A large portion of the content from this week was already sent. In case you missed it:

- Lululemon Earnings Review.

- Salesforce & SentinelOne Earnings Reviews + SoFi & PayPal CFO Interviews.

- Zscaler Earnings Review.

- Uber & Waymo News.

- Portfolio Updates.

A few Dozen More Earnings Reviews From This Season to Catch Up On:

- Meta & Microsoft Earnings Reviews

- AMD, Alphabet and Visa Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Tesla & Service Now Earnings Reviews

- Netflix and Taiwan Semi Earnings Reviews

- Robinhood, Starbucks & Lemonade Earnings Reviews

- Palantir & Hims Earnings Reviews

- Duolingo, Celsius & Mercado Libre Earnings Reviews

- Airbnb, Datadog and The Trade Desk Earnings Reviews

- DraftKings & Coupang Earnings Reviews

- Shopify Earnings Review

- Nu & Disney Earnings Reviews

- CrowdStrike Earnings Review

- Nvidia & Snowflake Earnings Reviews + Lemonade Investor Day

- Palo Alto Earnings Review (Section 3)

- Cava, Spotify & On Running Earnings Review

It’s called Stock Market Nerd for good reason… :-)

Table of Contents

- 1. Gitlab (GTLB) – Earnings Snapshot

- 2. Shopify (SHOP), Mastercard (MA) & Amazon (AMZN) …

- 3. Amazon (AMZN) – AWS Re:Invent 2024 Announcement …

- 4. Celsius (CELH) – Chief of Staff Interview:

- 5. Okta (OKTA) – Earnings Review

- 6. SoFi (SOFI) – Various News

- 7. More Headlines

- 8. Macro

Next week, coverage will include:

- Oracle, MongoDB and Adobe Earnings Reviews

- Disney, Uber, Shopify & DraftKings conference coverage

- So much more

1. Gitlab (GTLB) – Earnings Snapshot

As a reminder, earnings “snapshots” offer a very brief 30,000 ft. view of financials. Earnings “reviews” are where I offer detailed reports on all earnings materials.

a. Results

- Beat revenue estimates by 4.3% & beat guidance by 4.5%.

