Links to 40 detailed earnings reviews from this season

Link to my current portfolio & performance vs. the S&P 500

Table of Contents

- 1. MongoDB (MDB) – Earnings Review

- 2. Earnings Snapshots – GitLab (GTLB) & Adobe (ADB …

- 3. SoFi (SOFI) – CFO Chris Lapointe Interviews wit …

- 4. PayPal (PYPL) – PayPal’s Global Markets Preside …

- 5. Oracle (ORCL) – Earnings Review

- 6. Mercado Libre (MELI) – SVP of Strategy, M&A and …

- 7. Apple (AAPL) – WWDC 2025

- 8. Shopify (SHOP) – Checkout Options

- 9. Meta (META) – Scale AI

- 10. Starbucks (SBUX) – China, Talent & Menu

- 11. Alphabet (GOOGL) – Search Data & OpenAI

- 12. Headlines

- 13. Macro

Next week, I plan to publish a review of the Adobe earnings transcript and materials. Part one, which includes all quantitative charts and data, is in section 2 of this article. I will also publish a catch-up review on Lululemon next week. I was planning on pushing that to the end of the month to include it side-by-side with the Nike earnings review and I think I’ll have time to do it next week. Next week’s article will also include updated valuation comp sheets and the typical weekly newsflow.

1. MongoDB (MDB) – Earnings Review

a. MongoDB 101

MongoDB is a key player in data storage and analytics with a document-oriented setup. This differs from legacy relational-style databases and next-gen versions like Snowflake’s. How so? Legacy relational databases store data in rigid rows and columns linked by pre-set relationships. These databases look like giant Excel spreadsheets and use structured query language (SQL) to work. Legacy relational databases cannot seamlessly handle unstructured data like MongoDB’s data lake can. Legacy relational databases struggle to horizontally scale and unlock the most advanced, flexible and multi-stage querying. The datasets are fixed, with formatting and filtering more limited. This is a large limitation, considering how important unstructured data is for GenAI use cases. The inability to provide “not only SQL” (NOSQL) slows performance and diminishes value. MongoDB’s NoSQL database, called Atlas, and document-style storage fix these issues, which is why the pace of migration continues to ramp up.

“MongoDB’s platform enables developers to more easily represent the messiness of real-world data. This includes understanding relationships between structured and unstructured data, and managing data that is constantly evolving and changing. This fundamental architectural advantage provides customers greater flexibility, faster time to market, and the ability to scale without rearchitecting.”

CEO Dev Ittycheria

Atlas’s cloud-native database architecture uses a group of servers (or a cluster) to store data for app creation within its platform. The nature of MongoDB’s Atlas product allows clusters to be easily added to or subtracted from for seamless tweaking as needs fluctuate. It also offers MongoDB Realm as a mobile environment for app creation and MongoDB Search for data querying. Finally, MongoDB Data Lake is what specifically houses unstructured data for querying and analytics.

“MongoDB removes the constraints of legacy databases, enabling businesses to innovate at AI speed with our flexible document model and seamless scalability.”

CEO Dev Ittycheria

More Core Atlas Products:

- Vector Search allows clients to seamlessly scrape insights from data. It allows for theme-based querying rather than just word-based. It also provides retrieval-augmented generation (RAG). This pushes “semantic” search results into associated large language models (LLMs) to uplift querying precision.

- MongoDB 8.0 is its latest NoSQL platform. This offers 20% to 60% performance boosts vs. the old version and better time series (timeline-based) data services.

- Atlas Stream Processing allows for real-time data ingestion. That matters a lot for app developers who constantly toy with, split-test, and render every single little detail within their apps. Real-time access to data querying helps make that process painless.

- Atlas Search Nodes (nodes meaning servers) automate the optimal usage of compute capacity and separate database and search functions to enable easier, more affordable scaling.

Product Expansion:

MongoDB thinks it’s great at automating the cumbersome data modernization work needed for migrations. Its Relational Migrator product is a helpful tool to take client headache out of this. Now, it’s focused on leveraging Relational Migrator to actively help companies re-code their legacy applications and create a more end-to-end, full-service migration service. With this holistic strategy, MongoDB doesn’t just aid with data migration, but directs automation of software modernization to seamlessly run apps through its document-oriented foundation.

