In case you missed something from this past week:

- Nu & Airbnb earnings reviews

- The Trade Desk News Alert

- Cava & On Running earnings reviews

- Portfolio & Performance Updates

In case you missed something from this earnings season (labor of love):

- AMD Earnings Review (section 4).

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang Earnings Reviews

- Mercado Libre & Palantir Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews.

- Starbucks & Apple Earnings Reviews.

Next week, we’ll publish a Palo Alto review, two catch-up reviews on Spotify and Cloudflare, and more coverage.

Table of Contents

- 1. Datadog (DDOG) – Earnings Review

- 3. SoFi (SOFI) – Invest Roadmap

- 4. Nu (NU) – M&A?

- 5. Amazon (AMZN) – Groceries Expansion

- 6. Robinhood (HOOD) – July Data

- 7. Headlines & Analyst Notes

- 8. Macro

1. Datadog (DDOG) – Earnings Review

a. Datadog 101

Core Product Niche:

There’s a lot going on within this product suite and I think that understanding the basics is important. This recurring section will be review for some. If it’s not for you, let’s learn:

This is a dominant player in the data observability space. Observability simply refers to the practice of monitoring an entire asset ecosystem to track issues, vulnerabilities and performance. Knowledge is power, and so this organized surveillance has a way of expediting resolutions to challenges. Other players within this area include the hyper-scalers, Splunk, Elastic, CrowdStrike (through M&A) and many more. Datadog splits its observability niche into 3 smaller buckets: Infrastructure Monitoring, Log Management and Application Performance Monitoring (APM).

Infrastructure monitoring: provides a holistic view of assets like servers and networks. It automates the collection of traffic and overall usage insights. That means it can more expediently fix and uncover infrastructure problems. This can also help clients and their vendors uncover suboptimal compute distribution. Fixing those inefficiencies cuts expenses, expands available capacity, and will only get more popular in a world obsessed with controlling exploding GenAI costs.

Log management: collects and manages logs or “timestamped records of events.” This also facilitates faster issue remediation and optimization of performance. This product routinely supports infrastructure monitoring, BUT there’s a key difference between the two. Log management handles event-based data like customer service interactions, while infrastructure monitoring (as the name indicates) handles infrastructure-based metrics.

- Flex Logs are a cost-effective means to store and retain large batches of logs by separating storage and query usage. In turn, that separation makes it ideal for long-term data storage and regulatory compliance. Separation also unleashes more data scalability, query customization and cost optimization. Conversely, querying from a flex log is slower than standard logs. That makes Flex Logs better suited for lower priority data and where latency is not a crippling bottleneck.

Application Performance Monitoring (APM): tracks app performance and uncovers/prioritizes performance issues to be remediated.

- Within APM, it’s working hard on app-building products to allow developers to customize existing tools, apps and models with their own data and work.

There’s also a newer, related form of Datadog monitoring called Digital Experience Monitoring. It’s exactly what it sounds like. This product includes real-time user monitoring (RUM) to track precise, observed interactions, and also Datadog Synthetics, which is similar to RUM, but tracks a simulation of expected interactions – thus enriching the overall picture. Datadog delivers detailed churn analysis, engagement metrics and more from these tools. It also provides mobile app and feature testing, as well as actionable user journey visualization reports.

- Within Digital Experience Monitoring, it recently introduced mobile app testing. With it, users can conduct this testing right from their actual mobile phones. This expedites the finding of app issues and comes with session replays to ensure engineers don’t miss problems with product construction.

These four product categories, which frequently work together, form its “unified platform.”

Security:

Because Datadog already handles network viability, security is a wonderfully relevant growth adjacency. Here are some of the important security products:

- Cloud Infrastructure Entitlement Management (CIEM) for example, fortifies strict, minimum access identity controls, cutting risk of identity attacks in the cloud.

- Security Information and Event Management (SIEM) product allows for “long-term data log visualization for security investigations.” It’s helpful for broad threat management use cases. This can be done without dedicated staff, making cloud migration and usage easier.

- Most recently, it added agentless environment scanning (no security agent installation needed) to match with its agent-based product.

- It also has some data loss prevention scanning to flag, monitor and protect sensitive data.

- Finally, it offers application security and code security, which cater to use cases across the development, security and operations (DevSecOps) lifecycle. Datadog has been a large player in the Ops section (and increasingly Sec too). Code security is moving into the Dev section more meaningfully, or moving “further left” towards developers.

