In case you missed it, the convincing majority of our content from the week has already been sent:

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Portfolio & Performance Update

Other reviews from this season to read:

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews.

Part one of the Cloudflare and Spotify reviews are included as snapshots in section one of this piece. Cloudflare looks mostly good (aside from gross margin weakness), but with a sky-high valuation, it’s easy to see why shares weren’t more sharply rewarded. Especially with the flood of noisy headlines we got on Friday. Spotify looks pretty underwhelming at first glance. Revenue underperformance was foreign exchange driven, so not something to worry about. EBIT underperformance was amplified by higher-than-expected payroll tax from its rising share price, but even without this hit, it still would have missed its own guidance by 6.5%. After a string of such fantastic quarters from them, it was surprising to see this. Still, I should finish reading everything before I comment more. I plan to publish full reviews of Cloudflare and Spotify whenever I can find time this earnings season. With 10 reviews coming next week and several more snapshots, that will not happen until mid-to-late August.

Table of Contents

- 1. Brief Earnings Snapshots – Visa, Coinbase, Clou …

- 2. Starbucks (SBUX) – Detailed Earnings Review

- 3. Apple (AAPL) – Earnings Review

- 4. SoFi (SOFI) – Stock Offering

- 5. Headlines & Analyst Notes

- 6. Macro

1. Brief Earnings Snapshots – Visa, Coinbase, Cloudflare & Spotify

a. Visa

Demand:

- Revenue beat estimates by 3%. Services revenue beat by 1.7%

- Data processing revenue beat by 1.9%

- International transaction revenue slightly beat.

- Foreign exchange neutral (FXN) volume growth was 8% as expected.

- FXN Cross-border growth was 12% as expected.

Volume trends (great read on consumer spending):

- Total payments volume in the USA rose by 7% Y/Y vs. 6% Y/Y last quarter.

- USA debit volume growth was stable sequentially at 7% Y/Y.

- USA credit volume growth accelerated sequentially from 5% Y/Y to 6% Y/Y.

- International payments volume rose by 10% Y/Y FXN compared to 9% FXN last quarter.

- International debit growth was sequentially stable at 11% FXN.

- International credit growth accelerated from 8% FXN to 9% FXN.

- It’s important to note that sequential comps are easy because of Leap Day last quarter.

- As a relevant aside, Mastercard volume growth was stable Q/Q in both the USA and internationally. USA growth was again 7% Y/Y, while international growth was 14% Y/Y. Through July 28th, USA volume growth has accelerated to 8% Y/Y; international growth has decelerated to 13% Y/Y.

So far this month, USA payments volume has accelerated to 9% Y/Y, with debit accelerating to 10% Y/Y and credit accelerating to 9% Y/Y. Lapping the outage last year and July 4th timing are helping a bit, but so is general underlying consumer resilience.

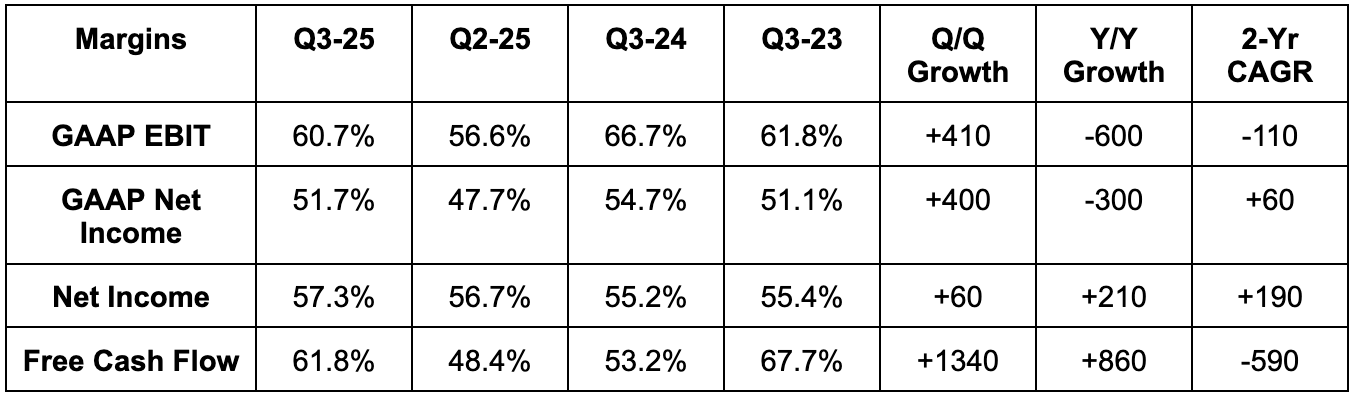

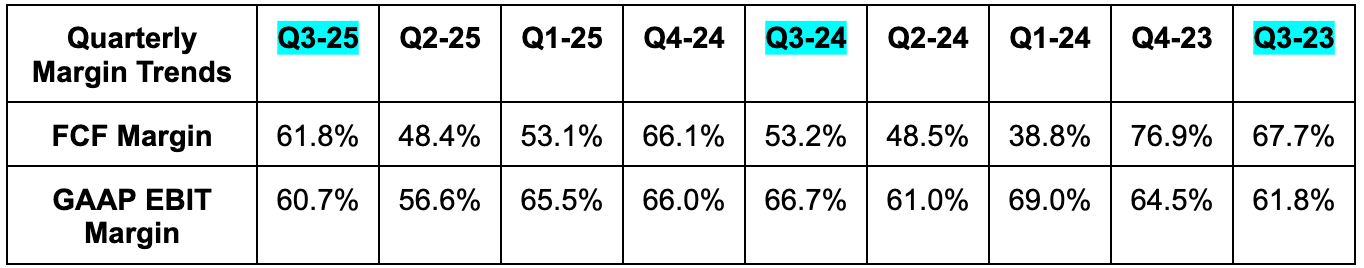

Profits & Margins:

- EBIT beat estimates by 4%.

- $2.98 in EPS beat $2.85 estimates by $0.13.

- A litigation provision drove the difference between GAAP & non-GAAP margins this quarter and last quarter.

Balance Sheet:

- $19.1B in cash & equivalents.

- $1.2B in non-current investment securities.

- $19.6B in long-term debt.

- Dividends rose by 10% Y/Y.

- Diluted share count fell by 3.5% Y/Y.

Guidance & Valuation:

