1. Progyny (PGNY) -- Earnings Review

“Our results reflect continued healthy utilization, further affirming the essential need of treatment and our members’ desire to pursue the care they need.” — CEO Pete Anevski

a) Demand

Progyny guided to $190.5 million in sales for 48% YoY growth with analysts expecting the same. The company posted $195.0 million, beating expectations by 2.4%.

It also guided to:

- 265+ clients for the quarter posted 273.

- At least 4 million covered lives for the quarter. It achieved 4.27 million.

More context on demand:

- Q1 is always Progyny’s best sequential growth quarter as most selling season wins go live as new clients.

- Please note that in Q2, SART suspended new fertility treatment cycles in light of the pandemic. That led to a sharp decline in growth that rebounded rapidly. As a result, subsequent sequential comps and the Q2 2021 YoY comp were easy.

b) Profitability

Progyny guided to:

- EPS of $0.015. Note that this guidance excludes expected tax deferment benefits. Analysts expected the same. It earned $0.09 with the tax benefits. It earned $0.19 per share last year which included a net $0.08 tax benefit.

- $29 million in adjusted EBITDA for the quarter while analysts were looking for $29.5 million. It earned $32.9 million, beating its expectations by 13.4% and analyst estimates by 11.5%.

- Gross margin above 19.1%. It shattered this expectation by 340 basis points (bps).

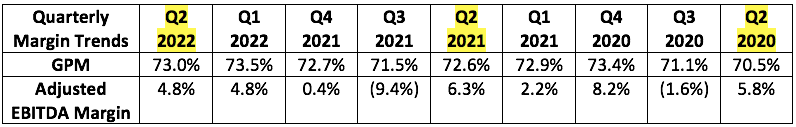

More context on margins:

- Progyny’s incremental EBITDA margin was 21.7% -- point to more margin expansion to come.

- 16.9% is a new company EBITDA margin record -- by a full 250bps

- Please not that OCF margin benefitted this quarter from a changing in contract receivables in its PBM business. This hurt OCF margin last quarter.

- GPM is adjusted for the newly issued stock based comp package issued this year. When excluding this impact in all comparable periods -- gross margin was 25.7% this quarter, 22.7% last quarter and 24.2% last year.

- Net income fell due to a tax provision vs. a tax benefit YoY. This hit net income

c) Balance Sheet

Progyny has $122.4 million in cash and equivalents this quarter, up 15.7% QoQ. There’s no debt. The balance sheet is beautiful and cash flows are strong.

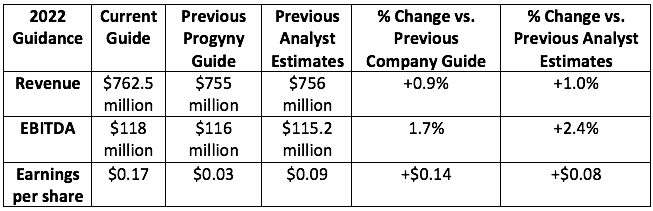

d) Guidance

More context on guidance:

- Note that this net income guidance still does not exclude expected tax benefits to be realized in 2022. EPS should end up being higher.

- Progyny expects to add more clients and members in 2022 vs. 2021. This implies 32%+ YoY growth. Based on revenue guidance, this rate should end up being significantly higher.

- Q3 2022 guidance similarly outperformed.

e) Notes from CEO Pete Anevski

On Progyny’s macro resilience:

- The time sensitivity and passion of pursuing treatment led to stable volumes amid the Great Recession DESPITE a larger portion of treatment at the time being paid for out of pocket. Progyny fixed that reality.

- Progyny see “no inflationary or economic softening impact on the business.” A tight labor market means more potential covered lives which is good for Progyny. Conversely, unemployment creeping back up to 5% like some have indicated is necessary to control inflation would hurt its results to a certain extent.

“Macro trends continue to be very positive for us which is reflected in the strength of our demand.” — CEO Peter Anevski

On the selling season:

- Engagement remains robust

- Gross retention remains near 100%

- Employers continue to expand coverage with contract sizes similar to previous seasons -- they’re not going with a smaller version in light of economic pain.

- The pipeline is extremely healthy

- Progyny is winning over new industries like auto makers and hotels. Newer verticals like hospital systems (its most sophisticated buyers) continue to adopt Progyny plans.

- There’s no change to the selling season schedule. It is not being elongated with worsening macro.

