In case you missed it from this earnings season:

- CrowdStrike Earnings Review

- Nvidia & SentinelOne Earnings Reviews

- Zscaler Earnings Review

- Trade Desk Earnings Review

- DraftKings & Coupang Earnings Reviews

- Shopify & Mercado Libre Earnings Reviews

- Uber Earnings Review

- Palo Alto & Snowflake Earnings Reviews

- Apple & Duolingo Earnings Reviews

- AMD & Datadog Earnings Reviews

- Lemonade Earnings Review

- Sea Limited & Cava Earnings Reviews

- Palantir & Hims Earnings Reviews

- Airbnb Earnings Review

- SoFi Earnings Review

- PayPal Earnings Review

- Meta, Robinhood & Starbucks Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Alphabet Earnings Review

- Tesla Earnings Review

- Chipotle Earnings Review

- ServiceNow Earnings Review

- Netflix & Taiwan Semi Earnings Reviews

- Nu, On Running & Cloudflare Earnings Reviews

And, my updated portfolio & performance vs. the S&P 500.

Table of Contents

- In case you missed it from this earnings season:

- 1. Lululemon (LULU) – Earnings Snapshot

- 2. SoFi (SOFI) – CFO Chris Lapointe Presents at Wi …

- 3. Zscaler (ZS) Investor Event & an Investor Confe …

- 4. Cava (CAVA) – CEO and CFO Present at William Bl …

- 5. Broadcom (AVGO) – Earnings Review

- 6. DraftKings (DKNG) – Illinois

- 7. The Trade Desk (TTD) – Amazon

- 8. Mercado Libre (MELI) — Argentina & Brazil

- 9. Starbucks (SBUX) — Changes

- 10. Headlines

- 11. Macro

1. Lululemon (LULU) – Earnings Snapshot

As a reminder, I liquidated my stake in April. The time-stamped sale and reasoning for the decision can be found via that link. No part of the reasoning changed from this report. I plan to finish reviewing this quarter alongside Nike when they report earnings later this month.