MDB also recently bought Voyage AI for another product expansion opportunity. Voyage is a key player in GenAI and agentic AI model trustworthiness. While models routinely create delightful, jaw-dropping experiences, they’re also wrong a lot. Hallucination rates (wrong answer rates) can often reach 25%. This makes models really only useful when you know what a right answer should look like and are double-checking. That limitation puts a tight ceiling on utility and is what Voyage aims to fix. It has two products. First is its set of Vector Embedding Models. As leadership puts it, these are the “bridge between models and a client's private data.” They facilitate meticulous information transferring into models. It organizes data as a number sequence to more closely group data points in a much more standardized manner that models can read. All of this helps with machine learning accuracy rates and uncovering patterns to reduce model mistakes. Secondly, it offers reranking models. These ingest and reorganize materials for a given model input based on data relevance. They filter model responses to help eliminate waste and inaccuracies. With Voyage, MDB gains a broader suite of GenAI services to round out a more cohesive platform. Now, it has Atlas, significant help for app and data migration/modernization, real-time data streaming, world-class search tools and highly-regarded embedding and reranking models under one roof.

“By combining these into one platform, we make it dramatically easier for developers to build intelligent, responsive apps without stitching together multiple systems.”

CEO Dev Ittycheria

And lastly, MongoDB also offers an environment for GenAI app creation. MongoDB AI Applications Program (MAAP) provides a slew of templates, guardrails, 3rd party integrations and configuration tools for fostering AI app creation.

Non-Atlas Business:

Enterprise Advanced (EA) refers to its on-premise (Atlas is cloud-based), database and app bundle. It allows companies to purchase licensing for subscription-based usage (rather than paying for consumption under Atlas).

Business Model:

Note that most of MongoDB’s growth is based on acquiring new customers and migrating workloads onto the platform, as well as consumption-based revenue from customers using its data products and growing workloads.

b. Key Points

- Much better quarter.

- Stronger focus on margin maintenance under the new CFO.

- AI is still not contributing much to revenue.

- Newer products like Relational Migrator are building traction.

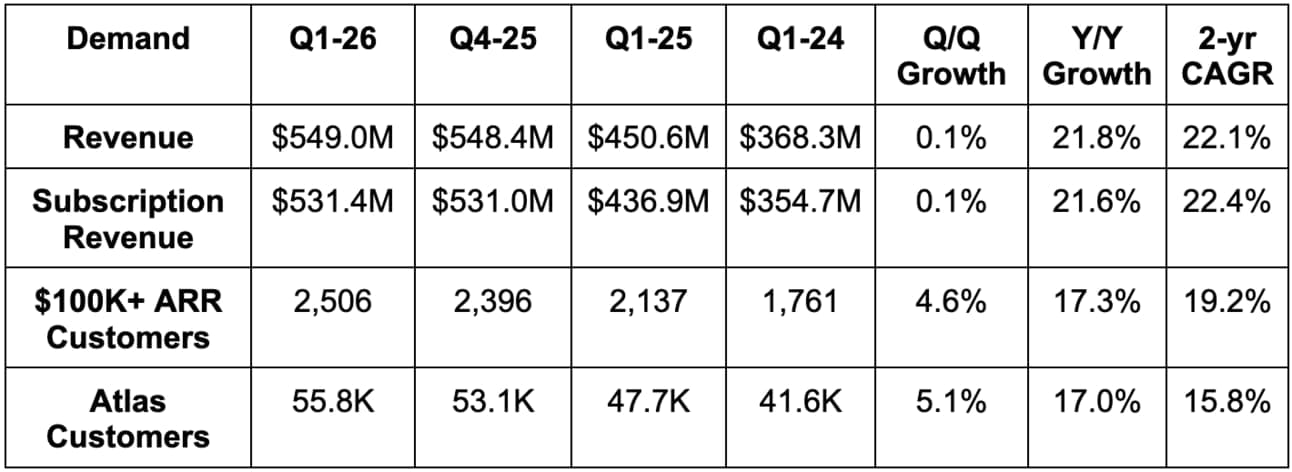

c. Demand

- MongoDB beat revenue estimates by 4.1% & beat guidance by 4.3%.

- They also delivered about 1.5% Q/Q Atlas revenue growth vs. guidance of flat to slightly higher Q/Q revenue.

