Today’s Piece is Powered by My Friends at BBAE:

1. Lululemon (LULU) – Earnings Review

a. Demand

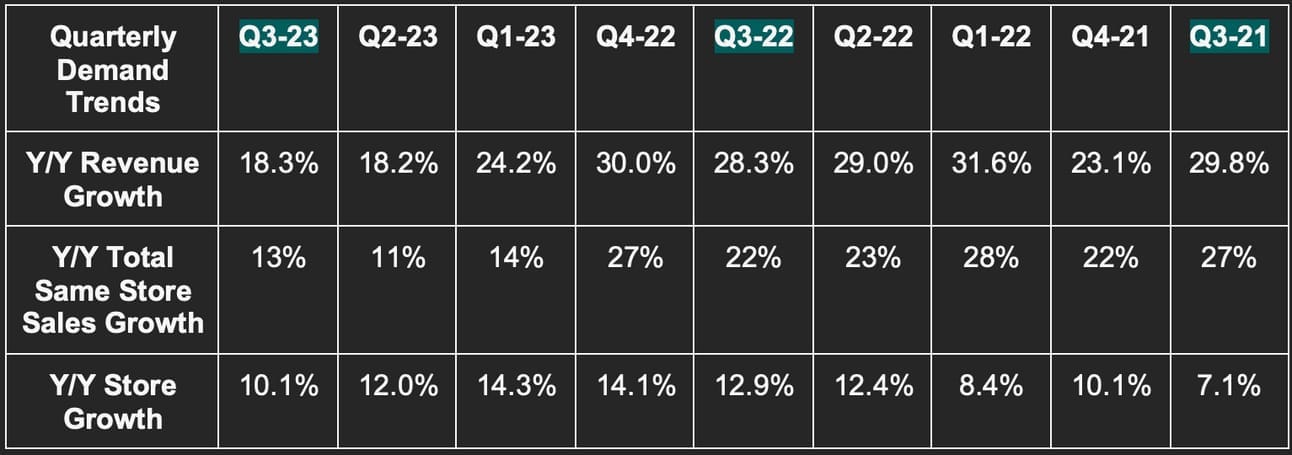

The company beat revenue estimates by 0.8% and beat its guidance by 1.2%. Please note that 3-year compounded annual growth rate (CAGR) comps remain very easy due to the pandemic. The firm, with normal comps, expects 15% annual revenue compounding.

