What an absolutely crazy week this was. If you blinked, you probably missed something. Luckily, I do not blink (ok, maybe I do). We covered the following earnings reports during the week:

We did not have time to get to the Revolve Group this week. After digging through the financial statements, it looked as ugly as we expected considering its young, aspirational customer and high price point. We have zero plans to trim and may entertain adding to the stake after getting through the rest of the report. We owe you a full review there in next week’s article or we may sneak it into The Trade Desk review mid-next week.

1. Match Group (MTCH) -- Q2 Earnings Review

a. Demand

- Beat revenue estimate by 2.3% & beat guide by 2.4%.

- Foreign exchange (FX) hit revenue growth by 180 basis points (bps; 0.01%). This was compared to an expected hit of just 100 basis points, yet it still comfortably beat revenue expectations and guidance.

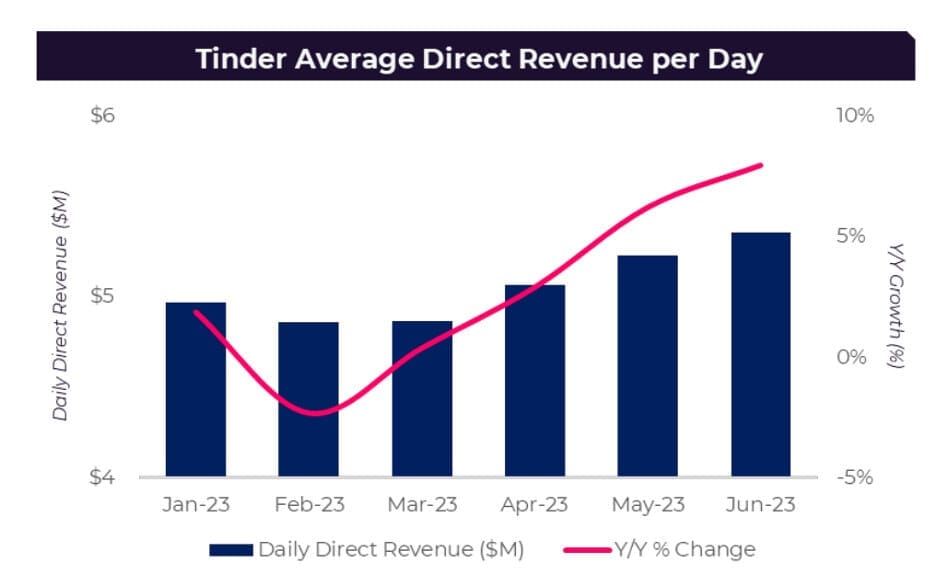

- Tinder direct revenue growth of 6% Y/Y beat low single digit growth guidance. Payers fell as part of the price hike strategy to maximize revenue.

- Hinge met guidance of accelerating Y/Y growth vs. last quarter with 35% Y/Y growth vs. 27% Y/Y growth last quarter.

- Match Group Asia beat FX neutral 0% growth guidance with 2.5% Y/Y growth.

Demand Context:

- Rapid revenue per payer progress is the result of recent price hikes while the payer decline was due to the same thing.

- 6.2% Y/Y FX neutral (FXN) revenue growth

- Tinder Direct revenue up 6% Y/Y (7% FXN); Hinge revenue rose 35% Y/Y to reach $90 million; Match Group Asia revenue fell 4% Y/Y (+2.5% FXN growth) while emerging and evergreen brands saw revenue fall 5% Y/Y.

- Revenue in the Americas rose 5% Y/Y, 9% Y/Y in Europe & -3% Y/Y in APAC.

