1. Match Group (MTCH) — New Position + Earnings Review

I plan to start a position in Match Group on Monday. I will publish a deep dive detailing the investment case later this year, but I wanted to provide a brief synopsis of why I’m bullish.

a. The Industry Basics:

- Online dating revenue CAGR of 12.7% from 2015-2020 will accelerate to 13.1% through 2025.

- 36% of adults use dating apps vs. 29% YoY and 11% in 2013 per Pew Research.

- 50% of Gen Z and Millennials feel positively about online dating vs. 30% for Baby Boomers.

- Still, just 13% of relationships begin online.

b. A Market Leader:

- Match owns 4/7 of the most popular dating apps globally — with 47% market share.

- Match owns 5/7 of the most popular U.S. dating apps — with 72% market share.

I generally try to take the terms like “first mover advantage with a large grain of salt — but in Match Group’s case I believe the description is accurate. The most important piece of attracting people to a dating site over others is size of community. It’s more fun when we can swipe through hundreds of eligible candidates rather than just 5 or 10 at a time for smaller alternatives. Match Group’s services give its consumers more at-bats — or tries — to find someone special than do other sites. This is key. The more people there, the more people join; it’s a classic network effect in action.

c. What’s Next For Tinder?

Geographic Focus:

- The Asia Pacific + (APAC+) region continues to rapidly grow. It now represents 20% of Match Group sales vs. 11% in 2017 and is the fastest growing company geography.

- APAC — encouragingly — has been shown to offer a similar Revenue Per Person (RPP) opportunity for Match Group compared to the Americas.

Explore page:

This is a new page for quirky, unique ways to meet people with more, filter-based user control. Tinder is fixated on creating deeper “social and interactive experiences” to boost activity levels and RPP. The explore page is a big piece of this:

- This boosted engagement/swipes/pay-rates and has closed the female monetization gap that Tinder deals with vs. Match’s other apps today.

- Plus One is an example of a new feature allowing users to find a wedding date.

Tinder Coins:

This is Tinder’s in-app currency that is now live in 12 markets. The coins are used to trade virtual goods, augment self-expression and to buy a la carte features like Boosts.

- This will be key to Match Group’s Metaverse ambitions such as “Single Town” (a virtual dating/socializing world for singles).

- Users are rewarded coins for being active users (to incentivize more traffic).

- One of the aims of the coin is to “unbundle its subscription features ”so people can pay for services on a per usage rather than per month/year basis. This should boost conversion rates of free users.

As a note, app store fees will rise for Match Group as a % of sales in 2022 as Hinge download growth explodes because that app is predominately Apple/iOS based. Apple has not yet lowered its fee but is being pressured to do so across the globe.

d. What’s Next For its Other Products?

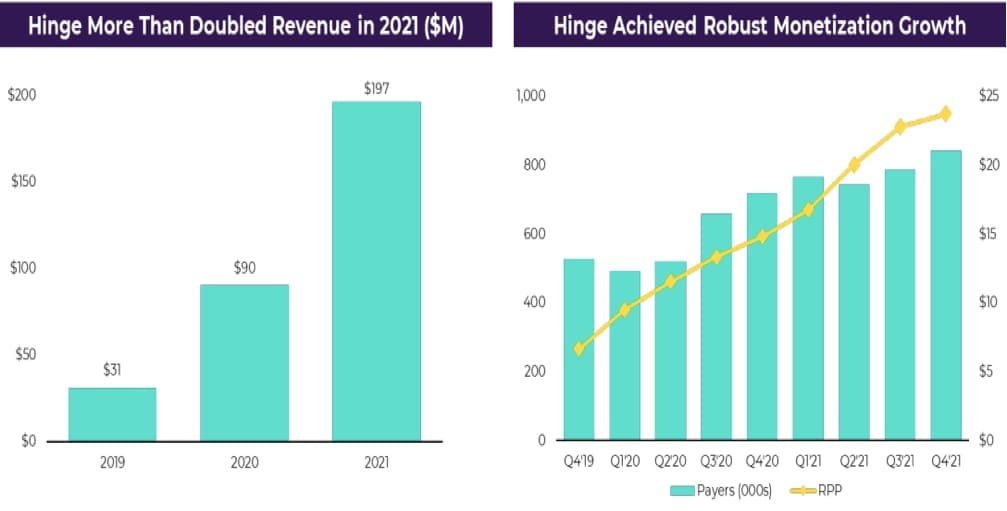

Match Group’s Hinge is growing at a triple digit revenue growth rate with an extraordinarily bright future. Impressively, the app has recently begun to outpace Bumble — Match Group’s best competition — for download and gross revenue data according to App Annie statistics. The industry is shifting to Tinder and Hinge as the most popular 2 options. This is fantastic news for Match Group (sorry Bumble).

