Table of Contents

- 1. Snowflake (SNOW) — Earnings Review

- 2. Palo Alto (PANW) – Earnings Review

- 3. DraftKings (DKNG) – New Position & M&A

- 4. Uber (UBER) – Ackman & In-Person Work

- 5. Latin American News of the Week – Nu (NU) & Mer …

- 6. Lululemon (LULU) – Reshuffle

- 7. Alphabet (GOOGL) and Shopify (SHOP) – Deepening …

- 8. PayPal (PYPL) – Venmo & a Notes Offering

- 9. SoFi (SOFI) – Miscellaneous

- 10. Earnings Round-Up – Workday (WDAY) & ELF Beaut …

- 11. Headlines

- 12. Macro

- 13. My Portfolio

1. Snowflake (SNOW) — Earnings Review

Snowflake 101:

Snowflake’s overarching platform is called the Data Cloud. This infrastructure unlocks the ability to affordably store, organize, query and learn from data sources at gigantic scale. It offers these services with elastic compute capabilities to allow for flexible scaling up and down of usage. The architecture naturally separates the functions of data storage and consumption, unlike legacy data warehouse solutions. That means data consumption capacity is untethered from public computing resources. This removes the computing capacity bottleneck and enhances the scalability of data storage.

Under this framework, I can store as much data as I want without the requirement for immediate processing. That processing utilizes computing capacity. In Snowflake’s case, the storage is done in a centralized data repository in the Snowflake Data Cloud. It’s processed only as needed. Data is utilized virtually, which removes the need for dedicated hardware. This scalable (or “elastic”) reality limits waste and cost. Snowflake does all of this for clients in a managed fashion to minimize client talent and infrastructure needs. There are a few key products to know & track:

The Snowflake Data Warehouse is where structured data is stored and (on command) processed. Structured data is formatted data. It’s utilized for record keeping and report creation. Data can be easily fetched via structured query language (SQL).

Snowflake Data Lake does what the warehouse does for unstructured data. Unstructured data is unformatted and used to uncover new insights and patterns.

- This debuted in 2020 (Warehouse in 2014).

- Generative AI leans heavily on unstructured data for model training. This means that proliferation will directly support unstructured data consumption on Snowflake.

“We announced support for unstructured data over 2 years ago. Now, about 40% of our customers are processing unstructured data on Snowflake. And we've added more than 1,000 customers in this category over the last 6 months.” – CEO Sridhar Ramaswamy

“Snowpark” is its application-building platform. It frees developers to work with data in any source code language. With it, developers can process and visualize data (through Snowpark functions) and build apps (through Snowpark Native Apps). Snowpark is their data-equipped playground to build new things. GenAI models are voracious data consumers. Snowpark Container Services allow GenAI models to run closer to the data that they require. This enhances performance and expedites model training. Movement of apps, workloads and developer attention from Apache Spark to Snowflake is a key source of growth here.

Snowflake data sharing is its secure product for, as the name indicates, sharing data among the rest of Snowflake’s participating users. As more opt in, a compelling network effect of relevant data builds and Snowflake’s value proposition deepens.

Miscellaneous tools:

- Snowflake Machine Learning is its suite for training ML models within the Snowflake Data Cloud. This can be used to automate data querying and organization.

- Snowgrid is an omni-cloud tool to unite a client’s data across the various clouds they use.

Snowflake’s revenue model is consumption-based in nature. This means visibility compared to SaaS business models is not as strong. It also means customers can more easily scale down (or up) usage when times are bad (or good).

