Welcome to the 229 new readers who joined us this week. We’re delighted to have you as subscribers & determined to provide as much value & objectivity as possible.

1. Duolingo (DUOL) -- Q4 2022 Earnings Review

a) Demand

- Beat revenue estimates by 3.9% and beat its guidance by 4.3%.

- Beat its bookings guidance by 11.4%. This is a great indicator for forward revenue growth.

More Demand Context:

Revenue grew 47% YoY in 2022 vs. the 2021 pandemic pull forward period while bookings 48% YoY. It accelerated user growth for the 6th straight quarter. 90% of this growth continues to be from organic word of mouth as it prioritizes product improvement over advertising to win user attention -- which clearly continues to work. There is no slowdown in view for this digital app unlike pretty much every other digital app post-pandemic. Comps got more & more difficult, yet it continued its acceleration. This is in direct contrast to macro trends, expectations, and peers. Wildly impressive to me. And as readers know, I only talk like this if the results are truly excellent. If they were bad, I’d tell you like I always do.

- Growth was entirely driven by paid subscribers. Advertising revenue was flat YoY amid a tough demand environment while subscription revenue rose 53% YoY and was unaffected by poor macro.

- Duolingo English Test (DET) growth is very lumpy.

- Foreign exchange (FX) diminished YoY bookings growth by 700 bps and revenue growth by 500 bps. FX impact hits bookings over a full year period vs. monthly for revenue. This is due to the annual subscription nature of this company’s business model.

- In-app purchase (IAP) grew 100%+ YoY.

- Annual subscribers and annual family plan subscribers reached 91% of total subscriptions vs. 85% QoQ. This makes its revenue growth ideally visible.

- 3 million DAUs have a 365+ day streak. It took it 8 years to get to 1 million and less than 2 years to get from 1 million to 3 million.

- Newer users are converting to paid at a higher clip than previous cohorts.

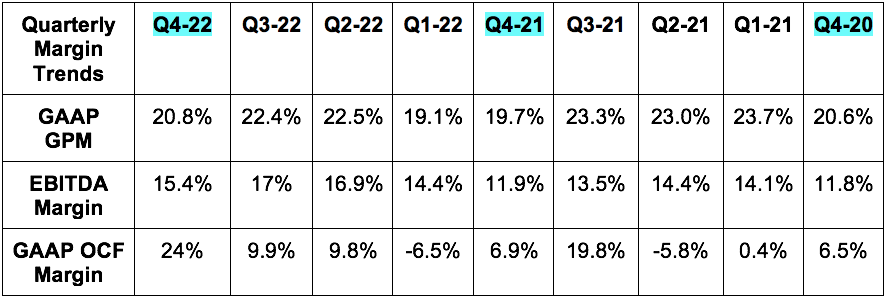

b) Profitability

- Duolingo was expected to lose $1.3 million in EBITDA while it guided to losing $1.3 million in EBITDA. It generated positive $5.2 million in EBITDA, sharply beating expectations.

- Beat -$0.53 GAAP EPS estimates by $0.18.

- Beat GAAP gross profit margin (GPM) estimates by 60 basis points (bps).

More Margin Context:

- It’s trying to operate at $0 in EBITDA, investing aggressively in product, yet it still generated positive EBITDA.

- Interest income is why GAAP Net Income was greater than GAAP EBIT.

- 2022 EBITDA of $15.5 million for a 4.2% margin compares to -$1.1 million last year and a -0.4% margin. This rapid margin expansion is set to accelerate further in 2023.

- GPM improvement was credited to stronger subscription retention and lower Google App Store fees.

- IPO related stock compensation continues to hit GAAP margins for now. This impact will continue to diminish over time. EBITDA offers a good sense of how profitable this company would be without these transitory non-cash expenses.

c) Forward Guidance

Q1 2023:

- Beat revenue estimates by 6%.

- Beat EBITDA estimates by 78%.

2023:

- Beat revenue estimates by 7.1%.

- Beat $23.6 million EBITDA estimates by 130%. That is not a typo. The EBITDA guide implies an 11% 2023 margin vs. 4.2% in 2022 and a 30% incremental EBITDA margin which -- for the first time ever -- matches Duolingo’s long term EBITDA margin target of 30-35%. Business is boomin’.