b. Margins

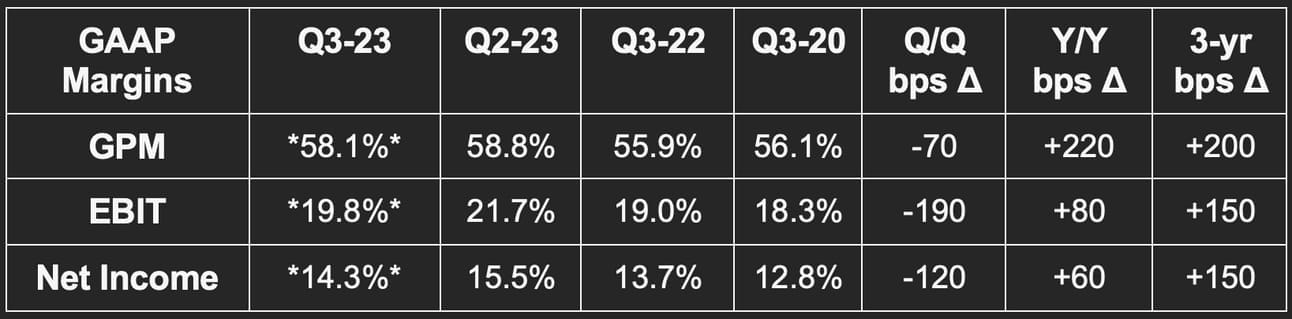

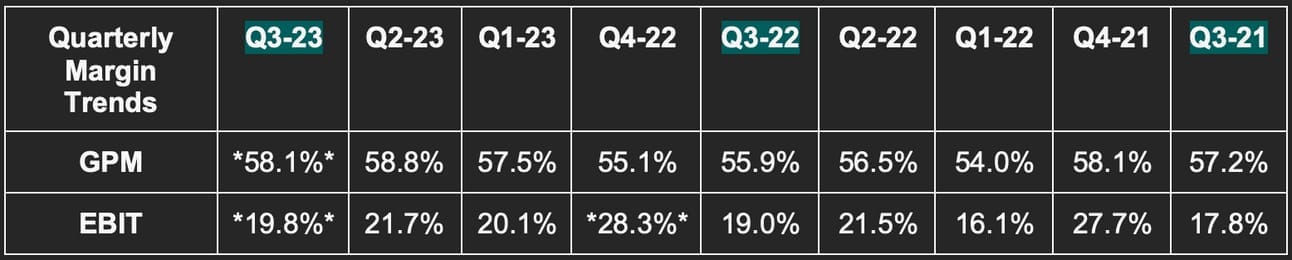

Lululemon doesn’t always offer non-GAAP profit metrics. It did this quarter due to provisions and restructuring costs related to its failed Mirror acquisition. The margins listed for Q3-2023 are adjusted for these items. Without this adjustment, gross margin would be 57.0%, EBIT margin 15.3% and net income margin 11.3%. These materially missed estimates which did not include these charges as timing for incurring this type of cost is uncertain. As you can see below, non-GAAP was well ahead across the board when removing this temporary noise.

- Beat earnings before interest and tax (EBIT) estimates by 6.2%.

- Beat $2.29 earnings per share (EPS) estimates by $0.24.

- Beat 57.7% gross profit margin (GPM) estimates by 40 basis points (bps; 1 bps = 0.01%) and beat its GPM guide by 50 bps.

c. Guidance

Q4 revenue guidance was 0.8% below expectations and represents 13.5% Y/Y growth at the midpoint. EPS guidance of $4.89 was $0.06 worse than expected.

For the full year, Lululemon slightly raised revenue guidance by 0.3% which would represent 18% growth at the midpoint. This was related to Q3 outperformance as Q4 was again a tad light. For full year EPS, Lulu raised its guidance from $12.10 to $12.38. This is $0.19 ahead of estimates and would represent 22.9% Y/Y growth. Please note that the $12.38 guide excludes the same provision and restructuring charges already mentioned. These charges were not in the guidance it offered last quarter, and were not baked into analyst estimates. Without this adjustment, its guidance of $11.81 is $0.29 light. I say this purely for your information. As the charges weren’t in previous guidance or estimates (and considering the nature of them), I consider this a raise. Mirror impairment charges will go away and are now entirely unrelated to the underlying operating profitability of this business.

- It now sees 70 bps of annual EBIT leverage vs. 50 bps as of last quarter and vs. 60 bps expected by analysts.

- It reiterated expectations of 200 bps of GPM leverage for the year.

- Inventory will be flat to slightly down Y/Y next quarter.

Finally, its 5 year financial targets first set back in 2021 were again reiterated.

d. Balance Sheet

- $1.1B in cash & equivalents.

- $400M in credit capacity.

- Inventory fell 4% Y/Y. This was better than its 8%-12% Y/Y growth expectation due to strong demand. Mirror inventory provisions helped too. It continues to expect markdown rates in 2023 to be stable vs. pre-pandemic periods.

- Share count fell slightly Y/Y.

- New $1B buyback (roughly 1.6% of float). It has $243 million left of its current buyback program.

“We remain comfortable with both the quality and quantity of our inventory.” – CFO Meghan Frank

e. Call & Release Highlights

Q4 Thus Far & Macro:

The team is “pleased” with its holiday weekend and quarter-to-date performance. It’s seeing strength across e-commerce and brick and mortar with new and existing product lines all working. Full price merchandise continues to perform very well as consumers largely overcome economic anxiety. This is despite materially “deeper discounting” Y/Y from competition during the quarter. Lulu, as always, did not have to match that promotional intensity to find demand – and it didn’t.