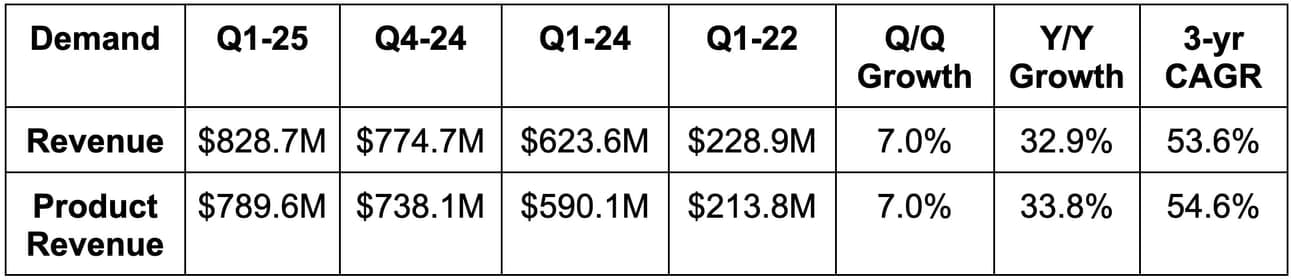

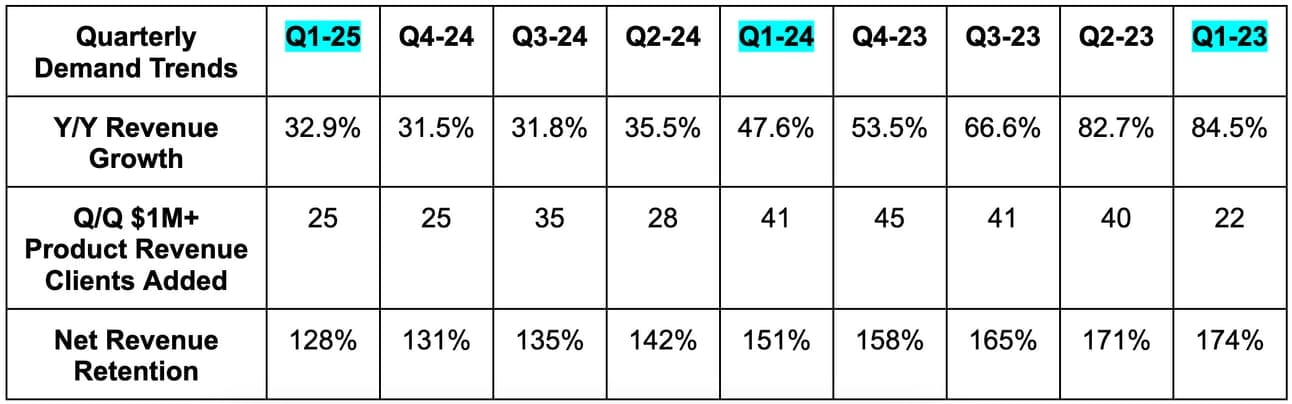

a. Demand

- Beat product revenue estimates by 5.6% & beat guidance by 5.7%.

- Product revenue excluding leap year rose 32% Y/Y.

- Beat revenue estimates by 5.3%. Its 53.6% 3-year revenue compounded annual growth rate (CAGR) compares to 60% last quarter and 66% 2 quarters ago.

- Excluding tiered storage (more volume-based discounting for smaller clients) headwinds, revenue rose by 34% Y/Y.

- $1 million+ product revenue customers rose 30% Y/Y; Global 2000 customers rose 8%.

- Remaining Performance Obligations (RPO) rose 46% Y/Y. That’s a strong forward-looking indicator for demand.

- Usage headwinds for its 10 largest customers continued to diminish. 7 of its 10 largest accounts grew revenue contributions Q/Q.

