Welcome to the hundreds of new subscribers who have joined us this week. We’re delighted to have you and determined to provide as much value as possible.

1. Olo (OLO) -- Q1 2023 Earnings Review

a. Demand

Olo beat revenue estimates & its guidance by 2.8%.

Demand Context:

- Net revenue retention was 114% vs. 108% last quarter.

- Negative location growth is solely via Subway migrating from the platform last year. It added 1,500 locations QoQ without this hit and added 9,000 YoY. Subway removed 15,000 locations.

- Subway migration is helping ARPU a lot as it was a 1 module client.

- Multiple module adoption from enterprise and emerging enterprise clients continues to nicely ramp.

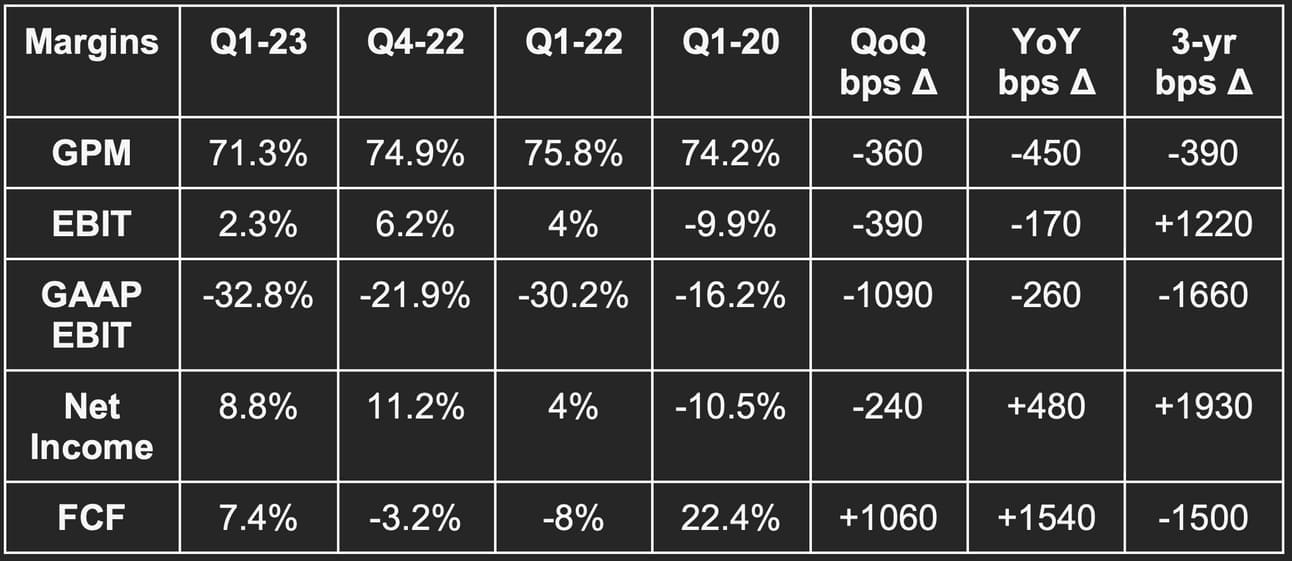

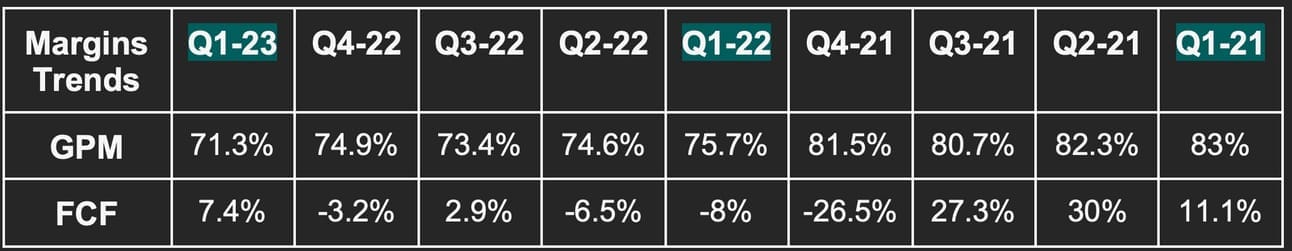

b. Profitability

- Beat $800,000 EBIT estimates & its guide by $400,000 or 50%.

