Earnings reviews to read from this current season:

- Cava & On Running.

- AMD Earnings Review (section 4).

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang Earnings Reviews

- Mercado Libre & Palantir Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews.

- Starbucks & Apple Earnings Reviews.

- Updated Portfolio & Performance vs. the S&P 500

Table of Contents

1. Airbnb (ABNB) — Earnings Review

a. Key Points

- Low-single digit North American growth.

- Good early traction for new product launches.

- Ongoing core product optimizations are bearing fruit.

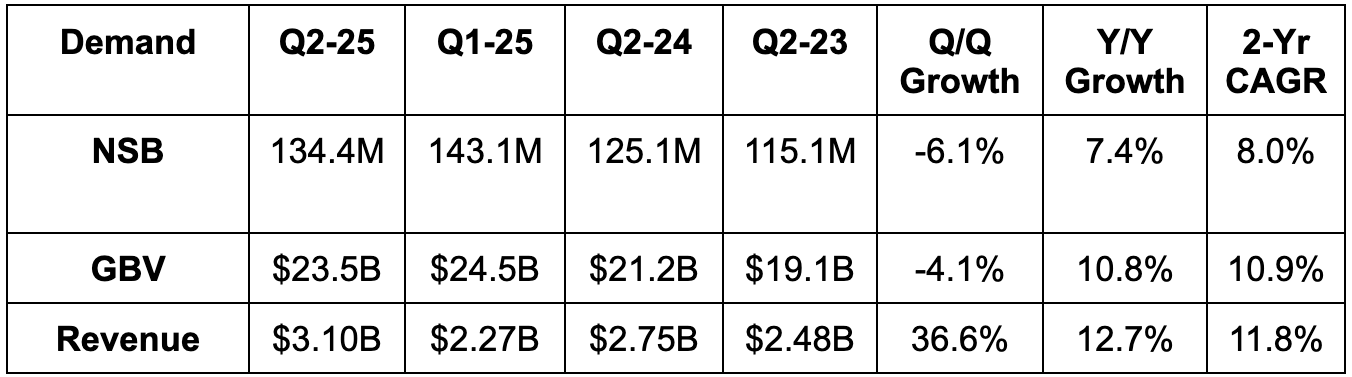

b. Demand

- Beat gross booking value (GBV) estimates by 3%.

- Constant currency (CC) GBV growth was 13% Y/Y and 11% Y/Y when also excluding the impact of favorable Easter timing (good indicator for underlying structural growth).

- Beat revenue estimates by 2.2% and beat guidance by 3.5%.

- Beat nights & seats booked (NSB) estimates by 0.5%. NSB growth was expected to moderate from 8% Y/Y last quarter. It was a tenth of a point away from rounding up to 8%.

- Average daily rate (ADR) rose by 3% Y/Y or 1% Y/Y CC. This was driven by modest price appreciation, as well as mix-shift to shorter-term and full-home stays in North America.

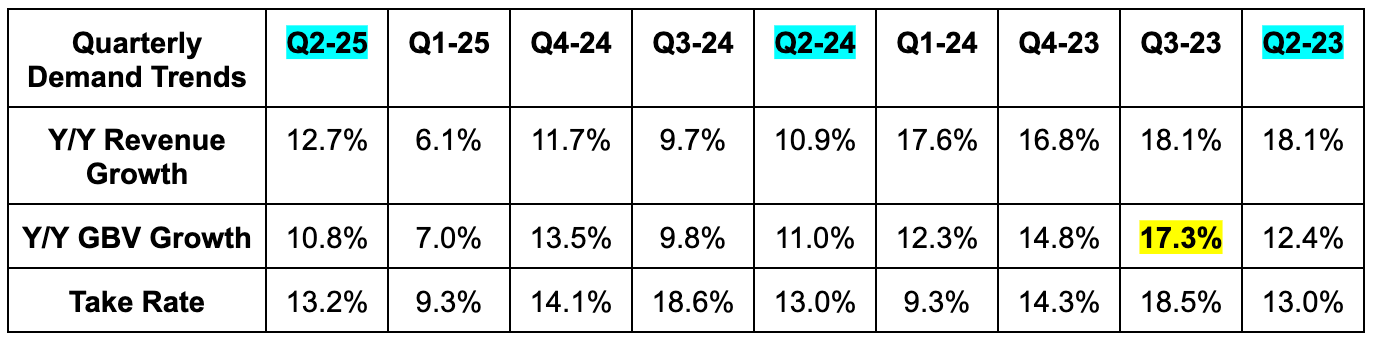

- Take rate rose Y/Y mainly due to Easter timing and the added cross-currency booking fee.