“Hinge is well on its way to becoming the second largest global dating app within a few years’ time and is now focusing on non-English speaking market expansion.” — CEO Shar Dubey

The Hyperconnect Acquisition:

In 2021, Match bought a South Korean firm called Hyperconnect for $1.73 billion (half cash, half stock) to accelerate its expansion into entertainment & social discovery.

- The main app — Azar

- This is the largest live personal video/audio app on Planet Earth.

- Allows users to rapidly and enjoyably connect with strangers, friends, celebrities and societies from around the world with real time voice and text translation to deepen connections.

- Azar generated 540 million downloads since its launch in 2014. Notably, the primary monetization engine here is buying a la carte items via its in-app currency — this equates to 90% of its sales and is where Match Group is heading for most of its apps.

- Other app — Hakuna

- This is similar to Azar but allows for larger groups to stream audio/video.

- Enables free toggling between video and radio mode to allow streamers to go live in remote settings with very little service.

- Like Azar, the monetization is based on virtual gifting with in-app currency but there’s also a subscription tier offering monthly currency allowances and other perks. Hakuna launched in 2019 and already has 23 million downloads — it has a far higher monetization ceiling vs. Azar via multiple relevant revenue streams.

Hyperconnect is the perfect geographical and demographical complement to Match Group. 80% of its sales come from Asia vs. just roughly 20% for Match Group overall (at the time of the deal) and nearly 75% of its users are under the age of 30. The team also comes with 200 highly capable software engineers to deepen Match’s bench.

What else Match gets out of Hyperconnect:

- Match will use Hyperconnect’s video capabilities to integrate the technology across most of its brands by 2023.

- Match will leverage Hyperconnect’s “award-winning, on-device AI” to augment its privacy, content moderation and security capabilities. As the market share leader in a somewhat promiscuous industry such as this one, protecting users whenever and wherever possible is imperative to minimize legal liability.

Volatile Macroeconomic backdrop:

The impact of the pandemic on Match Group’s business was mixed. Lockdowns did raise screen time which led to more activity, messaging and conversation for apps. Specifically, 71% of consumers using dating apps did so more amid Covid-19 vs. before the pandemic struck. At the same time, propensity to spend sharply fell as meet-ups became less feasible (see image below). This also contributed to that flattish 2021 growth for Hyperconnect due to South Korea and Japan’s slower pandemic recovery curve. The pandemic ebbing is a net positive for Match.

e. Leadership:

The company has been led by CEO Shar Dubey since Mandy Ginsberg stepped down in 2020. Dubey started with the company more than 15 years ago where she climbed all the way up the ladder to COO in 2017 and now CEO. She has also served as the Chief Product Officer for The Princeton Review and an EVP at Tutor.com.

Gary Swidler has been the company’s CFO since 2015 and COO since 2020. Before joining Match, he was a Managing Director at Bank of America for 18 years.

f. Financials/Earnings Review

Demand:

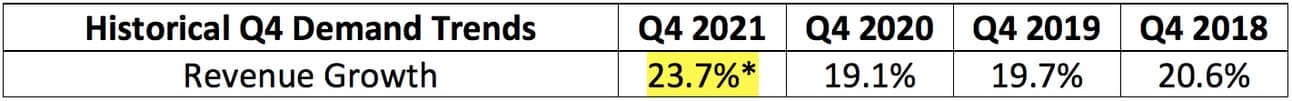

Match Group guided to a midpoint of $815 million in Q4 2021 sales and analysts were expecting $821 million. Match Group posted $806.1 million missing its guide by 1% and analyst estimates by 1.8%. This included a $9 million unanticipated foreign exchange (FX) impact via a strengthening dollar. Without this impact, revenue would have beaten internal expectations by 0.1% and missed analyst expectations by 0.7%.

