Table of Contents

- 1. Duolingo

- 2. Progyny (PGNY) – Earnings Review

- 3. Datadog (DDOG) — Earnings Review

- 4. Celsius Holdings (CELH) – Earnings Review

- 5. Earnings Round-Up – Hims; Axon; Robinhood; Upst …

- 5. SoFi (SOFI) – Noise

- 6. Amazon (AMZN) – Subscriptions, No Subscription …

- 7. Meta Platforms (META) – China

- 8. Lemonade (LMND) – Various News

- 9. Disney (DIS) — The Marvels

- 10. Macro

- 11. Portfolio

1. Duolingo

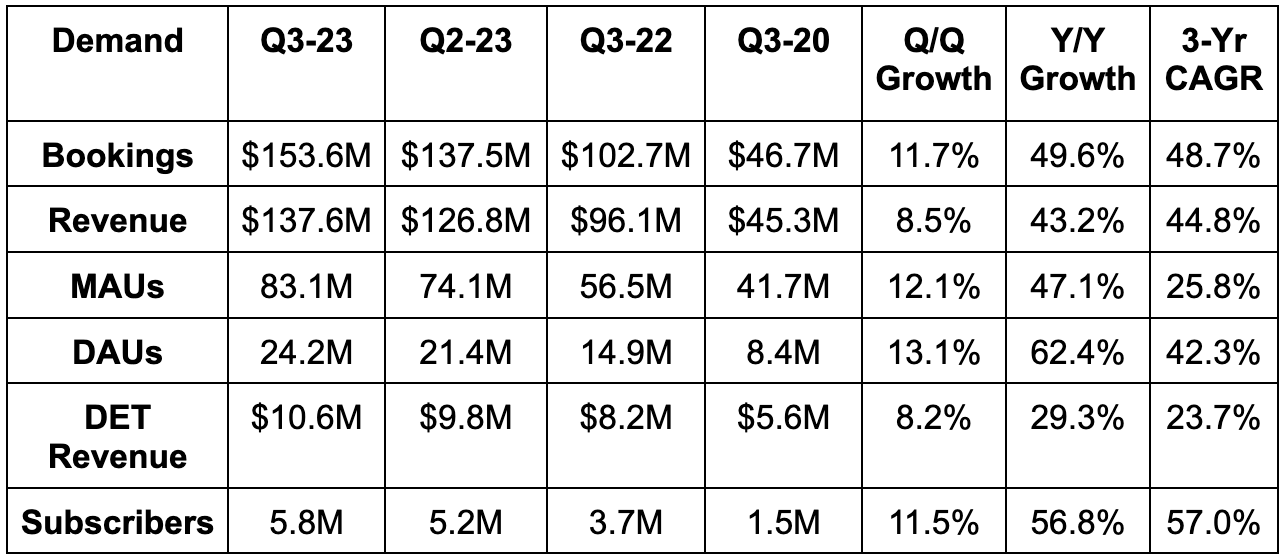

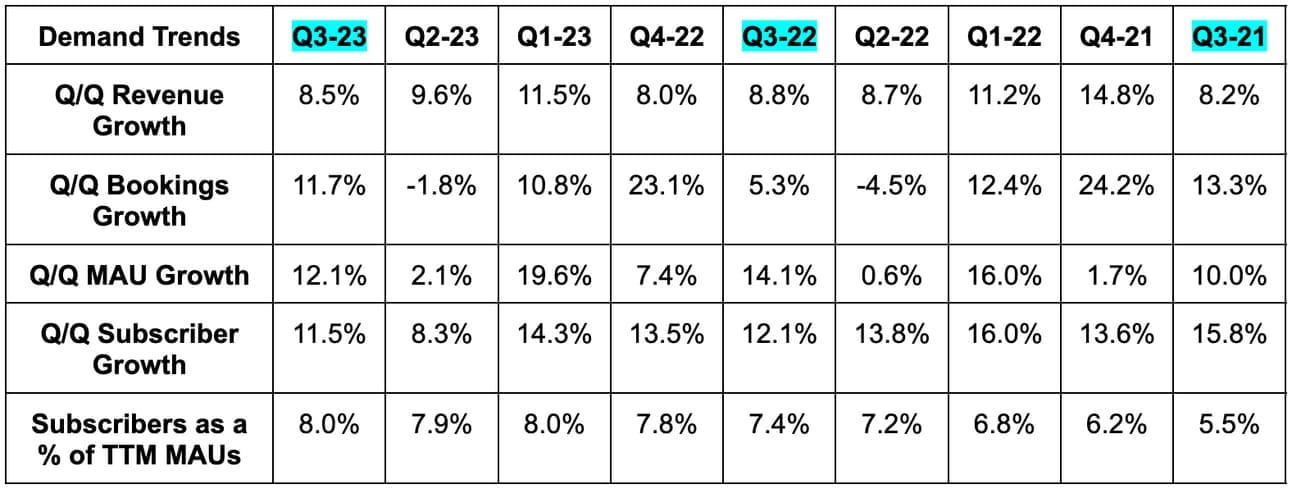

a. Demand

- Beat bookings estimates by 11.3% & beat bookings guidance by 11.3%.

