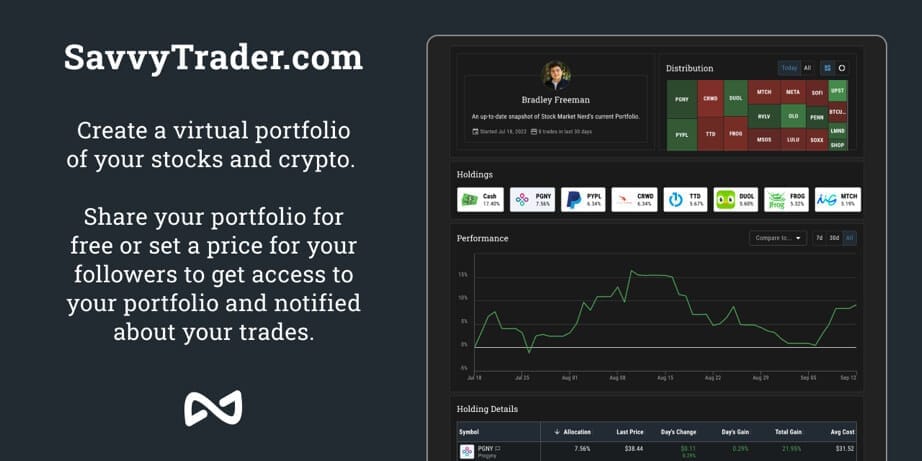

This piece is powered by my friends at Savvy Trader:

1. The Trade Desk (TTD) -- Netflix, Fubo, Snapchat & Secular Growth

a) Netflix (NFLX)

Please note that Netflix is not a holding. As such, I’m not concerned about the company’s earnings so much as its planned ad product and how The Trade Desk will benefit. So that is the main focus here. This is not meant to emulate earnings reviews that I publish for each holding.

On the Planned Advertising Product:

- Netflix is debuting a $6.99 per month plan with 5 minutes of ads per hour. This is far less ad load than linear, and that’s entirely thanks to the fully targetable nature of connected TV (CTV) vs. linear. The added efficacy that this fosters means advertisers can achieve target returns with fewer annoying breaks in the content. This ad supported tier will roll out next month.

- Netflix thinks the ad plan will be immediately neutral or accretive to margins. So? Considering how the cheaper price should create new demand, the company should be incentivized to promote its ad-supported products more than the full-priced subscriptions. Ads grow the addressable market while improving unit economics. A win-win. As an added bonus, advertisements also mean profile sharers are still monetized even if they’re not paying for their own plan. So? Monetization mirrors total hours watched more closely.

- Netflix’s ad inventory is oversubscribed. It still expects its Cost Per Mille (CPM) rate to be roughly 2-3X the competition. And how will that be? The only way this is remotely possible is by enabling open internet auctioning/bidding. When that happens (not if), The Trade Desk will be the player representing most of the available demand.

Quickly on the results:

- Netflix beat its earnings expectations by a roughly 50%. Conversely, its forward earnings guide sharply missed expectations. This, to me, seems to be a matter of timing more than anything as the company discussed shifting some OpEx from Q3 to Q4.

- The strong U.S. dollar is impacting its margins with an operating margin guide of 4% which would have been 10% on a FX neutral basis.

- Netflix beat revenue expectations slightly and missed revenue guidance slightly. Some called out Netflix’s revenue guide implying its slowest growth ever. That’s mainly related to a strong dollar.

- The highlight of the report was its 2.4 million net subscriber adds which more than doubled depressed expectations of 1.0 million adds. It reversed a 6 month trend of negative subscriber growth in North America as it distances itself from the positive pandemic shock.

“We’re excited to work with partners and advertisers to think about the ads experience… over the next couple of years, we’ll better understand the right native format for premium CTV ads.” -- Chief Product Officer Greg Peters

b) Fubo

Fubo pre-announced revenue ahead of its guidance and reiterated its path to free cash flow while ending its sports gambling business to get there. Why does this matter? Fubo was one of the first publishers to plug into Unified ID 2.0. And this past year, that integration has allowed its pricing per impression to FAR outpace impression growth while its peers haven’t enjoyed the same -- thus paving the way for the revenue beat. This is a small, anecdotal, yet still encouraging piece of news to pressure remaining publishers to embrace this new open internet identifier and The Trade Desk’s platform more broadly. Furthermore, this also hints at CTV remaining durable which is The Trade Desk’s largest and more promising (along with retail media) revenue channel.

c) Snapchat

This section functions to remind everyone how irrelevant Snap’s results are as a hint for The Trade Desk’s. Fubo and Netflix were the signals to focus on this past week. Next.

d) New Data

The Trade Desk released some encouraging data this week reiterating how compelling its niche truly is. Here were the highlights:

- 43% of Americans are embracing more ad-supported content this year vs. last. This is why HBO Max, Netflix and Disney are all now more openly embracing ad models than they have in the past.