- Its sensitive data scanner is a core piece of bringing all of these products to life.

AI:

Finally, this intro would not be complete without its GenAI product work. Toto is its first foundational large language model (FLLM) and Bits AI is its copilot. So far, this can summarize incidents and conversationally field questions. It’s also rolling out autonomous investigations, removing the manual work from uncovering issues with infrastructure, large language models, apps, usage patterns etc.

Much more is coming. And unsurprisingly, it also tweaked and configured its core products to cater to LLM observability.

b. Key Points

- Strong quarter thanks to ramping AI contributions.

- Security is gaining great traction.

- Rapid OpEx growth to fund the next era of innovation and growth.

c. Demand

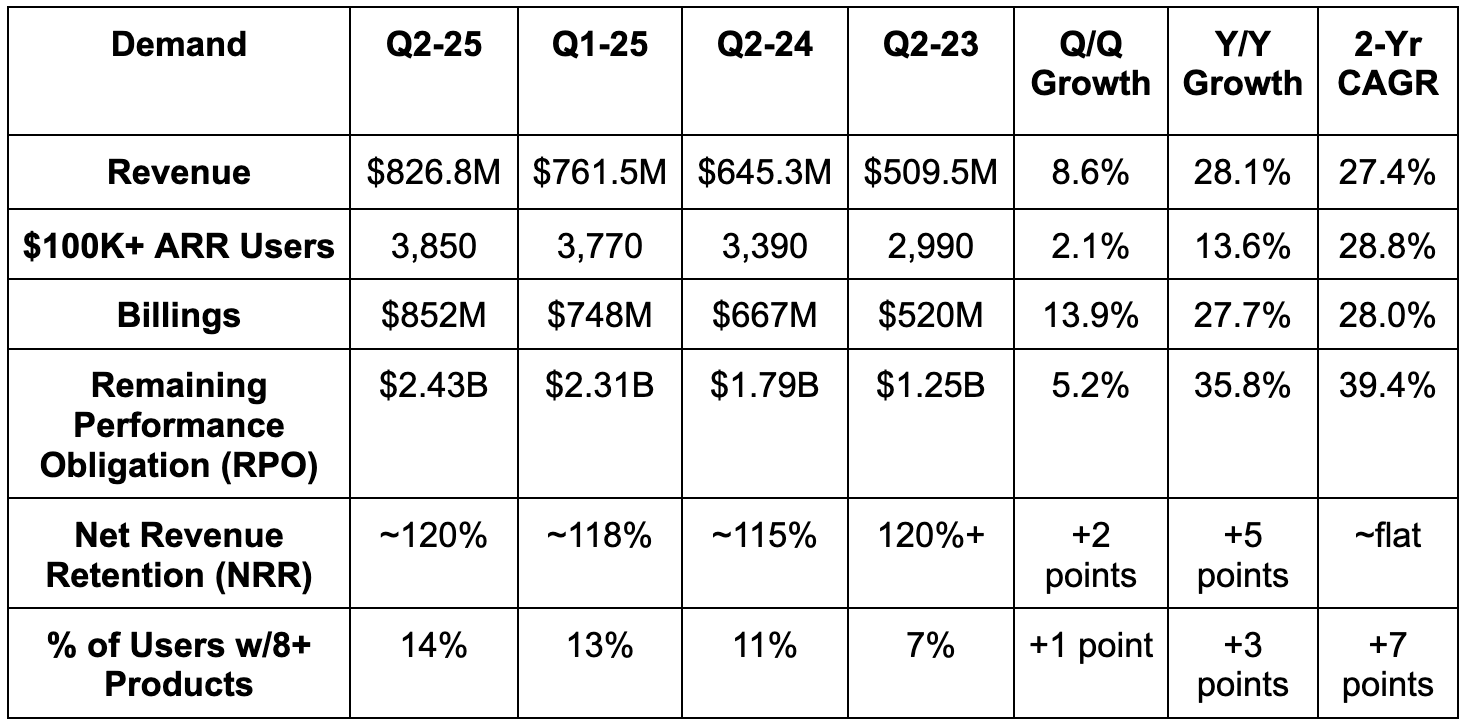

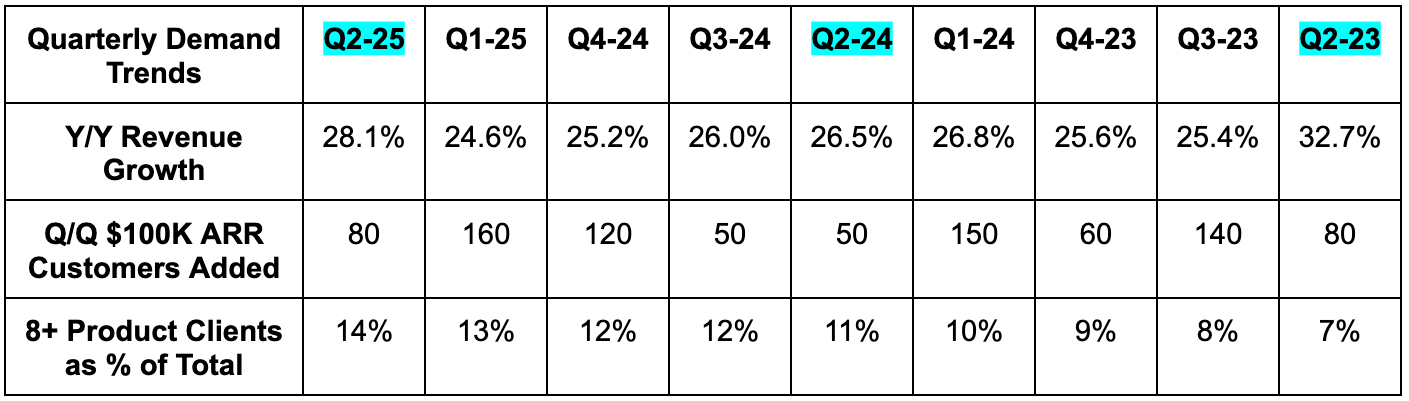

- Beat revenue estimate by 4.5% & beat guidance by 4.8%.

- Beat billings estimate by 4.6%.

- Total customers rose by 9.4% Y/Y.

- Gross revenue retention remained in the mid-to-high 90% range.

