Most of this week’s content was already sent:

- Portfolio Earnings Season Preview.

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews (from two weeks ago)

Table of Contents

- 1. Earnings Snapshots – Intel & Deckers

- 2. ServiceNow (NOW) – Earnings Review

- 3. PayPal (PYPL) – PayPal World

- 4. Analyst Notes

- 5. Headlines

- 6. Macro

1. Earnings Snapshots – Intel & Deckers

a. Intel (INTC)

Results:

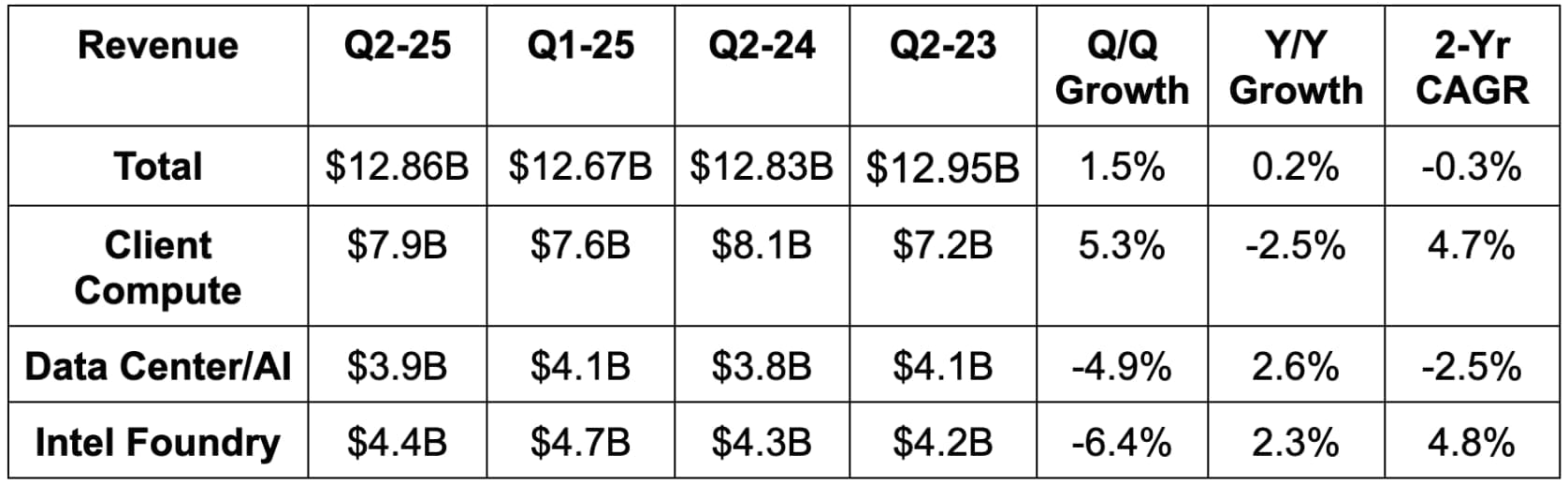

Intel added its network and edge segment to client compute and data center/AI last quarter. They offered reconciliation for Q1 2025 and Q2 2024. For Q2 2023, I estimated (based on how each segment was impacted following the change) that client compute would have been $400M higher and data center/AI would have been $900M higher. The data in the chart below reflects that, creating more fair 2-year demand comps.

- Revenue beat estimates by 8.2% and beat guidance by 13.8%.

- Client compute beat estimates by 8%.

- Data beat estimates by 4.7%.

- Foundry beat estimates by 0.6%.

