Table of Contents

- 1. Earnings Round-Up – Global-E, Adyen, Applied Ma …

- 2. Datadog (DDOG) – CFO Interview

- 3. Walmart (WMT) – Earnings Review

- 4. On Running (ONON) – Earnings Review

- 5. PayPal (PYPL) – Adyen and Fastlane

- 6. Lululemon (LULU) – Change of Heart

- 7. CrowdStrike (CRWD) – Sell-Side Research

- 8. Market Headlines

- 9. Macro

What a difference 2 weeks can make. I hope you’re all breathing more easily and patting yourselves on the back for staying the course. I’m glad we responded to market turmoil the right way. How? By leaning into executing, fairly-priced companies that were swept up in the indiscriminate selling. If history is any indication at all, market fits drumming up this indiscriminate selling have always been opportunities. And this time? We’ve seen several names in the coverage network rally 50% from lows in the blink of an eye. Years were made by tuning out the noise and doing what felt incredibly uncomfortable, yet right at the time.

I was not trying to time a bottom when buying so aggressively early last week. Who knows if I did — stocks will remain volatile and things could always go lower. And while the QQQ was still just 15% off of recent highs, many key names had already fallen much more. As I said in the alerts, I’m not in the business of bottom-timing. I just know that I want to own more shares of the right companies as multiples contract and risk-reward improves. It’s amazing how sticking to that plan can consistently yield such good results.

Cling to this feeling the next time Mr. Market inevitably pukes; remember this when it's again time to ignore how uncomfortable it is to be "greedy when others are fearful.” During every correction, “there will be brighter days ahead” has always been the right mindset. And if that ever becomes untrue, we probably will be focused on other dystopian things rather than our stocks.

During the week, I sent Nu, Sea Limited & Block Earnings Reviews. I also sent coverage of Progyny’s investor day, DraftKings tax news, the new Starbucks CEO and the rumored Alphabet breakup. Read that all here.

1. Earnings Round-Up – Global-E, Adyen, Applied Materials

a. Global-E (GLBE)