- Subscription revenue rose 47% Y/Y.

- Advertising revenue rose 10% Y/Y.

- Duolingo English Test (DET) Revenue rose 30% Y/Y.

- Other Revenue (in-app purchases) rose 86% Y/Y.

- Beat revenue estimates by 4.2% & beat revenue guidance by 5.0%.

- The 44.8% 3-year revenue compounded annual growth rate (CAGR) compares to 46.9% Q/Q & 60.3% 2 quarters ago.

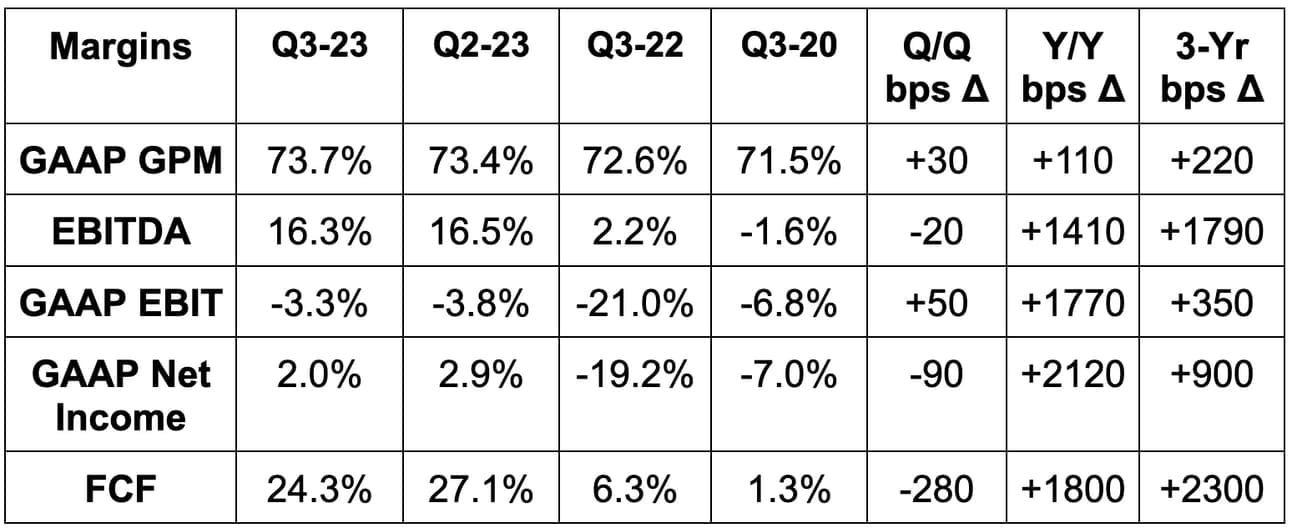

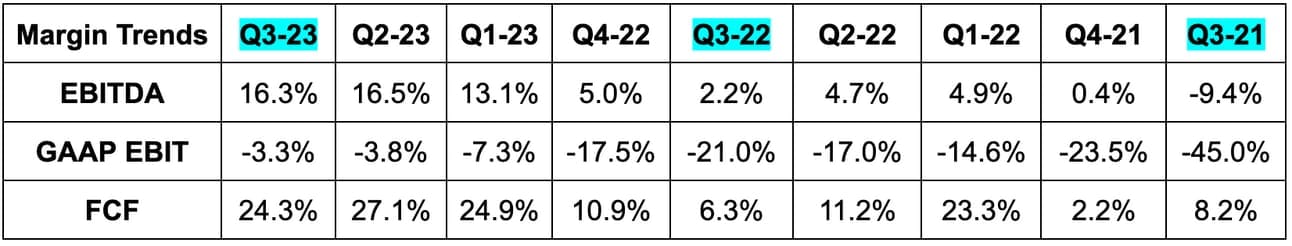

b. Profitability

- Beat EBITDA estimates by 20% & beat EBITDA guidance by 27.1%.

- Beat -$0.12 GAAP earnings per share (EPS) estimates by $0.19. GAAP EPS positive for the first time thanks to interest income. But that’s the luxury of a pristine, debt-free balance sheet and strong cash flows.

- It also beat GAAP EBIT loss estimates by more than 50%.

c. Guidance

Duolingo materially raised its full year guidance across the board. This was not solely powered by Q3 outperformance, but also expectations of outperformance in Q4. Specifically, for Q4:

- Beat bookings estimates by 6.9%.