- Non-Atlas revenue was better than expected, but that was timing related. It reiterated annual non-Atlas revenue guidance, as you’ll see below.

“Overall, we posted a strong Q1 despite a dynamic and fast-changing macro environment.”

CEO Dev Ittycheria

d. Profits & Margins

- Beat $56.4M EBIT estimate by 55% or $31M. Beat EBIT guidance by $31.4M or 56%.

- The EBIT beat was due to revenue outperformance and some expense timing favorability.

- Beat $0.66 EPS estimate by $0.34 & beat guidance by $0.35.

- Gross margin fell due to a mix-shift to Atlas.

e. Balance Sheet

- $2.45B in cash & equivalents.

- No debt.

- 11% Y/Y share dilution. This includes $200M in stock compensation, or about 1 million shares, from its Voyage AI M&A. Dilution was still 9.6% Y/Y excluding this.

- It did not buy back any shares during the quarter and plans to start doing so in Q2. It added $800M in buyback capacity during the quarter, giving it $1B in total.

f. Guidance & Valuation

- Raised annual revenue guidance by 0.4%, which met estimates.

- Q2 revenue guidance was slightly ahead of estimates. The annual raise was smaller than the Q1 beat. This implies slightly worse-than-expected Q3 and Q4 revenue guidance.

- Raised annual EBIT guidance by 26%, which beat estimates by 23%.

- Q2 EBIT guidance was comfortably ahead of estimates.

- The annual raise was larger than the Q1 beat.

- Raised $2.53 EPS guidance by $0.50, which beat estimates by $0.38.

- Q2 EPS guidance was comfortably ahead of estimates.

- The annual raise was larger than the Q1 beat.

Guidance continues to assume that non-Atlas revenue comp headwinds will represent a $50M headwind for annual revenue. The raise was due to Atlas (a good thing).

Recent negative profit quarters make valuation charts far less valuable. That’s why I used my least favorite metric (sales multiples).

MDB trades for 70x forward EPS. EPS is expected to fall by 15% Y/Y as it laps an abnormally strong period of high-margin non-Atlas revenue. EPS is expected to grow by 20% the next year and by 32% the year after.

g. Call & Release

Demand:

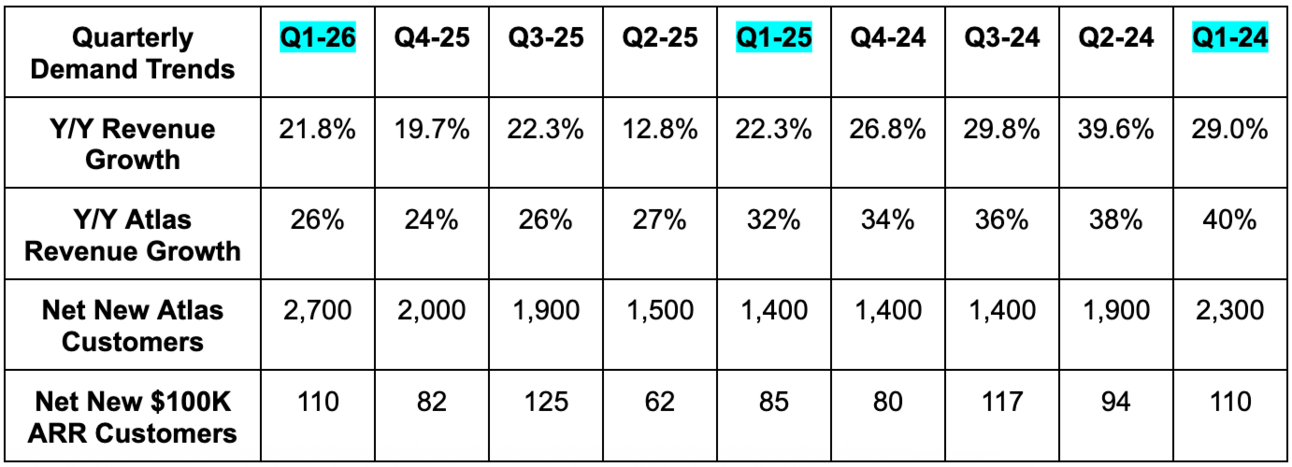

MongoDB added its highest total number of new customers in 6 years. Retention rates were strong, with net revenue retention steady at 119%. For Atlas specifically, consumption was as expected. They did see a dip in April following trade war drama, but February and March were both very good, while May showed a strong M/M recovery. This all helped growth for Atlas accelerate – even when adjusting for more days in this calendar quarter.