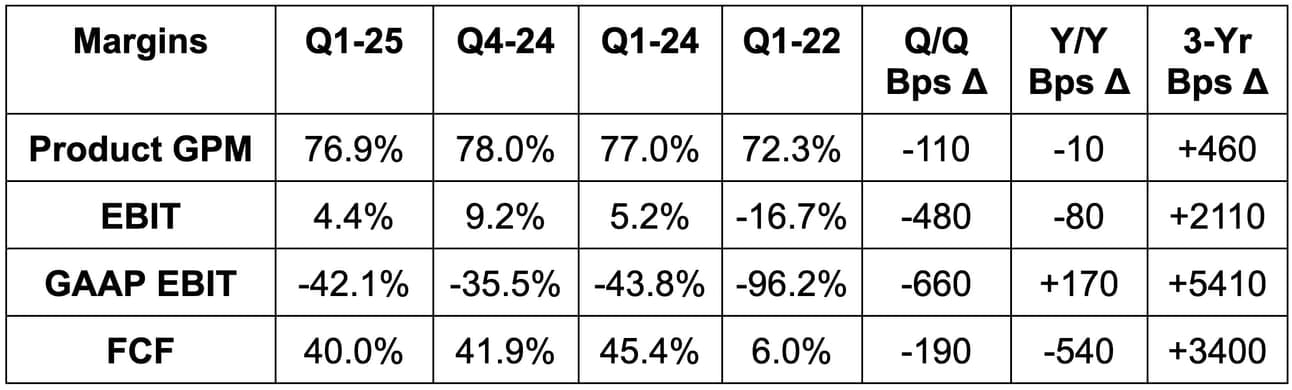

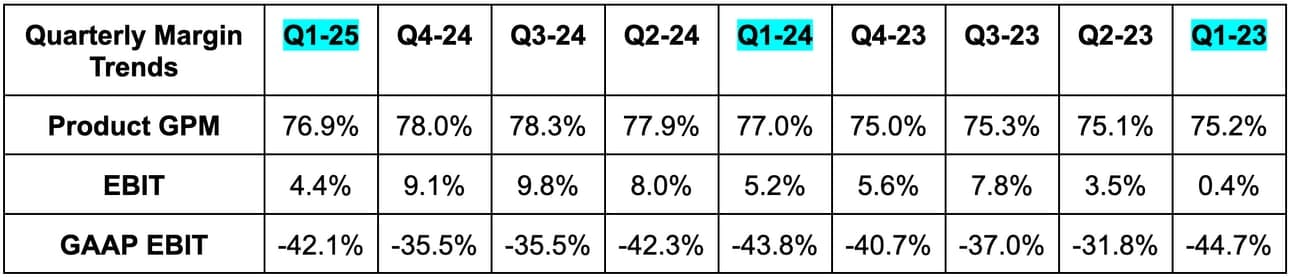

b. Profits & Margins

- Beat $27M EBIT estimate by $9M & beat 3.0% EBIT margin guidance by 140 basis points (bps; 1 basis point = 0.01%).

- Missed $0.17 EPS estimates by $0.03.

c. Balance Sheet

- $3.5B in cash & equivalents.

- No debt or convertible senior notes.

- $927M in investments.

- Head count rose 4.2% Q/Q and 15.6% Y/Y.

- Share count rose by 3% Y/Y. It repurchased $516M in stock and has $892M left on its current buy-back plan.

d. Annual Guidance & Valuation

- Raised annual product revenue guidance by 1.5%, which beat estimates by 1.5%. Demand guidance continues to exclude any potential contribution from newer products.

- Lowered EBIT margin guidance from 6% to 3%, which missed estimates by 300 bps.

- Lowered FCF margin guide from 29% to 26%, which missed estimates by 300 bps.

The margin cuts were related to updated plans to invest $50 million in graphics processing units (GPUs) and its purchase of TruEra AI Observability. TruEra optimizes large language model (LLM) building by guiding best practices for data usage, while delivering anomaly detection and model hallucination minimization (fewer wrong answers). This should help sharpen Snowflake’s efficiency-first, cost-minimizing model-building niche. Snowflake added 35 employees as part of the purchase.

Snow trades for about 150x this year’s EBITDA and 240x this year’s EPS. EBITDA and EPS are both set to materially fall Y/Y, before resuming expected rapid growth next year.

e. Call & Release

New CEO Sridhar Ramaswamy’s Priorities – Perfect the go-to-market:

Ramaswamy’s 3 priorities are: to listen and learn from customers, perfect SNOW’s go-to-market processes, and to accelerate product innovation and development. He spent the most time talking about the last two items. From a go-to-market point of view, the company is implementing sales processes and dedicated workloads (like for AI or data engineering) to drive product-market fit. Ramaswamy thinks steady progress has already been made; at the same time, he also thinks there’s “more to gain” in terms of efficiency to drive “further revenue growth.”

New CEO Sridhar Ramaswamy’s Priorities – Accelerate Product Innovation and Development:

Snowflake leadership has recently been critical of their own pace of innovation. They bluntly told the world that they needed to move faster, and signs of this happening are already emerging. Its mid-sized language model (MLM) called Arctic outperforms much larger models, such as Meta’s older Llama 2 on some benchmarks. This was built in 90 days and for an “eighth of the training cost vs. similarly-sized peer models.” Arctic was purpose-built for enterprise data and open-sourced to allow users to easily build models and apps. This, like for all open-source models, means 3rd party developers will improve Arctic over time through their own work. Arctic ranks highly in standard query language (SQL) generation and code following.