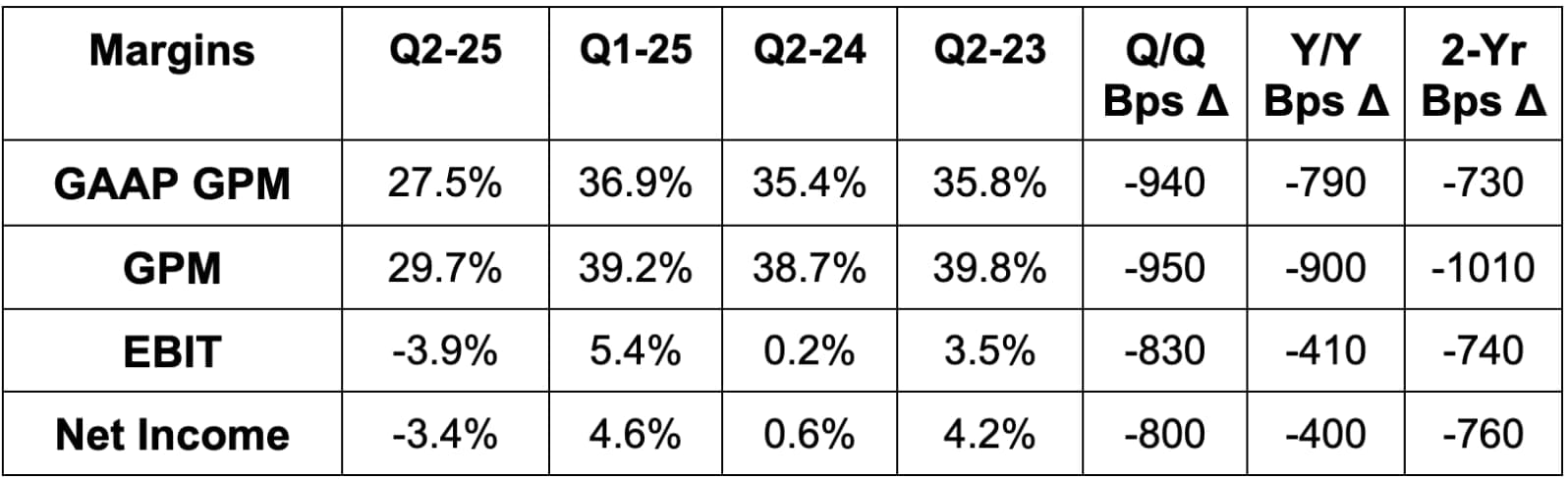

- Gross profit margin (GPM) missed 36.5% estimates by a whopping 680 basis points (bps; 1 basis point = 0.01%).

- GAAP GPM missed guidance by 680 bps.

- Sharply missed $104M EBIT estimates by $607M.

- Missed $0.01 EPS estimates by $0.11 & missed guidance by $0.10.

- Missed -$0.32 GAAP EPS guidance by $0.35.

Balance Sheet:

- $21B in cash & equivalents.

- $11.4B in inventory vs. $11.2B Y/Y.

- Share count rose by 2.4% Y/Y.

- A little over $50B in total debt.

Guidance & Valuation:

For next quarter, revenue guidance beat estimates by 3.7%. Gross margin missed 37% estimates by a point, but gross profit dollars met expectations. $0.00 EPS guidance missed estimates by $0.04.