Quick notes on growth:

- Sequential payer growth between Q3 and Q4 is generally light as it’s Match Group’s slowest time of the year.

- Payer growth was powered by 36% growth in the APAC+ region.

- Established brands returned to positive revenue growth in 2021 with 5% YoY expansion.

- Emerging brands — powered by Hinge — grew by 91% in 2021 vs. 2020.

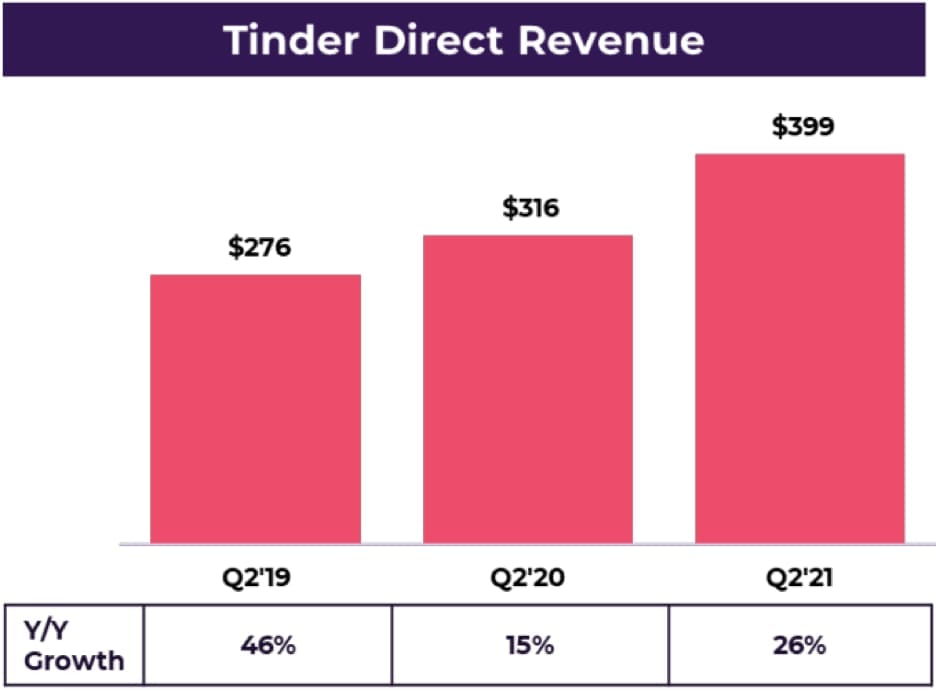

- For 2021 as a whole, Tinder Direct generated $1.7 billion in revenue vs. $1.4 billion for 2020. This represents roughly 22% growth vs. 18% growth between 2019-2020. Match had guided to 20% growth for Tinder in 2021.

*This includes inorganic growth from the Hyperconnect acquisition. Without it, revenue would have grown at a rate of 16.1% this quarter.*

Note that Match Group changed disclosures in recent years making most Q4 demand growth trends irrelevant. Transitioning from ARPU to RPP and subscribers to payers were the 2 sources of this change which is why neither are included in historical Q4 demand growth trends.

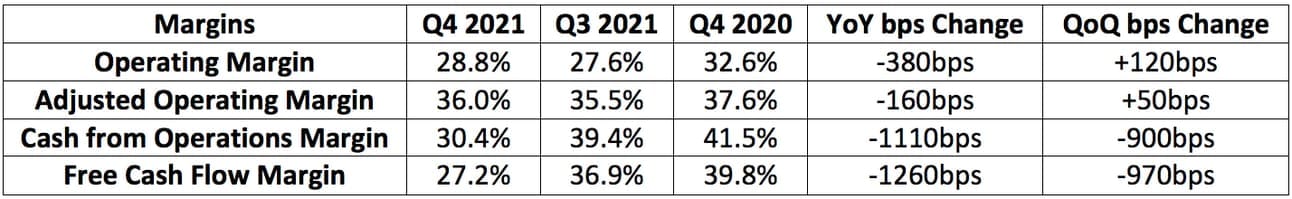

Profitability:

Match Group guided to $287.5 million in adjusted EBITDA (now called adjusted operating margin) which would have represented a 35.3% margin. Analysts expected the same. It posted a 36.0% margin beating estimates by 70 basis points.

