1. Lemonade (LMND) -- Earnings Review

“Our products continue to season. We expect returns from earlier investments to soon outstrip costs of new ones. Peak losses are expected this quarter with EBITDA improving thereafter.” — Co-Founder/CEO Daniel Schreiber

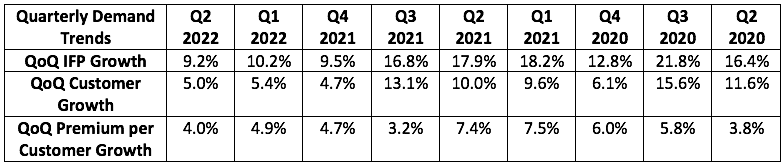

a) Demand

The company guided to $47 million in Q2 sales while analysts were looking for $47.6 million. Lemonade posted $50 million in sales, beating its forecast by 6.4% and analyst estimates by 5%.

Lemonade also guided to:

- In Force Premium (IFP) of $447.5 million. It posted $457.6 million, beating expectations by 2.3%.

- Gross Earned Premium (GEP) of $104 million. It posted $106.8 million, beating expectations by 2.7%.

More context on demand:

- This growth does not include any inorganic Metromile contribution. That closed after the quarter ended in July. This is all organic.

- Lemonade ceded 70% of its premiums to reinsurers this quarter vs. 75% in recent years. That fell further to 55% as of this week. This is an expected shift in light of its models and book maturing and is expected to continue. This move is a revenue tailwind as ceded premiums aren’t recognized as sales.

- Headcount grew 52% YoY but is flat vs. 6 months ago.

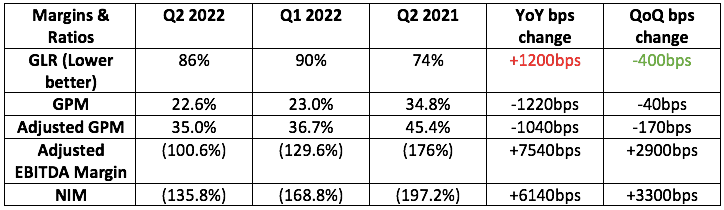

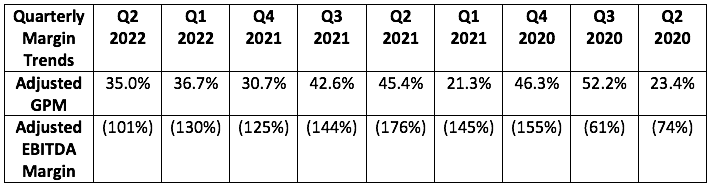

b) Profitability

Analysts were looking for an EBITDA loss of $65.2 million for the quarter while Lemonade guided to a loss of $67.5 million. It lost $50.3 million, sharply beating expectations. Lemonade also guided to $15 million in stock based compensation for the quarter while it paid of $13.9 million.

More context on margins:

- Inflation continues to weigh on GLR. Why? Claims float freely with inflation while premiums do not. Lemonade has filed the needed rate changes to combat this issue, but GLR is a lagging indicator and these changes have not yet shown up in improvement. It will next quarter and thereafter as GLR is expected to precipitously fall DESPITE Metromile adding ~400 basis points (4%) to the metric for the rest of the year.

- Lemonade is rapidly building out new products to bundle with its existing offering. These products debut at GLR maximums which mean they also debut at gross margin minimums. That is the reason for the YoY worsening in these two stats. Its legacy business continues to see margin expansion.

- That same ceded premium reduction from 75% to 55% hurts GPM as the denominator in the calculation becomes larger.

Lemonade has $1 billion in cash on hand and no debt.

c) Guidance

Lemonade now sees an EBITDA loss of $242.5 million for the year vs. previous expectations of $272.5 million. This includes $30 million in added EBITDA loss from roughly 4 months of Metromile contributions (so without Metromile the loss would be $212.5 million). It’s controlling costs, yet still sees $237.5 million in 2022 sales (well ahead of expectations) for 83% top line growth.

Along the lines of cost-control, the team committed to no more external capital raising until turning profitable. It isn’t saying it will never fundraise again. It’s saying it doesn’t want to have to do so from a point of weakness, which a dwindling cash position and no path to profitability would create. I was pleasantly surprised that this was such a prominent piece of the prepared remarks. In recent quarters, it has given the impression that it would spend on growth at all costs. It seems to have responsibly walked that back a bit with this new context. Considering where we are in the current macro cycle, this philosophical change shows management’s willingness to cater to public market appetite when need be. That’s important to me.