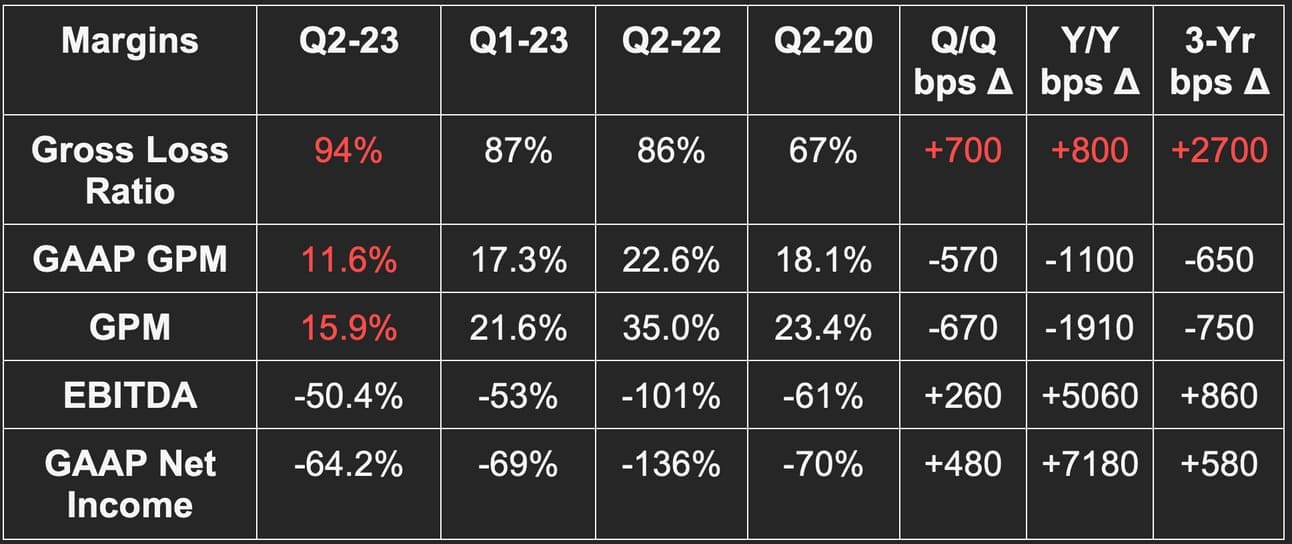

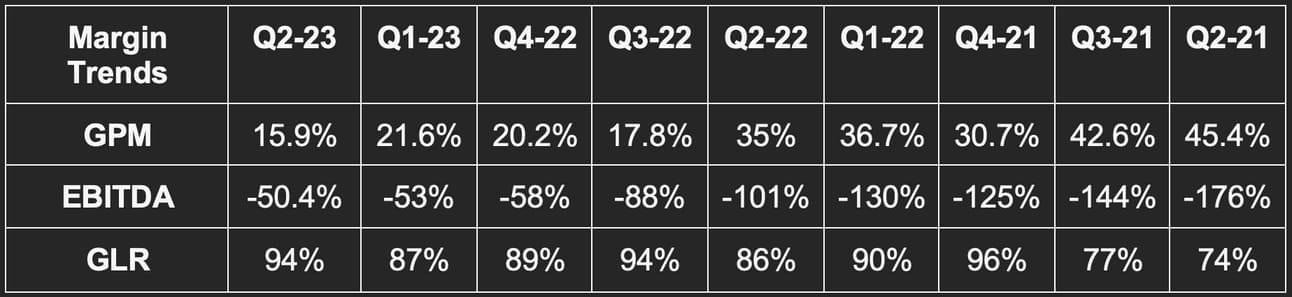

b. Margins

- Beat EBITDA estimates by 8% & beat guidance by 8.5%.

- Beat GAAP EBIT estimate by 7.7%.

- Beat $0.45 GAAP earnings per share (EPS) estimate by $0.04.

Margin context:

- $441 million legal settlement charge for Tinder litigation in Q2 2022 hit cash flow margins.

- Marketing spend was flat at 16% of revenue Y/Y and so was R&D.

- In-app payments rose 140 bps as a percent of revenue.

- As Tinder is the firm’s highest margin product, its outperforming demand yields outperforming profits as was the case this quarter.

c. Outlook

Next quarter:

- Revenue guidance was 1.8% ahead of estimates and represents 8.5% Y/Y growth at the midpoint (6.5% Y/Y growth FXN).

- Tinder revenue to rise 10% Y/Y. Growth was not expected to reach 10% Y/Y until Q4, so this is a full quarter ahead of schedule. Love it.

- Hinge to keep accelerating beyond 35% Y/Y growth.

- Hyperconnect to keep showing improvement but Pairs won’t.

- Includes a 200 bps FX TAILWIND.

- Indirect revenue (ads) to rise Y/Y as the demand environment improves.

- RPP growth to continue accelerating beyond this quarter’s 9.8% Y/Y growth result.

