Table of Contents

- In case you missed it – I published a Palantir ear …

- 1. Progyny (PGNY) – Earnings Review

- 2. Nu Holdings (NU) – Fun Milestone & a Credit Rat …

- 3. CrowdStrike (CRWD) – Partner & Product News

- 4. Disney (DIS) – Insider Buying & Re-Bundling

- 5. Earnings Round-Up – Robinhood (HOOD), Celsius ( …

- 6. Market Headlines

- 7. Macro

- 8. Portfolio

In case you missed it – I published a Palantir earnings review article, a Disney and Datadog earnings review article, an Uber and Shopify earnings review article, and a Trade Desk, Duolingo and Airbnb earnings review article during the week.

1. Progyny (PGNY) – Earnings Review

Progyny is the leader in managed fertility benefits for large clients like Amazon, Meta, Uber, Google, Microsoft etc.

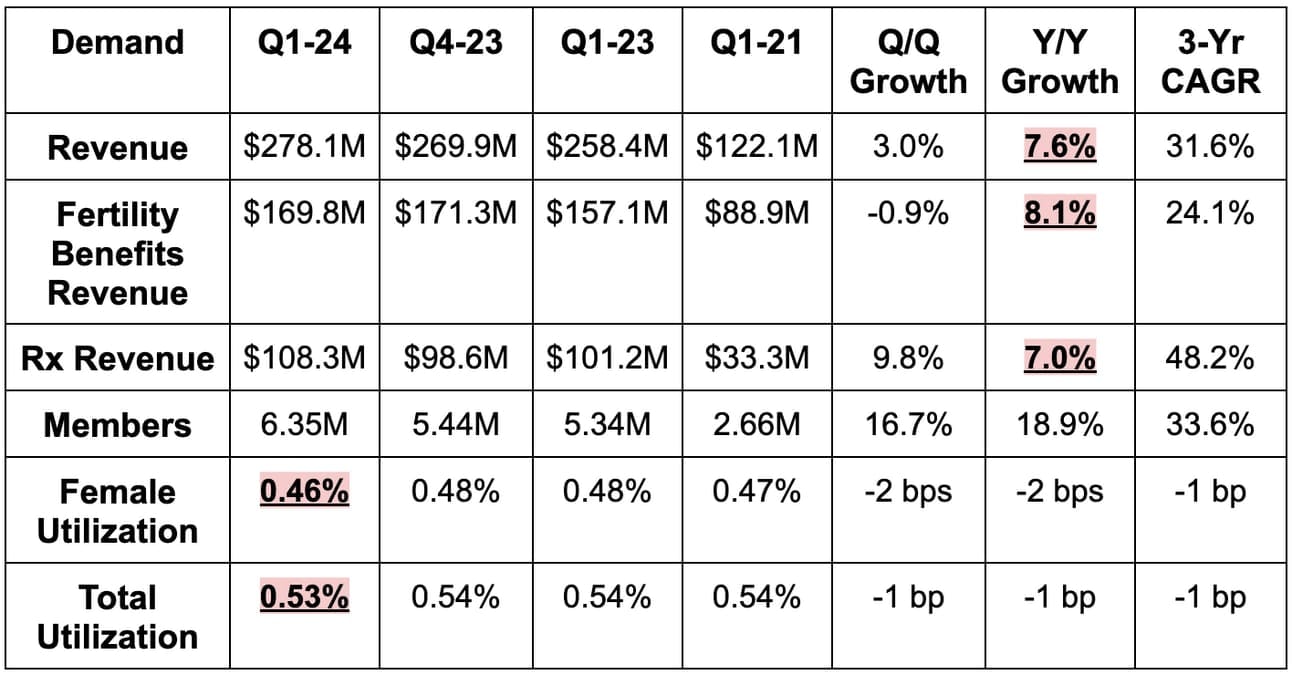

a. Demand

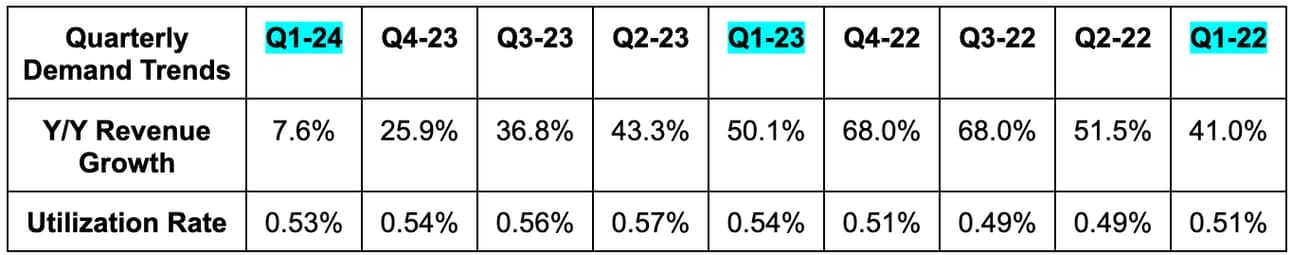

Missed revenue estimates by 3.5%. Assisted reproductive treatment (ART) cycles rose 12.4% Y/Y. Its 31.6% 3-year revenue compounded annual growth rate (CAGR) compares to 39.1% last quarter and 41.6% 2 quarters ago.

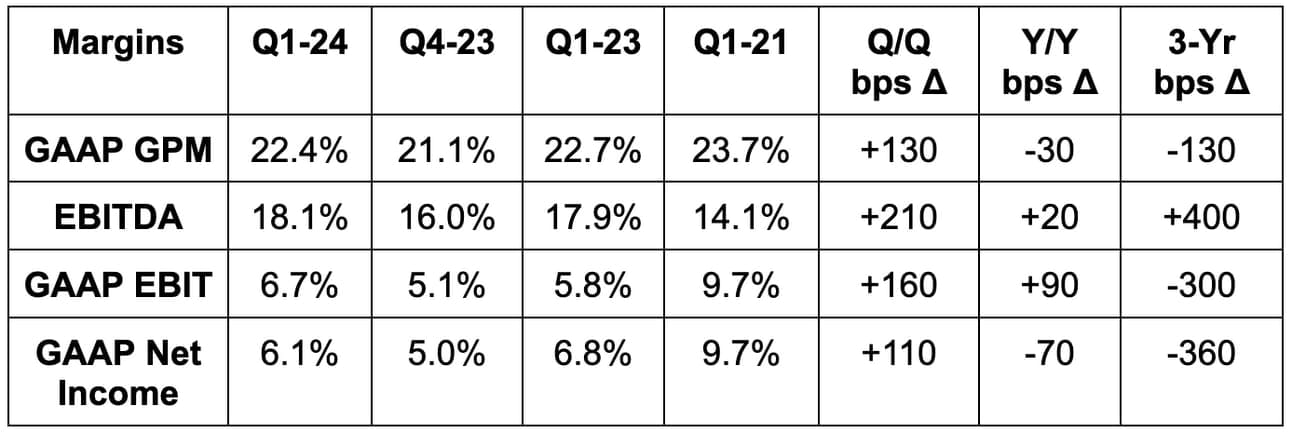

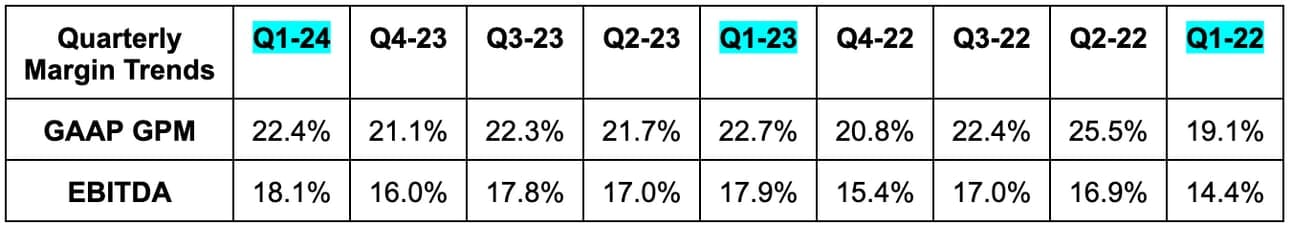

b. Profits & Margins

- Slightly beat EBITDA estimates and its EBITDA guidance.

- It enjoyed 120 basis points (bps; 1 basis point = 0.01%) of general and administrative (G&A) leverage. That was the source of the small margin improvement.

- Incremental EBITDA margin was 20%.

- Beat $0.13 GAAP EPS estimates by $0.04.

