Today’s piece is powered bySavvy Trader:

Welcome to the 370 new readers who joined us this week. We’re delighted to have you as subscribers & determined to provide as much value & objectivity as possible.

1. PayPal (PYPL) -- Q4 Earnings Review

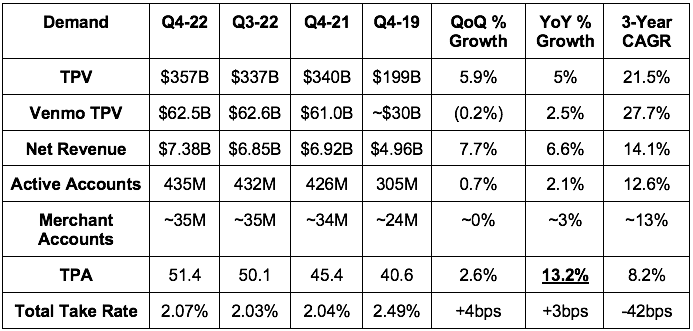

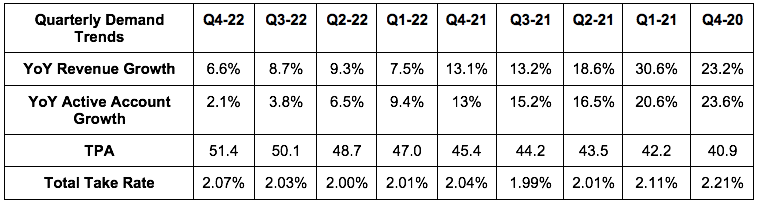

a. Demand

- Met revenue estimates & its guidance with an expected foreign exchange (FX) headwind of roughly 150 basis points (bps).

- Missed total payment volume estimates by 2.2%.

More Demand Context:

- The 14.1% 3-yr revenue CAGR compares to 16.1% last Q & 16.5% 2 Qs ago.

- FX was a 200 bps headwind to revenue & 400 bps headwind to TPV. It’s larger for TPV because hedging gains of $152M in Q4-22 help offset the revenue FX headwind but have no impact on the volume FX headwind.

- This is the first time in several years that PayPal’s take rate grew sequentially for 2 straight quarters. This is DESPITE its eBay take rate falling from 2.29% to 1.95% YoY due to eBay’s payments migration.

- Added 8.6 million net new active accounts in 2022 vs. guidance of 9 million.

- PayPal core daily active accounts are growing at a 3-yr CAGR of 12%.

- TPA & TPV growth powered by Braintree and Venmo.

- For 2022 as a whole, revenue grew 8% YoY, 10% on an FX-neutral basis and 13% FX-neutral and ex-Ebay migration (which is now in the rearview mirror).

b. Profitability

- Beat EBIT estimates by 2.4%.

- Beat $1.20 EPS estimates & its guide by $.04.

- Missed $0.84 GAAP EPS estimates & its guide by $.03.

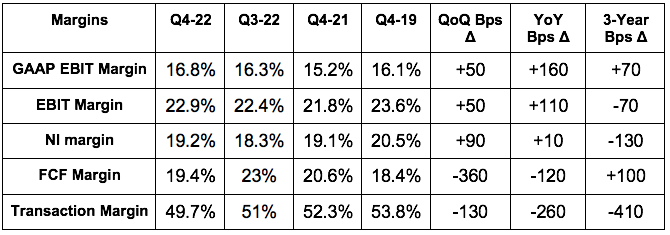

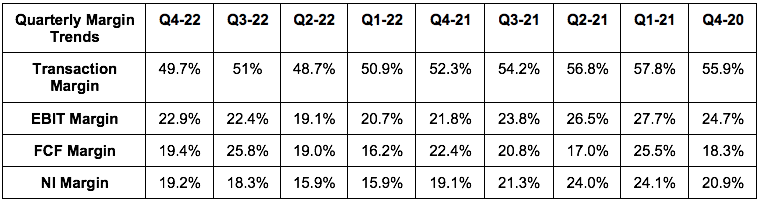

More Margin Context:

- Non-transaction OpEx fell 6% YoY vs. double digit growth we had seen in 2021 & early 2022.

- PayPal’s effective tax rate this quarter was 16.6% vs. 9.2% YoY. Net income margin expanded while EPS grew by 12% YoY regardless of this headwind as PayPal’s cost controls have taken hold & are accelerating.

