Today's piece is powered by Commonstock:

1. Meta Platforms (META) -- TikTok and Various News

a) Tick Tock, TikTok

A bipartisan movement in the Senate Intelligence Committee is calling on the FTC to investigate TikTok. The request is centered on TikTok’s insistence that American consumer data isn’t accessible in China -- when in fact it is. The same BuzzFeed story we discussed last week that leaked audio clips of ByteDance employees having free access to sensitive consumer data started this whole process. It’s likely that much more political momentum will be needed to bar TikTok from operating in the United States. In the off but growing chance that a ban does occur, Meta Platforms along with its social media competitors and YouTube would benefit greatly.

b) Various News

- For June, Instagram gained more downloads than TikTok with 57 million to TikTok’s 55 million. The rest of the Family of Apps chipped in over 100 million downloads.

- Goldman Sachs channel checks revealed that digital ad spend has been durable thus far, holding up better than expected. Guggenheim issued a note with the exact opposite sentiment. Interesting times.

- EU Lawmakers passed the Digital Services Act (DSA) into law which essentially tightens the data sharing and privacy grips of the Digital Markets Act (DMA). The EU is also working on new restrictions of data flows between Meta’s Family of Apps.

- One week after Meta announced a delay to launching its “Novi” crypto wallet on WhatsApp, it’s canning the project entirely due to extreme volatility and resource re-allocation. Customers have been asked to withdraw funds. The NFT marketplace is still in full swing, for now.

- Meta is removing the Facebook login requirement to use its Oculus device to power broader interoperability. Users will now log in through “Meta Accounts” and Meta Horizon will be the social piece of the experience.

- Meta built a new AI model for real time translation of 200 languages.

2. Upstart Holdings (UPST) -- Preliminary Results

Upstart released un-audited Q2 2022 results this week which were largely negative, but with some meaningful green shoots. As we’ve been discussing on the last several issues, 2022 will stink for this company as it suffers from exogenous capital market factors and external funding activity dwindles.

a) The Bad

Upstart posted $228 million in revenue vs. expectations of $300, representing a large 24% miss. It also posted a net loss of $29 million vs. previous expectations of losing $2 million, while the cash flow generation continued. The larger net loss was a product of lower volumes keeping Upstart from extracting as much value out of its fixed cost base as it had been in previous quarters.

Macroeconomic pressures like a soaring 2-year yield and spiking credit spreads have crippled capital market funding appetite (temporarily) which is still where Upstart finds a slight majority of its revenue. Its operations are readily sourcing new consumer demand, but it is still funding-constrained as institutions tighten parameters with Upstart’s sub-prime niche being the first to go when times get tough. This is a supply-side issue. Last quarter, it remedied this issue with its own balance sheet to plug funding gaps, and markets utterly despised this decision. As a result, this quarter it left its balance sheet out of the funding equation and instead chose to turn down borrowers without partner or investor funding. Frustrating, but necessary.

More negatives:

- Upstart-sourced loans passing through capital markets shifted from excess returns in 2018-2020 to missing those expectations by nearly 100 basis points in 2021 -- that’s a wide margin in the lending space.

- It only added roughly 3 new (maybe a couple more) lending partners during the period vs. adding 15 total partners in the previous quarter. It does have more time to add new partners before its call in August, but the pace has to meaningfully accelerate to catch back up to the 1 partner per week tempo it was on. Considering that institutional demand will be fragile and inconsistent this year, it needs to rapidly build out the partner roster to make up the difference.

b) The Positives

Upstart took this quarter to clean up its balance sheet entirely. It listened to market pundits telling them to focus on being the marketplace rather than the lender and it took that message to heart. During the period, it converted the nearly $200 million in loans it previously funded with its balance sheet to cash. Given the rising rate environment Q2 experienced -- which makes loans worth less as the yields rise -- this led to a large contra-revenue item and was a growth headwind which will not recur.

Furthermore, the unit economics of its actual loans were strong and strengthening. Contribution margin (which deducts all variable costs floating with demand from revenue) came in a full 200 basis points ahead of expectations at 47%. This is direct evidence of the loan volume that is continuing to churn for Upstart coming with favorable terms for the company. That would not happen unless partners were pleased with the results.

CFO Sanjay Datta in the release reiterated that Upstart’s partner-retained loans have continued to uniformly meet or exceed loss and residual cash flow expectations since 2018 when the program began. While the excess demand -- which is often lower-quality demand -- funneled through capital markets during 2021 looks fragile, partner operations look quite durable.