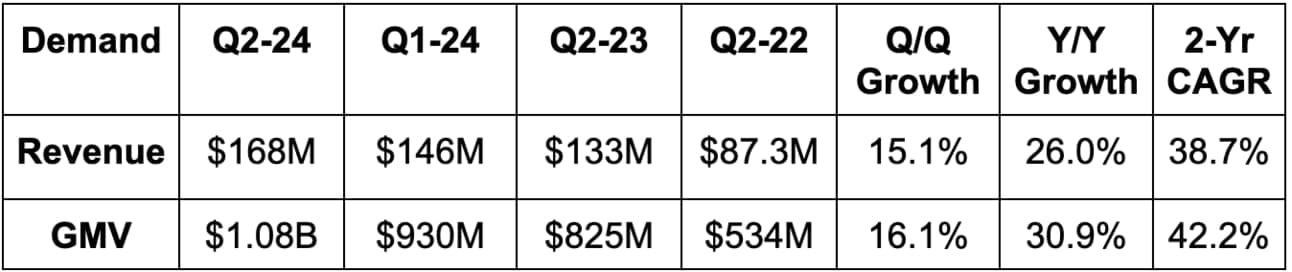

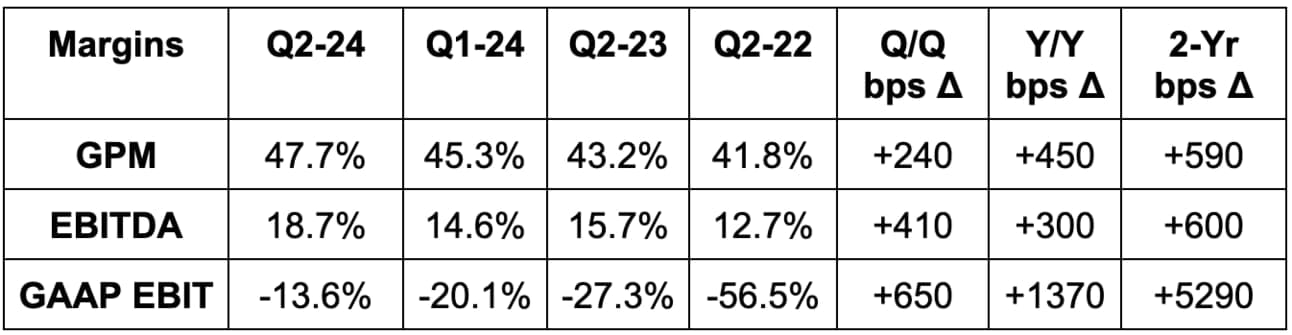

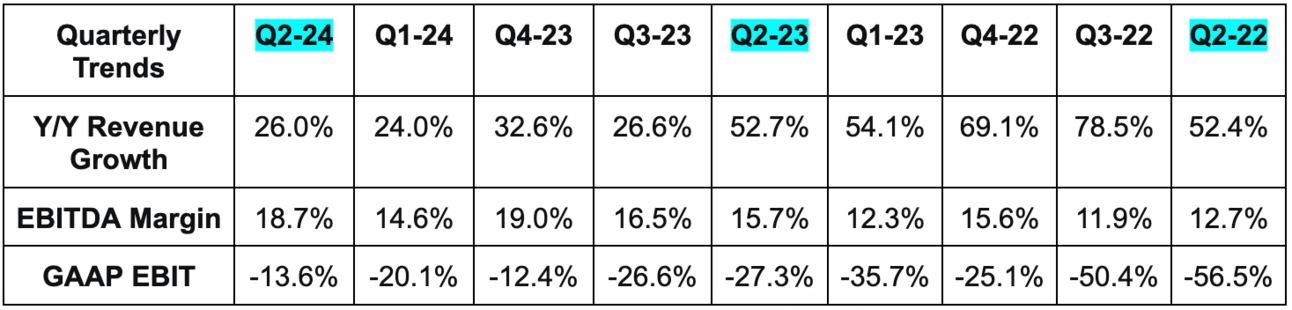

Results:

- Beat revenue estimates by 1.2% & beat its guidance by 1.5%.

- Beat gross merchandise value (GMV) guidance by 3.3%.

- Beat EBITDA estimates & beat its identical guidance by 18.1% each.

- Beat -$27.5M GAAP EBIT estimates by nearly $5M.

Balance Sheet:

- $340 million in cash & equivalents.

- No debt.

- Diluted and basic share counts rose by 1.7% Y/Y.

Guidance & Valuation:

- Slightly cut its annual GMV guidance.

- Cut annual revenue guidance by 3.1%, which missed by 2.4%.

- Raised annual EBITDA guide by 2.3%, which beat by 3.2%.