“I definitely saw a more promotionally driven environment by some of our peers, by some of the new entries into this category. We didn't deviate. We didn't change. And our results I talked to indicate that we didn't need to. Guests respond to innovative products and that's what our pipeline is full of.” – CEO Calvin McDonald

The one soft spot was men’s apparel in North America – a key growth segment. The team blamed uncertain macro and men being more prone to cutting apparel costs amid that uncertainty vs. women. While this sounded. like an excuse, continued strong market share gains for men in North America point to it being a legitimate one. The market share data is per Circana, not internal claims. This makes it more meaningful. The firm is also taking share across the globe, but there aren’t great data sources allowing it to precisely quantify those gains.

The moderate men’s softness (and still having 2 months left in its quarter) led to leadership’s continued prudent, conservative guidance methodology for Q4. This was repeated several times during the call as a wink to Wall Street. Under-promise, over-deliver. I expect this beat- and -raise machine to beat -and -raise once more in three months.

A Promising New Marketing Lever:

Members of Lululemon “Essentials Tier” continue to grow briskly. It doesn’t update the total every quarter, and didn’t this time, but likely will early next year. This is creating a large, highly relevant base of passionate fans to specifically target. That led to it debuting an early access Black Friday promotion for members. The promo resulted in an app download increase of 250,000 without materially adding to marketing costs. These subscription bases will be highly efficient marketing pools as they continue to scale successfully.

More Growth Metrics:

- Growth was strong in August, cooled in September due to lack of marketing activity and product launches, and again re-strengthened in October.

- Direct- to Consumer (DTC) revenue represented 41% of total revenue vs. 41% Y/Y.

- Other revenue (wholesale, licensing and Lululemon Studio) represented 10% of total revenue vs. 10% Y/Y.

- Company operated stores represented 49% of total revenue vs. 49% Y/Y.

- Women’s revenue rose 19% Y/Y while men’s rose 15% Y/Y.

- North American revenue rose 12% Y/Y which is in line with its long term targets despite the added macro uncertainty. International rose 49% Y/Y including 53% Y/Y growth in China. China stores continue to outperform internal expectations.

- Every market in Asia Pacific and Greater Europe grew by 10%+ Y/Y.

Peloton:

As previously announced, Peloton and Lululemon have a new 5 year partnership. Peloton is now the exclusive fitness content provider for Lulu’s various subscription tiers while Lulu is Peloton’s exclusive apparel provider. As a result, Lulu will halt content creation just like it halted Mirror hardware sales. This led to impairment charges discussed already in the margin section.

Margins:

Gross margin outperformed thanks to lower freight costs and utilization. Foreign exchange offset some of this strength.

Sales, general & administrative expenses accounted for 38.2% of revenue vs. 36.8% Y/Y. This was actually 50 bps better than expected. The contraction was well-telegraphed and is due to “strategic growth and brand investments.” It’s leaning in.

Product Line Highlights:

Its new Wundermost women’s line is its softest fabric to date. This blends Lulu’s edges in “raw material creation, technical construction and fabric innovation to engineer a new sensation and feel for guests.” These competitive edges are highly subjective. What isn’t subjective is Lulu’s consistently strong results.

Men’s shoes will launch in Q1 2024. Its new men’s product lines like Steady State and Soft Jersey performed so well that it’s now “chasing into more inventory.”

“We're seeing enough positive guest signals that we think we have an opportunity in this shoe category. We're going to take a long-term view and build it, but we’re excited about what we're seeing so far.” – CEO Calvin McDonald

Brand Building:

Lulu has ample room for rising brand awareness. This is why it’s investing so heavily in growth at this stage. Brand awareness in the USA is at 25% overall and just 13% for men. Total awareness is under 10% in every other market besides Canada (where it started) and Australia. This minimal awareness/long runway for growth with men led Lulu to introduce a successful national joggers campaign in North America for men.

f. Take

This would be a great quarter for nearly every other player in the space. It’s an average quarter for Lulu simply based on the consistently elite execution & results we’ve all come to expect. The Q4 miss is clearly based on guidance sandbagging while market share gains remain brisk. Was this perfect? No. Is this concerning? Not in the least. Annual guidance was raised and the ambitious 5 year growth targets were reiterated. More execution, more success, and another all-time high for the stock.

