To view my current portfolio click here.

1. The Trade Desk (TTD) -- Investor Conference

A Quick, oversimplified Refresher on The Trade Desk:

The Trade Desk’s Programmatic advertising niche allows for granular ad targeting. This means that when a person enters a site or an app, there can be a real time auction run in less than a second to source the most relevant ad for that buyer. The Trade Desk connects its advertising buyers to all of those impressions and explicitly tells them which to buy based on highest expected return. Publishers get higher CPMs (cost per 1,000 impressions) thanks to personalization AND buyers get a higher return on ad spend (ROAS). The Trade Desk commands a hefty cut thanks to the immense value-add it fosters via a 50% reduction in cost per impression placement and vastly enhanced return metrics.

On the unit economics of streaming:

“The math is great for streamers. When you minimize things like distribution deals with Multichannel Video Programming Distributor (MVPDs), the margins get better. Also personalization makes it so much better. The personalization makes it possible for publisher CPMs to be 5, 6, 7X what they were before because they’re that much more effective.”

Green reminded us that Hulu makes more on its ad customers than its premium subscribers. He was then explicitly challenged on how the “math could be great” if ad load falls from 15 minutes to 3-5 minutes per show. That reality is possible precisely because of the CPM boost The Trade Desk brings. It already far more than triples this metric and so a consumer doesn’t need to see nearly as many ads for an advertiser to be successful.

On Netflix and Microsoft:

“Even though most of the World heard Microsoft and was confused, I was excited about it. I have a great relationship with Microsoft and Netflix so I don’t want to overshare things they wouldn’t want me to. But in broad strokes, I would say Netflix needed a great sell-side partner. There are few strong supply partners who can guarantee inventory. One of them is Google. If you believe the future of Netflix’s business is ad-funded, it would have outsourced its future to Google if it chose them. I believe they avoided that by picking Microsoft.”

“On the buy-side, Xandr (Microsoft’s ad platform) is barely in the top 10 of demand sources. To me that means the only way Netflix can get high CPMs is to do what we advised. Where the demand side is competing against each other to win the ad opportunities for the highest CPM. By selecting Microsoft, it means Netflix is part of the open internet. That means great things for us. We can be the demand side with Xandr the supply side.”

As an aside, Green used to be an advisory board member for Xandr. The relationship is tight.

On Apple:

Green spoke against Apple more strongly than I’ve heard him do so in a long, long time.

“Apple provides a positive disclaimer on wonderful personalization for itself while showing a warning ‘are you sure you trust this company’ when asked to be tracked by anyone else. They’re hypocrites… Apple’s ad on what happens on the iPhone stays on the iPhone is one of the biggest lies in privacy.”

On UID2’s Value:

“If a player like P&G wants to use their data against Disney’s inventory, they now both have a common understanding and audit trail of where a consumer opted in to follow privacy rules. P&G gets to put their data to work in a privacy safe way with better efficacy. Disney adopts UID2 to get those high CPMs to compete in streaming with everyone else.”

On the forward (up-front) market upgrade in beta testing:

The Trade Desk is beta testing an upgraded up-front ad-buying model. It’s trying to transform up-fronts from a once-a-year process with no data usage into a real-time process with several layers of data to more closely mirror CTV’s efficacy. Tests here are ongoing but it’s early stages. To note, this is really just a way to eliminate friction while marketing spend shifts from up-fronts to programmatic. The Trade Desk wants to be a bigger part of that transition, which provides more of a right to win ad-dollars that finally move to programmatic.

Click here for my TTD Deep Dive.

2. Shopify (SHOP) -- Investor Conferences, Leadership Changes & a Shelf Offering

a) Outgoing CFO Amy Shapero Interviews with Citi

On Shopify’s Impact to the Ecosystem:

“We do an economic impact review every year. In 2021, for every $1 we made, our merchants made $38 and our partners made $7. And the communities our merchants serve generated $444 billion in economic activity.”

On Macro:

Shapero split this response into two answers: The short term and long term. In the shorter term, she reiterated 2022 as being a “re-set” year for Shopify in terms of fundamental performance. Pandemic e-commerce trends reversed more than Shopify and others anticipated and it suffered via things like layoffs as a result. So? It sees growth challenged in 2022, yet is still leaning heavily into key investments with its typical long-term mindset. This is why profit will look really bad this year and is expected to briskly improve thereafter.

For the longer term, it still sees a miles-long growth runway, ample margin expansion and consistently growing market share with e-commerce growth now back to pre-pandemic levels after the underwhelming growth we saw in early 2022.