- Won CSX to migrate its railroad transportation operations portal.

- LG’s LG Uplus in Korea built its new AI assistant with Atlas and a Vector Search integration.

Competition & Postgres:

- PostgreSQL (Postgres): Popular, open-source relational database system that’s gaining traction with hyperscalers and several other data vendors in their SQL-based offerings.

- JavaScript Object Notation (JSON): Standardized, text-based format for data exchange. MongoDB heavily relies on a JSON document model to power its NoSQL database services. When customers use Atlas, they’re routinely working with JSON-formatted data. MongoDB also stores data via a binary-based version of JSON (BSON) that supports more data types than JSON.

The main theme of the Q&A was developers seemingly embracing Postgres, with both Snowflake and Databricks making purchases in the area to bolster their offerings. Does MongoDB see this as a threat to their NoSQL niche and a reason to think SQL will take share back from its offering? The short answer is no.

Leadership sees this M&A as “validating” the importance of its world-class capabilities within Online Transaction Processing (OTP). Competition is skating to where MongoDB already specializes.

“Architecturally, we are far better optimized for this new world of complex modern applications, especially in the world of AI. MongoDB was designed to address the needs of this modern world.”

CEO Dev Ittycheria

Vendors like Snowflake are fantastic at analytical workload processing, but are less mature in the transactional space. Their move to Postgres is to get better in OTP, which is vital for catering to GenAI and agentic AI needs. It’s what provides needed access to real-time information to power inference capabilities at scale. Dev reminded us that Databricks and Snowflake (through Unistore) had been trying to build out these capabilities internally; he thinks their decisions to buy Postgres vendors serve as evidence of how unique and defensible MongoDB’s architecture truly is. It’s hard to match. The “bolted-on” capabilities these two vendors purchase, per Dev, mean document sizes beyond 2 kilobytes cannot be ingested without conceding “very poor performance.” MDB scales far beyond that because of its natively JSON-fueled NoSQL foundation.

“Some vendors are retrofitting products with JSON or vector support as brittle afterthoughts. This is a tacit admission that our approach is the best way to model real-world data. While their features may check a box, they fall apart in production.”

CEO Dev Ittycheria

Dev then reminded shareholders of how rich MDB’s product suite is beyond data storage & querying. Companies need several point solutions beyond Postgres for things like keyword search, vector search, embedding models and more. They can have all of that in one place via MDB – with superior NoSQL functionality.

Finally, Dev also pushed back on the idea of Postgres taking market share from NoSQL use cases. In his mind, the rising popularity of Postgres is because Oracle and other SQL offerings are ceding rapid share to it. Not because NoSQL demand is shifting back to SQL. Dev thinks Postgres will win more SQL workloads and MongoDB will keep thriving in NoSQL areas – such as AI.

- Zepto migrated its commerce platform away from Postgres to MDB. This helped the client cut latency by 40%, 6x traffic capacity and, generally speaking, improve customer experience. Tools like data sharding (distributing data across many machines to improve scalability and processing throughput) were key contributors to the win.

Fixes Working & Self-Serve Momentum:

MDB attributes a “solid new business quarter” to two main things. First, its product innovation is resonating. For example, MongoDB 8.0 is enjoying its “fastest uptake of any major release,” with adoption pace doubling the previous one. Voyage debuted two new retrieval models with better model accuracy and 80% lower data storage costs. From there, the combined entity launched its own Model Context Protocol (MCP) service with Cursor, GitHub, Anthropic and other needed 3rd-party connections. These connections are what enable developers to create agentic workflows that can more freely tap into the information they need across companies to augment task completion potential.

Second, its revamped go-to-market approach is working. MDB shifted resources to a batch of large enterprise accounts with great up-sell potential. Sales productivity for this newer team is “high” and it’s pleased with momentum.