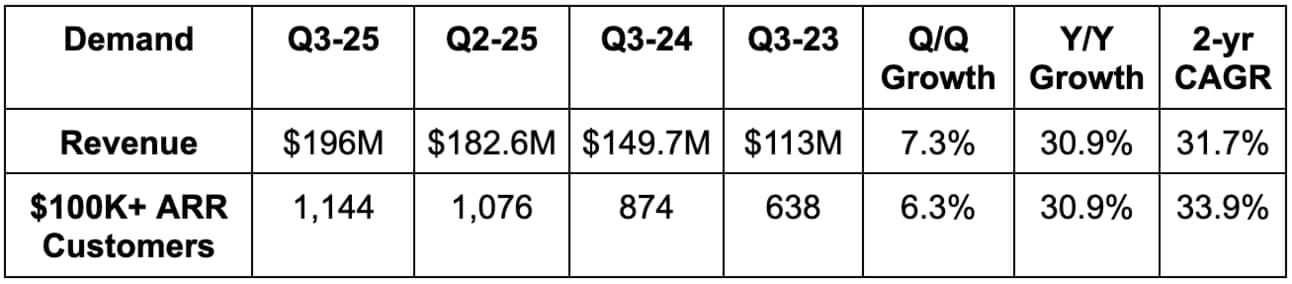

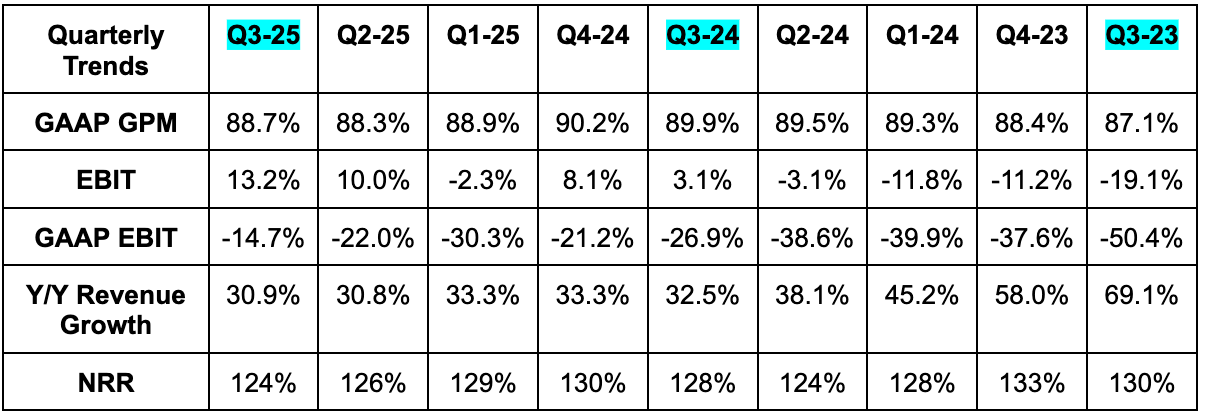

- 31.7% 2-yr revenue CAGR vs. 34.2% Q/Q & 39.1% 2 Qs.

- 124% net revenue retention (NRR) vs. 126% Q/Q & 129% 2 Qs ago.

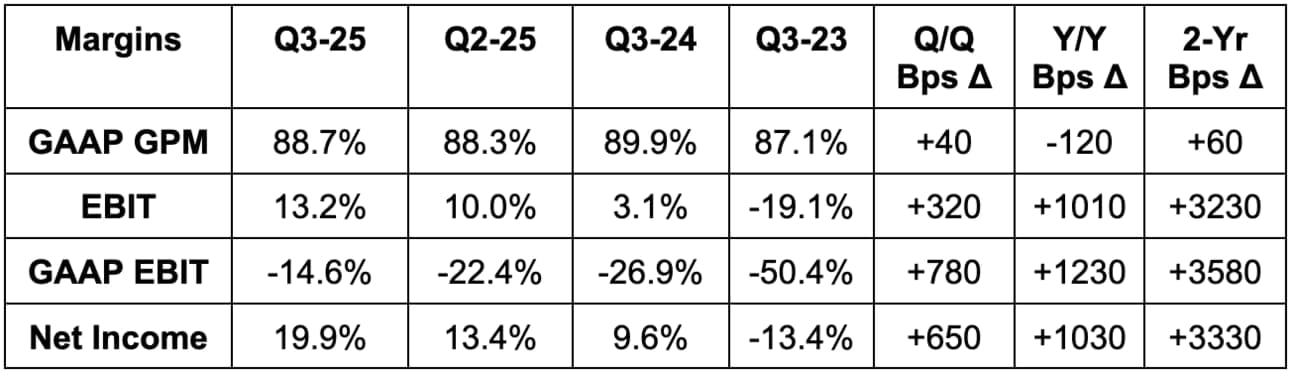

- Beat EBIT estimates by 27% & beat guidance by 33%.

- Beat $0.15 EPS estimates by $0.08 & beat guidance by $0.07.

b. Q4 Guidance & Valuation

- Raised Q4 revenue guidance by 0.9%, which slightly estimates by 0.3%.

- Raised Q4 EBIT guidance by 26%, which beat estimates by 23%.

- Raised Q4 EPS guidance from $0.13 to $0.22, which beat by $0.07.

GTLB trades for 86x forward EPS and 78x forward FCF. EPS is expected to compound at a 29% 2-year clip. FCF is expected to compound at a 43% 2-year clip.

c. Balance Sheet

- $915 million in cash & equivalents.

- No debt of any kind.

- Diluted share count rose by 8% Y/Y.

- Basic share count rose by 4% Y/Y.