It was encouraging to me to see YoY EBIT, net income and cash flow margins improve. A combination of the following factors had been weighing on margin lines since end of 2020

- eBay take rate compression

- Braintree proliferation

- lapping credit reserve releases

- lapping the stimulus-related debit and demand shocks

- pandemic-related cross-border struggles

It’s now finally resuming the previous operating leverage trend that investors had grown accustomed to through cost controls, Braintree economies of scale and Venmo monetization rapidly diversifying beyond ultra-low margin peer-to-peer (P2P) payments.

c. Balance Sheet

- $15.9B in cash & equivalents.

- $10.8B in debt.

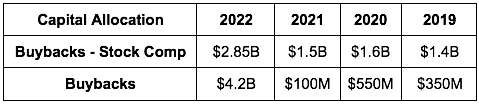

- Bought back another $1 billion in stock in Q4 to bring total 2022 buybacks to $4.2 billion or 5% of the overall market cap.

As I’ve said many times before, the relative strength of PayPal’s balance sheet vs. most of its competition puts it in an ideal position for selective M&A as valuations have plummeted. It can plug any pressing innovation gaps that it sees from acquisitions thanks to this strong liquidity position and hefty free cash flow generation.

d. Forward Guide

Q1 2023:

- PayPal guided to 7.5% YoY revenue growth which missed estimates by 0.4%. The guidance includes a 150 bps foreign exchange headwind.

- Missed GAAP earnings per share (EPS) estimates of $0.71 by $0.08. This includes a $0.02 benefit from its equity investments.

- Beat EPS estimates of $1.07 by $0.02.

2023:

- Met GAAP EPS estimates. This includes a $0.20 negative impact from its investment portfolio valuation.

- Beat $4.76 EPS estimates by $0.11.

- PayPal raised its EBIT margin expansion guide for 2023 from 50 basis points 2 quarters ago to 100 basis points last quarter and now to 125 basis points as of this quarter. It continues to find more areas of cost savings while assuring investors it is still aggressively investing in high conviction growth areas & branded checkout.

- Expecting FCF of $5 billion. Flat YoY FCF growth is due mostly to a higher expected tax rate.

- Effective tax rate to be 18% vs. 16% YoY.

- GAAP Effective tax rate to be 28% vs. (2%) YoY.

- Expecting 75% of FCF ($3.75 billion) to be allocated to buybacks (82% of FCF was allocated to buybacks in 2022).

- PayPal’s shift to a focus on engagement vs. account growth will continue to lead to low engagement account churn as it eliminates promotions to retain them. This will lead to flat active account growth for 2023 but still modestly growing monthly active account growth from the 190 million it has today.

- Braintree growth to decelerate throughout 2023 as comps get tougher.

e. Call & Earnings Release Highlights

Schulman Retiring:

Dan Schulman will retire at the end of 2023. I’m not quite sure if this was voluntary or if the board forced his hand but let’s assume the best. Schulman’s team struggled to model pandemic trends and was caught with their pants down in late 2021. While it has effectively integrated several key acquisitions, a reputation of “slow innovation” has crept up on Schulman since 2020. And it’s somewhat warranted with factors like slow Venmo product expansion for critics to point to. I think Schulman effectively tightened PayPal’s belt and put it in a strong position heading out of this downturn, but I still view this as a positive transition (depending on who the replacement is).

Branded Checkout:

Schulman immediately told us on the call that PayPal “at a minimum” maintained e-commerce branded checkout market share throughout 2022. He added he was confident the company would continue to hold market share across its core markets with a possibility of share gains as “branded volumes have accelerated so far into February” per Schulman.

A few institutions have come out with notes hinting at this branded share eroding, so this was wonderful to hear and likely why it was addressed so early in the call. Schulman alluded to some analyst confusion with modeling e-commerce share being a factor of having no perfect data source to track it.

- Branded PayPal checkout volume grew 5% YoY in 2022 as a whole.

- PayPal branded checkout gained share in November, lost less share during Black Friday-Cyber Monday (largely due to an extra Amazon Prime Day YoY) and held share in December with gains so far in 2023. It’s gaining share in Europe, losing share in Australia and maintaining share in North America.

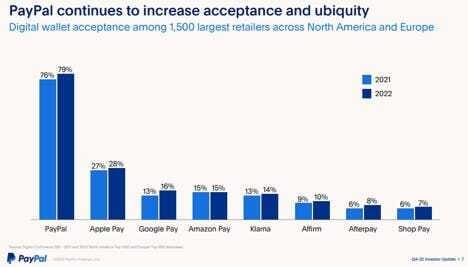

- PayPal’s digital wallet (which is an intimate complement & extension to branded checkout) continues to grow market share vs. manual card entry & competition.

