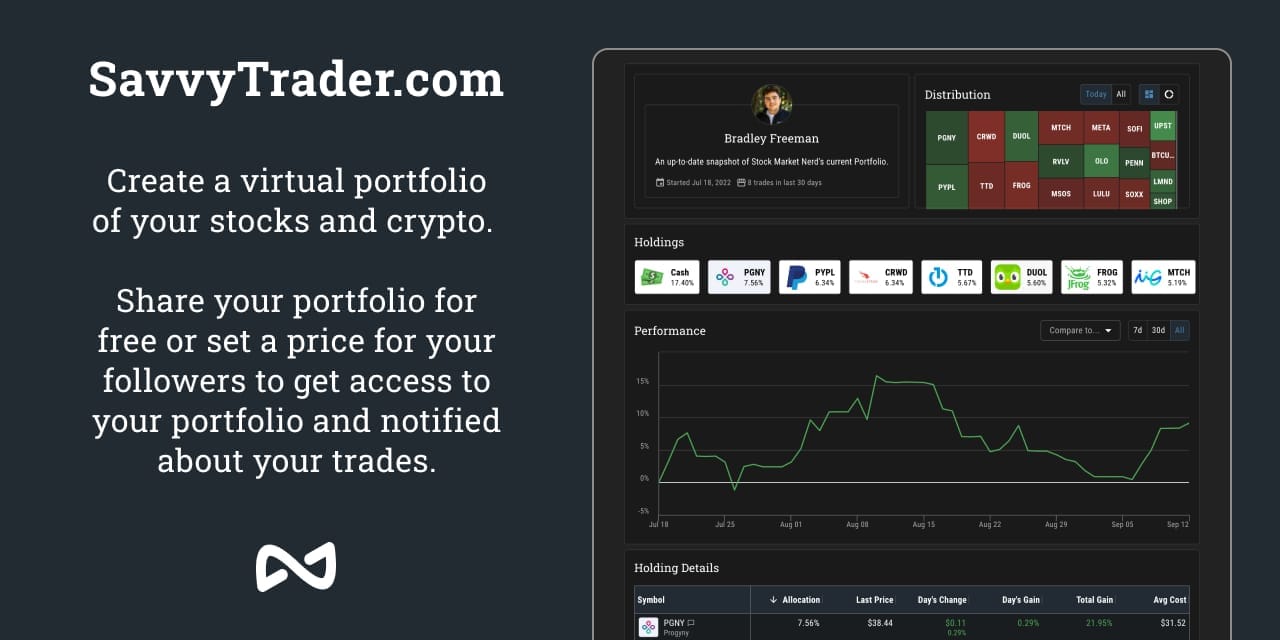

Today’s Piece is Powered bySavvy Trader-- the only place you can findmy portfolio:

Welcome to the 342 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. SoFi Technologies (SOFI) -- More Buying & Student Loans

a) More Buying

Following the $8.8 million in stock that CEO Anthony Noto has purchased in recent months, he purchased $2.5 million more via yet another open market purchase.

While some like to point out Asana’s CEO as the reason why this doesn’t matter, I wholeheartedly disagree. Why? 2 main reasons:

- The evidence is entirely anecdotal and there are many more instances indicating that it is a bullish signal for shareholders.

- Noto is not worth billions of dollars like Asana’s founder is. He’s worth around $100 million… meaning he placed over 10% of his total net worth into SoFi shares with these purchases ALONE. Not to mention that his liquid net worth is much less than $100 million and a large chunk of his wealth is already invested in SoFi.

b) Student Loans

The Supreme court will field arguments pertaining to Biden’s pandemic-era loan forgiveness policy in February. I’m not here to tell you what I think about the politics behind this move. I know you don’t care about reading that. I’m here to tell you what this could potentially mean for SoFi. Regardless of what happens here, any kind of final resolution will almost definitely be a large positive for business. Why? The proposed forgiveness equates to just 14% of outstanding Federal loan balances for SoFi’s target demographic. The moratorium ending either means 100% of that target volume will become more motivated to refinance with SoFi, or 86% of it will.

Regardless, that outcome would be far better than what we have today with loan customers having virtually zero incentive to seek refinancing and no clarity on when that incentive will return. Dragging out the moratorium is what will delay SoFi’s full fundamental recovery -- not if a small chunk of the debt ends up being forgiven. Hopefully these hearings will resolve this annoying issue once and for all. But we shall see. And regardless, forgiveness expiration is not in the company’s forecasts and Sofi still expects 35%+ revenue growth and more margin expansion for 2023.

2. Airbnb (ABNB) -- Regulation

a) Puerto Rico

New data from Puerto Rico revealed that a 10% rise in short term rentals inflates average home prices by about 7%. With the proliferation of Airbnb’s in the territory, it could consider (I’m speculating) a special tax on properties to remedy this issue which would hurt the company’s unit economics to a certain extent (taxes always push us away from equilibrium and create deadweight loss). A more restrictive ban seems very unlikely considering how important this market has been to that economy’s post pandemic recovery. Banning Airbnb’s would be cutting off the nose to spite the face.

b) EU

In the last month, the EU has been moving towards expanding the Digital Services Act to require more data-sharing from rental companies like Airbnb, Booking.com and Expedia. The added data sharing obligations would include things like host identity, stricter tax disclosures and safety measures among other things. It would also create stricter host registration requirements to monitor properties and platforms -- something that has been tough to do in the past due to properties routinely being listed in multiple locations. This would create requirements at the platform level for Airbnb to disclose needed information to the EU on a monthly basis.

The main worry here is that this will embolden cities to act like Barcelona (banned rentals of a month or less) and restrict short term rental availability in certain areas. For now, the legislation does not seem to call for that and even seems to make it less likely. Why? This pushes more of the regulation from the city level to the continent level which could make cities less motivated to create their own restrictive legislation to diminish economic activity. More organization, more clarity and more data-sharing should, I think, assuage some local concern -- all else equal.

Airbnb supposedly “welcomes the regulation” and plans to continue working closely with European governments to find a solution. In a company statement, Airbnb also called the proposal a “major step forward to harmonize rules and unlock benefits of hosting for European families while allowing the Government to clamp down on speculators.” It sees this as potentially RESOLVING strict rules in places like Paris and Barcelona by creating a more open and centralized framework. It has to say this… but still good to hear.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. CrowdStrike (CRWD) -- Accolade

Frost & Sullivan crowned CrowdStrike as its top Cyber Threat Intelligence vendor for 2022. It took first place in both growth and innovation. The research organization estimated its market share to be over 15% and called its growth “remarkable.” I agree. It sees CrowdStrike quickly pushing towards a one-stop shop for stopping breaches.

“Unlike most other vendors on the Frost Radar, CrowdStrike can leverage client threat telemetry from deployments of its endpoint solution. CrowdStrike’s strategy addresses the needs of the most basic customers that are implementing threat intelligence for the first time, and the more strategic requirements of advanced organizations and government entities. -- Frost & Sullivan Global Research Director Jared Carleton

4. Duolingo (DUOL) -- Insider Buying & Fundamental Strength

Durable Capital Partners -- a 10%+ owner of Duolingo -- added roughly 300,000 ($21 million) more shares to their sizable Duolingo stake via 3 separate open market purchases this week. This equates to about a 9% boost to its position and follows a string of consistent purchases since the company has gone public.