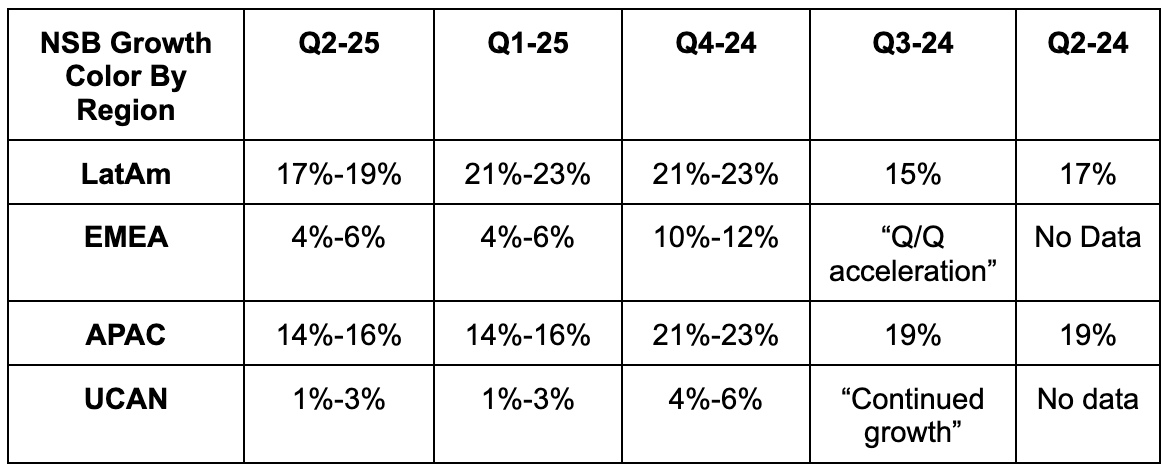

NSB growth was above 10% excluding North America (UCAN). Mix-shift, stay length and lead time trends ex-UCAN were all called stable. The lead time note is important, as it depicts consumers willing to make large purchases for services well in advance. That doesn’t happen when the world is panicking and the consumer base is economically struggling. Lead times were quite pressured during April and May trade drama; they fully normalized by June, with some Y/Y elongation actually kicking in by July.

In North American specifically, NSB rose at a low-single-digit clip Y/Y. Early in the quarter, trade war drama and weak Canada-to-USA demand led to significant UCAN headwinds. As those tensions stabilized and improved, UCAN growth accelerated accordingly. Specifically, growth improved M/M from April through June and kept gaining steam through July. There is still weakness in terms of Canadians traveling to the USA, but they’re making up for that with nights booked elsewhere, while Americans are feeling more and more confident. These two countries are 30% of this total business. As they go, Airbnb goes… and fortunately things are going better. I do not think the services and experiences launches (more later) are remotely close to large enough to explain this improvement, so it is core business progress as the backdrop improves.

