I published my Snowflake & Palo Alto Earnings Reviews during the week. I also published a portfolio & performance update. Next week, I will be covering Nvidia, Salesforce, Zscaler and SentinelOne Earnings.

In case you missed it from this earnings season:

- Trade Desk Earnings Review

- DraftKings & Coupang Earnings Reviews

- Shopify & Mercado Libre Earnings Reviews

- Uber Earnings Review

- Apple & Duolingo Earnings Reviews

- AMD & Datadog Earnings Reviews

- Lemonade Earnings Review

- Sea Limited & Cava Earnings Reviews.

- Palantir & Hims Earnings Reviews

- SoFi Earnings Review

- PayPal Earnings Review

- Meta, Robinhood & Starbucks Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Alphabet Earnings Review

- Tesla Earnings Review

- Chipotle Earnings Review

- ServiceNow Earnings Review

- Netflix & Taiwan Semi Earnings Reviews

- Nu, On Running & Cloudflare Earnings Reviews.

Table of Contents

- 1. Earnings Snapshots – Workday & Deckers

- 2. Alphabet (GOOGL) – IO 2025 Event & More

- 3. Airbnb (ABNB) – Catch-Up Earnings Review

- 4. Amazon (AMZN) – Chips & no Dip

- 5. CrowdStrike (CRWD) – Kurtz

- 6. Nu (NU) and Mercado Libre (MELI) — Latin Americ …

- 7. Headlines

- 8. Macro

1. Earnings Snapshots – Workday & Deckers

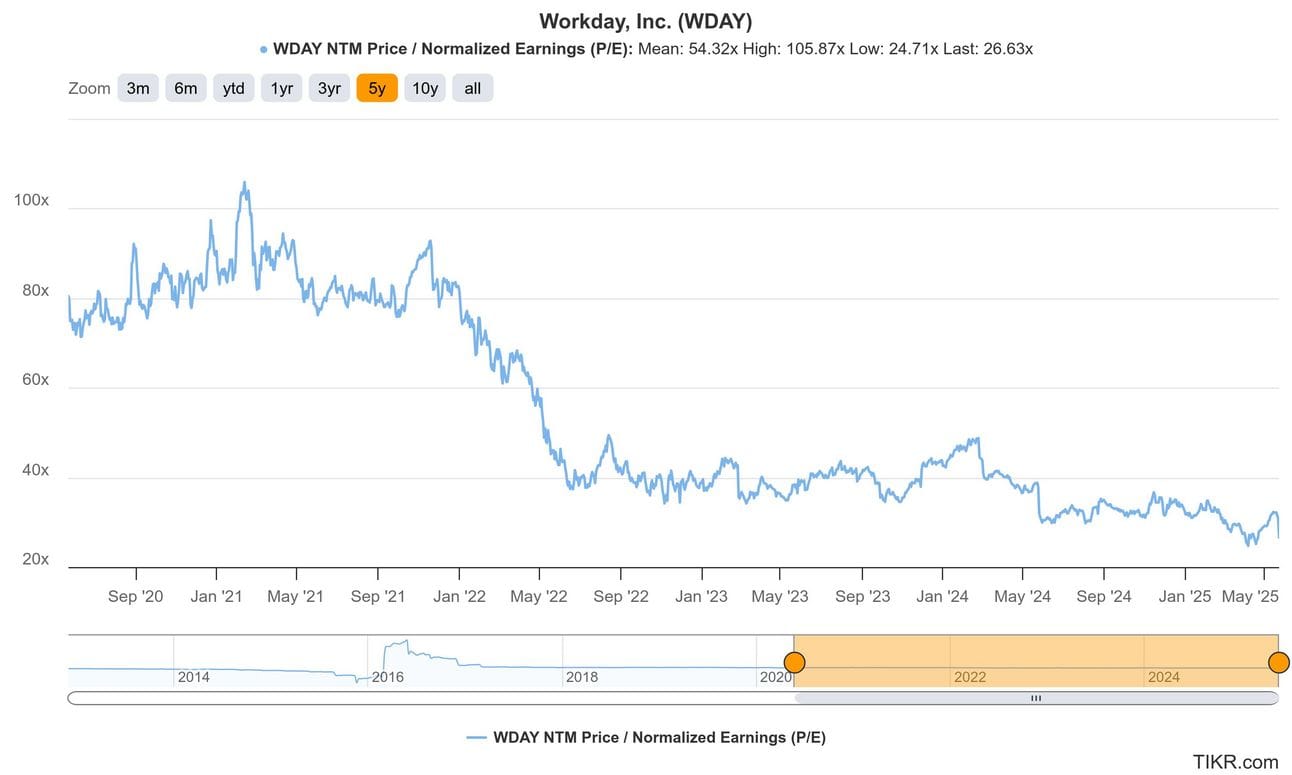

a. Workday (WDAY)

Results:

