Today’s Piece is Powered byStock Unlock:

Welcome to the 320 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. Lululemon Athletica (LULU) – Earnings Review

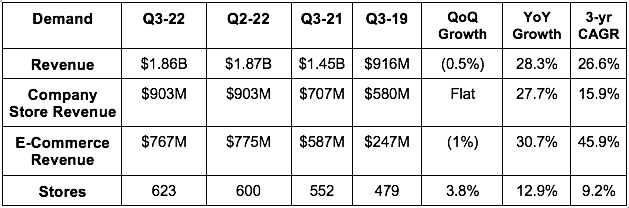

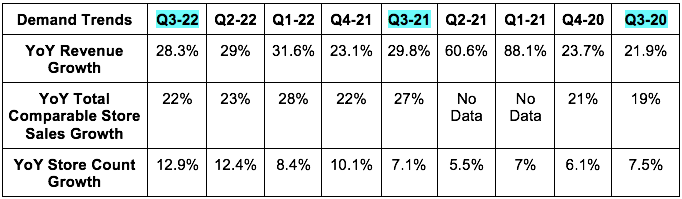

a) Demand

Lulu beat its revenue guidance by 3.9% and analyst estimates by 2.8%.

More Context on Demand:

- Net revenue rose by 26% in North America and 41% internationally.

- Total comparable sales growth was 25% YoY when excluding the foreign exchange (FX) hit.

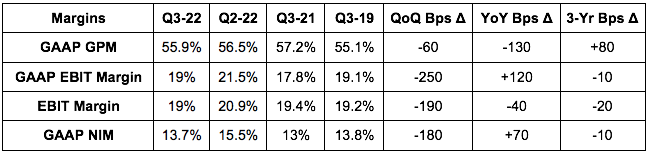

b) Profitability

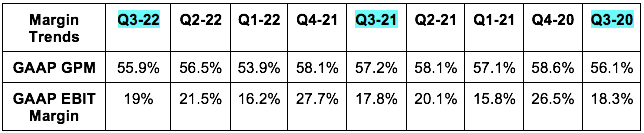

GPM = gross profit margin; EBIT = earnings before interest and taxes; NIM = net income margin; BPS = basis point = 0.01%

More Margin Context:

- Why gross margin fell:

- 60 basis point headwind from FX.

- 40 basis point headwind from higher markdowns and inventory provisions.

- Some de-levering of fixed costs (temporarily) from distribution center investments to support future growth.

- All of this was expected except for the FX hit which is why GPM fell by 60 basis points more than expected YoY.

c) Balance Sheet

- Lulu has $350 million in cash & equivalents and another $395 million in untapped credit capacity.

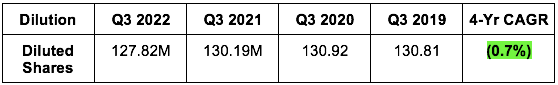

- The company slowed its buyback pace greatly during the quarter. It repurchased $17 million in stock vs. $125 million sequentially. It has $800 million left on its $1 billion buyback program.

- Inventory grew by 13% QoQ & 85% YoY to $1.7 billion. Most of this YoY growth was from previous quarters, but I wanted to see sequential inventory growth below sequential revenue growth. That did not happen.

- Still, the company believes that “inventory is well positioned to support growth.”

d) Guidance

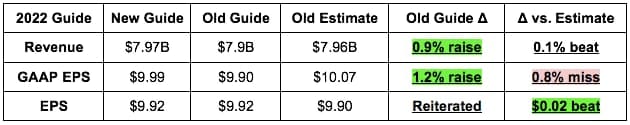

Full year Guidance:

- Now expects 120 bps of GPM contraction for 2022 vs. 2021 vs. previously 115 bps.

- Now expects a flat operating margin for 2022 vs. 2021 vs. previously “flat to slightly up.”

Q4 2022 Guidance:

- Q4 guidance missed estimates for both revenue and GAAP EPS by less than 1%.

- Expect gross margin for the quarter to rise 10-20 bps YoY.

- Markdown rates are not expected to rise.

- The guide of around 23% YoY growth assumes a continued vast outperformance of its long term 15% growth expectations.

- Now expects to open 79 stores this year vs. 75 previously.

- CapEx guidance rose with the small boost to revenue guidance to support new distribution space.

- EPS guidance does not include any share buybacks.

e) Call Notes

On Demand Trends to Date:

“Guest metrics have been consistently healthy across traffic, new guest acquisition and dollar spend.” -- CEO Calvin McDonald

On the Holiday Weekend:

- CEO Calvin McDonald is “Pleased with the results.” He talked about the wildly volatile macro backdrop, but added that he’s encouraged with the results in the current quarter to date.

- Lulu gained more share (150 basis points YoY) in its sector than any other brand per NPD Group Consumer tracking.

On Supply Chains:

- More supply chain improvements with its suppliers now back to pre-pandemic production levels.

- Ocean delivery times continue to fall.