- Beat -$1.6 million FCF estimates by $5.5 million.

- Missed gross margin (GPM) estimates by 160 basis points (bps).

- Met ($0.08) GAAP EPS estimates.

- Beat $0.01 EPS estimates by 2 pennies.

More Margin Context:

Its previous Wisely and Omnivore acquisitions continue to hit gross margin for now as it invests into those newer opportunities. Higher compensation to support location onboarding and Olo Pay processing costs not present in the YoY period also hit gross margin.

The EBIT margin contraction was related to timing of its Beyond 4 conference. That conference took place in Q1 2023 vs. Q2 last year. So? It added about 500 bps to sales and marketing as a percent of revenue. That’s why the EBIT margin didn’t materially expand YoY with G&A falling to 20% of sales vs. 26% YoY (thanks to scale). Not operating profitability. Not demand. Just timing of the spend. No issues here. R&D spend was stable at 30% of sales with leverage expected to kick in for the rest of the year.

c. Balance Sheet

- $438 million in cash and equivalents.

- No debt.

- Stock compensation was 26.9% of sales but buybacks represented 143% of stock compensation for the quarter. It has $60 million left on the current buyback program.

- The buyback is a necessary offset to somewhat hefty dilution. Share count rose by 1.5% YoY as it controls share count growth much more effectively. It doesn’t see these buyback dollars as replacing investment dollars, but as excess cash.

d. Guidance

Q2:

- Beat revenue estimates by 3.3%.

- Met EBIT estimates.

2023:

- Raised its revenue guidance by 1.2% and beat estimates by 1.2%

- Raised its EBIT guidance by 3.3% and beat estimates by 3.3%.

e. Call & Release Highlights

Customer Wins:

- Noodles and Co expanded with Olo Pay across its 300+ locations. This is Olo Pay’s largest win to date. Leadership called the Olo Pay pipeline rock solid. Up-selling to its existing client base will be a 5-year cycle as payment contracts are typically signed in 5 year increments.

- Denny’s launched with Olo’s Engage modules in a key up-sell win.

- Added Shipley Do-Nuts and its 300+ locations. It’s launching with 5 Olo modules including Pay.

Olo Connect:

As an extension of Olo’s thriving partner ecosystem of 300+ tech vendors, it’s launching Olo Connect. The program ranks partners based on service quality and usage to guide customers on their tech stack building journeys. This sounds like it could upset some partners ranked in a less favorable light, but Founder/CEO Noah Glass told us that the “partner response has been positive.” Perhaps the net benefit of painting more important partners in a more concretely positive way outweighs the con of pushing less important partners down the cue.

Adyen:

As recently announced, Olo announced a new partnership with Adyen. This enables Olo to add card-present transactions into the Olo Pay fold with new “embedded financial services coming in the future.” This will help Olo Pay customers fully unify digital and on-premise payments while creating an overarching means of gleaning and utilizing the data from all of these interactions. This also “eliminates the need to use multiple tools for reconciliation, refunds, fraud and chargebacks” for a consolidated view of financial performance. As an aside, this more precise demand data will inherently help the two partners offer more affordable access to capital. Another perk of brands tapping into network level scale on the Olo platform. This will launch in 2023 and represents a 6x revenue expansion opportunity for Olo pay.

Product Updates:

- Launched AI-driven kitchen capacity management to enhance customer throughput on-premise.

- Launched open check to allow customers to continuously add items to a ticket to be consolidated upon checkout on their mobile device for payment.

- Also launched a pay at table function to allow guests to control when they pay a bill and leave.

On Demand Resilience:

“End market restaurants are reporting a lot of resilience and growth. This supports the positive signs we’re seeing from sales and deployment. As we look ahead through the year, we want to remain prudent in terms of how we think about the potential for upside in the model given we’re early in the year. There are a lot of encouraging signs but still quite a bit of time in the year.” -- CFO Peter Benevides

f. Take

What a wonderfully boring quarter. Olo Pay seems to be a shining star in the making for the company. Resilience in the restaurant industry paired with some trading down to less expensive brands (which Olo predominantly serves) is helping. Growth should accelerate after 2023 when comps get easy and macro gets more favorable. That should coincide with steady margin expansion as M&A integration work wraps up, product investments bear fruit, and module up-selling continues. Expensive names with no GAAP net income are not in vogue at the moment. But growth will eventually get a bid and that bid should favor highly recurring revenue models with strong unit economics -- like Olo’s. It’s a de-facto technology layer for enterprise restaurant brands and that only became truer this quarter.