- Beat revenue estimates by 3.6%.

- Beat EBITDA estimates by 33.0%.

d. Balance Sheet

- $700 million in cash & equivalents. This is approximately 8% of its market cap.

- No debt.

Share count rose by 5% Y/Y. This is being heavily influenced by IPO-related awards and must slow. Thankfully, it is fully expected to do so as the firm has consistently guided to 2% annual dilution. It actually lowered this dilution guidance to 1.5%. Good news.

e. Call & Letter Highlights

The Learning App:

Duolingo is evolving from a language learning app to a general learning app. While Duolingo’s revenue represents less than 1% of the current total addressable market, it has broader ambitions than language learning.

It already launched Duolingo ABC for literature, Duolingo Math and just launched Music courses too. Importantly, all of these new courses will be integrated into the central Duolingo app we all know and love. This consolidation, it thinks, will drive greater user value, faster scaling, better engagement and more success overall. It will allow the firm to more quickly borrow insight from the core language courses.

Split Testing Machine:

Split testing means testing a single variable within a user experience with two options to see which is better received. It could be as simple as making a button green or orange to observe which is better for engagement.

Duolingo continues to generate almost all growth organically and continues to vastly outperform across the board. But if external marketing isn’t driving this fabulous success, what is? A fixation on product iteration and perfection. This company is a split testing machine as it’s constantly testing various pieces of the user experience (UX) to directly observe what works and what doesn’t. This leads to a more engaging product, more word-of-mouth growth and less reliance on paid user acquisition. With its unmatched dataset within language learning, this is an edge that it can continue to leverage. Its award-winning, viral and hilarious social media presence certainly helps too.

But when it does sparingly lean into marketing, campaign iteration via ample split testing is working wonders too. As an example, the firm’s back to school campaign this year delivered 50% more user growth than the Y/Y period with flat Y/Y costs. That is not a typo. Split testing refines everything they do and drives incredible improvements. It’s one thing to guess what will be effective… it’s a better thing to observe what actually is. Duolingo observes and reacts.

Duolingo Max:

Duolingo’s new premium subscription called Duolingo Max is slowly being rolled out to users. It’s seeing “increased usage” of the AI features meant to differentiate that tier from other paid tiers.

Margins:

Duolingo capitalized some incremental R&D costs this quarter vs. the Y/Y period related to its new apps and subscriptions. EBITDA margin would have ~only~ expanded by 1200 bps Y/Y without this help.

Gross margin was helped by lower 3rd party payment processing fees and price hikes for Duolingo English Test. Weak advertising demand was a gross margin headwind during the quarter. Within operating expense buckets, the company enjoyed significant leverage across the board in both GAAP & non-GAAP terms.

Of the $26 million in stock-based compensation, about $7 million was from pre-IPO founder awards. These count as stock comp dollars even if share price targets needed for this comp to vest are never realized. That reality is another reason why I prefer tracking share count growth over stock compensation dollars.

Revenue per Subscriber:

Revenue per subscriber fell by around 8% Y/Y. This was due to better-than-expected user acquisition in lower priced countries as well as foreign exchange headwinds. It is also related to regional pricing changes implemented last year. The firm had one fixed price across all countries. It changed that pricing structure to mirror the GDP of each individual country. It will lap this pricing change next quarter and expects revenue per subscriber growth to resume in 2024. It will also ”experiment with raising prices over time.”

e. Take

The quarter was flawless as we’ve been groomed to expect since Duolingo went public. The execution is admirable to say the least and there’s no slowdown in sight. With all of that said, this is still a very expensive name. Even after large sell-side upward profit revisions, it’s still expensive at 73x 2023 earnings. Not egregious, but expensive. As I sit on 130%+ profits, it feels prudent to take some off the table. So I did. I view this firm in a very similar light as Shopify and The Trade Desk. All are elite companies with valuations that sometimes get out of hand. When that happens, I will trim as I’ve done with all 3 names this year. When the flip side happens (like with TTD this quarter), I will look to add. Another perfect quarter. Go owl go.

