Table of Contents

- 1. Amazon (AMZN) – Anthropic & More

- 2. Alphabet (GOOGL) – Antitrust & More

- 3. Palo Alto (PANW) – Earnings Review

- 4. SoFi (SOFI) – Galileo

- 5. The Trade Desk (TTD) – Ventura

- 6. Walmart (WMT) – Earnings Snapshot

- 7. Starbucks (SBUX) – China

- 8. Market Headlines

- 9. Macro

1. Amazon (AMZN) – Anthropic & More

Amazon will invest another $4 billion in Anthropic, bringing its total cash outlay to $8 billion. This will be paid out in three equal increments. The announcement includes a significant deepening of an already tight relationship. In addition to being Anthropic’s primary cloud partner, it will now be its primary Foundational Model (FM) training partner as well. Per the press release, Anthropic is “excited” about AWS’s cost performance here. I think they’re also excited about access to another $4 billion in funding, but this still offers more evidence of Amazon’s training chips (appropriately called Trainium) gaining adoption. The two will work to further customize this hardware for Anthropic-specific needs. Amazon has spoken a lot on the last few calls about needing to deliver cheaper alternatives to Nvidia’s world-class, yet expensive processors. Trainium is an instrumental part of that. Anthropic will also use AWS’s inference chips (called inferentia), but it doesn’t sound like that will be as exclusive of an arrangement.

Beyond price performance and a large incremental investment, this news is also a response to the fantastic growth AWS Bedrock has delivered for Anthropic’s Claude models. It’s a lot easier to find business when directly plugging into a cloud business environment that does $100 billion+ in revenue per year.

Finally, the two will offer shared customers the ability to customize Claude models with their own first-party data. According to the press release, fine-tuning for these specific models will be a “benefit uniquely enjoyed by AWS customers.” Anthropic is considered world-class in terms of pure-play model builders creating elite products. It’s as good or better than OpenAI, Cohere etc. Considering this, the exclusive customization item is quite the selling point for winning more cloud workloads.

Read more about Anthropic in Section 5 of this article.

- Truist’s card data for Amazon’s marketplace is “slightly ahead” of estimates as of this Monday.

- The AI Alexa upgrade is having latency issues.

2. Alphabet (GOOGL) – Antitrust & More

News:

The company will be openly referred to as “Search Giant” or “mega-cap” in this piece to avoid Gmail flagging the email send.

The Department of Justice is formally requesting a sale of Chrome by the Search Giant. This past summer, Judge Amit Mehta ruled that Alphabet created an illegal search monopoly, and this is the DOJ’s recommendation to resolve that finding. One may hear “illegal search monopoly” and think… uh what about Microsoft or all other mega-caps building integrated search engines or the new disruptors like Perplexity that everyone is (supposedly) using. That’s entirely fair, but remember that Chromium is what powers a lot of these players. This is Google’s open-source project used to build Chrome, Edge and many others and is the view regulators are taking to think of this as a monopoly. I think that’s a large reach.

Mehta will decide on the DOJ’s recommendation. If accepted, the search king will surely appeal and drag this process out for years. Based on the company calling this a gross power grab and bad for consumers, I think that’s a safe assumption.

Mehta’s concerns centered on two main things. First, its practice of pre-installing Chrome software on Android devices cuts consumer flexibility. It all but ensures consumers will use Chrome, as it’s the first one they see and perfectly integrated into all of the other productivity products they use every day. Secondly, the judge also explicitly called out its $20 billion deal with Apple to make Google Search the default option on Safari. This isn’t directly related to Chrome, but ties into the same dominant web presence that is being scrutinized here.

Mehta openly spoke out against these arrangements. He did not even mention the idea of forcing asset sales to weaken its grip on the industry.

Implications:

Chrome has a 60% market share and is a key piece of this mega-cap collecting needed data to target marketing impressions within ad campaigns and personalize content across search and YouTube. While it isn’t directly a cash printer for the company, it does strengthen the cash printing abilities of so many of its other products. For this reason, I don’t really find a forced sale to be a positive thing. Yes, it will make about $20 billion (estimated) from a sale and pocket another $20 billion if judges rule its Apple deal to be illegal. But? The ecosystem is what makes this company so truly special and dominant. Weakening data sharing and control within it is not good for the Search Giant in my mind. Still, if this were to happen, the company would surely create back-door data sharing agreements and preferred partnerships with Chrome to maintain as much control as it can. For this reason, I think this would be a small negative for for the company (still negative).