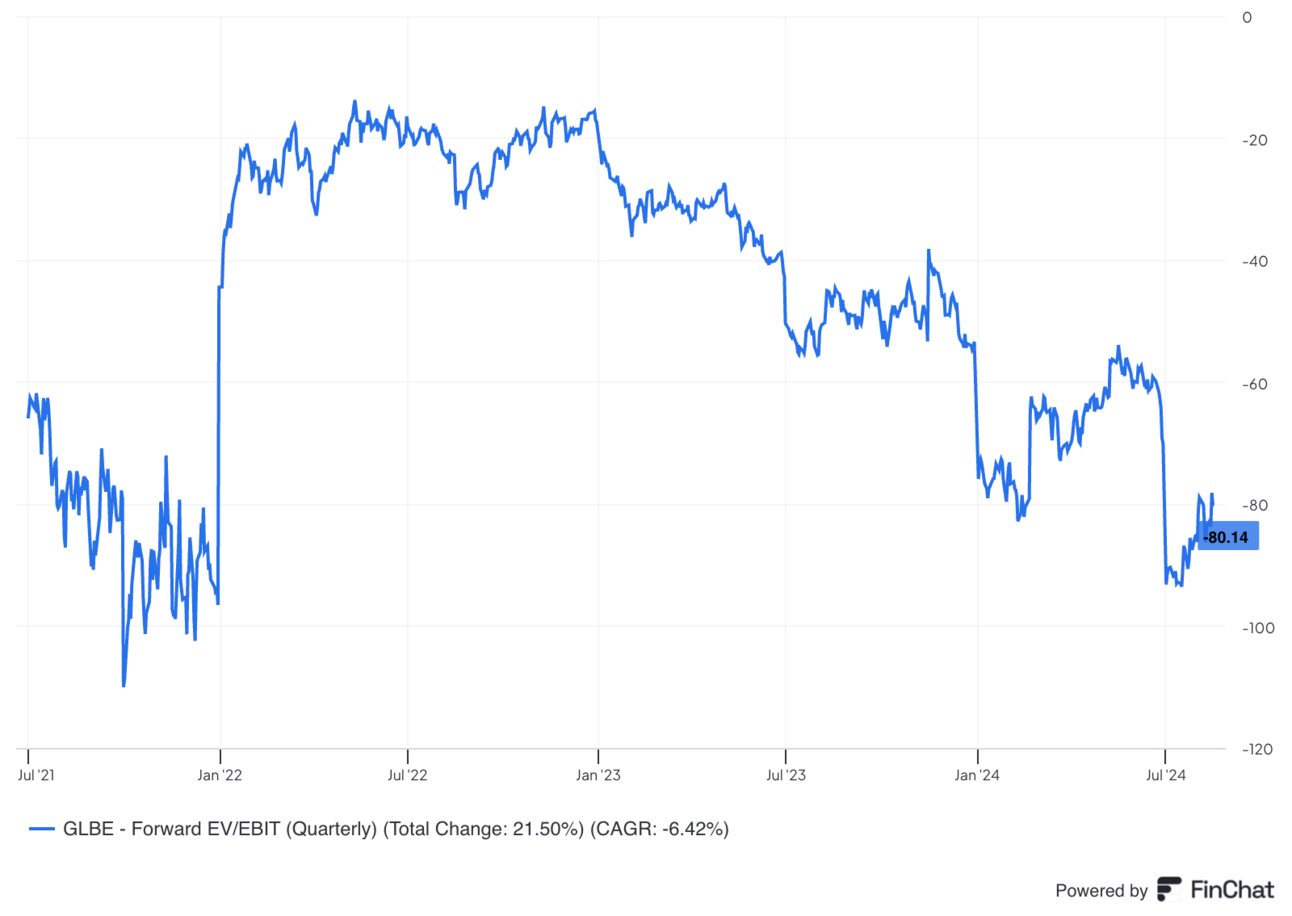

Global-E trades for 45x 2024 EPS. EPS is expected to grow by 30% Y/Y in each of the next two years.

b. Adyen (ADYEY)

Results:

- Beat revenue estimates by 0.5%.

- Beat EBITDA estimates by 2.3%.

Balance Sheet:

- €8.3B in cash & equivalents.

- No debt.

- Share count is flat Y/Y.

Guidance & Valuation:

Adyen reiterated roughly 25% revenue compounding and a 50%+ EBITDA margin by 2026. It trades for 40x forward EPS, with profit expected to grow by 26% in each of the next two years.

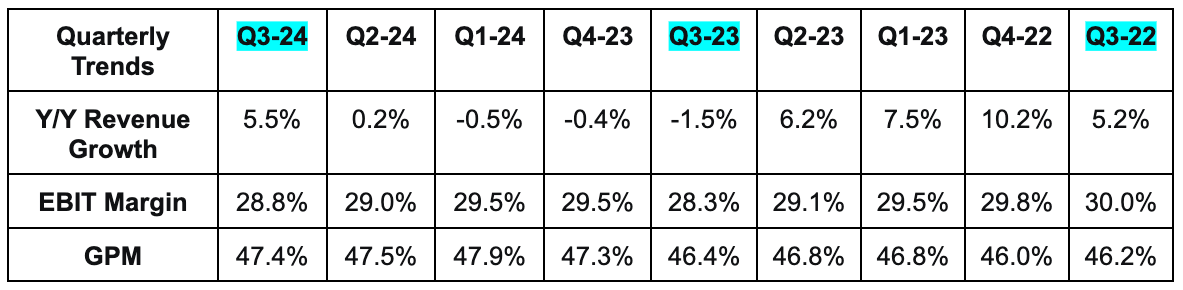

c. Applied Materials (AMAT)