- EBITDA guidance was 2.0% ahead of estimates.

- Marketing intensity to rise 200 bps Y/Y to support Tinder, Hinge, The League and Archer.

- Q/Q payer growth to still be negative but to moderate vs. this quarter’s -184,000 result. It continues to build back momentum and roll out the pricing increases across the U.S. It’s on track to return to positive user growth in the coming quarters. Still, payer growth will be negative until the first half of 2024 as only 50% of its U.S. user base has had their prices changed to date.

Full year:

The team is increasingly confident in its ability to exit the year at 10%+ Y/Y growth at Tinder and overall. It added that growth will be “solidly double digits” in what could be interpreted as a small raise. It also improved its EBITDA margin guidance from flat or better Y/Y to just better Y/Y. The team hinted at 50 bps of Y/Y expansion expected. Strong. All of this led to a 6.5% Y/Y 2023 growth guide with analysts expecting 5.5% Y/Y growth and vs. Match’s previous guidance of near 5% Y/Y growth. Love it.

“If Tinder delivers solidly double digit Q4 growth, it’s logical to think the overall company will deliver growth similar to that.” -- CFO Gary Swidler

d. Balance Sheet

- $741M in cash & equivalents.

- $3.9B in total debt.

- Net leverage sits at 2x which is better than its 3x goal.

- $33M in buybacks as it started its $1 billion buyback program.

“We began buying back shares in the open window after our last earnings call, but we weren't able to buy back as many shares as we had intended over the past 3 months due to the strong stock price run-up, which occurred after the window had closed. We will revisit buybacks again after this call.” -- CFO Gary Swidler

e. Call & Letter Highlights

Momentum:

New CEO Bernard Kim called the quarter evidence of an “ability to reignite momentum” at Match. Organizational improvements to accelerate product testing and sharpen focus are bearing fruit. That’s the cause… The strong results are the effect. Kim called the team more “stable, focused, and united.”

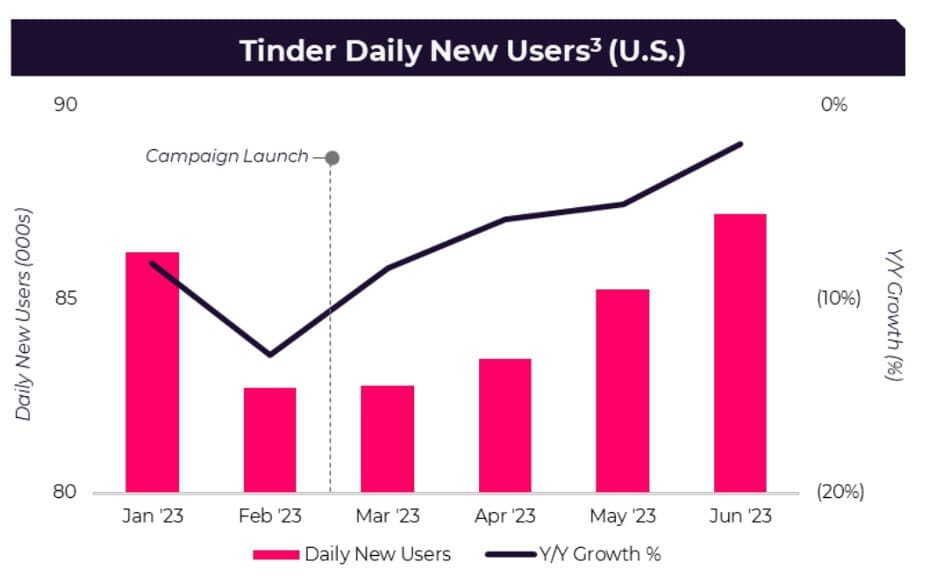

Tinder:

Tinder is the first, second and third most important asset at Match today. Signs of a turnaround are now evident. The Q1 marketing campaign (“it starts with a Swipe”) to take back its brand narrative directly led to revenue and user trend improvements. This was especially true with younger females which is ideal for driving better ecosystem balance. Sign-up growth spiked higher exactly when this campaign started:

When taking that tailwind together with weekly subscriptions working wonders along with price hikes, Tinder’s growth continued to “accelerate throughout the quarter.”