- GAAP EPS fell from $0.18 to $0.17 Y/Y due to a $5.6 million tax bill vs. a $1.3 million tax benefit Y/Y. With this same tax impact for Q1-2024, it would have earned $0.24 per share vs. $0.17 Y/Y.

- Adjusted EPS rose 15% Y/Y to $0.39.

c. Balance Sheet

- $476 million in cash & equivalents.

- No debt.

- Diluted share count rose by 0.7% Y/Y; basic share count rose by 3.1% Y/Y. It has $32 million left on its current buyback program.

d. Guidance & Valuation

Second Quarter:

- Revenue missed by 9%.

- EBITDA missed by 9%.

- Missed $0.18 GAAP EPS estimate by $0.01.

Full year:

- Lowered revenue guide by 3.8%, which missed estimates by 3.8%.

- Raised $0.69 GAAP EPS guide by $0.02, which beat estimates by $0.03.

- Lowered EBITDA guide by 3.1%, which missed estimates by 2.6%.

- Raised incremental EBITDA margin guidance from 19.4% to 20%+.

- Raised $1.57 EPS guide by $0.08 to $1.65. As non-GAAP EPS is a new disclosure for Progyny, there isn’t a large enough sample size of estimates to meaningfully compare this result to. Still, it did beat the anecdotal sample size estimate.

- Reiterated client and member targets for the year.

Progyny trades for 16x 2024 EPS and 15x 2024 GAAP operating cash flow (OCF). EPS is expected to grow by 20% Y/Y and GAAP OCF should be down Y/Y as its EBITDA to cash flow conversion rate normalizes from over 100% to 75%.

e. Call & Press Release

A Weak First Half & Guide:

There were two variables that impacted Q1 growth rates. One was as expected and one was not. First, the treatment mix-shift anomaly we covered last quarter reverted back to normal as expected. The temporary shift led to a $15 million hit to revenue for the quarter, which was in line with assumptions and is now a thing of the past.

Secondly, Progyny cited worsening utilization rates in the month of March as leading to the Q1 miss and the poor Q2 revenue guide. The timing of this weakness coincided perfectly with the Alabama Supreme Court ruling that banned abortions. This ruling created more uncertainty around IVF, as that process involves discarded embryos. That, it thinks, led to some treatment delays and cancellations for concerned mothers.

Since March ended, it has enjoyed a material tick up in utilization, which has been most pronounced in the strictest abortion states. Utilization is not back to record 2023 levels, but it is back above 2022 levels to show there’s no sudden change in appetite for treatment. That trough and geographic pattern both offer more evidence of the Alabama ruling being the true source of the weakness.

A few things here. First, I’m disappointed that the team told us this ruling would be immaterial to results. They were wrong, and the large Q2 revenue guidance miss is the result.

Secondly, after sitting with this report for 24 hours, I don’t think this changes much about the long term prospects of the company. Leaders from the left and right wings have all come out to loudly support IVF and fertility treatment protection. Structural tailwinds like later average age of birth are intact; 34+ year-old birth rates continue to rise and coverage continues to grow. Thirdly, as mentioned, utilization is improving and its selling season momentum remains strong. That points to strong forward-looking demand.

Between a bottoming in utilization and mix-shift normalizing, Progyny expects revenue growth to re-accelerate to 21% Y/Y for Q3 and Q4. This is frustrating to me. I see how things could sharply recover from here and I see how this could be a blip on the radar. If they do deliver those second half expectations, it should be handsomely rewarded. There is no reason to believe this company can’t find its footing very quickly. It’s a market share taker with strong tailwinds. On the other hand, the lack of understanding of how the Alabama ruling would impact its business does reduce the trust and faith I have in this team. It makes me less confident in that Q3-Q4 strength actually playing out. Language during the call did not make it seem like this guide was overly conservative either.

The Selling Season:

While the first half of 2024 has been poor for Progyny… there are some reasons for optimism. Progyny’s selling season is again going very well. It expects to meet or exceed the number of members and clients that it added from its 2023 selling season, which is its goal every year. Business as usual here. Early win activity, conversion of former “not-nows” to clients and pipeline size are all favorable. The pipeline this year also includes multiple state and local government populations, while its initial federal government client is interested in expanding coverage as expected.

- To augment its go-to-market, Progyny is looking to add several new channel partners to its roster to join CVS, Blue Cross Blue Shield and others.

