Table of Contents

- 1. Turning the Calendar

- 2. 2024 Portfolio Management Expectations

- 3. SoFi Technologies (SOFI) – Downgrade

- 4. Walt Disney (DIS) – Activist & Sentiment

- 5. PayPal (PYPL) – Q4 and 2024

- 6. Amazon (AMZN) – More Upgrades

- 7. SentinelOne (S) – M&A & Contemplating

- 8. Market Headlines

- 9. Macro

- 10. Portfolio

1. Turning the Calendar

The first week of 2024 was certainly a volatile one. Volume returned to exchanges on Tuesday and volatility kicked back in following a tranquil end to 2023. I don’t focus on short-term price action, but I did want to discuss this phenomenon in a bit of detail and where the sharper price action came from.

In my mind, it stemmed from two places. First, 2023 was a very fun year. Most quality companies were convincingly up year to date with a few notable mega-cap standouts carrying the indexes notably higher. Fund managers without solid stakes in the “magnificent 7” (FAANG + Nvidia and Microsoft), had some explaining to do to their investors wondering why they missed the boat. This likely added buying pressure to the biggest winners through the end of the year to appease investor concerns over holdings. More buying pressure means higher prices – all else equal.

Secondly, year to date profits in 2023 mean capital gains taxes for those choosing to liquidate winning positions in the calendar year. If those positions are sold off after January 1st, investors can delay the taxation event by over a year. That is the rational decision considering that cash can safely earn you 5% in today’s environment. When combining these two factors, we are left with more incentive to bid up winners and less incentive to sell them into the New Year. The calendar turned, and those incentives reversed while seasonally light volume returned to more normal levels. You’ll likely notice that your best performers from 2023 were hit the hardest at the beginning of the week. This is likely why.

To be candid, this type of price action is not something I care about or want to manage my portfolio around (aside from delaying taxation). After all, for us long-term investors, demand and profit compounding are by far the two most important things that matter for returns. I simply think it helps to understand where the sudden price action came from. Knowledge is power.

2. 2024 Portfolio Management Expectations

2022-2023 were years in which “don’t fight the Fed” meant expressing caution when building out positions. I trimmed more readily than I’d normally like to; I kept more cash on hand than I’d normally like to; and I demanded more multiple contraction to justify adding to positions. My bias always leans towards accumulation as I consistently have new funds hitting my account. Still, that bias has been less pronounced for nearly 2 years.

Well? 2024 is the year in which “don’t fight the Fed” does a 180 in terms of meaning. Rates are peaking with cuts expected this year; quantitative tightening will likely slow as that process plays out. Hawkish policy intensity is dwindling while employment and economic activity remain quite healthy on a relative scale. That recipe is perfect for stocks. A strong economy and falling cost of capital are ideal for investing. That falling cost of capital and rate cuts should also lead to gradual multiple expansion looking ahead. Faster growth, larger rewards for that growth.

My portfolio management approach is going to get more aggressive this year. I am going to accumulate with smaller multiple contraction bands and let positions run more freely than I have been. Considering this, I’m grouping the holdings into strategic buckets, which more clearly depict the approach. When going through this, please note that I don’t use traditional multiples to determine expensive vs. cheap. I use price to profit to growth multiples to reward the pace of profit expansion. I think PEG ratios (P/E divided by multi-year earnings growth) are far superior to P/E ratios.