- Duolingo’s implied 2023 EBITDA multiple shrank from over 140x to 70x with this massive beat. Still expensive, but so much more reasonable considering EBITDA will triple YoY in 2023. I also think these estimates will continue to rise as Duolingo has established a strong track record of under-promise, over-deliver since going public.

- It will hire less people in 2023 than 2022 but will continue to hire with no layoffs. Duolingo’s revenue growth rate has doubled its headcount growth over the last 4 years.

- Operating leverage across all cost lines for 2023 is expected.

“Our user diversification results in a business largely uncorrelated with macro and geographic trends.” -- Co-Founder/CEO Luis von Ahn

d) Balance Sheet

- Duolingo has about 18% in total stock dilution that will take effect over the next 10 years.

- It expects 2023 diluted share count to grow 2% YoY vs. 3% growth in 2022 as IPO-related equity awards slow.

- Stock comp was 20.3% of sales vs. 22.4% YoY. Please note that this includes founder awards that will not vest until Duolingo eclipses share price targets. The next target is $178.50 per share.

- $608 million in cash & equivalents.

- No debt

I wouldn’t mind a small buyback to offset comp-related dilution like we’ve seen with other growth stocks like Olo and The Trade Desk. It generates cash and has a large enough cash position to comfortably continue growing operating expense buckets while allocating funds to repurchases. A buyback would not preclude investments in product perfection & expansion.

e) Letter & Call Highlights

Duolingo’s Unique Flywheel:

- More data = more split testing (A/B testing) = better products = more word-of-mouth growth.

Unlike competitors which conversely lean on…

- More ad dollars = more external customer acquisition = more growth.

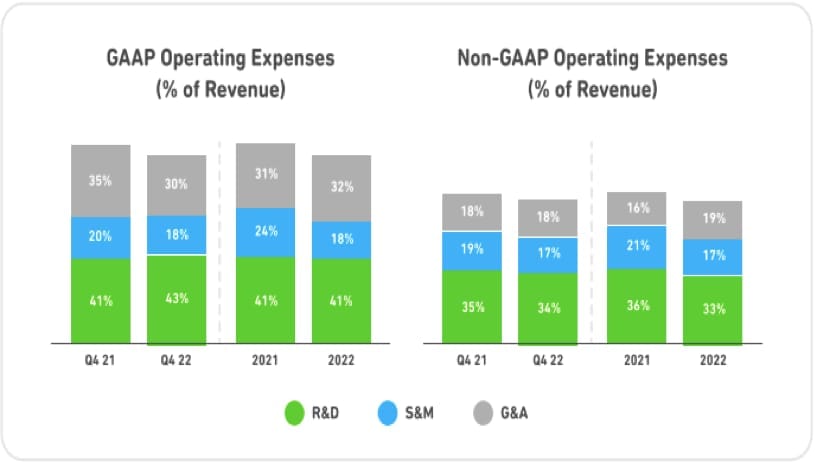

This is why Duolingo’s 2022 revenue growth rate was more than double its sales & marketing growth rate. This continues to pave the way for more operating leverage as can be visualized in the image below:

2023 Priorities:

Generative AI (mentioned 9 times in the call) was a key theme of the shareholder letter and transcript. Duolingo isn’t embarking on this journey alone, but through a tight partnership with OpenAI (AKA ChatGPT parent) where the two crafted generative AI models purpose-built for language learning. Duolingo brings the largest language learning data set in the world to the table to rapidly season models built by OpenAI and Duolingo in tandem.

Duolingo has always invested heavily in AI algorithms like its Bird Brain model (which designs individual course difficulty based on historical user data). Now, it’s ready to extend those investments to the world of generative AI as it thinks “technology has advanced to a level of our vision to teach nearly as well as a human tutor.” Generative AI benefits in the short term are expected to include more engaging content as well as cheaper, more expedient content creation.

As part of this newer focus, Duolingo will launch a new, more expensive subscription tier -- called Duolingo Max -- to markets this year. New tools from this tier include “Explain my Answer” for AI-powered explanations talking through learning blunders. The other tool called “Roleplay” lets users talk with Duolingo characters to emulate conversational skill building.