d. Profits & Margins

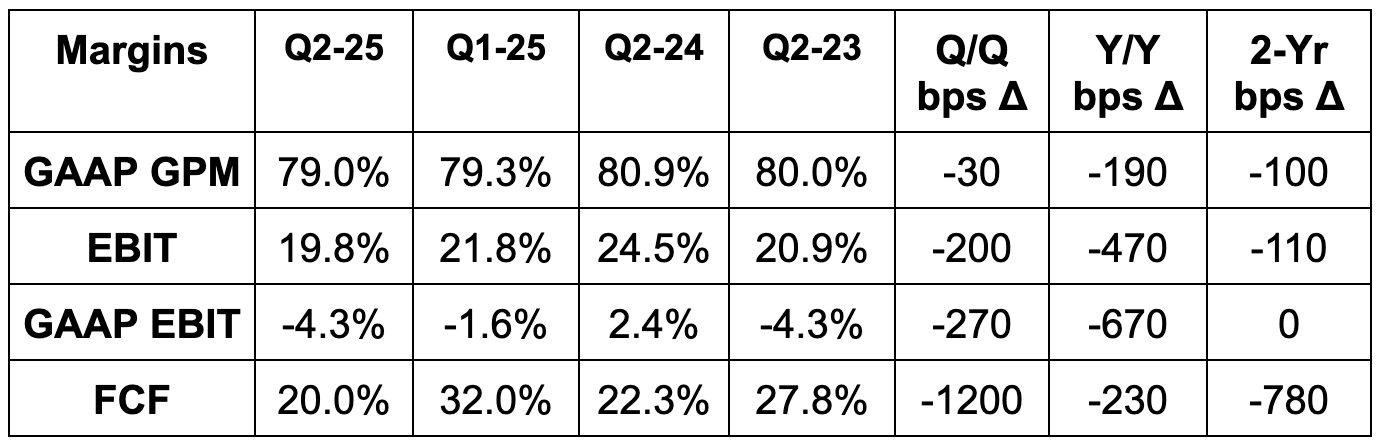

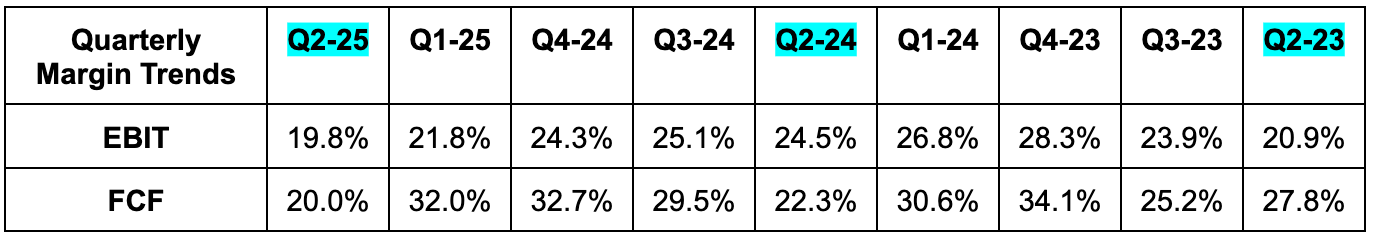

- Beat EBIT estimates by 7.7% & beat EBIT guidance by 9.3%.

- Beat $0.41 EPS estimates & identical guidance by $0.04 each.

- EPS rose by 8% Y/Y.

Gross margin was pressured by ongoing growth investments, with some offsetting help from engineering and cloud cost efficiency gains. For the same reason, OpEx rose by 30% Y/Y, powering the sharper EBIT margin contraction. It’s worth noting that excluding FX headwinds and their annual DASH product event, EBIT margin would have been 22%. At the same time, the product event happened last year too, so comps are apples-to-apples.

e. Balance Sheet

- Nearly $4B in cash & equivalents.

- $981M in convertible senior notes.

- No traditional debt.

- Share count rose by 0.5% Y/Y.

f. Guidance & Valuation

- Raised annual revenue guidance by 2.9%, which beat estimates by 2.4%.

- Q3 guidance was ahead by 3.5%.

- Raised annual EBIT guidance by 8.5%, which beat estimates by 6.3%.

- Q3 guidance was ahead by 11%.

- Raised annual $1.69 EPS guidance by $0.13, which beat estimates by $0.11.

- Q3 guidance was ahead of $0.41 estimates by $0.04.

Like it typically does, DDOG leadership baked considerable prudence into forward guidance to set up another quarter of probable outperformance. They remain quite confident in their long-term growth opportunities.

In a note from Bank of America this week, they cited traffic growth for DataDog accelerating a full 7 points compared to June – slightly beyond typical seasonality.