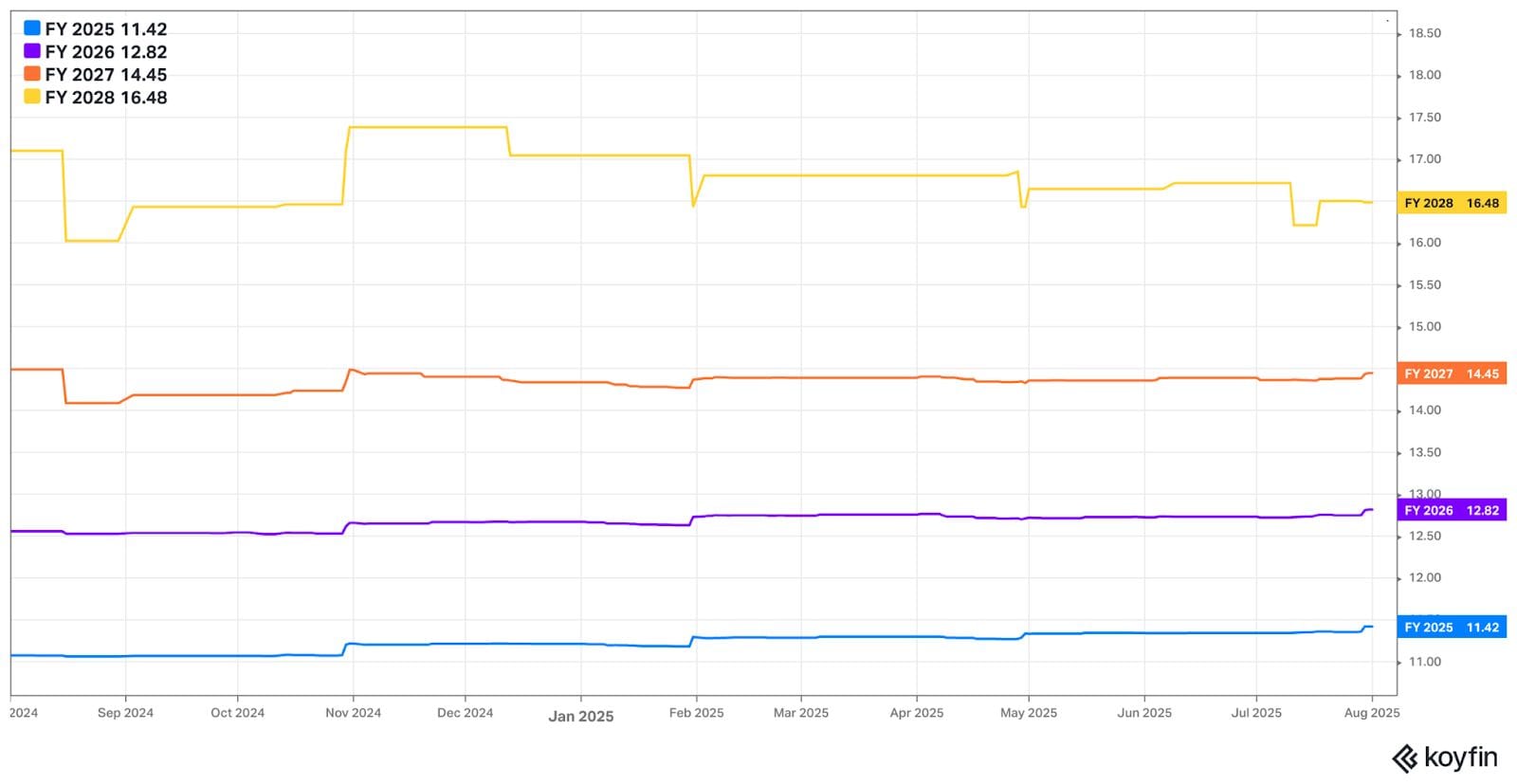

Visa guides to FXN growth rather than nominal growth. For Q4 2025, it guided to roughly 10% revenue growth and 7%-9% EPS growth. Revenue estimates were stable following this news; EPS estimates fell from $3.01 to $2.96. 2026 sales and profit estimates actually both rose a tad.

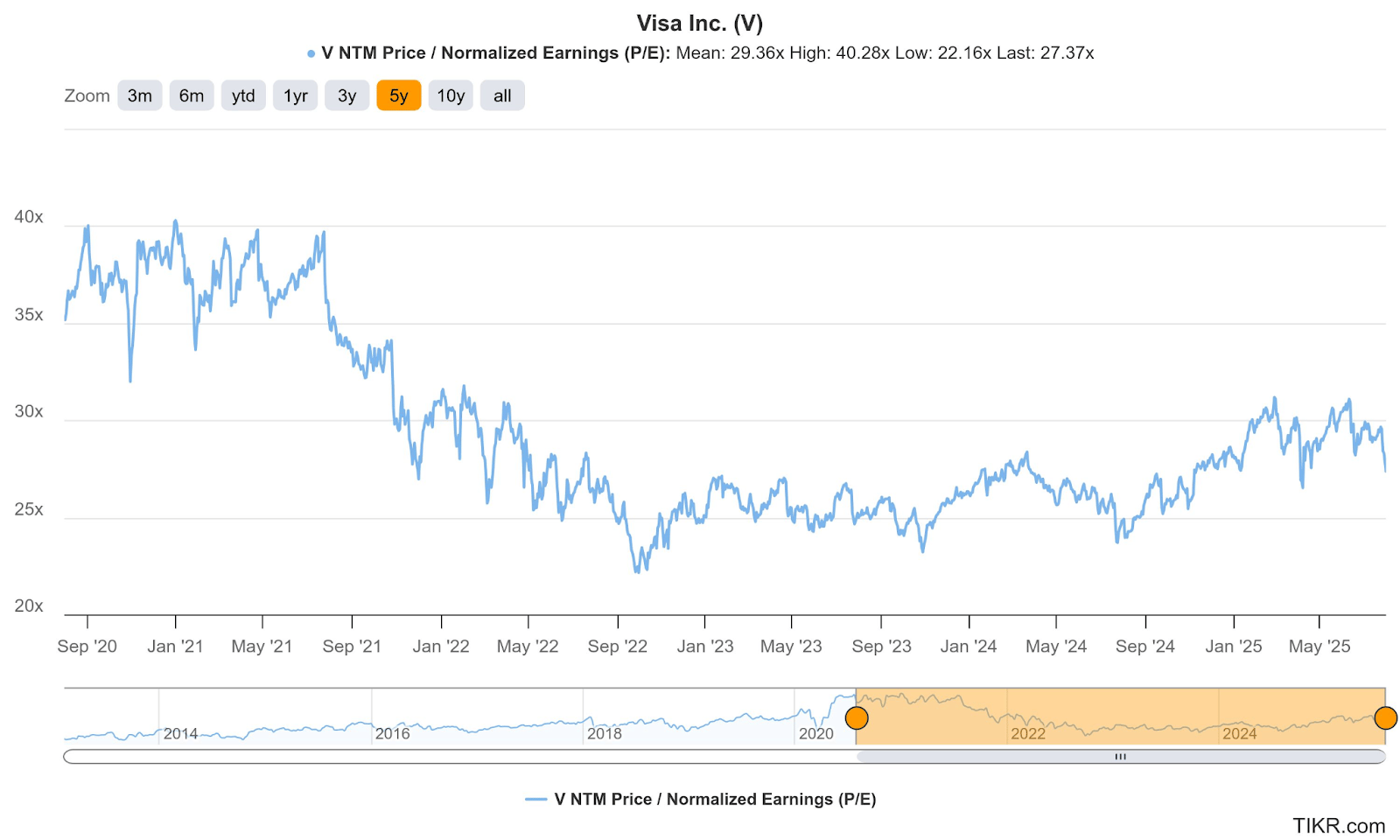

Visa trades for 27x forward EPS. EPS is expected to rise by 14% this year and by 12% next year.