Looking for a better investment platform? Enter BBAE. The product speaks for itself. The Town Square copy trading tool allows you to emulate Wall Street’s finest. Its curated stock themes (under BBAE Discover) inspire new ideas, and its valuable technical and fundamental research tools guide you through key concepts.

BBAE is the broker dedicated to giving investors what matters to us. No gimmicks, no charms, no confetti, and never any pressure to trade. This is THE broker for long-term investors. Oh… and it’s offering generous deposit bonuses of up to $400. Check it out here. You’ll be glad you did.

2. GitLab (GTLB) – Earnings Review

We’ve covered JFrog a lot within the world of software development and operation (DevOps), but not GitLab. I wanted to provide a brief GitLab 101 as I introduce this into the coverage network. So what does it do?

First and foremost, GitLab offers Git Repository Management. This is an aggregated destination to store source code and files. Within it, developers can review source code health and alterations while resolving conflicts in a secure environment. In the world of DevOps, this is furthest to the “left” (or earliest on) in a software package’s journey to runtime. It always starts with source code and this is GitLab’s bread and butter.

Beyond the git repository, GitLab also offers continuous integration (CI). This is what automates the testing of source code and apps as well as conversion of source code into binaries. Conversion creates what’s called an artifact. Artifacts are usually binaires which are a series of 0s & 1s that can be read by machines. This is where large players like JFrog Artifactory come into the fold. Machines can’t read dozens upon dozens of source code languages. They can read 0s and 1s.

GitLab is now trying to extend its end-to-end DevOps platform further “right” (or later on) in the process to post artifact conversion. This is being done via products like Continuous Deployments (CD) which, (as the name indicates) involves the binary or software package being deployed into runtime. Its Pipeline product allows for the conjoining of CI and CD into a single step (intuitively called CI/CD). Finally, it offers some observability and security tools to monitor the performance of apps being worked on or deployed. The other functions mentioned, when paired with this one, place GitLab firmly in a “DevSecOps” niche.

Within this quarter’s theme of software platforms distancing from point solutions, that’s what GitHub is trying to emulate in DevSecOps. Considering 75% of organizations will be on one DevSecOps platform by 2027 vs. 25% today, this approach is well placed. It wants to be the single platform to do it all.