Likelihood & What Happens Next:

In addition to the negative impact here being modest, I don’t think this DOJ decision is at all material or meaningful. Why? Because the people making this decision will not be in power in a few weeks. The assistant attorney general has been working in tandem with FTC Chair Lina Khan on this decision. These are two of the most anti-mega-cap decision makers we’ve had in office in a long time. The new administration has already explicitly said it can create a “more fair company without breaking it up” which already offers clear evidence of the new leaders carrying a more friendly mindset.

I think it’s likely that the new administration is more friendly to this company. I also think it’s likely that a forced data sharing proposal between Google and its competitors will be thrown out. A hearing will take place next April, with a final decision expected next August.

One more note here. There’s a separate ad-tech-related antitrust suit that the Search Giant is currently dealing with. I think this one is actually a lot more material and will force the company to change its ad exchange practices. It is surely a conflict of interest to represent sell-side ad demand and to control a lot of the impressions this demand is routed to. I think that will have to change in the future, but see the material impact being a healthier digital advertising ecosystem, more so than a weak Alphabet.

More News:

- Nvidia and the Search Giant are collaborating to build quantum computing machines.

3. Palo Alto (PANW) – Earnings Review

a. Palo Alto 101

Palo Alto is a cyber security company competing across endpoint, cloud and network use cases. It’s pushing very hard to bundle next-gen products into larger deals to differentiate vs. firewall-based competitors like Fortinet and beat next-gen disruptors. It calls this process “platformization,” which will again be a key piece of this review. There are 3 major pieces of their initiative:.

Cortex: Its endpoint security segment is called Cortex. Extended Security Information and Event Management (XSIAM) is the centerpiece for platformizing this section. XSIAM brings together Extended Security Orchestration, Automation and Response (XSOAR), Extended Detection and Response (XDR) and Security Information, Event Management (SIEM). XSOAR helps automate and guide best practices for incident response while ranking severity of threats. XSOAR is also where its attack surface management product (called Cortex Xpanse) lives to obsessively seek out and uncover any vulnerabilities. XDR infuses non-endpoint data sources into breach protection to extend coverage beyond strictly that endpoint. It relies on significant 3rd party data sharing to optimize potential utility. SIEM aggregates data and events. XSOAR relies on scaled, complete data ingestion; SIEM’s and XDR’s capabilities allow that to happen.

Strata: The network security suite is called Strata. This is where Palo Alto is supplanting legacy firewall vendors by offering (what it views as) superior, software-enabled firewalls alongside a suite of network security software. It deploys software-defined wide area networks (SD-WANs) within firewall environments. SD-WANs serve as virtual network securers using a software-based approach to protection. Palo Alto protects networks using a “zero trust” architecture. Zero trust means a bad actor cannot penetrate the most vulnerable part of a digital ecosystem and move freely within it thereafter. Zero trust ensures consistent and complex validation of these permissions at every turn. It ends the game of “everyone within a firewall environment getting perpetual, unconditional access” and greatly limits the potential damage of network breaches.

There are two pieces of the network bucket: modern hardware and software. In hardware, PANW provides “next-gen firewalls” with tools like contextual app inspection (more malleable access rules), intrusion prevention, URL filtering, data loss prevention (DLP) and more. Secure Access Service Edge (SASE) is the overarching software product that ties its network platformization approach together. SASE conjoins tools that help prevent unauthorized access to data, abuse of networks (like phishing attacks to overwhelm networks with traffic) and broad visibility into health and performance of a network.

Prisma: The cloud security suite is called Prisma. Like XSIAM and SASE are the platformization pillars in endpoint and network, in cloud it’s the Cloud Native Application Protection Platform (CNAPP). CNAPP includes Cloud Security Posture Management (CSPM), which organizes access compliance, provides overarching cloud ecosystem visibility, and proactively blocks misconfigurations. Beyond that, Cloud Workload Protection Platform (CWPP) is Prisma’s cloud workload protection tool. Most recently, Palo Alto debuted (CDEM) to “evaluate internet exposure risks and discover unknown internet-exposed cloud assets.” Finally, it added cloud detection and response (CDR).