2. Progyny (PGNY) – Earnings Review

a. Demand

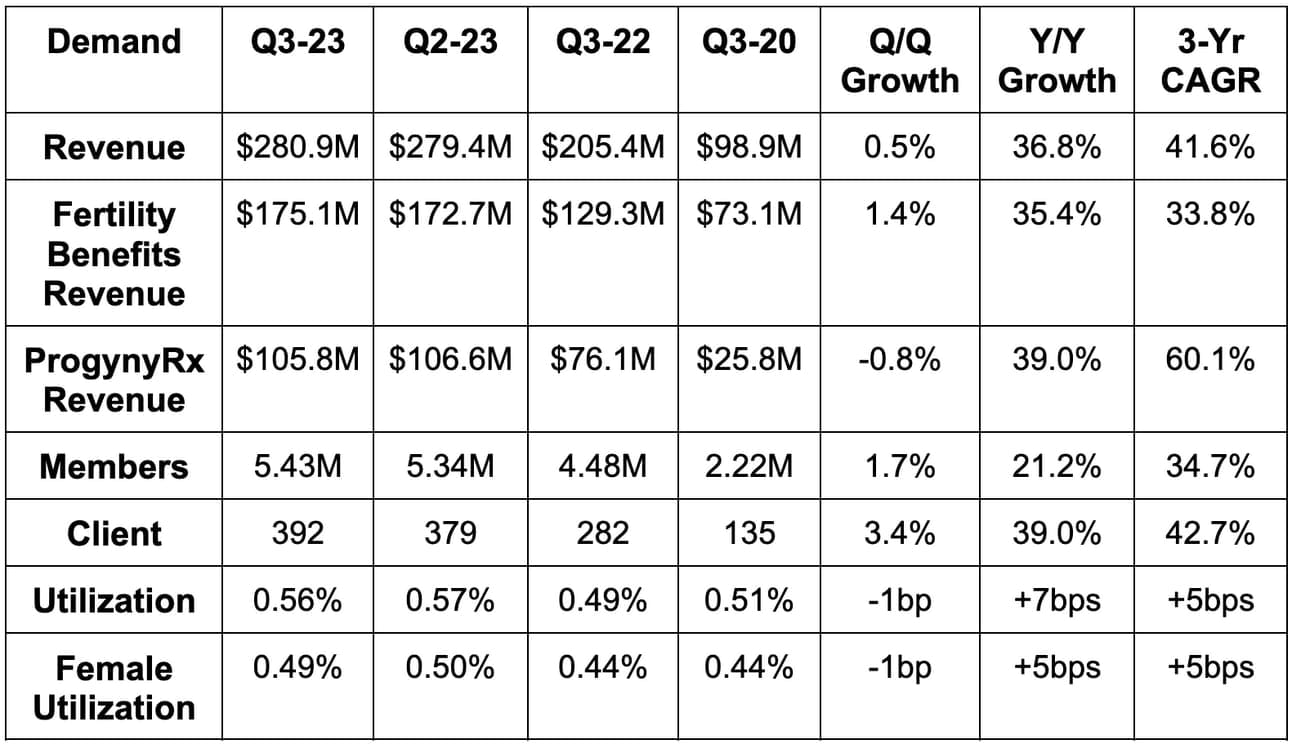

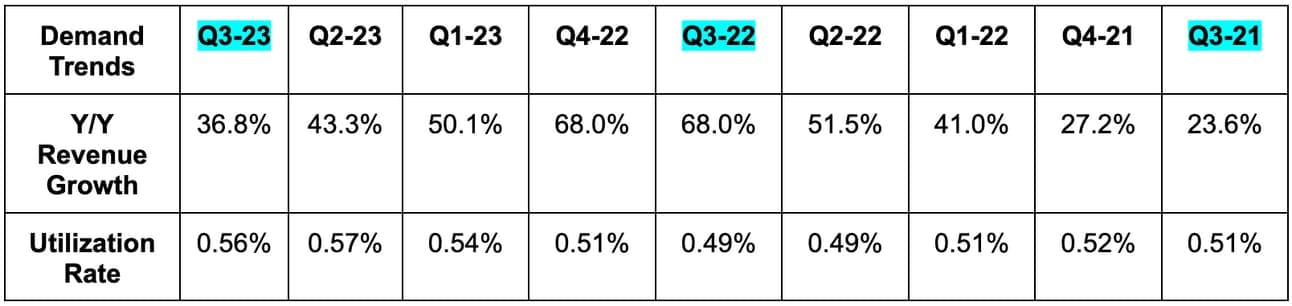

Progyny beat revenue estimates by 3.5% & beat guidance by 3.8%. Its 41.6% 3-year revenue CAGR compares to 62.9% Q/Q & 47.2% 2 quarters ago.

Note that member growth experienced a uniquely tough comp. In Q3 2022, Progyny added an abnormally large chunk of early covered lives in the range of 250,000. This threw off typical seasonality for the quarter.