2. Revolve Group (RVLV) -- Q1 2023 Earnings Review

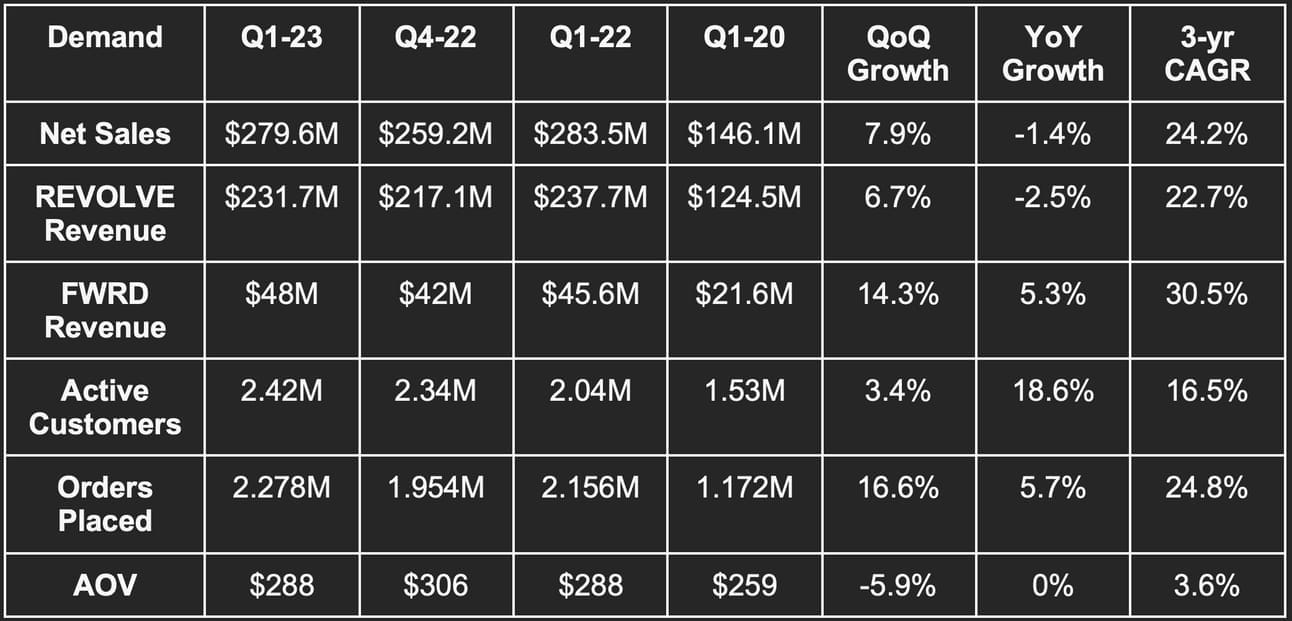

a. Demand

Revolve missed Q1 revenue estimates by 3.6%. It does not provide quarterly revenue guidance.

More Demand Context:

U.S. sales fell 5% YoY; international sales rose 16% YoY. Global growth was notably strong in China as that country reopened as well as in Mexico and India. It was notably weak in Europe.