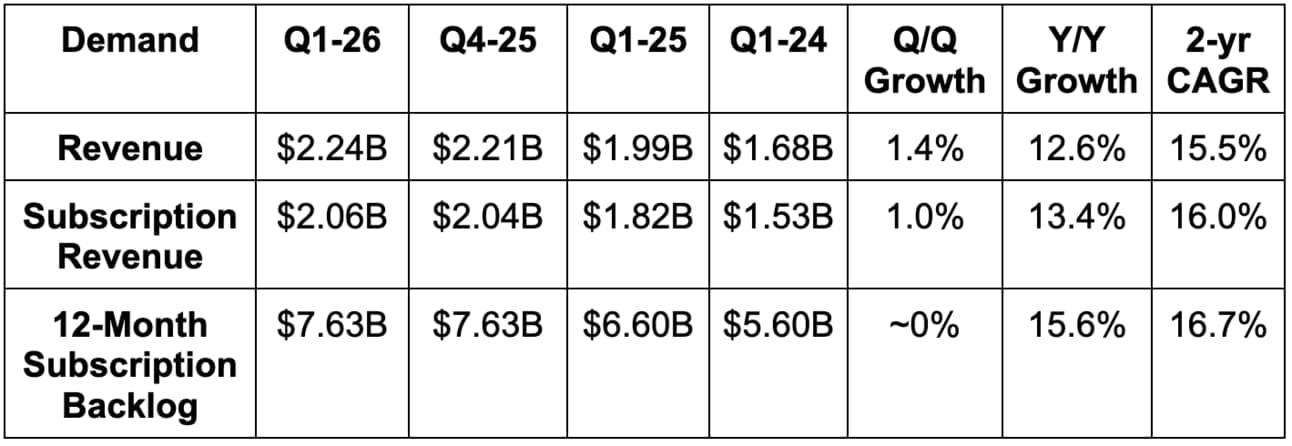

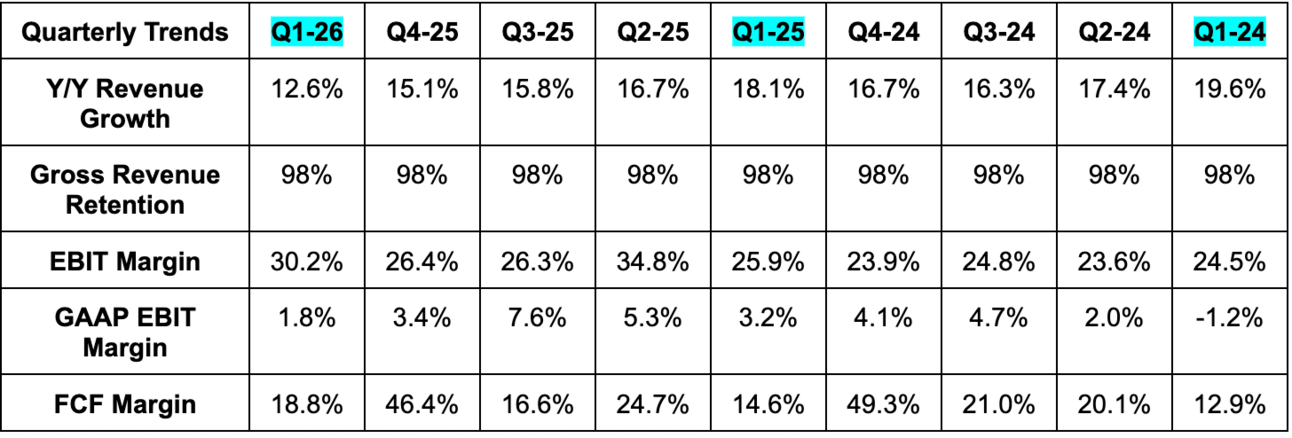

- Beat revenue estimate by 0.9%.

- Slightly beat subscription revenue estimate & beat guidance by 0.5%.

- Beat 12-month subscription backlog estimate by 0.5%.

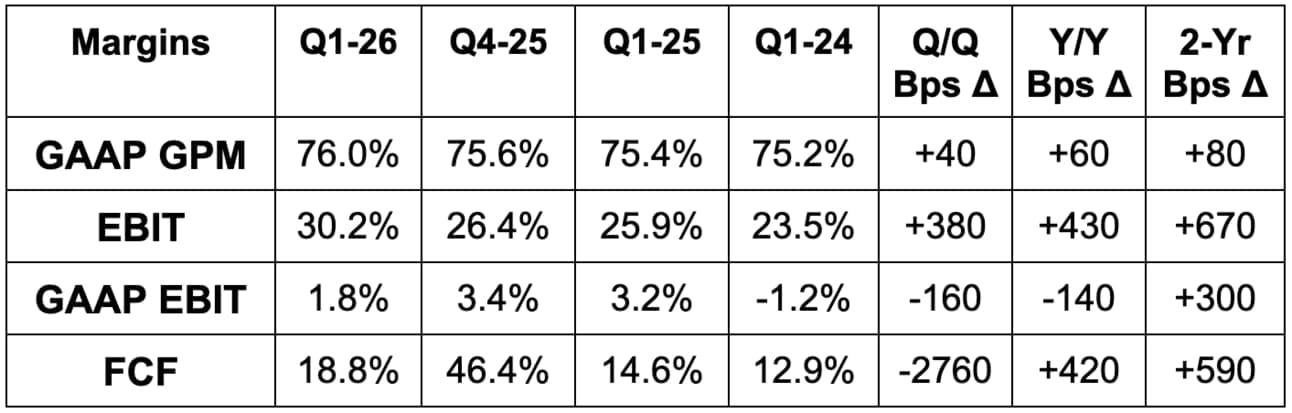

- Beat EBIT estimate by 8.8% & beat 28% EBIT margin guidance by 220 bps. A moderated pace of hiring helped drive the beat.

- GAAP EBIT margin was 9.1% ex-restructuring charges.

- Beat $2.01 EPS estimate by $0.22.

Guidance & Valuation:

- Q2 subscription revenue very slightly missed estimates by 0.2%. You could call this a rounding error.

- Q2 28% EBIT margin guidance beat 27.6% margin estimate.

- Workday reiterated annual subscription revenue guidance, implying slightly lower Q2-Q4 expectations (considering the small Q1 beat). They seem to be approaching macro cautiously. 28% EBIT margin guidance was also reiterated and in line with expectations.

Balance Sheet:

- $8B in cash & equivalents.

- $3B in debt.

- Basic share count rose 0.8% Y/Y.

- Diluted share count was flat Y/Y.