“Our current pipeline size and commitments to date continue to be favorable vs. the record level of activity that we experienced a year ago… we’ve received record new commitments as of this point in the season.” — CEO Peter Anevski

f) Miscellaneous Notes from CFO Mark Livingston

- New clients went with ProgynyRx at an 84% clip vs. 73% YoY.

- A rise in sales and G&A costs was due to the stock based comp package issued last year.

g) My Take

This was a flawless quarter which put a massive smile on my face. There’s nothing to pick at. Its results are great, its value proposition is expanding and its forward momentum is palpable.

Click here for my Progyny Deep Dive.

2. Duolingo (DUOL) -- Earnings Review

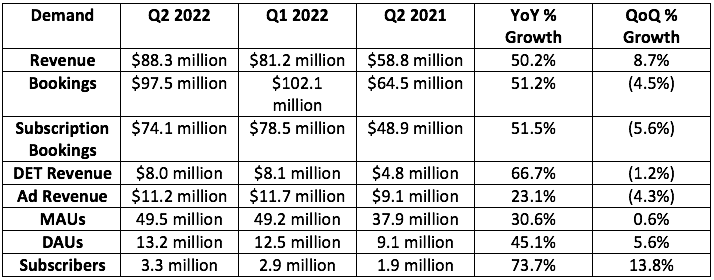

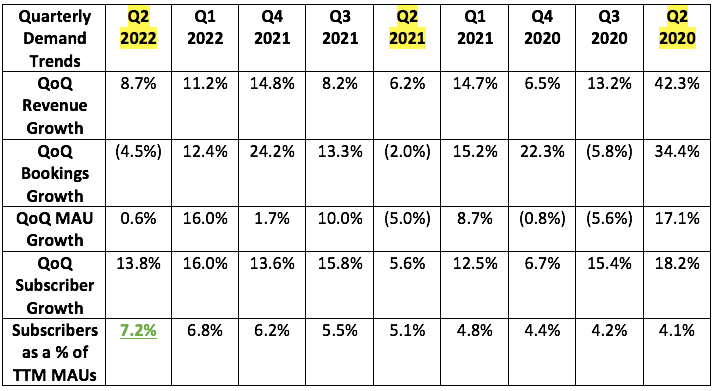

a) Demand

Analysts expected $85.7 million in sales while Duolingo guided to $85.5 million. It generated $88.3 million in sales, beating analyst estimates by 3.0% and its guidance by 3.3%.

Duolingo also guided to $87.5 million in bookings, it posted $97.5 million, beating expectations by 11.4%.

More demand context:

- Subscribers as a % of MAUs at 7.2% was wildly impressive to me. That’s its main growth driver today.

- While Duolingo did benefit from the pandemic juicing screen time, that was also an overall headwind. Duolingo does A LOT of revenue within the K-12 system and relies on travel and international studies for other sources of revenue. The pandemic ending helps all of this -- which is why growth has accelerated vs. other app-players seeing shriveling growth.

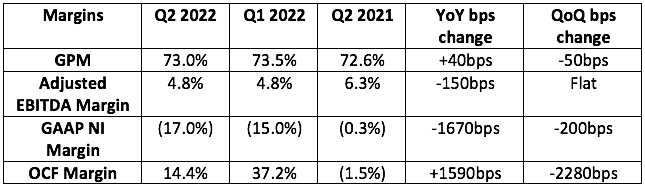

b) Profitability

Analysts expected a loss of $1.9 million in EBITDA with Duolingo guiding to a loss of $2.5 million. It earned $4.2 million in EBITDA for the quarter -- shattering expectations.

More margin context:

- Duolingo is trying to operate at breakeven and invest every possible dollar in growth. It generated positive EBITDA regardless.

- Sales and Marketing as a % of revenue was 17.3% this quarter vs. 16.2% YoY

- 2022 gross margin is being helped by lower app store fees charged by Google.

- DET is a drag on margins. Its outperformance is a short term margin hit.

- Please note that cash flow margins are being greatly propped up by stock based compensation and net income margin is being greatly hit by this same factor. This is why both are important to consider.

c) Balance sheet

Duolingo’s balance sheet is a company strength. It has $577 million in cash and no debt.