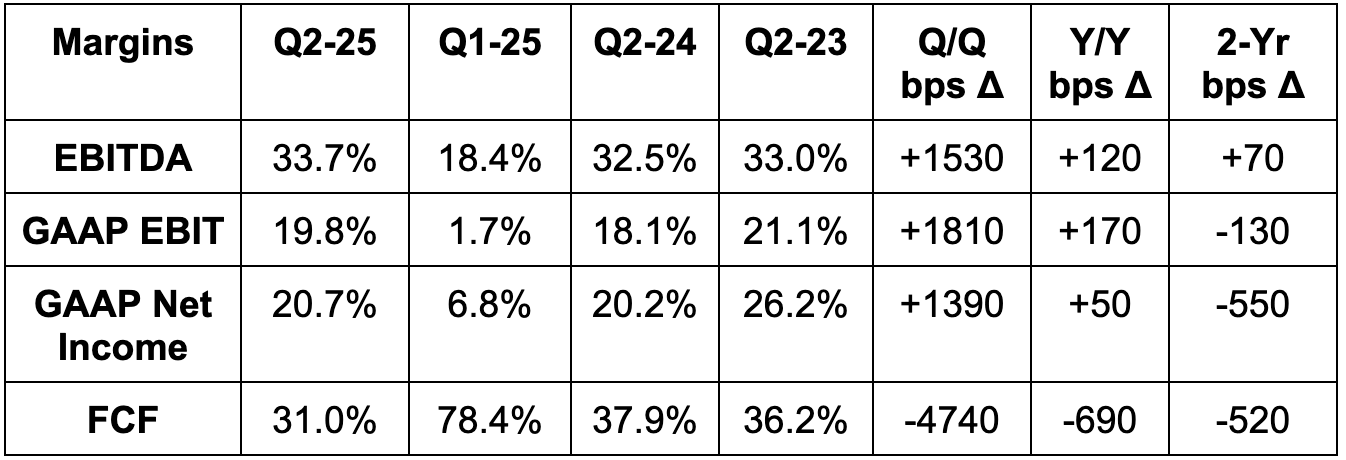

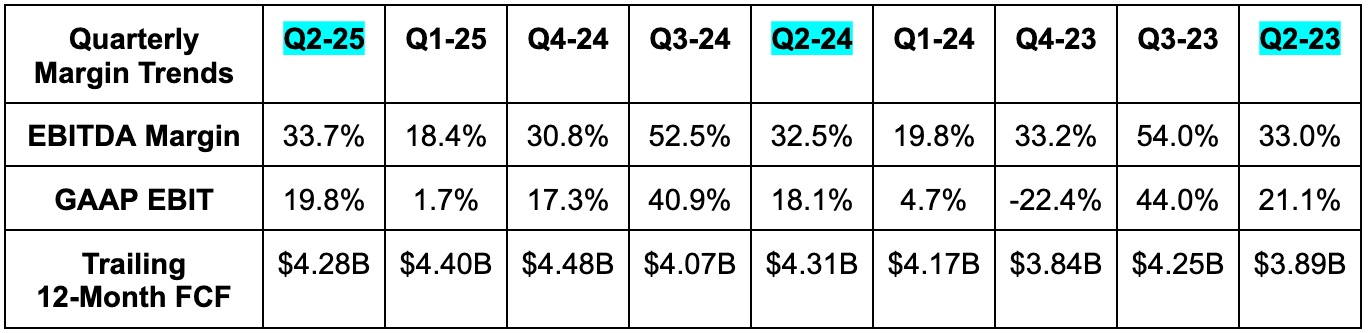

c. Profits & Margins

- Beat EBITDA estimates by 7.5%.

- EBITDA margin expanded, which compares favorably to flat-to-down Y/Y EBITDA margin guidance.

- Beat FCF estimates by 4.2%.

- Beat $0.94 GAAP EPS estimates by $0.09.

d. Balance Sheet

- $11.4B in cash & equivalents.

- $2B in total debt (which is current).

- Diluted share count fell by 3.1% Y/Y.

- $7.5B in total buyback capacity following a new $6B buyback announcement. That’s nearly 10% of the total market cap.

e. Guidance & Valuation

Q3 revenue guidance of $4.06B was slightly better than expected and represents 9% Y/Y growth. The team is "encouraged by trends” so far during Q3 (including the important UCAN acceleration in July) but was quick to remind us that growth comps get more difficult during Q3 and Q4. For context, GBV rose by more than 17% Y/Y during Q3 2024, which is a full 5 points faster than this quarter’s Y/Y comp.

They also reiterated 34.5%+ EBITDA margin guidance for the year and called for between $2B and $2.23B in Q3 EBITDA. This was at least 6.9% better than expected, although estimates just dipped from $2B to $1.88B right before the report. They didn’t explicitly say $2.23B was the ceiling, but they said EBITDA would be above $2B and that EBITDA margin would be below 52.5%. Airbnb lowered new business expense guidance from $225M to $200M for the year. Finally, the team guided to stable Q/Q NSB growth (~7% Y/Y) and 0% constant currency (CC) ADR growth, with modest nominal growth driven by foreign exchange.