b. Profitability

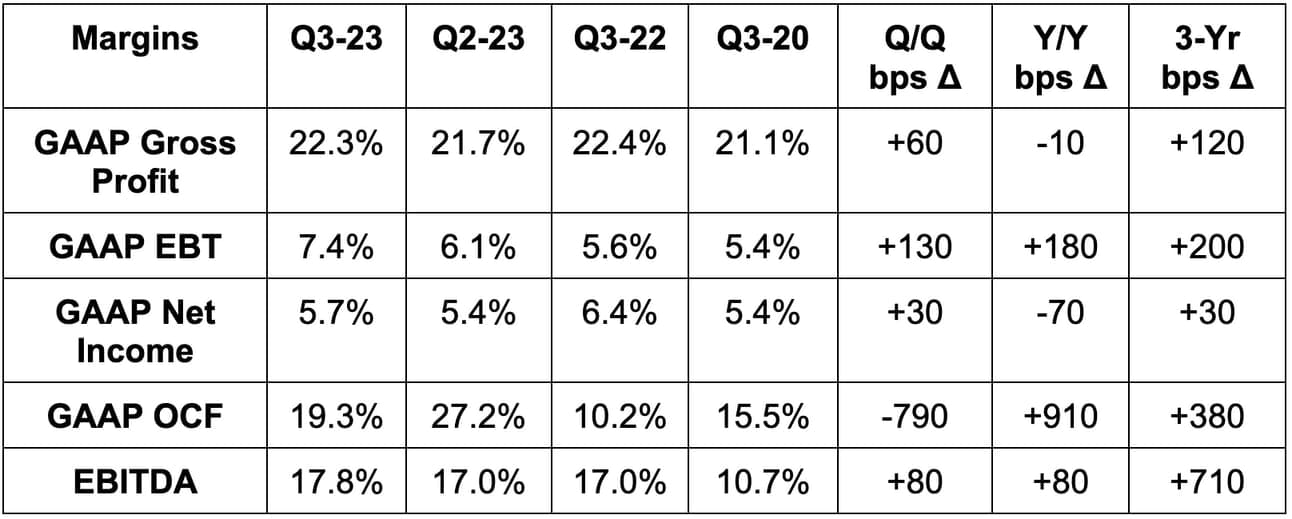

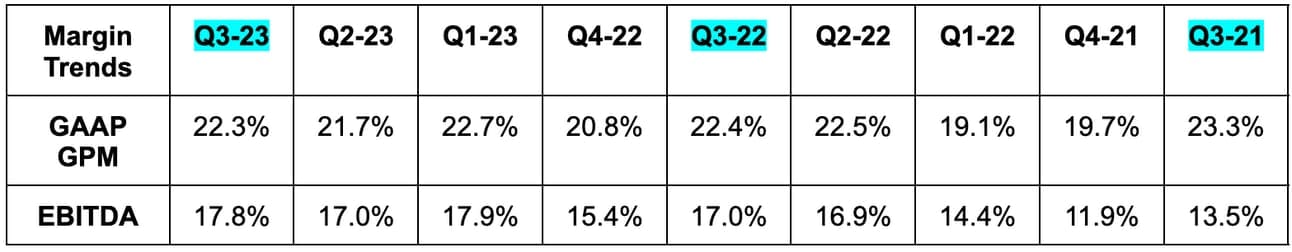

- Progyny beat EBITDA estimates by 8.9% and beat its EBITDA guidance by 9.9%. It also beat GAAP earnings before tax (EBT) estimates by 42%.

- Its incremental EBITDA margin was 19.9% vs. 17.3% Q/Q & 21.7% Y/Y. This directly points to more leverage ahead.

- Its $0.16 in GAAP earnings per share (EPS) was $0.05 ahead of estimates and $0.07 ahead of its guidance.

- EPS and net income rose by 23.1% Y/Y despite a $5 million tax charge vs. a $1.7 million tax benefit in the Y/Y quarter. With the same tax impact Y/Y, EPS would have risen by 71% Y/Y.

c. Guidance

Progyny’s Q4 guidance was 0.8% light on revenue and 5% light on EBITDA. It was in line with estimates on GAAP EPS. Importantly, full year guidance was raised across the board. This points to the “Q4” miss being more related to timing of revenue and profit recognition than anything. It makes the large Q3 beat a tad less impressive, but still impressive.

Progyny expects to add 85+ new clients to reach “at least” 460 in 2024. It also expects to add 1.3 million covered lives for 2024 with near-100% client retention. This represents 24.3% Y/Y client growth as well as 24.1% Y/Y member growth. Analysts were expecting 474 clients for 2024 with this guidance keeping that firmly on the table. It usually adds a handful of smaller clients that go live early during that same year. Analysts were also expecting 6.4 million covered lives with Progyny’s guidance about 4.2% better than that estimate.

Importantly, 300,000 of these members are from its first federal government agency. This deal includes only its patient care advocates and case management. Meaning? It will come with a lower revenue contribution during year one with Progyny optimistic that it can up-sell more services thereafter. This revenue will also be higher margin than the rest of its business. Without this help, member guidance was roughly in line. But again, Progyny generally adds more clients and members within a given year. It’s not solely last year’s selling season that feeds next year’s growth for the firm.

Margins will fall Q/Q in the fourth quarter as it adds the talent needed to support all clients going live in 2024. This is typical.