Results:

- Beat revenue estimate by 1.6% and beat guidance by 2.0%.

- Beat $2.05 EPS estimate by $0.07 and beat guidance by $0.11.

Balance Sheet:

- $9.1 billion in cash & equivalents.

- $5.6 billion in inventory (roughly flat year-to-date).

- $6.3 billion in total debt ($100 million is current).

- Diluted share count fell by 1.2% Y/Y; basic share count fell by 1.4% Y/Y.

- Dividends rose by 23.5% Y/Y.

Guidance & Valuation:

- Revenue guidance roughly met estimates.

- $2.18 EPS guidance beat estimates by $0.04.

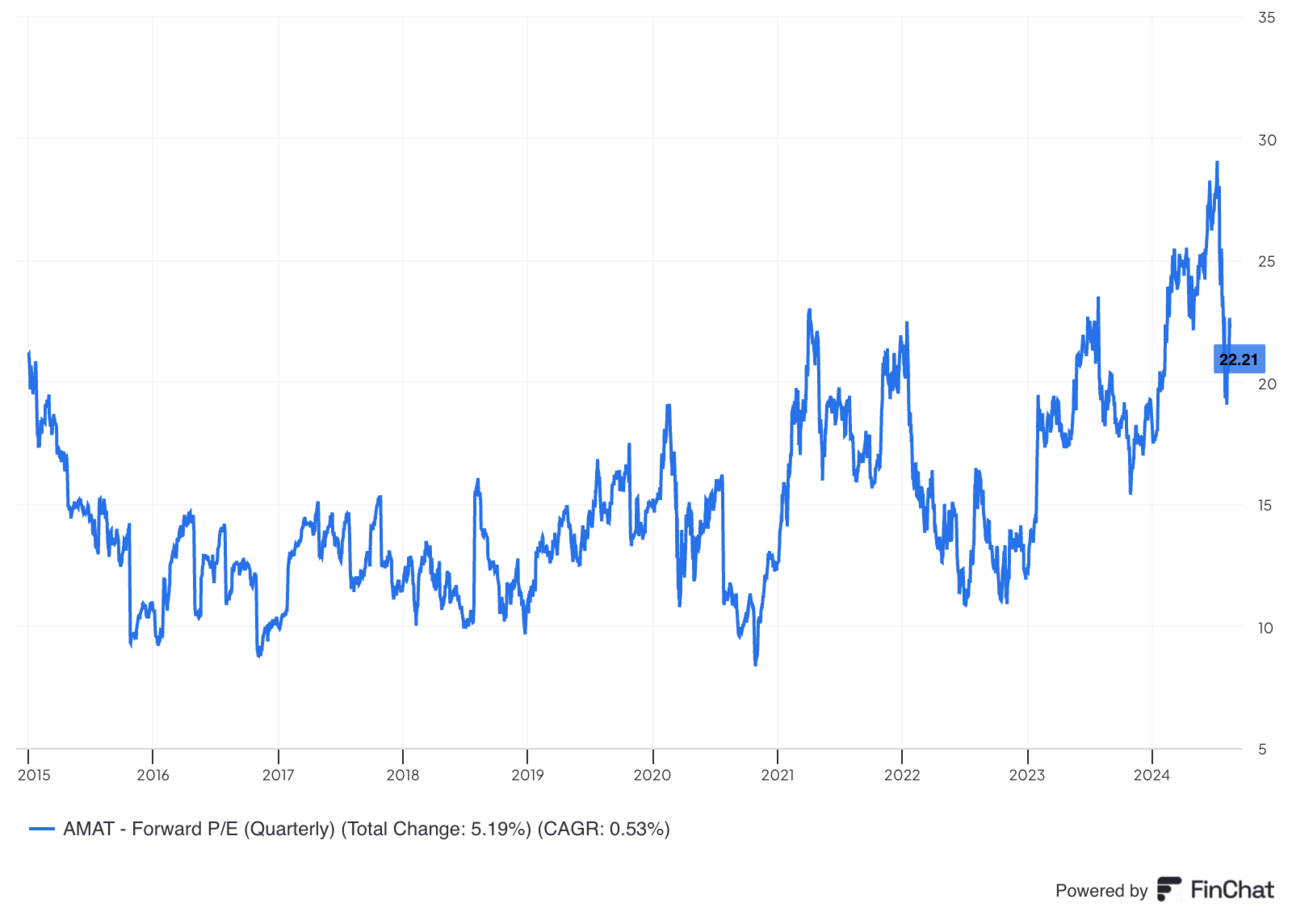

AMAT trades for 25x forward EPS. EPS is expected to grow by 5% this year and by 15% next year.

2. Datadog (DDOG) – CFO Interview

Datadog’s CFO sat down for an interview with Oppenheimer this past week. As DDOG’s earnings report was last week, there wasn’t much newness in the report. Here’s what we did learn:

Vendor Consolidation:

CFO David Obstler sees vendor consolidation within DDOG’s industry as in the third inning. It expects to continue gaining market share in software development, security and operations (DevSecOps) as this trend keeps playing out. Whether it’s experience monitoring, large language model (LLM) observability or DDOG’s cloud service provider entrance, it continues to add to its use cases and ability to displace more point solutions.

Macro:

Obstler was asked how its small, medium business (SMB) category has fared so well amid hectic macro uncertainty. He thinks this stems from two things. First, Datadog’s SMB clients skew heavily to the “M” rather than the “S.” They’re at the larger end of this category. Secondly, he thinks this shows how mission critical DDOG’s products are.

Stable Usage Growth:

Datadog guided to stable Y/Y usage growth next quarter vs. this past quarter. Q3 2023 is when Datadog’s clients practiced their sharpest workload optimization, which weighed on its growth. For this reason, many expected usage growth to accelerate Q/Q for the firm. Obstler was asked if the stable usage growth implies an expected deceleration as comps get tougher starting in Q4 2023. He said no. This is because DDOG’s new client momentum remains strong as of this past week. That new revenue source is more than making up for the very modest weakness in usage growth.

Security:

Security is arguably the best way for Datadog to drive the all-important vendor consolidation for clients. Observability, monitoring and security are all perfectly complementary. Still, Datadog has struggled a bit with product delivery within security. For example, it had to retool its Security Information and Event Management (SIEM) cloud security product to get it to work better with its log management products. It remains “optimistic about the potential attach rate for SIEM to its monitoring tools… but also remains in “build mode.”