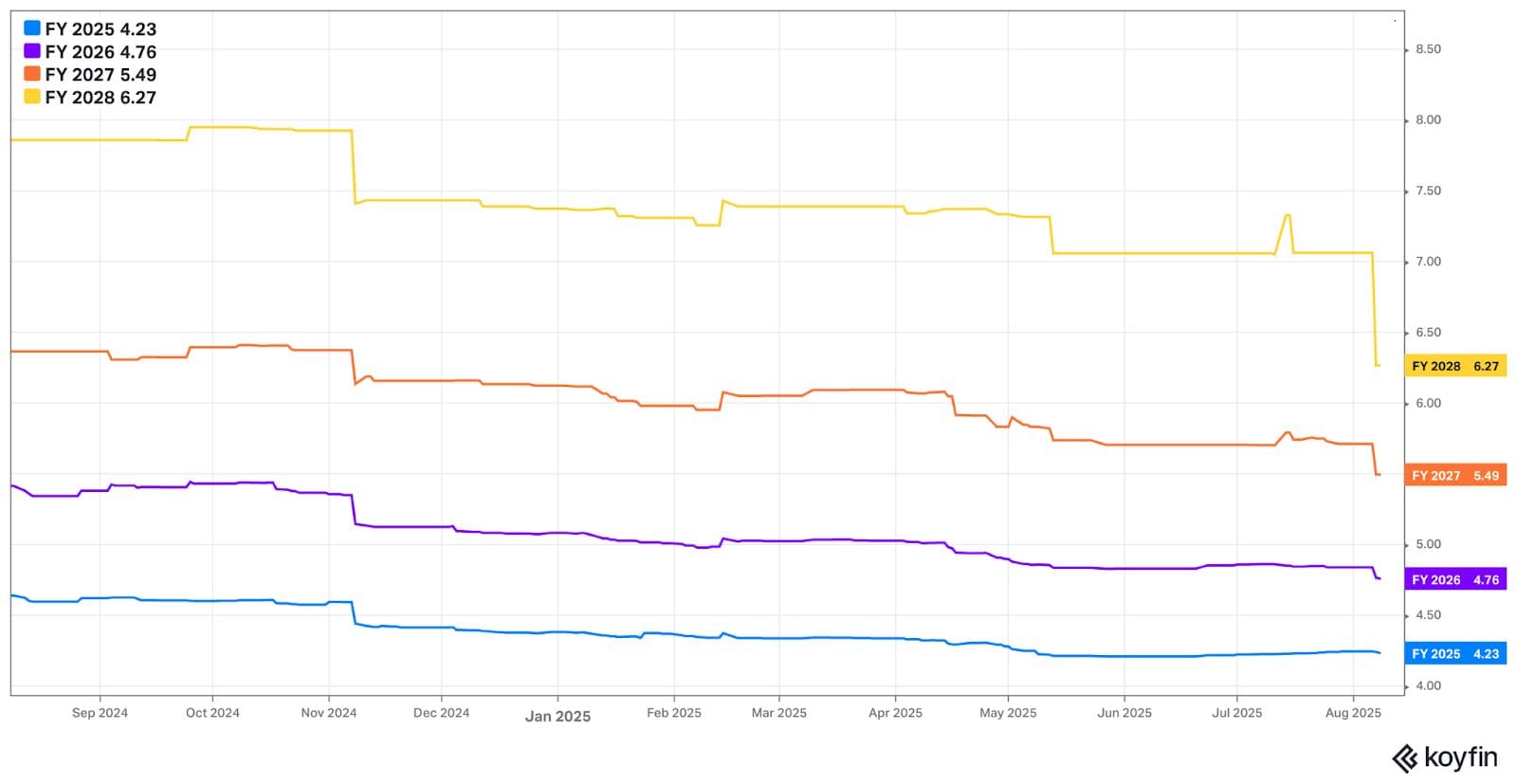

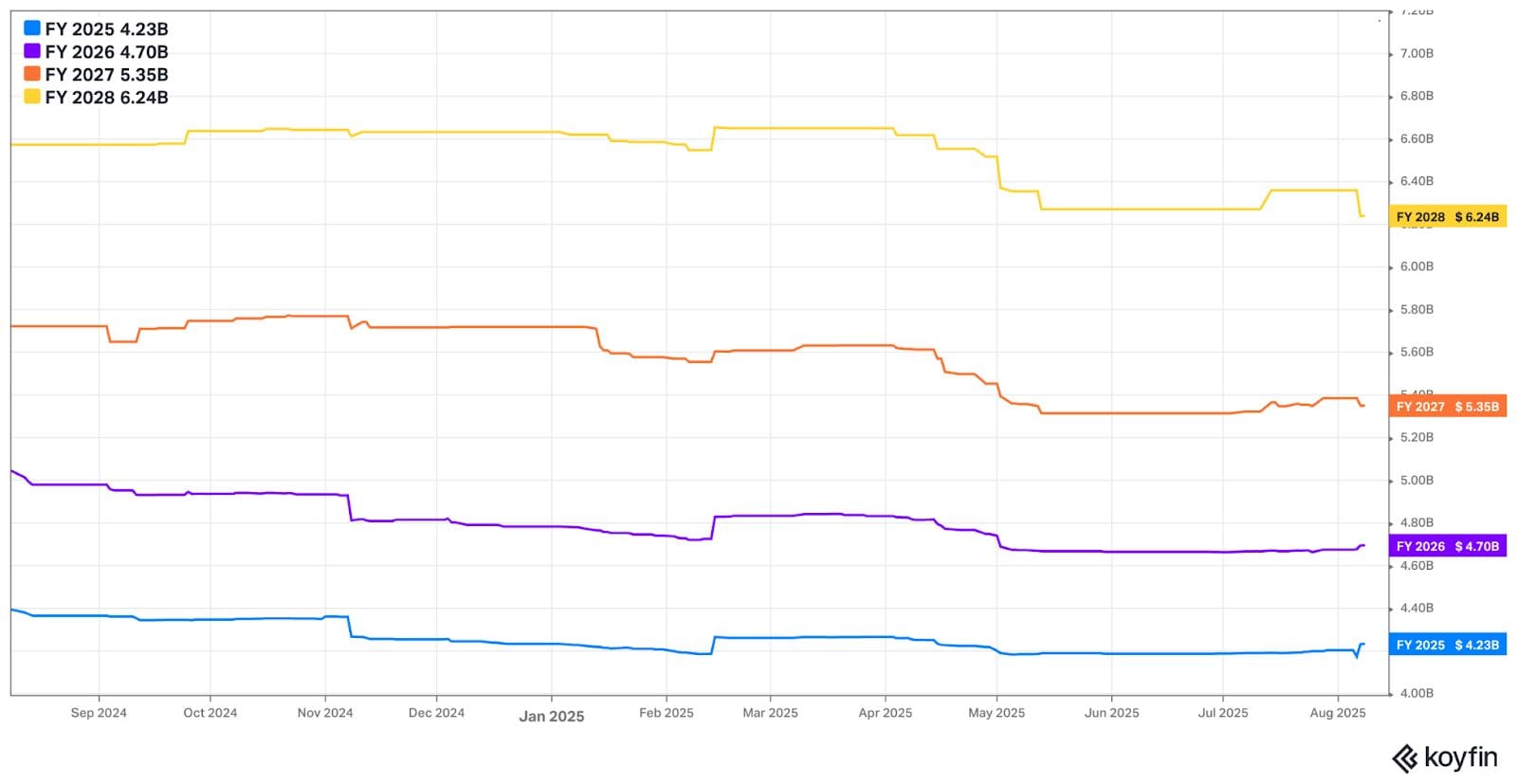

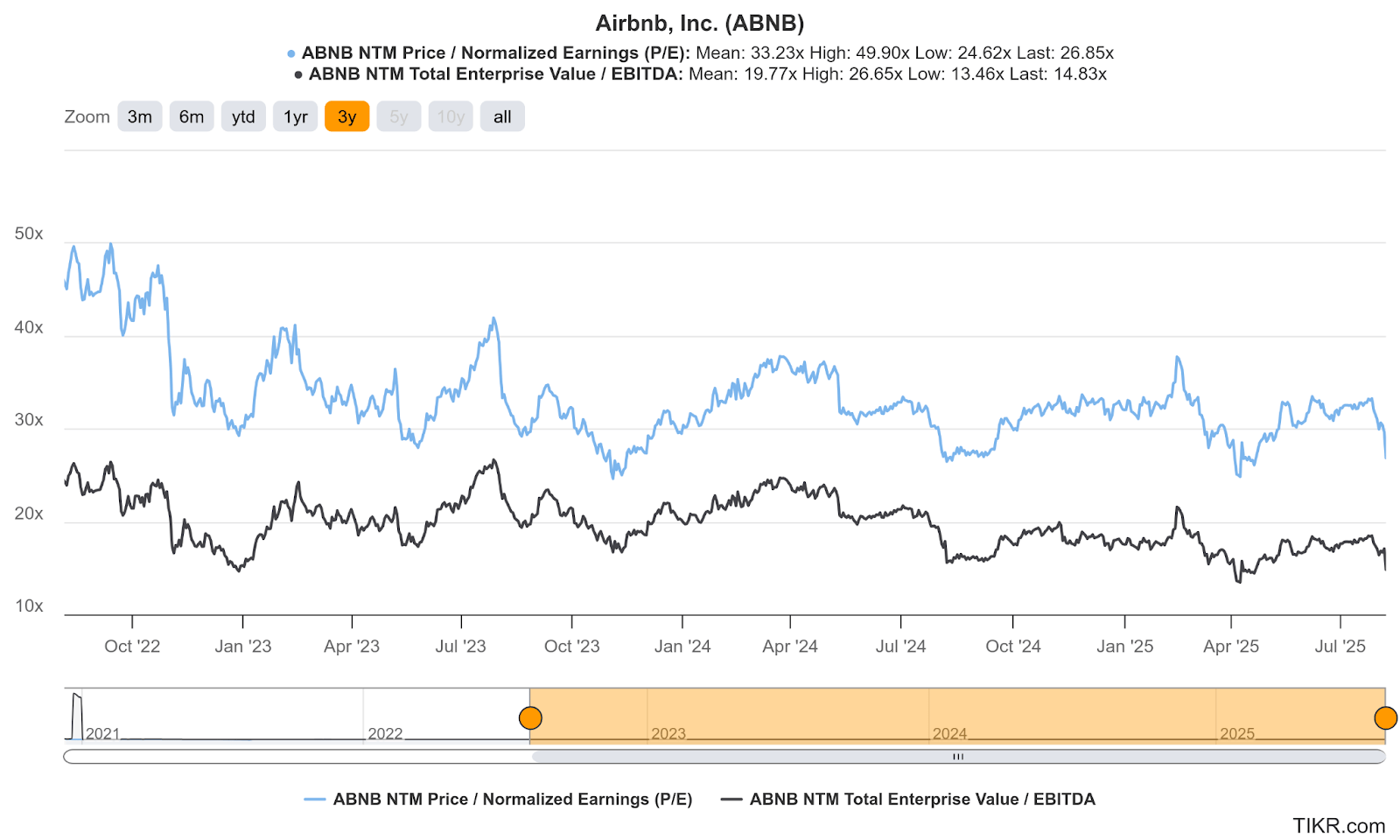

ABNB trades for 27x GAAP EPS and 15x EBITDA. GAAP EPS is expected to grow by 3% this year and 12% next year. EBITDA is expected to grow by 5% this year and by 11% next year.

f. Call & Letter Highlights

More on Geography-Specific Demand:

Its expansion market playbook continues to bear reasonable fruit. As a reminder, most of its business is in 5 countries, with places like Korea, India, Japan, Germany, Brazil and many others offering significant room for adoption. They are determined to keep putting the local teams in place needed to nurture growth in a highly relevant manner. There were more signs of this working during the quarter and showing how globally transferable this model can be. The growth gap between expansion and core markets widened Q/Q from an already large 100% difference.

In Europe, the Middle East and Africa (EMEA), ADR rose 3% CC Y/Y, with Germany the noted standout. NSB rose by 10%+ Y/Y and accelerated considerably in that European nation. In Latin America, NSB growth was nearly 20% Y/Y, as recent investments in Brazilian marketing clearly continue to work. Brazilian NSB expanded by nearly 20% Y/Y and first-time customers rose by the same amount. New payment financing methods in that country were also a big help. LatAm ADR actually fell 3% Y/Y in that region, but rose 2% Y/Y CC.