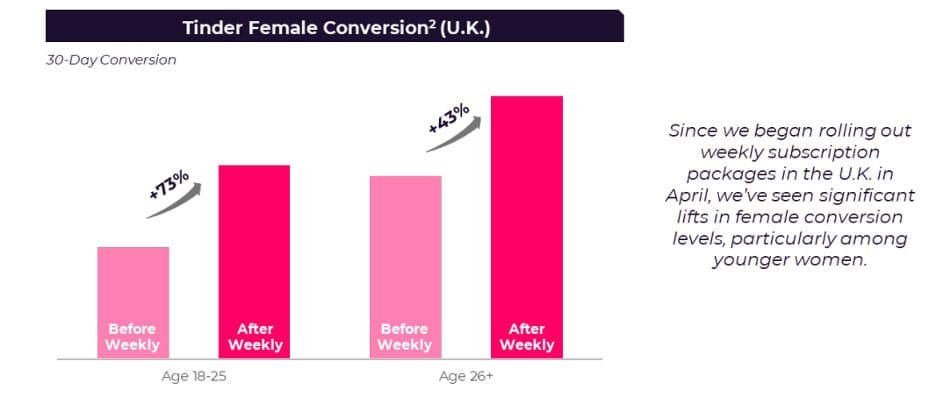

Tinder will debut weekly subscriptions globally this quarter. These weekly subscriptions are raising paid conversion ESPECIALLY FOR FEMALES resulting in a better app gender balance.

The team is now developing a new user experience to cater to Gen Z. This is expected to bolster “authenticity” by making self-expression easier and more data driven. It will make it easier to customize profiles with best picture recommendations and quizzes. The core swipe feature that made Tinder famous will remain as this rolls out in August.

- Importantly, churned users from the price increases are still staying on the platform as non-paying users.

- The team is “increasingly optimistic about the long-term trajectory.”

- It tested the same pricing initiatives in international markets which didn’t deliver any benefit. That’s inevitable when you ramp split testing. Strikeouts are ok. Maximize quality at-bats. One experiment won’t work… others will.

- Will roll out its ultra-expensive subscription tier for power users later this year. This could deliver “tens of millions” in annual incremental revenue.

“Tinder outperformed our expectations in the quarter as the revenue momentum we saw from price optimizations in the U.S. and weekly subscriptions over-delivered.” -- CEO Gary Swidler

Hinge:

Payer growth was 24% Y/Y to reach 1.2 million while RPP crossed $25 (vs. $5 when Match bought it). Downloads rose 50% Y/Y as its global expansion efforts work like a charm. Incredibly, it’s already a top 3 dating app in 14 countries (with Tinder and Bumble the other two in most markets). This is just a year into the initiative. Revenue is on pace to grow 40% Y/Y to pass $400 million annually. Match paid $150 million for Hinge in 2019. What a purchase.

“Product market fit is clear in every market thus far.” -- CEO Bernard Kim

Match Group Asia:

Azar revenue rose 24% Y/Y while Pairs and Hakuna struggled. Azar’s new AI-powered matching algorithm was credited for the delightfully surprising growth. It’s raising engagement and monetization. While Match overpaid for Hyperconnect, it’s not just the apps it got. Match also got a large team of engineers who are now actively working on product upgrades and unification across ALL Match Group properties. Plenty of Fish will run live streaming through Hyperconnect and Tinder’s work in AI will be thanks to Hyperconnect. It wasn’t a zero. Still not a great purchase from the old team.

“Given Hyperconnect’s strong reputation in Korea, we expect to grow the engineering team more quickly & effectively than we could in other markets.” -- CEO Bernard Kim

Pairs continues to struggle in Japan as that market remains weak and the dating stigma strong. It’s the leader there, but leading isn’t all that lucrative right now. The team is “re-evaluating brand strategy to raise growth.” It thinks now that dating app TV marketing is legal in the country, it can begin to see better momentum. We’ll see.

AI:

“We’re approaching AI very thoughtfully as dating requires unique considerations. It's imperative that our features and tools enhance trust, authenticity and respect and, ultimately, lead to better matches and dates in real life… By the end of the year, we expect to have launched a number of initiatives that will use generative AI to eliminate awkwardness, make dating more rewarding and surprise and delight users, all in a way that focuses on authenticity and maintaining the highest ethical and privacy standards.” -- CEO Bernard Kim

Things like profile creation are real points of friction for new users. Match will roll out tools such as AI-powered photo selection algorithms to make it more seamless.