Analysts expected $0.60 in earnings per share. Match Group lost $0.48 per share due entirely to a non-recurring $441 million legal settlement to former Tinder employees/founder. This fee will be funded from its cash on hand. Without this charge, Match Group would have earned roughly $0.90 per share based on a share count of 283 million.

2022 Annual Guidance:

- Match Group expects a midpoint of 17.5% revenue growth (15-20%) for 2022. This implies sales of roughly $3.5 billion. Analysts were expecting $3.63 billion so this missed expectations by 3.7%.

- Its previous guidance called for 20% growth including the Hyperconnect acquisition meaning this was a reduction which was driven by an additional $60 million in incremental FX headwinds added to the guide.

- Match Group continues to expect 0.5%-1.0% margin profile performance driven by a reduction in Google app fees and legal costs. With Hyperconnect — margins should be similar YoY.

“The slightly more conservative outlook reflects 2 macro headwinds: FX and Omicron. Our current outlook reflects an additional 3% of negative impact on growth vs. the previous outlook — 2% from FX and 1% from the pandemic. We’re not assuming a huge summer of love right now in our outlook that would certainly provide upside or at least the ability to reach the higher ends of the outlook.” — CFO Gary Swidler

2022 Q1 2022 Guidance:

- Match Group expects a midpoint of $795 million in sales ($790-$800 million) vs. analyst expectations of $837 million.

- Match Group expects a midpoint of $262.5 million in adjusted operating income ($260-$265 million). Analysts were expecting $288 million.

f. Shareholder Letter + Conference Call Notes

Match Group continues to experience pandemic headwinds:

“We experienced continuing COVID impacts — especially in certain markets like Japan — and more recently due to Omicron which reduced mobility globally in early December… we pulled back on marketing spend, which increased only 3% YoY, as we maintained ROI discipline given the macro climate.” — CFO Gary Swidler

For example, Japan has had 3 states of emergency since 2020 ended which all hit mobility rates and propensity to spend on dating produces. The Omicron outbreak has Japan back into a less restrictive but still serious lockdown. Personal mobility in so many of Match’s markets are still being impacted by the pandemic. Match Group’s marketing engine also relies on word-of-mouth as a core driver and less socialization diminishes this channel for user growth.

“We’ve seen periodic uptakes in new users when COVID is not dominating the news cycle. But by and large, that has not fully recovered in a sustained way. For other categories, the pandemic pulled forward new demand. For us, non-users breaking into the category even at a normal cadence is still to come.” — CEO Shar Dubey

Tinder:

Daily swipe and messaging activity is near all-time highs as of the beginning of 2022. This is probably our best indication of future company performance.

“To date, the level of adoption of Explore has exceeded our expectations with 2/3 of active users engaging with it.” — CEO Shar Dubey

Tinder Platinum (most expensive subscription) now has over 1 million subscribers and represents 13% of total Tinder subscribers.

Hinge’s Incredible Rise:

“Hinge downloads saw a material acceleration in Q4 2021 leading to a great start for 2022. Third party data (the same App Annie data I cited) now shows that Hinge is the 2nd most downloaded dating app in several key English-speaking markets — including the UK — during this critical peak season since New Year’s Day.” — Match Group Shareholder Letter

Hinge plans to launch in certain European countries next quarter and is set to grow sales by 70%+ to at least $334 million for 2022. It now has 850,000 payers.

Hyperconnect:

“Both Azar and Hakuna saw better December performance vs. preceding months. We’re stabilizing the core business and plan to return them to growth later this year.” — CEO Shar Dubey

Match Group brands launching new features with Hyperconnect’s IP:

- Meetic opened online video cafes.

- Match is offering its own 1 on 1 video chat (was using a 3rd party service before).

- OK Cupid is testing live video streaming.

Turkey is a large market for Hyperconnect and so its hyper-inflationary environment did weigh on its $50 million quarterly revenue result.

g. Conclusion and my take

There’s much more to cover and share about this fascinating innovator in the dating space. My Deep Dive on the company later in the year will discuss everything in more detail. For now, I wanted to give you all a sense of why I am bullish.

The quarter was underwhelming but not alarming. The company continues to be challenged by macroeconomic headwinds that will fade away at some point. When they do, we will be left with a dominate market share leader poised for profitable, accelerating long term compounding.