The Q4 revenue guide, conversely, represents negative Q/Q growth which is different from last year. This bothered me, but I reached out to my contact with the firm to clear things up. The abnormally large batch of early go-lives in Q3 2022 impacted seasonality. When a client launches, it takes a while for coinciding members to work through courses of treatment. These members also start with lower dollar services (like diagnostics) vs. higher-value treatment. The development of cycles takes time. So? Because so many early launches happened in Q3 2022, Q4 2022 revenue was abnormally high. The same abnormally large early-go-live factor played out in 2019; the pandemic threw off seasonality in 2020 and 2021 via clinic closures and subsequent re-openings. This is Progyny finally getting back to normal seasonality. And again, the full year raise is really what I care about.

d. Balance Sheet

- $336 million in cash & equivalents. This is over 10% of its entire market cap.

- Share count rose 1.0% Y/Y.

- No debt.

e. Call & Release Highlights

Overall demand environment & wrapping up the 2023 selling season:

Member engagement remains healthy as family building remains a top priority for younger employees. Progyny’s better treatments with 7 years of growing outcome leads, better cost structure, better support and better specialist network is all helping to continue to drive robust demand. Secular tailwinds like the later age of average pregnancy and rising same-sex marriage rates are helping too. Its value proposition is best in class in an industry ripe for improvement and growth. Good spot to be in.

“Given the results of the sales and renewal season we just completed, we are entering 2024 well positioned to deliver another strong year of growth.” – CEO Pete Anevski

Competition seems to be falling further behind. Anevski thinks the sector is getting “less competitive” as “known losses were way lower than last year.” It continues to briskly take more market share.

Labor Market Health:

As the team has told us would be the case, it’s seamlessly overcoming layoff headwinds from 2023. Meta, Microsoft, Amazon and several other giants are all Progyny clients who have conducted large layoffs to right-size the cost base. This led to investor concern about its membership growth. Just like we were told, the hit from these layoffs was as expected and more than offset by non-tech clients adding more employees.

Domino Effect:

Progyny leadership constantly talks about a domino effect for its industry penetration. After it lands a bellwether from a certain sector, competition generally follows suit to ensure they remain competitive in talent recruiting. This year, winning its first sports team soon led to it winning an entire sports league. It’s also gaining rapid traction within labor union populations after landing its first contract there last year. Today, it has clients representing 46 sectors overall.

Up-Selling:

Up-selling momentum continues. Its new clients went with 2-3 treatment cycles per employee on average which is consistent with previous years despite heightened budget focus. Notably, 20% of existing clients are adding more services for 2024 vs. 25% doing so last year. This decrease is simply because its Rx penetration is now much closer to 100%. 98% of its new clients selected ProgynyRx for its highest attach rate ever. In 2024, its overall Rx attach rate will rise to a new record of 93%. It just keeps climbing. This is why it’s so important that Progyny not only fosters better outcomes but also cuts significant costs. Its better practices mean less NICU usage, less treatment per fertilization and better adherence to fertility meds. All of this helps Progyny outperform when times demand budget scrutiny like right now.

Its pre-conception, maternity support, postpartum and menopause offerings will go live in 2024 to create more up-selling potential. Its male infertility product just recently went live this year.

Today’s Not-Nows are Tomorrow’s Wins:

Progyny’s “Not-Nows” are clients that want to launch but aren’t yet ready to do so. The proportion of not-nows in its selling season this year may have ticked higher. It was unclear in the call if that rate was steady or modestly elevated. Either way, this is not a concern considering robust 2024 member and client guidance.

Not-now motivation is (or might be) elevated because of a few items. First, poor macro leads to sales cycle elongation and budget tightening. Progyny, with the non-discretionary nature of its service, is insulated but not immune from this. Furthermore, this budget tightening trend is coinciding with an explosion in weight loss drug demand. This means another priority for employers to gauge in a growingly complex balancing act. Benefit plans have finite budgets.

“Even with these factors, we’ve seen fertility remain a significant priority as we enter 2024 with meaningful tailwinds behind us.” – CEO Pete Anevski

Whatever it is… again… it’s not concerning even if the rate did tick higher. Why? Every year, Progyny’s not-nows represent a large chunk of its client wins in the following year. We have years of evidence pointing to not-nows actually being not-nows rather than not-evers. In 2021, it cited this same factor due to pandemic issues and that backlog converted into accelerating client growth as forecasted. It expects 2024 to be no different with most early client wins coming from this bucket.

“We have a very healthy pipeline of advanced opportunities… pipeline is larger than a year ago which is really positive.” – CEO Pete Anevski

Margins:

Progyny continues to generate operating leverage within the general & administrative (G&A) cost bucket. Specifically, G&A was 10.5% of sales vs. 11.5% Y/Y. More leverage here is expected to come. This is powering Progyny’s 20%+ incremental EBITDA margin expectation for 2023. That expectation offers concrete evidence of more overall margin expansion to come.