Emerging & Evergreen Brands:

Match is working on a long-term project to eliminate redundant costs by operating all legacy brands under a shared tech stack. It has moved two brands as of today, but this project will take it another 18 months to complete. Cost savings will be realized as this takes place.

Archer launched in New York City and will be live across the nation by 2024. It will focus on user growth first and revenue second.

f. Takeaway

This was the quarter where the new team started to put everything together. Split test acceleration is bearing fruit, rational marketing campaigns are working, cost cuts are continuing and its two most important apps (Tinder & Hinge) are both meaningfully accelerating. It’s good to own 50%+ share of a global market set to grow by nearly 10% annually for the foreseeable future. It’s good to be Match. Some people took negative price action to mean the category was saturated and the company was a dinosaur. Not even close.

This was a gratifying quarter for me personally as I’ve defended the investment case through the worst of the stock’s volatility.

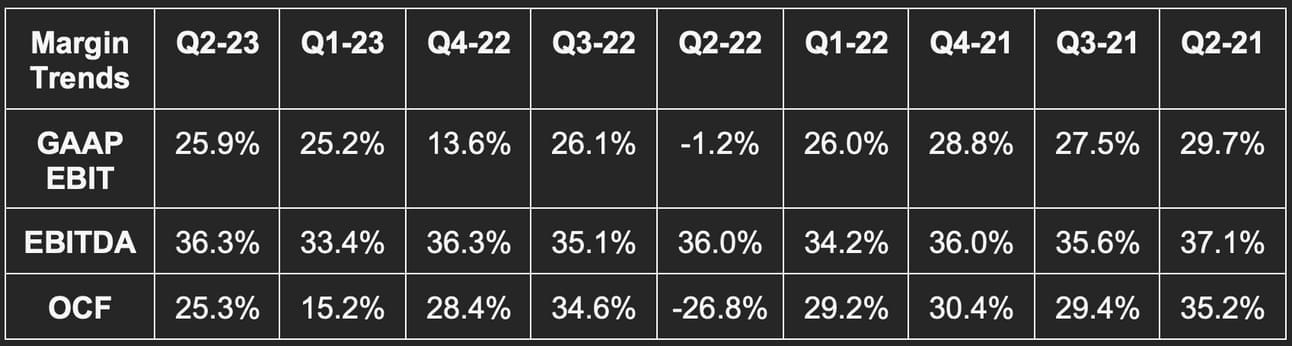

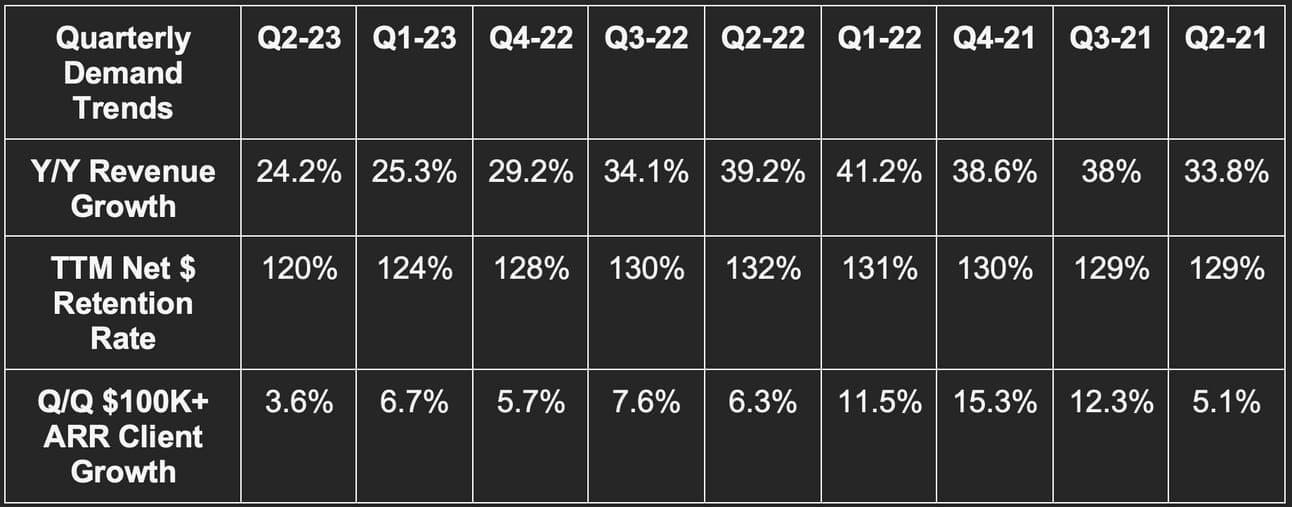

2. JFrog (FROG) -- Earnings Review

a. Demand

- Beat revenue estimates by 1.4% & beat guidance by 1.4%.

- Met cloud revenue estimates.

Demand Context:

- 32.3% 3-yr revenue CAGR vs. 34.5% Q/Q & 35.5% 2 quarters ago.

- Cloud revenue = 33% of total vs. 21% Q/Q and 28% Y/Y.

- JFrog Platform Enterprise+ (full suite subscription) = 45% of revenue vs. 44% Q/Q and 36% Y/Y.

- Gross retention is stable at 97%.

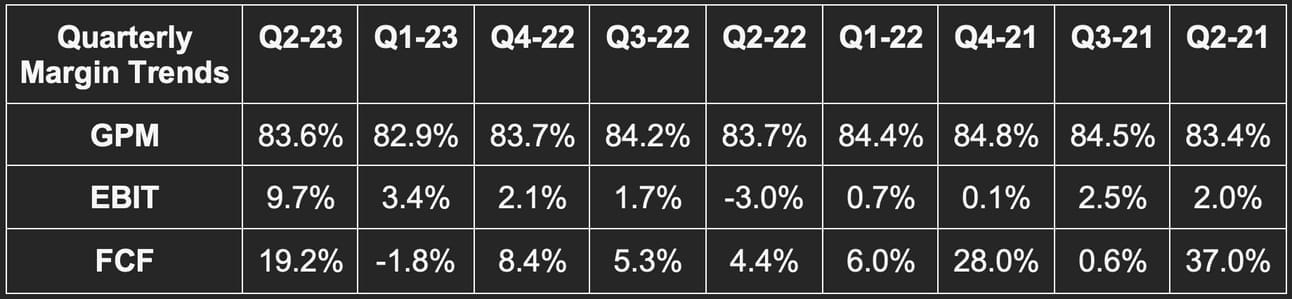

b. Margins

- More than doubled EBIT estimates of $3.5 million.