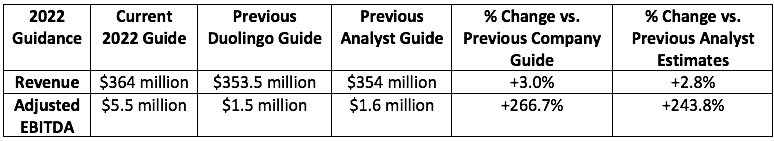

d) Guidance

“The beat on Q2 guide was driven by the fact that when we issued it, we were early in the quarter with a lot of macro uncertainty. We were being prudent. There was also outperformance even over internal expectations. And so, we’re taking outperformance into account in the new guide but still layering on a prudent outlook given continued uncertainty.” — CFO Matthew Skaruppa

Q3 2022 guidance was equally strong.

e) Notes from Co-Founder/Co-CEO Luis von Ahn

On Subscriber Growth:

“Subscribers as a percent of MAUs has outperformed what I thought would happen... I don’t see a reason why this can’t get to the mid-teens.” — Co-Founder/CEO Luis von Ahn

90% of Duolingo subscribers are now on annual plans vs. 80% as of a few quarters ago. This makes its revenue generation wonderfully visible.

On Macro:

“The macro environment is pretty crazy, but so far we have seen no weakness in our numbers whatsoever. We expect strong numbers… no layoffs are coming and we continue to hire.” — Co-Founder/CEO Luis von Ahn

Quite the flex from leadership.

On DET:

- DET is in 3,7000 universities today vs. 3,6000 last quarter.

- 100% of the top 25 Universities in the United States accept this test.

- Duolingo is now more aggressively expanding to Canada, The U.K. and Australia with the product.

On China:

Duolingo’s app was reinstated on China’s App stores in May. This prompted its DAUs in the region to immediately recover. China is just 2% of the company’s users today, but it represents a key growth region going forward.

On India:

India is now a top 5 market for Duolingo. Duolingo turned off monetization in the region because its “freemium” offers were being translated by Indian users as everything being behind a pay wall. It’s now working monetization back into the region in a more culturally fitting way.

On Quests:

Born from relentless, data-driven split testing and with the luxury of market leading scale, Duolingo launched Quests this quarter. Quests are daily challenges to be competed alone or with friends to earn rewards and badges. It’s quirky, seemingly un--important changes like this which make Duolingo so successful. These quests are optional tasks on top of Duolingo’s linear progression path (like Candy Land) debuted last month to a warm reception.

f) The Shareholder Letter

This letter essentially functioned as a victory lap for Founder/CEO Luis von Ahn who explained why Duolingo has been so successful I explained all of this in my deep dive which can be found here.

As an aside, Duolingo was named to Fast Company’s Best 100 workplaces. Cultural awards for this company are becoming a cliché.

g) My Take

This was yet another fantastic quarter from the team. Their obsession with product development over marketing spend is paying dividends and the results are merely the effect. I expect great quarters like this to continue for the company and its CEO quickly becoming one of my favorites.

3. Green Thumb (GTBIF) -- Earnings Review

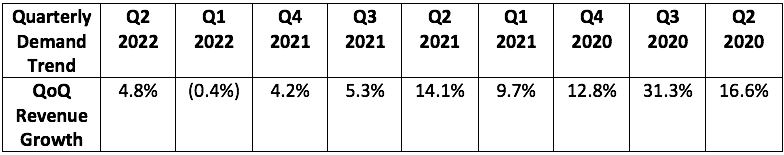

a) Demand

Green Thumb guided to at least flat sequential growth or around $242.6 million in sales while analysts were looking for $248.7 million. It generated $254.3 million in sales, beating expectations by 2.3%.

More demand context:

- Demand growth was powered by New Jersey rec sales, continued strength in Illinois, 19 new shops YoY and rising same store traffic.

- Retail revenue rose 11.7% QoQ.

- QoQ same store sales grew 9.9% while YoY same store sales fell 1.5%. It seems like the worst of the post-pandemic pull-forward hangover is behind us.

- Ticket size fell but more traffic more than made up for it.

b) Profitability

Analysts were expecting $72.5 million in adjusted EBITDA. Green Thumb posted $78.7 million, beating expectations by 8.6%.

Analysts were also expected $0.04 in earnings per share. Green Thumb earnings $0.10 (fully diluted) per share, shattering expectations. Lack of 280E reform proved to be no problem for the company. I borrowed Green Thumb’s graphic from its Q1 report as a reminder of what 280E reform would mean:

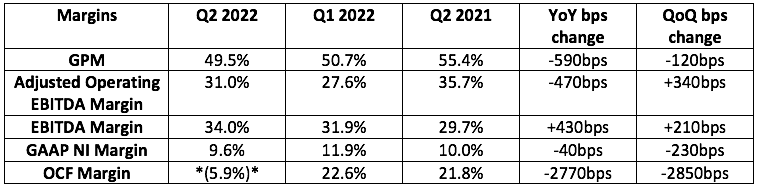

More margin context:

- Gross margin suffered a 150bps headwind from re-allocating more expenses into the input cost bucket starting this quarter. Without this change, gross margin would have expanded 30bps sequentially and fallen 440bps YoY.