Beyond this, the generative AI investments are expected to improve Duolingo’s ability to teach English to more advanced speakers. It sees the dichotomy of 90% of global language students learning English, yet just 45% of Duolingo users doing so as a growth vector to address.

New Products:

- It expects $0 in bookings from the new Duolingo Max subscription. I am confident that this contributes materially to 2023 bookings and allows them to raise guidance throughout the year.

- Duolingo expects $0 in bookings contribution from the new Math and ABC apps. It takes its time on monetization to ensure product market fit before charging and this will not be a source of guidance upside.

Final Notes:

- Current user retention rate (probability of a DAU coming back) is now 80% vs. 65% at the IPO.

- Duolingo’s subscription price changes in international markets (to lower costs in line with GDP per capita) are largely complete. Interestingly, outperforming conversion is leading management to think it can re-hike some of the prices in these markets in 2023.

- China’s online degree ban has had no impact on Duolingo English Test (DET) revenue.

- While travel is a use case for Duolingo learners, it is a minor use case. The travel acceleration we’ve seen from vendors throughout the quarter and into 2023 is not the source of this outperformance. It is more structural in nature than that.

- 50% of revenue continues to be non-dollar denominated. For every 100 bps in currency exchange fluctuation, Duolingo will earn $2 million more or less in revenue.

f) My Take

As I said on Twitter, this was the best quarterly report and guide I’ve covered this season. There’s nothing negative to pick at, only positives to celebrate as a shareholder. Two thumbs up from me -- and if I had a third it would be pointed up as well.

I have no plans to trim despite the large spike in the stock. Rapidly rising profit estimates mean that appreciation in share price is entirely earned in my view.

2. Progyny (PGNY) -- Q4 2022 Earnings Review

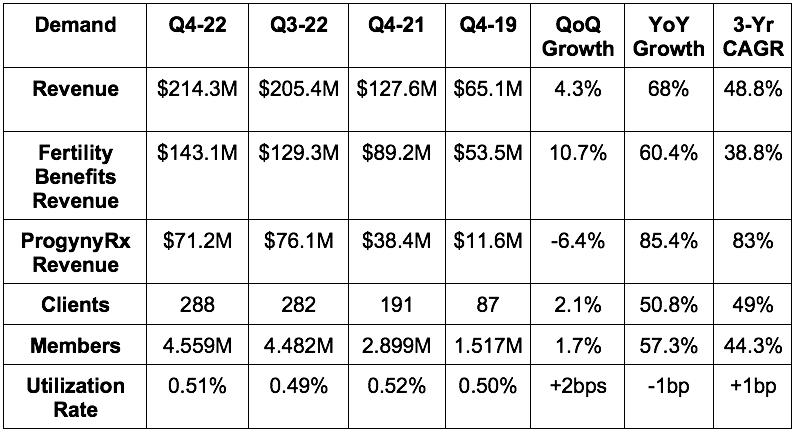

a) Demand

Mid-period, Progyny revised its fourth quarter revenue guidance higher from $207.4 million to roughly $212.4 million. It beat this raised bar by 1.0% and beat analyst estimates (which rose in conjunction with the announcement) by 1.2%. It beat its original guide by 3.3%.

More Context on Demand:

- 7th straight year of near 100% gross client retention. Once an employer adds a benefit, they’re “extremely reluctant” to take that coverage away from their employees.

- Progyny’s 48.8% 3-year revenue CAGR compares to 49.7% last Q & 51.4% 2 Qs ago.

- As we can see above, the fourth quarter is not a large contributor to annual growth for this healthcare service provider. Typically, most clients won during the year go live in the following year’s first quarter.

- Utilization rates remain largely stable despite erroneous short seller claims. This is despite outperforming new client growth and utilization rates for new clients beginning at a trough.

- New fertility treatment courses were briefly halted at the beginning of the pandemic in Q2 2020. That led to easy comps and is why Q2 2021 revenue grew by 99.1% YoY. Resurfacing variants again weighed on growth in late 2021 which makes this quarter’s YoY comp somewhat easy. Growth will slow to the 30-35% range going forward. Fine with me.