- More than doubled EPS estimates of $0.05.

- Beat FCF estimates by 70.5%.

Margin context:

- Gross margin is supposed to move towards 80% over time as its cloud business grows at slightly lower margins vs. on-premise.

- EBIT margin was helped by moving some Q2 OpEx to Q3. Still, its large annual EBIT guidance raise points to this not being a matter of timing, but efficiency.

c. Guidance

Next Quarter:

- Met revenue estimates.

- Beat EBIT estimates by 22.6%.

- Beat $0.04 EPS estimates by $0.045.

- Strong cloud consumption trends continued through July.

Full year:

- Raised revenue guidance by 0.3% & beat estimates by 0.3%.

- Raised EBIT guidance by 25.6% & beat estimates by 26.2%.

- Raised $0.20 EPS guidance by $0.12 & beat estimates by $0.11 or more than 50%.

- Reiterated mid 40% cloud revenue growth Y/Y.

- Reiterated low double digit FCF margin for the year.

d. Balance Sheet

- $470M in cash & equivalents

- Share count was up 3.5% Y/Y (being hit by some M&A).

- No debt.

e. Call & Release Highlights

Security:

Since JFrog Advanced security was rolled out for hybrid deployment last quarter, momentum has been strong. It has already added dozens of notable up-sells to client subscriptions with a rich forward-looking pipeline. While X-ray brought software composition analysis to JFrog’s tool kit, newer services like contextual analysis/protection and code security have been popular selling points here… especially thanks to the native binary management tool (Artifactory) integration which allows JFrog to be a customer’s “single source of record.” Growth within this product bucket was cited as a central reason for the outperformance.

