1. CrowdStrike (CRWD) -- Germany, Culture & a Case Study

a) Germany

In another public sector win for CrowdStrike, the company was added to Germany's "Federal Office for Information Security list of qualified response service providers.” This list serves as a curated menu of options for government agencies and the private sector to select heavily vetted security vendors to meet their growing needs. CrowdStrike was able to seamlessly pass an intense, 2-part exam where its technology was tested for compliance and efficacy. I looked into the most recent version of this list and Palo Alto -- a formidable incident response and endpoint protection competitor -- was not on it. SentinelOne isn’t either but they don’t do much in incident response.

Goldman Sachs also issued an upbeat note on CrowdStrike. I don’t really care about price target changes, but I do care about is the institution’s ability to have its finger on the pulse of enterprise-level spend which drives CrowdStrike’s growth. Goldman's findings aren’t surprising but are still encouraging as a reiteration of our current climate: Exploding demand for cybersecurity will continue to be a tide lifting all boats.

b) Culture

CrowdStrike also made Fortune’s list of the 100 Best Companies to work for the second straight year. The three most formidable endpoint and cloud workload protection competitors for CrowdStrike -- I believe -- are Microsoft, Palo Alto and SentinelOne. None of those three made the list. In a world of pressing talent shortages, especially within this space, these small pieces of evidence are good signs pointing to CrowdStrike’s ability to effectively compete for new hires.

c) Case Study

CrowdStrike released a new case study on its success with the century+ old company: Heidelberger Druckmaschinen (a German engineering bellwether with 11,500 employees). The firm beta-tested CrowdStrike’s Falcon platform with just 200 users as Heidelberger was skeptical that the promised scalability and visibility would lead to an inundation of false positives like with other next-gen security alternatives it had tried.

According to the prospective client's Chief Information Security Office (CISO) Dr. Andre Loske, “there were no problems.” CrowdStrike freed this global firm to achieve far better endpoint protection with far less time, energy and resources needed to do so. The German firm has a very small team of security professionals, so CrowdStrike’s asset-light pairing of autonomous & cloud native protection with a managed, human element (when needed) stood out.

“We had a traditional antivirus solution but this led to a real lack of visibility for recognizing threats and reacting in time. We researched many solutions and went with CrowdStrike despite it being in the upper price range as it provides real added value. The integration worked surprisingly well… with Falcon, we have truly achieved a paradigm shift.” — Heidelberger Druckmaschinen CISO Dr. Andre Loske

2. Teladoc Health (TDOC) -- Livongo and India

a) Livongo

Piper Sandler channel checks prompted the institution to raise its Q1 2022 estimates for total Livongo app downloads (owned by Teladoc). This metric rose over 50% sequentially from Q4 to Q1 which represents the service’s best sequential Q4 to Q1 growth since at least 2018. Furthermore, daily downloads consistently ramped higher throughout the entire first three months of the year. These are great signs which should lead to outperforming access fee revenue -- its largest segment by far.

While the last year of owning this name has been brutal from a stock perspective, I continue to see consistent evidence of the company fundamentally executing. As one of the largest pandemic beneficiaries out there, it still expects AT LEAST 25% annual growth for the next three years and its EBITDA margin continues to greatly expand with more cross-selling and economies of scale. Other large Covid-19 beneficiaries have guided to far less impressive forward growth as their own demand fades. The narrative surrounding Teladoc of it being incapable of turning a profit is also just not accurate. Without M&A charges which will end in the 4th quarter of this year, it would already be generating positive net income.

b) India

India launched its first ever telemedicine center “based entirely on Teladoc’s technology.” This center greatly expands a physician’s ability to provide out-patient service in a virtual setting to India’s gigantic population. The center will also make collaboration with doctors in other nations far more seamless while greatly expanding access to medical services for people in India. Telehealth’s ability to free doctors to do “more with less” is especially vital in a world featuring pressing doctor shortages.

c) BetterHelp

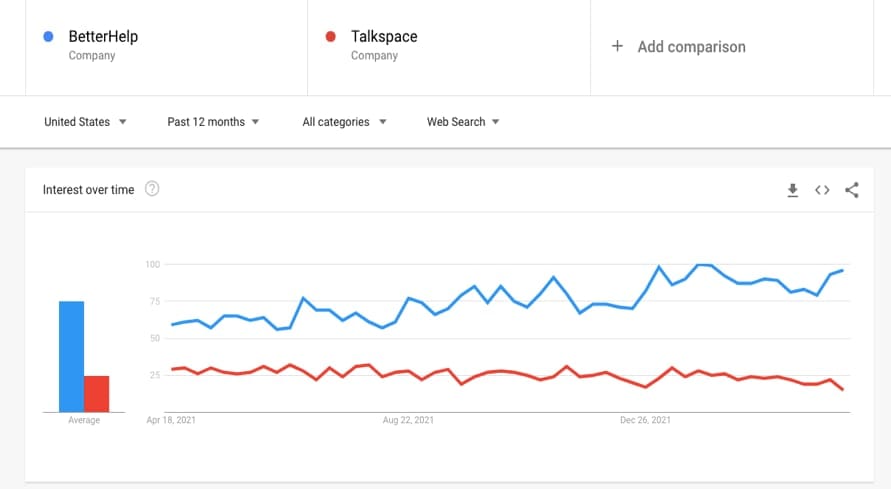

Twitter conversations this week inspired me to check on BetterHelp’s (Teladoc’s B2C mental health product) traffic trends. They were strong. Per Data.Ai, BetterHelp has steadily climbed from the 79th overall Health and Fitness App in the USA to 46th -- in just 90 days! It’s now a top-100 app in 14 nations across the globe vs. 10 earlier in the year. Google Trends data is just as notably strong (TalkSpace is the most formidable & direct competitor):

3. The Trade Desk (TTD) -- Solimar Tailwinds & Proxy Statement

a) Solimar Tailwinds

Solimar -- The Trade Desk’s new ad platform -- paved the way for the company to build dedicated ad-platforms for giant retailers like Walmart and Home Depot. These behemoths revere Solimar as it provides them with a far more effective and lucrative means to use, contextualize and eventually profit from their 1st and 3rd party retail sales data.

The enhanced utility appears to be in high demand as research out of Ad-Week indicates that marketers will seek to use this retail sales data at nearly triple the rate in 2022 vs. 2021. Not only does this make The Trade Desk’s service even more valuable for established retail brand clients to extract value from their data, but it motivates more retailers to sign on. According to Co-Founder/CEO Jeff Green from an earnings call in 2021, the organization was working on arrangements with “dozens” of other large retailers which are the companies that "investors would expect The Trade Desk to be working with." We should learn a lot more about that this year.

Click here for my TTD Deep Dive.

b) Proxy Statement

Highlights from The Trade Desk’s newly released proxy statement:

- Jeff Green’s total compensation in 2021 was a whopping $828 million as he received a handsome options package for clearing large performance benchmarks.

- Other executives also got nearly $45 million in bonuses for clearing these benchmarks.

- Baillie Gifford owns 12.1% of The Trade Desk's class A shares vs. 6.8% YoY and now controls 6% of its voting power vs. 4.3% YoY.

- Morgan Stanley showed up as a 5%+ shareholder for the first time with 6.4% of The Trade Desk's class A shares and 3.2% of the voting power.

- Prudential is no longer on that 5%+ list.

- Vanguard grew its stake from 8.9% to 9.0% YoY.

- Jeff Green owns 97.7% of the class B shares vs. 97.9% YoY and now owns 1.1% of class A shares vs. close to 0% YoY (equity awards).

- He has 49.3% of all voting power vs. 50.6% YoY.

- Co-Founder/CTO Dave Pickles continues to hold 2.8% of all voting power.

- All executives and directors own 51.5% of the company's voting power vs. 52.7% YoY.