- PayPal continues to onboard merchants to its new fully in-line (meaning checkout happens within the merchant’s site rather than bouncing a shopper out to PayPal and back). This has been shown to juice conversion rates considerably due to the diminished friction.

- 33% of PayPal’s top 100 merchants are on its latest checkout tech stake vs. 25% YoY. It plans to reach 50% in 2023. PayPal is gaining significant branded share with its cohort of merchants on this upgraded checkout stack.

- This upgrade delivers a mean conversion boost of 6.5% for merchants.

PayPal’s large merchant adoption share lead continued to grow in 2022 vs. 2021. Surprisingly & encouragingly it jumped 300 bps vs. Apple Pay (which I view as the biggest PayPal threat despite the new partnership) which rose just 100 bps on a lower base:

Buy Now, Pay Later (BNPL):

- Leadership reiterated plans to sell a large chunk of BNPL receivables in 2023 to strengthen the balance sheet. It has done this with some other U.S. receivables with Synchrony Bank in the past. I love this move. Be asset light.

- PayPal BNPL has now crossed 30 million users just 2 years into its launch.

- BNPL users spend 30% more through PayPal and churn 10% less frequently on average.

- 90% of BNPL repayments are through debit fund sources which means higher transaction margins for PayPal due to lower 3rd party interchange fees.

- Added “Pay Monthly” as a new BNPL repayment format during the quarter.

- Keep in mind that BNPL is still a tiny portion of overall PayPal volume. But It’s going very well and is arguably PayPal’s biggest success story for homegrown product innovation over the last few years. It didn’t buy an AfterPay-like competitor to get here. Just minor M&A and effective R&D.

- PayPal’s reserve coverage ratio of 7.4% for BNPL was flat QoQ due to solid repayment performance of these loans continuing. PayPal maintained its industry leading authorization & loss rates. Good combination.

- 2 million merchants now offer PayPal BNPL with transaction volume in 2022 rising 160% YoY to $20.3 billion. This marks an acceleration from the 157% year to date growth that PayPal BNPL reported in Q3 2022.

300,000 merchants now offer PayPal BNPL upstream from their checkout pages vs. 200,000 just 6 months ago and 30,000 18 months ago. This means the option is presented to customers earlier on in the shopper flow which materially bolsters PayPal’s checkout market share.

Venmo:

- Venmo TPV for 2022 as a whole grew 7% YoY after 44% growth in 2021 via a large pandemic demand pull-forward. This represents a 24% 2-year CAGR when smoothing out the impact of this acceleration.

- Pay with Venmo on Amazon is now fully rolled out to U.S. customers.

- Starbucks added pay with Venmo as an option for its loyalty program. Users can now save their accounts in the app to pay in store or ahead. Furthermore, they can use Venmo as a funding source to replenish account balances.

Cost Controls:

“The quarter was clearly a positive inflection point and a clear sign of cost discipline in our pursuit of profitable growth.” -- CEO Dan Schulman

PayPal now expects $1.9 billion in total OpEx savings in 2023 vs. previously guiding to $1.3 billion. This was the source of the 2023 profit beat vs. guidance. Leadership sees growth and operating leverage over the next several years but declined to specifically guide to that. Importantly, PayPal’s cost structure has now been right-sized in the eyes of leadership.

2023 Guide:

PayPal’s 18% EPS growth guided to for 2023 (vs. previous guidance of 15%) assumes wildly pessimistic revenue expectations. Schulman on the call told us that “actual revenue expectations” are well higher than the plans for 2023 assume. If this better revenue performance comes to fruition, a significant portion of that would feed incremental bottom line growth.

“2023 guidance is what we see as a worst-case revenue assumption with global recession, persistently high inflation and muted discretionary spend… We designed our targets based on what we believe to be a conservative planning assumption of mid-single-digit FX-neutral revenue growth rate in order to give confidence in EPS targets.” -- CEO Dan Schulman

PayPal’s 2023 baseline assumptions also include low single digit e-commerce growth vs. the significantly faster rate that e-commerce had gotten used to before the pandemic pull-forward. Leadership acknowledged macro green shoots forming, but decided not to build any of the positive news into its forecast. Still, we were told that “Q1 is off to a much stronger start than expected” which bodes well for the year as comps will ease while macro shouldn’t worsen too sharply and could even improve throughout 2023.

New White-Label Initiative:

PayPal has now fully released its non-branded end-to-end payments service for SMBs called PayPal Complete Payments (PPCP). It’s working with Adobe and TikTok as selling partners for this new product in France.

