Today’s piece is powered bySavvy Trader:

Welcome to the 307 new readers who joined us this week. We’re delighted to have you as subscribers & determined to provide as much value & objectivity as possible.

In case you missed it, I published an Airbnb earnings review, a Shopify earnings review and an Upstart earnings review (along with my plans for the troubled position going forward) during the week.

1. The Trade Desk (TTD) -- Q4 2022 Earnings Review

a. Demand

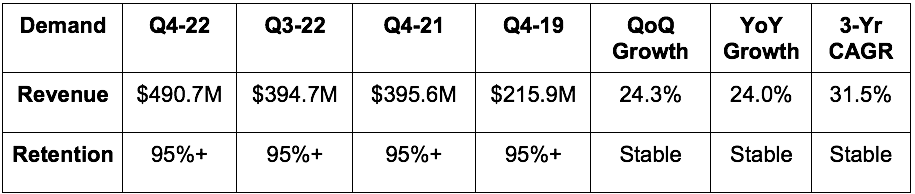

The Trade Desk missed revenue estimates by 0.2% but beat its “at least” revenue guide by 0.1%.

Demand Context:

- Client retention has been over 95% for 9 straight years.

- The 31.5% 3-yr revenue CAGR compares to 34% last quarter & 33.1% 2 quarters ago.

- 95% of spend continues to come from highly visible & stable master service agreements.

- Connected TV (CTV) rose to roughly 45% of total revenue vs. closer to 40% last quarter as its largest channel continues to be one of its fastest growing channels.

- Political spend represented a low single digit percent of total spend during the quarter.

b. Profitability

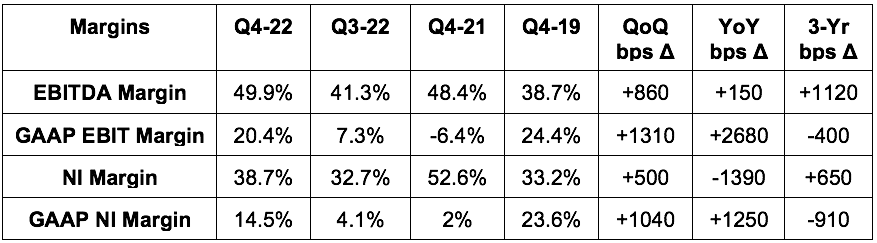

- Beat EBITDA estimates by 6.6% & beat its EBITDA guide by 7%.

- Beat GAAP EBIT estimates by 9%.

- Missed $0.16 GAAP EPS estimates by $0.02.

- Beat $0.36 EPS estimates by $0.02.

More Margin Context:

The Trade Desk paid $41 million in taxes vs. realizing a net tax benefit of $34.6 million YoY. Had the firm enjoyed the identical benefit this quarter for normal YoY comps, net income would have been $265.7 million. This would have represented earnings per share (EPS) of $0.53 vs. $0.42 YoY for 26% growth vs. the -9.6% growth it reported. The shrinking EPS was solely a matter of effective tax rate differences -- not operating leverage. That’s why its EBITDA margin expanded nicely YoY.

- GAAP margin expansion was significantly aided by less stock comp YoY.

- Operating expenses (OpEx) rose 22% YoY as it continues to invest in its team, tech, and product. It never got too excited with cost growth and hiring during the pandemic bubble and so its margins continue to be quite lofty. Revenue growth has led OpEx growth consistently since 2019.

- It will continue hiring throughout 2023, although at half the pace it did in 2022.

- The Trade Desk spent $50 million in capital expenditures during the quarter to build out its data center footprint.

c. Q1 2023 Guidance

The Trade Desk guides to minimum quarterly revenue (which I would love all of my holdings to practice). Its “at least” revenue guide still slightly beat estimates by 0.2%. Its EBITDA guide beat consensus estimates by 2%.

Leadership told us that the first 6 weeks of Q1 2023 saw consistent demand acceleration throughout. Its December was a “bit slower than normal” but those trends have since fully normalized.

It plans to grow OpEx YoY in 2023 as it continues investing in more profitable growth.

d. Balance Sheet

- Announced a new $700 million buyback to offset the $600 million founder package awarded to Jeff Green Q4 2021 in connection with eclipsing all performance benchmarks. I love this decision.

- Stock comp was 25% of sales vs. 30% QoQ and 51% YoY when the founder package began vesting. That package will finish vesting by the end of 2023 -- but again now all of that dilution is being offset.

- $1.45 billion in cash & equivalents.

- $0 debt.

- Leadership teased the idea of more M&A going forward.

e. Call & Presentation Notes

On Winning Despite Macro:

The Trade Desk’s report and guidance stood out among ad-tech. While peers cited a cautious ad market and issued underwhelming forward guidance, The Trade Desk encouragingly and convincingly bucked this theme. How? A few reasons. First, its open internet market share lead (on the demand side) gives it an inherent data and targeting advantage.