While these three product groups are technically separate, they routinely pull context, service and data from each other to uplift overall value creation. Again, that’s how PANW is looking to more effectively compete. Prisma Access is important for network security, its CDR Cortex tool readily utilizes Prisma, etc.

b. Demand

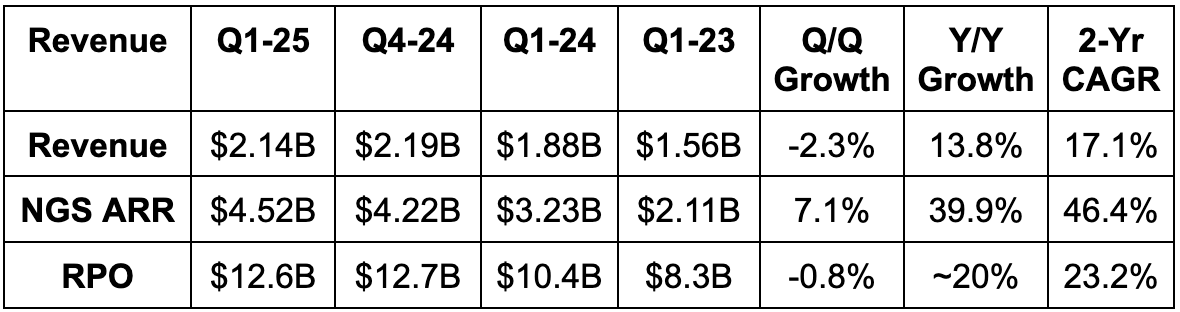

- Beat revenue estimates by 0.9% and beat guidance by 1.1%.

- Product revenue drove the outperformance. Subscription and support revenue was about in line.

- Next-generation security (NGS) annual recurring revenue (ARR) beat estimates by 3.0% and beat guidance by 3.8%.

- NGS ARR excluding its original network security niche crossed $2 billion.

- Remaining performance obligations (RPO) beat estimates by 1.3% and beat guidance by 1.2%.

Cybersecurity remains the most macro-insulated, non-discretionary spend bucket in technology in the eyes of Palo Alto leadership (they’re right).

c. Profits & Margins

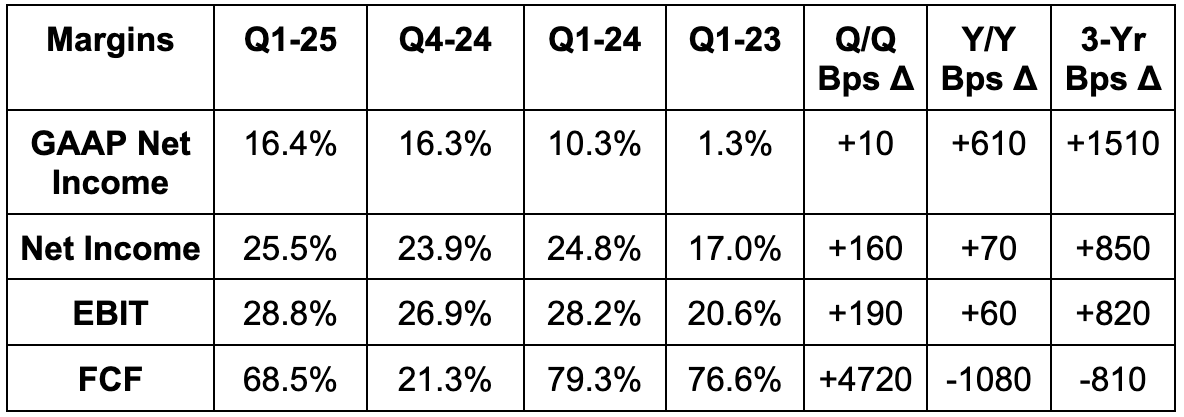

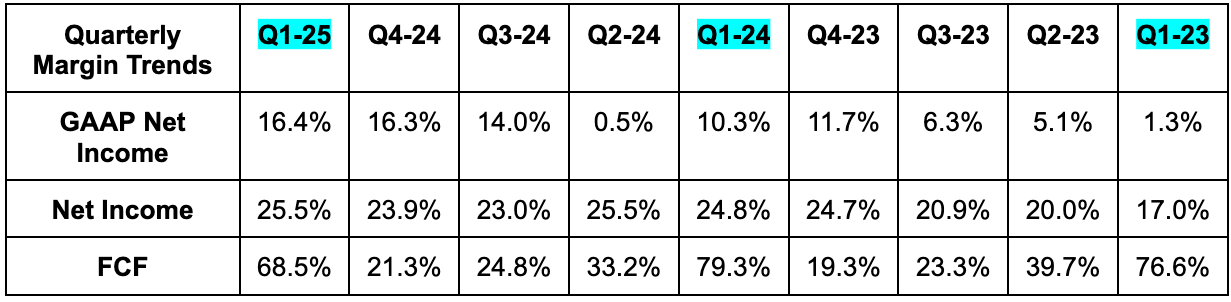

- Missed 77.5% gross profit margin (GPM) estimates by 20 bps.