PPCP complements Braintree’s Fortune 500 brand niche and adds another $750 billion in total addressable market (TAM) to its white-labeled checkout suite. Furthermore, lower volumes per SMB merchant will mean better margins for this endeavor vs. Braintree as a whole. This could be a timely offset to the margin headwind that Braintree on its own presents.

New Products & the Digital Wallet:

PayPal continues to work on integrating all of the new “disparate” (Dan’s words) products it offers (high yield savings, bill pay, charitable giving, international remittance, cards, rewards, Honey deals) into a “seamless user experience” on PayPal’s digital wallet as well as Venmo’s.

Schulman also spoke on a renewed focus on P2P payments. While it’s ultra-low margin, it leads to higher account balances which translate into incremental high margin volume through debit interchange fees.

Revenue Mix:

Unbranded processing now makes up 30% of PayPal revenue vs. 24% YoY & 19% in 2019. This is taking total TPV share from PayPal Branded checkout which is now 30% of total volume vs. 33% YoY.

- eBay is now 2% of volume vs. 4% YoY.

- Venmo is stable YoY at 18% of volume.

- The Other Merchant Services bucket is stable YoY at 10% of volume.

f. My Take

If you listen to social media herd, nobody uses PayPal or its suite of products just like nobody uses Meta’s Family of Apps anymore. It’s easy to get lost in that noise while it’s far more productive to track user and engagement numbers as evidence of these trends rather than relying on random opinions.

The data for PayPal continues to be positive in my view. Branded checkout share was maintained throughout 2022 with acceleration thus far in 2023. That is an imperative piece of this investment working. Margins are being bolstered through needed cost controls all while revenue continues to compound at a multi-year double digit growth clip. With 18% EPS growth confidently expected in 2023, the firm now boasts a PEG ratio of 0.91. This is a clear example of growth at a compelling price. Not a perfect quarter, but still a thumbs up from me.

2. JFrog -- (JFROG) Q4 2022 Earnings Review

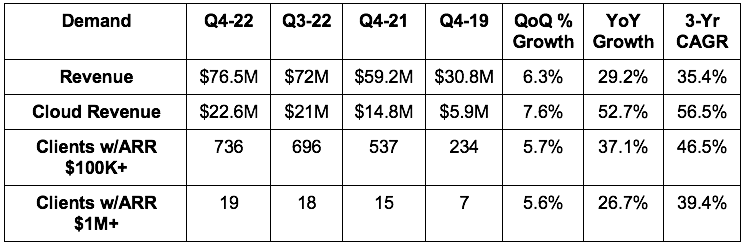

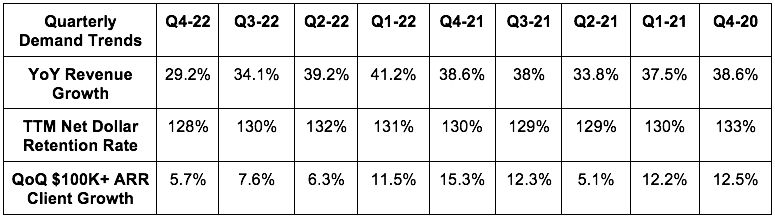

a. Demand

- Missed its revenue guide & estimates by 0.6%.

- Met cloud growth guidance of 50%+.

More Demand Context:

- JFrog enjoys 89% of the Fortune 100 as clients. Most of its growth going forward will come from net revenue expansion with existing clients. JFrog customer count grew by 8.2% YoY in 2022 vs. about 10% growth in 2021.

- Gross retention rate is stable at 97%.

- Revenue rose 35% YoY for 2022 as a whole.

- JFrog Complete (its full platform) = 43% of total revenue vs. 35% YoY.

- Cloud revenue = 30% of total revenue vs. 25% YoY. Cloud for 2022 as a whole grew by 60% YoY to $80M.

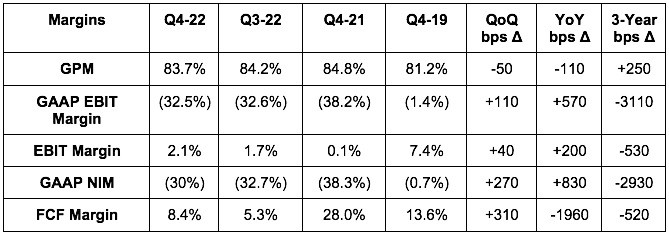

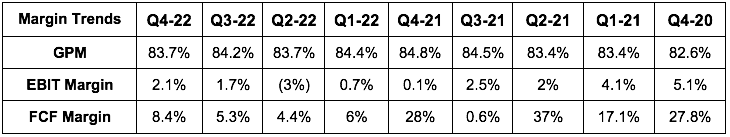

b. Profitability

- Beat its non-GAAP EBIT guide & estimates by 6.7%.