In other security news, JFrog recently launched JFrog curation. This is based on the reality that 90% of software packages now utilize open-source libraries of source code. This new tool allows customers to guard their software ecosystems against malicious open-source code (like Log4J). It seamlessly automates the scanning and authorization of open-source code before it even enters a company’s infrastructure to ensure no policy violations and proper hygiene. The product will be sold on a per-seat basis with a market essentially the size of all software developers and little competition today.

It’s now actively marketing these new tools to existing clients approaching renewal dates.

Interestingly, a security solution being managed on-premise is more common than its other product categories. So? JFrog sees this accelerating on-premise revenue growth from the 17% Y/Y figure it posted this quarter.

Cloud Consumption:

JFrog sees the wave of cloud usage optimization as largely behind it just like we heard from Amazon this week. Accelerating cloud consumption was the other notable driver of JFrog’s successful performance along with security proliferation.

“We are pleased with improving usage trends during the first half of 2023.” -- CFO Jacob Shulman

Client Wins:

- A Fortune 100 and top 5 healthcare and retail company (CVS or Walgreens?) moved from Google Container Management and Sonatype’s Artifactory competitor to JFrog. It wrapped up a proof of concept which motivated them to add even more JFrog products.

- A “leading biopharma” company is going with JFrog to overhaul its supply chain. It’s adopting the full platform.

Generative AI:

As the de facto binary repository for software packages, generative AI will be a large tailwind for JFrog’s business. Products like Copilot and CodeWhisperer are making code creation as easy as arithmetic. That will mean much more code creation and all of this code will be stored as binaries. Large Language Models (LLMs) are voracious consumers of data and code… JFrog will fully take advantage. All source code languages that will be used to write generative AI code are integrated into JFrog’s ecosystem.

f. Takeaway

Solid quarter. Security products are gaining rapid traction which offers JFrog yet another source of revenue expansion and demand runway. It’s trimming costs and seeing margins explode higher while not seeing much of an impact on demand. Churn is minimal, 3-year return on investment is over 400% and pricing power is real. This platform is mission critical and it showed this quarter. Some software names like Zoom Info blamed poor macro on poor results. JFrog cited improving macro as a boost to its own results.

3. Lemonade (LMND) -- Q2 Earnings Review

a. Demand

- Beat in force premium (IFP) guidance by 3%.

- Beat gross earned premium (GEP) guidance by 4.4%.

- Beat revenue estimates by 7.2% and beat guidance by 7.8%.

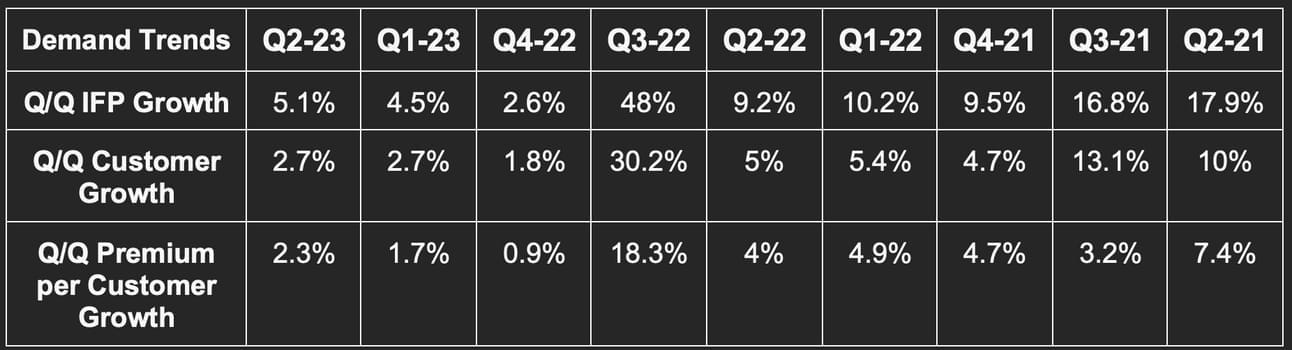

Demand Context:

- Q3 2022 inorganic contribution from Metromile M&A. Organic growth was 28% Y/Y.

- Premium per customer up 24% Y/Y.

- Ceded 53% of premiums to reinsurers vs. 71% Y/Y.

b. Profitability

- Beat EBITDA estimates by 5.6% & beat guidance by 6.7%.

- Beat GAAP EBIT estimates by 6.1%.

- Beat -$1.02 GAAP EPS estimates by $0.05.