On Fulfillment:

Shapero was asked -- for the millionth time -- about Amazon competition in fulfillment. And for the millionth time, she reminded us that Shopify is not looking to build out its own massive fulfillment network. Yes, it has a few large distribution centers. But to say it’s trying to compete with Amazon here is just not accurate. It’s using its warehouse software to move inventory from factory to port to consumer in the most efficient and affordable way possible. And it’s doing so with fulfillment partners, not a massive 1st party fleet.

On Amazon Buy with Prime:

“Merchants want to control their business and so many will never use Amazon fulfillment. We’ve always encouraged large tech to open their infrastructure. It’s a good thing. We’ve always supported approved integrations for our merchants to sell on Amazon. With respect to Buy with Prime, there’s no formal integration. It’s a disjointed process for the buyer. They have to leave the merchant’s store. We want to work with Amazon to provide an approved integration. We’re in discussions but there’s nothing new to report.”

b) President Harley Finkelstein Interviews with Goldman Sachs

On a Company Strength:

Harley offered us a condensed review of a Shopify edge: It’s ability to allow merchants to take advantage of massive economies of scale WITHOUT sacrificing their brand ownership and data is truly unique. For smaller organizations, the only options previously were to join marketplaces and lose control of their operations or expensively build internally. Now, all companies have access to these lucrative economies of scale and while keeping total control of their brand and data. So? Smaller businesses enjoy shipping rate bargaining power, marketing tools and affordable access to capital that was previously reserved for the largest companies.

On Consumer health today:

“I think there’s stabilization in consumer spending today… longer term I think we’ll settle in at industry growth rates similar to pre-pandemic.”

Harley briefly spoke on the concern over falling e-commerce penetration this year. He pointed out that the pandemic boost was largely related to physical retail shuttering and the coinciding smaller denominator when measuring e-commerce as a total piece of the pie. That brick and mortar shopping has since returned. So? While e-commerce sales in dollars have grown, commerce overall has grown (or recovered) more quickly. Growth has continued on despite temporarily falling adoption.

On Shopify Fulfillment Network (SFN):

“SFN on its own is going to make money. The unit economics are strong. We have enough merchants using it to understand that business and unit economics are already there.”

Harley covered the three main pieces of Fulfillment:

- From Factory to port where it uses a Flexport partnership to ship product most effectively.

- Balancing (AKA anticipating where the products need to go to which warehouse and when) to minimize last mile delivery cost. Deliverr does this for Shopify.

- Shopify’s Fulfillment Management Software allows warehouses and logistics companies to use extra warehouse capacity for Shopify merchant goods while optimizing inventory and warehouse management. The logistics partners then handle delivery while Shopify gives them business. With thousands of warehouses globally below capacity, this is a tangible efficiency force multiplier.

Please note that all of this value also juices a merchant’s volumes and that benefit accrues to Shopify.

“We’re making it so that Shopify merchants don’t have to think about logistics anymore… phase 1 is our goal to do 2-day affordable deliver for 90% of the U.S. customer base. We’re about there.”

Shopify sees guaranteeing delivery time as far more important than minimizing it. For its sake, hopefully it’s right because the firm can’t match Amazon’s fulfillment speed.

Shopify Audiences:

This new marketing tool has been shown to juice ROAS by 5-7X for several merchants. The data sharing restrictions from Apple’s IDFA change has made this tool even more valuable as other forms of targeting got more difficult.

On Profitability:

“We were a bootstrap company for a long time and were not born on VC funding. That culture is in our DNA… we absolutely plan to return to profitability after 2022’s investment year.”

c) Leadership Changes

Jeff Hoffmeister was named Shopify’s newest CFO this week. He will replace Amy Shapero after this upcoming quarterly report. Hoffmeister is a banking veteran coming from Morgan Stanley and actually served as the lead underwriter for Shopify’s IPO many years ago. According to leadership this past week, Jeff “brings an understanding to the table that we don’t currently have.” This seems to be more of an intentional replacement vs. Shapero voluntarily leaving. And with as wrong as Shopify was with extrapolating pandemic trends (just like countless other companies), this does make some sense. Hoffmeister will feature a laser-focus on cost discipline to marry with Harley’s and Tobi’s ambitious philosophies on building the 100 year company. These seems like a better balance to me.