- Beat EBIT estimates by 5%.

- Beat $1.48 EPS estimates & beat identical guidance by $0.08 each. EPS rose 13% Y/Y.

- Roughly met free cash flow (FCF) estimates.

d. Balance Sheet

- Nearly $3.4 billion in cash, equivalents & short term investments.

- $4.1 billion in long term investments.

- $646 million in convertible senior notes.

- Diluted share count rose by 1.3% Y/Y; basic share count rose by 5.4% Y/Y.

- Approved a two-for-one stock split. This should take place on December 13th.

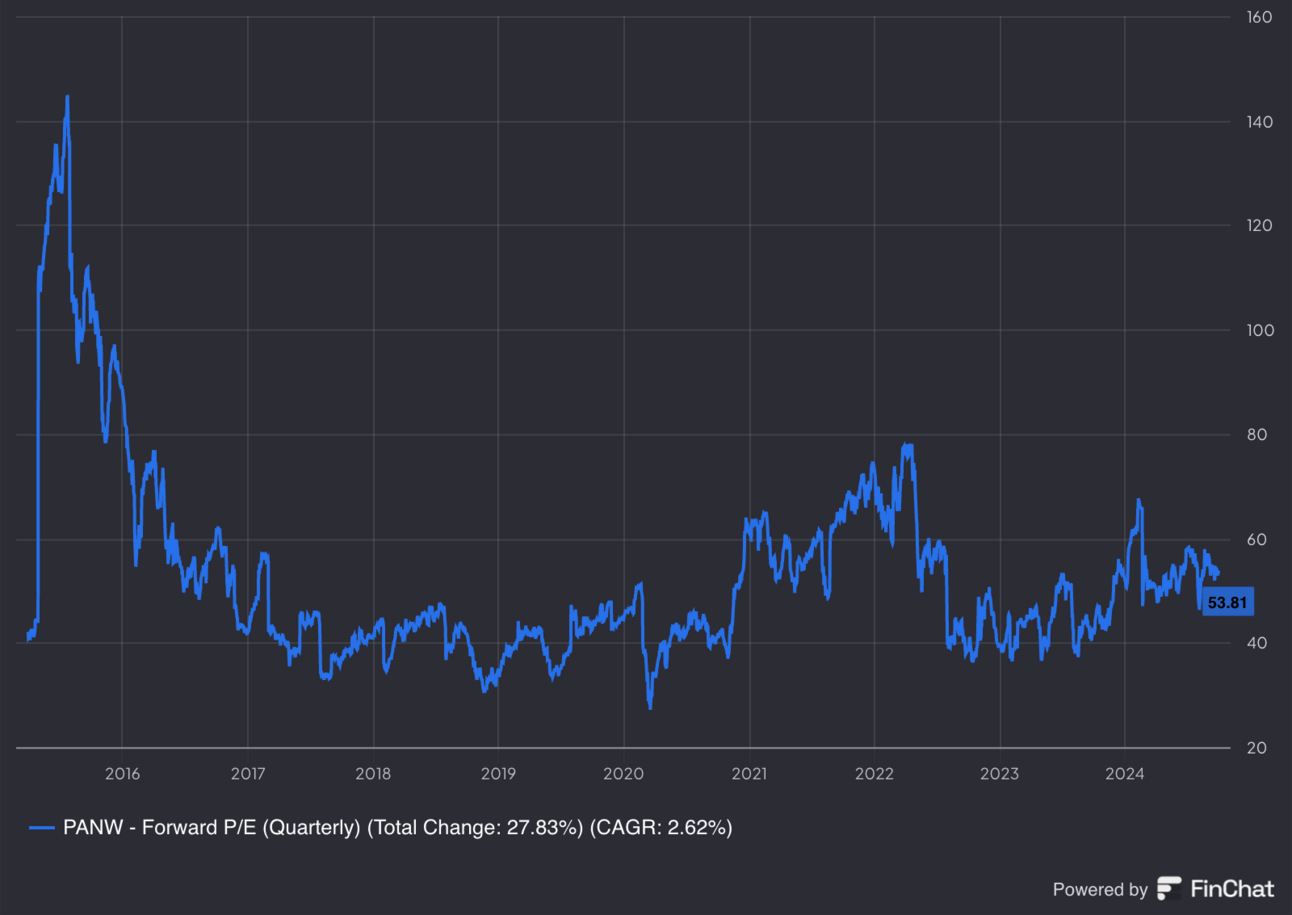

e. Guidance & Valuation

- Slightly raised annual revenue guidance by 0.2%, which slightly beat estimates by 0.1%.