2. Meta Platforms (META) — Earnings Review

“If last year was about putting a stake in the ground for where we’re heading, this year will be about executing.” — Founder/CEO Mark Zuckerberg

Meta is changing its ticker symbol from FB to META by the summer of this year.

a. Demand

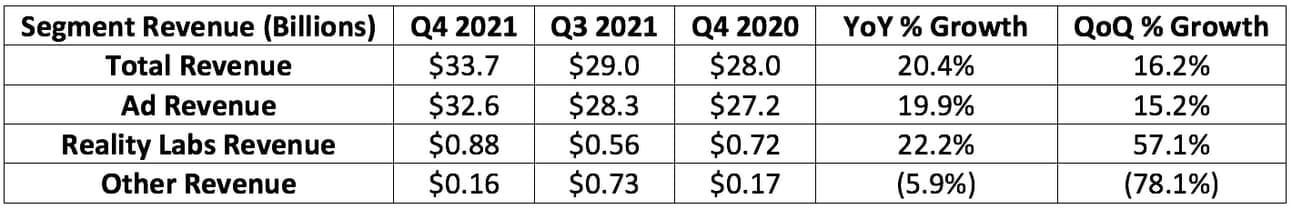

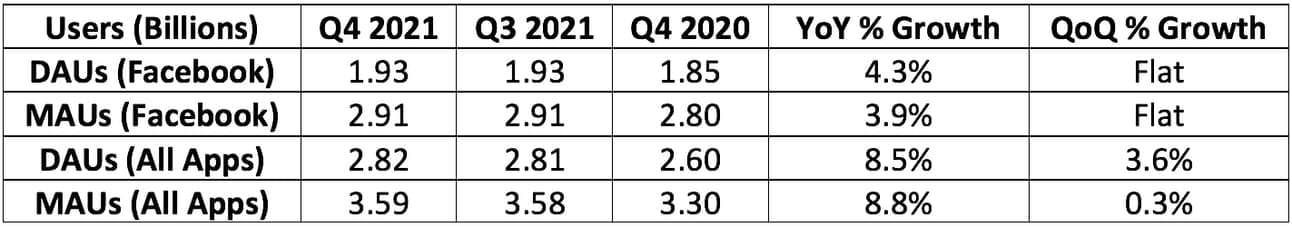

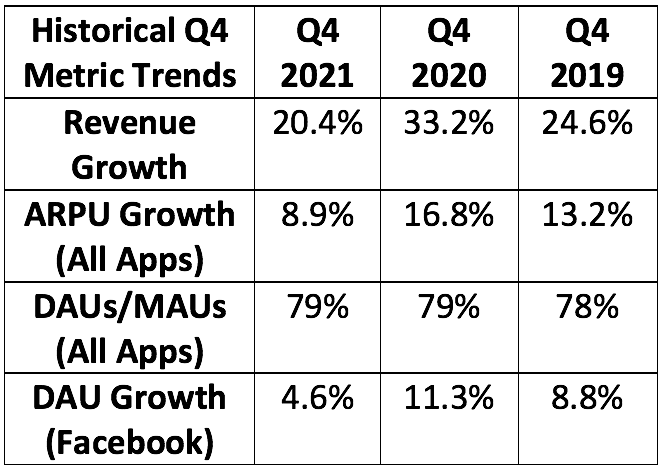

Meta guided to a midpoint of $32.75 billion in sales for the quarter ($31.5-$34 billion). Analysts were looking for $33.4 billion in sales. It posted $33.7 billion beating its midpoint by 2.9% and analyst estimates by 0.9%. The company faced a $307 million FX headwind.

Ad impressions across the Family of Apps rose 13% YoY this quarter and 10% YoY for 2021 as a whole. This was thanks to APAC and rest of world with North America impressions actually shrinking year over year.

Note that Q4 is a seasonally strong period for ad demand. This aided sequential growth.

Last quarter, ad revenue shrank sequentially as Apple’s ATT and IDFA changes impacted marketing conversions and reporting abilities. COO Sheryl Sandberg told us that Facebook would address 50%+ of the underreporting by 2022.