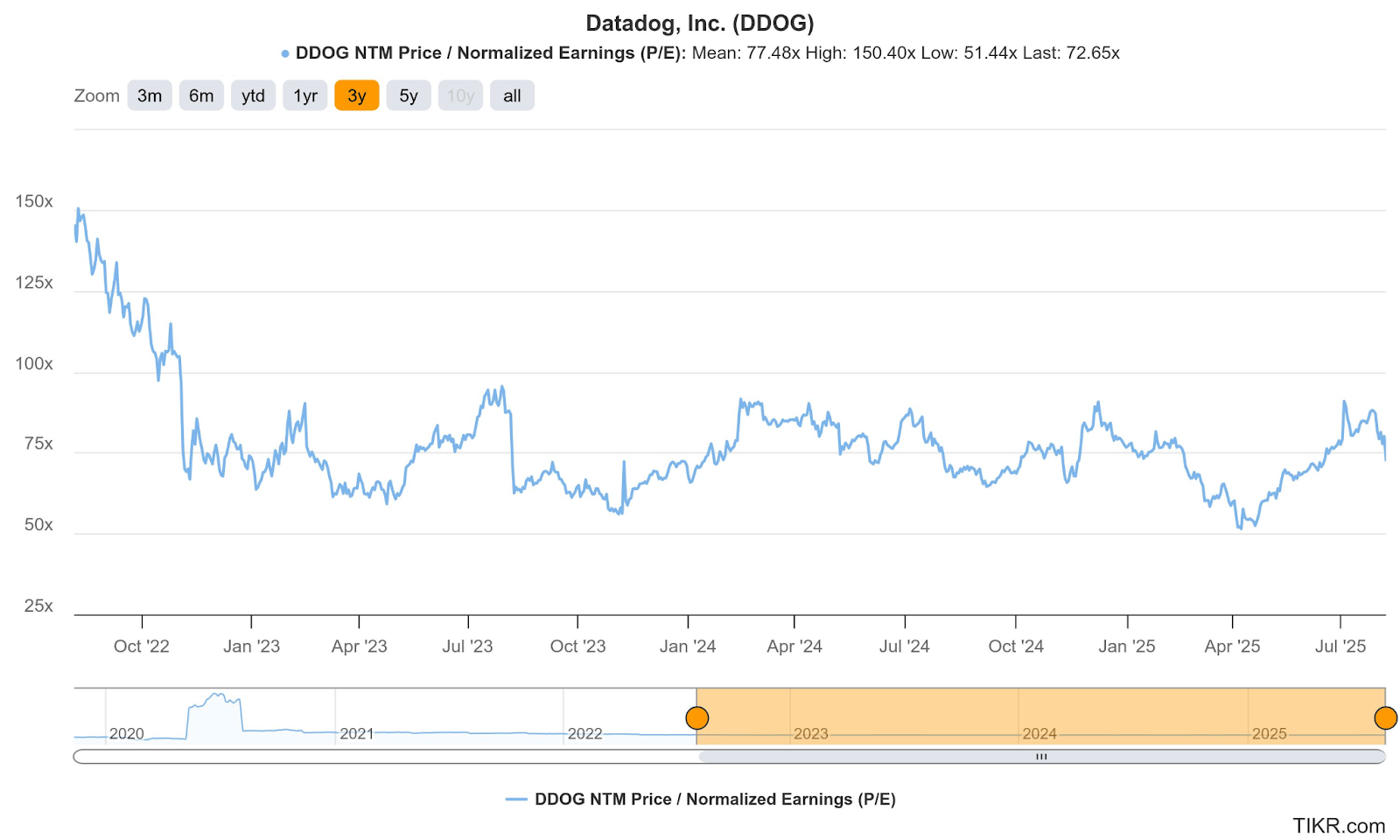

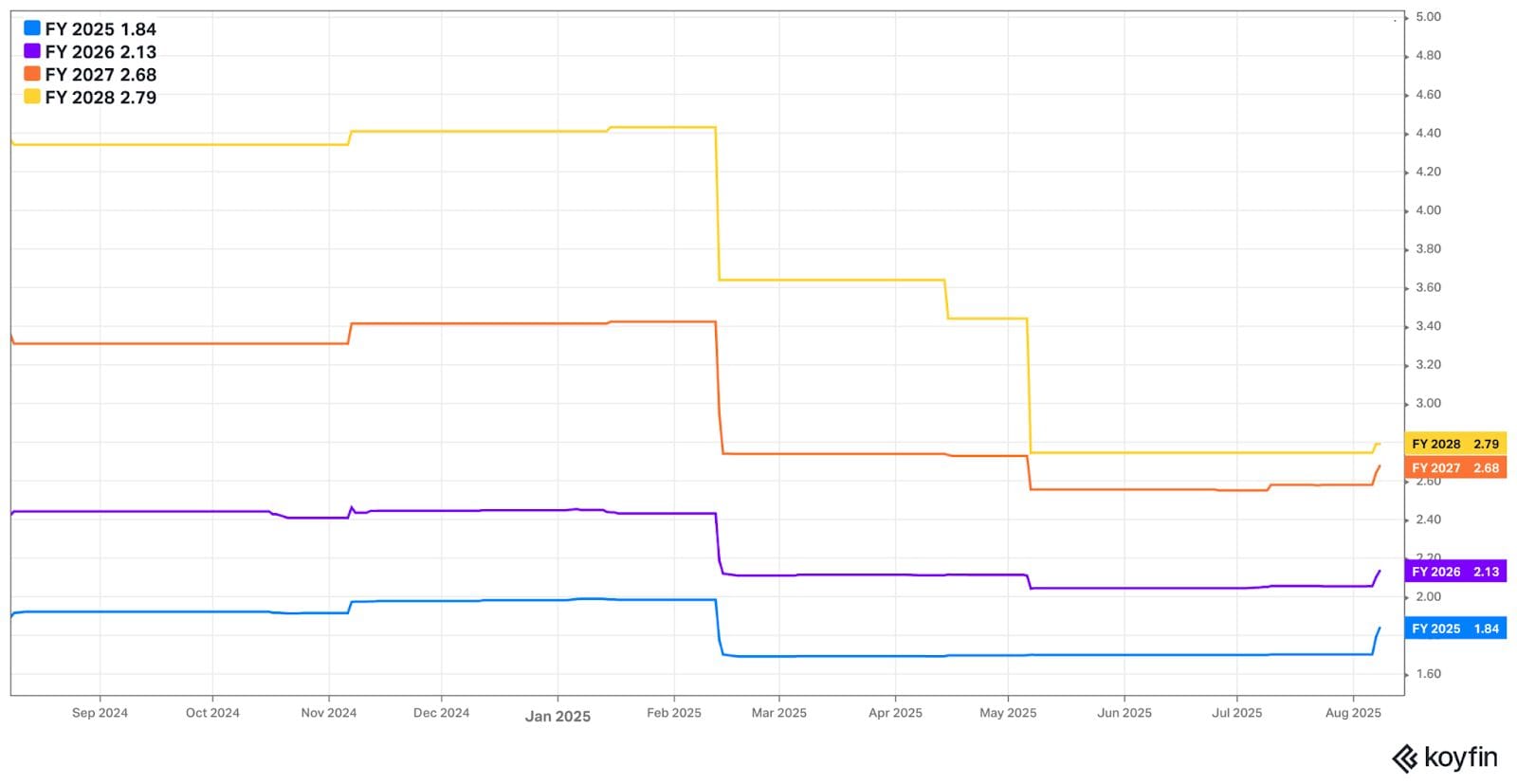

DDOG trades for 65x forward EPS. EPS is expected to grow by 1% this year, 17% the following year and 25% the year after. It also trades for 49x forward FCF. FCF is expected to grow by 8% this year before compounding at a 27% clip over the next two years. They’re in investment mode for 2025.

g. Call & Release

Core Business & AI Demand Trends:

Overall usage growth was better than expected during Q2, which drove the top-line outperformance. This was driven by AI-native cohort strength. That specific chunk of business has already morphed into a rapidly growing and scaled piece of this company. Specifically, this bucket is now 11% of revenue vs. just 4% Y/Y, and delivered 10 incremental points of Y/Y revenue growth vs. 6 points Q/Q and 2 points Y/Y. That single-handedly allowed revenue growth to accelerate on a Y/Y basis, which is both exciting and a bit nerve-wracking.

That’s because a lot of this contribution is coming from a single customer (OpenAI). As we’ve covered during the quarter, there’s been a bit of a sell-side analyst battle on the size of this risk. Most believe OpenAI will build some of these tools on its own to vertically integrate and streamline its cost structure. The debate centers on whether or not that will slow the growth engine beyond expectations, or if the rest of the AI cohort (and the core business) deliver strong enough momentum to offset that headwind. We didn’t really learn much about that this quarter, as OpenAI has not begun this expected vendor consolidation process just yet. What we did learn is that AI-native cohort growth ex-OpenAI is very strong and stable Q/Q. They have 80 