- Beat its EPS guide of $0.015 by $0.025 & estimates of $0.02 by $0.02.

- Missed GAAP EPS estimates of ($0.18) by $0.05.

- Beat FCF estimates by 10.3%.

More Margin Context:

- FCF continues to be negative without the stock compensation add back.

- GAAP margin worsening is all IPO stock comp & ramping product investments related. Operating leverage is expected going forward. This is also why it generated just $17 million in free cash flow in 2022 vs. $24 million in 2021.

- Non-GAAP gross margin worsened from 84.1% to 84.0% in 2022 vs. 2021. Falling gross margin is the result of cloud growing in proportion of total sales vs. on-premise. Leadership expects GPM to converge towards 80% over time.

“As we step into 2023, we see opportunities to leverage investments we’ve made to expand profitability while delivering top line growth. JFrog was founded in a recession and is well positioned to deliver in uncertain times.” -- Founder/CEO Shlomi Ben Haim

c. Balance Sheet

- $443.2M in cash & equivalents.

- No debt.

- Stock comp was 24.5% of sales in 2022 vs. 27.6% YoY. Too high and I want to see faster progress here.

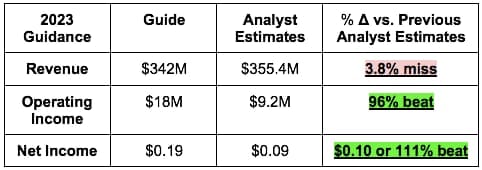

d. Guidance

Q1 2023 Guide:

- Missed revenue estimates by 3%.

- Beat non-GAAP EBIT estimates of $900K by 122% or $1.1 million.

- Beat EPS estimates of $0.01 by $0.03.

More 2023 guidance color:

- Continued single digit new logo growth in 2023.

- Cloud growth is expected to slow from mid-50% range to mid-40% range.

- JFrog is clearly tightening its belt and prioritizing more of a growth & profit balance vs. growth at all costs. The guide was called conservative.

e. Notes from the Call

Macro:

DevOps and security markets are among the most resilient areas of tech spend. Still, JFrog is dealing with incremental lengthening of sales cycles, added budget approval layers and continued cloud usage optimization. These headaches worsened further into the start of 2023 and are expected to continue worsening all year. This is why YoY revenue growth is expected to slow to 22% while net revenue retention falls towards 120% throughout the year.

We heard very similar commentary from GitLab (JFrog’s source code complement that it’s frequently deployed alongside) this week as it laid off 7% of its staff. When combining this news with JFrog’s retention and competitive win rates remaining consistent and strong, it’s clear this weakness is macro-related.

Customer Wins & Competition:

- Leading global payment processor standardized on the JFrog Complete platform in a Sonatype Nexus displacement.

- One of the largest Commercial Banks in Europe added JFrog Artifactory and Advanced Security. This was already a GitLab customer, providing more evidence for how complementary source code and binary players are within DevOps.

- Fortune 100 Pharmacy went with JFrog’s security solutions ($500,000 contract) to replace multiple existing vendors including AWS.

Leadership was asked about Microsoft’s new source code automating tool called autopilot. It sees this as complementary to its product offering just like its GitLab and Microsoft’s GitHub are. Constant software releases rely on endless scalability. Endless scalability relies on translating disparate source code languages into machine readable binaries. That’s what JFrog Artifactory does.

Price Hikes:

JFrog will raise on-premise subscription prices in 2023 to accelerate the shift to the cloud. This will add $6 million to its 2023 revenue number.

Cloud:

JFrog’s Pay as You Go tier for cloud customers is 25% of cloud revenue vs. 33% YoY. Longer subscription plans lead to slower short term growth but more visible revenue generation and higher customer lifetime value.

f. My Take

This was an underwhelming yet still fine JFrog quarter. Unlike other growth stocks, its 2023 revenue miss was small while its profit guide nearly doubled expectations. It’s effectively controlling costs to bolster margins while poor macro persists. And if it can do so while still delivering 20%+ growth during a hectic year, that works for me.

JFrog owns binary management market share and has ample opportunities to continue to effectively up-sell its new value-added products on top of that. That’s why management sees long term 30%+ revenue compounding and why I do too.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.