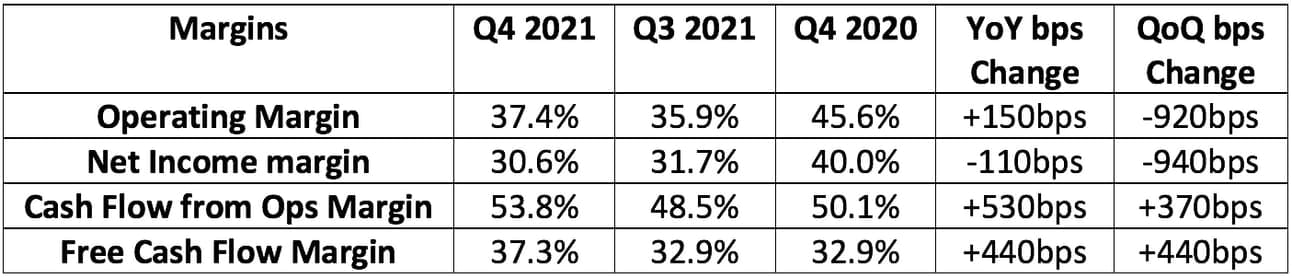

b. Profitability

Analysts looking for $3.84 in earnings per share. Meta posted $3.67 missing expectations by $0.17. Note that year over year net income growth comparisons here are impacted by an effective tax rate of 19% in the quarter vs. 14% in the YoY period.

Price per ad rose 6% YoY this quarter and 24% YoY for 2021 as a whole.

Meta bought back $19.2 billion worth of stock during the quarter and $44.8 billion (more than 5% of its enterprise value) in 2021. The company has $48 billion in cash and equivalents on its balance sheet.

We’ve been told over and over again that margins would compress as Meta spends heavily on new growth projects. This is no surprise.

Segment operating margins:

- 47.2% Family of Apps operating margin.

- -377% Reality Labs operating margin

c. Guidance Updates

Q1 2022 Guide:

- Meta guided to a midpoint of $28 billion in revenue which missed expectations of $30.3 billion by 7.6%. CFO David Wehner attributed this weakness to the following:

- Increased competition impacting ad impressions.

- An engagement shift to Reels which monetizes less compellingly than other content forms.

- Comping vs. a period where Apple’s IDFA changes weren’t yet live.

- The aforementioned input cost inflation.

- A strong dollar.

2022 Annual Guide:

- Meta expects to incur $90-$95 billion in total expenses vs. previous guidance of $91-$97 billion.

- Its CapEx guide remains at $29-$34 billion in CapEx for 2022 (71% growth at midpoint).

d. Zuckerberg Conference Call Notes

On 2 business headwinds impacting Facebook’s Results:

- Competition — “People have a lot of choices for how they want to spend their time. Apps like TikTok are growing very quickly. This is why our focus on Reels is so important over the long term.”

- Content transition — Meta is moving to a larger reliance on short form video content for monetization. Places like the News Feed that are being cannibalized from this are better monetization vehicles at this point in time.

“As a result of these 2 things and also our focus on serving young adults over optimizing overall engagement — we’re going to continue to see some pressure on impression growth in the near term.”

“While video has historically been slow to monetize, we believe that over time, short-form video will monetize more like feed or Stories than Watch.”

Some Major Investment Priorities of 2022:

Reels:

“Reels is now our fastest growing content format by far and the biggest engagement growth contributor on Instagram. It’s growing very quickly on Facebook too.”

Ads:

“With Apples iOS changes and new Europe regulation, there’s a clear trend of less data available to deliver personalized ads.”

The iOS comp headwinds will continue through the first half of the year when YoY comps will then normalize.

AI:

Zuckerberg reminded us of Meta’s “AI Research SuperCluster” which Meta believes “will be the world’s fastest supercomputer once it is complete later this year.”

“This will enable new AI models that can learn from trillions of examples which will be key to the experience we are building.”

Metaverse:

- Oculus Quest store content sales have eclipsed $1 billion.

- It is aiming to release a “high-end” VR headset in 2022.

e. COO Sheryl Sandberg and CFO Dave Wehner Conference Call Notes

Ads:

“Efforts to close the iOS web conversion underreporting gap and creating tools to drive better ad insights will help mitigate some Apple targeting challenges but we expect targeting headwinds to moderately increase from Apple and regulatory changes through 2022.” — COO Sheryl Sandberg