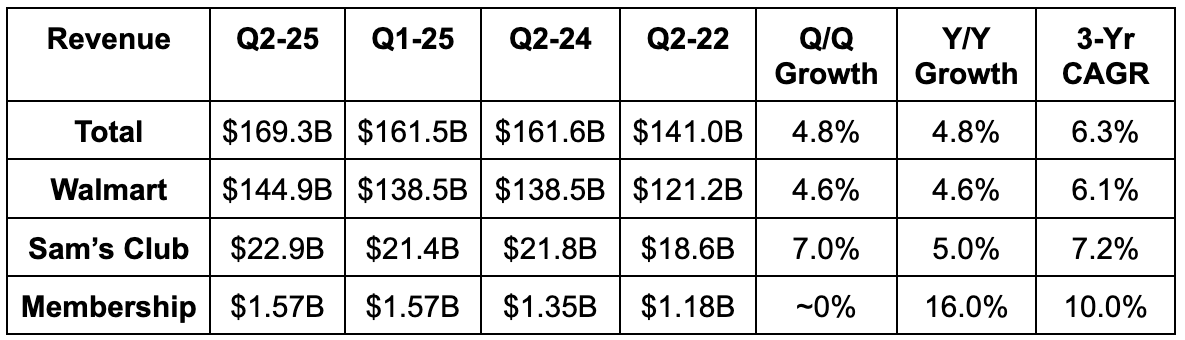

3. Walmart (WMT) – Earnings Review

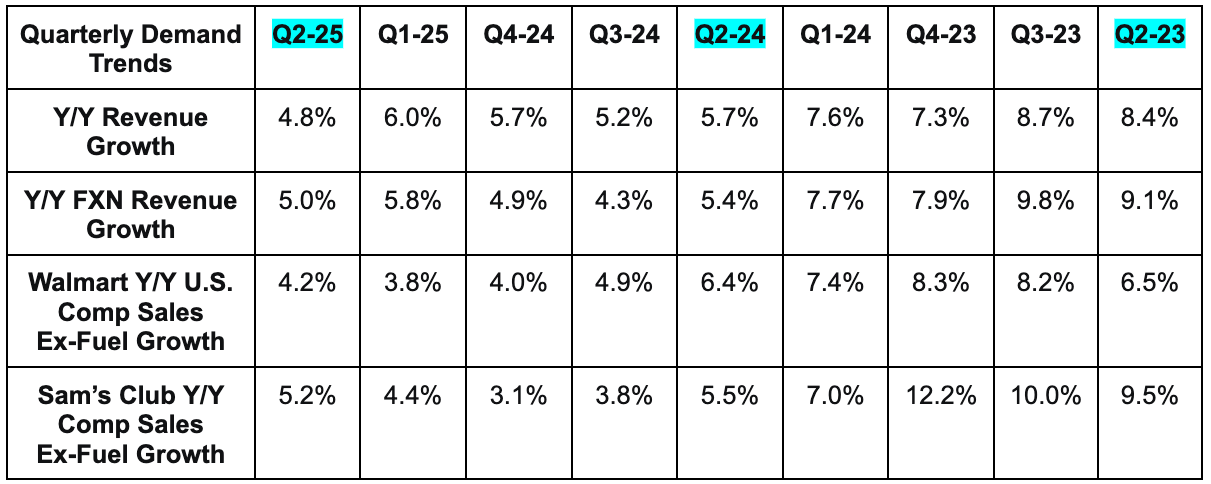

a. Demand

- Beat revenue estimates by 0.8%.

- Walmart U.S. and Sam’s Club were both ahead by about 1%. Walmart International missed by 1% due to FX headwinds.

- U.S. Comp sales excluding fuel rose by 4.2% Y/Y vs. 3.5% Y/Y growth expectations. Both Walmart and Sam’s Club comp sales were ahead of expectations.

- Global e-commerce and advertising revenue rose by 21% & 26%, respectively.

- E-commerce growth was led by 50% growth in store-fulfilled delivery. It’s highly efficient to use existing brick-and-mortar capacity for this added source of revenue.

- Walmart Marketplace ad revenue rose by 32% Y/Y.