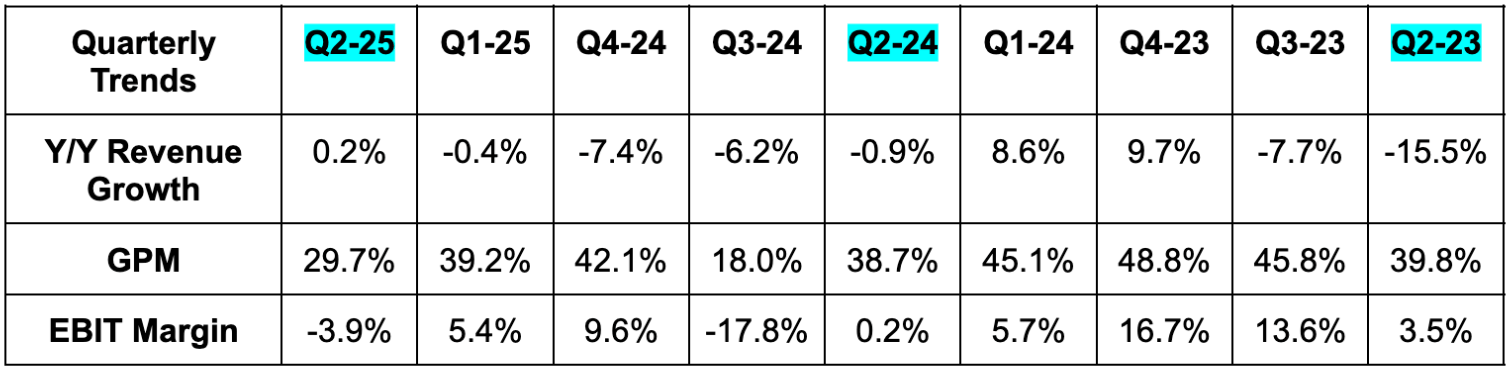

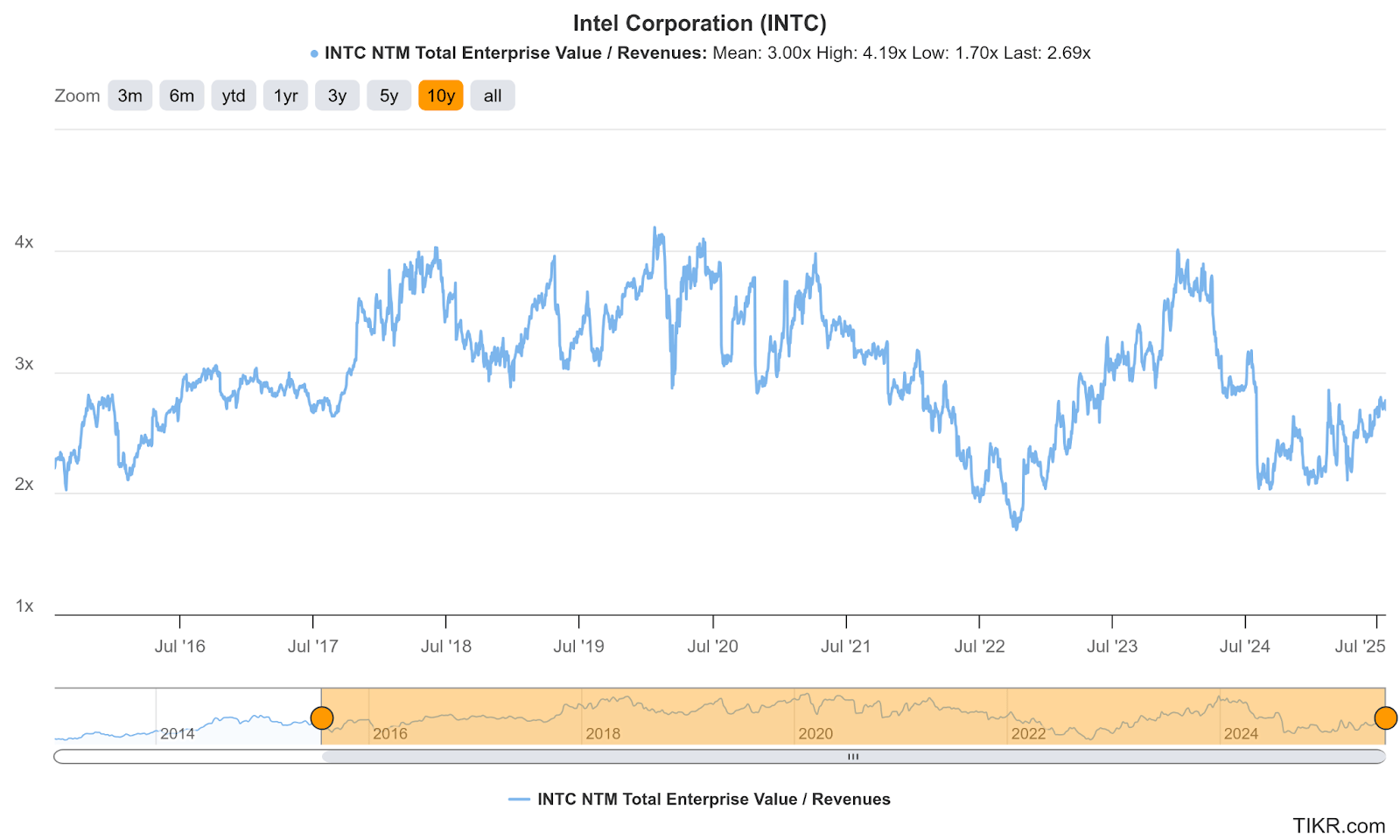

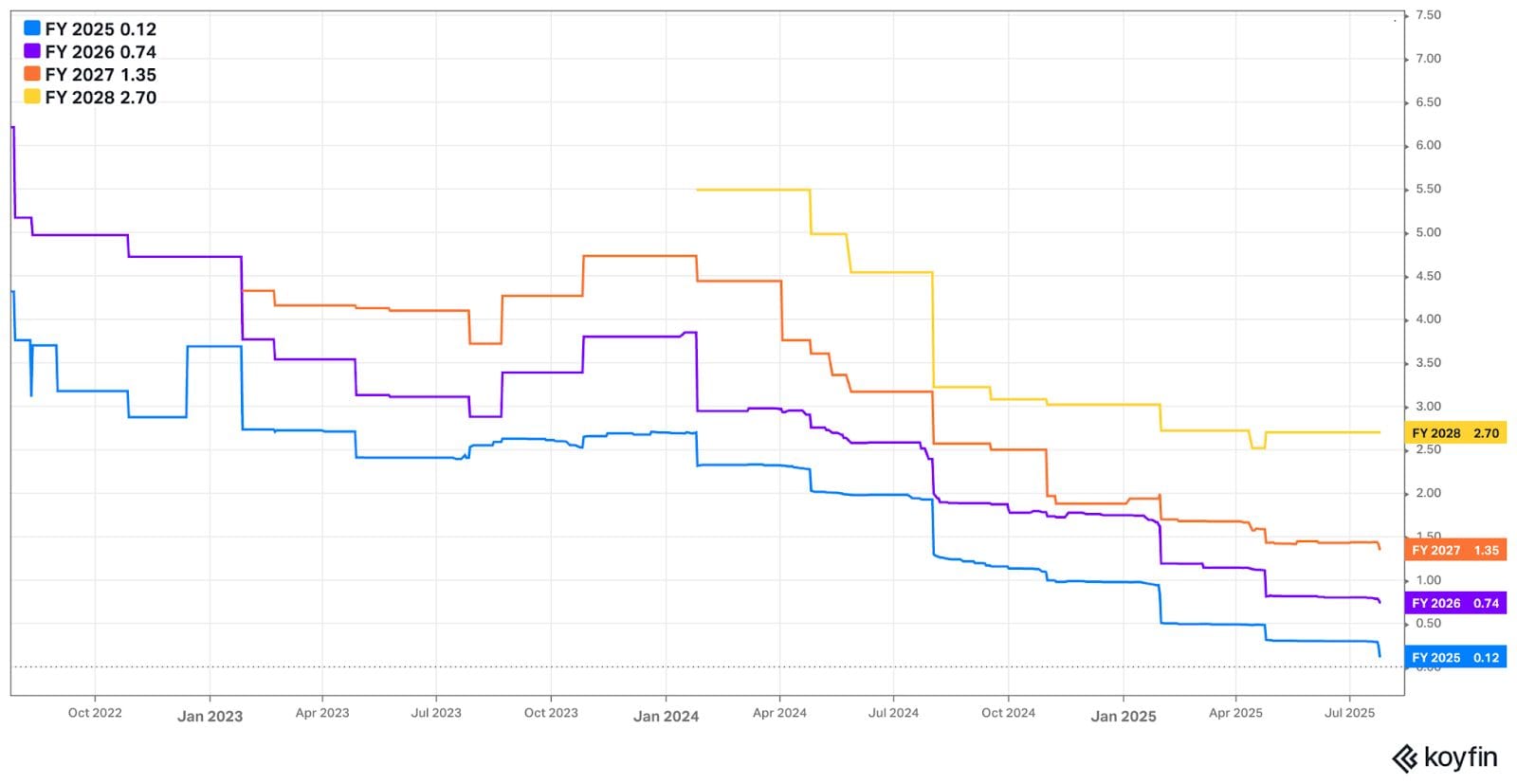

Intel trades for 77x forward EPS and 2x forward sales. EPS is expected to move from -$0.13 last year to $0.12 this year and grow by 500% the following year to $0.74. While that’s nice, it’s due to EPS sharply declining for three consecutive years (2022-2024). Revenue is expected to fall by 3.4% this year (5th straight year of declines) and grow by 4% the following year.

b. Deckers (DECK)

Results:

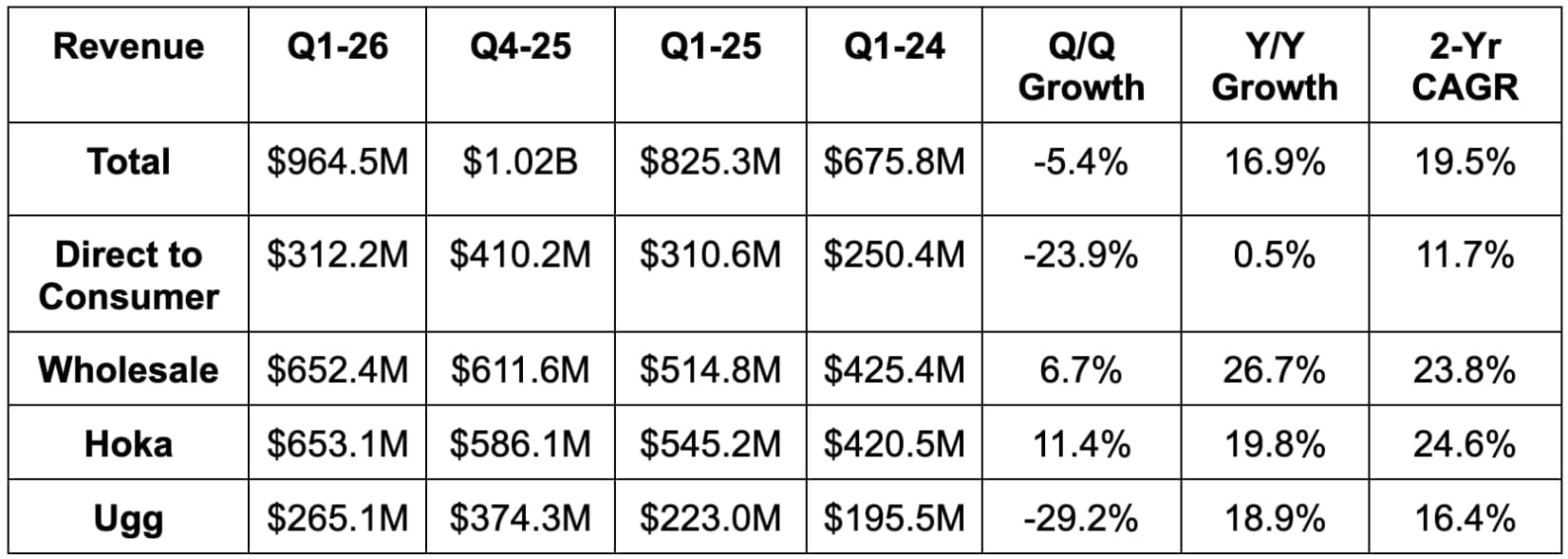

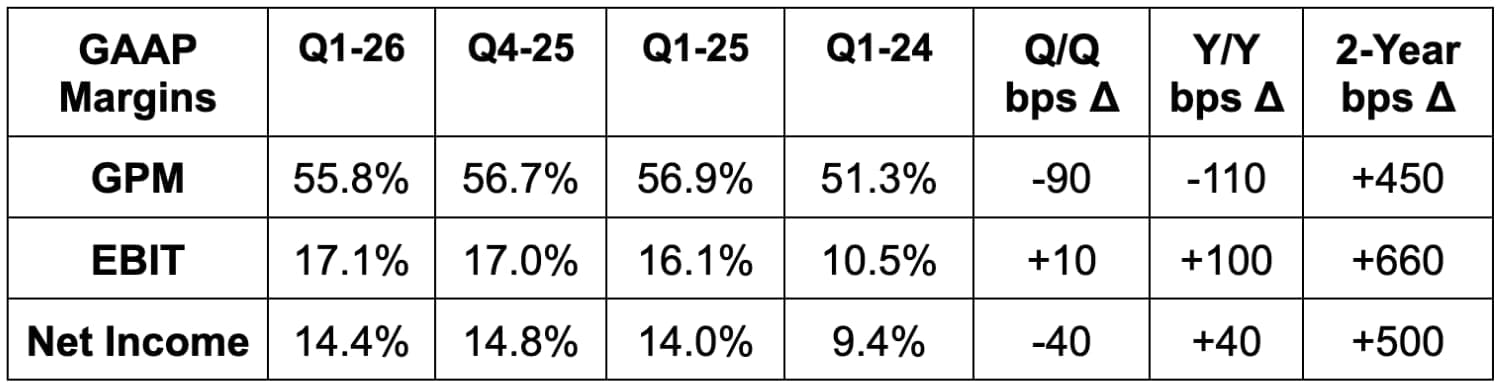

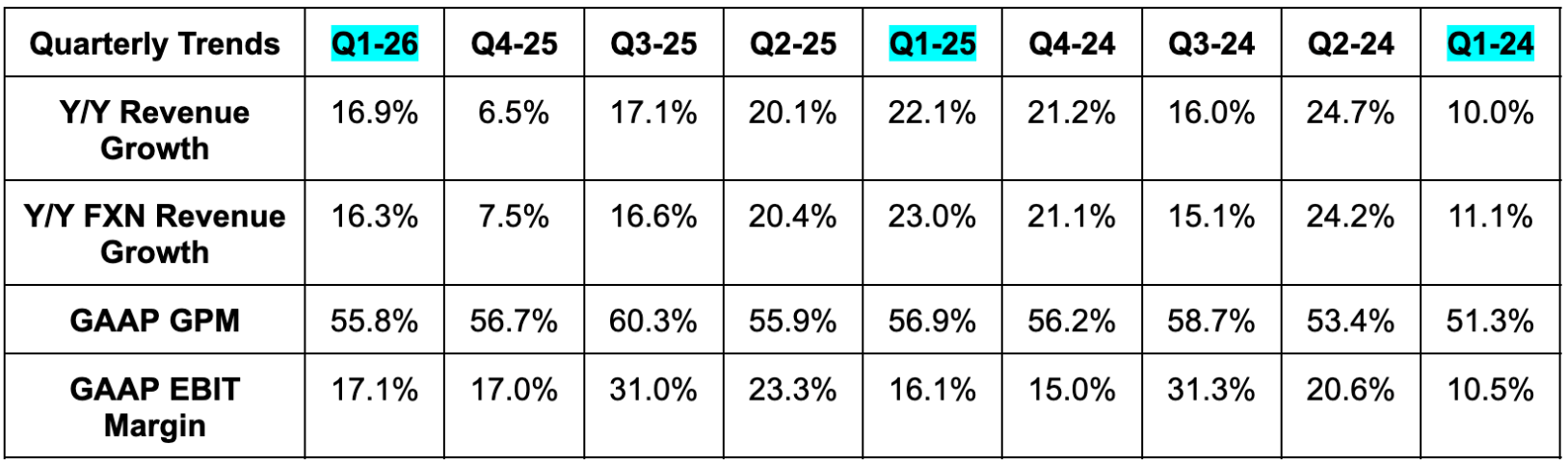

- Beat revenue estimates by 7.1% & beat guidance by 7.2%.

- Beat GPM estimates by 110 bps.

- Beat EBIT estimates by 39.5%.

- Beat $0.68 GAAP EPS estimates by $0.25 & beat guidance by $0.28.

Balance Sheet:

- $1.72B in cash & equivalents.

- Inventory rose by 12.8% Y/Y.

- No debt.

- Share count fell by 2.5% Y/Y.

Guidance & Valuation:

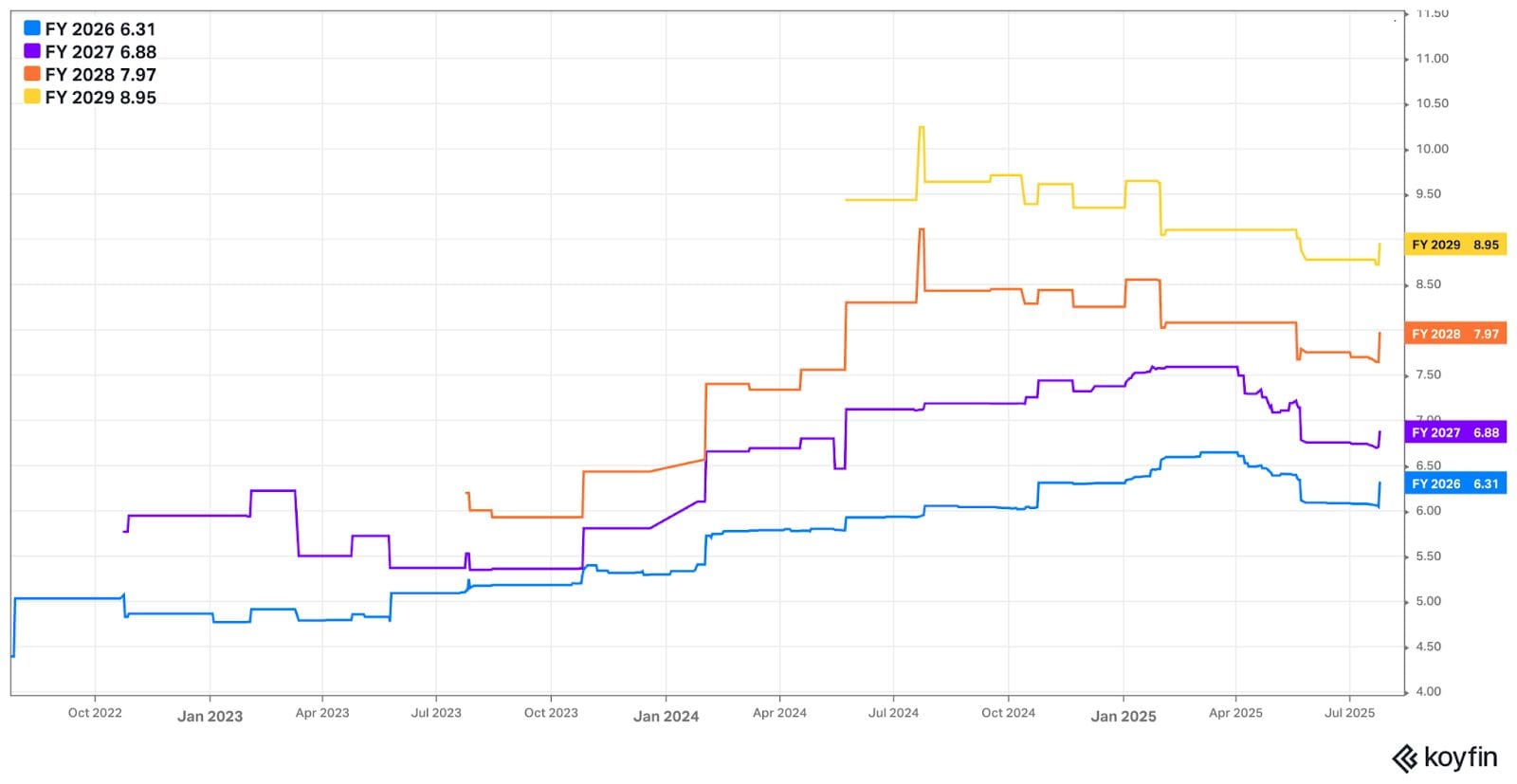

Deckers Q3 revenue guidance met expectations while EPS guidance beat $1.51 estimates by a penny. For the full year, they reiterated GPM contraction as expected and raised tariff impacts from $150M to $185M. This was related to Vietnam’s tariff rate rising from 10% to 20%.