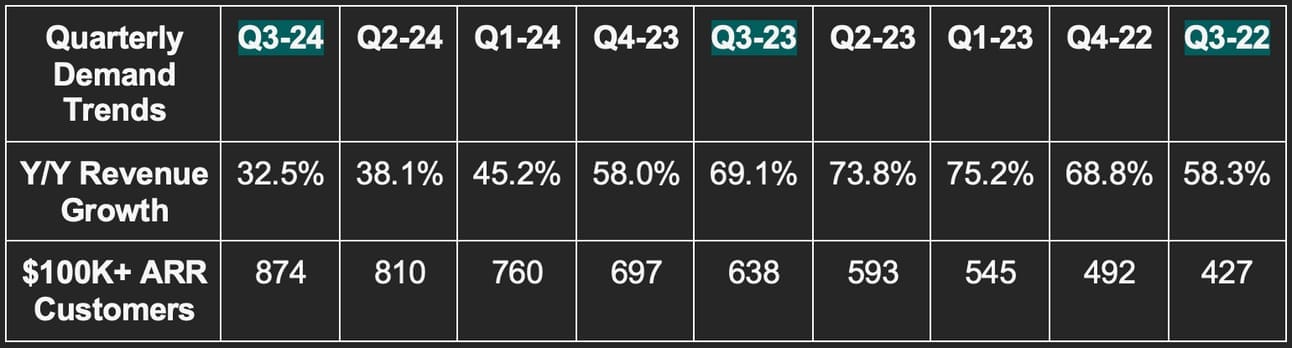

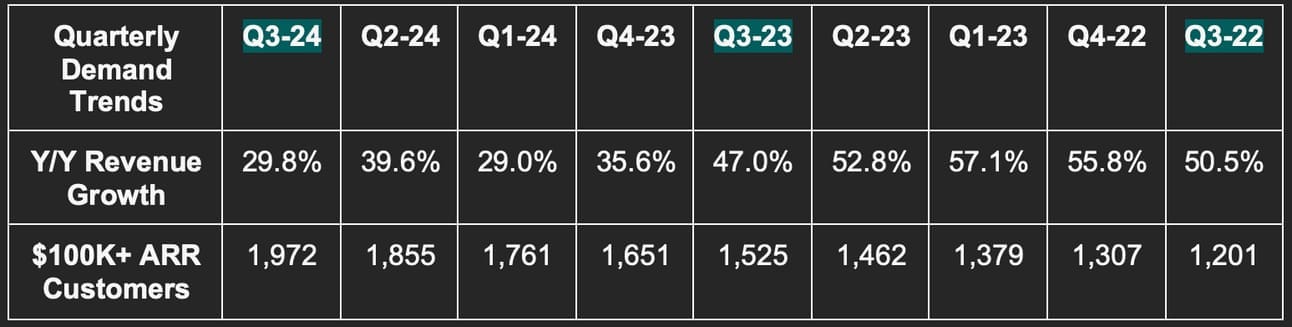

a. Demand

GitLab beat revenue estimates by 6.2% & beat its guide by 6.5%. Its 49.7% 2-year revenue compounded annual growth rate (CAGR) compares to 55.0% as of last quarter and 59.5% 2 quarters ago. Note that dollar-based net revenue retention (DBNRR) of 128% is still very good. The 400 basis point (bps; 1 bps = 0.01%) sequential expansion is also comparatively good vs. its peers.

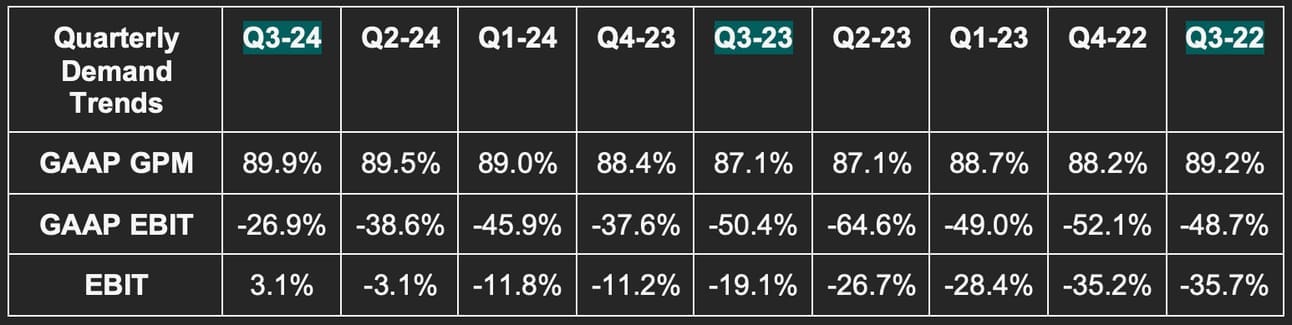

b. Margins

- Beat -$5.5 million EBIT estimate & beat its same guide by $10.1 million or nearly 200% each.

- Beat -$0.01 EPS estimate & beat its same guide by $0.10 each.

- Gross profit margin (GPM) was comfortably better than estimates. It doesn’t guide to GPM.

- As part of tax negotiations with global regulatory bodies, GitLab recorded a $254 million income tax adjustment which heavily hit GAAP net income for the quarter. It did this to optimize its tax position going forward.

c. Q4 Guidance

- Next quarter revenue guide is 5.4% ahead of estimates

- Next quarter EBIT guide of $5.5 million is $11.9 million ahead of estimates.