- Adjusted EBITDA includes $15 million in non-operating adjustments.

- SG&A shrank to 25% of sales vs. 32.5% YoY. That made me very happy although it was partially related to a one-time non-cash item.

- The company is beginning to see some pricing stabilization across markets with some room to go.

- Cash flow from operations was negative, the result of 2 large tax payments in Q2 totaling $65 million vs. $0 in the first quarter. It’s now up to date on tax payments.

- SG&A growth was powered by one-time items and would have grown 2% sequentially on a normalized basis.

c) Balance Sheet

Last Q had $174.5M in cash and equivalents vs. $244.2M in debt. Now has $145.3 million in cash and equivalents with $253 million in debt. Ben was asked explicitly about his willingness to add leverage to the balance sheet. His bias remains heavily skewed towards internal financing considering how much more affordable it is vs. restrictive capital markets. But he also added that all M&A is still on the table.

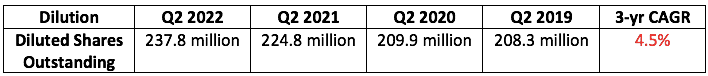

Considering how artificially expensive debt issuance is for these companies, dilution is understandable for now. But it’s still very much worth noting. With American cannabis operators under the current regulatory framework, dilution is often the most efficient source of new capital.

“Considering the punitive tax road and fickle capital markets, we continue to focus on cash at Green Thumb.” — Founder/CEO Ben Kovler

d) Notes from Founder/CEO Ben Kovler

On Individual States:

- New York is shaping up to be another California for now -- unfortunately. Expectations there have been greatly tempered.

- New Jersey was the “star of the portfolio” with its rec sales turning on and no supply issues to date. Connecticut and Rhode Island will flip this year as well.

- Illinois has started to issue social equity licenses after two years of “frustration.” That led to a nice uplift in the state during the quarter.

- Minnesota edible sales went live this month to “very strong demand.”

- Virginia’s loosening of med card regulation is juicing card demand.

On Margins:

- State diversification and an ability to push more product through retail vs. wholesale via its large state footprint and vertical integration allowed it to combat very real pricing pressures in a few states.

- The company pushed $9 million more into its dispensaries in Q2 vs. Q1.

- It’s leaning into its “&Shine” brand in light of strong demand. This cheaper brand comes from similar margins vs. premium products via lower input costs.

On Macro:

“While the market will continue to fluctuate based on various economic factors, it does not change the fact that cannabis is a growth industry with strong demand tailwinds.” — Founder/CEO Ben Kovler

e) Notes from CFO Anthony Georgiades

- Terrible macro could eliminate weaker comp with heavier reliance on wildly expensive external funding.

- CPG revenue fell 12% QoQ as Green Thumb leaned into retail.

- The company has “taken steps to limit SG&A growth through the rest of 2022 to combat macro pain.

f) My Take

This was a shockingly good quarter to me. The firm guided to flat sequential growth and shattered those expectations. The headline 49.5% gross margin was the sore spot, but the reasoning behind it (change in accounting) made that entirely ok. This is why it’s so important to read through ALL of the earnings materials vs. just the release. At Stock Market Nerd, we do it for you to save you hours and hours of valuable time. Great quarter.

4. Match Group (MTCH) -- Earnings Review

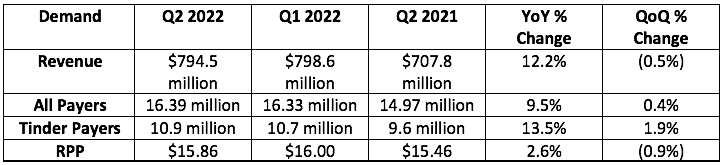

Match Group guided to a midpoint of $805 million in sales while analysts expected $804.3 million. Note that this guidance assumed a 500 basis point FX headwind. Match posted $794.5 million in revenue with a 700 basis point FX headwind. Specifically, it would have posted $807.5 million in sales in the FX headwind assumed in its previous guide didn’t worsen. In other words, the shortfall was not demand driven.

a) Demand