On Inventory:

“As we’ve discussed, inventory was too lean last year and we’ve made the decision to build inventories this year… we remain comfortable with both the quality and quantity of our inventory… Q3 will also represent the high point for inventory.” -- CEO Calvin McDonald

“We’re in a much better inventory position this year vs. last to meet guest demand… we remain pleased with inventory levels” -- CFO Meghan Frank

- The inventory growth was in line with its internal expectations.

- The company guided to 60% YoY inventory growth next quarter vs. previously seeing 55%-60% growth. The rise was to take advantage of continued supply chain improvements and robust demand.

- Lulu was able to stock all 11 SKUs of its outerwear “Wunder Puff” line for women this season which all sold very well. It was supply constrained here last year.

- Markdown levels were flat vs. 2019 and met expectations. It is in no way, shape or form feeling a need to liquidate inventory. Roughly half of it is season-less, and all of it is high quality.

On International:

- Mainland China missed revenue estimates due to pandemic closures but still grew 70% YoY.

- On track to 4X international revenue from 2021-2026 like it guided to at its last investor day. Growth has been above estimates consistently, but it’s not yet ready to raise its growth forecasts for the planning period.

f) My Take

Some were alarmed by the inventory growth, but that was entirely expected and also entirely ok when it coincides with such impressive demand outperformance. I thought this was a great quarter with more market share gains, new product momentum and solid execution overall. I selfishly hope the price keeps falling so I can build out the new position. Great quarter.

2. PayPal Holdings (PYPL) – CEO Dan Schulman Interviews with UBS

On Quarter to Date Results vs. Q4 Guidance:

- The holiday period for PayPal is shaping up as expected. Schulman said PayPal “either maintained or slightly grew” its market share.

- PayPal is ahead of its $900 million in cost savings guide for 2022. Schulman thinks earnings will come in slightly ahead of its guidance for the quarter.

- Revenue for the quarter so far “right on track to grow by around 9%” which is in line with previous PayPal guidance.

On 2023 Guidance:

- PayPal now expects more than $1.3 billion in 2023 cost savings as operating expenses will shrink next year vs. previous expectations of them being stable.

- PayPal is “clearly on track” to expand its operating margins by at least 100 basis points and grow EPS by AT LEAST 15% like it previously indicated.

These estimates assume an arguably overly bleak outlook for e-commerce and macro for 2023. Per Dan, “if macro is better than expected, we’ll be in great shape. But it’s prudent to plan for a more difficult environment.”

“We are planning for dire times.” -- CEO Dan Schulman

Similarly to Match, this seems like a wonderful setup for some “under promise and over deliver” to come. Macro won’t suck forever.

On Checkout:

- Checkout latency is down 40% year to date.

- PayPal’s availability is pushing 99.999% vs. 99.99% previously. This matters when you’re serving tens of millions of merchants.

- 50% of the PayPal user base can now skip passwords entirely and prove identity with passkeys.

- A new PayPal software development kit (SDK) now allows all PayPal white-label checkout (the “commerce platform” which caters to smaller merchants than unbranded Braintree) to be done within the merchant’s app or site. This was previously only available to Braintree’s massive customers. This fully in-app experience boosts checkout conversion rates by up to 9%.

- The unbranded PayPal commerce platform will soon allow Apple Pay as an alternative payment method. This was previously only for Braintree’s massive customers.

A Review of What the New Apple Partnership Means:

- PayPal merchants can now use their iPhone as a mobile point of sale to accept offline transactions through PayPal’s platform on an iPhone.

- Venmo and PayPal cards can be added to Apple Wallets. This happened in Germany with Google’s Wallet where Google enjoyed a 20% boost to checkout volume from this integration ALONE.

On Buy Now, Pay Later (BNPL):

- PayPal BNPL volume rose 110% YoY during Cyber 5.

- Schulman thinks it’s now the #1 preferred vendor in the space 2.5 years post launch.

- PayPal’s 90%+ acceptance rate vs. ~60% for most competitors coincides with some of the lowest loss rates in the space. So it accepts more and loses less. That’s the benefit of having a deep historical portrait of every customer’s financial lives to guide your underwriting.

- Unlike others, PayPal has seen zero deterioration in its loss rates this year.

- PayPal is close to 300,000 merchants with BNPL upstream presentment (showing the PayPal checkout option on the product page). This directly raises its checkout share.

“Competitors are having to pull back because they can’t continue to lose money. So we have a big advantage… we are winning global accounts coming up for rebid there… there’s a flight to quality that we’re picking up on.” -- CEO Dan Schulman

Venmo:

“What PayPal was to eBay will be what Venmo is to Amazon. We’re excited.” -- CEO Dan Schulman

As a reminder, Checkout with Venmo just launched on Amazon and is expected to be a domino motivating other large merchants to follow suit. Clearly, things are off to a good start here.

“I feel good about the progress that Venmo has made, but I feel we can make better progress going forward.” -- CEO Dan Schulman