- Next quarter EPS guide of $0.08 is $0.09 ahead of estimates.

- Annual guidance was raised across the board as a result of Q3 results and Q4 guidance.

Leadership also reiterated its plans to reach free cash flow (FCF) breakeven next year. It continues to work on de-consolidating from its China Joint Venture called JiHu. Without the operating losses from this segment, non-GAAP EBIT for 2024 would be breakeven.

d. Balance Sheet

- $1 billion in cash & equivalents.

- Share count rose by 4.2% Y/Y. This needs to slow & likely will as it moves further away from IPO-related equity awards.

e. Call & Release Highlights

The Platform Play:

Just like ServiceNow, Zscaler, Salesforce, CrowdStrike and other software platform plays, GitLab’s full DevSecOps platform approach is working. The depth and breadth of their offering, from code creation to package deployment, is a complete platform for better efficacy at lower cost. That’s why 50% of its total bookings for Q3 came from its full-product subscription tier called the Ultimate Tier. This is its fastest growing bundle. I continue to repeat this same overarching idea for good reason: There’s a clear pattern.

“Breadth and depth of the platform across the full software dev life cycle differentiate us from point solutions and our main competitor, GitHub.” – CEO Sid Sijbrandij

The value proposition led to some compelling customer wins this quarter. A global financial services platform migrated to GitLab after a failed attempt to integrate needed tools with GitHub. The manual stitching together of these products fostered friction, confusion, inefficiency, and higher cost. GitLab displaced Microsoft GitHub and provided all needed add-on products into its single-interface platform. The customer enjoyed reduced costs, 8x faster deployment speed and 4x faster feature delivery.

A large business networking firm saw a similar result when it migrated from GitHub to GitLab. This customer kept hitting usage limits when trying to run software packages through GitHub. As leadership stated on the call, it “was not efficient enough to support growth.” GitLab 7Xed its package running efficiency. It also provided the security and compliance tools needed to displace point solutions – which GitHub couldn’t match.

As an aside, these anecdotes remind me of CrowdStrike’s successful competitive journey against Microsoft Defender. More niche players focused on fewer missions are seemingly outperforming the product utility of Microsoft as it juggles dozens upon dozens of product priorities.

When 3rd party security solutions are used, it routinely means developers must pause work to wait for security team verification and scanner results. This lengthens time to source code vulnerability detection and remediation. GitLab has a new security findings workflow tool. This allows developers to access security scanning results from within their GitLab developer environment.

GitLab is working on bringing more project management functions within its holistic platform to consolidate more potential point solutions. This matters a lot. Why? Per the 9th annual Global DevSecOps report, 66% of enterprises want to consolidate vendors and 84% of them use 2-10 different tools for full DevSecOps capabilities. GitLab is in the right place at the right time with a compelling sales pitch.

Customer & Research Organization Case Studies:

- Per a GitLab commission Forester study, it delivers a 427% return on investment for clients within 36 months. It also delivers an investment payback period of 6 months.

- Gartner ranked it #1 in ability to execute and #2 behind GitHub for completeness of vision in its latest research. Forrester ranks GitLab as the only leader in the space.

- Delivered a 114x in product release velocity for Airbus and 99% faster software release times (24 hours shrunk to 10 minutes).

- Shrunk T-Mobile’s software release cycle from 18 months to 3 months.

- Eliminated 90% of Lockheed Martin’s time spent on software maintenance.

AI Upgrades:

GitLab infuses GenAI models and tools throughout its entire platform. Today, it offers 14 AI features with many more to come. It thinks that the entirety of these tools can 7x software cycle speed.