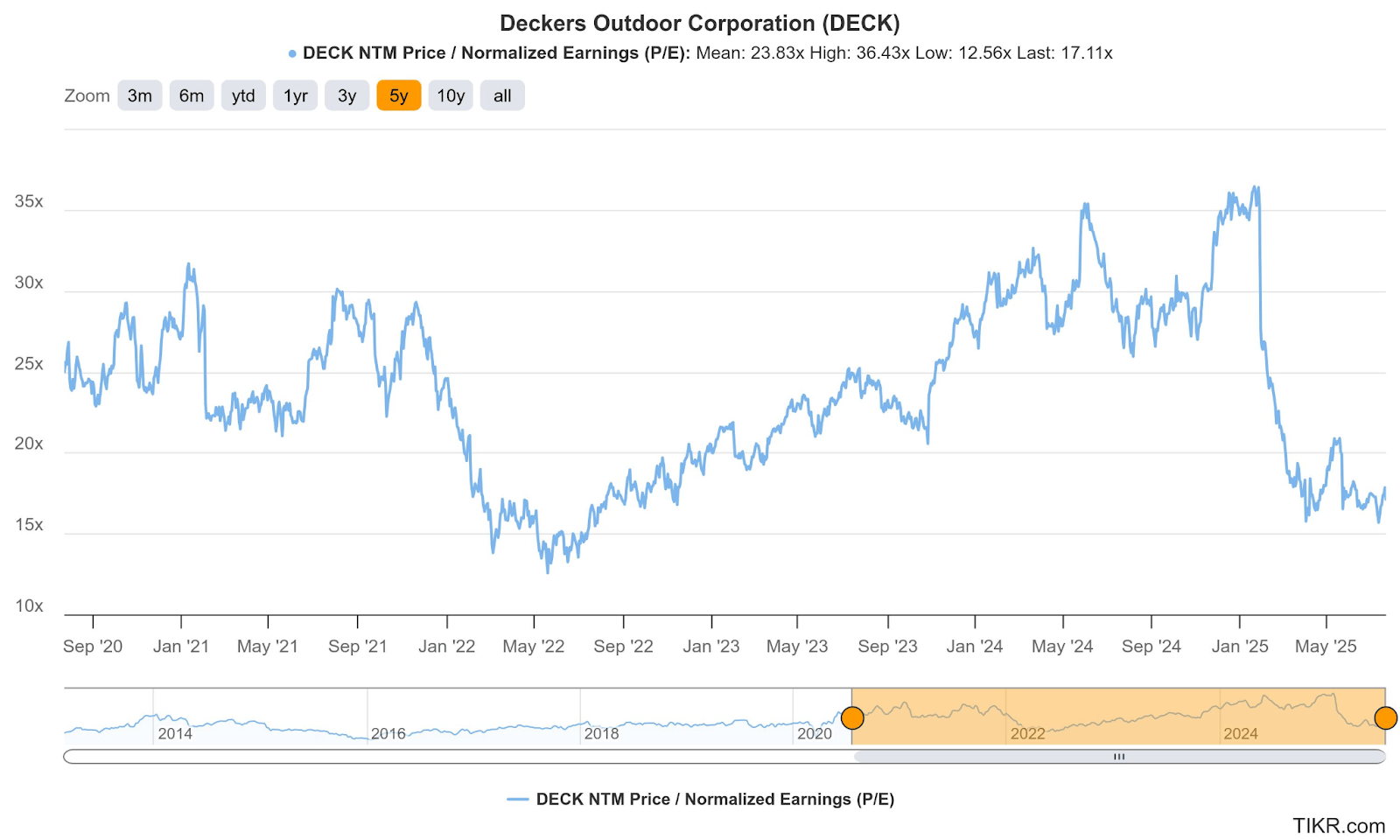

Sales and EPS estimates for this year and next year both modestly rose following this report. That was thanks to the excellent Q1 results. DECK trades for 17x forward EPS. EPS is expected to be flat this year and grow by 9% next year.