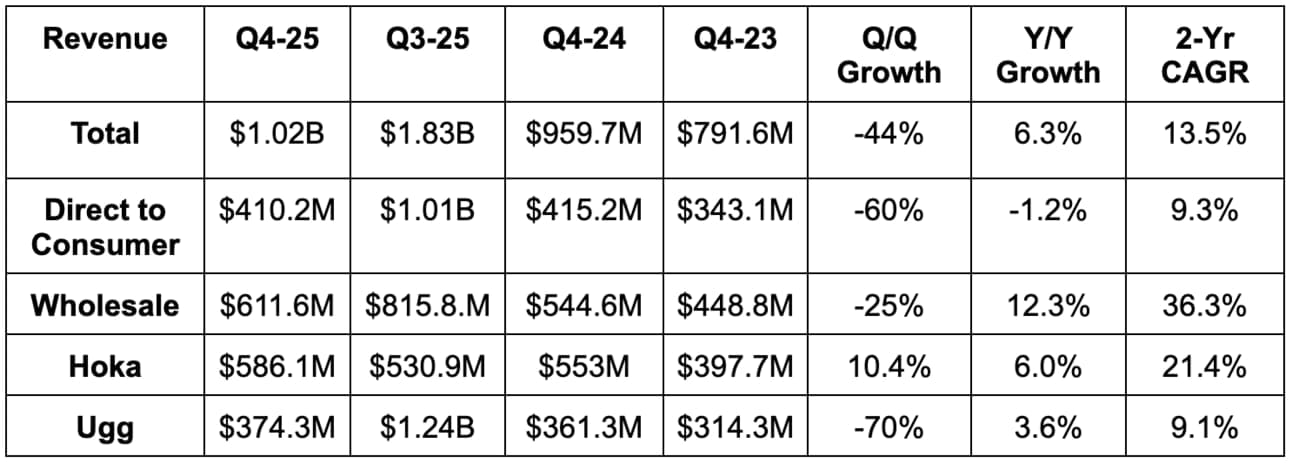

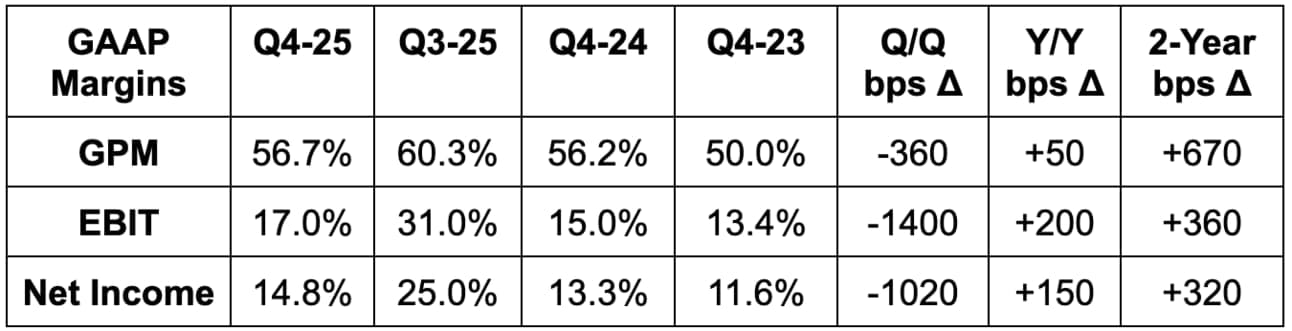

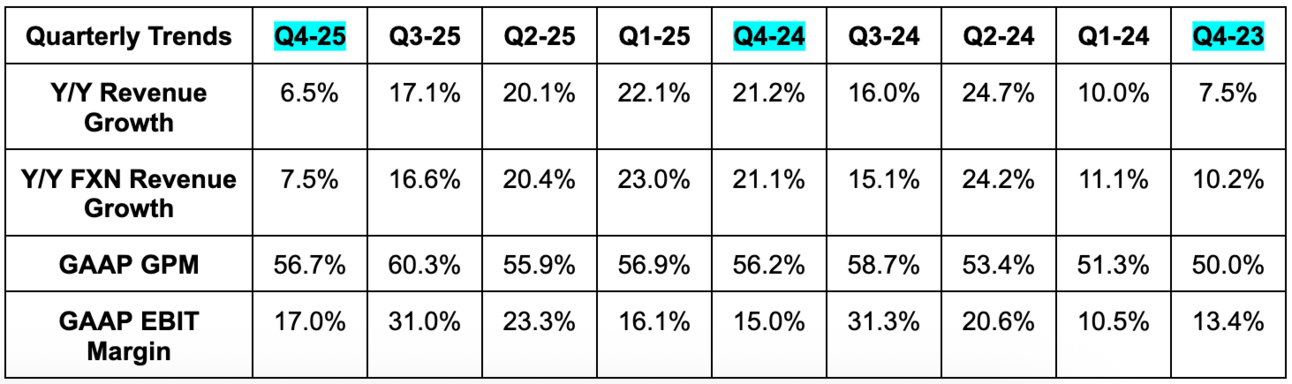

b. Deckers (DECK)

Results:

- Beat revenue estimate by 1.6% & beat guidance by 9%.

- Estimates shifted to reflect currency favorability during the quarter. Revenue grew 7.5% Y/Y FXN.

- Revenue is seasonal. Q/Q comp is not important.

- Beat EBIT estimate by 58% & beat guidance by more than 100%.

- Beat $0.60 EPS estimate by $0.60.

- Beat 54.2% GPM estimate by 250 bps.

Guidance & Valuation:

- Deckers refrained from providing full-year guidance like it normally does. It cited uncertain macro as the reason.

- Q1 revenue guidance missed estimates by 2.7%.

- $0.65 Q1 EPS guidance missed estimates by $0.14.

Balance Sheet:

- $1.89B in cash & equivalents.

- Inventory rose by 4.4% Y/Y.

- No debt.

- Share count fell by 2% Y/Y.

2. Alphabet (GOOGL) – IO 2025 Event & More

As a reminder, this company ironically flags emails as spam when you use their name too many times. That’s why I will use “mega-cap” and “Search King” a lot throughout this piece.

The theme of this event was the firm driving rapid product innovation across every part of its full-stack AI machine… from models, to infrastructure to apps. That will be the focus of this piece.

AI Infrastructure Foundation Facilitating Leading Model Strength:

The Search Giant has broad product offerings for every facet of the AI opportunity, and the foundational hardware arm may be the key enabler of it all. It’s how Alphabet builds what it views as the most efficient data centers on the planet. It’s how the company can create purpose-built compute for specific needs in a less general fashion than GPUs can. It’s highly important.