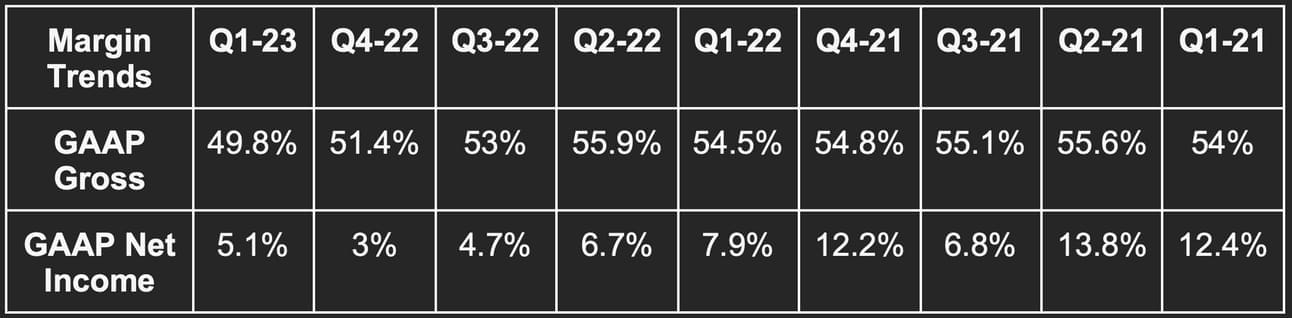

b. Margins

Revolve missed EBITDA estimates by 13.3% and missed GAAP EBIT estimates by 17.1%. Conversely, it beat $0.14 GAAP EPS estimates by $0.05. This was materially helped by $6.6 million in other income for the quarter vs. $516,000 in the YoY period. It also ever so slightly beat GAAP gross margin estimates by 10 bps. This beat its own gross margin guide by 30 bps.

More Margin Context:

- Free cash flow was aided by intentional inventory reductions. The company still expects inventory to be fully re-balanced by the end of Q2. It’s balanced for Revolve.com with still more work to do on Fwrd (its other site).

- Fulfillment costs as a percent of revenue rose 70 bps YoY via higher return rates while selling and distribution costs as a percent of revenue rose 200 bps YoY. Marketing conversely fell as a percent of revenue by over 200 bps.

- An insurance reimbursement helped net income a bit this quarter.

c. Guidance

Revolve doesn’t offer formal revenue guidance. It did tell us that sales for the month of April fell 7% YoY which is materially worse than consensus Q2 estimates. Still, it acknowledged that comps begin to get easier in May and June and so expects a more modest fall in YoY revenue next quarter or perhaps slight growth.

Gross margin is expected to significantly improve QoQ to reach 53.3% thanks to less mark downs and a healthier inventory position. It reiterated a 52.5% GPM for the year. It also sees fuel surcharges slowing and fulfillment costs easing as its new East Coast facility ramps.

“Some pressure points on our P&L in recent periods should begin to ease in the coming quarters.” -- Co-CEO Mike Karanikolas

Still, it now sees selling & distribution costs higher than it previously expected due to product return rates above its expectations. It attributed that to poor macro.

d. Balance Sheet

- $283 million in cash and equivalents.

- $0 in debt.

- Stock comp was less than 1% of revenue.

- Inventory fell nearly 12% QoQ and rose 6% YoY.

e. Call & Release Highlights

Macro:

Revolve blamed the miss on poor macro hitting discretionary spend paired with a difficult YoY growth comp. The 58.5% growth it posted in Q1 2022 compares to its run rate growth of around 20% for context. Over a 4-year period, its CAGR sits right around 20%. It pointed out that its worsening sales growth trend throughout Q1 was consistent with U.S. Department of Commerce retail sales data.

It will keep investing in its business, team and growth as it sees now as the opportunity for the strongest in its space to “separate from the competition.” Its liquidity and cash flows allow it to stay aggressive.

Efficiency:

- Revolve ramped investments in streamlining shipping and logistics and enjoyed some “early wins in optimizing costs in some regions.” It expects more improvement over the coming quarters.

- Like everyone else, it’s now using generative AI models to expedite design and marketing campaign creation. It’s also using these models to enhance search results and product discovery.

- Customer acquisition cost was better vs. previous periods.

“We are very focused on reducing the significant negative impact on our profitability from these increased shipping costs with several initiatives in place. More are being developed and tested.” -- CFO Jesse Timmermanns

Fwrd:

The company debuted new Fwrd product navigation on Revolve.com and is also now sharing inventory space for mutual brands between its two sites. It launched a new upgrade to improve web response time in its international stores to enhance localization and conversion. It will also expand Fwrd’s loyalty program to international markets this year.

The Fwrd re-selling program is thriving amid the poor macro environment that is pushing consumers to embrace their thrifty side. Growth here was 50% QoQ and the program was credited for its customer growth -- a highlight from the otherwise mixed report.