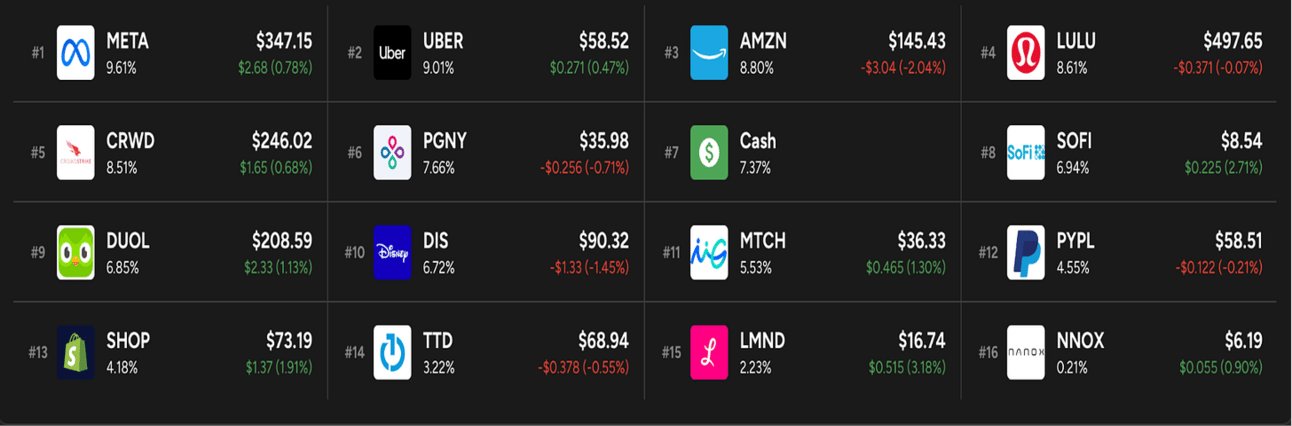

a. Priced Very Attractively & Fundamentally Performing

I consider Meta, Uber, Amazon, SoFi and Progyny to be in this bucket. All 5 sport forward PEG ratios around 1x or lower; all 5 consistently outperform quarterly expectations; all 5 are extremely well-run organizations. The first three are also in cost optimization mode, with profit estimates rapidly rising. I don’t think those estimates are finished rising. That’s despite the trio’s compelling pricing prior to any further upward revision. I haven’t had much of a chance to add to any in this group besides Progyny and SoFi in 2023.

Technical analysis is a small part of my process. Still, it’s a piece and all 5 holdings continue to gradually ride their moving averages higher. As someone who has the luxury to think in years and not quarters, I’d use these tools to slowly, carefully lean back in. I am willing to catch fundamentally thriving companies whose stocks are falling knives… but only very slowly and with a deep respect for my charting friends. Despite the cohort being among my largest holdings, I’d like to lean back into accumulation on all 5 if Mr. Market gives me a chance.

b. Priced Very Attractively & Fundamentally Uncertain

I consider Disney, PayPal and Match Group to be in this bucket. Like the first cohort, they all sport PEG ratios around 1x or lower. Disney needs to show me that they’re serious about solely focusing on making great content rather than influencing global culture. It needs to show me that it’s willing to behave rationally by selling part of ESPN to mega-cap tech rather than trying to go face-to face with them. The India sale is a great hint that it’s willing to do so. I loved that news. It needs to deliver on its plans for streaming to breakeven next year. These are the key events that I’m looking for from the Mouse. For PayPal, it’s as simple as seeing a convincing bottom in its transaction margin. For Match, I want to see payer growth turn positive in Q2 like we’ve been told to expect. This should easily happen as it laps price hikes. If it doesn’t, I will sell. I want to see the top of the funnel recover. I want a lack of additional blunders such as halting a successful marketing campaign. I want to see them execute across their entire app ecosystem… not just Hinge.

Match Group is on the do not add list. PayPal and Disney are on the “Mr. Market really needs to give you the deal of a lifetime to add” list (as Disney has been since I started the position). I will be more cautious with this group than the first. I will demand more multiple contraction and I will likely trim more readily into multiple expansion. All three are dominant players in their respective fields that have lost their ways to varying degrees. Why am I being so patient? The brand power, asset bases and commanding market share positions for all three put them in a great spot to right their ships. We’ll see if that can happen.

c. Fully Priced and Thriving

I consider Lululemon, CrowdStrike, Duolingo, The Trade Desk and Shopify to be in this bucket. All have been flawless performers (besides TTD’s latest quarter), share takers, consistent compounders, margin expanders and emerging titans in their respective fields. All are also quite expensive, with forward PEGs hovering around 1.5x-2x. Lululemon, Duolingo and CrowdStrike are pricey while The Trade Desk and Shopify are very pricey. But elite fundamental performance deserves a hefty premium like they’re all already getting. I don’t expect any multiple expansion here, but rapid profit compounding doesn’t need an expanding multiple to deliver strong annual returns.