“We’re not changing course, we’re changing pace… we can effectively deploy far more capital than this moderated plan will see us deploy -- just not at today’s cost of capital.” — Co-Founder/CEO Daniel Schreiber

With moderating spend, it now sees IFP of $612.5 million (61.1% YoY growth including Metromile) vs. previous expectations of $540 million. This -- which now includes the Metromile acquisition -- which was about $30 million less than I was expecting. That's the flip side of controlling costs, it’s pursuing new share less aggressively. Furthermore, the company has halted all Metromile marketing investments while it is integrated into the Lemonade umbrella. It doesn’t want to market the new product until it’s called “Lemonade Car” rather than Metromile. The natural churn inherent in car insurance will therefore lead to a few quarters of car business shrinkage before Lemonade turns the growth engine on. That profit prioritization is the source of this miss -- and I find these two reasons to be sound.

As Metromile closed this quarter, there is a large inorganic boost to guidance. As a result, I only included current guidance (not % changes vs. the pre-Metromile guide) vs. Wall Street estimates:

For Q3 2022, Lemonade guided to:

- $597.5M in IFP

- $128M in GEP

- $64M in revenue vs. analyst estimates of $57 million.

- ($71.5) million in EBITDA vs. analyst estimates of ($77.4) million

- Stock comp of $16 million

d) Shareholder Letter Notes

On Metromile notes:

- Car premiums jumped from 1% of Lemonade’s business to 20% with the close of this M&A. Renters fell from 50% to 33%.

- It’s now actively working on transitioning Metromile's data and tech stack (and brand) to Lemonade’s infrastructure.

- Lemonade gained immediate car access to 7 markets with rapid state expansion expected now that it has 49 state licenses in hand.

Click here for a detailed article on what Lemonade saw in Metromile.

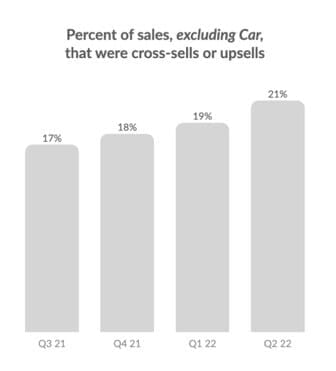

On Cross-Selling and Retention:

23% of Lemonade’s Q2 2022 sales (21% ex-car) was via cross-selling. This has been steadily rising and that trend should continue. Why? In Illinois where its car product is most mature, cross-selling is 36% of its business. This cross-selling in Illinois is also greatly juicing retention rates in the state to 93% vs. 83% for the rest of its book. These are encouraging signs.

The runway for continued cross-selling is simply massive. While nearly 25% of new product sales are via cross-selling, just 4% of Lemonade members have more than 1 product.

On Macro:

“Our results belie the global financial picture. One would struggle to detect a macroeconomic downturn based on our internal dashboards. We operate in an industry that is largely impervious to recessions and have a portfolio enabling us to offset local issues through re-balancing. Our screens show strong demand, marketing efficiency ahead of plan, operating efficiencies ascending and loss ratios descending.” — Co-Founder/CEO Daniel Schreiber

On Profitability:

“Even as we continue to launch new products and in new geographies, we have turned a corner. This phase change from growing losses to shrinking losses is occurring naturally. The business is doing what it was designed to do.” — Co-Founder/CEO Daniel Schreiber

Lemonade spoke at length on the leading indicators it sees that are offering it confidence to offer these words. These indicators will be shared in detail at its investor day in November. The biggest factor is that more and more of its business is coming from seasoned products, customers and geographies. Again, loss ratios naturally fall with this seasoning.

During the quarter, Lemonade launched the 6th generation of its lifetime value (LTV) and lifetime loss ratio ML model. This is expected to juice its LTV/CAC (currently near 3.0X) with the enhanced data granularity and precision. This model has already uncovered a large cohort of California home customers that its old model thought was profitable. They were actually cash burning users. Conversely, the model revealed how much more profitable its pet business is than the old system thought. It re-allocated resources accordingly.

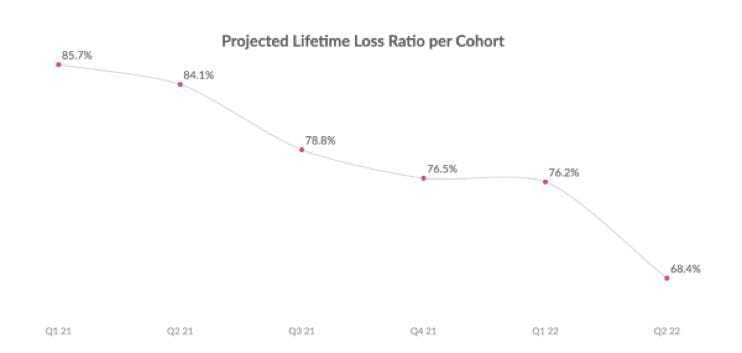

Management cautioned using static GLR to determine its underwriting quality as the indicator is lagging and doesn’t capture rapid improvement. This makes sense to me, but I would also caution that of course management doesn’t want us looking at GLR if it’s still too elevated -- which it is. Instead, management pointed us to lifetime loss ratio predictions and the vast improvements it’s seeing there:

For context, it takes 2 years for a Lemonade customer to see its GLR fall below the lifetime loss estimate. Thereafter, the loss rate is typically below the lifetime estimate. Today, 75% of its business is from products less than 2 years old (product growth is rapid) -- offering a clear path to continued loss ratio improvement over time. Lifetime loss ratio is the leading indicator, and it looks very strong per management.