Part of this go-to-market shift entailed letting its mid-market business become more self-serve. Many mid-market customers prefer initially consuming MDB products in this way, so removing some direct sales resources from this channel (in favor of large enterprises) has not cost them much at all. For review, self-serve means MDB products are procured in a way allowing developers to use them with more autonomy and less MDB support. MDB bases its platform off of what’s best for developers, and in the age of AI, self-serve is routinely the answer. Self-serve means easier on-boarding and building on top of the MDB ecosystem with less red tape. Considering how rapidly AI is evolving, that’s attractive. MDB also offers a semi-managed self-service format, which gives support for the backend maintenance work, thus giving developers that same degree of building freedom without requiring them to do tedious work. That’s really working. Finally, tight integrations with all the other products MDB offers mean this self-serve style comes with seamless access to all tools a developer needs in one place.

- Note that more mid-market self-serve business is why direct sales customers rose by just 5% Y/Y. They expect that to be a consistent theme as these changes play out.

- Self-serve momentum was called particularly strong during the quarter. MDB sees this batch of customers as having especially strong up-selling potential.

Finally, it thinks it’s doing a better job of educating customers on the value of Atlas. Whether that’s more thoughtfully equipping its team with certifications or being more present in investor events across the globe, they’re actively seeking out new business rather than relying on in-bound interest. They’ve also added onboarding documentation in four new languages to support global growth.

AI Positioning:

MDB envisions the FY 2026 financial contribution from AI as modest. It does have some companies experimenting with GenAI apps built with its platform, but “enterprises are still early in overall AI adoption.” Hesitation comes from finite knowledge and skills, as well as lack of trust in models. Its fully managed app-building ecosystem (and broad integrations) + Voyage helps with those things. It’s adamant that when infrastructure focus shifts to building custom GenAI apps, its platform is poised to capture a significant chunk of that demand. It knows that its ability to help modernize data and apps, paired with Atlas and products like MAAP will be a winning recipe in AI. We hear from countless firms that an AI strategy is not possible to implement without a strong, non-archaic data foundation. And that’s really where MDB thrives.

Leadership:

MongoDB hired Mike Berry as their new CFO. Berry doesn’t plan to change much beyond the previous go-to-market fixes. His main focus will be on advancing operating efficiency and shifting some focus to margin expansion (hallelujah). He has been the CFO at McAfee and NetApp, along with 5 other scaled companies as part of his 30 years of experience.

h. Take

Much better quarter than last time around. The company’s new CFO seems determined to prioritize margin optimization more than his predecessor. That’s already showing up in results without sacrificing any kind of revenue generation. The real AI demand contribution hasn’t even begun yet for MDB, so this demand resilience hints at the cost cuts eliminating redundant, unneeded pieces of the business… rather than needed assets. This company got bloated and is now fixing things. That leads me to wonder “what was the old CFO doing,” but the more important thing is that Berry is focused on the right things. I think Atlas is an excellent business and Voyage + app migration and building tools give them more of an overarching platform to sell. That should allow them to more effectively bundle products together, juice cross-selling opportunities and augment customer retention.

At 72x forward EPS and 99x forward FCF, this name is very expensive. That’s especially true considering EPS will fall this year, before compounding at a roughly 25% clip over the next two years (for a 2.9x growth multiple even when ignoring this year). Its FCF growth multiple is also right around 2x. While I think this is a high-quality company that just delivered their best quarter in nearly a year, I find other deals in software to be more compelling.

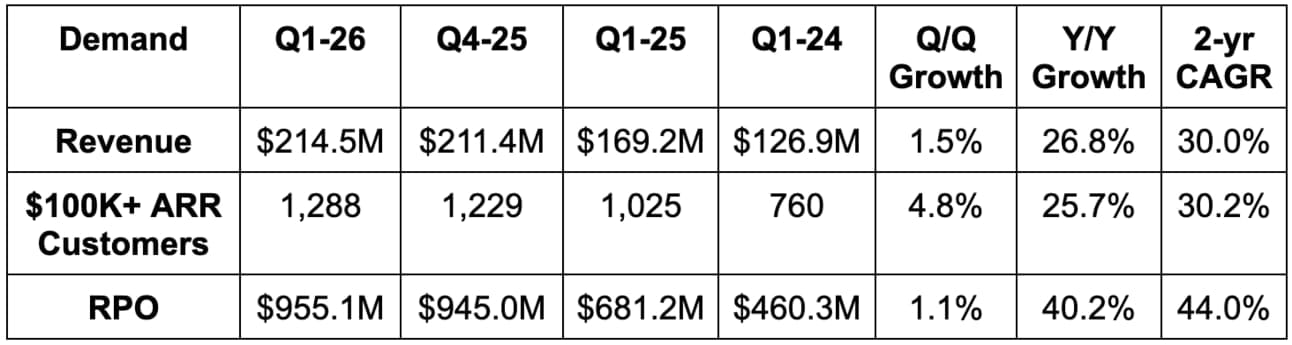

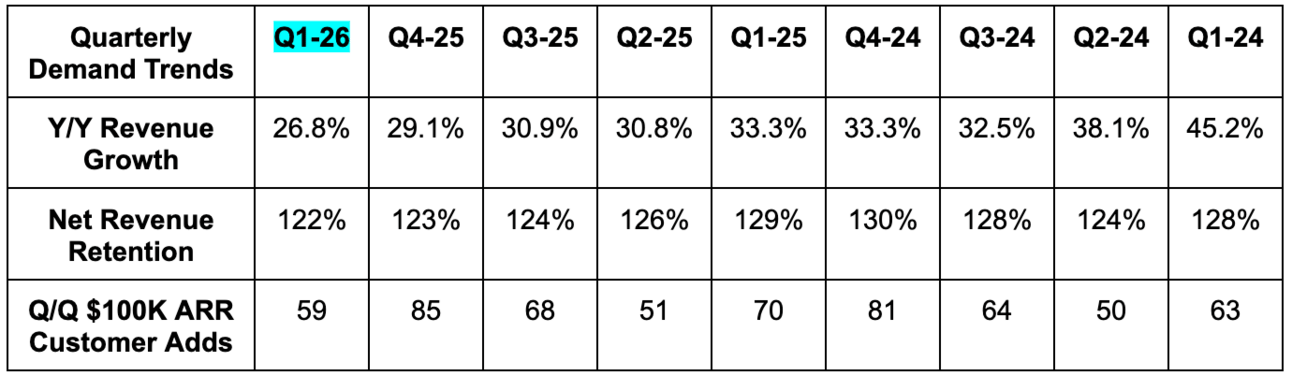

2. Earnings Snapshots – GitLab (GTLB) & Adobe (ADBE)

a. GitLab

Demand:

GitLab beat revenue estimates by 0.6% & beat guidance by 0.9%. Its 30% 2-year revenue CAGR compares to 31.2% Q/Q & 31.7% 2 quarters ago.

Profits & Margins:

- Beat $22.6M EBIT estimate by $3.5M & beat guidance by $4.6M.

- Beat $0.14 EPS estimate by $0.03 & beat guidance by $0.035.

Balance Sheet:

- $1.1B in cash & equivalents.

- No debt.

- Diluted share count rose by 4% Y/Y.

Guidance & Valuation:

- Reiterated annual revenue guidance, which missed estimates by 0.3%.

- Raised annual EBIT guidance by 6.7%, which beat estimates by 1.5%.

- Raised annual $0.73 EPS guidance by $0.045, which beat estimates by $0.015.

- Q2 guidance was slightly behind on revenue and EBIT and slightly ahead on EPS.

GitLab trades for 56x forward EPS. EPS is expected to grow by 2% this year, following 270% EPS growth last year. EPS is then supposed to grow by 23% the following year and by 35% the year after that.

b. Adobe

Demand:

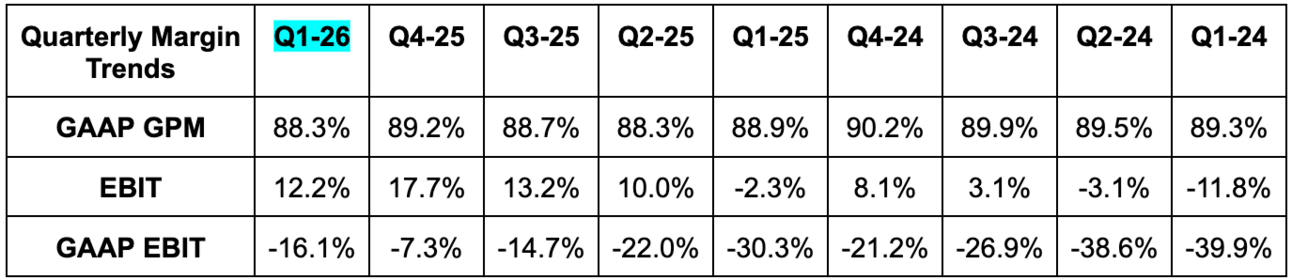

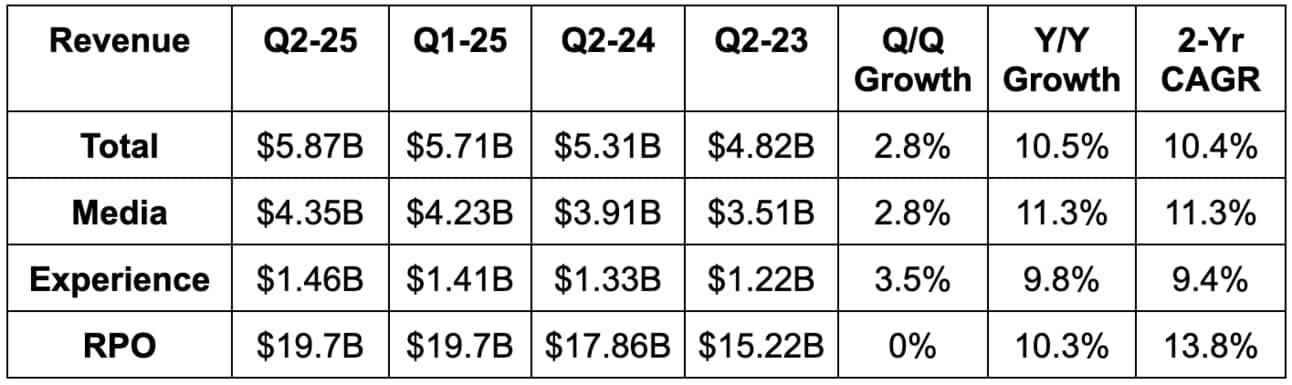

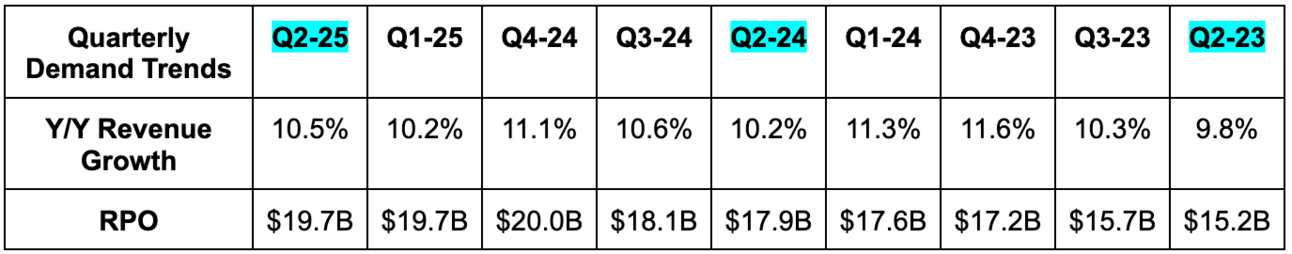

- Beat revenue estimate by 1.2% & beat guidance by 1.3%. Its 10.4% 2-year revenue CAGR compares to 11.3% Q/Q & 10.4% 2 quarters ago.

- Digital Media revenue beat guidance by 1.5%.

- Digital Experience revenue beat guidance by 1%.

- Missed remaining performance obligation (RPO) estimate by 0.6%.

- The lack of Q/Q RPO growth like we’ve seen in recent years between Q1 and Q2 could explain the lackluster share reaction. That’s a highly important forward-looking demand indicator.