AI-native customers spending $100,000K+ per year with them – including 8 of the top 10 largest in the space. That bodes well for overcoming the potential obstacle. And at the same time, their forward guidance bakes in pessimism beyond what they’re actually seeing because of risks like this. They saw cloud-native customers embark on the same cost optimization trend 3 years ago, and that caught them a bit by surprise. Now, they’re expecting that in (very strong) forward expectations, thus leaving surprise to the upside. It’s the right decision.

All in all, DDOG doesn’t think OpenAI will come close to slowing down this growth engine. They view AI as a large business tailwind mainly within the app layer; as we often talk about, that’s the layer (others are models and infrastructure) that takes the longest to monetize. Palantir is really the only software company doing it with dramatic, scaled growth right now.

Outside of AI, core consumption was similar to previous quarters. Small and medium business (SMB) growth accelerated modestly Q/Q, while large enterprise consumption was stable sequentially.

Platform Player Update:

Progress in rounding out DDOG’s value proposition, selling customers more products and becoming a platform play was palpable. DDOG has a seamless ability to add those products to its existing customer contracts and cover a larger part of customer technological infrastructure. Security is a great example of where it can achieve this, and that category crossed $100M in ARR during the quarter, growing at a roughly 45% Y/Y clip. Aside from that, multi-product adoption from customers (not just 8+ product customers in the chart above) is up and to the right… quarter after quarter.

