1. SoFi Technologies (SOFI) – CEO Interview

Owning the Tech Stack:

As a review, SoFi brought its tech stack in house by acquiring Galileo and later Technisys. Not only has this allowed more rapid product iteration, but two other key benefits as well. First, owning its tech stack means being the low cost digital financial service provider by eliminating 3rd party fees. Secondly, SoFi can take these two businesses and license the technology to other financial and non-financial entities looking for white label services for their existing client bases. That last point will become a larger portion of the SoFi bull case as it transitions from chasing smaller clients to prioritizing client quality, as the Technisys contribution margin drag eases and as revenue growth for the bucket re-accelerates into 2024. Management thinks it will. We shall see.

The Quarter, 2023 & Beyond:

The quarter is going as well as SoFi expected it to go and Noto “couldn’t be more excited” about continued member and product growth. It’s on track to add more than $2 billion in deposits sequentially and is enjoying the student loan volume ramp that commenced with the end of the payment moratorium. All of this led to Noto reiterating his confidence in SoFi’s annual guidance.

Noto further reviewed some basic math for SoFi’s plans to reach 20%-30% return on equity (ROE). Its EBITDA margin needs to be 30% with a 20% GAAP net income margin to get there. Well? Its incremental EBITDA margin has been over 40% for most of the year, depicting that the business is well positioned to reach that goal. He expressed confidence in the lending segment achieving and maintaining a 70% contribution margin run rate with the segment’s ROE already at 30%.

Financial service margin expansion has been a key pillar of Sofi’s progress. Interestingly, its older tools within the bucket like Money are already contribution-profit positive. SoFi is losing about $150 million annually in newer verticals like its credit card which shows it can still deliver robust incremental margins while aggressively investing in more growth.

SoFi Invest:

Noto was not asked about Wednesday’s SoFi invest outage but I wanted to discuss it here anyway. Brokerage outings are an occasional reality for all providers. Still, SoFi needs to be better than all other products and target 100% up-time to deliver on that objective. The outage is not acceptable but is in no way a red or even yellow flag for my investment case.

It also has more work to do on improving the product set within the still small offering… but that was by design. SoFi wanted to roll-out an Invest product that catered to beginners as novices make up the vast majority of its client base. So it intentionally debuted a bare bones offering to focus on the ease-of-use and minimize friction. That is now complete and the company will look to roll-out advanced tools for experienced investors as well. It will also release alternative asset investing in 2024. He didn’t say what this would include, but Fine Art, Private Equity, Crowdfunding and annuities are likely good guesses.

Student Loans:

Noto sees student loan volumes getting near 50% of 2019 levels by Q4. He thinks it will take several quarters (maybe a couple years) to get back to 2019 levels, but all improvement from here will be purely incremental to SoFi’s current financials. He reiterated the $200 billion opportunity for borrowers within its credit band which it can offer lower rates to. This doesn’t include borrowers looking to extend the timelines of their loan to lower principal payments.

Final Note:

Noto reiterated that SoFi’s APY sustainability will be better than all other Fintech’s due to its bank charter and ability to connect the deposit product with its credit originations. He sees SoFi’s deposit market share gains accelerating in a falling rate environment as competition will likely feel more pressured to cut their rates earlier and more often.

2. Uber Technologies (UBER) – CEO Interview

Winning:

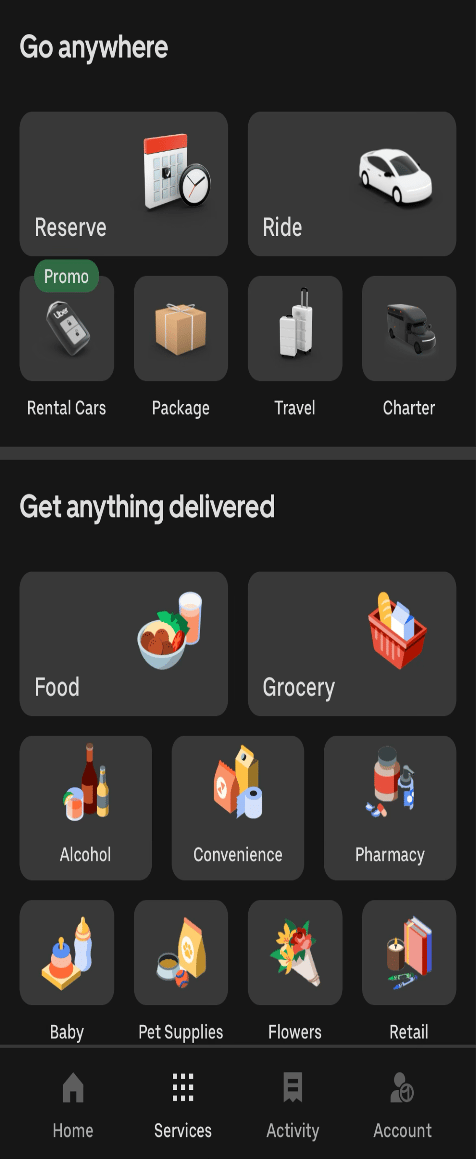

Uber’s ability to tie more products and utility into a single platform continues to stand-out vs. its mobility and delivery competition. That’s why it continues to take share in most markets with rapidly expanding margins. More bundling means more unique value delivered to consumers, more long-term value delivered to Uber, less churn and lower customer acquisition cost vs. everyone else. Here’s a stat to illustrate this in crystal clear fashion: delivery enjoys double the new customers from existing mobility users vs. all other paid channels combined (and with 75% lower acquisition cost). Lyft & DoorDash can’t enjoy this same benefit. Only Uber, with its massive network effect and full product suite, can be the low cost operator in a competitive and low margin transportation space. That’s the formula and it’s working like a charm.