- It teased more product launches coming, but wasn’t ready to get specific. Maybe it will announce these at its first analyst day in August.

f. Take

This was disappointing. I don’t appreciate being told that the Alabama ruling is immaterial to results when that turned out to be wrong. I wouldn’t go so far as to say this totally burned my trust in that team… but it certainly diminished it. This is back-to-back quarters of surprise headwinds that make me more hesitant about this investment. Are the issues impacting them their fault? Not really. But it’s not ok that they brushed the court ruling aside and it’s not ok that they didn’t fully grasp how this changed the landscape. These last two quarters cast doubt on how well it can navigate regulatory headwinds.

With that said… we are left with a 15%-20% revenue compounder trading at 15x earnings. It has industry-leading market share, clinical outcomes and scale. It sells a product suite that will be more and more needed by society over time… while that same suite makes Progyny’s clients richer and its members happier.

We are left with clear reasons to believe this could just be a blip on the radar. That’s why I didn’t exit. Regardless, my reduced trust in leadership did lead me to cut 50% of this holding on Friday. It’s now on my do-not-add list while I wait and see if they’re right about the second half of the year. Strike two.

2. Nu Holdings (NU) – Fun Milestone & a Credit Rating Boost

Nu Holdings reports earnings next week. The data should be excellent. Structural tailwinds are firmly in place and cyclical tailwinds are beginning to ramp as Brazil and others cut rates. What will the stock do? If this earnings season has been any indication… who the heck knows. I’ll focus on the data.

This week, Nu crossed 100 million total users compared to 93.9 million as of the end of 2023. It’s worth noting that this includes about 1 month's contribution from calendar Q2, but this is still encouraging. The 6.1 million net adds, when excluding the implied Q2 impact, remained at consistently strong levels. But more encouragingly, Mexico added 1.8 million consumers to reach 7 million as of this press release. That’s 2x the 900,000 customer adds it saw there last quarter; this marks a roughly 50% acceleration in monthly adds without the Q2 contribution. The high yield savings product, since broadly launching last year, is clearly thriving.

Nu is now the largest consumer banking platform outside of Asia by customer count. Its net promoter score (NPS) is also 3x higher than incumbents. I always take this subjectively calculated metric with a grain of salt, but still worth noting. Nu is powering broader financial inclusion in Latin America… delivering explosive, increasingly profitable growth… and pricing risk effectively across cycles. It’s winning, and I expect that winning to continue in a few days when it reports.

In other news, S&P Global upgraded Nu’s credit to BB globally and brAAA in Brazil. This brings it up to par with the highest quality incumbent banks there and should help grow the already tangible cost of capital lead vs. the pack. The deep dive will be published after this earnings report. It is ready to go, but I wanted to update it with more current financial data.

3. CrowdStrike (CRWD) – Partner & Product News

a. Partner & Competition News

CrowdStrike and Google Cloud are deepening an already strong relationship to “transform AI-native security.” CrowdStrike’s threat hunting team will now run Mandiant’s (owned by Google) Managed Detection and Response (MDR) offering. It will lean on CrowdStrike’s bread-and-butter Endpoint Detection and Response (EDR) as well as its budding identity security tools. This is expected to bolster shared-client protection within Google Cloud’s Security Operations.

So this marks strengthening Google, Amazon and Tata partnerships for CrowdStrike in the past two weeks… but there was perhaps an even more interesting announcement to dissect. CrowdStrike announced Falcon for Microsoft Defender this week. Falcon for Defender will deploy next-gen Extended Detection and Response (XDR) (basically more holistic EDR) in parallel to Defender. Microsoft’s multi-agent, multi-console, multi-license setup leads to frequent breaches, poor protection and soaring client costs. While Microsoft’s enterprise software bundle is the best in the world, its endpoint security product is not.

This will help those Microsoft clients enjoy the same visibility that has given Falcon its best-in-class reputation. The release also includes cross-domain threat hunting for Azure clients and what CrowdStrike calls its Cloud Detection and Response (CDR) product. CDR is similar to EDR and XDR, but for cloud workloads. Falcon CDR’s zero-trust make-up should limit the common Microsoft Defender issue of a hacker breaching the most vulnerable part of its environment and then freely moving throughout it thereafter. Falcon ensures these adversaries are constantly verified and that any suspicious behavior is expediently flagged.