We can’t get through an innovation section without talking about AI. Sorry… I don’t (do) make the rules. Cortex AI is what Snowflake calls its “AI layer.” It’s a slew of GenAI-powered tools to (as Snowflake always says) bring AI, application-building and analytics right “to a customer’s data.” Cortex can summarize and derive meaning from seemingly unstructured text, help beginners write SQL, gauge human sentiment from jumbled data and help with sharpening pattern recognition to tighten forecasting. 750 customers are now using it.

- Snowflake sees data migration, cleansing, engineering, SQL writing and an analytics copilot as GenAI areas of focus.

- It does not think it needs to invest billions in GPUs to build LLMs like many others are doing. Snowflake believes that most of the applications it needs can be powered by small and medium models.

“A cool thing about Cortex AI, in the context of our consumption model, is that our customers don't have to make big investments to see what value they're going to get because they don't have to make commitments to how many GPUs they rent. They just use Cortex AI, for example, right from SQL. And this means they can focus on value creation.” – CEO Sridhar Ramaswamy

- Snowflake Unistore is Snow’s hybrid table product, which can ingest and organize transactional and analytical workloads. This will be fully released later in the year. It will unlock many new types of applications that rely on transactional workloads in an efficient manner. Snow has specialized in analytical workloads to date.

- Document AI is its product that can derive structured insights and patterns from unstructured datasets.

- Snowflake will debut container services this year to manage the deployment of apps to runtime. More than half of Snowflake’s customers are using Snowpark.

Snowflake is currently finishing up its Iceberg table support, which will roll-out later in the year. These are open-sourced data storage offerings, often with lower storage costs, open-source integration flexibility and more data control. The proliferation here is leading to data storage and duplication revenue headwinds, with storage making up about 10% of Snowflake’s total business. Iceberg is creating more open access to data for enterprises. While this is a near-term headwind as some data is moved from Snowflake to Iceberg tables, leadership continues to think it will be a future accelerant. Clients who adopt these open source tables routinely have 90%+ of their data already outside of Snowflake. They will now see less friction associated with using all of Snow’s other applications and services for larger sums of their data. Storage is only 10% of revenue. This process will hurt that 10%, but may help the other 90% over the longer term.

Data Sharing:

33% of Snow’s customers are now sharing data with the rest of the ecosystem in some capacity vs. 24% Y/Y and 28% Q/Q. This creates a compelling network effect where Snow’s products become more uniquely valuable and potential clients are more incentivized to sign on. This quarter, the network effect, through a partnership with Fiserv, led to it winning 20 clients.

f. Take

This was a fine quarter. There were some pros and cons. The Q1 outperformance on the top line was certainly the highlight, and the smaller annual top line raise is likely just prudence regarding some baked-in assumptions. The innovation engine is accelerating and rapid RPO growth is a good hint for faster revenue growth in the future. Conversely, the margin cuts were quite material as it leans into CapEx to support its GenAI ambitions. This is likely the correct decision for the long haul, but as one of the most expensive stocks on the planet, investors should be able to demand investment and continued margin expansion.

2. Palo Alto (PANW) – Earnings Review

Palo Alto is a cyber security company competing across endpoint, cloud and network use cases. Most of its platform is made up of integrated M&A, while it competes with pretty much everyone besides identity brokers in the space. The network security suite is called Strata; the endpoint security suite is called Cortex (not the same as Snowflake’s Cortex product above); the cloud security suite is called Prisma. 13% of its customers now use all 3 platforms, with 51% using 2 of them. There’s a legacy network hardware portion of this business and next generation endpoint, cloud and network portions too. For other cybersecurity disruptors in endpoint and network, the next generation portion of this company is the read-through.

a. Demand

- Roughly met billings estimates & slightly beat billings guidance.