Uber’s “New Bets” category is where this transportation super-app vision is being rounded out. These buckets represent 12% of total mobility volume but a whopping 30% of new customers to further feed its cross-selling engine.

Dara called the company’s supply positioning very strong in absolute numbers “and vs. the competition.” That may have something to do with $35 per hour in driver earnings and its ability to provide those drivers more demand than others can. Uber will soon debut tablet and car-top ads to bolster driver earnings even more. For a larger supply injection, Uber continues to work on plugging all taxis into the network. That ambition has also allowed it to seamlessly craft unique business models in important geographies like Japan while appeasing regulators seeking to protect taxi drivers.

He also called current demand trends strong with Uber’s consumer remaining resilient and hinted at another quarter of outperformance vs. the company’s guidance soon to come. Dara explicitly said “this is the best I’ve ever felt about Uber demand and bottom line” and it’s obvious why that’s the case.

Enterprise Partnerships:

Uber continues to see business to business (B2B) partnerships as a lucrative growth lever for its business. For example, it works with Tesla to offer Uber credits to drivers having issues with a car.

Delivery:

Dara reiterated his commentary from last quarter that constant currency delivery volume growth will remain at 14% or better through the end of the year. Grocery delivery growth also continues to accelerate. 13% of Uber Eats customers now use Grocery Delivery vs. 10% Y/Y. That should continue to rise as it wraps up its internal work to fully integrate the two products and make cross-buying more intuitive on the app.

Uber One:

Similarly to the cross-selling platform theme, Uber One (its loyalty program) continues to thrive. This offers special promotions on Uber’s products as well as some perks with Uber’s partners to provide best in class subscriber value. These members deliver 4x engagement frequency, higher retention and higher lifetime value vs. non-members. Uber is now leaning into establishing more merchant relationships to tuck more discounts and special perks into this product. As a subscriber, I can’t wait.

Advertising:

Uber will exceed its goal of $1 billion in advertising revenue by the end of 2024. It’s already 65% of the way there. Impressively, it has gotten to this point by catering mainly to smaller businesses. How? Because its return on ad spend is a robust 700%. It’s now building out the needed customer segmentation, identity and targeting tools needed to better unlock larger buyers and brands.

Buybacks:

Dara again told investors to expect buybacks in the next couple of years as its free cash flow generation explodes higher.

An Aside:

Uber signed a 4 year extension with the NFL that will make it the organization’s official delivery and mobility partner.

3. Match Group (MTCH) – CEO & CFO Interviews

Change in Mindset:

When new CEO Bernard Kim took over, he saw an opportunity to drive more cohesive teamwork. All apps were operating essentially as silos and not sharing best practices with one another. Tinder and the others were entirely resistant to embracing the deep bench of tech, AI and innovation talent Match acquired as part of the Hyperconnect purchase. That has now changed. Hinge borrowed the weekly subscription idea from Chispa and BLK after it worked wonders there. Meetic leaned on Hyperconnect to add an AI-infused portfolio optimization tool. Tinder used Hyperconnect engineers to build an AI-powered photo selection tool which scrapes your smartphone library for the best pictures. It also added generative AI-created text response suggestions. AI will be key to creating modern dating app experiences that stay relevant for the long term. It will be imperative for optimal profile matching, easier account creation, safer verification and so much more.

As an important AI aside, 50% of eligible consumers still don’t use dating apps. A large reason for that is onboarding friction and just not knowing what to say to a potential special someone. AI should address this and incrementally push holdouts to finally enter the market.

Tinder:

Leadership this week told us to expect 10%+ Tinder growth in Q3 and thereafter vs. previously saying that wouldn’t come until Q4. Great news. Kim called continued Tinder momentum “tremendous.” He wasn’t explicitly asked about August revenue trends after the team recently told us how well July went. Still, his tone and dialogue were entirely optimistic. Tinder spent the first half of the year rebuilding momentum, shifting priorities, perfecting pricing and accelerating product release cadence. Now it sees much of this product and financial repair work as complete and is ready to lean into product upgrades and ecosystem improvements. Match also has more work to do with mending lost top of funnel momentum, but green shoots in its last earnings report showed new user growth vastly improving in all markets where it didn’t hike prices. It turned double digit declines in top of funnel to flat Y/Y growth in a matter of months and has its sights set on returning to material growth after price hikes finish working their way through the system in early 2024.

Tinder will launch a refreshed user interface later in the year to enhance profile customization. It has been hard at work on balancing that granularity with the easy swipe feature users know and love. In terms of ecosystem improvements, the focus is on banning self-promoters and bots while catering its currently successful marketing campaign directly to Gen Z women for better app gender balance.

“And so the revenue is there, and the revenue momentum is there which should carry well into 2024.” – CFO Gary Swidler

- The planned high-end subscription was just submitted to Apple’s app store.

Archer:

While Archer is still only live in New York City and LA, Match is enjoying meaningful demand from customers in other geographies wanting access to the service. So? It’s pulling forward the launch timeline. Good sign.