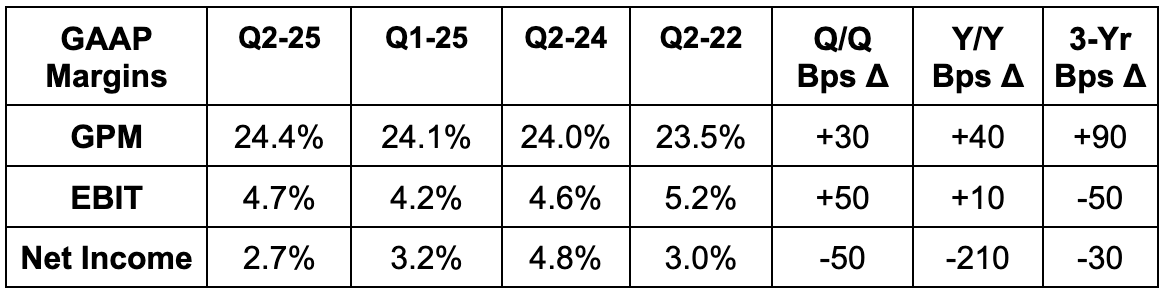

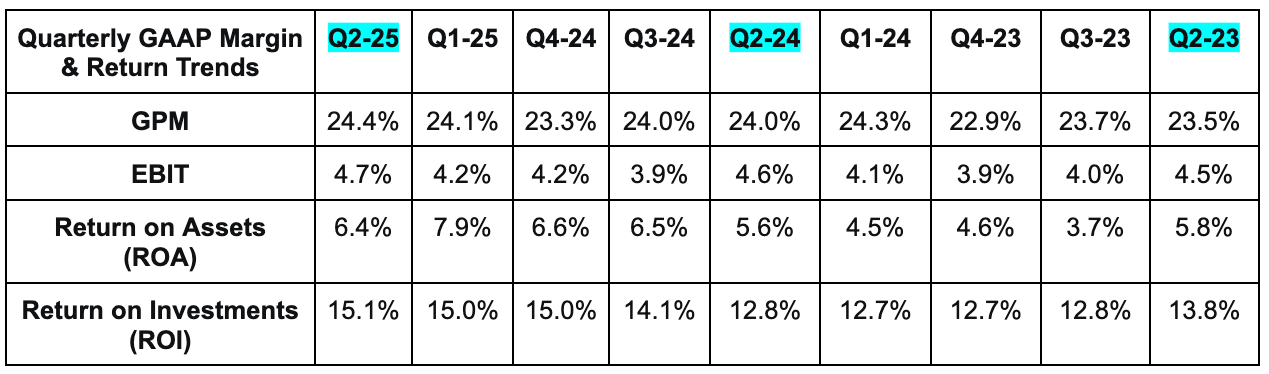

b. Profits & Margins

- Beat 24.0% GAAP GPM estimates by 40 basis points (bps; 1 basis point = 0.01%).

- Beat GAAP EBIT estimates by 2.2%. Beat 4.6% GAAP EBIT margin estimates by 10 bps.

- Beat $0.65 EPS estimates by $0.67.

- Year-to-date free cash flow (FCF) of $5.9 billion vs. $9.0 billion Y/Y. CapEx rose by $1.3 billion Y/Y to support expansion plans.

c. Balance Sheet

- $8.8 billion in cash & equivalents.

- Overall inventory fell 2% Y/Y and is in “healthy” shape.

- $47 billion in total debt.

- Dividend payments rose 9% Y/Y.

- Diluted and basic share counts both slightly fell Y/Y.

d. Guidance & Valuation

Q3 guidance:

- 3.75% consolidated FXN revenue growth slightly missed 3.9% growth estimates.

- 3.75% consolidated FXN missed 8.5% growth estimates.

- $0.52 adjusted EPS guidance missed $0.55 estimates.

Annual guidance:

- Now sees 4.25% consolidated FXN revenue growth vs. 3.50% when it originally guided and 4.0% last quarter. This missed 4.4% growth estimates.

- Now sees 7.25% consolidated FXN EBIT growth vs. 5.0% when it originally guided and 6.0% last quarter. This missed 8.5% growth estimates.

- Roughly reiterated $2.39 EPS guidance, which missed $2.44 estimates by $0.05.