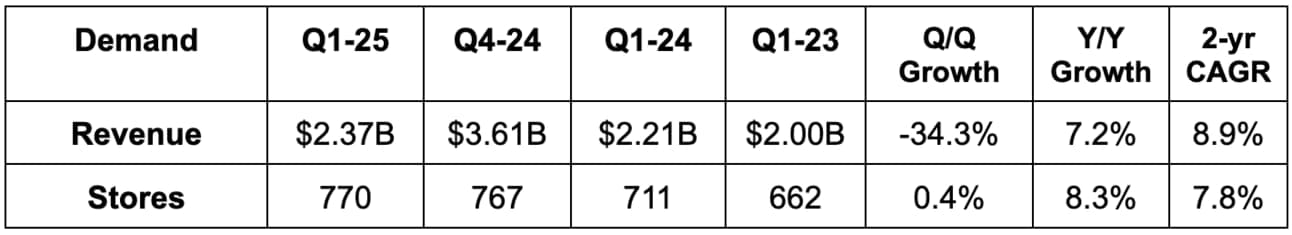

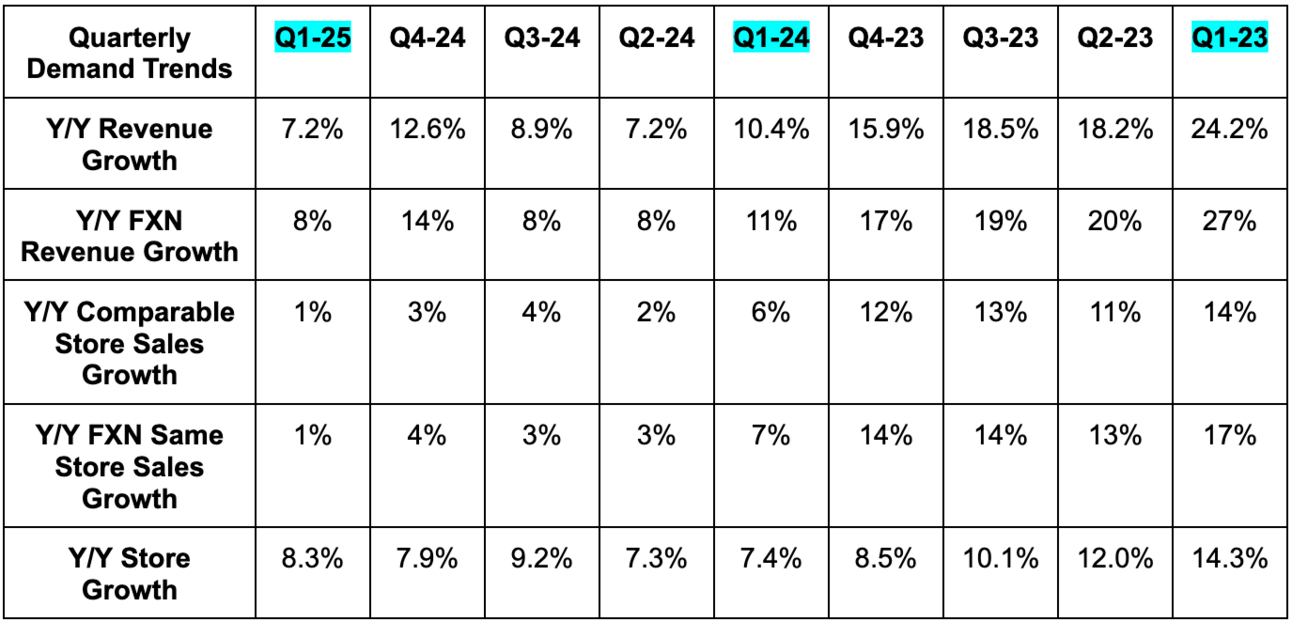

a. Demand

- Met revenue estimate & beat guidance by 1.1%.

- Its 8.9% 2-yr revenue CAGR compares to 14.2% Q/Q & 13.5% 2 Qs ago.

- Comparable store sales growth in the Americas and China was -2% and 7% respectively. Each missed guidance by a point.

- Rest of World comparable store sales growth missed 11% estimates by 5 points.

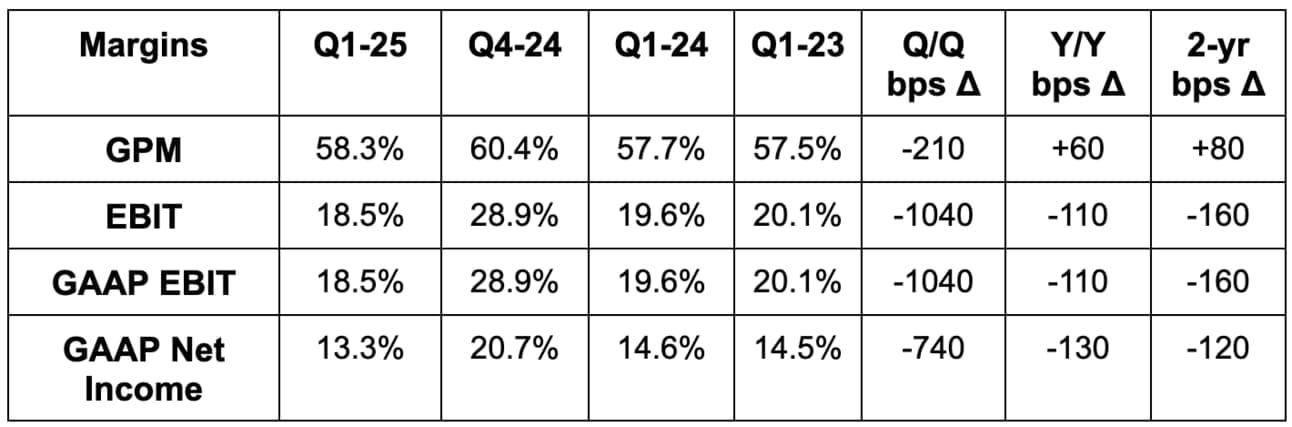

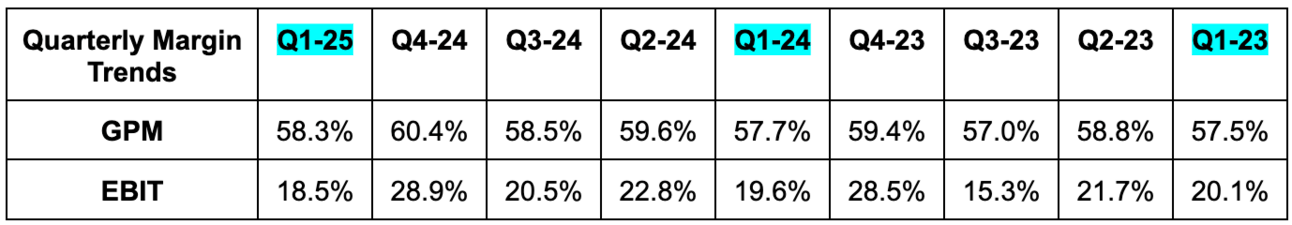

b. Profits & Margins

- Beat 57.7% GAAP GPM estimate by 60 bps.

- Markdown rates rose slightly Y/Y.

- Slightly beat EBIT estimate & beat guidance by 0.5%.

- Slightly beat $2.59 GAAP EPS estimate by $0.01 & beat guidance by $0.045.

c. Balance Sheet

- $1.33B in cash & equivalents.