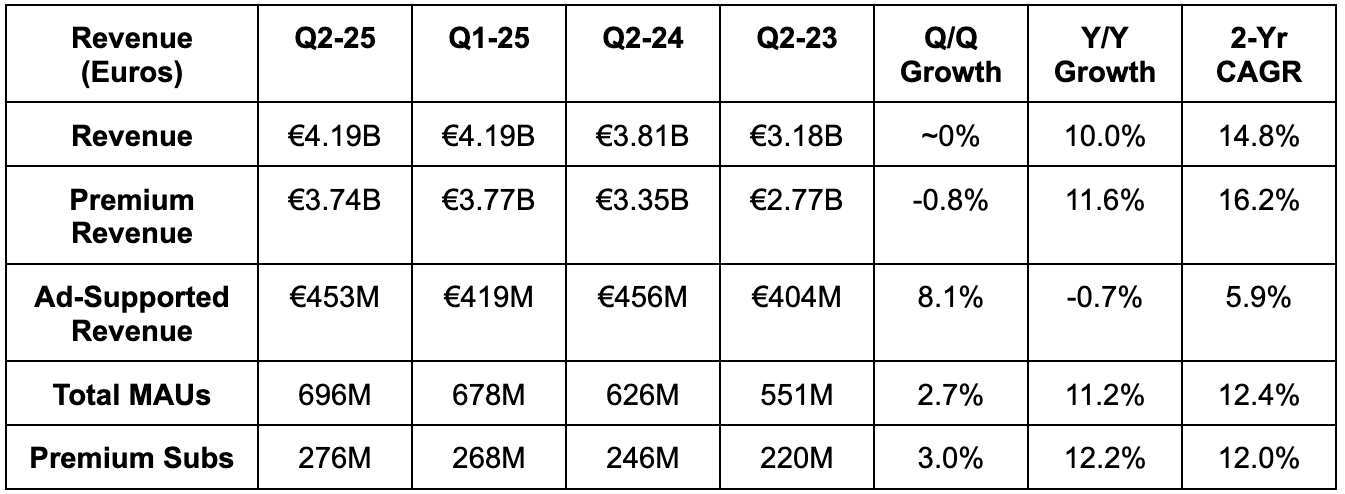

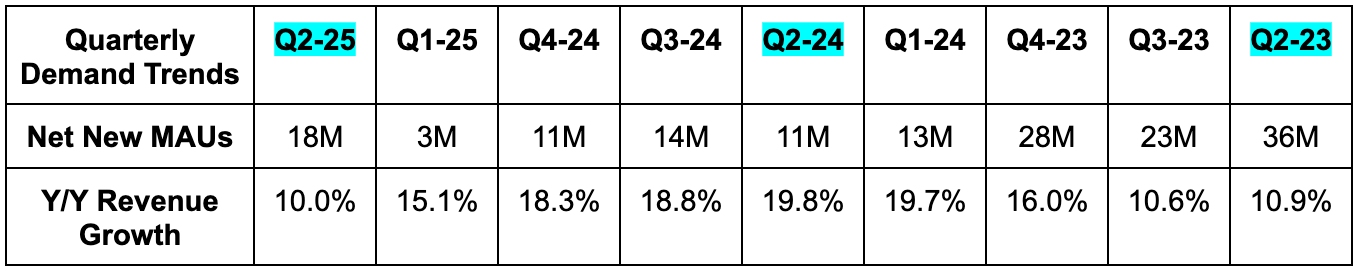

b. Spotify (SPOT)

Demand:

- Missed revenue estimates by 2% & missed guidance by 2.6%.

- The missed was related to FX headwinds that were €104M larger than expected. Without this item, revenue would have been slightly ahead of estimates and roughly in line with guidance.

- Ad revenue missed estimates by 5%.

- Premium revenue missed estimates by 1.3%.

- Beat Monthly Active Users (MAUs) estimates by 1% and beat guidance by 1% as well.

- Beat premium subscriber guidance by 1.1%.

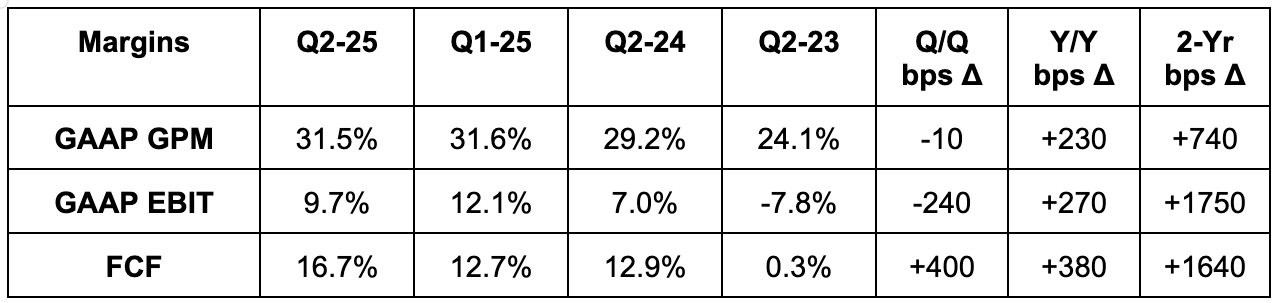

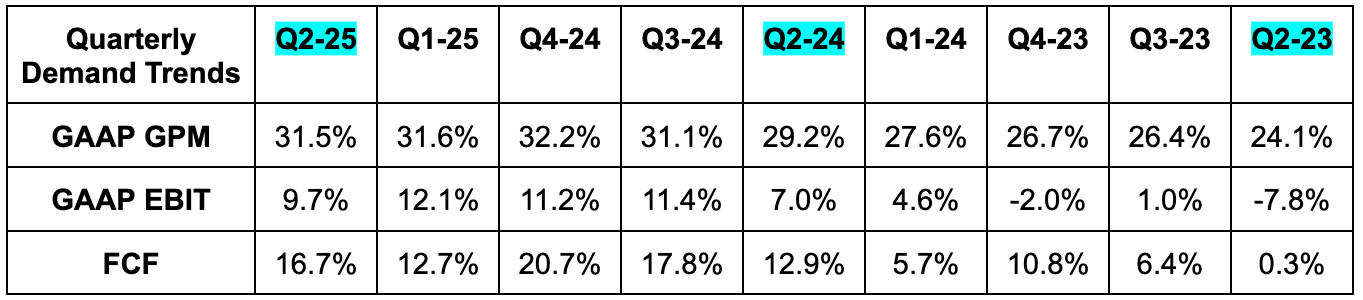

Profits & Margins:

- Gross profit margin met 31.5% estimates & identical guidance.

- Missed EBIT estimates by €89M or 18.1% & missed guidance by 25%.

- The misses included payroll taxes that were €98M larger than expected due to its rising share price. Without this headwind, which should have been at least partially baked into analyst estimates, it would have beaten EBIT estimates by 1.8% and missed its guidance by 6.5%.

- Social charges (payroll taxes) were. Still, you’d think analyst estimates would have moved to reflect that.

- Beat FCF estimates by 14%.

Balance Sheet:

- €8.4B in cash & equivalents.

- €1.93B in convertible senior notes.

- Share count fell slightly Y/Y.

Q3 Guidance & Valuation:

- Revenue guidance missed estimates by 6.4%.

- 31.1% gross profit margin guidance missed 31.5% estimates by 40 basis points (bps; 1 basis point = 0.01%).

- EBIT guidance missed estimates by 15%.

- MAU and premium subscriber guidance both slightly beat estimates.