And that’s how Upstart will be a sustainably successful investment -- by building durable partner retention businesses that are more resistant to macroeconomic cycles. Not by leaning on Asset-Backed Securitization (ABS) markets when times are historically good as that funding will inevitably dry up first when the economy starts to form cracks. A larger partner retention proportion means smoother revenue growth and also better unit economics as there are no investing institutions involved to command a profit. It’s a large win-win.

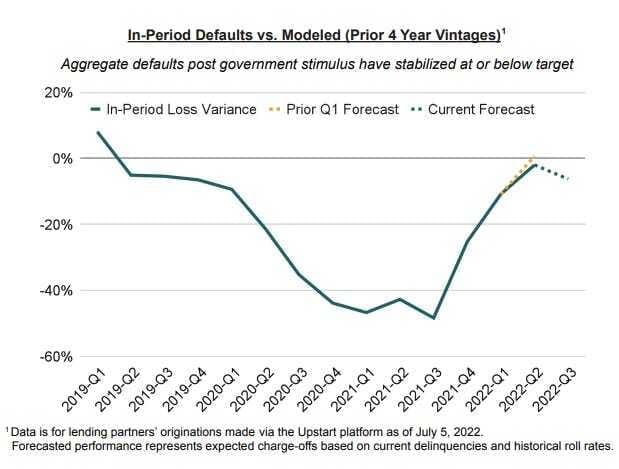

It also seems that Upstart’s risk algorithms have been effectively re-set to cater to our current environment as Datta told us that Upstart is “currently targeting returns of 10%+.” If this is the case and it can concretely demonstrate that result to institutions, it should have no problem finding funding. Finally, default trends are actually showing glimmers of hope. In Q1 2022, Upstart had anticipated that default rates would fully return to pre-stimulus levels. In reality, defaults have stabilized at a level below that rate.

c) My Take

Priority one was cleaning up the balance sheet and I commend the team for pulling that off in just a few weeks amid the chaotic environment. . Its partners continue to realize effective results from their Upstart loan pools, and that’s the most important revenue channel powering Upstart’s long term viability.

Still, this company intimately relies on capital market funding appetite to be able to match all of its borrower demand with funding supply. That will become less true as the partner roster builds out over time, but for now that is objectively the case. Upstart’s commitment to not use its balance sheet means the risk has shifted from balance sheet to volume growth in 2022. With its sizable $800 million cash position and continued cash generation, I think this company is seamlessly capable of putting its head down and getting through the year -- albeit with challenged growth. It’s worth noting that its authorized buyback now equates to nearly 25% of the company’s enterprise value and it plans to keep buying back shares. Some think this is a mistake, but considering its liquidity and profitability, I disagree. It’s still spending wildly on R&D -- proving that it can simultaneously walk and chew gum thanks to its unit economics.

2023 and beyond will be more inviting when rates peak and capital market cravings return: Institutional supply will turn back on at some point. If we look back and see that Upstart’s loan performance held up on a relative basis and delivered 10%+ returns like it’s targeting despite the terrible backdrop, it will surely be a beneficiary of that funding faucet flowing. At the same time, it will continue to build the partner roster (growth needs to re-accelerate there) to make its reliance on these delicate funding sources less precarious.

I don’t think this underwhelming quarter was a matter of Upstart being less capable than its competitors. In other words, I don’t think this was micro-based failure. I think it was a matter of overly-ambitious guidance from a team that’s new to public markets paired with a macroeconomic climate that didn’t warrant the expectations presented. Delivering 18% YoY revenue growth considering how poor the lending environment has become is quite impressive for a cyclical credit-facilitator like this one. But when living in public markets, expectation management is really all that matters for earnings season, and there the team swung and missed. When things are hectic and uncertain and dynamic, it pays to lean overly pessimistic in forecasting rather than optimistic. It will take them a few quarters of executing to earn back the trust of Wall Street.

Credit and monetary cycles are to be deeply respected. I had been trimming Upstart into strength over the last several months, but that trimming -- while correct and timely -- was insufficient. In light of the Federal Reserve tightening, it was more gradual than it should with the luxury of hindsight. Going forward, for companies connected to these cycles, I will be using macroeconomics to justify the same trimming/accumulation paths -- but with more aggression. I generally consider 33% of a position to be tradable around changes in forward multiples and the macro environment. For these financially-connected firms, that will move to 50% of the position going forward.

The company now trades near its IPO with exponentially more partners, volume and profit dollars than when it publicly debuted. Upstart is down… but not out.

Click here for my Upstart Deep Dive.