- Reiterated annual EBIT margin guidance, which implies a slight raise to annual EBIT dollar guidance given the small revenue raise. This roughly met expectations.

- Reiterated annual adjusted FCF margin guidance of 37.5%.

- Raised annual $6.25 EPS guidance by $0.07, which beat estimates by $0.04.

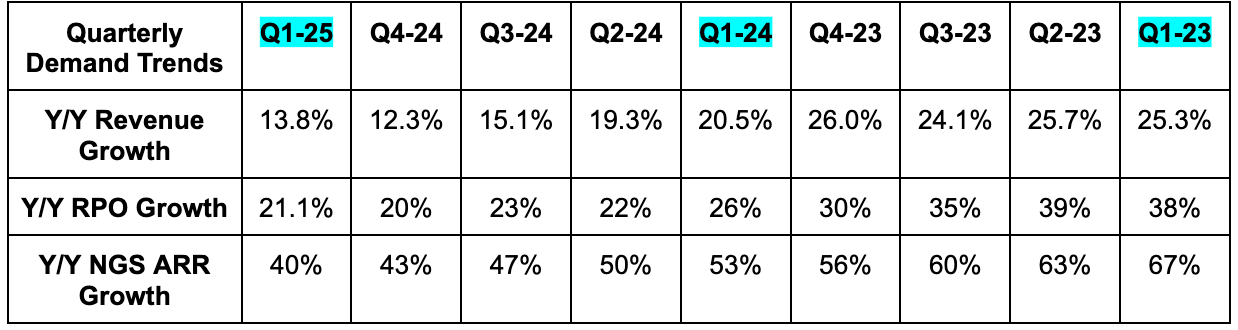

- Raised annual NGS ARR guidance by 1.8% (from $5.445 billion to $5.545 billion). This represents 31.5% Y/Y growth vs. 29% Y/Y growth in its previous forecast.

- Reiterated annual RPO guidance of $15.25 billion, which represents 19.5% Y/Y growth.

- Q2 revenue and EPS guidance were both in line with expectations.

It removed annual billings guidance and disclosure from the supplemental release. This is related to a shift in business focus. It is now prioritizing large, bundled, multi-year deals over things like product sales where billings is a more important metric. RPO encompasses total deferred revenue and backlog, which does a better job of capturing this shift.

EPS is expected to compound at a 13% clip over the next two years.

f. Call & Release

Platformization:

Platformization was again a key theme of the call, and will remain a key theme in the years ahead. The company completed 70 net new platformizations (standardizing on 1 or more of its product suites) to cross 1,100 during the quarter. Notably, about 23 of these came from its recent QRadar acquisition within security operations (SOC) and endpoint.

PANW remains on track to reach 2,500-3,500 platformizations by fiscal year 2030, and that’s important. Platformization means higher retention, lifetime value and customer loyalty. It also means more deferred revenue and trials, which both heavily impact billings. Again, that’s why PANW is shifting away from a billings emphasis, to a focus on ARR and RPO. It’s pushing for longer-term contracts where more revenue is collected over time, rather than upfront.

This shift continues to bear incremental fruit. This quarter, NGS ARR for platformized customers rose another 6% vs. last quarter and overall NGS ARR from platformized customers rose from 50% to 53% Y/Y. This is a big reason for its continued optimism in $15 billion in NGS ARR by fiscal year 2030. The company talked about setting the platformization trend and now all others are following suit. Candidly, I don’t think that’s accurate. PANW did invent the platformization word, which I guess is cool. But? Competitors across endpoint, network and cloud have been pushing for vendor consolidation and platform unification for years. PANW wasn’t first, but they are finding great success here today.

All in all, Gartner sees 75% of security leaders pushing for point solution displacement, with just 15% of these leaders having embraced an overarching platform approach to date. The runway is long.

“While many of our competitors are talking about their platform approach, we don't believe they're equipped to deliver it in the way we can.” –