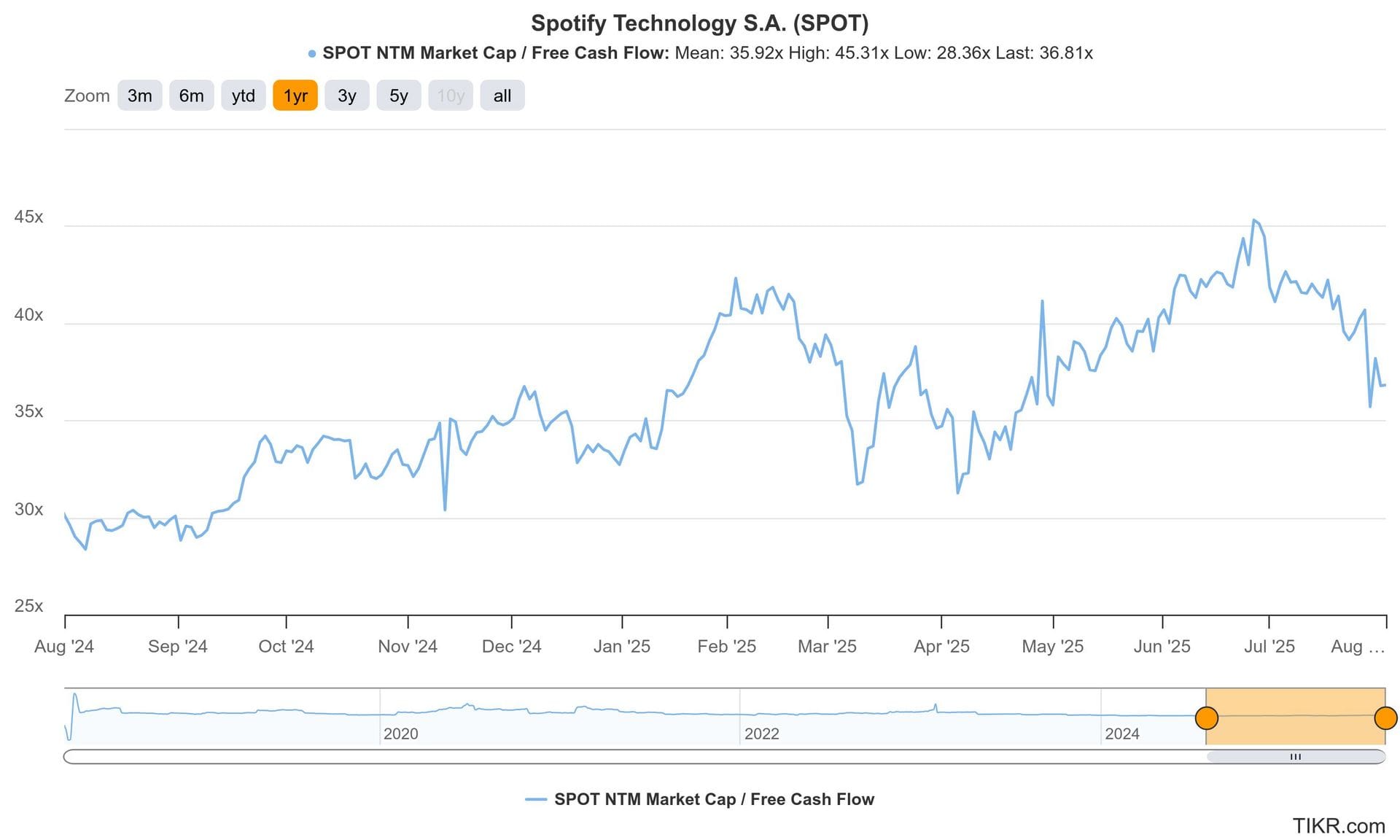

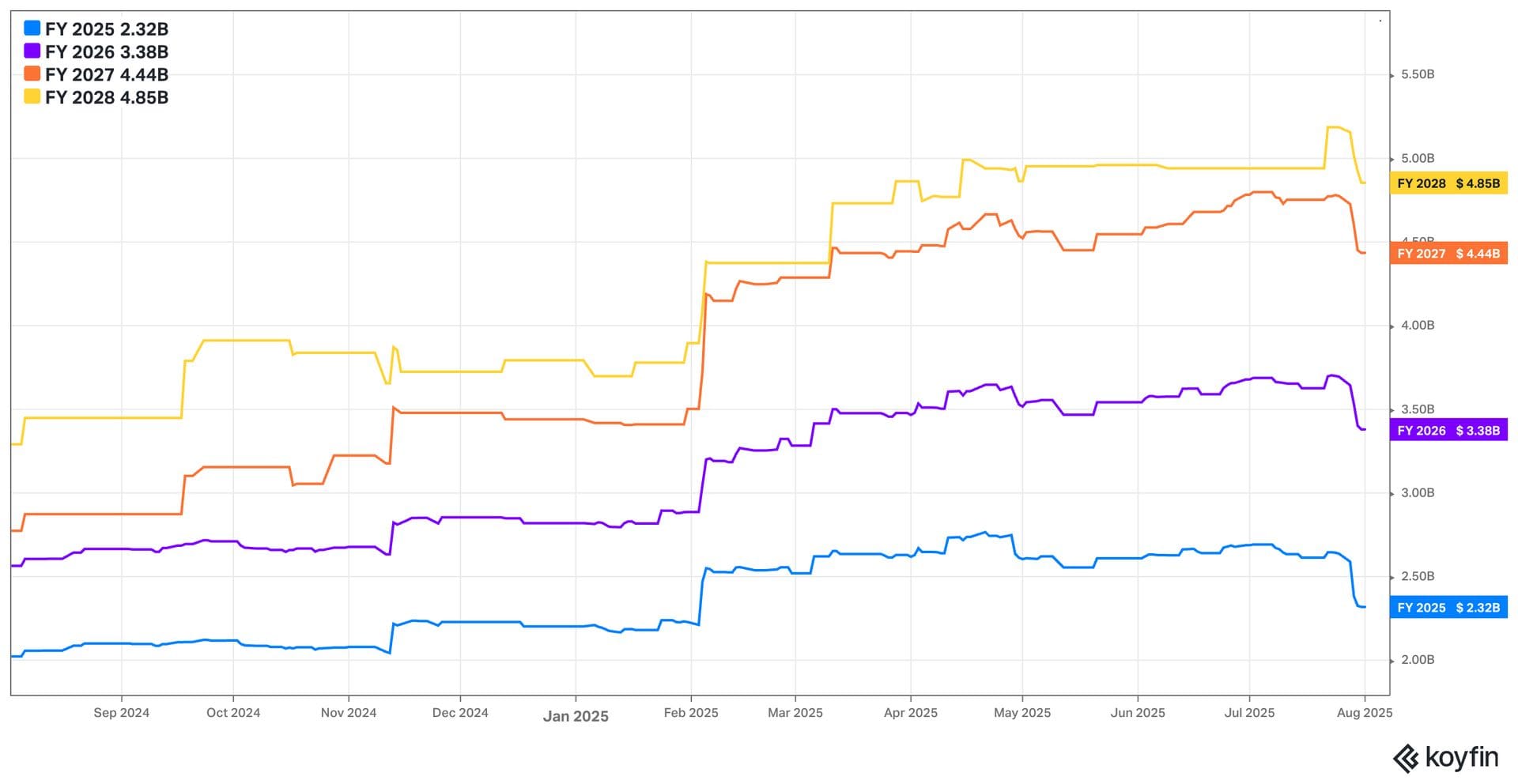

Spotify trades for 37x forward FCF. FCF is expected to grow by 19% this year and by 25% next year.

c. Cloudflare (NET)

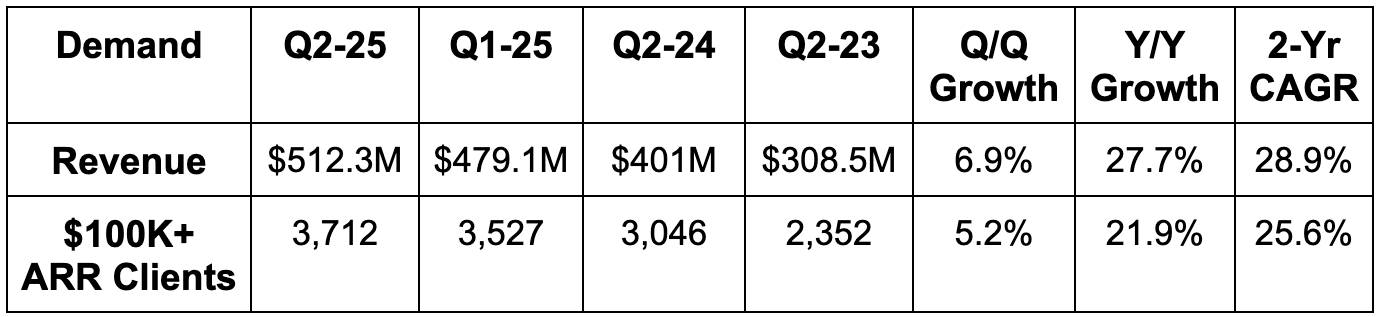

Demand:

- Beat revenue estimates by 2.1% & beat guidance by 2.4%.

- Beat remaining performance obligation (RPO) estimates by 2.9%.