So? I let all of these valuations run a bit more than others in the portfolio and will continue to do so. I will still look for significant multiple compression to lean in with bands larger than group A. I’m more comfortable with letting these names get more expensive than I am for the fundamentally fragile names.

d. Odd Balls

Nanox is on the do not touch list until commercial deliveries of its Arc hardware begin. We shall see if that ever happens. For now, I’m fine with it being such a tiny position. It could easily be a zero, but Arc is a game-changer for radiology if deployment ever can ramp.

Lemonade has actually executed flawlessly… it’s just miles from profitability. For that reason, I didn’t want to put it in group A as there is still so much to prove about the viability of its unit economics at maturity. I just can’t place it in the same breath as Meta and Amazon despite it doing everything correctly right now. I have been adding here, but with an important caveat that a “full position” in Lemonade is much smaller than a “full position” everywhere else. There’s no finite cap in mind, but I want it to be the smallest holding I have besides Nanox for now.

e. The Current Watch List

- JFrog (waiting for more geopolitical certainty to hopefully re-enter)

- SentinelOne (waiting for it to get closer to breakeven)

- Cava (waiting for it to hopefully get cheaper)

- Sweetgreen (waiting for it to establish a better track record of under-promise, over-deliver and accelerate Infinite Kitchen integration)

- Dutch Bros (interested but haven’t done enough work yet)

- MercadoLibre (interested but need to learn more about LatAm economics to grow comfortable enough to start a position outside of the U.S.)

Looking for a better investment platform? Enter BBAE. The product speaks for itself. The Town Square copy trading tool allows you to emulate Wall Street’s finest. Its curated stock themes (under BBAE Discover) inspire new ideas, and its valuable technical and fundamental research tools guide you through key concepts.

BBAE is the broker dedicated to giving investors what matters to us. No gimmicks, no charms, no confetti, and never any pressure to trade. This is THE broker for long-term investors. Oh… and it’s offering generous deposit bonuses of up to $400. Check it out here. You’ll be glad you did.

3. SoFi Technologies (SOFI) – Downgrade

Keefe, Bruyette & Woods (boutique research firm) downgraded SoFi this past week. It lowered its price target from $7.50 to $6.50. There are a few reasons for this. The first one is its recently positive stock movement leading to more downside stock risk. This is irrelevant and I don’t want to lend credence to this argument with further explanation. The other factors are what we need to focus on.

The firm sees a risk of lower fair value on incremental originations. This is due to falling rates leading to SoFi charging lower annual percent rates (APR). This entirely ignores multiple pieces of fair value measurement. It penalizes SoFi for lower APR WITHOUT rewarding future fair value for lower cost of capital and stellar loss rates. All three are variables in arriving at fair value.

Let’s dissect the APR and cost of capital pieces. SoFi has a unique FinTech edge (thanks to the charter) in its ability to use low-cost deposits for originations. This means lower cost of capital than those reliant on warehouse credit. SoFi also enjoys significant pricing power in its APR/weighted coupons. Why? Because of its excess credit demand and ultra-prime borrowers. It turns down 75% of applicants and enjoys heightened elasticity of demand from catering to the most affluent borrowers. The luxury of extreme selectivity helps too. That’s why its weighted average coupon rose faster than benchmark rates throughout 2022-2023. That’s also why its weighted average coupon will likely fall more slowly than rates during the dovish part of this cycle. So… structural cost of capital advantage and a structural weighted coupon advantage. This puts it in an ideal position, along with great loss rates, to maintain or even grow fair value of loans going forward.

There’s another vital point to cover. The fair value of loans is also based on the present value of the discounted cash flows of future repayments. As rates fall, that discounting becomes less intense. This directly props up fair value to offer more maintenance support.

The analyst also sees lower origination growth in 2024 as a risk. I agree that origination growth will slow, but not nearly as much as this firm implies in its revenue forecast. Why? Lower rates and easier monetary policy mean tighter credit spreads, better liquidity and more capital market demand. SoFi uniquely found capital market buyers at compelling gain on sale margin throughout 2022 and 2023 thanks to its pristine credit performance; it should find far more demand in 2024. That will mean more pocketed gain on sale margin, and more balance sheet flexibility to accelerate originations without approaching capital ratio minimums. It will also mean lower profit hurdle rates for capital market participants like hedge funds to clear. This could even potentially bolster its already strong gain on sale trends.