The income statement leverage is more telling and relevant than cash flow statement leverage. Operating cash flow is being positively influenced by new Rx contracts changing cash collection seasonality. I do love more free cash flow, but this needs to be called out.

f. Take

Great quarter. The Q4 revenue number is the lone weak spot which becomes somewhat meaningless given the strength of 2023 and 2024 overall. I care more about 8 quarters than 1. The sector is big enough to support rapid growth for years to come while not being too big to invite more competition. It’s a great spot for Progyny as the employer cost, employee cost and patient outcome leader. Rock-solid execution from a talented team with a defensible value prop. I added following the negative stock price reaction.

StockOpine is one of my favorite fundamental analyst shops. Their newsletter fixates on quality stocks that exhibit robust financials and a defensible moat. The goal is not to sell you anything or to convince you of anything either. It's for stock picking inspiration. StockOpine provides you with the tools, information and bias-less feedback needed to make an informed investment decision.

Better yet, they do so in a fraction of the time that it would take on your own. Their work is delivered in an elusively noise-free manner with carefully curated content to surface only the most compelling ideas. You could say that I'm a fan, and I don't use that word lightly. Sign up here for 2 in-depth reports per month, investment case descriptions, earnings reviews, portfolio updates and more... you will not regret it.

3. Datadog (DDOG) — Earnings Review

For those of you who follow this closely, last quarter was ugly. Macro headwinds were blamed while others cited improvement with those headwinds. Some were understandably concerned. Fast forward to this quarter, and things are looking so, so much better. Great results. Let’s dig in.

a. Demand

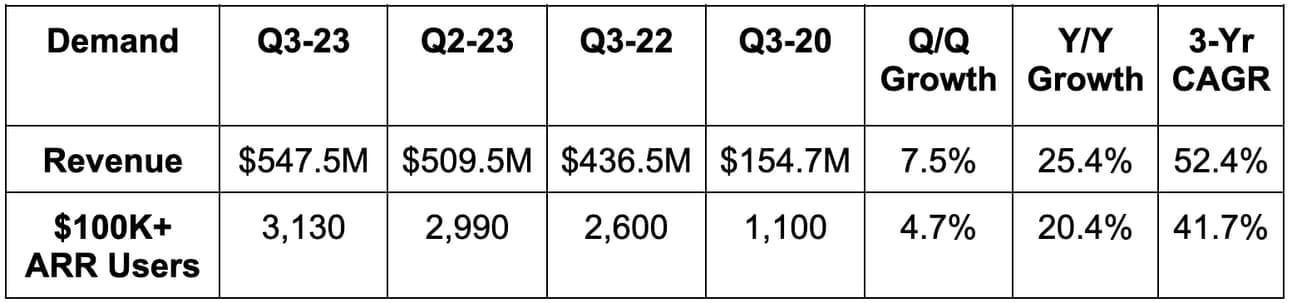

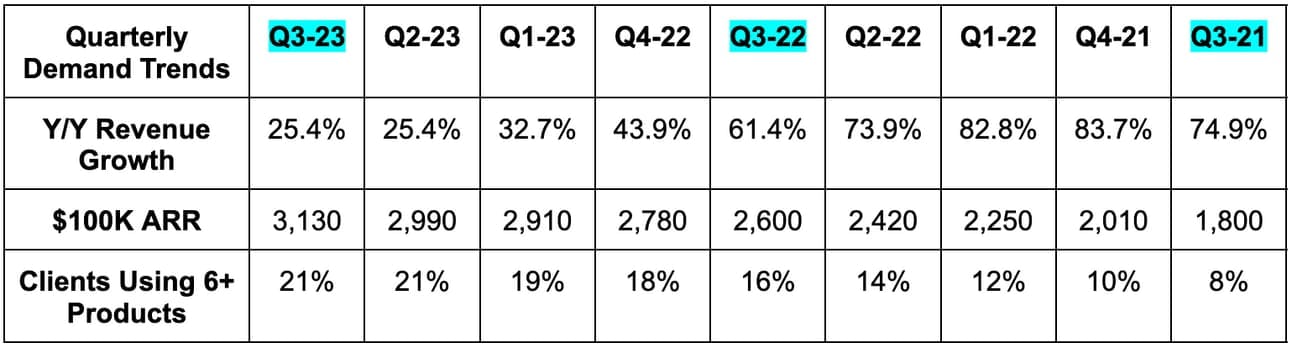

Datadog beat revenue estimates by 4.4% & beat its revenue guidance by 4.7%. Its 52.4% 3-year revenue CAGR compares to 53.8% last quarter and 54.2% 2 quarters ago.