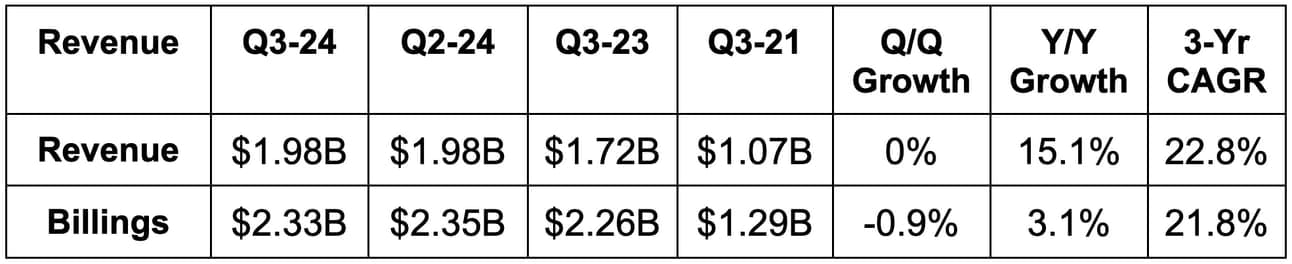

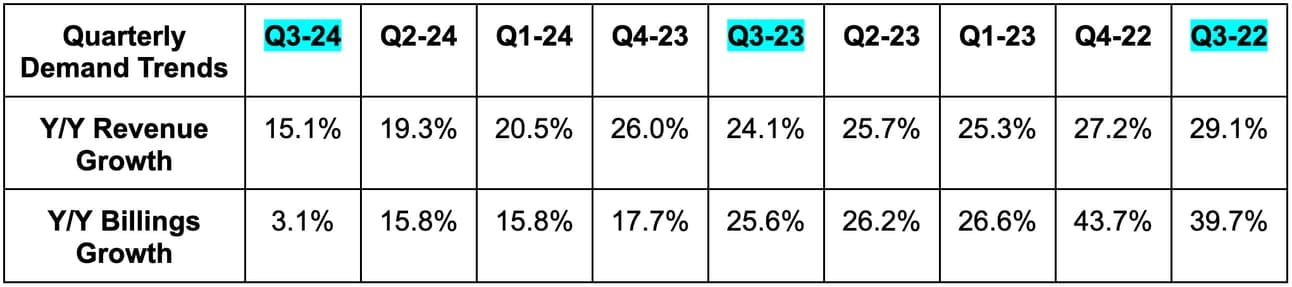

- Beat revenue estimates by 0.7% & beat guidance by 0.8%. PANW’s 22.8% 3-year revenue CAGR compares to 24.7% Q/Q & 25.7% 2 quarters ago.

- Next-gen security (NGS) annual recurring revenue (ARR) rose by 47% Y/Y.

- Product revenue rose 1% Y/Y while service revenue rose 20% Y/Y.

b. Profits & Margins

- Beat $1.25 EPS estimates & identical guidance by $0.07 each.

- Beat FCF estimates by 15.6%.