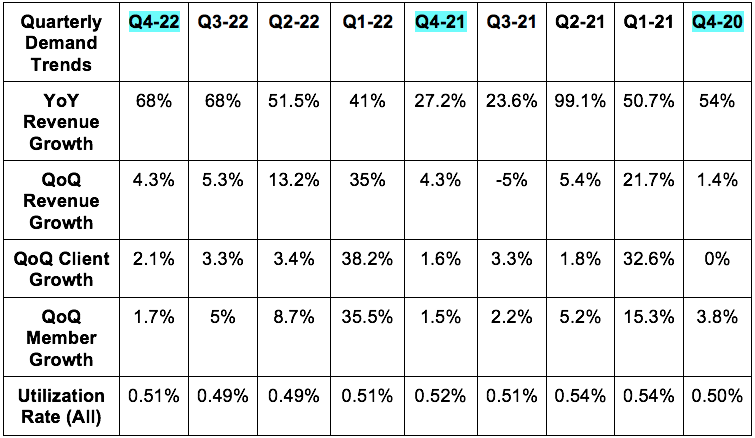

b) Profitability

- Beat EBITDA estimates and its identical guide by 3.1%.

- Beat $0.01 GAAP earnings per share (EPS) estimates and its identical guide by $0.02.

- It guided to operating cash flow (OCF) of $50 million mid-quarter when it raised its revenue guidance. This was stronger than expected by a wide margin. And it beat this strong update by another 3%. It is clearly having no issues with collections as EBITDA to OCF conversion continues to skyrocket from 38.6% to 64% YoY. And that’s not surprising considering its collections come from some of the richest companies in the world. Yet another short seller claim divorced from reality.

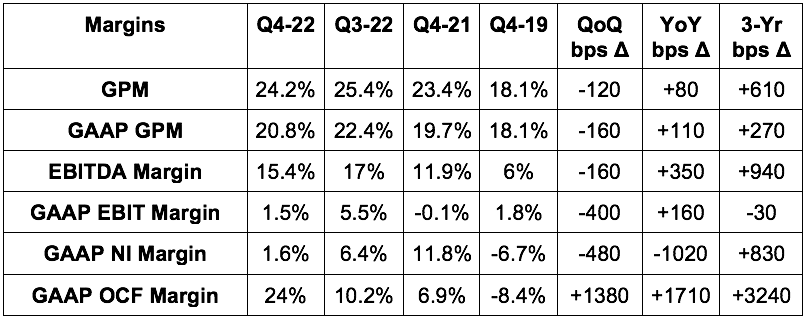

More Margin Context:

- Net income fell 78% YoY. That seems concerning on the surface, but it isn’t. This was solely related to a $733,000 tax expense this quarter vs. a $15.5 million tax benefit YoY. With this same benefit in Q4, 2022, net income would have been $19.6 million for 30% YoY growth. This is why adjusted EBITDA -- which doesn’t include this impact -- more than doubled YoY to $33 million.

- The difference between GAAP GPM and GPM is due to an equity package issued in Q4 2021. This will vest throughout 2023 when these margins will again converge. You’ll notice they were identical pre-package in Q4 2019.

- This same package hit GAAP income statement margins this quarter, last quarter and Q4 2021 as well. This amplified the YoY net income impact discussed in the first bullet.

- This package is the source of most GAAP cost buckets rising in 2022 vs. 2021. This is temporary and GAAP EBIT margin rose regardless thanks to excellent demand performance.

- YoY OCF comps are a bit weird due to recently re-negotiated pharmacy contracts as Progyny gains more scale and bargaining power. This raises its overall cash flow collection from the segment and changes the timing of these collections. That aided the wild margin expansion we saw here YoY. Still a strong result, but this needs to be noted.

- 2022 EBITDA margin was 16.0% vs. 13.5% YoY. Its 2022 incremental EBITDA margin was 20.4% which points to another 440 basis points of future operating leverage as contracts renew.

c) Forward Guidance

- Reiterated the anticipation of eclipsing 370 clients in 2023 and 5.4 million covered lives. It continues to assume 0 contribution from existing client organic employee growth as tech layoffs continue. Fortunately, most of the other sectors represented in its client base continue to hire with unemployment near generational lows.

- Met revenue estimates.

- Beat EBITDA estimates by 1.5%.

- Missed $0.33 GAAP EPS estimates by $0.04. This, as always, excludes income tax benefits including benefits via stock comp which should continue in 2023.

- Expects a 19.4% incremental EBITDA margin to power more margin expansion.

- Early client launches in 2022 to lead to slower second half growth vs. first half growth.

d) Balance Sheet

- Stock comp was 13.7% of sales vs. 11.3% QoQ & 11.8% YoY. This rise is due to more of the aforementioned equity package vesting.

- $274 million in cash & equivalents.

- $0 debt.

e) Call & Release Highlights

On Client Diversification More than Offsetting The Growth Headwind from Tech Sector Layoffs:

“We now have the most diverse client base in our history across 40 industries. Our results demonstrate the superiority of Progyny’s offering and the high demand for our solutions.” -- CEO Pete Anevski

On Winning & Competition:

“Unlike many digital point solutions that have sprung up across healthcare recently, including in fertility, Progyny continues to successfully differentiate based on outcome & value.” -- CEO Pete Anevski

“As we look across the marketplace today, we believe we're in the best competitive position that we've ever been in and that we're only widening the distance as the leader in the market… Our clients today include many of the most data-driven and sophisticated buyers of health care services in the world. They understand how to evaluate and choose the solutions that will best meet their needs.” – CEO Pete Anevski

- Reiterated all relationships with carriers remain strong.

- Reiterated 30% average cost savings per client by using Progyny vs. alternatives. It will hold client costs flat in 2023 vs. overall expected healthcare service inflation of 5%-8% to enhance this edge even more. Not just better outcomes… cost savings too.

- 25% of Progyny clients raised their benefit for 2023 vs. 2022.

- Most of the growth for 2023 came from deals signed in mid to late 2022 despite peaking macro headwinds at that time. Fertility is insulated from macro cyclicality as biological clocks are finite and parental passion strong.

- Demand for fertility benefits among millennials is “stronger than ever.”

2023 selling season (to impact 2024 financials):

- Early activity from new prospects and previous “not nows” continues to be “extremely positive.”

- The pipeline for 2023 has “meaningfully increased” vs 2022. Companies that do not offer fertility benefits appear to be experiencing competitive pressures to do so in order to attract and retain talent.

- Picked up a few early wins from an aviation manufacturing company, a union group and the Children’s Hospital Association. This represents 220 hospital systems in the USA. The deal doesn’t force these hospitals to use Progyny, but does recommend they do so.

- It announced signing its first professional sports team -- The Detroit Pistons -- after the call. (Love my Pistons… unfortunately)

“Although the last 2 years were good, that doesn't mean we think that's not achievable in the future. In fact, it's the opposite. We think the addressable market and the unmet need is still so big that we expect to continue to have these levels of success for the foreseeable future… The macro trends that have been fueling our growth are intact… No difference in feel from this year’s selling season vs. last year’s.” -- CEO Pete Anevski

ProgynyRx:

97% of new clients for 2023 implemented the ProgynyRx add-on. Rx penetration overall will be 90% in 2023 vs. 85% in 2022 and 73% in 2021.

New Products:

- Progyny’s preconception service is now being rolled out.

- Its male infertility service will be rolled out this quarter.

- Maternity and other women’s health products to be launched throughout 2023.

On Subtly Refuting More Short Seller Claims:

“As expected, accrued and un-billed receivables on a day sales outstanding (DSO) basis, improved by more than 12 days from Q3 to Q4 and ended the year in line with where we concluded 2021.” -- CFO Sean Livingston

e) My Take

I have to admit that this was a wildly satisfying Progyny quarter for me. The company had dealt with two separate short reports during the period. I viciously defended Progyny after both. I was right -- the reports were absolutely bogus. Progyny boasts brisk operating leverage, rapid compounding at scale, a still untapped greenfield opportunity and a tangible outcome & cost-based edge vs. all of the competition. Great company. Great quarter. Maybe someone can publish another shell of a short report so I can buy more shares.

3. SoFi Technologies (SoFi) -- Investor Conference & More

a) Investor Conference

SoFi CFO Chris LaPointe interviewed with KBW securities this past week. Here are the condensed highlights

On Guidance, Macro & Turning GAAP Net Income Positive Q4 2023:

SoFi’s 2023 guide assumes the Fed Funds rate reaches 5% and is cut twice in 2023. As a bank that can use deposits to generate yield and fund loan originations, less cuts in the back half of 2023 would be a profit tailwind for this business. While higher rates will dampen demand for its mortgages and some financial services, higher rates are an accelerant to SoFi’s personal loan product. Why? The rise motivates variable to fixed refinancing which is a main use case here. Personal loans will be a much more important piece of SoFi’s 2023 results than mortgages and financial services. It’s a net positive, and one that could be realized considering expectations of rate cuts continue to be pushed to early 2024.

“We have plenty of room to grow the personal loan business in this rate environment, but we’ll be extremely thoughtful and prudent with how we grow. We will maintain our maniacal focus on credit quality and underwriting the highest quality borrowers.” -- CFO Chris LaPointe

SoFi’s guide also assumes:

- 2.5% annual GDP contraction

- 5% unemployment.

- Unfavorable credit spreads in asset back securitization (ABS) markets where it still sells some loan pools. Encouragingly, it accessed ABS markets last month at spreads 90 basis point (bps) tighter (more favorable) than its previous deal.

If these pessimistic expectations are too negative, SoFi’s results will benefit. All of this is to say 2023 guidance does not rely on any exogenous tailwinds to be realized. If those exogenous tailwinds come, there will be upside. Ideal setup.

It’s already trending in the right margin direction with EBITDA more than 4Xing YoY and its quarterly EBITDA matching stock comp for the first time in its public history. This is a clear sign that operating profit is now eclipsing the GAAP net income drag that stock comp represents. EBITDA will continue to explosively grow as the business scales and intangible asset amortization related to Technisys M&A fades. This will happen while stock comp does not explosively grow as things like Preferred Stock Units (PSUs) from going public fade away.

On Galileo & the Tech Platform:

- Galileo’s cloud migration is now 99% complete. This means it will be freed from operating parallel tech stacks in the cloud and on premise which will be a material boost to margins.

- Galileo nearly tripled headcount since SoFi bought it to build out products and integrations. Now, SoFi thinks it’s “ready to realize some synergies and cost savings” from these investments and expects tech platform contribution margin contraction to reverse.

- The shifting focus to larger tech customers means longer sales cycles and longer on-boarding times. Once these deals are signed however, the revenue ramp will be far more meaningful than with other Galileo clients. And leadership continues to expect these deals to be a when not if. This is supposed to re-accelerate revenue growth as we move into 2024.

On Direct Deposits:

“We’ve seen no slowdown in overall inflows unlike a lot of other peers out there.” -- CFO Chris LaPointe

LaPointe reiterated that SoFi is enjoying 190 bps of savings with the charter by being able to fund loans with deposits vs. warehouse facilities. It has a lot of room to continue raising its savings annual percent yield (APY) to fortify that top of funnel for member growth. 190 bps of savings on SoFi’s $7.3 billion in deposits means $130 million in annual savings vs. using warehouse facilities to fund its loan book.

On Credit Quality:

SoFi’s overall loan portfolio continues to showcase a life of loan loss rate of 4.45%. Its risk tolerance is 6%-8%, so its loss rates continue to outperform and free cash flow from loans continues to outperform as well. Again, the target markets for SOFI are much higher income than other fintech’s such as Upstart.

b) More SoFi News

Goldman Sachs CEO David Solomon told the press this week that he’s “considering strategic alternatives” for their struggling consumer banking division -- including Marcus. This led many to believe that Goldman will attempt to liquidate its deposit assets and move on from this large earnings drag. Not only does this mean less competition for SoFi, but there’s some fun speculating (key word speculating) we can do here. SoFi’s Anthony Noto previously served as the Co-Head of Technology, Media and Telecommunications (TMT) research at Goldman Sachs. Galileo and SoFi are actively trying to land large banking partners as an investment proof of concept. Leadership is confident these wins will come. Does this mark Goldman thinking about consumer banking in a more partner-first, asset-light manner? Does that mean they’ll partner with or buy SoFi or use Galileo + Technisys to take another stab at consumer banking? Maybe. Maybe not. We’ll see.

- SoFI ranked 3rd in Fast Company’s list of most innovative personal finance firms.