In other news, Shopify COO Toby Shannan announced his retirement from the company after 13 years of service. Kaz Nejetian was promoted from VP of product to COO to replace him. Kaz is one of my favorite executives at the company as he has played an intimate role in successful new product innovations. I view this promotion as well-deserved. According to Harley, Kaz will renew the company’s focus on “connecting the right merchants to the right products at the right time” which is something he admitted the company needed to improve at. His role will be to merge product and revenue generation in the most utility-building way possible.

d) Shelf Offering

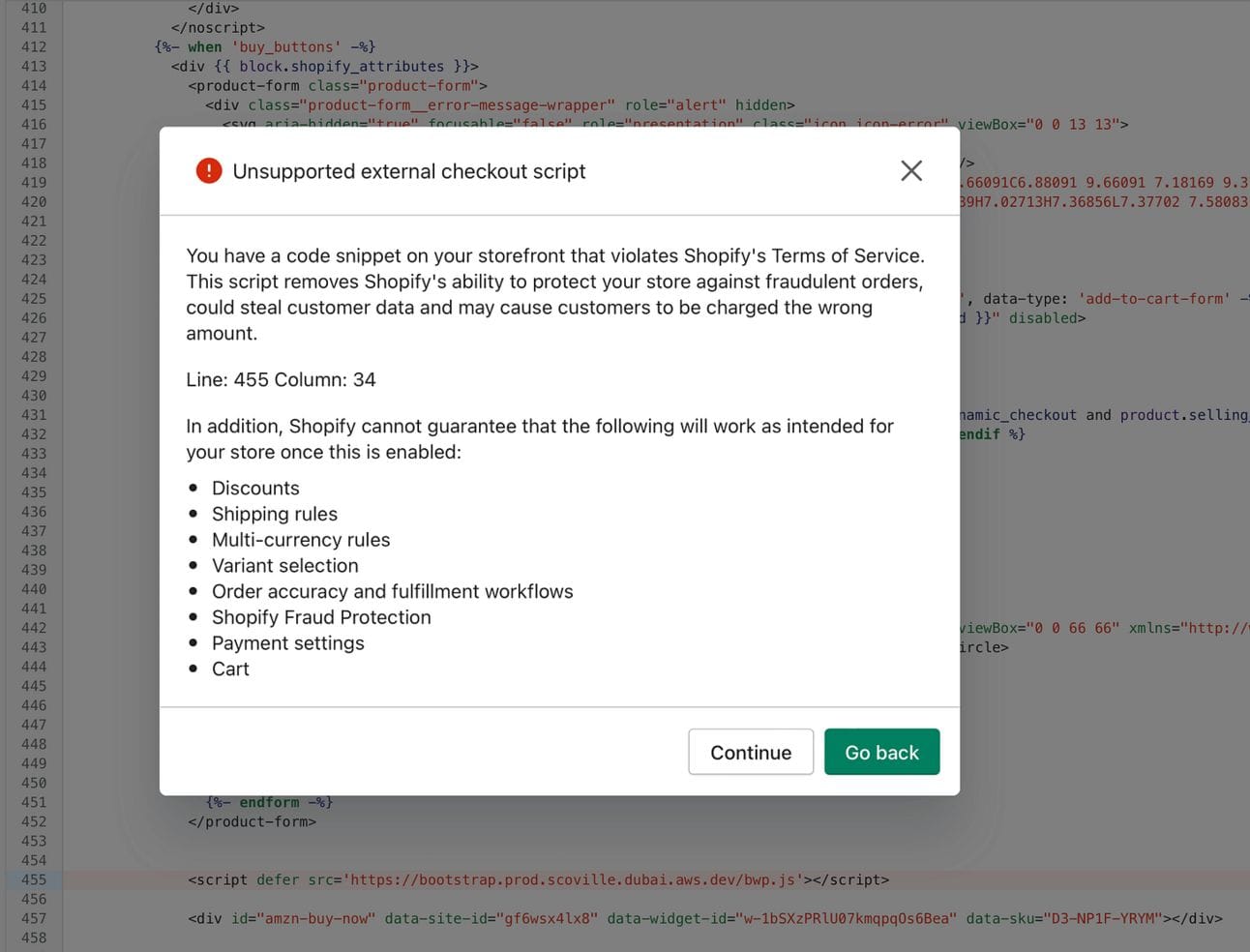

Shopify filed a mixed shelf offering allowing it to issue more debt and equity securities in the future.

Click here for my Shopify Overview.

3. Lemonade (LMND) -- CFO Tim Bixby Interviews with KBW

On marketing & utility:

The rising cost per acquisition that Lemonade had been dealing with this year (thanks a lot Apple) has finally leveled off. The company’s acquisition cost efficiency improvements are now outpacing the higher cost per acquisition. Marrying that with what Lemonade sees as an ability to more granularly grade risk profiles is a powerful combination (if it’s legitimate).