For security specifically, they have more work to do on go-to-market. DDOG thinks they can get better with “standardizing adoption wall-to-wall in large enterprise contracts.” It’s working on packages and incentives to nurture this momentum, which would be great for platform-level momentum.

Product Innovation & Wins:

DDOG unveiled a slew of new products at their user conference this past quarter. These were the highlights:

In the realm of AI agents, it introduced autonomous site reliability engineer (SRE) agents. This fully handles alert response, triaging and remediation, while offering fixes to and actionably resolving code bugs. Next, it added security agents that can investigate events, provide the best plan of action for remediation and address vulnerabilities in apps and source code. Finally, it unveiled voice agents that allow security analysts and users to fix any issues right from their mobile devices.

To upgrade DDOG’s software delivery workflows, it added the Internal Developer Portal. This is a cataloged, real-time dashboard of all packages and APIs, and has self-service support for software creation. It also debuted its Model Context Protocol (MCP), which ensures autonomous agents can fetch the required data from a wide array of sources across the web. Early integration partners include Cursor, OpenAI and Anthropic. With Cursor and OpenAI specifically, the new integrations allow DDOG products to be used within the integrated developer environments (IDEs) of each form.

In the spirit of staying ahead in its core niche, it announced some new observability products as well. Its APM Latency Investigator automates forensic investigations to rapidly generate root cause analysis and better optimize product performance. Proactive App Recommendations are also now available. These help analysts and developers stay up to date on tracking APM data to find issues more proactively. Next, it added a new tier to Flex Logs called “Flex Frozen.” This enables customers to store event data for 7 years, with easy querying options that don’t come with data transfer costs. And finally, observability tools for AI models, apps and even GPU performance all should help DDOG become a great partner for helping companies embrace this technological wave in a productive, ROI-maximized manner.

The last product category to discuss is security. Their sensitive data scanners have been retrofitted to handle LLM prompts and responses, while it added support for AI supply chain protection and model hijacking prevention – or maliciously manipulating models to elicit inaccurate responses. Furthermore, it added prompt injection protection and data poisoning help. The first protects against hackers inundating models with poor data to lower output quality; the second insulates companies from adversaries attempting to actually manipulate training data that has already been ingested by models.

- Also introduced LLM observability experiments to see how prompt or model changes impact app performance in a zero-stakes environment.

- MetaPlane M&A is expected to expedite DDOG’s AI data observability product expansion (and it already is).

If product innovation and solid go-to-market are the causes… big client wins is an effect. This quarter, there were several examples to mention:

- New 3-year, $60M contract with a large cap bank. They’re using 21 DDOG products to start.

- Raised a 7-figure annual contract to 8-figures with a large U.S. insurance company. They’re consolidating observability vendors with 19 DDOG tools and expect to save $9M per year as a result.

- 7-figure expansion deal with a large U.S. media company. This company is moving from 100 disparate point solutions to 21 DDOG tools – including all of its security products.

- New 7-figure deal with a large Brazilian e-commerce company (MELI was already a customer) that will begin with 7 products.

- Finally, a large U.S. mortgage company that was previously a customer came back to DDOG in a 7-figure annual deal.

- All in all, DDOG is quite pleased with sales productivity.

More on AI:

Most of DDOG’s AI work continues to be with AI-native customers. It has a real opportunity to grow data, application, and AI-asset monitoring as large enterprises move from experimentation to scaled distribution of AI-powered tools. All of these apps will be rich with context, agents and models that will all need to be monitored, optimized and protected. All of these apps will also need to constantly pull from various parts of the digital world to provide needed context and good experiences. That all means more demand for products that DDOG offers.

That’s when DDOG expects the most dramatic uplift from AI demand. And while that hasn’t happened yet, a 10-point boost to revenue growth from AI is still quite impressive. They also are confident that products like Bits AI will augment existing products and materially contribute to growth.

h. Take

Another good quarter from this rock-solid company. The product innovation cadence remains rapid and they’re showing clear signs of effectively selling these new products. AI contributions are ramping, while non-OpenAI growth remains quite strong as well. That diminishes a bit (not all) of the risk of OpenAI likely internalizing some of these capabilities in the coming quarters. Opex growth should begin to slow down next year, which is when profit growth should meaningfully accelerate to complement stable top-line expansion.