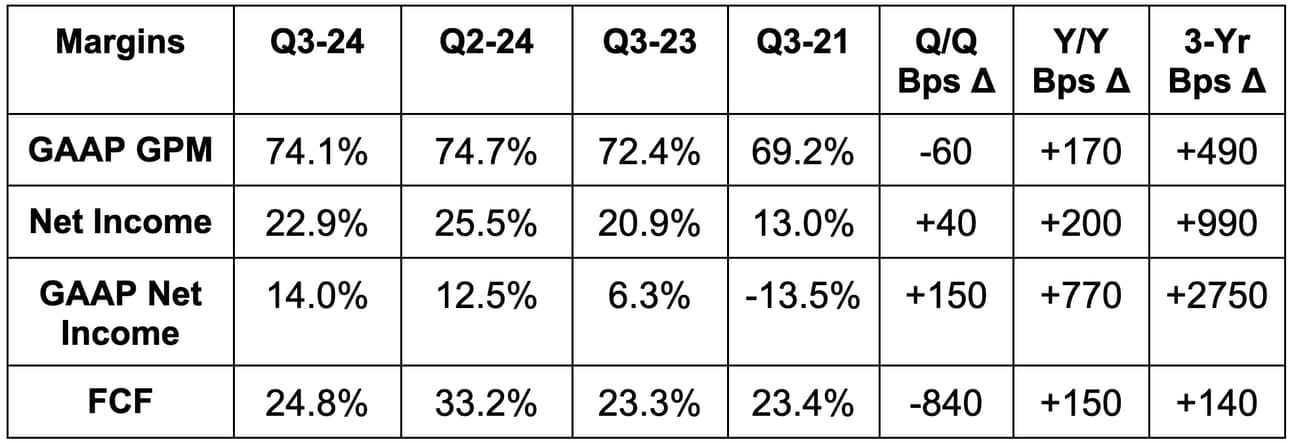

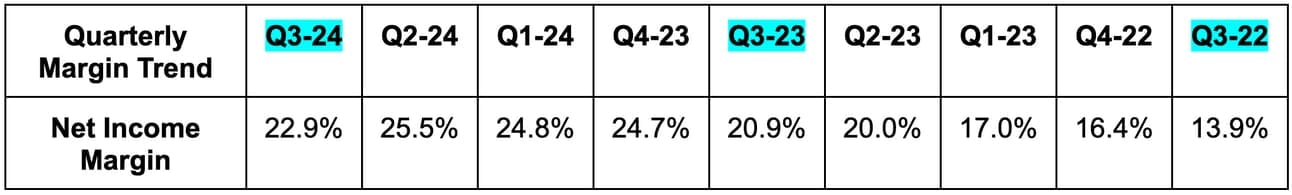

Please note that the Q2 2024 GAAP net income margin line excludes a one-time tax benefit.

c. Balance Sheet

- $1.9B in cash & equivalents.

- $3.5B in long term investments.

- $1.16B in convertible notes.

- Diluted share count rose 2.9% Y/Y.

d. Guidance & Valuation

- Slightly raised annual billings guidance by 0.5%, which roughly met expectations.

- Slightly raised annual revenue guidance by 0.3%, which roughly met expectations.

- Raised $5.50 annual EPS guidance by $0.07, which beat by $0.05.

- Second quarter guidance was exactly in line across the board.

- Raised NGS ARR growth guide from 34.5% Y/Y to 38% Y/Y. It also reiterated its $15 billion in NGS ARR by fiscal year 2030 guidance.

PANW trades for 57x this year’s earnings with EPS expected to grow by 25% Y/Y this year and 11.4% Y/Y next year.

e. Call & Release

The Threat Environment:

More of the same here. Between nation-state adversaries exploiting zero day (new) vulnerabilities and sophisticated attacks on large enterprises, the need for cybersecurity tools continues to rise. The new SEC disclosure mandates are merely adding to this momentum by highlighting the companies that are taking these real threats seriously… and those that aren’t. GenAI is lowering the bar for hackers to conduct detailed, intricate breaches and making rapid remediation all the more important. GenAI is also pushing companies to rapidly migrate their data and assets to cloud environments that can support next-gen apps and use cases. That heightens the need for strong protection. Across endpoint, cloud and network security, the demand environment remains robust. There was no mention of budget fatigue like last quarter, but instead commentary surrounding healthy budgets for Palo Alto’s products.

Platformization Progress:

As a reminder, last quarter PANW embraced what it calls “platformization.” This simply refers to pushing clients to embrace the full suites within all three of its platforms. The company had been waiting for contracts with competing point solution vendors to pursue these cross-selling opportunities. Now, it is proactively offering free trials to these clients while contracts unfold. This offers proof of concept and shrinks the sales cycle. PANW also believes this platformization process will help it stand out from legacy firewall vendors and firms with less complete offerings. It’s how companies “can keep pace with the volume of threats” to gain a more holistic view of operational security.

The team talked up its product leadership in 23 different subsections of its markets and wants to more proactively promote this holistic leadership to customers to further drive differentiation. The words platform and platformization appeared a combined total of 81 times in their earnings remarks. Maybe they’re trying to tell us something. Just maybe. To date, PANW has completed 900 platformizations, with its sights set on 1,600 more.

The IDC published a study highlighting the impact of PANW platformization. Per that research firm, the process directly lowers annual cost by 10% for customers and boosts efficiency by 30%-40%.

Platformization Financial Impact:

There are some financial positives and negatives stemming from this evolution over the next 18 months and beyond. First, the good. A big piece of platformization is pushing clients to its NGS products like cloud detection and response (CDR) and Extended Security Intelligence and Automation Management (XSIAM). When it lands a non-platformized customer, initial ARR is somewhere between $200,000-$300,000. For platformized customers, depending on how many of the 3 pillars they’re using (Cortext, Prisma, Strata) that jumps to $2,000,000-$14,000,000. The impact is massive.