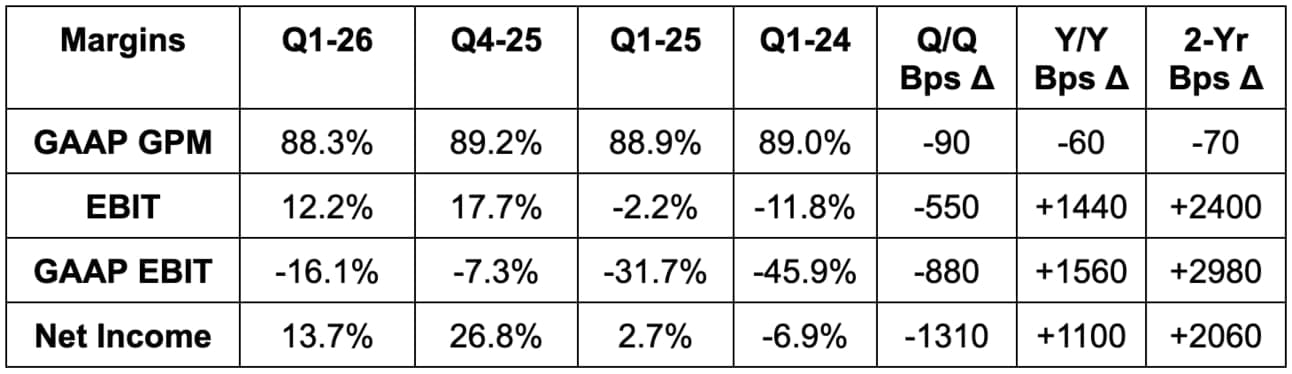

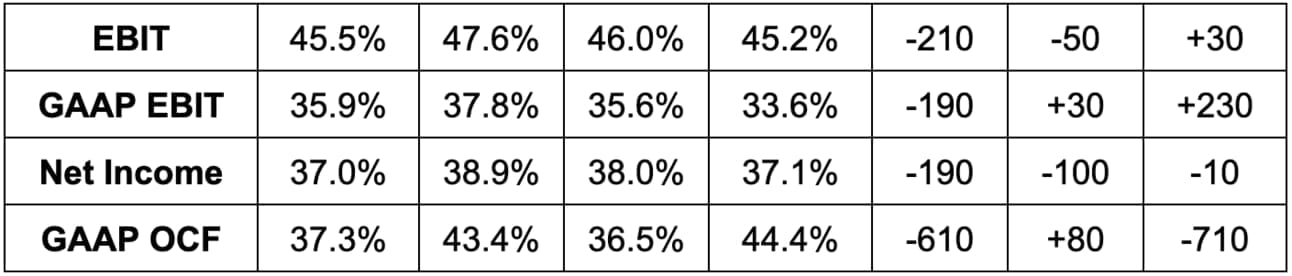

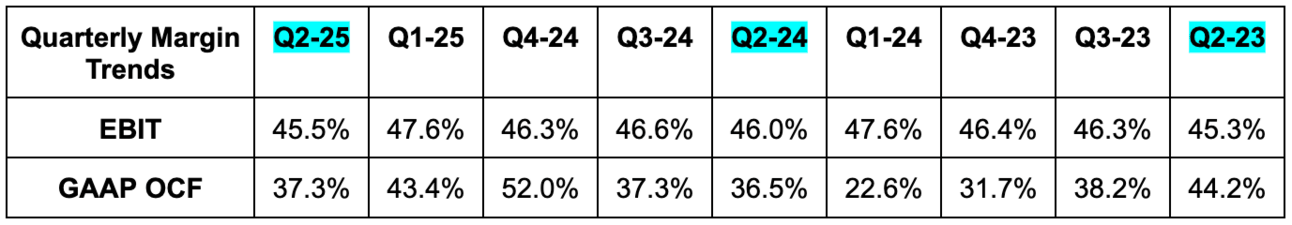

Profits & Margins:

- Beat EBIT estimate by 2%.

- Beat GAAP operating cash flow (OCF) estimate by 9.5%.

- Beat $4.97 EPS estimate by $0.09 & beat guidance by $0.095.

- Beat $3.87 GAAP EPS estimate by $0.07 & beat guidance by $0.115.

Balance Sheet:

- $5.7B in cash & equivalents.

- $6.2B in debt.

- Diluted share count fell by 4.9% Y/Y.

Annual Guidance & Valuation:

- Raised annual revenue guidance by 0.5%, which beat estimates by 0.4%.

- Annual digital media guidance was raised by 1.1%.

- Annual digital media ending ARR growth was reiterated.

- Annual digital experience guidance was reiterated.

- Raised annual $20.35 EPS guidance by $0.20, which beat by $0.19.

- Raised annual $15.95 GAAP EPS guidance by $0.45, which beat by $0.35.

Adobe trades for 19x forward EPS. EPS is expected to grow by 12% in each of the next two years.