Without this ironclad foundation, the mega-cap would not be leading the LMArena rankings in every single major benchmark… from reasoning to teaching to math and coding. It would not be doing that while offering world-class performance and output token efficiency. Without this same foundation, it would not have the three fastest models on the planet and would not be driving such rapid upward progress in its Elo scores (popular ranking system for models and other things). Simply put, this foundation is like feet for the body. Without them… we’re not going very far. And with them? This company is able to move forward at the pace needed to keep leading this hyper-competitive field. And this isn’t just a leadership claim; it’s world-renowned, independent research organizations affirming it.

Going forward, the organization will feature a constant, brisk pace of model innovation like the brand new Gemini 2.5 Flash iteration just announced. This is faster and cheaper than the current version… which was already the fastest and most efficient workhorse model out there. I say all of this because sentiment across social media would probably make people very surprised to learn that this enterprise is the best of the best at driving model improvement. And again, that is because of innovation like its 7th generation TPU driving 10x performance gains.

It pairs all of this model, research and infrastructure strength with 7 products distributed to 2+ billion people and all of the unique data that entails to drive better model training. Simply put, it’s in a far better spot than most investors seem to think.

“There's usually a hard trade-off between price and performance, yet over and over, we've been able to deliver the best models at the most effective price point. Not only are we leading this Pareto frontier, we've fundamentally shifted the frontier itself.”

CEO Sundar Pichai

AI Adoption Progress: