Today’s piece is powered byMasterworks:

Welcome to the 573 new readers who have joined us this week. We’re delighted to have you all as subscribers and determined to provide as much value & objectivity as possible. This piece was too long to send via email in its entirety.

1. Meta Platforms -- Apple

A lot has been made over the past few weeks of Apple’s entrance into the virtual/augmented/mixed reality (AR/VR/MR) space to rival Meta Platforms. While this is understandable, considering the firm’s cult-like following and unmatched balance sheet, it’s a net positive in the mind of Meta leadership. Why? Legitimacy. Zuckerberg has said time after time that Meta’s goal is to both command a strong share of the budding market and ALSO to “accelerate its arrival.”

Why is this acceleration so important? Because Apple and Google today own the mobile computing platform. That gives these two companies control over the software ecosystems Meta relies on for distribution. It also allows Apple to hurt Meta via things like blocking cross-app data sharing to weaken ad targeting capabilities — a move that shaved several percent off of Meta’s 2022 revenue growth.

Apple shifting resources to build out its competing virtual reality platform is a hint that it acknowledges that a sea change away from phone screens is coming. This is Apple doing its part to accelerate the Metaverse’s arrival.

Meta has no chance at garnering mobile hardware share and has no interest in doing so. It has a far higher probability of success to be a real player in the next computing platform. It leads on things like hand and facial expression tracking and is already creating compelling enterprise use cases. And if the company can command a sizable hardware share of this future, multi-trillion dollar opportunity, that will not only mean more revenue, but more control over its destiny by not being reliant on mobile gatekeepers behaving.

In case you missed it, click here for my Meta Earnings review from this past week.

2. Shopify (SHOP) -- Bullish Note & Buy with Prime

a) Bullish Note

Roth Capital upgraded Shopify to overweight this week. As always, upgrades and price targets don’t matter to me. BUT… the reasoning behind these notes -- when compelling & legitimate -- does matter to me. Roth Capital sees Shopify approaching 20% revenue growth in 2023 despite extremely tough comps, discretionary spending weakness and foreign exchange pressures. Furthermore, it sees the recently announced price hikes pushing more merchants to longer term subscription plans which will enhance the longevity and visibility of Shopify’s book of business.

The 20% growth expected merely brings Roth Capital in line with consensus estimates for 2023, but it’s still nice to see another firm raising their demand base case.

Shopify will largely wrap up an aggressive investment cycle by the end of the year as it builds out its Shopify fulfillment network (SFN). From now to then, margins are set to trough with profit growth resuming after a year-long pause. When pairing that with upcoming easier comps, strengthening revenue estimates, lapping its subscription take rate reduction, large merchant packages gaining clear traction and macro pressures beginning to ease, the 2023 set-up is quite compelling.

Unfortunately, markets seem to have sniffed that out over the last few months with the stock roughly doubling from the lows. That puts it around 18X 2023 gross profit which represents a more than 100% premium vs. markets. I think it deserves a hefty premium, but that may be a bit stretched at these levels. So? I’ve paused building out the position until multiple expansion begins to revert and (as noted last week) trimmed a small piece of the holding. I’m ok with accepting the risk of my position turning out to be smaller than I’d like if multiple compression doesn’t come. This high quality company is very expensive again and valuation always matters.

b) Amazon

Amazon launched its “Buy with Prime” offering to all merchants in the U.S. This extends its industry leading logistics services to 3rd party merchant sites for all products also offered on Amazon’s Marketplace. Similarly to SFN, “Buy with Prime” early on has delivered a 25% conversion spike for merchants due to shortened delivery windows. While this is clearly a strong competitor, it’s one that I view Shopify as fully capable of co-existing with. Why?

SFN doesn’t force merchants to plug into Amazon’s marketplace and so doesn’t force merchants to concede control of their data and brand relationships. 60% of Shopify’s merchants don’t sell on Amazon with many avoiding it for these reasons. While “Buy with Prime” trail-blazes a more direct consumer relationship, that can only be enjoyed if you list on Amazon -- which many merchants are simply unwilling to do. Direct to consumer (DTC) has become an imperative growth channel for countless merchants and SFN allows that DTC approach to be more complete and consistent without marketplace interruption.

Furthermore, Shopify is NOT trying to compete on Amazon’s delivery timelines or its logistics footprint. Shopify is merely trying to promise 1-2 day delivery to juice conversion rates so that merchants can sell more and Shopify can collect more revenue from happier clients. And it’s using fulfillment partners like FedEx and DHL to do so while sparingly leasing warehouse capacity in the most populous U.S. cities. Shopify’s expertise here is really on the software side of things. It has a great ability to plug cross-channel fulfillment into inventory management, marketing campaigns and all other areas of business for an seamless, cohesive, actionable view of operations. It’s not trying to come remotely close to matching Amazon’s fulfillment capacity, but is instead actively working on an integration while Shopify’s Deliverr is already an Amazon fulfillment partner.

As Shopify founder Tobi Lutke has frequently told us -- “this is not nearly as zero sum as people seem to think.” Some firms like UBS see “Buy with Prime” as a potential 1000 basis point headwind to Shopify growth, but “recognizes the actual impact could be lower” which is what I expect (and what most other firms expect as well).

If you follow me on Twitter, you’d know the pace of the Fed’s rate hikes has been the fastest since the 1980s. And during these hikes, investors lost an eye-popping $350B.

But one investing app posted record gains in 2022 through all of the chaos.

It’s called Masterworks – the company that has finally democratized access to fine art.

They make real multimillion-dollar paintings investible through shares, similar to how a company is broken up into pieces through stock.

And, the returns speak for themselves — all 11 exits were profitable:

It’s no surprise why. Their experts from Sotheby's and BofA analyzed +5,000,000 proprietary data points to identify great opportunities for your capital.

The takeaway? While your friends stress about market timing, inflation, and rate hikes, many Masterworks investors have enjoyed +10% net returns like clockwork… across all pieces of economic cycles.

Thanks to our partnership, if you have a +$250,000 portfolio, you can skip the waitlist now.

*“Net Return" refers to the annualized internal rate of return net of all fees and costs, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. See important Regulation A disclosures.

3. Match Group (MTCH) -- Q4 2022 Earnings Review

“2022 was worse than what we expect of ourselves. We made corrective changes & feel we’re going momentum into 2023.” -- New CEO Bernard Kim

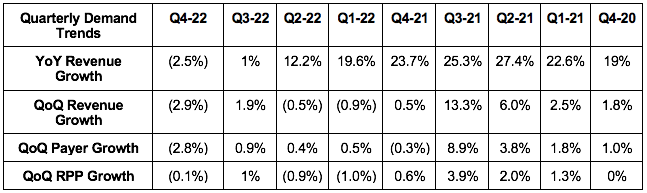

a. Demand

Match missed analyst revenue estimates by 1.1% & beat its guide by 0.1%. The guide assumed a 900 basis point foreign exchange (FX) growth headwind like it endured in the previous quarter. The actual FX headwind was 700 basis points. Match needed this assistance to simply meet its expectations. It told us that “weaker than expected business performance” across the globe but mainly in Europe was the cause of this relative weakness. Disappointing, but somewhat expected. Leadership needs time to turn Tinder around.

More Demand Context:

- Tinder Direct revenue of $444 million was flat YoY & up 8% YoY FX neutral.

- Macro was blamed partially for briskly slowing growth. Tinder execution was blamed as the main cause of the weakness.

- Tinder Payers rose 3% YoY to 10.8 million while payers within the rest of its app fell 8% YoY.

- Revenue Per Payer (RPP) was hit by an 800 bps FX headwind with that most pronounced in APAC. RPP actually rose 7% YoY FX neutral.

- Hinge grew revenue by 30% YoY in Q4 and 44% YoY for 2022 as a whole. It generated $284 million in 2022 revenue vs. $300 million estimates due to the delayed release of its new, more expensive subscription package.

- For 2022 as a whole, total Match Group revenue grew 7% YoY & 14% YoY FX neutral.

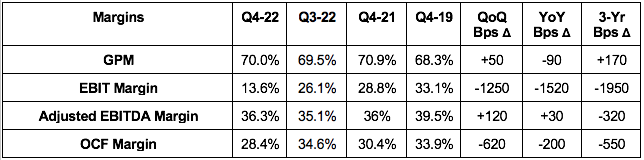

b. Profitability

- Match beat adjusted operating income estimates by 4.3% and its guide by 5.0%.

- Match missed GAAP EPS estimates of $0.46 by $0.15.

Margin Context:

- 2022 free cash flow was hit by $441 million in legal settlements. That’s why it generated $476 million in 2022 FCF vs. $832 million YoY. Ex-settlement, FCF would have grown 10% YoY to $917M.

- EBIT margin was hit by a $102 million impairment charge due to lower Meetic (one of its acquired dating apps) projections and rising discount rates for its Hyperconnect purchase valuation. Its financial targets for Hyperconnect did not change.

- Selling & marketing fell for the 3rd straight quarter by 9% YoY and represented 16% of revenue vs. 17% YoY.

- Match continues to hire new talent for Tinder and Hinge.

c. Balance Sheet

- $581 million in cash, equivalents & short term investments vs. $398 million last quarter.

- $3.9 billion in long term debt with 90% of it fixed rate.

- Fully undrawn $750 million credit revolver.

- Trailing 12 month net leverage ratio of 2.9X vs. 3.1X sequentially and vs. nearly 5X in 2020.

- Match paused its share buybacks in Q4 vs. buying back $267 million in stock in Q3. This was to “allow the cash balance to build” and amid “concerning stock volatility.”

- Will likely now restart buybacks with the bolstered cash pile.

- Basic share count grew 2.7% YoY in 2022 (related to new CEO hire) while diluted count fell by 3.3%.

- Stock comp was 6.7% of sales vs. 4.3% YoY due to to leadership changes.

d. Guidance

Q1 2023:

- Match’s revenue guide missed estimates by 3.2%.

- Match’s adjusted EBITDA guide missed estimates by 8%.

- This implies a 32% margin for the quarter.

2023 guide:

- REITERATED roughly $3.42 billion in 2023 revenue, meeting estimates.

- Leadership added that it’s “increasingly confident” in this guide.

- REITERATED “flat or better” adjusted EBITDA margins safely implying a 35% margin or $1.20 billion in 2023 adjusted EBITDA. This met estimates as well.

- This includes $14 million in unique severance & Google Escrow account headwinds and does not include any help from potential Google regulation or easing macro headwinds like FX.

- Growth & margins will improve throughout the year as better execution translates into better results at Tinder and as comps and macro get easier while cost savings initiatives take hold.

- $240 million in 2023 stock comp or 7% of revenue.

- Nearly $400 million in Hinge revenue for ~40% YoY growth.

- $840 million in free cash flow with a 70% EBITDA to FCF conversion rate. This gives it a 2023 FCF multiple of 15X. Still, this was 8% worse than expected.

So far in 2023, macro pressures have been “in line with expectations” and it continues to see itself exiting 2023 with double digit growth. It’s conducting a companywide cost review to reduce low return marketing, headcount and overhead. These savings will be infused into higher growth brands like Hinge, Tinder, Pairs and BLK as well as “new bets.”

“To the extent there are FX tailwinds, that would be a factor to push us to the higher level of our guidance or potentially above it. It’s too early to adjust the guide considering how volatile FX is.” -- CFO Gary Swidler

e. Shareholder Letter and Call Notes

Macro:

- Match will reduce the global workforce by 8% in 2023. This is partially due to reorganizing its leadership structure which involved combining emerging and evergreen brand departments. That combination created redundant roles that it’s now eliminating.

- Japan operations have not yet begun to recover while pandemic restrictions begin to ease. Match expects this recovery, but avoided including it in its 2023 guide. Japan’s comeback will present upside to guidance whenever it happens.

Tinder:

The team is preparing to launch a “bold global marketing campaign.” Leadership continued to talk about how Tinder’s historic virality & word of mouth growth fostered a bit of complacency on handling the brand narrative. It aims to reclaim this narrative and reshape it away from the “hookup app” label Tinder boasts today. This plan will raise Tinder marketing dollars as a percent of direct revenue by 200 bps in 2023 vs. 2022.

As evidence of new product initiatives working and the new team executing, Tinder -- through new perks like dynamic subscription offer surfacing, granular profile descriptions and Primetime Boosts -- reversed a negative trend in à la carte revenue. Match has seen encouraging stabilization to à la carte over the last several months:

- The loss of 300,000 Payers QoQ for Tinder was due to eliminating discounted packages in what was called a “revenue neutral” decision.

- Tinder continues to test new ad formats and subscription packages (including the plan tailored to female monetization).

- Product shipping cadence rapidly accelerated in the 2nd half of the year vs. the first half.

- Leadership sees significant “low hanging fruit” around pricing optimization.

- CEO Bernard Kim told us the previously rumored ultra-premium Tinder subscription plan was in very early testing.

- Tinder (and all other apps) are now seeing stability in peak season demand trends.

Hinge New Subscription:

- Launched its new, ultra-premium subscription tier called “Hinge X.” This costs $60 per month vs. $35 for the lower tier plan.

- Hinge X offers “better recommendations to raise awareness,” an “always on boost” to bring your profile to the top of everyone’s piles and likes pinned to the top of prospective match feeds.

- New plan is “delivering on expectations in its initial testing with significant take rates.” The conversion rate is actually higher than expected and this has not cannibalized à la carte revenue to date.

- The subscription will roll out to all Hinge markets by the end of February.

Hinge Going Global:

- 5 months into its Germany launch, it’s now the #3 dating app (vs. #4 last quarter).

- It’s #3 across the Nordics DESPITE only having launched in Sweden.

- With 0 marketing spend to date, Hinge is close to cracking the top 10 in France, Italy and Spain. It will wrap up product localization/translation there in the coming months and then launch marketing campaigns.

- Hinge is set to be fully translated across Europe this year before turning its attention to Asia and Latin America in 2024.

- International will NOT be a key 2023 revenue driver as it takes time to build enough scale in new markets to motivate premium subscription sales.

- Hinge is now a Top 3 dating app in: The U.K., Australia, Ireland, The U.S., Canada, Germany, Austria, Switzerland, Sweden, Norway, Finland and Denmark.

F. My Take

The report was largely as expected, the Q1 guide was disappointing and the full year 2023 guide was in line with expectations. I hoped that a weakening dollar would have provided some upside to its previous 2023 forecast -- but that guide was merely reiterated as leadership thinks it’s too early to get excited there. I wholeheartedly believe Bernard Kim is the perfect CEO to right this ship, but it will take time for the company’s operational improvements to gradually improve the financial trends we’re seeing.

Macro & micro are both hitting them at the same time. Macro headwinds will ease throughout the year as it attempts to get its micro-level mojo back through product roadmaps that are working well thus far. I’m not interested in trimming or adding after this report. I will hold.

4. Lululemon Athletica (LULU) -- Nike

Nike is suing Lululemon over footwear patent infringement on 4 shoe models. This is far from the first batch of legal drama we’ve seen from the two companies, and it will likely turn out to be a large nothing burger -- but I will keep an eye on this just in case.

5. PayPal (PYPL) -- Layoffs

PayPal announced that it will lay off 7% of its staff in another move to control costs. This has turned into an unfortunate cliché for even the strongest technology and fintech companies over the last year. It’s a necessary evil for PayPal in its drive to deliver the 15%+ earnings growth it has committed to for 2023 -- which is an imperative piece of this investment case.

The company (as leadership often admits) spread itself too thin across products and geographies in 2021 as it extrapolated the pandemic pull-forward as more permanent than it turned out to be. This is a painful part of removing that excess and becoming leaner and more focused on its higher-probability growth vectors like Venmo, Braintree, Europe and China.

6. Upstart (UPST)

a) Layoffs

It’s no secret: Macro headwinds paired with leadership blunders have hurt Upstart mightily over the last year. Knowing this, and in response to “significantly reduced or paused loan originations” across the sector, Upstart is “streamlining operations to return to profitability.” To do so, it’s firing 20% of its workforce and will incur about $15 million in Q1 2023 severance charges as a result. Once finished, this move will save Upstart about $57 million in operating expenses and will cut stock comp by $42 million as well. Furthermore, it is suspending the rollout of its small business loan product to release once macro is not so negative for the firm.

While we’ve seen strong macro green shoots for other lending players like SoFi, the same has not yet been true for Upstart within its lower credit quality category. Still, financial conditions continue to loosen with the 2 year yield now 51 basis points off of 52 week highs and that benefit will eventually make its way to Upstart’s demographic and funding supply.

As with PayPal, this is both a tough piece of news for the 365 people impacted and a necessary maneuver to ensure Upstart has the liquidity to comfortably survive the remainder of this downturn. In terms of my plans with the position, it remains on my Do Not Add list until funding supply (both from partners and investors) shows signs of bottoming. I haven’t seen those signs yet as delinquencies across its niche continue to rise and so capital appetite continues to be challenged.