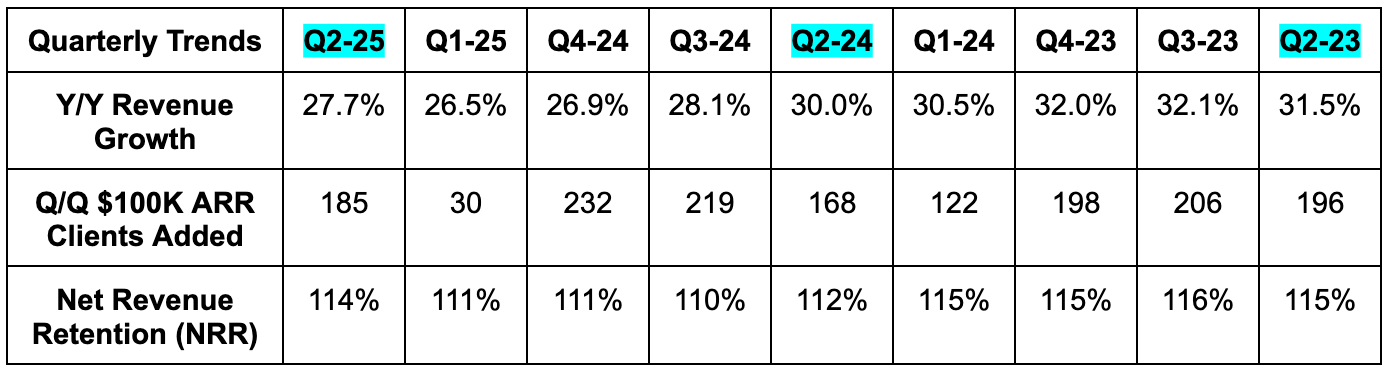

- Beat 111% net revenue retention (NRR) estimates by 3 points. This was its best NRR quarter since Q1 2024.

- Missed 3,712 $100,000+ ARR customer estimates by 22. Net new $100,000+ ARR customers rose 10% Y/Y.

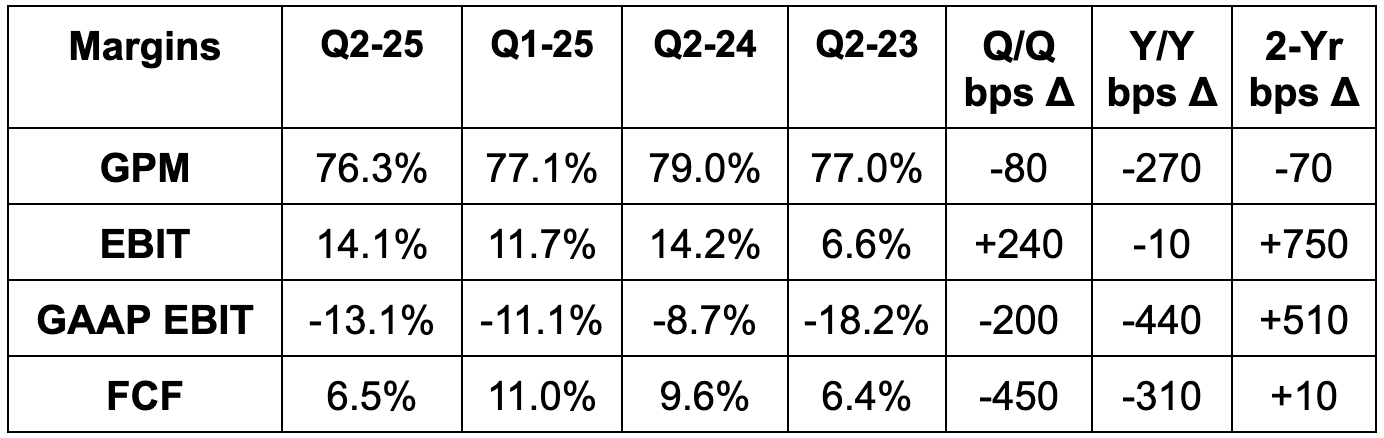

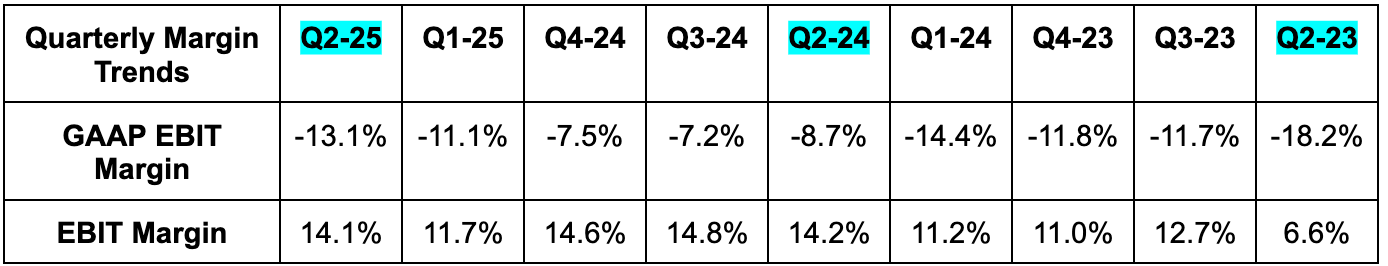

Profits:

- Beat EBIT estimates by 14% & beat guidance by 14.8%.

- Beat $0.18 EPS estimates & identical guidance by $0.03 each.

- Beat FCF estimates by 11%.

- Missed 77.8% gross margin estimates by 150 bps.

Balance Sheet:

- $3.9B in cash & equivalents.

- $3.26B in convertible senior notes.

- No traditional debt.

- 2.0% Y/Y share count dilution.

Guidance & Valuation:

- Q3 revenue guidance beat estimates by 1%.

- Q3 EBIT guidance beat estimates by 2%.

- Q3 $0.23 EPS guidance beat estimates by $0.02.

- Raised annual revenue guidance by 1.1% and beat estimates by 0.9%.

- Raised annual EBIT guidance by 4.0% and beat estimates by 3.6%.

- Raised annual EPS guidance by $0.06 and beat estimates by $0.055.

- Guidance raises were all larger than the Q2 beat, implying brightening rest-of-year expectations.