TTD has virtually all of the largest advertisers in the world feeding 1st party data to its algorithms to combine with ample 3rd party data. This means it can infuse more relevant insight into each impression purchasing decision and can segment individuals in a more precise manner. The result? Vastly bolstered Return On Ad Spend (ROAS). Specifically, for evidence, The Trade Desk cuts booking costs in half, and routinely delivers triple digit ROAS advantages thanks to this edge. As a result of more successful, higher return advertising campaigns, publishers can also enjoy higher impression bid prices so they can lower ad frequency, improve the customer experience and lower churn. It’s truly a win, win.

Some complain that The Trade Desk’s take rate is egregious, but considering the incremental, precision-based efficiency it fosters, the rate is well earned. And oh, by the way, that take rate has been consistent for 9 straight years now. So it appears that the world’s largest advertisers and agencies see no issue with it.

It’s all About the Return:

Especially amid poor macro when marketing budgets are being cut and return metrics obsessed over, The Trade Desk delivers in spades. When liquidity is abundant during boom times, marketers are pressured to place more and more dollars to drive growth. This makes them less picky. Well, when budgets are cut, that excess vanishes and selectivity becomes vital. Advertisers are pushed to be more discerning with finite dollars and they gravitate to only higher return placements. So? They’re pushed to The Trade Desk. This is why the firm took more share in 2022 than it did the previous 6 years; that momentum continued into 2023.

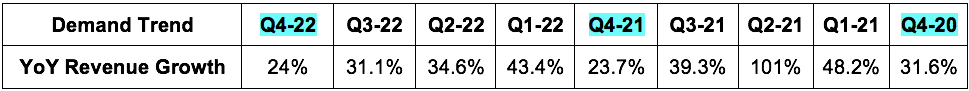

TTD’s 24% YoY growth for the quarter compares to a range of -2% to -9% YoY growth for its closest large competitors. Need more evidence? It quadrupled (on a large base) digital advertising growth in 2022 with 32% growth vs. 8% for the sector as a whole.

But there are more reasons for the outperformance. The Trade Desk’s bread and butter is CTV. It dominates this space on the demand side and is enjoying the large tailwind of Netflix, Disney and HBO embracing ads in 2022. This tailwind paired with rapid retail media growth serve as key contributors to its convincing outperformance. New partnerships here with Walmart, Target, Home Depot, Kroger, Meijer and many more continue to support its success. This past quarter it added Tesco & FairPrice (two large international grocers) to the large roster.

It is not fully immune to macro headwinds. It is more insulated than anyone else.

Unified ID 2.0 (UID2):

If The Trade Desk’s software, data scale and superior targeting algorithms are a delicious scoop of vanilla ice cream, UID2 is the chocolate sauce that goes on top. It extends and upgrades the targeting abilities of The Trade Desk by creating an always-on identifier to better understand who is actually behind the impression I’m buying.

Traction here is impressive:

The Trade Desk expects 75% of its gross spend to be UID2-tagged by Q2 2023 vs. 15% as of the end of 2021. Last quarter, the company guided to reaching 50% by Q4 2023 -- so clearly adoption is exceeding its expectations. And per Green, that adoption will allow The Trade Desk to “effectively solve the identity-matching challenge for the entire open internet beyond anything cookies ever accomplished with more privacy and consumer control.” The Trade Desk’s scale already insulated it from Google playing unfairly. This insulates it even further by making 3rd party cookies all but irrelevant for creating impression value.

Encouragingly, UID2 has also already won acceptance from key data infrastructure players like AWS, Snowflake, Salesforce and Adobe. Advertisers can use these integrations to query needed data and upload it into campaigns through TTD’s 1st party on-boarding feature called Galileo.

This merges more consistent identification with an ability for advertisers to easily tap into their lucrative, insight-packed data. Why does this matter? UID2 ensures customer identification. These integrations paired with The Trade Desk’s aggregated data indicate exactly what individual customers want to see.

More UID2 Notes:

- UID2 is delivering 12X more relevant audience reach for Disney+ advertisers using it.

- Paramount Advertising (Paramount, CBS etc.) integrated with UID2 during the quarter.

- UID2 doesn’t directly drive revenue. It simply enhances impression value and uncovers more impression buying opportunities. That, in turn, eventually drives incremental TTD revenue.

Tearing Down the Walled Gardens:

Per Insider Intelligence, 2022 was the first year in which Meta and Google didn’t control more than half of digital advertising.

Green explained that as agencies growing tired of the secretive ways in which Google and Apple report marketing return metrics to advertisers. It’s somewhat of a “take my word for it” approach. This is part of what the Department of Justice recently deemed abusive activity in its new Google lawsuit.

At the same time, these walled gardens are dealing with more formidable competition within channels like CTV and its targeting precision plus honest reporting. And because The Trade Desk does not serve the supply side too, advertisers can be sure their impression purchases are being placed in a zero-bias manner. Google cannot honestly make this same claim but may need to in the future to maintain its dominant share.