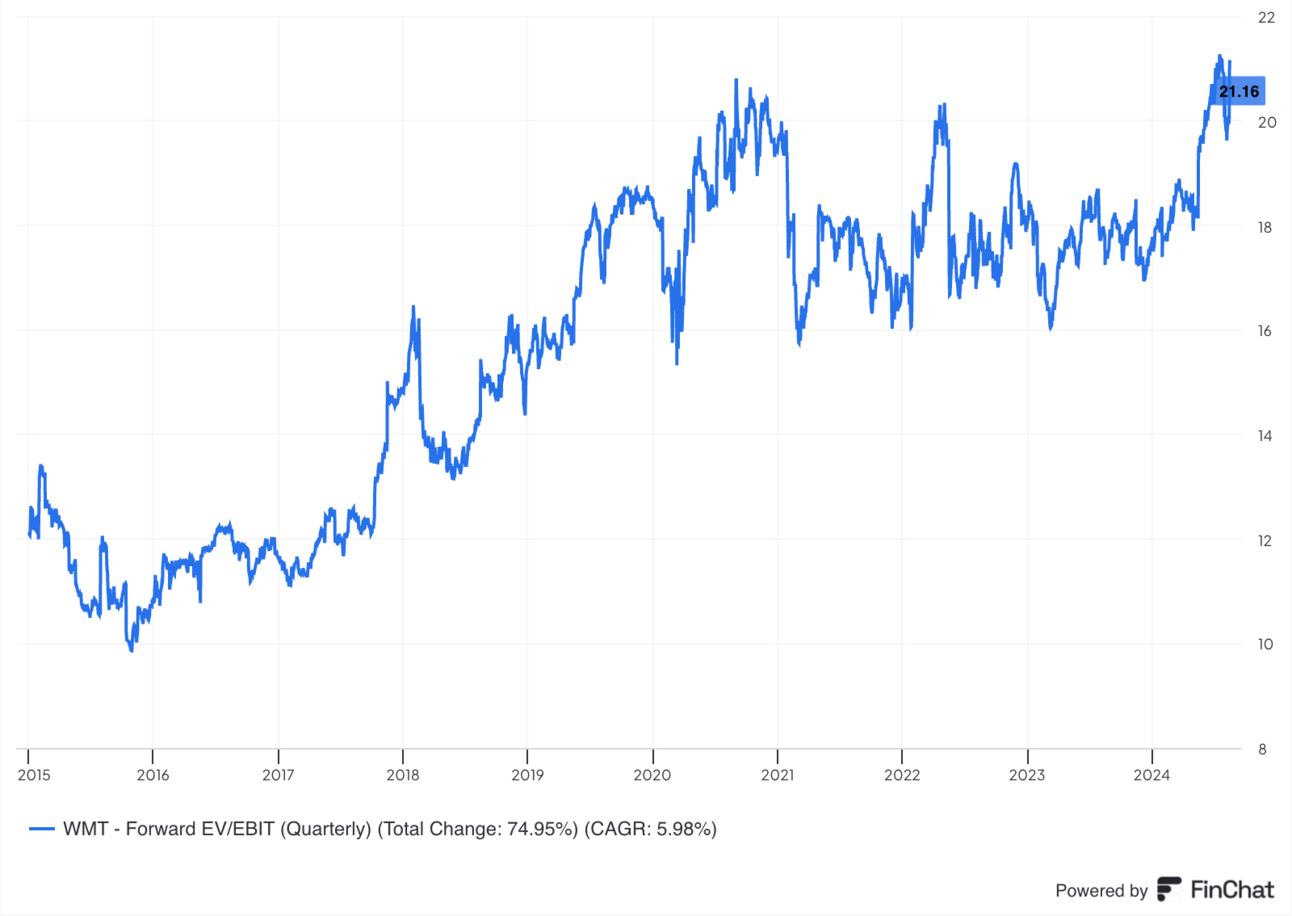

Walmart trades for 30x forward earnings. EPS is expected to grow by 10% in each of the next two years.

e. Call & Release

Walmart U.S. Performance:

Revenue rose 4.1% Y/Y for Walmart’s domestic business. Walmart’s 4.2% Y/Y comparable store sales growth slowed considerably from 6.4% last year. This was driven by lower basket size inflation of 0.6% this year vs. 3.4% last year. On the transaction side, growth of 3.6% actually accelerated compared to 2.9% last year.