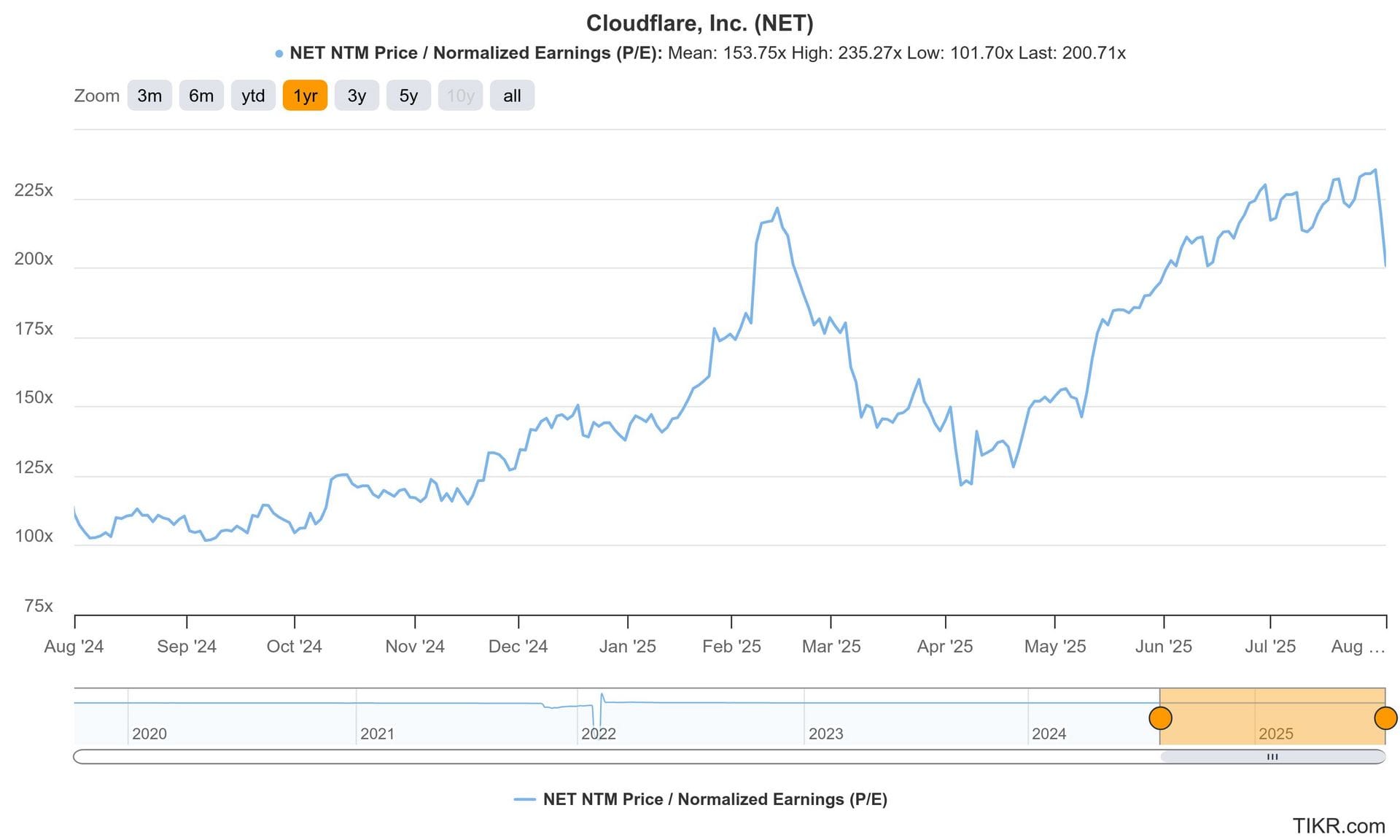

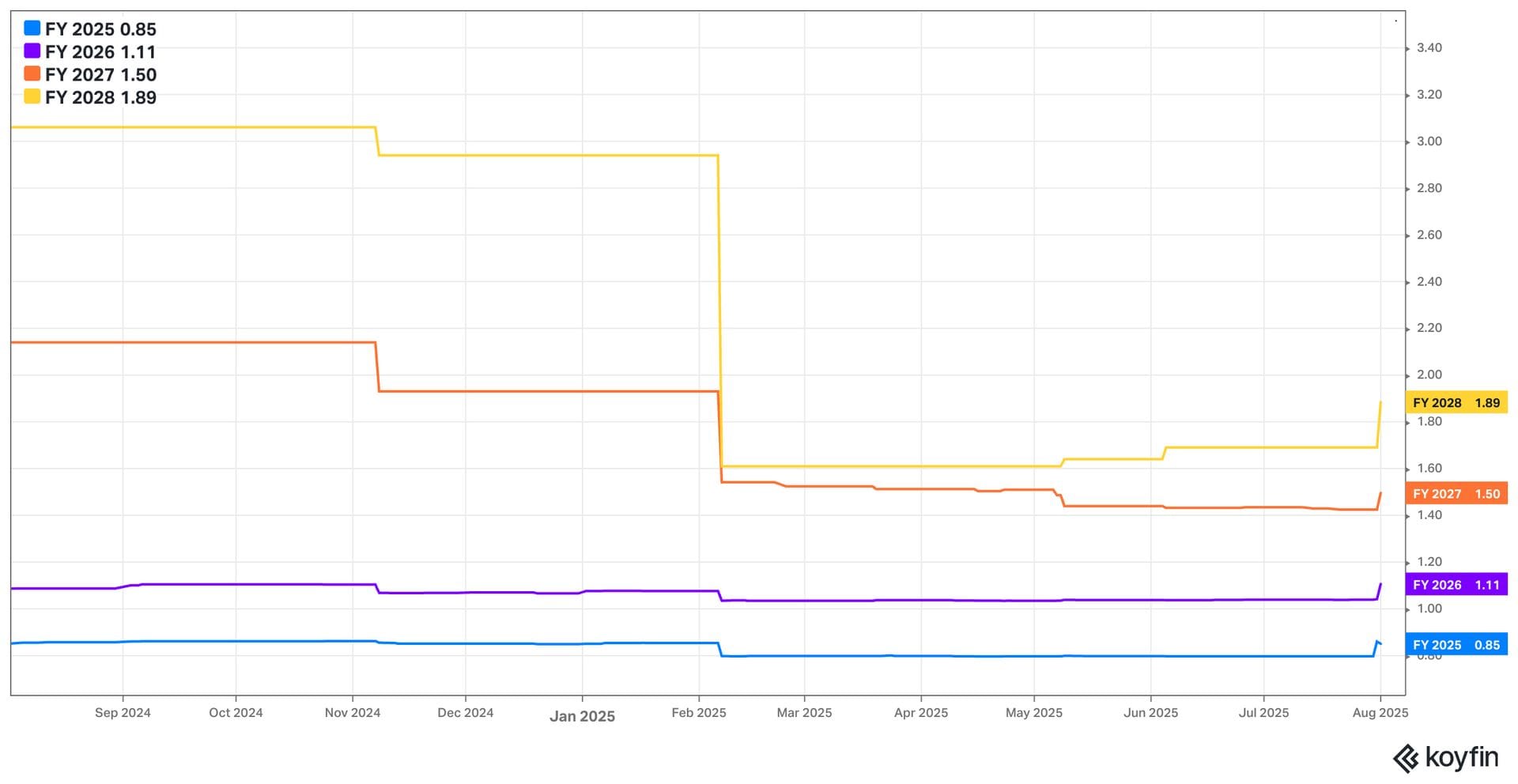

Cloudflare trades for 200x forward EPS. EPS is expected to grow by 13% this year and by 30% next year. It also trades for 219x forward FCF. FCF is expected to grow by 52% this year and by 39% next year. Very expensive name. Has been since the IPO.

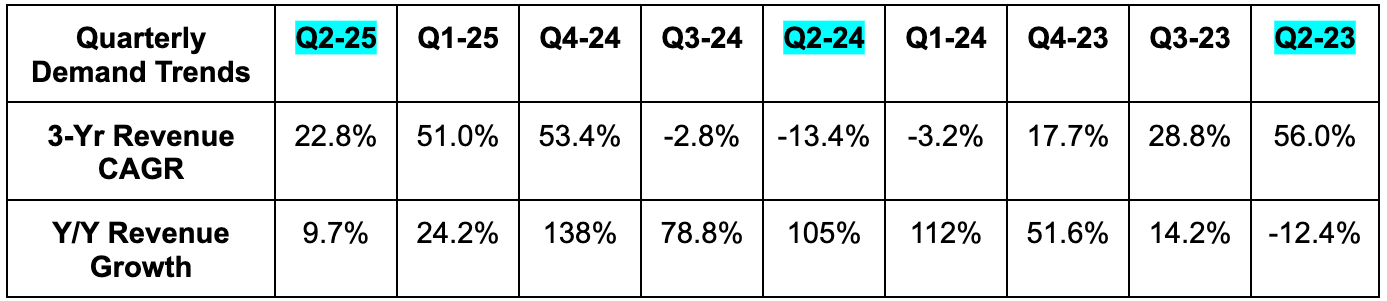

d. Coinbase (COIN) – Earnings Snapshot

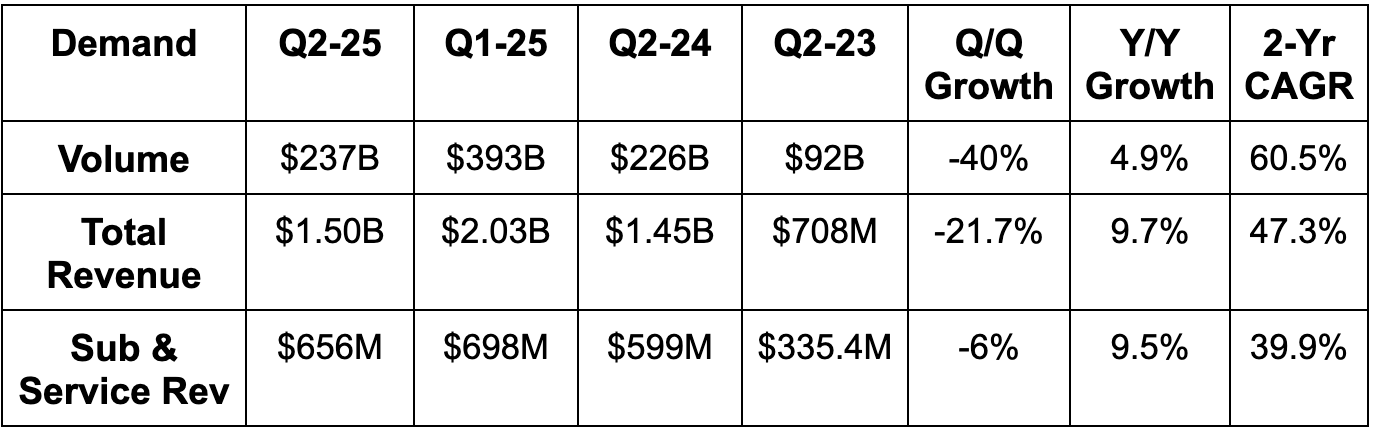

Demand:

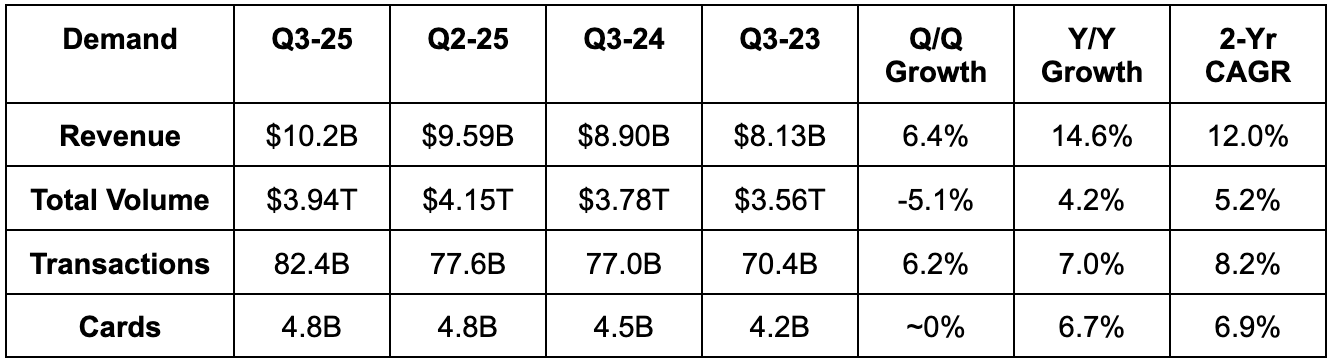

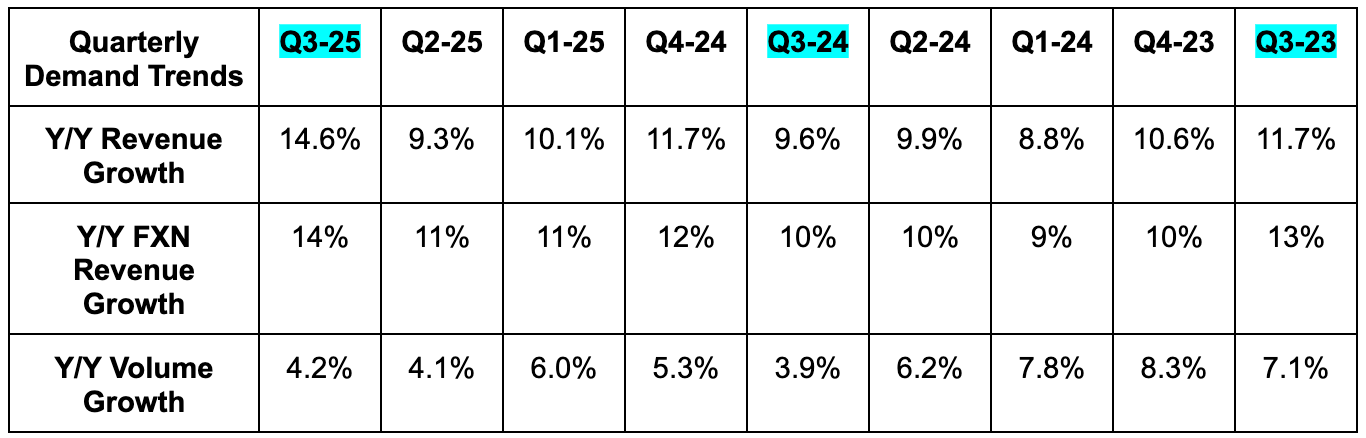

- Missed trading volume estimates by 6.3%.

- Missed revenue estimates by 5.7%.

- Missed subscription & service revenue estimates by 5.9% & beat guidance by 2.5%.

- Missed transaction revenue estimates by 5.6%.

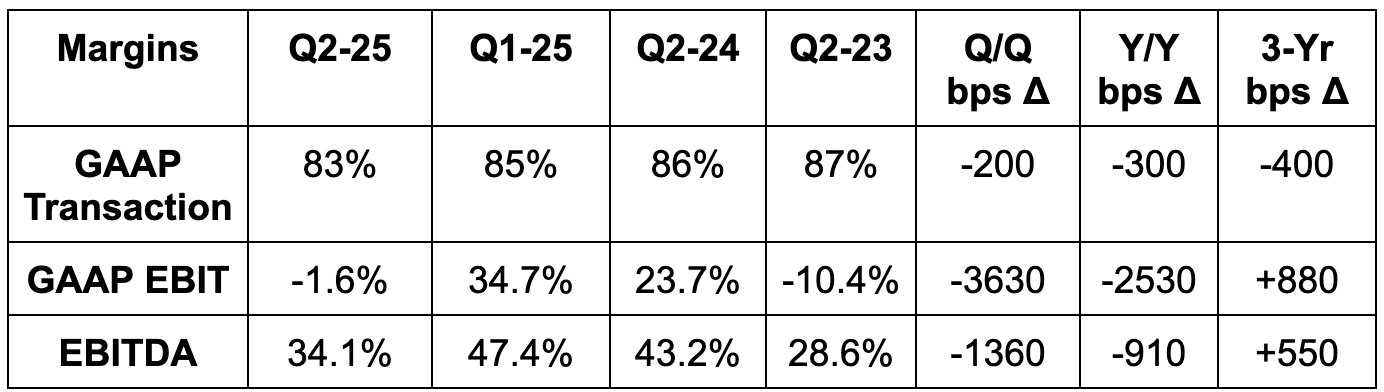

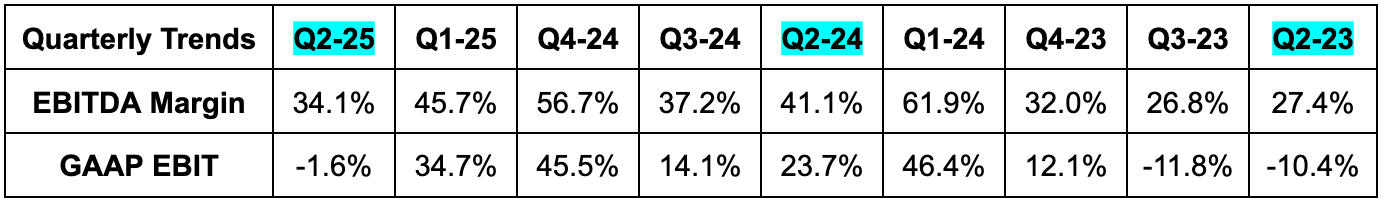

Profits & Margins:

- Came in at the low end of transaction margin guidance calling for transaction expenses at a mid-single-digit % of revenue.

- Missed EBITDA estimates by 15.8%.

- Sharply beat GAAP EPS estimates. This line item is highly influenced by mark-to-market gains/losses on equity investments. It recorded a $1.5B gain this quarter, which is 103% of total net income for the period. Best to ignore GAAP EPS for this company and focus on other profit metrics.

Balance Sheet:

- $7.54B in cash & equivalents; $803M in loans receivable vs. $475M year-to-date.