2.Shopify (SHOP), Mastercard (MA) & Amazon (AMZN) – Holiday Weekend

Shopify delivered $11.5 billion in global sales over the Black Friday, Cyber Monday weekend. This represents 24% Y/Y growth, which is stable compared to last year despite a shorter holiday shopping season vs. last year. This also matches its fastest rate of growth since the pandemic. Customer count for its overall merchants rose by 25% Y/Y and Shop Pay volume rose by 58% Y/Y. This was an undeniably strong showing that I found impressive. The company continues to establish itself as the de-facto commerce operating system and take meaningful share in a $1 trillion market. And with its cost base now fixed, it’s continuing to do so while explosively growing margins. All of this data prompted Deutsche Bank to think Shopify will meet or exceed Q4 Gross Merchandise Value (GMV) estimates.

“Our merchants had a great holiday weekend… The business is enjoying a bunch of growth drivers that are all performing very well.”

Shopify CFO Jeff Hoffmeister This Week

Overall Cyber Monday e-commerce revenue beat Adobe’s internal forecast of $13.2 billion, according to the company. Mastercard observed 3.4% Y/Y growth in Black Friday volume and 14.6% Y/Y growth in e-commerce volume.

“Our real-time insights show that consumers are comfortably in the gift-giving spirit as price reductions and deals occur across sectors, supporting budgets for holiday shopping.”

Mastercard Chief Economist Michelle Meye

We didn’t really hear much from Amazon on how the weekend went. It called it the largest holiday event it has ever had, but considering this is still a growth company, I would hope so. It talked up meaningful consumer savings and having lower apples-to-apples prices than competitors. Per JP Morgan, holiday shopping results were in line with or better than expectations. It sees e-commerce penetration rising from 23.3% to 24.5% Y/Y and thinks that will keep marching to 40% over time. It also cited a stable 45% e-commerce market share for Amazon.

All of this data continues to point to a resilient U.S. consumer.

3. Amazon (AMZN) – AWS Re:Invent 2024 Announcements

Amazon made a series of AWS announcements at this week’s AWS conference. Basically, all of the announcements involved high-performance compute and its various GenAI layers.

Starting with the infrastructure layer, AWS debuted new compute instances (virtual machines used to run cloud-native workloads) for its cloud footprint. It now offers well over 800 types of VMs. These new instances feature Blackwell chips from Nvidia, as well as its own Trainium 2 chips. Trainium 2-powered instances are 4x faster and come with 4x more memory than Trainium 1. Trainium 3 is coming next year. Notably, Amazon leadership also told us that demand for AMD’s Blackwell competitor isn’t seeing much demand. This is why they haven’t begun offering cloud instances involving that company’s GPUs. Notably, Apple is now using Trainium to train Apple Intelligence. Apple’s senior director of AI and machine learning had some very nice things to say about Amazon’s offering this week at the company’s conference.

Amazon is going all in on Trainium to focus on model training cost efficiency. It is abandoning work on its model inference chip set called Inferentia. Some of that Inferentia work will be borrowed by Trainium, as the two products combine best tech and practices.

With 100,000s of these chips, Amazon plans to build a massive super training cluster/supercomputer for Anthropic. It added a new chip linking tool called Ultraserver to combine up to 64 Traimium Chips. Nvidia is able to connect 144 total Blackwell chips, so it’s clearly ahead here… but that’s ok. Amazon is not trying to replace Nvidia. It can’t. It’s merely trying to offer cheaper solutions for customers and better overall supply of processors to power the high-performance compute revolution.

In cloud-based data storage, it added a new simple storage service (S3) for open-source Iceberg Tables. This is important. Snowflake has recently added support for this type of data table to augment interoperability and create an easier platform for developers to use more data. That has inspired more data transference and consumption within SNOW’s platform, and I’d expect a similar benefit here. This new Iceberg support product offers 3x faster querying and 10x faster transactions than Apache Iceberg Tables. Separately, it now offers S3 Metadata to power easy data tagging and discovery. This will become increasingly important considering unstructured data is the centerpiece of GenAI model training and inference. Within its suite of database products, it added another tool to its relational, standard query language (SQL)-powered Aurora product. This is called Distributed SQL (DSQL) to make Aurora a multi-cloud region product.