“We have said all along that while the cost of launching new products is heavily front-loaded, these will prove profitable in the fullness of time. And that’s what is happening… Leading indicators strongly suggest that the business will prove profitable.” — Co-Founder/CEO Daniel Schreiber

e) My Take

This was another pleasantly surprising quarter from Lemonade. Management is effectively controlling costs while still delivering the rapid growth we’ve come to expect. Its path to profitability, while still long, is as clear as it has ever been and my confidence in the team is rising. I’ve taken this off of my hot seat (do not accumulate list) and am ready to resume opportunistically adding into pricing volatility. This quarter put a large smile on my face just like the last one did.

2. Olo (OLO) -- Earnings Review

a) Demand

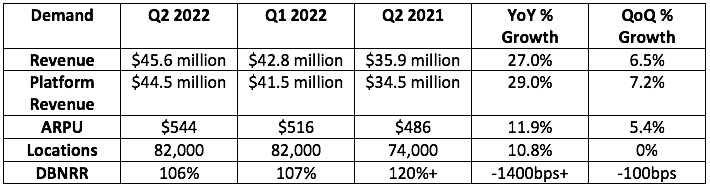

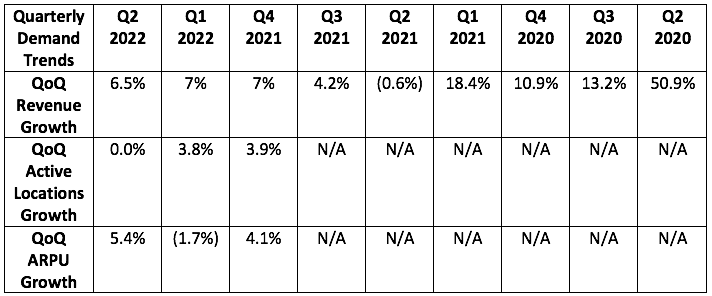

Olo guided to $45.8 million in revenue while analysts expected the same. It generated $45.6 million in sales, slightly missing expectations.

More context on demand:

- Olo added 3,000 gross QoQ locations but lost its Subway Rails contract which cost it 2,500 locations. This also cost Olo about 500bps on its DBNRR. More on this later.

- Sequential ARPU growth was actually boosted by Subway beginning its migration away from Olo -- Subway's ARPU was far lower than Olo’s client average.

b) Profitability

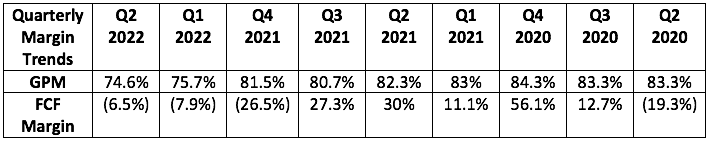

Olo guided to $800,000 in non-GAAP operating income while analysts expected $1.2 million. It earned $2 million, sharply beating expectations. This was the bright spot of the report.

More context on margins:

- The Wisely and Omnivore acquisitions continue to weigh on margins.

It has $464.7 million in cash equivalents and investments with no debt.

c) Guidance

Q3 2022:

- Olo guided to $46.8 million in sales. This missed analyst estimates of $51.2 million by 8.6%.

- Olo guided to $3.6 million in non-GAAP operating income. This beat analyst estimates of $3.3 million by 9.1%.

2022:

- Olo lowered its previously issued 2022 sales guidance by 7.4% from $196 million to $183.5 million. This came in about 7.2% below consensus estimates. Yuck.

- Olo lowered its previously issued 2022 non-GAAP operating income guide by 4.8% from $8.4 million to $8 million. This came in 25% below consensus estimates. Double yuck.

d) Notes from the Call

On Subway:

Olo expects Subway to migrate its remaining 12,500 locations to their home grown solution by Q1 2023. While this will weigh on active location growth (still expects to add 6,000 net new locations through the end of the year), it interestingly wasn’t the reasoning behind its guidance reduction. The company has been anticipating this move for several quarters and had already factored it into its guide by reducing Subway’s contribution from a few million to near $0 through Q1 and Q2. I would’ve liked to know about it as soon as Olo began factoring it into the guidance earlier in the year. An analyst on the call rightfully asked the team if there are any other brands like this to be aware of. Glass said no.

Glass also assured us that conversations with the top 20 enterprise restaurant brands continue to be productive and frequent. He’s confident they can land some of these whales. We shall see.