All of this led to Green’s prediction that Google and other walled gardens would begin opening up their ecosystems in the coming years. Year after year, I’ve heard Green make bold predictions like this one. Year after year, they’ve come to fruition.

Streaming is Too Fragmented for Walled Garden Proliferation:

Streaming is not set up for walled gardens to thrive like search and social had been. Why? Nobody in streaming has monopoly or duopoly power. So? These more fragmented publishers have more incentive to play fair and plug their inventory into an aggregated bidding ecosystem to enjoy maximum impression prices. That’s the only way they can generate the rates needed to fund their premium content. None have the fire power on their own to create high enough impression value alone. They must collaborate and they must allow open bidding. Because a large chunk of these bids come from TTD clients through its platform, that’s great news for the company.

On a New Forward Market Product:

The Trade Desk will debut its new, “always-on” forward market product this year. Forward (AKA up-front) markets require advertisers to buy massive blocks of impressions once a year with little access to consumer data to guide pricing. Incredibly, up-front markets remain little changed since 1962 when they were created. The Trade Desk is changing that.

“We don't think that we have to compete with anything here other than a 1962 product.” -- Founder/CEO Jeff Green

Perks of this new tool include:

- Larger piece of up-front spend for The Trade Desk.

- Makes publisher impressions more valuable and advertiser returns higher due to the sheer amount of market inefficiency this resolves.

- Allows The Trade Desk to be a better partner for advertisers as they shift from linear to CTV advertising.

On OpenPath:

As a reminder, OpenPath allows opted-in publishers to connect directly to TTD’s demand. This is NOT The Trade Desk working for the supply side. It is, however, The Trade Desk allowing publishers that want to perform their own supply side functions like yield management to do so. Considering most large streamers now own supply side ad-tech firms, this has been well received so far.

OpenPath cuts out a lot of the middlemen and unnecessary fees from the supply chain by blazing this direct line of demand and supply matching. This ability to “clean up the supply chain” should mean less proverbial mouths to feed and so better return metrics and impression prices for stakeholders.

On the Google Antitrust Lawsuit:

“The Department of Justice has clearly done their homework, which I'm encouraged by. I know there's some at Google suggesting that we've been through this 3-4 times before. I do believe that this is fundamentally different. And part of that is just because of how detailed I think the case is… We will win regardless of the outcome. We’ve won in an unfair market. Imagine what we can do with more fairness” -- Founder/CEO Jeff Green

As a reminder, the DOJ is suing Google over its involvement in both the supply and demand side of ad-tech. They claim it unfairly pushes advertisers to un-optimal impressions for its own gain because it makes more profit when those impressions are matched with its own supply or certain partners. Other complaints involve it reporting return metrics in intentionally opaque ways

f. My Take

This was a standout quarter. The Trade Desk fetches a valuation premium vs. all other ad tech names -- and for good reason. It has the scale, leadership and execution track record to insulate it from mega caps while providing the best returns in the open internet. The evidence is the rapid share gains and gaudy margins. I did trim a little bit of the position following the post-earnings pop as valuation is candidly getting stretched over the short term. For the long term, the runway is near-endless and its ability to capitalize is objectively clear.

2. Meta Platforms (META) -- The Year of Efficiency Continues

The Financial Times reported this past weekend that Meta Platforms will implement more job cuts in March. The firm still sees headcount bloat and a large cohort of remaining employees “getting paid to do nothing.” I know many of us have seen the viral videos of mega-cap tech employees walking us through their work days of luxurious meals and accommodations but no productivity.

Considering this, I wholeheartedly support the move and unfortunately see it as the correct decision. The impacted workers will enter a historically good job market (outside of tech) for finding new work and Meta will continue delivering incremental cost savings to feed its bottom line. If the last earnings call was any indication, these cuts could involve middle management layers that Zuck talked about removing to streamline decision making. If this is the case, payroll savings could be even more meaningful than with the first round of cuts.

This is the “year of efficiency” and it is clear that leadership continues to think they can trim more fat and do “more with less.” (what a cliché that term has become over the last year) Just a few quarters ago, it seemed as though Zuckerberg was unwilling to appease investors and markets while moving full speed ahead with investment plans. My how things have changed for the better. For now, this round of planned layoffs is leading to 2023 budget delays and mumblings of frustration from teams within Meta as they wait for spend approvals.

Other Meta News:

- Marne Levine resigned from her role as the company’s Chief Business Officer. She had been with the company for 13 years.

- Instagram halted its live shopping product as it continues to refine its commerce strategy.

- Meta seems to be launching a competitor to Discord via its planned “Broadcast Chat Channels.” Mimicry is the most sincere form of flattery… and it’s good business.

- Tencent is cutting its VR hardware program as it turns bearish on the space. This is concerning, but many institutions like McKinsey have called the Metaverse a more than $1 trillion market opportunity. Maybe Tencent just saw themselves falling too far behind.