Within foundational models (FMs), it debuted a series of products under the “NOVA” FM family umbrella. Nova Micro is its text-only model for the lowest latency and cost queries. Nova Lite, Pro and Premier are differently sized multi-modal models (in order from smallest to largest) that can field text, audio and video-based prompting. The different parameter sizes emulate OpenAI’s various GPT models and are meant to reflect the diverse array of needs from customers. Some want more speed. Some want more complexity. Some want a bit of both. Finally, Nova Canvas and Nova Reel are its new text-to-image and video generation models.

As a reminder, SageMaker allows developers to build custom models on top of Bedrock for more granular and company-specific needs. It’s very similar to Microsoft Copilot Studio. Amazon debuted SageMaker Unified Studio to batch all products and tools here into a unified suite of utility… from machine learning, to data processing to Bedrock and more. Soon, this will include a GenAI business intelligence app called Business Intelligence, as well as data streaming and search analytics upgrades in the near future. HyperPod Flexible Training Plans helps customers build an optimal timeline and path for model training. Hyperpod Task Awareness makes sure you have efficiently distributed compute capacity and minimal waste. SageMaker also entered the data lakehouse field to create a unified environment for data ingestion right where a company does all of their app and model work. Lakehouses are more organized and gated data lakes for unstructured data.

Now for some Bedrock news. Bedrock is Amazon’s fully managed environment for using GenAI models to build applications. It offers the latest and greatest products from Meta, Mistral, Cohere, Anthropic and more and has tens of thousands of customers so far. As anticipated, it added Model Distillation to morph larger models into smaller products trained on local data. These models are less powerful and a lot cheaper for companies with less intense needs. Bedrock Automated Reasonable Checks cut model hallucination rates, while a new agent collaboration tool enables cross-app collaboration to broaden use cases. Prompt Caching saves similar queries and stores them for future usage to reduce duplicates and waste. Next, Bedrock Data Automation makes onboarding needed context into AWS seamless while Bedrock Guardrails can “now support multimodal toxicity” to eliminate inappropriate, or inaccurate responses. Bedrock also added new integrations to make Retrieval Augmented Generation (RAG) (model output optimization) more convenient.

Bedrock Marketplace is its destination of 100+ FMs for customers to pick from. Again, it fixates on letting clients pick whichever models they want and knows one single product cannot rule them all. If a customer has no strong preference for models, they can use Bedrock’s Intelligent Prompt Routing to be matched with the best one for their specific needs.

Finally, within GenAI apps, Amazon made several Amazon Q announcements. As a reminder, Q is their AWS companion. It has a Q for developers product to assist in code writing and a Q for enterprise product to help manage client data strategies. This week, Q for developers added software package testing, code reviews, issue flagging and more. It also debuted new tools for application translation. For businesses, it added a new structured data searching product. More interestingly, it released a new tool to essentially mimic manual workflows to make them endlessly more scalable, with optimization tools to ensure work is being done efficiently.

This encompasses the most important announcements from the event. AWS leadership is adamant that these releases will be “needle moving” as it builds on its multi-billion GenAI business.

Amazon has gotten a lot of criticism (including from Bezos) due to a perception that it’s falling behind in GenAI. Regardless of whether or not that was ever true, I think it’s now clear that it isn’t.

4. Celsius (CELH) – Chief of Staff Interview:

A Tough Year:

Celsius has had a tough year. Sector-wide growth has greatly slowed, while convenience store traffic has turned negative for some large chains like 7/11. Celsius is impacted by this more than others for two main reasons. First, the company strongly over-indexes towards new-to-category users. Customers are inherently less inclined to consume new things when they’re feeling worse about the economy… especially in consumer discretionary. As this pattern persists, Celsius is focusing more on existing customer frequency to optimize growth. Secondly, Celsius picked up a massive amount of shelf space throughout 2022 and 2023. This should have teed them up for a lot more growth and positioned them for more market share gains. Considering this, it had the most to lose from macro worsening and category growth halting.