b. Profitability

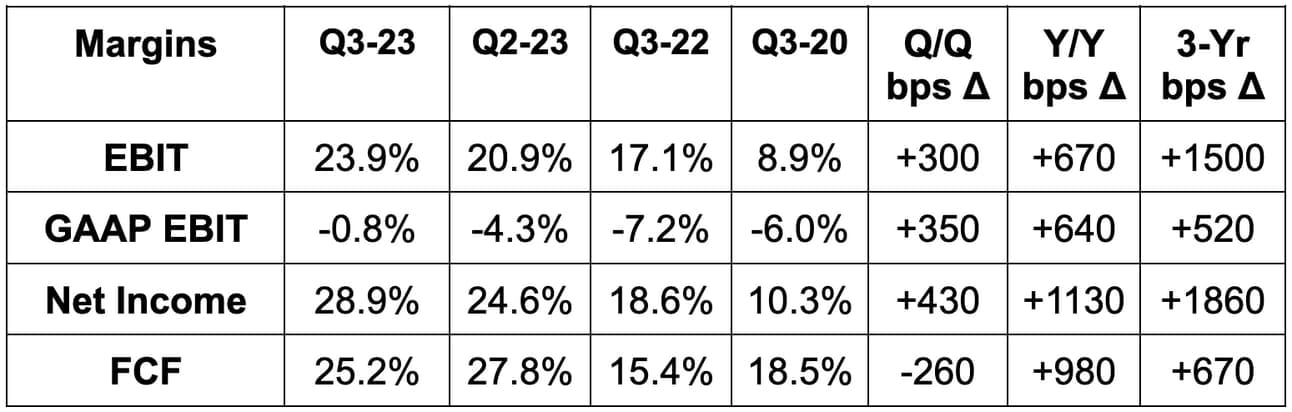

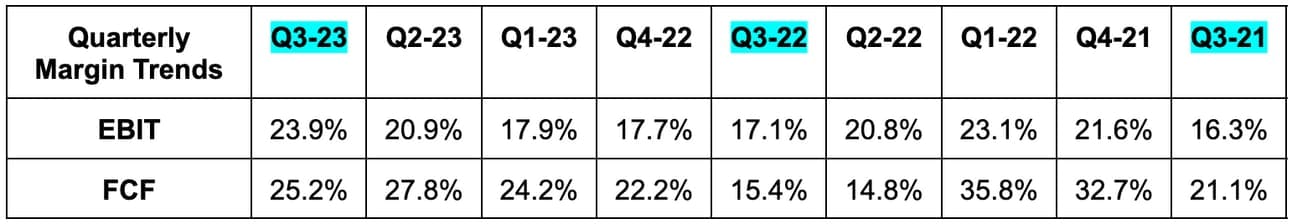

- Beat EBIT estimates by 30.2% & beat EBIT guidance by 30.8%.

- Beat $0.34 EPS estimates & its same guidance by $0.11 each.

- Beat FCF estimates by 67%.

c. Fourth Quarter Guidance

- Beat revenue estimates by 4.0%.

- Beat EBIT estimates by 27.2%.

- Beat $0.34 EPS estimates by $0.09.

d. Balance Sheet

- $2.3 billion in cash & equivalents.

- $740 million in senior convertible notes due in 2025.

- No debt.

- Share count rose by 3.0% Y/Y.

e. Call & Release Highlights

Demand & Macro:

Datadog enjoyed “robust” new logo bookings. Product usage growth for Q3 rebounded vs. Q2 and resembled more normal levels of demand. Q2 is looking like it was an anomaly. The team is seeing clear signs that cloud optimization is moderating. The headwind is not gone, but its “breadth and intensity are moderating.”

As seen in the firm’s 6+ product adoption trend, Datadog is transforming into a platform play within DevSecOps (Development, Security and Operations infrastructure). Its ability to consolidate and replace point solutions on its platform is both a cost saver and value builder. That’s how companies like ServiceNow outperformed this quarter and is how Datadog did too. Point solutions are not working in this cost-obsessed world we live in. This platform approach is working. It signed 4 deals in the 7-figure range during the quarter. All 4 replaced multiple point solutions (12 were replaced in one deal) and enjoyed better customer service, infrastructure maintenance, innovation and cost. That’s the formula here as Datadog enjoyed another record quarter for $100,000+ customer adds. Trust the process? No. Trust the platform.

“The use of our cloud cost management product plays a large role in delivering cost performance and efficiency improvements.” – Datadog CEO and Co-Founder Oliver Pomel

The 3 Pillars of Observability:

Datadog is a new name in the coverage network for me. I wanted to spell out the various pieces of its niche to set the table for future coverage. Observability simply refers to the ability to monitor an entire software ecosystem to track issues, vulnerabilities and performance. It further splits this Observability niche into 3 smaller buckets: Infrastructure Monitoring, Log Management and Application Performance Monitoring (APM).