- $4.3B in debt.

- 4.5% Y/Y share dilution.

Guidance & Valuation:

Guided to $705M in subscription and service revenue and a roughly 85% transaction margin.

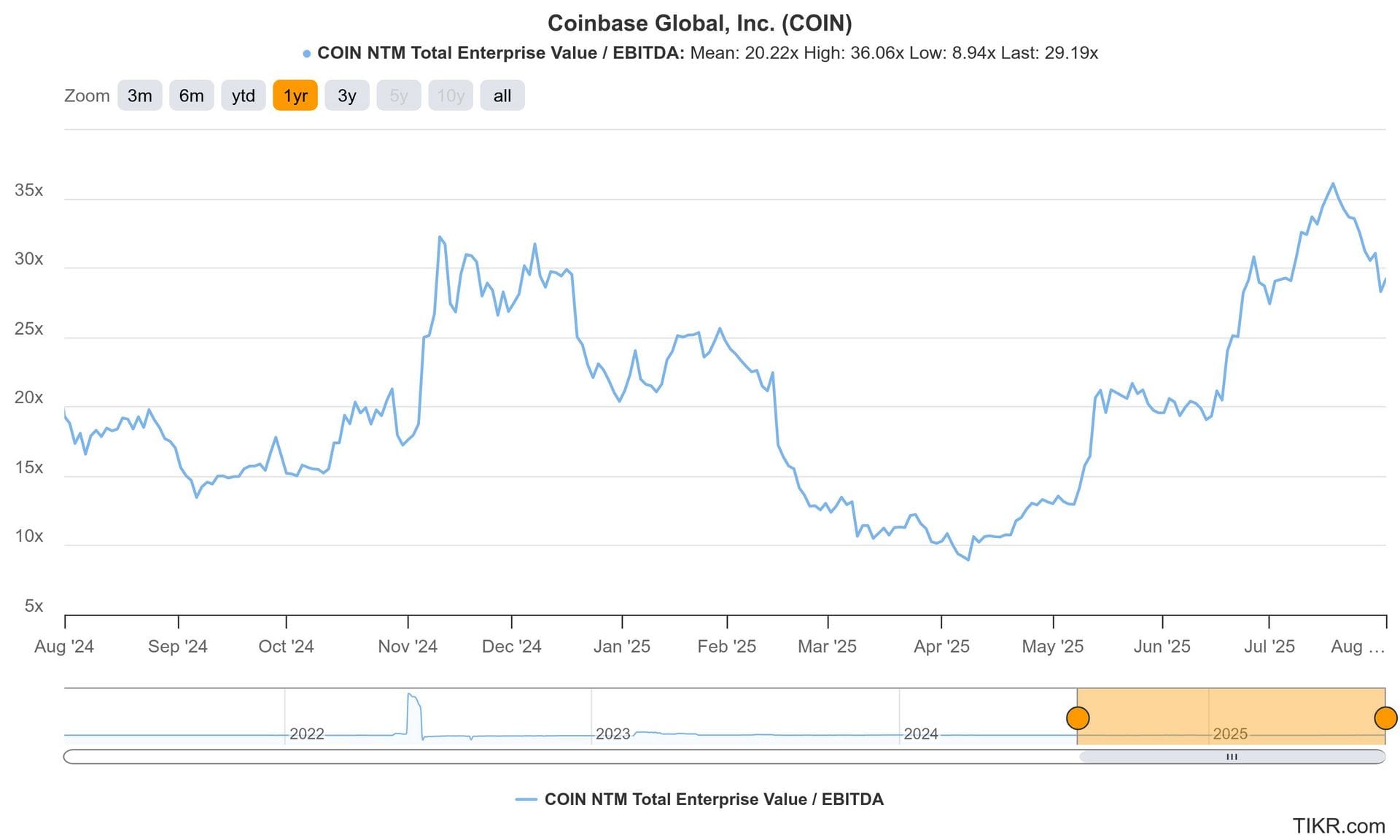

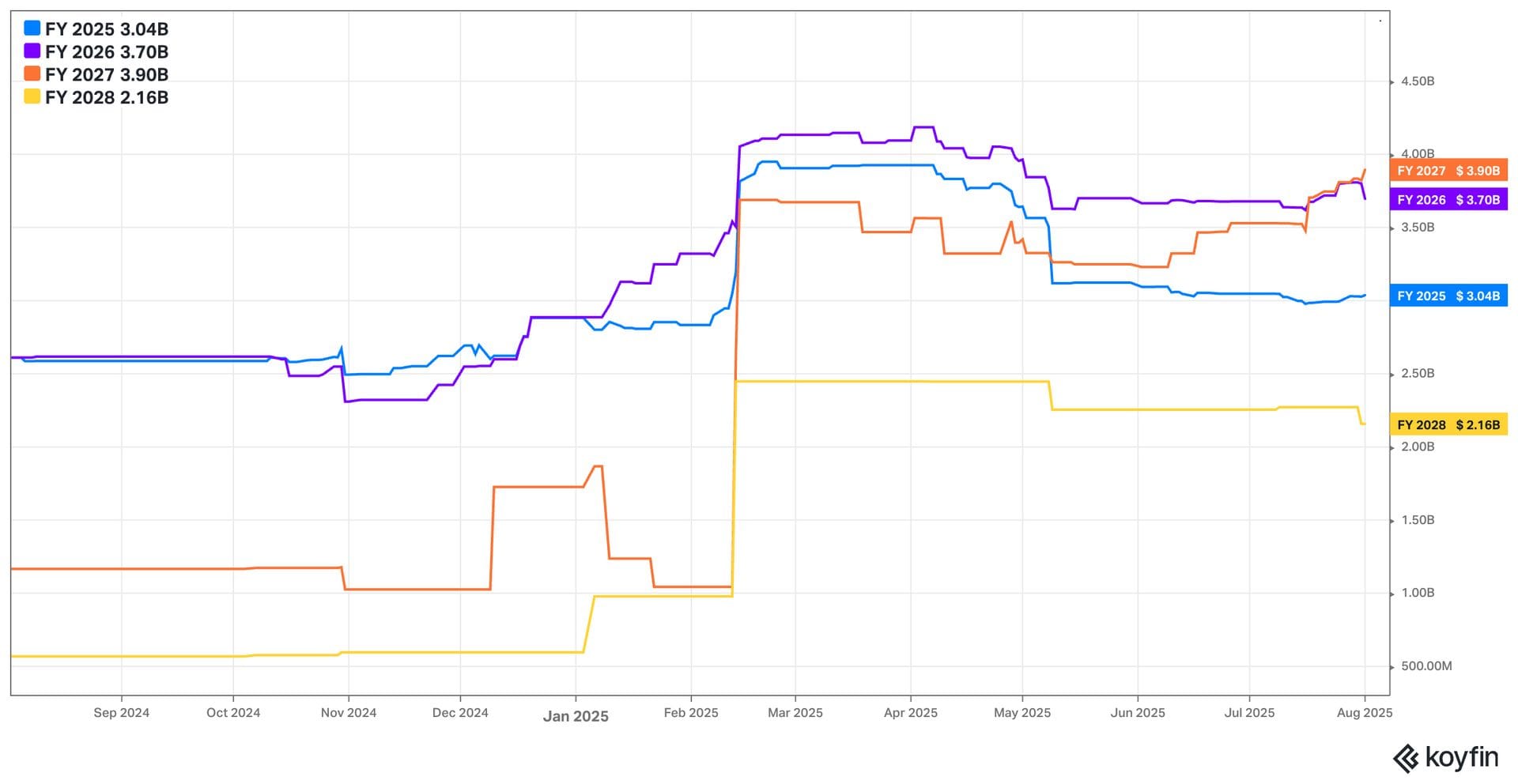

COIN trades for 29x forward EBITDA. EBITDA is expected to fall by 9% this year (following 300%+ compounding for 2 years) and grow by 22% next year.