In Asia Pacific (APAC), NSB growth was around 15% Y/Y and ADR rose 1% Y/Y CC. Considering efforts in Korea have been very successful so far, they extended that focus to Japan. Early results were called “encouraging,” with 15% Y/Y growth in first-time customers there.

Core Products:

Airbnb continues to extract more platform engagement and conversion through simple, yet highly targeted and data-driven improvements to its core offering. Work on checkout flow, authorization and options as well as upgraded messaging tools (for hosts and guest groups) are all working. The travel giant is also already enjoyed 15% customer service inquiry automation through AI innovation. All of these small updates combined to form a material revenue lift during the quarter — and there’s encouragingly more to do.

On supply volume and quality, things continue to look better. Growth slightly outpaced NSB, which should support affordability. And since prioritizing better supply in 2023, rather than accepting whatever listing comes their way, they’ve cut 500,000 total options. Its guest favorites tab is another way to steer customers towards the best listings, thus further improving retention and engagement. Together, listing pickiness and this favorites tab are directly uplifting customer service issues and scores, as well as chargeback rates. It’s doing a better job with making sure hosts are being honest about their housing options, while diminishing double-booking risk and other sources of marketplace fraud.

And to improve supply availability rates, its co-hosting network is doing the trick. This connects individual hosts to a second manager able to handle reservations and take the headache out of individually listing a home. This is helping hosts offer their homes far more frequently and has been a “home run” so far.

New Products – Airbnb Services & Experiences:

As a reminder, the 2025 summer product release event was especially significant. It included Airbnb’s second attempt at meaningfully expanding beyond its core offering. Specifically, it announced the Airbnb Experiences (“Experiences”) re-launch and a new Airbnb Services (“Services”) offering.

Experiences makes travel more personal. It moves away from monotonous tourist attractions by connecting guests with local experts who have a keen understanding of what there is to do, and what these people want to see. Early examples include unique tours, cooking classes, private workouts and much more. For those wanting something especially remarkable, they’re also debuting “Airbnb Originals.” It matches guests with famous athletes and celebrities to up-level the memory-making. You do not need to purchase a traditional listing to use these offerings, which means Experiences and Originals can eventually turn into a top-of-funnel tool alongside augmenting cross-selling. Experiences are constantly vetted and re-evaluated, with lower-quality options habitually removed.

To deepen differentiation and turbo-charge Experiences supply growth, Airbnb added partnerships with Tour De France, FIFA World Cup and Lollapalooza while it extended its Olympic Committee partnership. It’s very easy to see how exclusive relationships with these ubiquitous events can create ample opportunities to offer special things that others simply can’t match. That’s how this can work… with pricing power… and with a defensible value proposition. Airbnb is working with many other 3rd party vendors to create critical supply mass for this product as quickly as possible.

The other big announcement was Services. This offers add-ons for bookings, as well as standalone purchase options. Airbnb knows folks generally want to do other things besides solely stay at their listing. With this, people can book personal trainers, hair appointments, massages and more. Hosts will have an average of a decade of experience, with guests getting access to easily book on “detailed listing pages.” As I’ve said before, I do think the risk of disintermediation for this product is higher than for ABNB’s core business. If I travel to Mexico and hire a great private chef for the evening… it’s easy to stay in contact with them and book directly the next time I’m there. While that’s also true for homes, that option comes with much higher risk. Booking a residence without Airbnb means the listing could be fraudulent or the host could have easily approved several reservations for the same weekend, pocketed the money and disappeared. When traveling far away from home, I think knowing the listing will be exactly as presented (and actually available) discourages disintermediation. I don’t think the stakes are as high with Services and worry a bit that this marketplace could be cut out of some transactions. We shall see.

It’s very early for these two products, but momentum so far was called “strong.” Guest feedback has been positive (4.93 star rating vs. 4.80 for its core business) and “potential host interest has been overwhelming.” Airbnb has already gotten 60,000 applications. Media attention has been “significant” and a global tour from its leadership team amplified this momentum.

“I’m very bullish. I think a large percentage of travelers on Airbnb would love to use Airbnb Experiences.”