- Inventory rose by 23% Y/Y.

- $393M in available credit revolver capacity to borrow against.

d. Guidance & Valuation

- Reiterated annual revenue guidance, which slightly missed estimates.

- Next quarter revenue guidance missed by 1%.

- Lowered $15.05 GAAP EPS guidance by $0.37, which missed by $0.26.

- The word tariff came up 30 times during the call and was blamed for the reduction. It’s creating uncertainty for the business, but thinks it’s “better positioned than most” to maneuver through the dynamic backdrop.

- Next quarter $2.875 EPS guidance missed by $0.465.

- Guidance assumes a 30% China tariff and a 10% tariff on the rest of the countries in makes goods in remain in place.

Lulu called the U.S. consumer “cautious” in its prepared remarks. The team thinks they’re doing reasonably well with improving product newness, which is perhaps why market share rose in both men’s and women’s premium athletic wear. Still, weak USA macro and trade wars were blamed for the negative revisions.

Lulu trades for about 17x its new EPS guidance and probably somewhere around there based on sell-side estimates once they fall to reflect this downward revision. EPS growth will be roughly 0% Y/Y based on new guidance this year. EPS is currently expected to grow by 10% next year, but I wouldn’t be surprised to see those estimates fall a bit.

2. SoFi (SOFI) – CFO Chris Lapointe Presents at William Blair’s Growth Event

I spoke about SoFi a lot in my weekly chat with Evan and Tannor on Wednesday. That conversation can be found here.

This event was unfortunately 25 minutes of Lapointe reviewing the business model and only 5 minutes of Q&A. My SoFi Deep Dive gets into all of the repeated ideas he covered. I’ll focus on the pieces of newness from the chat and offer some personal thoughts on the tech segment.

Current Trends:

Its ultra-prime customer base continues to spend at healthy levels, with him hinting at interchange volume growth accelerating into Q2. Borrower health remains strong and capital market demand for its loans remains equally strong. These things were all mentioned on their earnings call 6 weeks ago, but the backdrop is highly fluid and I take comfort in their important trends remaining healthy. I will gladly listen to them reiterate this as many times as they’d like to. Whether it’s unmatched breadth of person-to-person payments, strong SoFi Plus momentum, excellent cross-selling cadence, robust engagement, ramping student loan demand as payments resume or brightening tech platform momentum, things are going well.

More on Student Loans:

SoFi unsurprisingly expects the current acceleration in student loan volume to continue. It expects to be the primary beneficiary of that, considering its 60% refi market share and potential rate cuts fueling the fire (not needed but would certainly be welcomed). They see $280B in potential demand to serve, and again, thriving capital market demand for its paper to ensure it can capture these borrowers without the balance sheet ballooning in size.

Liquidity:

SoFi has an “internal stress buffer” beyond mandated capital ratio levels that gives it the required comfort to pursue all of its growth opportunities. Their 15.5% total risk-based capital ratio is well beyond the 10.5% minimum and that buffer. The balance sheet is in excellent shape.

Tech Platform:

There wasn’t anything new here, but I wanted to talk about this piece of the business a bit. Some folks think the Galileo and Technisys purchases were mistakes because revenue growth has underwhelmed for about a year now. I could not disagree more. We’ve well documented the four simultaneous headwinds that have raged for this segment: A cumbersome go-to-market change, a regional banking crisis, 5 points of rate hikes and diverting product innovation assets to fully integrate Technisys. But I wanted to add another item here.

Cost advantages are everything in banking and financial services. SoFi’s branch-less model matches the advantages of other disruptors. It then pairs that model with a bank charter to match the advantages of incumbent lenders. That combination is rare in its sector, and the tech platform deepens that rarity significantly. When the Technisys integration project is soon complete, SoFi will shed reliance on third-party vendors and the expensive contracts needed to run its front and back ends. It will own its entire tech stack, thus side-stepping hefty costs and creating an incremental revenue opportunity that I view as icing on the cake. That icing is beginning to taste much better, with recent commentary on pipeline and several late-stage deals coming (per Noto), but the main ingredient is the cost lead that SoFi enjoys over everyone in its sector. Nobody has the charter… the lack of branches… the digitally native operations… and the vertically integrated tech stack.

This means SoFi can continue to pay more savings interest than most can. It means it can profitably offer more credit card rewards over time. It means it can offer significant discounts on loan interest rates. It means it can offer more travel and event perks under SoFi Plus. Generally speaking, it means it can rationally provide more value than the incumbents – which is where all of its market share gains are coming from. Owning Galileo is what makes SoFi unique. While I expect the tech segment to accelerate meaningfully next year, that’s not required for this to be a vital contributor. This is a bank and a tech company. Being both is what makes it special and is why it has compounded at such a robust clip across cycles and through loan moratoriums.