- Using The Trade Desk’s data driven ad buying platform, advertisers can precisely control ad frequency to effectively cut 38% of low return impressions with frequency control. By re-investing those savings through The Trade Desk, advertisers efficiently expand reach by 24% on average.

2. SoFi Technologies (SOFI) -- Galileo and Insurance

a) Galileo

SoFi’s Galileo unit and its client -- T. Rowe Price -- debuted a new app this week. Together, the two will offer “Waysaver” through T. Row Price’s platform. Waysaver is a “smart savings app providing easy, secure and automatic ways to create emergency savings funds.” T. Rowe built most of the front end while Galileo is running most of the backend. This marks a deepening of an already tight relationship where the two worked together on SoFi’s bread and butter student loan offering.

Developments like this one make me more excited than positive developments from the consumer facing app. Yes, SoFi’s annual percent yield (APY) is a fantastic top-of-funnel differentiator to juice direct deposit and member growth. But aside from that, there are countless FinTech apps featuring most (not all) of what SoFi provides. Many have a comparable APY at this point as well.

So? If it’s also powering FinTech’s backend through Galileo and Technisys, that makes a successful investment case less reliant on picking a winning brand (hard to do) vs. picking a rapidly growing sector like FinTech (easier to do). Furthermore, nearly 100-year-old firms with $1 trillion+ in assets trusting their businesses and customer relationships to Galileo is a positive reputation signal to say the least.

Business to business (B2B) traction has been brisk thanks to the sleek nature of SoFi’s application programming interface (API) suite and its ability to do things like act as a sponsor bank for non-chartered FinTech’s. That role saves Galileo clients a bit on 3rd party fees while SoFi enjoys more revenue and profit from the unique cross-sale.

b) Insurance

SoFi and Bindable Technology are partnering to offer SoFi members branded insurance products as the one-stop shop continues to round out its offering. SoFi has dabbled in things like crypto insurance for investors, but this marks a more pronounced focus here -- as we’ve been told to expect the last two quarters.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. PayPal Holdings (PYPL) -- Rewards Program

PayPal debuted a new rewards program this week. The offering adds tracking, saving and redeeming of rewards capabilities directly to the new PayPal digital wallet to join all of the newer shopping features. And thanks to PayPal’s ubiquitous scale, this means the app will function as a true hub for saving on commerce by brining together tens of millions of merchant rewards plans. Perks of the new program include:

- Combination of rewards from various purchases from different merchants.

- A seamless Honey integration (which is its smart shopping tool with an automated coupon finder and tracker).

- No category restrictions or rewards minimums for redeeming points.

- Easy transferal of points to linked bank accounts to quickly turn rewards into cash.

People always care about savings. But the motivation to seek out savings becomes more and more pressing as the economic backdrop grows more precarious. That’s what is happening now, which is why products like Honey have been standouts for PayPal as of late.

4. Meta Platforms (META) -- UFC, ROAS & Branded Content

a) UFC

Last week, The UFC and Meta Quest announced a new fully-immersive content experience. Fans will now be able to throw on their Quest headset for a front row seat to the most popular fights.

Whether it’s a more convenient work set-up, risk-free medical training, design, fitness or entertainment, VR use cases are proliferating at a rapid clip.

As an aside, I saw some concerns circulating around Meta Horizon currently having less users than the company originally anticipated. To focus on if Meta has 200,000 or 300,000 or 400,000 monthly active users (MAUs) today, in my opinion, is failing to see the forest through the trees. The near future is about hardware enhancement, more software integrations with firms like Microsoft, more enterprise use cases with organizations such as Puma, and more selling partners like Accenture to drive adoption. The total users on Version 2 of this product is simply irrelevant to me. What this product looks like even 12 months from now will be astronomically different than it is today.

b) Channel Checks

RBC channel checks continue to show advertising green shoots for Meta’s Family of Apps. Its new Advertising+ product (to help with measurement and addressability) is bearing fruit and “advertiser forward commentary favors Meta vs. Google” per the institution. When pairing this with last week’s news that I shared on Meta’s Return on Ad Spend (ROAS) metrics trending well above 2021 levels, it appears that the Family of Apps (FOA) may be seeing a performance trough. That would be extremely welcome news and -- if FOA can evolve back into a wildly stable growth and cash flow machine -- would likely make the investment community more tolerant of the speculative Metaverse investment.

c) Branded Reels Content

Meta is debuting its own branded Reels content on the Family of Apps.

d) TikTok

Forbes reported that TikTok employees were attempting to track locations for various America citizens using the app. I still think a TikTok ban in the United States is a “when not if” event. I just don’t have a clue when it will happen.