GitLab Duo is the overarching “suite of workflows” within GenAI to augment developer speed and work quality. Duo Vulnerability Summary generates reports of vulnerabilities and best course of action to resolve issues. Duo Code Suggestions, similarly to GitHub Copilot, is a GenAI code creation tool powering 50% efficiency gains for beta testing clients. It’ll be fully introduced this month. Considering how much potential there is to automate code creation with GenAI, success here will vastly bolster its cost cutting value proposition for clients. This could potentially allow software developers to pocket a full 25% of their total time spent on work. Imagine what they can do with that time. GenAI models and their vast data consumption needs also mean more demand for software packages, which is good for GitLab as well.

Furthermore, Duo Chat creates project status reports, explains code suggestions, troubleshoots CI/CD issues and allows for package testing without context switching (meaning moving in and out of a developer environment). It’s a “natural language AI assistant” like ChatGPT, but with more specific use cases.

Security & Governance Upgrades:

GitLab Dedicated is a tool that provides proper compliance within data isolation and residency. That, in turn, means GitLab can offer its full platform (with all layers of automation) even in the most tightly regulated sectors.

GitLab, like many others, commits to never using a client’s code to train its own GenAI models. It sees this layer of separation and transparency as a key reason why “50%+ of the Fortune 100 trusts GitLab to secure their IP.”

Demand Trends & Macro:

Per CFO Brian Robbins, the sales cycle did elongate sequentially. That was surprising to hear given the strong results. Buying behavior for its largest customers did stabilize, but that was not the case for smaller clients. Importantly, win rates continued to rise sequentially, pointing to GitLab being a clear market share taker. Those share gains will be rewarded with even more business as macro improves.

Similarly to Snowflake, most of GitLab’s revenue (about 75%), is usage based. This means it’s easier for clients to reduce their business with GitLab than with a pure SaaS model like Zscaler. Considering this, the resilient demand is impressive and points to just how mission-critical this platform is in our digital world.

f. Take

Note to self: Next time Google aggressively scoops up shares of a public company like GitLab, pay close attention. While the company struggled with execution and guiding expectations earlier in the year, those issues have seemingly vanished. Demand and margin trends are both very positive and should get even better as its smaller client cohorts struggle less with macro. Its ability to monetize GenAI tools and take advantage of this current wave is quite compelling and its secular tailwinds are raging.

At 17x gross profit (more than double market averages) and 100x calendar year 2025 operating income, this is one of the most expensive names on markets. It will need to continue delivering fantastic quarters like this one to keep justifying what is a large, large premium. There is virtually no margin of safety here. They must be perfect. This quarter was perfect.

3. MongoDB (MDB) – Earnings Review

MongoDB is a key player in data storage and analytics with a document-oriented setup. I’ll explain what that means later.

Its most exciting product is called MongoDB Atlas. This is its database service to implement a group of servers (or a cluster) used to actually store the data. The nature of MongoDB’s product allows clusters to be easily added to or subtracted from for easier flexing up & down as needs fluctuate. It also offers MongoDB Realm as a mobile environment for app creation, MongoDB Stitch to build apps without servers or any needed infrastructure maintenance and MongoDB Search for data querying. Finally, it offers MongoDB Data Lake specifically for unstructured data which directly competes with players like Snowflake. There are more products, but these are the big ones with new releases discussed below.

a. Demand

MongoDB beat revenue estimates by a comfortable 7.2% & beat its guidance by 7.7%. Its 38.1% 2-year revenue CAGR compares to 46.0% as of last quarter and 42.3% 2 quarters ago.

b. Margins

MongoDB obliterated profit expectations. EBIT was 78% ahead of estimates and 85% ahead of its guidance. It earned $0.97 per share vs. expectations of earning $0.50. This is its 3rd consecutive quarter of greatly outperforming all expectations. Similarly to Nvidia, the magnitude of these consistent beats will likely lead to sell side estimates positively diverging from its guidance over time. It will raise the bar for what is considered a successful quarter. Great problem to have considering it’s based on stellar performance.

Note that some marketing spend was pushed from Q3 to Q4. This helped margins a bit. Still, the large annual increases in profits and margins show that this wasn’t the main source of outperformance.