2. ServiceNow (NOW) – Earnings Review

a. ServiceNow 101

Product Niche:

ServiceNow is one of the largest enterprise software firms in the world. It infuses layers of automation into productivity-enriching software and tech stacks. For this reason, it calls itself the “leading digital workflow company.” All products and services are neatly tied into its “Now Platform.” The firm describes this overarching ecosystem layer as a way to “optimize processes, connect silos and accelerate innovation on a single unifying platform.” That’s a fancy way of saying that it makes every piece of work more seamless and expedient.

In terms of product organization, ServiceNow splits work by technology workflows, Customer Relationship Management (CRM), industry and core business workflows and creator workflows:

- Technology workflows include Information Technology Operations Management (ITOM) and Information Technology Service Management (ITSM). The names of these products tell you exactly which types of workflows they’re meant to automate. This also includes IT asset management (ITAM), security operations and operational technology management.

- CRM, industry & core business workflows include customer service management, field service management, HR service, legal service and workplace service segments.

- Creator workflows include its app engine and workflow data fabric, which I’ll define later in the 101 section.

Product Innovation:

ServiceNow has been hard at work on GenAI innovation to bolster automation capabilities. Its Now Platform “Vancouver” release got the ball rolling by consolidating all GenAI model and app projects into an intuitive set of products. It built on that debut with Now Platform “Washington D.C.” and “Xanadu” releases. These are both essentially a large batch of GenAI-inspired upgrades to the Now platform. They add to the progress of the Vancouver release. Washington D.C. ties together NOW’s product categories to drive better interdepartmental work, data sharing, multi-step-and-department task completion and communication. It makes using all of its tools and capabilities across teams more intuitive and obvious. Xanadu focused on completing the Microsoft Copilot integration and infusing agentic AI (goal-oriented AI that you simply tell what to do) into the Now platform. More specifically, the release focused on two product categories. First, its security and threat management products. Xanadu uses models that are trained on a company’s own data, which has been shown to accelerate incident response. Automated threat triaging (prioritizing) helps too. Second, Xanadu adds new capabilities within financial and supply chain workflows – starting in sourcing and procurement.

ServiceNow also offers the “Workflow Studio” as a way to create intricate workflows via a wonderfully easy, no-code or low-code drag-and-drop process. It’s a unified workspace that taps into all of the automation and workflow performance analytics tools ServiceNow provides, without needing to be a talented developer to work with them. Various teams can easily access the studio, enabling seamless collaboration and better work.

These platforms establish the foundation for its own GenAI apps used internally and sold to customers. A big example is “Now Assist AI.” This is ServiceNow’s GenAI assistant/companion app infused across most of its products. More GenAI product examples include:

- The AI Lighthouse Program: This aims to expedite GenAI adoption through Nvidia and Accenture partnerships. NOW brings the apps; NVDA brings the hardware; Accenture brings the professional services.

- The RaptorDB Lighthouse Program: Its newest database that’s built to support the speed and needed scalability of GenAI use cases. It offers an extensive list of 1st and 3rd-party data sources to utilize, with easy conversational querying to up-level data scientist productivity.

- StarCoder 2: This provides access to large language models (LLMs) to automate code creation. Bring Your Own (BYO) GenAI model support allows for ultimate developer flexibility as they pick and choose which models serve them the best.

- The NOW App Engine: ServiceNow’s platform for building apps. Creator Studio was just added to the NOW App engine to push its “low-code app leadership” to fully no-code building.

- Now Assist Skill Kit: Helps developers deploy new GenAI prompts and workflows. ServiceNow has templates for pretty much all common needs, but it cannot possibly build models for every niche workflow. That’s where this comes into play.

“Plus SKUs” are how ServiceNow bundles all of its GenAI work into subscription packages. It up-charges clients for access to these SKUs, as its approach to GenAI monetization has been more aggressive than most. These Plus SKUs do things like automate customer service, expedite issue resolution and provide more conversational fetching/querying of a firm’s data.

Most Recent Product Innovation:

Most recently, ServiceNow debuted Yokohama as its latest batch of AI innovation. Like Xanadu, this focuses on agentic AI and more tightly connects Workflow Data Fabric – its unified data aggregation management tool – and Raptor DB to ensure models, apps and agents have access to all needed context. This seamlessly unlocks interoperable data scraping from a wide array of 3rd-party partners and 1st-party insight to enable more complex, goal oriented and automated work completion. One of the more interesting products is its new AI Agent Orchestrator. Because agentic reasoning models do need to collect signals from many different places, that clutter of information must be effectively organized in an actionable manner. Enter AI Agent Orchestrator.