conservatism” in these targets. It also reiterated $40B for annual CapEx expectations. They expect CapEx to stay around those levels in 2026 and beyond. As long as revenue continues to grow like it should, that will drive enhanced capital efficiency.

“Recent developments are positive for AI's long-term demand outlook. The explosive growth in token volume demonstrates increasing AI model usage and adoption, which means more computation is needed, leading to more leading-edge silicon demand.

CEO C.C. Wei

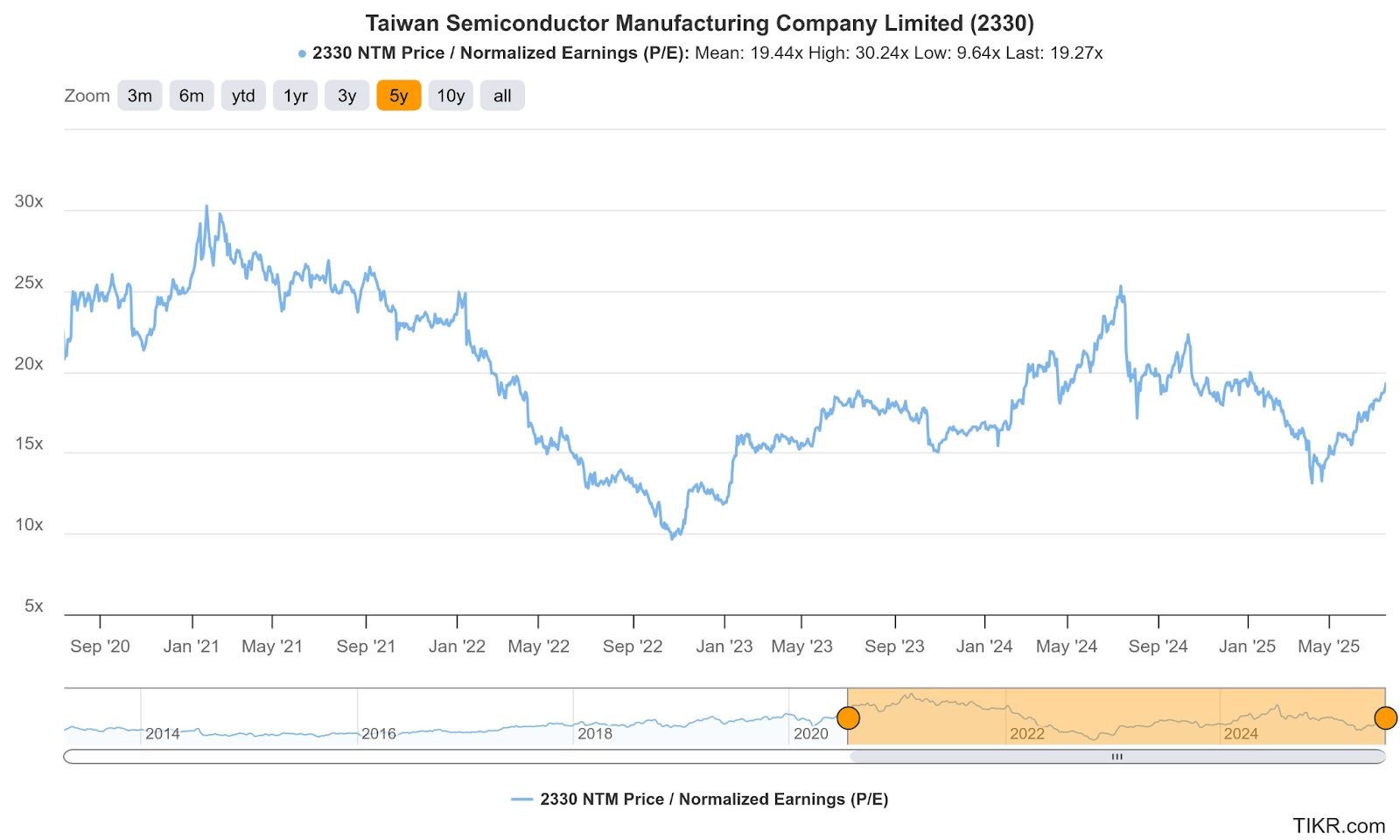

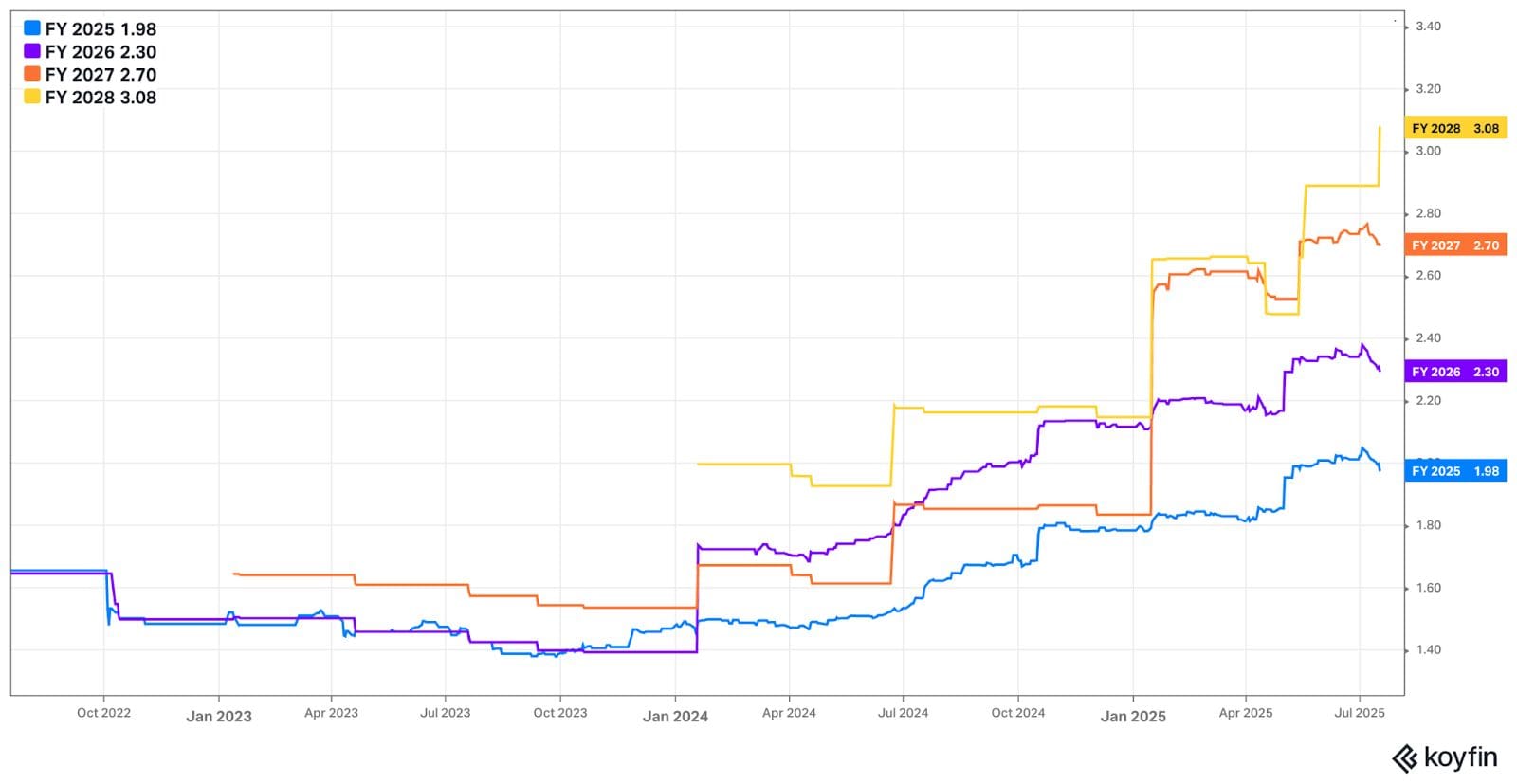

TSM trades for 18x forward EPS. EPS is expected to grow by 28% this year and by 16% next year. Estimates could modestly rise following this report (thanks to the annual revenue growth raise).

g. Call & Presentation

Demand Context:

As expected, advanced technology drove TSM’s impressive, scaled and high-margin growth. As a reminder, this bucket includes all high-performance compute (HPC) and AI-related use cases and now makes up 74% of total revenue vs. 73% Q/Q and 67% Y/Y. Within advanced technology, N3 technologies again carried TSM, with that product soaring to 24% of revenue vs. 15% Y/Y. N5 and N7 as a % of advanced revenue both fell Y/Y as customers shift demand to N3 at a rapid pace.

Specifically by Platform:

- HPC was 60% of total revenue vs. 59% Q/Q & 52% Y/Y.

- Data center demand continues to be massive and improved Q/Q.

- Smartphone was 27% of total revenue vs. 28% Q/Q and 33% Y/Y.

- Auto and IoT were both 5% of revenue and roughly stable both Y/Y and Q/Q.

Nvidia H20 Sales in China:

Nvidia will again be allowed to sell its H20 chips in China. It’s too early to say how this will impact its roughly 45% AI hardware CAGR over the coming years, but they were clearly excited about this news. It sounds like they could be raising that 45% target in the coming quarters if regulation continues to coorporate.

Manufacturing Footprint:

Most of this section is review, as construction plans were all reiterated this quarter.

TSM keeps marching full-speed ahead with its plans to invest $165B in USA manufacturing. Over the coming years, when this is all wrapped up, the new facilities will support 30% of its sub-N2 manufacturing. Leadership knows companies want to de-risk exposure to Taiwan amid its consistently heightened geopolitical risk. This is a great way to do that, with healthy support from the U.S. government and an ability to charge a premium for “Made in the USA” products.