CEO Brian Chesky

And interestingly, both products are unleashing modest local consumer demand. For instance, 40% of Airbnb Originals volume is from locals. That eventually could untether Airbnb’s addressable market from the (already massive) travel space, to add entertainment and daily services. That would be great for frequency, engagement, retention and overall growth. For Services specifically, the local relevance is even more compelling. It’s a brand new segment (while Experiences was re-launched) and is much smaller than Experiences, but already 10% of this business is from local residents. Airbnb envisions an eventual massive catalog of categories to choose from. Right now, they have 10. Dozens more are coming and this team is even more upbeat about the Services opportunity than the Experiences business.

Again… excitement for both products will not lead to material revenue contributions in the coming quarters. Airbnb’s core revenue bucket is simply too massive. But a good start is a prerequisite for eventual, needle-moving scaling. They’re effectively walking before they can run. Right now, Airbnb is a one-trick pony. It has built a gigantic business with one product, and the growth engine for that segment is clearly slowing. If it wants to deliver double-digit top-line growth in the years to come (and it does), these tools need to eventually be real contributors.

This quarter, the new business progress will be focused on boosting product attach rates in cities like LA and Paris.

“While we don't expect meaningful revenue from our new businesses in the near term, we expect -- excuse me, we believe the opportunity is significant and are building with a multiyear view.”

CFO Ellie Mertz

New Tech Stack & App to Enable Successful Experiences & Services Launches:

Airbnb spent the last few years overhauling and modernizing its technological foundation to give these product launches a better chance at success. This is how it upgraded the app and website interface to unlock these new offerings, without creating merchandise clutter or confusion. Product discovery is already noticeably better, and that’s key. Confusion was one of the reasons Airbnb Experiences did not work the first time. They’re determined to make sure that doesn’t repeat. The new user interface (UI) has a dedicated page of Experiences and Services, with personalized suggestions, itinerary and upgraded messaging. It also features a listing process upgrade to make adding new services and experiences seamless for hosts.

“The biggest problem we've had historically with attach rates is that people didn't know Airbnb even had experiences.”

CEO Brian Chesky

One exciting new product for the app is its “Trips tab.” This organizes and displays travel itinerary for guests and is rapidly gaining traction. While this isn’t all that impactful to immediate growth, this page is ripe for enhancing the cross-selling momentum. Airbnb can seamlessly leverage its extensive customer data profiles to offer personalized suggestions across its Services and Experiences segments. AI will be a big part of this – just like it’s already helping customer service quality and will soon be adding to in-app search.

- App bookings rose from 55% of total NSB to 59% Y/Y.

Marketing:

Leadership doesn’t plan to sharply increase marketing spend for Services or Experiences to support scaling. It did some dedicated advertising right when the two products debuted, but not much since then. Instead, it’s focused on holistically marketing its growing product suite – housing, services and experiences. This fall, it has campaigns planned to showcase how all of these products work quite well together.

For marketing channel usage, it’s shifting away from linear TV and towards social media. Leadership thinks it has the “most relevant brand for young American travelers” and sees those consumers exploring travel through more of a “browse and discover” process. It used to be more targeted, highly-intentioned search. Based on this, Airbnb feels social channels are perfect. This change in behavior patterns also means more consumers are coming to their marketplace with an open mind and less listing pickiness vs. the searchers who already have their minds made up.

How Can USA Growth Accelerate?

“We are not satisfied with 10% Y/Y revenue growth. We want the company to reaccelerate. We think we have a great plan to reaccelerate.”

Founder/CEO Brian Chesky

A company re-acceleration will start and end with North America. Sell-siders were noticeably frustrated with this geography’s lack-luster growth, which has been a theme for a few quarters. How can they re-accelerate things? Well… July sounds like it was off to a good start. Near-term, re-acceleration will come from app usability improvements, easier host onboarding, co-hosting growth, payment method optionality, targeting under-penetrated states in the U.S. and accelerating hotel supply growth. In aggregate, these things have already generated hundreds of millions in incremental revenue. Services and Experiences will not be large enough to deliver this upward bend in the growth curve for a while.

More Notes:

- Still no near-term plans on a loyalty program. I think there should be greater sense of urgency here. Online travel agencies have them.

- Big event partnerships like the Olympics are great for driving first-time host supply growth. And these hosts routinely re-list.

- They’re interested in exploring M&A to drive revenue growth. The cash pile is massive and I think this would be a good idea.